North America Guitar Market

Market Size in USD Billion

CAGR :

%

USD

8.13 Billion

USD

12.43 Billion

2024

2032

USD

8.13 Billion

USD

12.43 Billion

2024

2032

| 2025 –2032 | |

| USD 8.13 Billion | |

| USD 12.43 Billion | |

|

|

|

|

North America Guitar Market Size

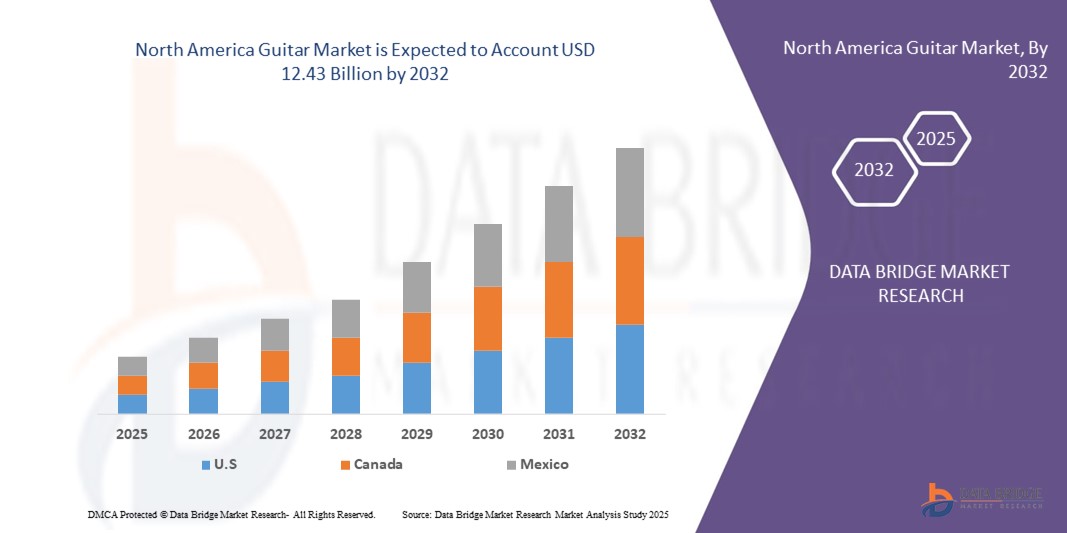

- The North America guitar market size was valued at USD 8.13 billion in 2024 and is expected to reach USD 12.43 billion by 2032, at a CAGR of 5.44% during the forecast period

- The market growth is largely fuelled by the rising popularity of music as a leisure activity, increasing participation in live performances, growth of online music education platforms, and the influence of digital and social media in promoting musical trends

- Growing demand for premium and customized guitars, driven by professional musicians and enthusiasts seeking unique sound quality and design, is further boosting the market expansion

North America Guitar Market Analysis

- The market is witnessing steady demand due to the growing interest in music among younger generations and the increasing adoption of guitars for both professional and recreational purposes

- Technological advancements, such as smart guitars with integrated digital features, are expanding consumer interest and enhancing the playing experience

- U.S. guitar market captured the largest revenue share of 82% in 2024, fueled by the strong popularity of diverse music genres, widespread adoption of both acoustic and electric guitars, and high spending on branded instruments

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America guitar market due to increasing interest in music education, rising adoption of beginner and mid-range guitars, and expanding online and specialty retail channels catering to new players

- The Acoustic Guitar segment held the largest market revenue share in 2024, owing to its popularity among both beginners and seasoned musicians. Acoustic guitars are versatile, affordable, and widely used across genres such as folk, pop, and country, making them the most accessible option for learners. Their portability and simplicity further enhance their appeal, as they do not require external amplification. Continuous innovation in design and materials has also improved sound quality and durability, ensuring sustained demand

Report Scope and North America Guitar Market Segmentation

|

Attributes |

North America Guitar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Guitar Market Trends

Rise Of Online Music Learning Platforms And Digital Engagement

- The growing shift toward online music education is transforming the guitar market by making learning more accessible, interactive, and personalized. Virtual platforms and mobile apps allow beginners to take lessons at their own pace, while advanced players can explore techniques from global instructors. This flexibility is driving higher adoption among all age groups and skill levels

