North America Healthcare Bpo Market

Market Size in USD Billion

CAGR :

%

USD

134.60 Billion

USD

321.54 Billion

2024

2032

USD

134.60 Billion

USD

321.54 Billion

2024

2032

| 2025 –2032 | |

| USD 134.60 Billion | |

| USD 321.54 Billion | |

|

|

|

|

North America Healthcare BPO Market Size

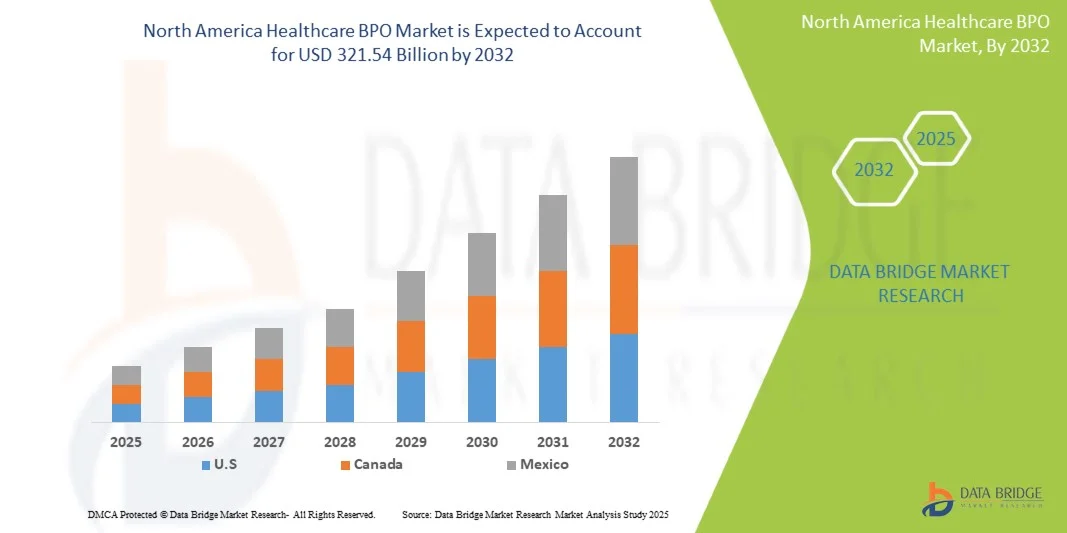

- The North America Healthcare BPO Market size was valued at USD 134.6 billion in 2024 and is expected to reach USD 321.54 billion by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the increasing outsourcing of healthcare processes, including medical billing, coding, claims processing, and revenue cycle management, driven by the need for operational efficiency and cost optimization in healthcare providers

- Furthermore, rising demand for streamlined administrative workflows, enhanced data management, and compliance with regulatory standards is accelerating the adoption of Healthcare BPO solutions, thereby significantly boosting the industry’s growth

North America Healthcare BPO Market Analysis

- The North America Healthcare BPO Market, comprising outsourced services such as medical billing, coding, claims processing, and revenue cycle management for healthcare providers, is witnessing significant growth as organizations seek operational efficiency, cost optimization, and improved patient care

- Rising demand for streamlined administrative workflows, advanced data management, and compliance with evolving regulatory standards is further accelerating the adoption of Healthcare BPO solutions, significantly boosting industry growth

- The U.S. dominated the North America Healthcare BPO Market with the largest revenue share of 44.3% in 2024, supported by the presence of leading service providers, advanced healthcare infrastructure, and strong adoption of digital healthcare solutions

- Canada is expected to be the fastest-growing market in the healthcare BPO sector, projected to register a CAGR of 7.6% during the forecast period, driven by increasing healthcare investments, rising patient volumes, and growing adoption of outsourced healthcare services by hospitals and clinics

- The Payer Services segment dominated the market with the largest revenue share of 42.8% in 2024, driven by the increasing demand for claim processing, revenue cycle management, member enrollment services, and data analytics

Report Scope and North America Healthcare BPO Market Segmentation

|

Attributes |

Healthcare BPO Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Healthcare BPO Market Trends

“Emerging Trend Towards Process Optimization and Digital Transformation”

- A significant and accelerating trend in the North America Healthcare BPO Market is the increasing adoption of advanced process optimization and digital transformation initiatives. Organizations are leveraging cloud-based platforms, robotic process automation (RPA), and analytics-driven workflows to improve operational efficiency, reduce costs, and enhance service quality

