North Americal Heavy Metals Testing Market Analysis and Size

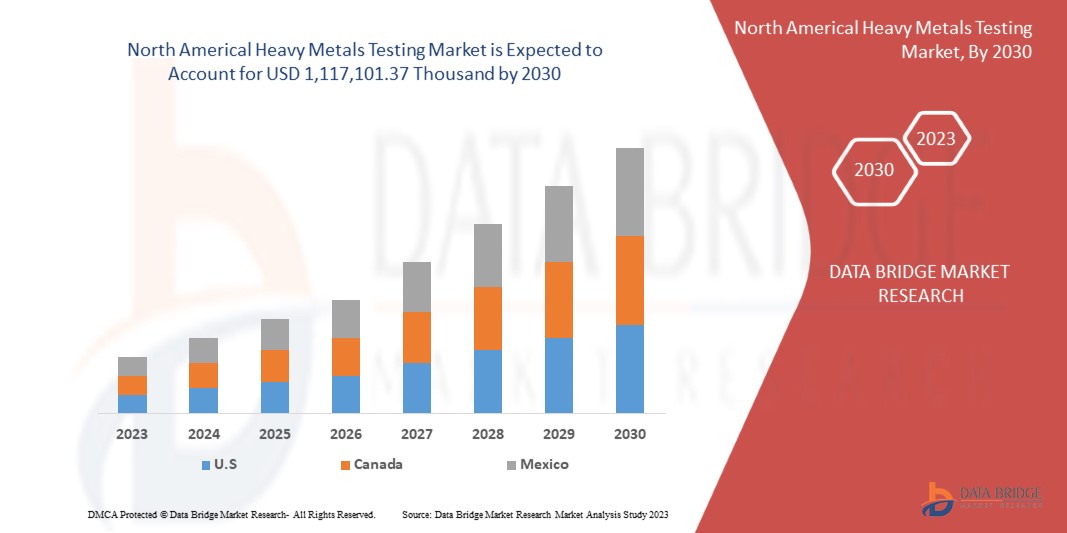

The heavy metals testing market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.8% in the forecast period of 2023 to 2030 and is expected to reach USD 1,117,101.37 thousand by 2030. The major factor driving the growth of the market is the rising popularity of heavy metals testing products among the consumers, and growing awareness regarding the properties of the heavy metal tesing products.

The heavy metals testing market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Technology (ICP, Metals Speciation (Methyl Mercury), Atomic Absorption Spectroscopy (AAS) and Others), Offering (Hardware, Software, Services), Automation (Manual, Semiautomatic, Fully Automatic), Target Metal (Arsenic, Cadmium, Lead, Mercury, Chromium, Tin, Copper, Tungsten, Zinc, Nickel, Selenium, Others), By End Use (Food, Dietary Supplement, Beverages, Feed Products, Pharmaceutical, Personal Care And Cosmetics, Fats And Oils, Blood And Other Samples, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

SGS Société Générale de Surveillance SA, Intertek Group plc, Eurofins Scientific, TÜV SÜD, ALS, Mérieux NutriSciences, Corporation, LGC Limited, AsureQuality. Microbac Laboratories, Inc., EMSL Analytical, Inc., ifp Institut für Produktqualität GmbH, OMIC USA Inc., Applied Technical Services., Brooks Applied Labs., Quicksilver Scientific, Inc., Symbio LABORATORIES, Alex Stewart International, UFAG LABORATORIEN and Consumer Product TestingSM Company. among others. |

Market Definition

Heavy metals are a group of metals and metalloids with relatively high density and are toxic even at ppb levels. Heavy metals normally occur in nature and are essential to life, but they can become toxic through accumulation in organisms. Heavy metal testing is important for irregular levels of toxic or potentially harmful metals in the food, pharmaceutical industry, personal care, or human body. The driving factors growth of the market includes growing consumer awareness regarding packaged Food and personal care ingredients.

