North America Health Screening Market

Market Size in USD Billion

CAGR :

%

USD

2.02 Billion

USD

5.03 Billion

2025

2033

USD

2.02 Billion

USD

5.03 Billion

2025

2033

| 2026 –2033 | |

| USD 2.02 Billion | |

| USD 5.03 Billion | |

|

|

|

|

North America Health Screening Market Size

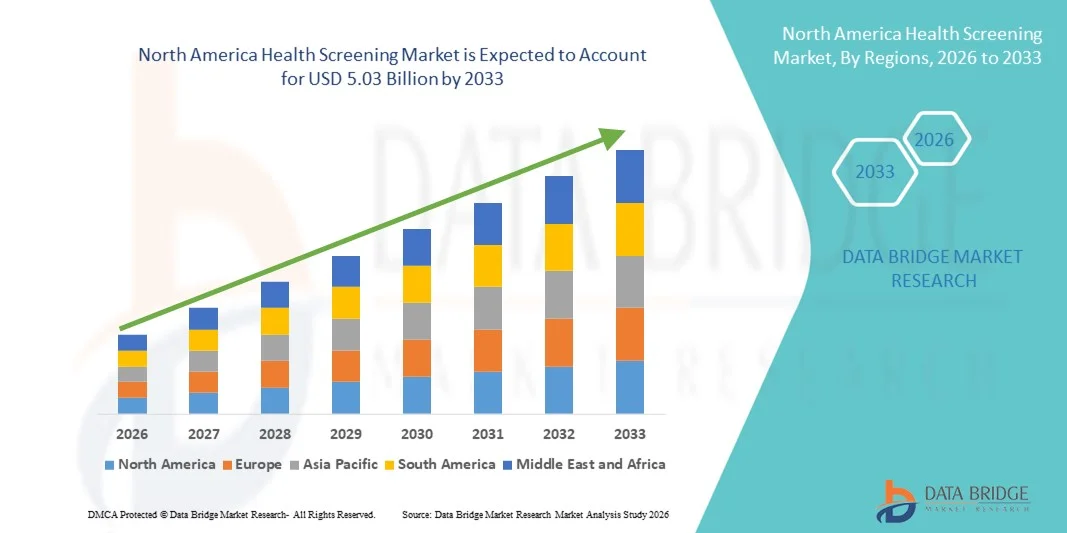

- The North America health screening market size was valued at USD 2.02 billion in 2025 and is expected to reach USD 5.03 billion by 2033, at a CAGR of 12.1% during the forecast period

- The market’s growth is largely driven by increased emphasis on early disease detection and preventive care, rising prevalence of chronic conditions such as diabetes and cardiovascular diseases, and well‑established healthcare infrastructure that supports widespread screening programs across the United States and Canada

- Furthermore, advancements in diagnostics technologies, higher consumer awareness of health risks, and expanding adoption of personalized and digital screening solutions are fueling demand for routine and specialized screening services across both clinical and community health settings

North America Health Screening Market Analysis

- Health screening, encompassing preventive tests and diagnostic evaluations for early disease detection, is becoming an essential component of modern healthcare systems in both clinical and community settings due to its ability to improve patient outcomes, reduce long-term treatment costs, and support population health management

- The rising demand for health screening is primarily driven by increasing awareness of chronic diseases, government initiatives promoting preventive healthcare, and the growing adoption of digital and at-home diagnostic solutions that offer convenience and timely results

- The United States dominated the North America health screening market with the largest revenue share of 81.4% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the strong presence of leading diagnostics companies, with substantial growth in routine and specialized screening programs for cancer, cardiovascular, and metabolic disorders, supported by innovations in lab-based and point-of-care testing

- Canada is expected to be the fastest-growing country in the region during the forecast period, driven by increasing public awareness of early disease detection, government-backed preventive healthcare initiatives, expanding community-based and at-home screening programs, and rising adoption of digital diagnostics solutions

