North America Gym Management Software Market

Market Size in USD Billion

CAGR :

%

USD

6.61 Billion

USD

13.27 Billion

2024

2032

USD

6.61 Billion

USD

13.27 Billion

2024

2032

| 2025 –2032 | |

| USD 6.61 Billion | |

| USD 13.27 Billion | |

|

|

|

|

North America Gym Management Software Market Size

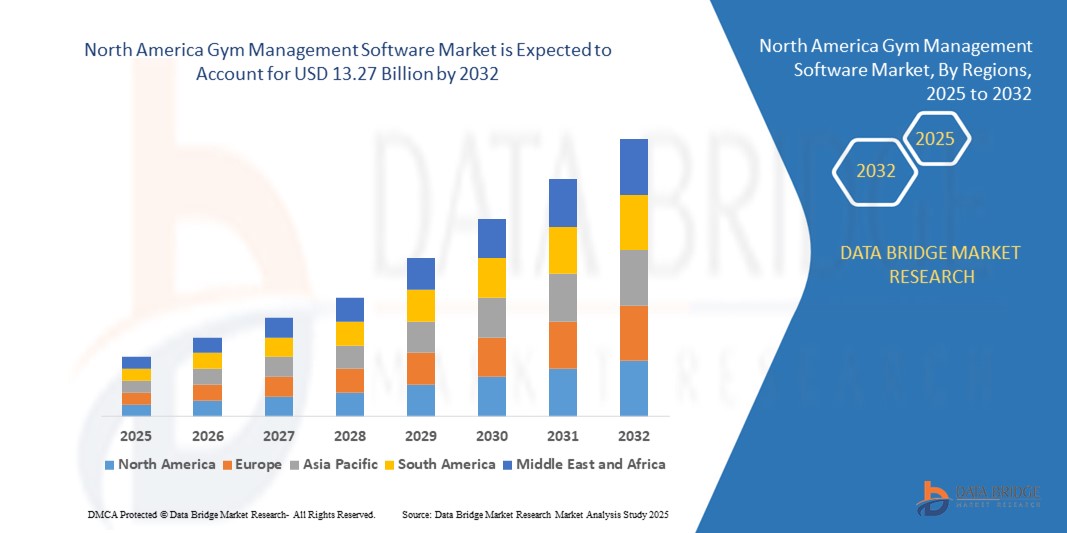

- The North America gym management software market size was valued at USD 6.61 billion in 2024 and is expected to reach USD 13.27 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is primarily driven by the increasing number of fitness centers and health clubs across the region, coupled with the rising demand for digital tools that streamline operations, member engagement, and billing processes

- In addition, the shift toward cloud-based platforms and mobile-friendly solutions is transforming how gyms manage daily activities, memberships, and performance analytics. These evolving needs are propelling the adoption of gym management software, thereby fueling significant market expansion

North America Gym Management Software Market Analysis

- Gym management software, designed to streamline administrative, operational, and member-related functions in fitness facilities, has become an essential tool for gyms, studios, and wellness centers across North America due to its ability to automate scheduling, billing, and member engagement

- The rising demand for gym management software is primarily driven by increasing health consciousness, a surge in boutique fitness studios, and the need for efficient digital platforms to manage hybrid fitness offerings

- U.S. dominated the gym management software market with the largest revenue share of 41.72% in 2024, supported by widespread internet penetration, early SaaS adoption, and strong investments in fitness tech, with the country seeing robust uptake among independent gyms and chains seeking to improve retention through personalized digital experiences

- Canada is projected to be the fastest growing country in the gym management software market during the forecast period due to growing health awareness, increasing gym memberships, and digital transformation initiatives

- The cloud-based deployment segment dominated the gym management software market with a share of 48.3% in 2024, attributed to its scalability, cost-effectiveness, and flexibility in managing multi-location fitness centers

Report Scope and North America Gym Management Software Market Segmentation

|

Attributes |

North America Gym Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Gym Management Software Market Trends

AI-Driven Personalization and Integrated Member Engagement

- A notable and rapidly evolving trend in the North America gym management software market is the integration of artificial intelligence (AI) and data analytics to deliver personalized fitness experiences and enhance member engagement. This intelligent automation is transforming how fitness centers interact with their members

- For instance, platforms such as ABC Trainerize and Mindbody are leveraging AI to generate personalized workout plans, send automated reminders, and offer real-time performance feedback, helping gyms tailor offerings to individual preferences and behaviors

- AI-powered insights enable operators to analyze usage patterns, predict member churn, and launch timely engagement campaigns, such as loyalty rewards or reactivation offers for inactive users. Fitness clubs can now automate communication through multiple channels, ensuring members stay connected and motivated

- Integrated engagement tools, including mobile apps, virtual class bookings, digital wallets, and personalized dashboards, are becoming central to gym management software, providing users with seamless control over their fitness journey and subscriptions

- This trend toward smart, data-driven, and highly interactive software ecosystems is redefining gym management, with companies such as Glofox and Zen Planner rolling out AI-centric updates focused on business intelligence and customer retention