Heavy Metals Testing Market Dynamics

Drivers

- Growing consumer awareness regarding packaged food and personal care ingredients

The demand for high-quality and safe food has increased. This rising demand for high-quality food is caused by the food quality issues such as the Maggi case in 2015. It has been found that Maggi has a poisonous amount of lead. This case made a large consumer base aware, in response to market pressure and reaction to other factors such as health concerns, which have been seen due to the increased number of foodborne illnesses. The increasing incidences of foodborne diseases have prompted consumers to bring about vital changes in their diet and lifestyle, making them more concerned regarding food safety and the quality of the food they purchase. Consumers are very much aware of the food they eat, and food safety is their prime concern when choosing any brand or packaged food item. Food safety is important for consumers' health, the entire food industry, and regulatory authorities. With the rising concern about food safety among consumers, the government is taking initiatives to promote safe food to consumers.

- Increase in the occurrence of foodborne diseases

Foodborne illness is caused by the consumption of spoiled or contaminated food with pathogenic microorganisms or inappropriate chemical composition, leading to illness. The rising instances of foodborne disease among consumers globally create huge demand for food chemical and pathogen testing equipment. The primary reason behind the increasing amount of foodborne disease in the food industry is the unaware workforce, food handlers, and manufacturers, as they lack knowledge of modern technologies, good manufacturing practices (GMP), hazard analysis, and critical control point (HACCP) systems, quality control. Several reports state the history and future of these increasing foodborne diseases around the globe.

Opportunities

- Stringent laws and regulations concerning the safety of products

The strict rules and standards governing food testing and personal care product composition testing will propel the market's expansion because authorities want to ensure that the food on the market is safe for consumption. In order to ensure consumer food safety and the highest possible food quality, along with the possible side effects of using personal care products, the government is developing new laws and regulations. The World Health Organization (WHO) estimates that 600 million people, or about 1 in 10, get diseases from eating tainted food. Therefore, to avoid food contamination and guarantee food safety worldwide, the governments of different countries have established strict laws for personal care products and food &beverage manufacturers.