- Cancer screening segment dominated the market with a market share of 35.9% in 2025, fueled by the high prevalence of cancer, emphasis on early detection, and widespread adoption of advanced imaging and molecular diagnostic techniques

Report Scope and North America Health Screening Market Segmentation

|

Attributes |

North America Health Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Health Screening Market Trends

Digital and AI-Enabled Screening Solutions

- A significant and accelerating trend in the North America health screening market is the integration of digital platforms and artificial intelligence (AI) into preventive and diagnostic testing, enhancing accuracy, efficiency, and patient engagement

- For instance, AI-powered imaging platforms now assist radiologists in detecting early-stage cancers, while digital platforms enable patients to schedule, track, and receive results from multiple screenings through mobile applications

- AI integration in health screening allows predictive risk assessments, personalized recommendations, and automated alerts for follow-up testing, helping healthcare providers optimize patient care pathways. For instance, some diagnostic companies use machine learning algorithms to flag abnormal biomarker patterns for timely interventions

- The seamless combination of AI, cloud-based data management, and telehealth services enables centralized monitoring and analysis of patient screening records, allowing healthcare professionals to manage large populations efficiently

- This trend toward intelligent, accessible, and patient-centric screening solutions is reshaping expectations for preventive healthcare. For instance, companies such as Guardant Health and Freenome are developing AI-enabled liquid biopsy tests that offer early cancer detection with minimal invasiveness

- The demand for digital and AI-driven health screening solutions is growing rapidly across hospitals, diagnostic centers, and at-home testing services as consumers increasingly prioritize convenience, early detection, and comprehensive preventive care

- Collaborations between tech startups and healthcare providers are expanding the adoption of remote and automated screening solutions. For instance, AI-powered telehealth platforms are being integrated into routine population health programs to increase coverage and efficiency

North America Health Screening Market Dynamics

Driver

Rising Health Awareness and Preventive Care Initiatives

- The growing emphasis on preventive healthcare, rising prevalence of chronic diseases, and expanding healthcare infrastructure are major drivers of the health screening market

- For instance, in March 2025, LabCorp announced expansion of its digital health screening platform, aiming to integrate AI-powered risk assessment tools across multiple screening services

- As patients increasingly seek early detection solutions, health screening programs offer advanced diagnostics, risk prediction, and timely intervention, creating strong demand over traditional reactive care approaches

- Furthermore, the widespread adoption of telehealth and at-home testing kits is making preventive health screening more accessible and convenient for diverse populations

- The ability to track results digitally, schedule follow-ups, and share data with healthcare providers via mobile applications drives adoption across clinics, hospitals, and residential settings

- Increasing government and private insurance initiatives to cover preventive screening are encouraging higher participation rates. For instance, new policies in the U.S. and Canada offer reimbursement for AI-assisted cancer and cardiovascular screenings

- Rising consumer awareness about lifestyle-related diseases and the benefits of early detection motivates proactive participation in health screening programs. For instance, social campaigns highlighting diabetes and hypertension prevention have boosted demand for routine screenings

- Collaborations between diagnostic labs and technology providers are accelerating market adoption, enabling faster, more efficient, and scalable screening solutions. For instance, AI-enabled imaging combined with telemedicine platforms is being deployed in urban and rural areas alike

Restraint/Challenge

Data Privacy Concerns and High Costs

- Concerns regarding patient data privacy, cybersecurity, and regulatory compliance pose a significant challenge to market growth in North America

- For instance, high-profile reports of healthcare data breaches have made some consumers hesitant to adopt digital screening and telehealth platforms

- Addressing these privacy and cybersecurity concerns through secure encryption, HIPAA-compliant platforms, and robust authentication is crucial for building patient trust. In addition, the relatively high cost of advanced screening technologies can limit access, particularly for smaller clinics or underinsured populations

- While prices for basic health screening tests have decreased, premium services such as AI-driven imaging or multi-biomarker panels often remain expensive, restricting adoption among price-sensitive patients

