North America Heart Pump Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.48 Billion

USD

9.24 Billion

2024

2032

USD

2.48 Billion

USD

9.24 Billion

2024

2032

| 2025 –2032 | |

| USD 2.48 Billion | |

| USD 9.24 Billion | |

|

|

|

|

North America Heart Pump Devices Market Size

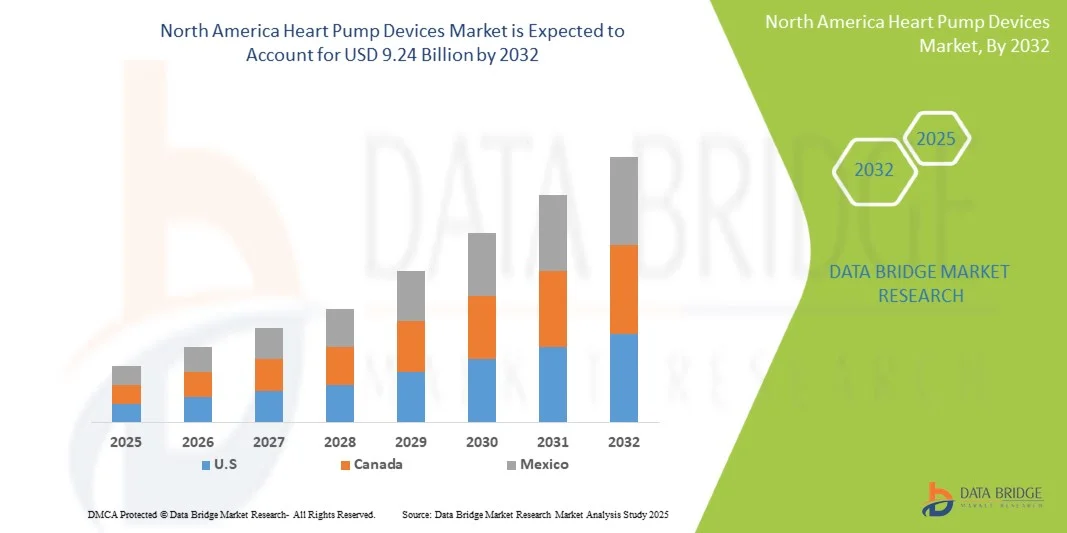

- The North America Heart Pump Devices Market size was valued at USD 2.48 billion in 2024 and is expected to reach USD 9.24 billion by 2032, at a CAGR of 17.87% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases and advancements in medical device technology, which are driving the adoption of innovative cardiac support solutions

- Furthermore, increasing demand for minimally invasive procedures, improved patient outcomes, and long-term cardiac support solutions is accelerating the uptake of Heart Pump Devices, thereby significantly boosting the industry's growth

North America Heart Pump Devices Market Analysis

- The North America Heart Pump Devices Market is witnessing increasing demand due to the rising prevalence of cardiovascular diseases, growing geriatric population, and enhanced awareness regarding advanced cardiac treatment options. The adoption of minimally invasive and implantable heart support devices is driving market expansion globally

- Market growth is primarily fueled by technological advancements in cardiac support devices, increasing investments in healthcare infrastructure, and the rising preference for devices that improve patient outcomes and survival rates

- U.S. dominated the North America Heart Pump Devices Market with the largest revenue share of 84.5% in 2024, driven by advanced healthcare infrastructure, high patient inflow, strong presence of key medical device manufacturers, and government initiatives to promote cardiac care. Hospitals and specialized cardiac centers in the U.S. are increasingly adopting advanced heart pump technologies, including ventricular assist devices and implantable pumps, to manage heart failure and related conditions effectively

- Canada is expected to be the fastest-growing market in the heart pump devices sector during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032. Growth is supported by increasing cardiovascular disease prevalence, rising healthcare expenditure, expanding urban healthcare facilities, and government programs to improve access to advanced cardiac treatments in both urban and semi-urban areas

- Implantable Heart Pump Devices dominated the North America Heart Pump Devices Market with a revenue share of 48.1% in 2024. The dominance is attributed to minimally invasive implantation, reduced infection risks, and long-term patient mobility

Report Scope and North America Heart Pump Devices Market Segmentation

|

Attributes |

Heart Pump Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Heart Pump Devices Market Trends

“Enhanced Efficiency and Adoption in Clinical Settings”

- A significant and accelerating trend in the North America Heart Pump Devices Market is the increasing adoption of advanced heart pump technologies across hospitals, specialty clinics, and outpatient centers. This expansion is significantly improving patient care and procedural efficiency

- For instance, modern percutaneous and implantable heart pump systems are being integrated into catheterization labs and intensive care units, allowing clinicians to provide rapid circulatory support in acute and chronic heart failure cases. Similarly, ventricular assist devices (VADs) are increasingly employed in specialized cardiac centers to manage end-stage heart disease

