North America Hearing Aids Market

Market Size in USD Billion

CAGR :

%

USD

5.84 Billion

USD

9.67 Billion

2024

2032

USD

5.84 Billion

USD

9.67 Billion

2024

2032

| 2025 –2032 | |

| USD 5.84 Billion | |

| USD 9.67 Billion | |

|

|

|

|

North America Hearing Aids Market Size

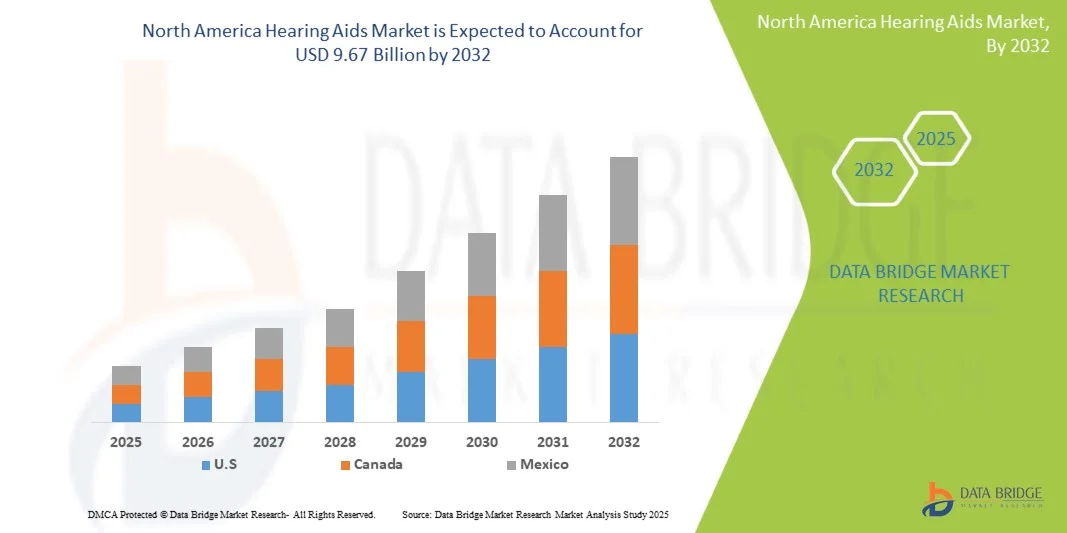

- The North America Hearing Aids Market size was valued at USD 5.84 billion in 2024 and is expected to reach USD 9.67 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of hearing loss globally, coupled with increasing awareness about the benefits of early diagnosis and advanced hearing solutions. Continuous technological innovations such as Bluetooth-enabled devices, rechargeable batteries, and AI-based sound processing are enhancing user experience and driving adoption across all age groups. Moreover, government initiatives to improve hearing healthcare access and insurance coverage for hearing devices are further propelling market demand

- Furthermore, growing consumer preference for discreet, comfortable, and high-performance hearing aids is leading to the rapid development of next-generation products with improved connectivity and customization features. The integration of digital health technologies, such as remote monitoring and smartphone-based adjustments, is expanding the accessibility and usability of hearing aids. These converging factors are accelerating the uptake of Hearing Aids solutions, thereby significantly boosting the industry’s growth

North America Hearing Aids Market Analysis

- Hearing aids, designed to amplify sound and improve hearing for individuals with hearing loss, are becoming increasingly essential medical devices in both clinical and personal healthcare settings due to their advanced technology, comfort, and ability to significantly enhance quality of life

- The escalating demand for hearing aids is primarily fueled by the rising prevalence of age-related and noise-induced hearing loss, increasing awareness about auditory health, and continuous innovations in digital signal processing, miniaturization, and wireless connectivity

- The U.S. dominated the North America Hearing Aids Market with the largest revenue share of 42.3% in 2024, driven by advanced healthcare infrastructure, high adoption of digital hearing aid technologies, and a strong presence of leading manufacturers such as Starkey, Sonova, and GN Hearing. The growing geriatric population, increasing prevalence of hearing loss, and supportive reimbursement policies are further accelerating market demand. In addition, the integration of AI-powered and Bluetooth-enabled hearing aids is enhancing user convenience, boosting adoption rates across both clinical and direct-to-consumer channels