- Slow regulatory approvals for new AI-driven or automated screening technologies can delay market entry and adoption. For instance, some advanced liquid biopsy tests have faced extended evaluation periods by U.S. and Canadian regulatory agencies

- Variability in healthcare infrastructure across regions creates disparities in access to screening services. For instance, rural areas often face shortages of specialized diagnostic centers and trained personnel

- Consumer skepticism regarding the accuracy of AI-assisted or at-home screening tests can hinder adoption. For instance, some patients prefer traditional in-clinic testing due to concerns over reliability of remote diagnostics

- Overcoming these challenges through enhanced data security, patient education on digital health benefits, and the development of more affordable screening options is vital for sustained market growth

North America Health Screening Market Scope

The market is segmented on the basis of test type, package type, panel type, sample type, technology, condition, sample collection site, and distribution channel.

- By Test Type

On the basis of test type, the North America health screening market is segmented into cholesterol tests, diabetes test, cancer screening, general check-up test, STDs, blood pressure test, and others. The Cancer Screening segment dominated the market with the largest revenue share of 35.9% in 2025, driven by the high prevalence of various cancers and the growing emphasis on early detection for improved survival rates. Cancer screening tests, including mammograms, colonoscopies, and liquid biopsies, are widely adopted across hospitals and diagnostic laboratories, contributing to consistent revenue generation. Patients and healthcare providers increasingly rely on advanced imaging and molecular diagnostics to detect cancers at an early stage. Moreover, insurance coverage and government initiatives for preventive cancer screenings further support the dominance of this segment. The availability of AI-enabled diagnostic tools enhances the accuracy and efficiency of cancer detection, boosting market uptake. Healthcare campaigns promoting awareness about cancer prevention and early intervention also drive consistent demand for screening tests.

The Diabetes Test segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising prevalence of diabetes, lifestyle changes, and increasing awareness about disease management. At-home and clinic-based glucose monitoring solutions are expanding accessibility to diabetic populations. The convenience of early diagnosis through non-invasive or minimally invasive testing methods encourages more routine testing. Growing government programs for metabolic disorder prevention support higher adoption rates. Technological advancements in continuous glucose monitoring and AI-assisted predictive analytics make diabetes testing more efficient. Rising health consciousness and preventive care adoption among millennials and senior citizens further propel growth in this segment.

- By Package Type

On the basis of package type, the market is segmented into basic health screening, senior citizen profile, women health check, men health check, heart check, diabetes check, and others. The Basic Health Screening segment dominated the market in 2025, owing to its wide applicability across all age groups and ease of administration. It typically includes general blood tests, urine analysis, blood pressure measurement, and basic metabolic panels. Hospitals, clinics, and diagnostic labs frequently offer these packages as introductory preventive care solutions. These packages are cost-effective, making them highly attractive to individuals seeking routine health monitoring. The growing emphasis on early disease detection ensures sustained demand for basic screening. Healthcare providers often bundle basic packages with other preventive services to increase patient engagement and adherence.

The Senior Citizen Profile package is expected to witness the fastest growth from 2026 to 2033, driven by the aging population in the U.S. and Canada and increasing focus on geriatric preventive care. These packages typically include cardiovascular tests, bone density screening, cancer markers, and metabolic assessments tailored to senior health needs. With the rise of age-related chronic diseases, early detection becomes critical for reducing complications. Hospitals and diagnostic centers are increasingly offering specialized preventive programs for seniors. Growing insurance coverage for senior preventive packages encourages adoption. Digital health platforms and AI-enabled risk assessments further enhance the effectiveness of these packages, fueling rapid growth.

- By Panel Type

On the basis of panel type, the market is segmented into multi-test panels and single-test panels. The Multi-Test Panels segment dominated the market in 2025, as they provide comprehensive health insights through a single visit, enhancing convenience and compliance for patients. These panels combine multiple tests such as liver function, kidney function, lipid profiles, and metabolic markers, reducing the need for repeated visits. Hospitals, clinics, and diagnostic labs favor multi-test panels for efficiency and revenue optimization. These panels are particularly popular among working professionals and health-conscious individuals seeking complete assessments. AI-assisted interpretation of multi-panel results improves diagnostic accuracy and personalization of care. The growing adoption of preventive care programs and corporate health check-ups supports the dominance of this segment.