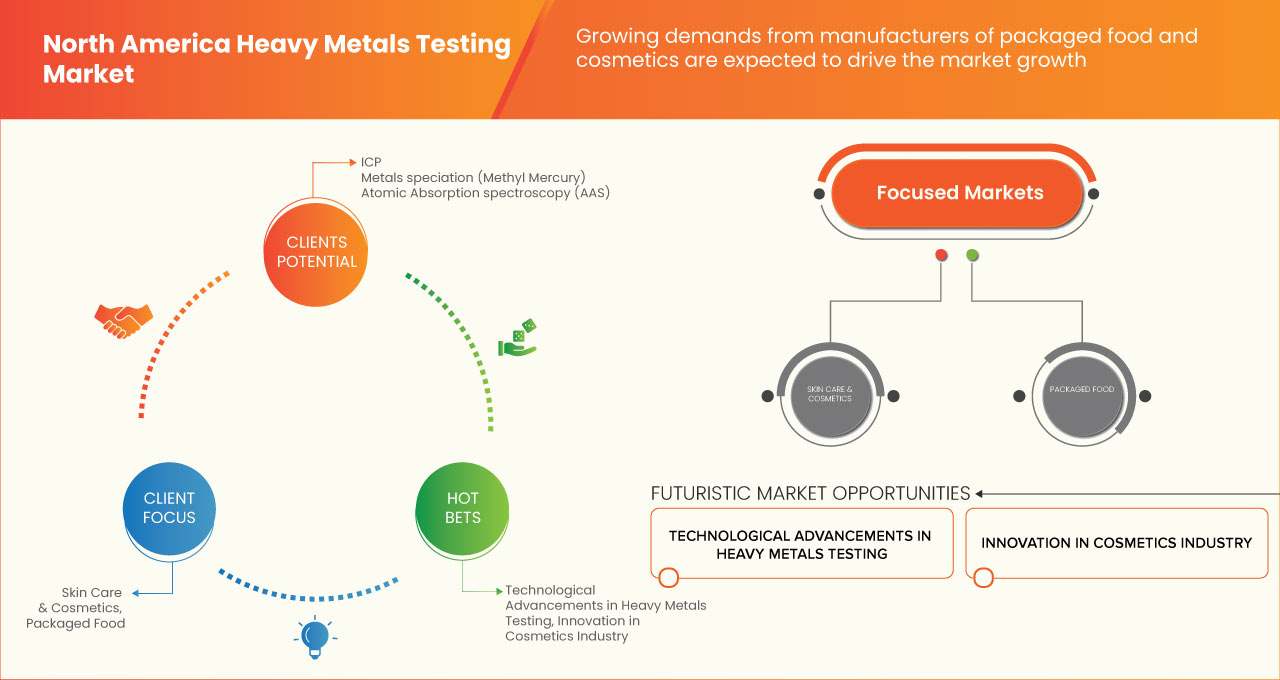

- Technological advancements in heavy metals testing science

The technology significantly influences the North America heavy metals testing market by updating old methods and discovering new ways to detect and identify the presence of heavy metals in food articles or personal care products, improving quality and cost reduction. Continuous innovation in this segment and their increasing trend can lead the North America heavy metals testing market to face extreme growth in the near future. All segments, such as food, dietary supplements, beverages, feed products, and pharmaceuticals, rely on the advancement in heavy metals testing and analysis. Several limitations are present in the science of heavy metals testing. However, researchers and the scientific community are working hard to overcome the limitations. Due to these reasons, there is an opportunity being created for the North America heavy metals testing market.

Restraints/Challenges

- Rise in heavy metal pollution in water

Heavy metals are toxic metallic elements with a high density, specific gravity, and atomic weight. Expeditious expansion and industrial development near the rivers have led to more stress on the river, and with increased stress, the water becomes polluted, and worsening environmental health is observed. Development and industrialization are taking place rapidly, which are considered major sources of water contamination. With heavy metals in lakes, rivers, groundwater, and various water sources, water gets polluted by the increased concentration of heavy metals and metalloids in water bodies. Heavy metals have the property of environmental persistence and bioaccumulation through which these heavy metals enter into the aquatic system and impair not only the quality of the aquatic ecosystem but also human health.

- Lack of technical expertise and knowledge in operating proper testing

Laboratory testing is an important tool to assist manufacturers in evaluating the amount of heavy metal in food, water, personal care products, and clinical purposes. Recent advances in analytical techniques and expanded consumer access to environmental laboratories led to a rise in laboratory testing for various environmental toxicants, including metals. However, a lack of knowledge and skills among small enterprises and manufacturers of heavy metals testing products will affect the evaluation and inspection of products.

The main threat to human health from heavy metals is lead, cadmium, mercury, and arsenic exposure. Lack of experience and technical knowledge, especially in small enterprises, will not be able to diagnose contaminants properly, which can lead to food and water-borne diseases and cause severe problems.

Recent Development

- In September 2022, LGC opened The Native Antigen Company (TNAC) as part of LGC Clinical Diagnostics at the Oxford Technology Park. This new site offers TNAC expanded manufacturing capacity for producing infectious disease reagants, antibodies and assays, which are vital development in clinical diagnostics. It helped the company to expand its consumer base and support consumers

- In July 2022, LGC launched a free app-based cannabis testing training app CannLearn which provides training on various aspects of testing. It will be considered a great tool for people new to the industry to get the required cannabis knowledge

Heavy Metals Testing Market Scope

The heavy metals testing market is categorized based on technology, offering, automation, target metal, end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Technology

- ICP

- Metals Speciation (Methyl Mercury)

- Atomic Absorption Spectroscopy (AAS)

- Others

On the basis of technology, the heavy metals testing market is segmented into ICP, metals speciation (methyl mercury), atomic absorption spectroscopy (AAS) and others.

Offering

- Hardware

- Software

- Services

On the basis of offering, the heavy metals testing market is segmented into hardware, software and services.