- The high demand for convenient learning options is accelerating the popularity of subscription-based guitar courses and digital tutorials. These resources enable players to access structured content without the constraints of physical classes, helping overcome barriers such as time limitations and availability of instructors

- The affordability and interactive features of online tools are making them attractive for routine practice and long-term skill development. Learners benefit from on-demand content, progress tracking, and gamified elements, which enhance engagement and retention

- For instance, in recent years, leading music education platforms have reported significant growth in guitar course enrollments following the launch of interactive tutorials and AI-powered practice assistants. These tools provided real-time feedback and motivation, improving learning outcomes and user satisfaction

- While digital platforms are expanding accessibility and driving guitar adoption, their long-term impact depends on continued innovation, affordability, and reliable internet access. Developers must focus on localized content, flexible pricing, and enhanced user experience to sustain this growing trend

North America Guitar Market Dynamics

Driver

Growing Popularity Of Music As A Hobby And Rising Influence Of Social Media

- The rising trend of music as a recreational activity is pushing individuals to take up the guitar as a versatile and expressive instrument. From acoustic to electric guitars, the wide range of options caters to hobbyists, enthusiasts, and professional musicians alike, fueling consistent demand

- Aspiring players are increasingly aware of the social and personal benefits associated with learning music, including stress relief, creativity, and community engagement. This awareness has encouraged higher adoption across diverse demographics

- The influence of social media platforms and content-sharing apps has significantly boosted guitar adoption, as viral performances, tutorials, and collaborations inspire audiences to pursue the instrument. Brand endorsements and artist-led promotions further support this trend

- For instance, leading guitar manufacturers have witnessed higher sales following campaigns where popular artists showcased their instruments in digital concerts and online challenges, highlighting the aspirational value of playing guitar

- While demand is growing, sustained momentum requires consistent innovation in product design, affordable entry-level instruments, and accessible learning resources to attract new players and retain long-term interest

Restraint/Challenge

High Cost Of Premium Instruments And Limited Access To Quality Training

- The high price point of professional-grade guitars makes them inaccessible for beginners and casual hobbyists. Premium models are often reserved for collectors or professional musicians, limiting widespread adoption among entry-level players

- Many aspiring guitarists face challenges in accessing quality training, particularly where skilled instructors are scarce or lessons are cost-prohibitive. This gap often discourages long-term commitment, resulting in high dropout rates among beginners

- Market expansion is also restricted by the need for consistent after-sales support, including maintenance, repairs, and replacement parts. The absence of reliable service infrastructure reduces user satisfaction and long-term loyalty

- For instance, consumer surveys have revealed that a significant number of first-time players discontinue guitar practice due to poor guidance and lack of affordable, durable instruments, citing cost and training barriers as primary reasons

- While guitar technology and learning tools continue to evolve, solving affordability and accessibility challenges remains crucial. Industry stakeholders must focus on cost-effective models, digital training integration, and scalable solutions to ensure long-term market growth

North America Guitar Market Scope

The market is segmented on the basis of type, wood material, covers, tailpiece, neck shape, number of strings, string material, music type, color, distribution channel, and application.

- By Type

On the basis of type, the North America guitar market is segmented into Acoustic Guitar, Electric Guitar, Electric-Acoustic Guitar, Classical Guitar, Bass Guitar, Resonator, Extended Range Electric Guitar, Lap Steel Guitar, Double Neck Guitar, and Others. The Acoustic Guitar segment held the largest market revenue share in 2024, owing to its popularity among both beginners and seasoned musicians. Acoustic guitars are versatile, affordable, and widely used across genres such as folk, pop, and country, making them the most accessible option for learners. Their portability and simplicity further enhance their appeal, as they do not require external amplification. Continuous innovation in design and materials has also improved sound quality and durability, ensuring sustained demand.

The Electric Guitar segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its dominance in genres such as rock, blues, and metal. Electric guitars offer a wide tonal range and compatibility with amplifiers, pedals, and digital effects, making them a preferred choice for professional performers and experimental musicians. Their popularity is further amplified by cultural influence, online tutorials, and endorsements from leading artists. Manufacturers are also introducing lightweight models and extended-range versions to attract new players. This combination of creativity, versatility, and cultural relevance is driving growth in this segment.