The Single-Test Panels segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing demand for targeted screening based on individual risk factors. Patients often prefer specific tests for conditions such as diabetes, cholesterol, or cardiovascular risk assessment. At-home test kits and point-of-care devices make single-test panels convenient and accessible. Rising awareness of personalized health monitoring encourages adoption. Technology integration, such as AI-enabled predictive analytics, enhances the value of single-test panels. The lower cost and simplicity of single-test panels make them ideal for rapid deployment in clinics and remote areas, driving their rapid growth.

- By Sample Type

On the basis of sample type, the market is segmented into blood, urine, serum, saliva, and others. The Blood sample segment dominated the market in 2025, owing to its broad applicability in detecting metabolic disorders, cancer markers, cardiovascular risk factors, and infectious diseases. Blood tests offer high diagnostic accuracy and reliability, making them the preferred choice in hospitals and diagnostic laboratories. Most multi-test panels rely on blood samples, further supporting this segment’s dominance. The growing adoption of preventive health check-ups and routine monitoring drives consistent demand for blood-based tests. Integration with digital reporting and AI-assisted analysis enhances efficiency and patient engagement. Healthcare policies and insurance coverage also promote regular blood testing as a preventive measure.

The Saliva sample segment is expected to witness the fastest growth from 2026 to 2033, driven by non-invasive testing trends and the rise of at-home diagnostic kits. Saliva is increasingly used for hormone tests, genetic screening, and certain infectious disease tests. The convenience, ease of collection, and minimal discomfort encourage higher adoption. Startups and diagnostic companies are innovating with saliva-based testing platforms integrated with AI for rapid analysis. Growing awareness of personalized preventive care fuels interest in saliva-based tests. Telehealth and home delivery services further enable the expansion of this segment, accelerating its CAGR.

- By Technology

On the basis of technology, the market is segmented into immunoassays, medical imaging, QPCR, Q-FISH, TRF, STELA, and others. The Medical Imaging segment dominated the market in 2025, driven by its critical role in early detection and diagnosis of conditions such as cancer, cardiovascular diseases, and neurological disorders. Imaging technologies such as MRI, CT scans, and mammography provide high-resolution visuals that allow accurate and timely diagnosis. Hospitals and diagnostic centers heavily invest in imaging infrastructure due to its reliability and broad applicability. Integration with AI enhances image interpretation, improving diagnostic accuracy and patient outcomes. Preventive healthcare programs routinely recommend imaging as part of multi-test panels, supporting revenue dominance. Government initiatives and insurance coverage for imaging-based screenings further drive adoption.

The QPCR (Quantitative Polymerase Chain Reaction) segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for molecular diagnostics and infectious disease testing. QPCR is widely used for rapid, sensitive detection of pathogens, genetic markers, and biomarkers for metabolic and cancer-related conditions. Its ability to provide precise quantification in minimal sample volumes makes it suitable for both hospitals and at-home test kits. Technological advancements and automation improve efficiency and turnaround time. Growing emphasis on personalized medicine and predictive healthcare supports adoption of QPCR tests. The method’s adaptability to high-throughput platforms enables scalable testing for population health programs, accelerating growth.

- By Condition

On the basis of condition, the market is segmented into cardiovascular disease, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, hepatitis-c complications, immunology-related conditions, and others. The Cancer segment dominated the market in 2025, owing to the high prevalence and mortality associated with various cancers and the increasing focus on early detection for improved survival rates. Hospitals, diagnostic centers, and specialized clinics widely use cancer biomarkers, imaging, and liquid biopsy tests. Government and insurance initiatives for routine cancer screenings further reinforce the dominance of this segment. Technological advancements such as AI-assisted imaging and predictive analytics improve diagnostic accuracy. Preventive healthcare awareness campaigns targeting early cancer detection drive patient participation. Multi-test panels often include cancer screening as a core component, enhancing the segment’s revenue share.