- Technological improvements in heart pump devices, including miniaturized designs, enhanced flow control, and real-time monitoring capabilities, are enabling safer and more effective interventions. These devices reduce procedural complexity, improve patient hemodynamics, and support better clinical outcomes

- The seamless integration of heart pump devices into cardiac care protocols facilitates more precise and continuous patient management. Through real-time monitoring and control, clinicians can optimize therapy, reduce complications, and improve recovery times

- This trend towards more efficient, reliable, and clinically integrated heart pump systems is fundamentally transforming expectations in cardiac care. Consequently, companies such as Abbott, Medtronic, and Abiomed are developing advanced heart pump solutions with improved durability, patient comfort, and device reliability

- The demand for heart pump devices is growing rapidly across both acute and chronic care segments, as healthcare providers increasingly prioritize improved clinical outcomes, reduced complications, and extended patient support

North America Heart Pump Devices Market Dynamics

Driver

“Growing Need Due to Rising Cardiovascular Disease Prevalence and Advanced Clinical Adoption”

- The increasing prevalence of cardiovascular diseases, including heart failure, cardiogenic shock, and acute myocardial infarction, coupled with expanding hospital and specialty clinic infrastructure, is a significant driver for the heightened demand for heart pump devices

- For instance, in March 2024, Abiomed launched an upgraded version of its Impella heart pump platform, aimed at providing improved circulatory support for high-risk cardiac procedures. Such initiatives by key companies are expected to drive the Heart Pump Devices industry growth in the forecast period

- As hospitals and cardiac care centers strive to provide better patient outcomes, heart pump devices offer advanced features such as enhanced flow management, reduced hemolysis, and real-time hemodynamic monitoring, providing a compelling upgrade over conventional circulatory support methods

- Furthermore, the growing adoption of minimally invasive procedures and increased preference for percutaneous and implantable solutions are making heart pump devices an integral component of modern cardiac care

- The ability to manage acute and chronic heart failure, provide temporary circulatory support, and reduce ICU stays are key factors propelling the adoption of heart pump devices in both hospitals and specialized clinics. Expansion of cardiac care programs and increasing awareness of device benefits further contribute to market growth

Restraint/Challenge

“Concerns Regarding High Costs and Reimbursement Limitations”

- The relatively high cost of advanced heart pump devices poses a significant challenge to broader market penetration. Hospitals and clinics with budget constraints may hesitate to adopt premium systems, limiting accessibility, particularly in developing regions

- For instance, despite clinical efficacy, the upfront and maintenance costs of ventricular assist devices and percutaneous heart pumps can restrict adoption in smaller healthcare facilities

- Addressing these cost concerns through favorable reimbursement policies, leasing options, and cost-effective device innovations is crucial for broader market acceptance. Companies such as Medtronic and Abbott are focusing on improving device affordability and demonstrating cost-effectiveness through clinical outcomes

- The perception of high device cost, combined with limited insurance coverage in some regions, can hinder widespread adoption, especially for healthcare providers who prioritize budget allocations for multiple cardiovascular interventions

- While prices are gradually decreasing and reimbursement awareness is improving, the perceived premium for advanced heart pump technologies can still impede adoption. Overcoming these challenges through education, improved insurance coverage, and cost optimization will be vital for sustained market growth

North America Heart Pump Devices Market Scope

The market is segmented on the basis of product, type, therapy, and end user.

• By Product

On the basis of product, the North America Heart Pump Devices Market is segmented into Ventricular Assist Devices (VADs), Intra-aortic Balloon Pumps (IABPs), and Total Artificial Heart (TAH). The Ventricular Assist Devices (VADs) segment dominated the market with the largest revenue share of 46.3% in 2024. This dominance is due to widespread adoption in advanced heart failure management, high clinical reliability, and significant improvements in patient quality of life. VADs are extensively used for bridge-to-transplant and destination therapy, supported by minimally invasive procedures. Hospitals and specialized cardiac centers across the U.S. prefer VADs for their proven outcomes, patient safety, and integrated monitoring systems. Availability of reimbursement programs and strong clinical evidence further reinforces market leadership. Leading manufacturers have invested in device miniaturization, enhanced durability, and advanced telemetry features, increasing usability. Patient preference for long-term support and improved survival rates drives continuous adoption. VADs’ compatibility with other therapies, such as drug regimens and cardiac rehabilitation, strengthens their position. Additionally, robust training programs for clinicians, along with government support for advanced cardiac therapies, ensure consistent demand.