- Canada is expected to be the fastest-growing market in the hearing aids industry during the forecast period (2025–2032), projected to register a CAGR of 8.6%. This growth is attributed to rising awareness of hearing health, expanding access to advanced audiology services, and government initiatives promoting early hearing loss detection. Increasing availability of over-the-counter (OTC) hearing aids and digital platforms offering remote audiology consultations are also fueling market expansion, especially in semi-urban and rural regions

- The Digital Hearing Aids segment held the largest market share of 84.3% in 2024, attributed to their superior sound processing capabilities, programmability, and compatibility with smartphones and wireless accessories

Report Scope and North America Hearing Aids Market Segmentation

|

Attributes |

North America Hearing Aids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Hearing Aids Market Trends

“Technological Advancements and Integration of AI in Hearing Devices”

- A significant and accelerating trend in the global North America Hearing Aids Market is the growing integration of artificial intelligence (AI), advanced signal processing, and connectivity features that enhance personalization and hearing precision. AI-powered hearing aids are revolutionizing user experience by automatically adjusting sound levels and environments based on listening contexts, such as crowded places, quiet rooms, or outdoor settings

- For instance, leading manufacturers such as Oticon and Widex have developed AI-driven models capable of learning user preferences and optimizing sound profiles in real time, ensuring natural hearing experiences with minimal manual adjustment. Similarly, Phonak’s Paradise series incorporates intelligent noise management and directional microphone technology to deliver superior speech clarity and background sound reduction

- The integration of AI and digital algorithms in hearing aids enables features such as real-time language translation, tinnitus masking, and adaptive sound enhancement based on environmental acoustics. For instance, Signia’s Augmented Xperience (AX) platform uses advanced processing to separate speech from background noise, creating clearer communication in complex sound environments. Furthermore, enhanced Bluetooth connectivity allows users to seamlessly stream audio from smartphones, televisions, and other digital devices, improving overall convenience

- The combination of smart sensors, AI-driven feedback management, and automatic sound optimization is enabling hearing aids to transition from simple amplification devices to intelligent health companions. Through integrated mobile applications, users can monitor hearing health, adjust settings remotely, and receive updates or tele-audiology consultations, fostering a connected and user-centric hearing care ecosystem

- This trend toward intelligent, adaptive, and digitally integrated hearing solutions is fundamentally transforming user expectations and clinical practices. Consequently, companies such as ReSound, Starkey, and GN Hearing are focusing on expanding their AI-based product lines with features like motion detection, health tracking, and advanced sound personalization

- The demand for AI-integrated hearing aids is increasing rapidly across both elderly and younger populations, as users increasingly prioritize convenience, improved sound accuracy, and seamless integration with digital lifestyles

North America Hearing Aids Market Dynamics

Driver

“Rising Prevalence of Hearing Loss and Growing Geriatric Population”

- The rising prevalence of hearing impairment, especially among the aging population, is a primary driver for the growth of the North America Hearing Aids Market. According to the World Health Organization (WHO), over 430 million people globally require hearing rehabilitation, and this number is expected to rise to 700 million by 2050, accounting for a significant portion of this population

- For instance, in March 2024, Starkey announced the European launch of its Genesis AI hearing aid, which uses deep neural network processing to replicate natural human hearing more precisely. Such developments are expected to accelerate market expansion during the forecast period

- As awareness of hearing health grows, more individuals are seeking early diagnosis and advanced treatment options, driving demand for technologically sophisticated and cosmetically appealing hearing aids

- In addition, rising healthcare expenditure, supportive reimbursement frameworks, and growing accessibility to audiology centers across globe are strengthening market adoption

- The growing preference for invisible, rechargeable, and Bluetooth-enabled hearing aids that deliver superior sound quality and comfort further contributes to market growth. The increasing acceptance of remote hearing care and tele-audiology services is also enabling patients to access fitting and adjustment support conveniently, especially in rural or underserved areas

Restraint/Challenge

“High Cost and Limited Awareness in Developing Regions”