Automation

- Software Manual

- Semiautomatic

- Fully Automatic

On the basis of automation, the heavy metals testing market is segmented into manual, semiautomatic, and fully automatic.

Target Metal

- Arsenic

- Cadmium

- Lead

- Mercury

- Chromium

- Tin

- Copper

- Tungsten

- Zinc

- Nickel

- Selenium

- Others

On the basis of target metal, the heavy metals testing market is segmented into arsenic, cadmium, lead, Mercury, chromium, tin , copper, tungsten, zinc, nickel, selenium, and others.

End Use

- Food

- Dietary Supplement

- Beverages

- Feed Products

- Pharmaceuticals

- Personal Care And Cosmetics

- Fats And Oils

- Blood And Other Samples

- Others

On the basis of end use , the heavy metals testing market is segmented into Food,dietary supplement, beverages, feed products, pharmaceuticals, personal care and cosmetics, fats and oils, blood and other samples, and others.

Heavy Metals Testing Market Regional Analysis/Insights

The heavy metals testing market is segmented on the basis of technology, offering, automation, target metal, and end use.

The countries in the heavy metals testing market are the U.S., Canada, Mexico.

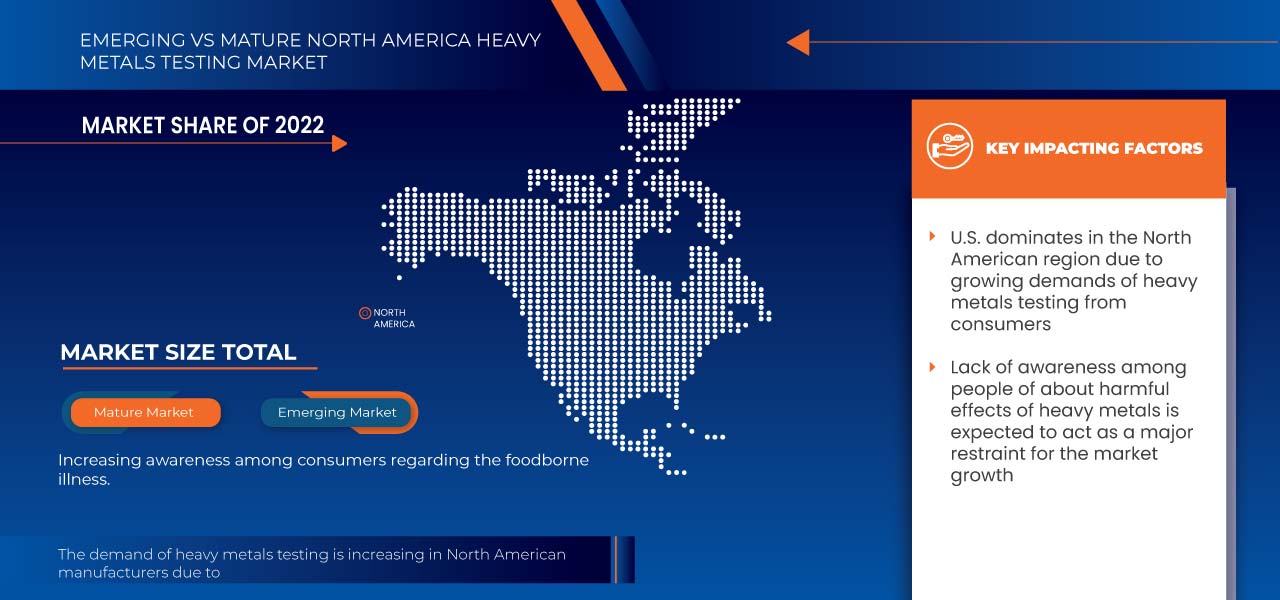

The U.S dominates in the North American region due to growing awareness regarding the properties of the heavy metals products.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Heavy Metals Testing Market Share Analysis

The heavy metals testing market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the heavy metals testing market.