The Cardiovascular Disease segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising incidence of heart-related disorders, lifestyle changes, and increasing awareness about preventive cardiac care. Blood pressure, cholesterol, and ECG-based screenings are becoming routine in clinical and at-home settings. Digital and wearable monitoring solutions allow continuous cardiac risk assessment, supporting proactive interventions. Insurance coverage for heart health check-ups encourages adoption. Integration with telehealth platforms enables remote monitoring of high-risk patients. Corporate wellness programs and senior citizen health initiatives further contribute to the growth of cardiovascular screening.

- By Sample Collection Site

On the basis of sample collection site, the market is segmented into hospital, homes, diagnostic laboratories, offices, and others. The Hospital segment dominated the market in 2025, as hospitals offer comprehensive diagnostic services, access to advanced technologies, and skilled personnel for accurate health screening. Multi-test panels, imaging, and molecular diagnostics are primarily conducted in hospital settings to ensure reliability and clinical supervision. Hospitals provide standardized procedures and follow-up consultations, increasing patient confidence. Corporate health packages often coordinate with hospitals for large-scale employee screenings. Government-backed preventive programs frequently utilize hospital infrastructure for routine checks. Hospitals’ reputation for high-quality testing continues to reinforce dominance in this segment.

The Homes segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing availability of at-home testing kits, telehealth services, and remote monitoring solutions. Home-based screenings offer convenience, privacy, and timely access to results, especially for chronic disease monitoring. Companies are integrating digital platforms and AI-enabled diagnostics to guide sample collection and interpretation. Growing health awareness and busy lifestyles encourage adoption of home testing. Wearable devices and saliva/blood-based kits further drive market penetration. COVID-19 accelerated the acceptance of home testing, creating a sustained growth trajectory.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. The Direct Tenders segment dominated the market in 2025, driven by large-scale procurement of health screening services by hospitals, government health programs, and corporate wellness initiatives. Direct tenders allow bulk pricing, standardized service delivery, and integration with institutional healthcare plans. Multi-year contracts with diagnostic labs ensure steady revenue and market stability. Public health campaigns often rely on direct tenders to conduct screenings across large populations. Hospitals and diagnostic chains prefer this channel to streamline procurement and reduce administrative burden. Strong vendor relationships and competitive tendering practices reinforce dominance in this segment.

The Retail Sales segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for at-home testing kits, pharmacy-based screenings, and online health platforms. Convenience, affordability, and accessibility drive consumer adoption through retail channels. Retail expansion into urban and semi-urban markets improves penetration. Digital integration allows consumers to order tests, track results, and consult doctors remotely. Awareness campaigns targeting preventive healthcare enhance retail uptake. Technology-driven retail solutions such as AI-assisted test interpretation accelerate growth.

North America Health Screening Market Regional Analysis

- The United States dominated the North America health screening market with the largest revenue share of 81.4% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and the strong presence of leading diagnostics companies, with substantial growth in routine and specialized screening programs for cancer, cardiovascular, and metabolic disorders, supported by innovations in lab-based and point-of-care testing

- Patients and healthcare providers in the region increasingly value the convenience, accuracy, and comprehensive insights offered by modern health screening solutions, including multi-test panels, AI-assisted diagnostics, and at-home testing kits

- This widespread adoption is further supported by government-backed preventive care initiatives, corporate wellness programs, growing health awareness, and the integration of digital health platforms, establishing health screening as a core component of routine healthcare for both individuals and organizations

The U.S. Health Screening Market Insight

The U.S. health screening market captured the largest revenue share of 81.4% in 2025 within North America, driven by advanced healthcare infrastructure, high healthcare expenditure, and widespread adoption of preventive care programs. Consumers and healthcare providers are increasingly prioritizing early disease detection and comprehensive health assessments through multi-test panels, AI-assisted diagnostics, and at-home testing solutions. The growing preference for digital health platforms, telehealth integration, and personalized preventive care further propels the market. Moreover, government initiatives, corporate wellness programs, and insurance coverage for routine screenings are significantly contributing to the market's expansion.