- The relatively high cost of advanced hearing aids remains a key challenge to widespread adoption, particularly among patients without insurance coverage or those in developing European economies. Premium models equipped with AI, Bluetooth, and health-tracking features can be significantly more expensive than basic analog devices, deterring price-sensitive consumers

- For instance, while entry-level hearing aids may cost around €600–€800 per device, advanced AI-based options can exceed €3,000, creating accessibility barriers for many individuals

- Moreover, limited awareness about hearing health, social stigma associated with wearing hearing aids, and lack of regular hearing check-ups continue to hinder market penetration

- To address these barriers, companies are focusing on affordable product lines, awareness campaigns, and innovative payment models such as subscription-based hearing aid services. In addition, initiatives by European governments and health organizations to expand screening programs and provide reimbursement for digital hearing solutions are expected to boost accessibility

- Overcoming these challenges through education, affordability programs, and technological simplification will be crucial for ensuring long-term market growth. Continuous improvements in miniaturization, comfort, and AI-driven functionality are expected to gradually reduce costs and improve user acceptance of modern hearing aids across the region

North America Hearing Aids Market Scope

The market is segmented on the basis of product, device type, type of hearing loss, patient type, and distribution channel.

By Product

On the basis of product, the North America Hearing Aids Market is segmented into Hearing Aid Devices and Hearing Implants. The Hearing Aid Devices segment dominated the market in 2024, accounting for a 72.5% share of total revenue. This dominance is attributed to their non-invasive nature, affordability, and widespread use among both elderly and adult patients with mild to moderate hearing loss. The growing adoption of digital and rechargeable hearing aids, along with miniaturized designs such as behind-the-ear (BTE) and completely-in-canal (CIC) models, continues to support segment growth. In addition, increasing product innovation by major players such as Phonak, Oticon, and ReSound in terms of connectivity and comfort has significantly boosted user preference for hearing aid devices. Favorable reimbursement policies and awareness campaigns for early hearing loss management further strengthen this segment’s market position. The continued rise in geriatric population and product accessibility through retail and online channels contribute to sustained demand.

The Hearing Implants segment is projected to witness the fastest growth, registering a CAGR of 9.8% from 2025 to 2032. The growth is driven by advancements in cochlear and bone-anchored implant technologies that offer effective solutions for patients with severe or profound hearing loss who do not benefit from conventional hearing aids. Increasing clinical success rates, enhanced surgical outcomes, and improved post-implantation hearing performance have expanded their acceptance globally. Furthermore, government initiatives promoting early cochlear implantation in infants and children are expected to fuel demand. Technological innovations such as hybrid implants and MRI-safe devices are also propelling segment growth. As awareness increases and costs gradually decline, the implant segment is set to emerge as a major revenue contributor in the long term.

By Device Type

On the basis of device type, the North America Hearing Aids Market is segmented into Digital Hearing Aids and Analog Hearing Aids. The Digital Hearing Aids segment held the largest market share of 84.3% in 2024, attributed to their superior sound processing capabilities, programmability, and compatibility with smartphones and wireless accessories. Digital aids convert sound into digital signals, enabling advanced noise reduction, automatic environment adjustment, and feedback cancellation. The availability of AI-enhanced models and real-time sound customization through mobile apps has increased their adoption significantly. Manufacturers are focusing on innovations such as Bluetooth streaming, directional microphones, and rechargeable lithium-ion batteries, enhancing convenience and sound clarity. In addition, audiologists prefer digital aids for their precise fitting flexibility and diagnostic capabilities. The trend toward connected hearing care and tele-audiology further strengthens this segment’s dominance.

Conversely, the Analog Hearing Aids segment is anticipated to witness the fastest growth during the forecast period, with a CAGR of 7.4% from 2025 to 2032. This growth can be attributed to their lower cost, longer battery life, and preference among users who seek simple amplification without advanced digital processing. Analog devices are commonly used in developing regions or among first-time users transitioning from traditional hearing solutions. The rising availability of hybrid analog-digital models offering basic noise filtration and gain control is expanding this segment’s relevance. As affordability becomes a critical factor in emerging markets, analog hearing aids continue to serve as an entry-level solution for cost-conscious consumers, ensuring steady demand.