- For instance, several leading BPO providers are implementing centralized claims processing solutions and automated revenue cycle management platforms, streamlining administrative tasks, and improving turnaround times for healthcare providers. Similarly, outsourcing firms are increasingly offering specialized services for telemedicine, patient engagement, and remote monitoring support, enabling hospitals and clinics to focus more on core medical functions

- Digitalization in Healthcare BPO allows for greater accuracy in billing, coding, and claims adjudication, while analytics-driven insights help identify inefficiencies and improve resource allocation. Advanced workflow management systems provide end-to-end visibility across healthcare operations, enabling better decision-making and improved patient satisfaction

- The integration of secure data platforms and interoperable systems is helping Healthcare BPO firms offer scalable, flexible, and compliant solutions across multiple regions. This trend towards more streamlined, technology-enabled, and data-driven operations is reshaping expectations for service providers and healthcare organizations alike

- Companies such as Cognizant, Accenture, and TCS are increasingly investing in cloud-based Healthcare BPO solutions that incorporate predictive analytics, automated reporting, and workflow standardization, enhancing operational efficiency and compliance adherence

- The demand for healthcare BPO services focused on digital transformation and process optimization is growing rapidly across hospitals, clinics, and insurance providers, as organizations prioritize efficiency, cost-effectiveness, and high-quality patient care

North America Healthcare BPO Market Dynamics

Driver

“Rising Need for Operational Efficiency and Cost Reduction in Healthcare”

- The increasing complexity of healthcare administration, growing patient volumes, and rising costs are driving organizations to adopt BPO services for improved efficiency. Outsourcing functions such as medical billing, coding, claims processing, and patient support allows providers to reduce administrative burdens and operational expenses

- For instance, in March 2024, Optum, a leading healthcare services company, announced the expansion of its Revenue Cycle Management (RCM) services in North America, deploying AI-driven analytics to improve claims accuracy and reduce reimbursement delays. Such initiatives are expected to drive the North America Healthcare BPO Market growth during the forecast period

- Healthcare providers are seeking external expertise to navigate regulatory complexities, maintain compliance, and improve overall service delivery. BPO solutions provide scalable, flexible, and reliable support across different healthcare processes, from patient onboarding to post-treatment follow-ups

- The increasing adoption of cloud-based platforms, real-time analytics, and workflow automation is enabling better resource allocation, faster turnaround times, and enhanced patient experience, further propelling the adoption of Healthcare BPO services

Restraint/Challenge

“Concerns Regarding Data Security and Compliance”

- Data privacy, security, and compliance remain significant challenges for healthcare BPO providers. Sensitive patient information handled during billing, claims processing, and patient support must adhere to strict regulations such as HIPAA in the U.S. and GDPR in Europe. Any breaches or lapses can result in severe legal and financial penalties, affecting trust and market adoption

- For instance, in July 2023, a prominent healthcare BPO firm experienced a minor data breach affecting a limited number of patient records, emphasizing the need for robust cybersecurity protocols and regular audits to maintain compliance and client confidence

- In addition, the relatively high initial investment required to implement advanced BPO solutions, including RPA, cloud infrastructure, and analytics platforms, can be a barrier for smaller healthcare providers or organizations in developing regions

- While cloud-based solutions and outsourcing models are becoming more cost-effective, perceived risks and upfront costs can still hinder widespread adoption

- Overcoming these challenges through stronger data protection measures, regulatory compliance frameworks, and scalable, affordable service offerings is vital for sustained market growth

North America Healthcare BPO Market Scope

The market is segmented on the basis of component, and end user.

• By Component

On the basis of component, the North America Healthcare BPO Market is segmented into Payer Services, Provider Services, and Pharmaceutical Services. The Payer Services segment dominated the market with the largest revenue share of 42.8% in 2024, driven by the increasing demand for claim processing, revenue cycle management, member enrollment services, and data analytics. Payer organizations are outsourcing administrative and operational tasks to reduce operational costs, improve accuracy, and enhance overall efficiency. The segment benefits from advanced AI-driven tools, cloud-based platforms, and automation solutions that streamline claims management and reporting. Rising focus on compliance, fraud detection, and process optimization further reinforces the segment’s dominance across North America and Europe.