Canada Health Screening Market Insight

The Canada health screening market is expected to witness the fastest growth during the forecast period, fueled by government-backed preventive healthcare initiatives, rising awareness of chronic disease management, and expanding telehealth adoption. Canadians are increasingly seeking accessible and convenient screening options, including at-home testing kits and community-based health programs. The growing focus on early detection of cancer, cardiovascular diseases, and metabolic disorders is supporting rapid adoption. In addition, technological integration through AI and digital reporting platforms is enhancing diagnostic accuracy and patient engagement, driving market growth.

Mexico Health Screening Market Insight

The Mexico health screening market is projected to grow at a significant CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing awareness of preventive healthcare. The adoption of health screening services in hospitals, diagnostic centers, and corporate wellness programs is increasing steadily. Government initiatives to improve public health and early disease detection are fostering greater accessibility and adoption. At-home testing and telehealth platforms are gaining popularity, particularly in urban areas. Growing investment in healthcare infrastructure and partnerships with international diagnostic providers are supporting market expansion

North America Health Screening Market Share

The North America Health Screening industry is primarily led by well-established companies, including:

- Quest Diagnostics Incorporated (U.S.)

- Labcorp (U.S.)

- BioReference Health, LLC (U.S.)

- Natera, Inc. (U.S.)

- Siemens Healthineers AG (U.S.)

- Exact Sciences Corporation (U.S.)

- QuidelOrtho Corporation (U.S.)

- Teladoc Health, Inc. (U.S.)

- ARUP Laboratories (U.S.)

- DDRC Agilus Diagnostics Limited (Canada)

- LifeLabs LP (Canada)

- Clinical Reference Laboratory, Inc. (U.S.)

- Freenome Holdings, Inc. (U.S.)

- Genova Diagnostics, Inc. (U.S.)

- ACM Medical Laboratory Inc. (U.S.)

- LabPlus (U.S.)

- BlueHive Health (U.S.)

- Guardant Health, Inc. (U.S.)

- Cleveland HeartLab (U.S.)

- SpectraCell Laboratories (U.S.)

What are the Recent Developments in North America Health Screening Market?

- In May 2025, the U.S. FDA approved the first at‑home cervical cancer screening test, the Teal Wand, enabling women to collect HPV screening samples at home and mail them to a lab, offering a comfortable and convenient alternative to in‑clinic Pap smears. The approval was based on a clinical study showing comparable accuracy to clinician‑collected samples, marking a significant expansion of accessible preventive screening options

- In February 2025, an improved at‑home colorectal cancer screening test, Cologuard Plus, was announced for availability starting June 2025, offering higher sensitivity and longer sample viability than the original test, potentially increasing early detection rates and coverage. This upgraded version supports easier non‑invasive colorectal screening for individuals aged 45 and older

- In February 2025, the Canadian Cancer Society launched a nationwide awareness campaign to increase breast cancer screening uptake across Canada, targeting women and gender‑diverse people aged 40–74 who have never been screened or haven’t been screened recently. The campaign emphasizes the importance of regular mammograms and aims to improve early detection participation

- In August 2024, the U.S. Food and Drug Administration approved the first over‑the‑counter at‑home syphilis antibody test, developed by NOWDiagnostics, designed to improve screening for sexually transmitted infection exposure outside traditional clinical settings. This approval supports broader STI screening access and earlier detection

- In July 2024, the FDA expanded approval for HPV tests using self‑collection in health care settings, allowing patients to collect vaginal samples themselves for HPV screening if they prefer not to undergo a pelvic exam. This regulatory expansion increases patient choice and comfort in cervical cancer screening

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.