By Type of Hearing Loss

On the basis of hearing loss type, the North America Hearing Aids Market is segmented into Sensorineural Hearing Loss and Conductive Hearing Loss. The Sensorineural Hearing Loss segment dominated the market in 2024, capturing a 79.6% revenue share. This dominance is driven by the high prevalence of age-related and noise-induced hearing impairments worldwide. As this condition typically involves damage to the inner ear or auditory nerve, hearing aids and cochlear implants are often the most effective management options. Increasing exposure to occupational and environmental noise, coupled with an aging population, continues to expand the affected patient base. The introduction of advanced sound processing and noise suppression technologies in digital aids enhances hearing clarity for this group. In addition, early detection programs and government-led hearing health campaigns are boosting diagnosis and treatment rates for sensorineural conditions.

The Conductive Hearing Loss segment is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032. The growth is supported by rising incidences of ear infections, otosclerosis, and congenital ear malformations that result in conductive impairment. Growing awareness of surgical and device-based corrective options, such as bone conduction hearing aids and middle ear implants, is also driving adoption. Improvements in diagnostic precision and tailored device design for specific ear conditions are expected to enhance treatment outcomes. Furthermore, ongoing product innovations, such as water-resistant and MRI-compatible bone conduction systems, are contributing to market expansion in this segment.

By Patient Type

On the basis of patient type, the North America Hearing Aids Market is segmented into Adults and Pediatrics. The Adult segment held the largest market share in 2024, accounting for 81.4% of global revenue. The prevalence of age-related hearing loss (presbycusis) and lifestyle-related auditory damage from prolonged exposure to loud environments are major contributing factors. Adults also demonstrate higher purchasing power and greater access to hearing care services, further supporting dominance. The increasing number of adults adopting hearing aids for occupational and social functioning improvements enhances segment growth. Moreover, technological advancements that allow discreet, customizable, and app-controlled hearing aids appeal strongly to this demographic. Awareness initiatives focusing on early screening and destigmatizing hearing aid use among adults are also fostering adoption.

Meanwhile, the Pediatric segment is forecast to register the fastest CAGR of 10.2% between 2025 and 2032. The rising number of congenital and early-onset hearing loss cases, coupled with improved neonatal hearing screening programs across Europe, North America, and Asia-Pacific, is fueling demand. Governments and healthcare institutions are emphasizing early intervention, which significantly improves language and cognitive development outcomes. Pediatric-focused hearing aids designed for comfort, durability, and wireless connectivity are gaining traction. In addition, educational support systems and government-funded child hearing programs contribute to segment growth.

By Distribution Channel

On the basis of distribution channel, the North America Hearing Aids Market is segmented into Large Retail Chains, Manufacturer-Owned Retail Chains, Public, and Others. The Large Retail Chains segment dominated the market in 2024 with a 38.7% share, supported by wide product availability, convenience, and bundled audiology services. Retail chains offer consumers the ability to compare multiple brands, access professional fitting, and benefit from promotional financing. The growth of retail audiology centers such as Boots Hearingcare and Amplifon across Europe and North America has strengthened this segment’s presence. In addition, expanding partnerships between hearing aid manufacturers and retail giants are increasing accessibility to premium devices. Consumers increasingly prefer in-store consultations combined with post-purchase support, enhancing trust and satisfaction levels.

The Manufacturer-Owned Retail Chains segment is expected to witness the fastest growth, with a CAGR of 9.1% from 2025 to 2032. The rise of vertically integrated models, where companies such as Sonova, Demant, and GN Store Nord own distribution channels, is enabling better brand control and customer service consistency. These outlets provide tailored fitting solutions, seamless warranty support, and direct access to the latest product innovations. In addition, digital integration with tele-audiology platforms allows these retailers to extend aftercare services remotely. As manufacturers increasingly focus on direct-to-consumer engagement, the segment is set to capture a greater share of the overall distribution network.