- By Wood Material

On the basis of wood material, the North America guitar market is segmented into Solid and Laminate. The Solid segment dominated the market in 2024 due to its premium tonal quality and resonance, making it a top choice for professionals and enthusiasts. Solid wood guitars improve in tone over time, which adds value for serious players. While more expensive, they are seen as long-term investments for quality sound production. Leading brands frequently use solid woods such as mahogany, spruce, and rosewood to enhance tonal depth and sustain. This preference continues to secure demand in the premium segment.

The Laminate segment is expected to witness the fastest growth rate from 2025 to 2032, driven by affordability and resilience to environmental changes. Laminate guitars are less prone to warping or cracking, making them ideal for beginners and casual players. They are lighter in weight, easy to maintain, and widely available across mass-market channels. Their cost-effectiveness makes them highly attractive in the student and entry-level category. With growing demand for budget-friendly instruments, laminate guitars are playing a key role in expanding the user base worldwide.

- By Covers

On the basis of covers, the North America guitar market is segmented into Solid Body, Semi-Hollow Body, Hollow Body, and Others. The Solid Body segment accounted for the largest revenue share in 2024, as these guitars are durable and suitable for high-volume performances. Solid body guitars minimize feedback, which makes them particularly favored for live shows and heavy music genres. Their structural integrity allows for advanced hardware and pickup integration. They also support innovative designs and custom finishes, appealing to a wide audience. Strong demand among rock and metal players has cemented their dominance in the market.

The Semi-Hollow Body segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its unique tonal balance between acoustic warmth and electric sharpness. These guitars are popular among jazz and blues musicians who value resonance and versatility. Their lightweight design also makes them comfortable for extended use. The rising popularity of cross-genre experimentation has further increased their relevance in modern music. With players seeking hybrid sound experiences, semi-hollow body guitars are gaining notable traction.

- By Tailpiece

On the basis of tailpiece, the North America guitar market is segmented into Vibrato Arms, Floating Tailpiece, Hard Tail, and String-Through Body. The Hard Tail segment held the largest share in 2024, attributed to its tuning stability and ease of use. Hard tail designs are straightforward, require minimal maintenance, and are reliable for long-term play. They are widely favored by beginners for their simplicity and by professionals for consistency in live performances. Their durability and resistance to string slippage further support their adoption. Overall, this design continues to dominate the mainstream guitar market.

The Vibrato Arms segment is expected to witness the fastest growth rate from 2025 to 2032, as musicians increasingly prefer expressive features for bending pitch and creating dynamic effects. Vibrato arms allow for enhanced creativity, especially in genres such as rock and metal. Their popularity has surged with the growth of solo performances and experimental music. Manufacturers are also introducing advanced vibrato mechanisms to improve tuning stability. This trend is expected to keep driving adoption among both professionals and enthusiasts.

- By Neck Shape

On the basis of neck shape, the North America guitar market is segmented into C Necks, U Necks, V Necks, and Others. The C Necks segment dominated the market in 2024, due to its ergonomic design and wide acceptance among players of all levels. Known for its comfort, the C shape supports long practice sessions without causing strain. It has become a standard in modern guitars and is especially favored by manufacturers for its universal appeal. Beginners often prefer this design due to its ease of playability. Its popularity across acoustic and electric guitars ensures continued dominance in the market.

The V Necks segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its appeal among vintage guitar enthusiasts. This shape offers a distinct grip and tactile feel, making it attractive for players seeking traditional playing experiences. Many collectors and professionals prefer V necks for their historical association with iconic guitar models. While less common in modern mass production, its niche appeal is growing steadily. Rising demand for retro-style instruments is further fueling this trend.

- By Number of Strings

On the basis of number of strings, the North America guitar market is segmented into Six Strings, Eight Strings, Twelve Strings, and More Than Twelve Strings. The Six Strings segment dominated the market in 2024, being the most widely used configuration across genres and skill levels. It is considered the standard for beginners and professionals alike, offering familiarity and ease of learning. Its versatility in producing a wide tonal range ensures popularity across acoustic and electric models. Manufacturers also focus on producing affordable six-string variants for mass adoption. This segment is expected to maintain its leading position throughout the forecast period.