- The demand for gym management platforms that blend automation, personalization, and ease of access is accelerating across both boutique studios and large chains, as fitness providers prioritize member satisfaction and operational efficiency in an increasingly competitive market

North America Gym Management Software Market Dynamics

Driver

Increased Digitalization in Fitness Operations and Member Experience

- The widespread digital transformation of the fitness industry, particularly in the U.S. and Canada, is a key driver propelling the adoption of gym management software. Fitness businesses are increasingly seeking cloud-based tools to optimize scheduling, payments, and member communication

- For instance, in February 2024, Club Automation launched a new suite of mobile-first features aimed at enhancing member self-service capabilities, helping gyms reduce administrative burden while improving user convenience

- The shift to hybrid fitness models combining in-person training with on-demand virtual content has further amplified the need for centralized, integrated platforms capable of managing both physical and digital operations

- In addition, growing consumer demand for contactless services, digital check-ins, and flexible class bookings is encouraging gyms to adopt robust management systems. These solutions support business scalability, offer real-time analytics, and help improve customer retention and satisfaction

- The growing penetration of smartphones and fitness apps across North America has increased consumer expectations for seamless, app-based gym interactions, further pushing operators to digitize their services

- Fitness franchises and multi-location gym chains are increasingly investing in enterprise-level software solutions to ensure consistency in operations, member experience, and performance tracking across all sites

Restraint/Challenge

Data Privacy Concerns and Software Adoption Barriers

- Data security and privacy remain critical concerns for gym operators and members alike as, especially as management software platforms handle sensitive user data, including health information, payment details, and attendance history

- For instance, growing scrutiny over compliance with privacy regulations such as HIPAA in the U.S. and PIPEDA in Canada has made security features and data governance a key focus for software vendors and buyers

- Any lapse in data protection can significantly damage a fitness brand's reputation and erode customer trust. Therefore, ensuring compliance with evolving data regulations and implementing robust cybersecurity frameworks is crucial

- Moreover, smaller gyms and independent trainers may face financial or technical barriers when adopting full-featured platforms. The initial cost of software subscriptions, onboarding, and staff training can discourage digital adoption

- Addressing these challenges through simplified pricing models, enhanced data security protocols, and better user support will be essential to drive adoption and long-term market growth

- A lack of digital literacy or resistance to technological change among gym staff and management teams may slow the implementation of advanced software systems, particularly in traditionally operated fitness centers

- Inconsistent internet connectivity or insufficient IT infrastructure in some areas may also limit the effectiveness of cloud-based gym management solutions, particularly in rural or underserved regions

North America Gym Management Software Market Scope

The market is segmented on the basis of deployment type, enterprise size, sales channel, and application.

- By Deployment Type

On the basis of deployment type, the North America gym management software market is segmented into cloud and on-premises. The cloud segment dominated the market with the largest revenue share of 48.3% in 2024, driven by its scalability, flexibility, and lower upfront infrastructure costs. Cloud-based platforms allow gym owners and managers to access real-time data and perform administrative functions from anywhere, offering convenience and centralized control across multiple locations. The seamless integration of cloud-based solutions with mobile apps and third-party platforms is also contributing to their widespread adoption across fitness chains and independent studios.

The on-premises segment is expected to witness fastest growth during forecast period due to its control over data security and offline capabilities. However, its growth is slower compared to cloud solutions due to higher setup and maintenance costs and limited remote accessibility.

- By Enterprise Size

On the basis of enterprise size, the North America gym management software market is segmented into large scale enterprises, medium scale enterprises, and small scale enterprises. Large scale enterprises held the largest market share in 2024 due to their broader adoption of fully integrated platforms that manage complex operations across multiple branches and departments. These enterprises typically require advanced analytics, automation, and CRM features to manage a high volume of members, transactions, and class schedules.

The medium scale enterprises segment is projected to register the fastest growth rate during the forecast period, supported by increasing investments in digital transformation and a shift toward cloud-based and AI-enhanced gym management tools that balance affordability with functionality.

- By Sales Channel

On the basis of sales channel, the North America gym management software market is bifurcated into B2B and B2C. The B2B segment dominated the market in 2024, with gyms, studios, and fitness clubs purchasing software directly from solution providers. B2B platforms offer tailored packages that cater to the unique operational needs of businesses and allow for integration with other systems such as POS, biometric scanners, and digital marketing tools.

The B2C segment is expected to see growing traction during forecast period, particularly with the rise of direct-to-consumer platforms offering simplified versions of gym software for independent trainers and fitness professionals. This shift is being driven by the increasing number of personal trainers and fitness influencers operating their own virtual or micro-gyms.

- By Application

On the basis of application, the North America gym management software market is segmented into gyms and health clubs, sports clubs, and others. Gyms and health clubs accounted for the largest share in 2024 due to their strong demand for software solutions that streamline membership management, class scheduling, and billing. These facilities increasingly rely on automation and analytics to improve retention, manage peak hour traffic, and personalize member experiences.