North America Hearing Aids Market Regional Analysis

- North America dominated the North America Hearing Aids Market with the largest revenue share of 40.8% in 2024, driven by the high prevalence of hearing loss, advanced healthcare infrastructure, and growing adoption of technologically enhanced hearing solutions

- The region’s dominance is supported by increasing awareness about hearing health, strong reimbursement frameworks, and the presence of leading global manufacturers such as Sonova, GN Hearing, and Starkey

- In addition, the widespread use of AI-driven and Bluetooth-enabled hearing aids is enhancing sound quality and user experience, contributing to significant market penetration across both clinical and direct-to-consumer segments

U.S. North America Hearing Aids Market Insight

The U.S. North America Hearing Aids Market dominated the North American North America Hearing Aids Market with a commanding revenue share of 42.3% in 2024, primarily driven by the rising aging population and increasing incidence of hearing impairment. The adoption of digital and smart hearing aids has grown rapidly, supported by advanced distribution networks and strong brand presence from major players like Starkey and Sonova. Moreover, favorable government support, technological innovations such as rechargeable and AI-powered devices, and the availability of over-the-counter (OTC) hearing aids are driving greater accessibility and adoption. The increasing preference for personalized and wireless hearing solutions is also propelling steady market expansion.

Canada North America Hearing Aids Market Insight

Canada North America Hearing Aids Market is projected to be the fastest-growing market in the region during 2025–2032, with an expected CAGR of 8.6%. This growth is fueled by increasing awareness of hearing health, expanding access to specialized audiology care, and proactive government initiatives promoting early screening and treatment for hearing impairment. The country’s healthcare policies support affordability and access to digital hearing aids, while the growing acceptance of OTC devices and tele-audiology platforms enhances convenience for consumers. Moreover, technological advancements and collaborations between hearing aid manufacturers and healthcare providers are expected to sustain strong growth momentum across Canada’s market.

North America Hearing Aids Market Share

The Hearing Aids industry is primarily led by well-established companies, including:

- Sonova (Switzerland)

- GN Hearing (Denmark)

- William Demant (Denmark)

- WS Audiology (Denmark)

- Starkey Hearing Technologies (U.S.)

- Amplifon (Italy)

- Cochlear Limited (Australia)

- MED-EL (Austria)

- Eargo (U.S.)

- Widex (Denmark)

Latest Developments in North America Hearing Aids Market

- In January 2024, Lexie Hearing launched the Lexie B2 Plus self-fitting over-the-counter (OTC) hearing aids powered by Bose. The updated version introduced an optional in-app hearing test and a portable charging case offering up to 18 hours of battery life on a single charge. This innovation reflects the growing consumer demand for affordable, user-friendly hearing aids that allow individuals to self-adjust their hearing experience without requiring professional fittings

- In May 2024, Jabra Enhance unveiled its Select 500 hearing aid, the company’s smallest OTC model to date. The device supports next-generation Bluetooth LE Audio and Auracast broadcast audio, enabling users to stream sound directly from compatible devices and public venues. This launch reinforced Jabra’s focus on enhancing connectivity, accessibility, and personalization within the consumer hearing segment

- In August 2024, Sonova Holding AG introduced its new Sphere Infinio hearing aid platform, built on the powerful DEEPSONIC chip technology. The platform utilizes real-time artificial intelligence (AI) capable of processing speech 53 times faster than previous models. This advancement allows for more accurate speech enhancement and noise reduction, offering users a natural listening experience even in complex acoustic environments

- In August 2024, GN Hearing expanded its ReSound Nexia product family, incorporating improved Bluetooth connectivity and more flexible fitting options. The launch was aimed at supporting individuals with varying degrees of hearing loss while enabling seamless integration with smartphones and assistive devices. This expansion underscored GN’s ongoing commitment to accessible and adaptive hearing technology

- In October 2024, Starkey launched its Edge AI hearing aid featuring the new G2 Neuro Processing Unit (NPU). The device integrates artificial intelligence to enhance speech clarity, suppress background noise, and even monitor user health parameters such as physical activity and fall detection. Starkey’s innovation marks a major step toward combining audiology with digital health technology

- In March 2025, Google announced that Android 16 would introduce system-wide support for Auracast and Bluetooth LE Audio streaming for hearing aids. This update will enable users to connect directly to broadcast audio in public spaces such as airports, theaters, and classrooms. The move signifies a major milestone in accessibility, aligning smartphone ecosystems more closely with modern hearing-assistive devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.