The Eight Strings segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its rising use in progressive and experimental music. Musicians favor extended-range guitars for their ability to cover deeper tones and complex compositions. This configuration appeals to players seeking innovation and distinct soundscapes. With the growth of niche music genres, demand for eight-string guitars is expanding steadily. Increasing endorsements by professional artists are further boosting interest among advanced learners and enthusiasts.

- By String Material

On the basis of string material, the North America guitar market is segmented into Steel, Nylon, and Others. The Steel segment held the largest revenue share in 2024, driven by its bright, powerful tone and widespread use in popular genres such as rock, pop, and metal. Steel strings are durable and deliver louder projection, making them ideal for both studio and live performances. Their compatibility with acoustic and electric guitars further reinforces demand. Steel remains the first choice for professionals and enthusiasts aiming for sharp tonal clarity. Its continued dominance is supported by consistent innovation in coated and long-life variants.

The Nylon segment is expected to witness the fastest growth rate from 2025 to 2032, largely due to its adoption in classical, flamenco, and folk music. Nylon strings produce a softer, mellower sound, making them beginner-friendly and ideal for fingerstyle techniques. They are also easier on the fingers, attracting new learners and casual hobbyists. Growing global interest in traditional and acoustic genres is further fueling this demand. Manufacturers are introducing hybrid nylon strings to expand appeal across diverse player groups.

- By Music Type

On the basis of music type, the North America guitar market is segmented into Rock, Blues, Pop, Metal, Jazz, Electronica, Traditional, and Others. The Rock segment accounted for the largest market share in 2024, reflecting the guitar’s iconic status in this genre. Rock continues to drive consistent sales of electric guitars, amplifiers, and accessories. Its influence on culture and media ensures ongoing relevance. The genre’s global fan base provides stable long-term demand. Manufacturers also align marketing strategies around rock legends and performances, further sustaining this segment’s dominance.

The Pop segment is expected to witness the fastest growth rate from 2025 to 2032, as guitars are increasingly integrated into mainstream and contemporary music. Pop culture’s influence across social media and streaming platforms is fueling this adoption. Rising collaborations between guitar brands and popular artists further boost sales. Affordable entry-level models marketed toward youth audiences have strengthened accessibility. With pop music’s mass appeal, this segment is expected to see robust growth in the coming years.

- By Color

On the basis of color, the North America guitar market is segmented into Black, Brown, Red, Light Tan, Light Yellow, Amber, and Others. The Black segment dominated the market in 2024, owing to its classic, professional, and versatile aesthetic. Black guitars are widely popular across all genres and skill levels. They are also favored by manufacturers for their timeless appeal in both acoustic and electric designs. The segment continues to attract consistent demand due to its universal acceptance. Enduring popularity ensures its leading position in the market.

The Red segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for bold, visually distinctive instruments. Red guitars appeal to younger audiences seeking individuality and stage presence. Their eye-catching design makes them a favorite for performances and artist endorsements. Manufacturers are increasingly introducing red finishes in multiple models to cater to this trend. Growing consumer preference for personalization and stylish instruments is driving momentum in this segment.

- By Distribution Channel

On the basis of distribution channel, the North America guitar market is segmented into Specialty Stores/Music Stores, E-Commerce, Supermarkets/Hypermarkets, and Others. The Specialty Stores/Music Stores segment captured the largest market share in 2024, as these outlets offer personalized consultation, product trials, and expert guidance. They also provide after-sales services such as maintenance and repairs, which enhance customer trust. Many players prefer in-person testing of instruments before purchase, supporting demand for offline retail. Exclusive launches and promotional events further strengthen their position. This segment is expected to remain dominant due to the hands-on experience it offers.

The E-Commerce segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing digital adoption and consumer preference for convenience. Online platforms provide a wider product range, competitive pricing, and home delivery options. Detailed reviews, video demonstrations, and virtual try-out features have improved buyer confidence. Rising adoption of smartphones and secure payment systems is also fueling growth in online sales. As digital platforms expand globally, e-commerce is set to transform the distribution landscape for guitars.