The Total Artificial Heart (TAH) segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032. The rapid growth is fueled by increasing cardiovascular disease prevalence, rising demand for end-stage heart failure solutions, and technological advancements in artificial heart systems. TAH adoption is particularly strong for bridge-to-transplant therapy in patients ineligible for conventional interventions. Improvements in portability, energy efficiency, and remote monitoring enhance patient usability and clinical acceptance. Ongoing clinical trials and research innovations contribute to increased adoption rates. Growing awareness among cardiologists and patients, alongside supportive healthcare policies, further accelerate market expansion. Enhanced safety protocols, regulatory approvals, and integration with hospital management systems strengthen confidence in TAH solutions. The expanding geriatric population and higher patient inflow drive continuous demand. Increasing government and private investment in cardiac care technologies also boosts TAH adoption.

• By Type

On the basis of type, the North America Heart Pump Devices Market is segmented into Implantable Heart Pump Devices and Extracorporeal Heart Pump Devices. Implantable Heart Pump Devices dominated the market with a revenue share of 48.1% in 2024. The dominance is attributed to minimally invasive implantation, reduced infection risks, and long-term patient mobility. Hospitals prefer implantable devices for bridge-to-transplant and destination therapy because of better patient compliance and proven clinical outcomes. Continuous innovation in device miniaturization, wireless monitoring, and energy efficiency drives sustained adoption. Training programs for clinicians and extensive clinical evidence supporting long-term efficacy strengthen market position. Availability of reimbursement and insurance coverage also encourages utilization. Implantable devices are widely used in specialized cardiac centers, enhancing accessibility for patients. Integration with other cardiac therapies and rehabilitation programs contributes to steady adoption. Ongoing improvements in device durability, reliability, and hemodynamic support maintain leadership.

Extracorporeal Heart Pump Devices are expected to witness the fastest CAGR of 9.8% from 2025 to 2032, driven by rising acute heart failure cases and increasing adoption in critical care settings. Portable extracorporeal devices are gaining traction for temporary cardiac support during high-risk surgeries. Hospitals utilize these devices for bridge-to-candidacy and emergency interventions. Enhanced safety features, real-time monitoring, and device portability further drive adoption. Growing awareness among clinicians and patients contributes to rapid uptake. Technological advancements enabling improved hemodynamic support increase reliability. Rising investments in emergency cardiac care infrastructure boost demand. Increasing prevalence of cardiovascular diseases accelerates market growth. Ongoing product innovation in materials and design enhances user confidence and patient outcomes.

• By Therapy

On the basis of therapy, the North America Heart Pump Devices Market is segmented into Bridge-to-Transplant (BTT), Bridge-to-Candidacy (BTC), Destination Therapy (DT), and Other Therapies. Bridge-to-Transplant (BTT) dominated the market with a share of 44.7% in 2024 due to the high number of patients awaiting heart transplants and proven efficacy of BTT devices. BTT is widely adopted in specialized cardiac centers for its reliability, long-term hemodynamic support, and compatibility with transplantation protocols. Device integration with monitoring systems ensures patient safety. Robust clinical evidence and high survival rates strengthen adoption. Hospitals prefer BTT devices for end-stage heart failure management. Availability of insurance coverage and reimbursement programs promotes utilization. Ongoing training for healthcare professionals ensures standardized treatment. Technological advancements enhance procedural efficiency. BTT devices’ ability to support both bridge-to-transplant and destination therapy increases flexibility. Patient quality of life improvements encourage preference. The segment maintains strong leadership due to established clinical outcomes.

Destination Therapy (DT) is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by increasing geriatric population, rising prevalence of chronic heart failure, and preference for long-term support in patients ineligible for transplant. Expansion of specialized cardiac centers offering DT solutions accelerates adoption. Improvements in device safety, portability, and monitoring enhance usability. Patient awareness and acceptance are growing. Technological innovations support home-based and outpatient monitoring. Clinical guidelines increasingly recommend DT for high-risk patients. Government healthcare initiatives encourage adoption. Supportive reimbursement policies facilitate wider utilization. Rising patient inflow and chronic disease prevalence boost growth. Ongoing research and device innovation further accelerate segment expansion.

• By End User

On the basis of end user, the North America Heart Pump Devices Market is segmented into Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories, Research Institutes, and Others. Hospitals dominated the market with a revenue share of 50.2% in 2024 due to comprehensive infrastructure, trained specialists, and ability to manage complex cardiac cases. Hospitals are primary sites for implantation, monitoring, and long-term management. Advanced cardiac centers ensure high-quality outcomes. Robust procedural protocols and emergency support contribute to steady adoption. Clinical expertise and device availability strengthen market leadership. Ongoing investments in hospital cardiac units increase accessibility. Hospitals serve as central hubs for multiple therapies, reinforcing dominance. Insurance and reimbursement programs further support hospital adoption. Integration of devices with hospital management systems enhances efficiency.