The sports clubs segment is expected to witness the fastest CAGR during the forecast period, driven by the growing adoption of digital tools to manage team training schedules, registrations, and performance tracking. Enhanced coordination and centralized operations are encouraging sports organizations to adopt comprehensive software platforms.

North America Gym Management Software Market Regional Analysis

- The U.S. dominated the gym management software market with the largest revenue share of 41.72% in 2024, supported by widespread internet penetration, early SaaS adoption, and strong investments in fitness tech, with the country seeing robust uptake among independent gyms and chains seeking to improve retention through personalized digital experiences

- Fitness operators in the U.S. prioritize software solutions that offer integrated scheduling, mobile access, payment automation, and performance analytics, aligning with the growing consumer expectations for tech-enabled fitness experiences

- This strong market position is further reinforced by high smartphone usage, a health-conscious population, and substantial investments in fitness startups and SaaS platforms, making gym management software a critical enabler of operational efficiency and member retention across the U.S. fitness sector

U.S. North America Gym Management Software Market Insight

The U.S. gym management software market captured the largest revenue share in 2024 within North America, fueled by the country’s mature fitness ecosystem and rapid digital transformation across gyms and wellness centers. Fitness operators are increasingly adopting software platforms that support mobile apps, virtual training, automated billing, and AI-driven engagement. The growing preference for hybrid fitness models, which combine in-person and online experiences, further drives demand. In addition, rising consumer expectations for personalized fitness journeys and contactless solutions continue to stimulate market expansion.

Canada Gym Management Software Market Insight

The Canada gym management software market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing investments in fitness infrastructure and the digitalization of gym operations. With a strong focus on health and wellness, fitness providers in Canada are integrating management platforms to streamline member services, automate class scheduling, and enhance data analytics. The rising popularity of boutique studios, along with government initiatives supporting physical wellness and technology adoption, is further accelerating software uptake in the country.

Mexico Gym Management Software Market Insight

The Mexico gym management software market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a growing fitness-conscious population and rising demand for modernized fitness services. Gyms and wellness centers are increasingly deploying software to enhance member retention and simplify operations. As digital adoption rises across urban centers, software vendors are expanding their reach by offering localized, cloud-based platforms tailored for small and mid-sized gyms. This trend is expected to continue as Mexico’s fitness industry evolves and embraces technology-driven solutions.

North America Gym Management Software Market Share

The North America gym management software industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- Oracle (U.S.)

- MINDBODY, Inc. (U.S.)

- Zenoti (U.S.)

- WellnessLiving Systems Inc. (Canada)

- Jonas Fitness Inc. (U.S.)

- Virtuagym (Netherlands)

- Wodify Technologies Ltd (U.S.)

- Zen Planner, LLC (U.S.)

- RhinoFit (U.S.)

- TeamUp Sports, Inc (U.K.)

- PushPress, Inc. (U.S.)

- ABC Glofox (Ireland)

- ShapeNet Software (U.S.)

- TeamUp Sports, Inc (U.K.)

- Treshna Enterprises Ltd. (New Zealand)

- Omnify (India)

- Exercise (U.S.)

What are the Recent Developments in North America Gym Management Software Market?

- In June 2024, ABC Fitness Solutions, a leading U.S.-based provider of gym management software, launched ABC Pulse, an AI-powered engagement and retention tool designed to help fitness operators personalize member experiences and improve retention. By analyzing behavioral data and class participation trends, the platform enables gyms to deliver targeted communications and incentives. This innovation highlights ABC’s commitment to leveraging advanced technologies to address retention challenges and enhance member satisfaction across fitness facilities

- In May 2024, Mindbody Inc., a major wellness and fitness software provider, announced a strategic integration with Apple Health and Google Fit to offer real-time health data syncing within its mobile app. This enhancement allows fitness studios and members to monitor wellness metrics directly through the Mindbody ecosystem, promoting a more holistic and data-driven fitness experience. The move reinforces the company’s dedication to digital wellness and member engagement through seamless cross-platform connectivity

- In April 2024, Glofox, a gym management platform under ABC Fitness, introduced a new feature suite focused on hybrid fitness delivery, including enhanced live-streaming capabilities, on-demand class hosting, and automated virtual bookings. These upgrades are tailored for North American boutique fitness studios looking to scale digital services. This development reflects Glofox’s strategic push to support evolving business models that blend in-person and virtual experiences

- In March 2024, ClubReady, a U.S.-based gym and studio management software provider, partnered with Trainerize to launch integrated nutrition and personal training modules. This collaboration offers gyms a unified solution for managing training programs, diet plans, and client communication, streamlining member services under one system. The partnership underscores the growing demand for all-in-one fitness platforms that cater to comprehensive wellness goals

- In January 2024, Zen Planner, a U.S. provider specializing in gym management for small and mid-sized fitness businesses, introduced a new analytics dashboard and reporting tool designed to help gym owners make data-driven decisions. The feature enables real-time tracking of KPIs such as member attendance, revenue trends, and class popularity. This launch reinforces Zen Planner’s focus on empowering smaller operators with enterprise-grade intelligence to optimize performance and growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.