- By Application

On the basis of application, the North America guitar market is segmented into Professional Performance, Learning and Training, and Individual Amateurs. The Professional Performance segment accounted for the largest revenue share in 2024, reflecting demand from touring artists, studio musicians, and live events. Professional players drive consistent sales of high-end models and custom instruments. The segment benefits from artist endorsements, global concerts, and professional associations. It also creates aspirational value for younger audiences. Strong demand in this category is expected to sustain its leading market position.

The Learning and Training segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rapid rise of online tutorials and music education platforms. Affordable entry-level guitars, combined with structured digital lessons, are encouraging more beginners to take up the instrument. Schools, academies, and e-learning providers are driving structured adoption in this category. Interactive learning tools and gamified applications further enhance student engagement. This segment is emerging as a major driver of long-term guitar adoption.

North America Guitar Market Regional Analysis

- U.S. guitar market captured the largest revenue share of 82% in 2024, fueled by the strong popularity of diverse music genres, widespread adoption of both acoustic and electric guitars, and high spending on branded instruments

- Consumers increasingly prioritize premium quality, innovative designs, and advanced features such as electric-acoustic hybrids. The rise of online learning platforms and robust e-commerce penetration further boosts accessibility

- In addition, the presence of leading global manufacturers, strong youth engagement in music, and the expansion of live concerts and festivals significantly contribute to the U.S. market’s dominance

Canada Guitar Market Insights

The Canada guitar market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising interest in indie and alternative music genres, as well as increasing focus on music education. Consumers are showing growing demand for both affordable beginner guitars and premium handcrafted models. Expanding online retail networks and the influence of local music communities are strengthening the adoption of guitars across the country. Furthermore, the increasing use of guitars for professional training and recreational purposes is set to accelerate Canada’s market growth.

North America Guitar Market Share

The North America guitar industry is primarily led by well-established companies, including:

- Fender Musical Instruments Corporation (U.S.)

- Gibson Inc. (U.S.)

- PRS Guitars (U.S.)

- B.C. Rich Guitars. (U.S.)

- C.F. Martin & Co. Inc. (U.S.)

- The ESP Guitar Company (U.S.)

- Godin Guitars (Canada)

- Schecter Guitar Research (U.S.)

- TAYLOR-LISTUG, INC. (U.S.)

- Michael Kelly Guitar Co. (U.S.)

- Yamaha Corporation of America and Yamaha Corporation (U.S.)

Latest Developments in North America Guitar Market

- In September 2024, Gibson launched an AI-powered guitar tuning app designed to deliver precise tuning and personalized practice routines. The app integrates seamlessly with Gibson guitars, offering advanced convenience for both beginners and professionals. By combining artificial intelligence with music practice, the innovation enhances user experience and supports skill development. The move is expected to attract tech-savvy musicians while boosting Gibson’s competitive edge. Overall, this launch strengthens the company’s digital ecosystem and contributes to higher sales in the smart instrument segment

- In October 2024, Fender unveiled a new line of sustainable guitars crafted with eco-friendly materials such as hemp wood. The launch reflects Fender’s commitment to environmental responsibility while preserving its reputation for craftsmanship and sound excellence. This development resonates strongly with eco-conscious musicians and collectors seeking sustainable alternatives. By introducing green innovation in instrument manufacturing, Fender positions itself as a leader in responsible production. The initiative is projected to enhance brand loyalty and attract a broader base of environmentally aware customers

- In September 2024, Gibson rolled out its “Modern Collection,” featuring enhanced playability with redesigned necks and versatile pickups. The collection is aimed at professional musicians and enthusiasts seeking innovation alongside the brand’s iconic design. By improving comfort and tonal flexibility, the models appeal to players across diverse music styles. This product line elevates Gibson’s market offering and reinforces its tradition of merging heritage with modern needs. The launch is expected to strengthen its presence among both long-time fans and new customers

- In July 2024, PRS Guitars introduced the “Core 24-01” model, featuring a newly engineered bridge system designed for superior sustain and tuning stability. The release reflects PRS’s ongoing focus on innovation and precision engineering. With customizable, high-performance features, the guitar caters to professional musicians demanding reliability and tonal excellence. The launch adds depth to PRS’s core lineup and reinforces its positioning as a premium brand. This innovation is expected to drive stronger demand among advanced players and collectors worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.