Ambulatory Surgical Centers are expected to witness the fastest CAGR of 9.6% from 2025 to 2032 due to rising outpatient cardiac procedures, minimally invasive surgeries, and growing infrastructure investment. These centers provide patient convenience, shorter recovery times, and cost-effective solutions. Expansion of cardiac care services in outpatient settings drives adoption. Portable devices and improved monitoring enable safe use in ambulatory environments. Awareness among clinicians and patients encourages growth. Investment in advanced surgical facilities boosts capabilities. Rising prevalence of cardiovascular diseases in outpatient populations supports expansion. Technological advancements in portable pumps enhance safety and efficiency. Integration with telehealth and remote monitoring systems accelerates adoption.

North America Heart Pump Devices Market Regional Analysis

- U.S. dominated the North America Heart Pump Devices Market with the largest revenue share of 84.5% in 2024, driven by advanced healthcare infrastructure, high patient inflow, strong presence of key medical device manufacturers, and government initiatives to promote cardiac care. Hospitals and specialized cardiac centers in the U.S. are increasingly adopting advanced heart pump technologies, including ventricular assist devices and implantable pumps, to manage heart failure and related conditions effectively

- Canada is expected to be the fastest-growing market in the heart pump devices sector during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032. Growth is supported by increasing cardiovascular disease prevalence, rising healthcare expenditure, expanding urban healthcare facilities, and government programs to improve access to advanced cardiac treatments in both urban and semi-urban areas

- This widespread adoption is further supported by high healthcare expenditure, well-established clinical protocols, and growing awareness among clinicians regarding the benefits of advanced heart pump interventions

U.S. North America Heart Pump Devices Market Insight

The U.S. North America Heart Pump Devices Market captured the largest revenue share of 84.5% in 2024 within North America, driven by advanced healthcare infrastructure, high patient inflow, a strong presence of key medical device manufacturers, and supportive government programs to enhance cardiac care. Hospitals and specialized cardiac centers are increasingly adopting advanced heart pump technologies, including ventricular assist devices and implantable pumps, to manage heart failure and related conditions effectively.

Canada North America Heart Pump Devices Market Insight

The Canada North America Heart Pump Devices Market is expected to be the fastest-growing market in the Heart Pump Devices sector during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032. Growth is supported by rising prevalence of cardiovascular diseases, increasing healthcare expenditure, expansion of urban healthcare facilities, and government initiatives to improve access to advanced cardiac treatments in both urban and semi-urban areas.

North America Heart Pump Devices Market Share

The heart pump devices industry is primarily led by well-established companies, including:

- Abiomed, Inc. (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Sorin Group (Italy)

- Braun SE (Germany)

- HeartWare International, Inc. (U.S.)

- CARMAT SA (France)

- HeartWare International, Inc. (U.S.)

- NuPulseCV (U.S.)

- Berlin Heart GmbH (Germany)

- Jarvik Heart, Inc. (U.S.)

- SynCardia Systems, LLC (U.S.)

- LivaNova PLC (U.K.)

Latest Developments in North America Heart Pump Devices Market

- In December 2024, the U.S. Food and Drug Administration (FDA) expanded the indications for the Impella 5.5 with SmartAssist and Impella CP with SmartAssist heart pumps to include specific pediatric patients with symptomatic acute decompensated heart failure and cardiogenic shock. This premarket approval (PMA) is the highest level granted by the FDA for the safety and efficacy of medical devices

- In October 2024, Abbott initiated the TEAM-HF clinical trial, a first-of-its-kind study designed to improve outcomes in patients with worsening heart failure who could benefit from advanced therapy options. The trial aims to establish new, objective criteria to identify patients most at risk for developing end-stage heart failure and potentially offer life-saving therapeutic options sooner in their disease progression

- In May 2024, Stanford Medicine initiated a clinical trial for a pediatric heart pump device, demonstrating its potential to support children awaiting heart transplants. This device aims to bridge the gap for young patients with heart failure, offering a viable solution during the waiting period

- In January 2024, Abbott announced plans to discontinue production of its HeartMate II left ventricular assist device (LVAD) by 2026. This decision reflects the company's focus on advancing its HeartMate 3 LVAD technology, which has shown improved outcomes in patients with advanced heart failure

- In March 2025, BiVACOR, Inc. commenced an FDA-approved, first-in-human Early Feasibility Study (EFS) to evaluate the safety and performance of its BiVACOR total artificial heart (TAH) as a bridge-to-transplant solution for patients with severe biventricular heart failure. This innovative device utilizes magnetic levitation technology to provide continuous blood flow, aiming to address the limitations of current heart pump devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.