The Provider Services segment is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032. Growth is fueled by the increasing adoption of outsourced medical billing, coding, revenue cycle management, patient engagement, and care coordination services. Hospitals and healthcare providers are leveraging BPO solutions to reduce administrative burden, improve workflow efficiency, and enhance patient satisfaction. Integration of AI-based analytics, telehealth support, and real-time performance monitoring accelerates the adoption of Provider Services globally. The rising trend of digital healthcare and value-based care models further supports the rapid expansion of this segment in both developed and emerging markets.

• By End User

On the basis of end user, the North America Healthcare BPO Market is segmented into Hospital, Dental Clinics, Public Services, Life Sciences Companies, Medical Devices Companies, Pharmacy Benefit Managers, and Others. The Hospital segment accounted for the largest revenue share of 44.5% in 2024, driven by extensive outsourcing of administrative tasks, IT support, medical coding, billing, and patient data management. Hospitals are increasingly adopting BPO solutions to streamline operations, ensure regulatory compliance, reduce errors, and optimize revenue cycles. The segment also benefits from implementation of cloud-based solutions, automation, and AI-enabled analytics that improve operational efficiency and reduce turnaround times.

The Life Sciences Companies segment is expected to witness the fastest CAGR of 20.7% from 2025 to 2032, driven by the outsourcing of research and development, clinical trial management, regulatory affairs, pharmacovigilance, and data management services. Life sciences companies are increasingly relying on specialized BPO providers to accelerate drug development, ensure global regulatory compliance, and optimize operational efficiency. Integration of AI-powered analytics, real-time monitoring, and digital reporting platforms further supports rapid adoption. Rising R&D investment and demand for faster clinical trial outcomes continue to propel this segment forward across North America, Europe, and Asia-Pacific.

North America Healthcare BPO Market Regional Analysis

- North America dominated the North America Healthcare BPO Market with the largest revenue share in 2024, driven by increasing demand for efficient healthcare operations, process automation, and adoption of digital healthcare solutions

- The region’s growth is supported by advanced healthcare infrastructure, high investments in hospitals and clinics, and a strong presence of leading service providers offering comprehensive BPO solutions

- High patient volumes, increasing complexity of healthcare administration, and the need for operational efficiency are further fueling the adoption of Healthcare BPO services across North America

U.S. North America Healthcare BPO Market Insight

The U.S. North America Healthcare BPO Market captured the largest revenue share of 44.3% in 2024, supported by the presence of leading service providers, advanced healthcare infrastructure, and strong adoption of digital healthcare solutions across hospitals, clinics, and insurance providers. The increasing focus on operational efficiency, faster claims processing, and better management of patient data is driving the growth of the North America Healthcare BPO Market in the U.S.

Canada North America Healthcare BPO Market Insight

Canada North America Healthcare BPO Market is expected to be the fastest-growing market in the Healthcare BPO sector, projected to register a CAGR of 7.6% during the forecast period. This growth is driven by increasing healthcare investments, rising patient volumes, and growing adoption of outsourced healthcare services by hospitals, clinics, and other healthcare facilities. Canadian healthcare providers are increasingly leveraging BPO services to optimize administrative processes, reduce operational costs, and improve overall service delivery.

North America Healthcare BPO Market Share

The Healthcare BPO industry is primarily led by well-established companies, including:

- Cognizant (U.S.)

- Accenture (Ireland )

- Wipro Limited (India)

- Infosys Limited (India)

- TATA Consultancy Services Limited (India)

- Genpact (U.S.)

- HCL Technologies (India)

- EXL Service Holdings, Inc. (U.S.)

- Conduent, Inc. (U.S.)

- Tech Mahindra Limited (India)

Latest Developments in North America Healthcare BPO Market

- In October 2024, Priority Health and Healthcare Management Administrators, Inc. (HMA) announced a strategic alliance to launch a Third-Party Administrator (TPA) solution for self-funded employers, effective January 1, 2025. This collaboration aims to provide employers with access to Priority Health's comprehensive provider network while empowering them to customize their health plans to meet the unique needs of their employees

- In January 2022, Hinduja Global Solutions Limited (HGS) completed the sale of its healthcare services business to wholly-owned subsidiaries of Betaine B.V., a Netherlands-based entity owned by Baring Private Equity Asia Fund VIII. The transaction, valued at approximately $1.2 billion, involved the transfer of all client contracts and assets, including infrastructure related to the healthcare services business. Over 29,000 employees from HGS across four geographies—India, the U.S., Jamaica, and the Philippines—joined the new organization, effective January 6, 2022

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.