Some of the major market players operating in the market are SGS Société Générale de Surveillance SA, Intertek Group plc, Eurofins Scientific, TÜV SÜD, ALS, Mérieux NutriSciences, Corporation, LGC Limited, AsureQuality. Microbac Laboratories, Inc., EMSL Analytical, Inc., ifp Institut für Produktqualität GmbH, OMIC USA Inc., Applied Technical Services., Brooks Applied Labs., Quicksilver Scientific, Inc., Symbio LABORATORIES, Alex Stewart International, UFAG LABORATORIEN and Consumer Product TestingSM Company. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEAVY METALS TESTING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 NORTH AMERICA HEAVY METALS TESTING MARKET PRODUCT LIFELINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRICE INDEX

4.5 RAW MATERIAL COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMER AWARENESS REGARDING PACKAGED FOOD AND PERSONAL CARE INGREDIENTS

6.1.2 INCREASE IN THE OCCURRENCE OF FOODBORNE DISEASES

6.1.3 RISING DEMAND FOR FOOD SAFETY AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 RISE IN HEAVY METAL POLLUTION IN WATER

6.2.2 LACK OF TECHNICAL EXPERTISE AND KNOWLEDGE IN OPERATING PROPER TESTING

6.3 OPPORTUNITIES

6.3.1 STRINGENT LAWS AND REGULATIONS CONCERNING THE SAFETY OF PRODUCTS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN HEAVY METALS TESTING SCIENCE

6.4 CHALLENGES

6.4.1 HIGH COST ASSOCIATED WITH RESEARCH AND DEVELOPMENT IN HEAVY METALS TESTING KITS

6.4.2 DISRUPTION IN THE SUPPLY CHAIN DUE TO COVID-19

7 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ICP

7.2.1 ICP-OES

7.2.2 HIGH-RESOLUTION ICP-MS

7.2.3 TRACE ICP-MS

7.3 METALS SPECIATION (METHYL MERCURY)

7.4 ATOMIC ABSORPTION SPECTROSCOPY (AAS)

7.5 OTHERS

8 NORTH AMERICA HEAVY METALS TESTING MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SERVICES

8.2.1 MAINTENANCE & SUPPORT

8.2.2 SYSTEM INTEGRATION & CONSULTING

8.2.3 MANAGED SERVICES

8.3 SOFTWARE

8.4 HARDWARE

9 NORTH AMERICA HEAVY METALS TESTING MARKET, BY AUTOMATION

9.1 OVERVIEW

9.2 FULLY AUTOMATIC

9.3 SEMI AUTOMATIC

9.4 MANUAL

10 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TARGET METAL

10.1 OVERVIEW

10.2 MERCURY

10.3 CADMIUM

10.4 LEAD

10.5 ARSENIC

10.6 ZINC

10.7 TIN

10.8 CHROMIUM

10.9 SELENIUM

10.1 COPPER

10.11 TUNGSTEN

10.12 NICKEL

10.13 OTHERS

11 NORTH AMERICA HEAVY METALS TESTING MARKET, BY END-USE

11.1 OVERVIEW

11.2 FOOD

11.2.1 SEAFOOD PRODUCTS

11.2.2 FRUITS & VEGETABLES

11.2.3 CEREALS & GRAINS

11.2.4 READY MEALS

11.2.5 SNACKS

11.2.6 CONVENIENCE FOOD

11.2.6.1 READY TO EAT PRODUCTS

11.2.6.2 SOUPS & SAUCES

11.2.6.3 NOODLES & PASTA

11.2.6.4 SEASONINGS & DRESSINGS

11.2.6.5 OTHERS

11.2.7 PROCESSED MEAT PRODUCTS

11.2.7.1 BEEF

11.2.7.2 POULTRY

11.2.7.3 PORK

11.2.7.4 OTHERS

11.2.8 BABY FOOD

11.2.9 CHOCOLATE & CONFECTIONERY

11.2.9.1 LIQUORICE

11.2.9.2 MARSHMALLOWS

11.2.9.3 CHEWING GUM

11.2.9.4 CANDIES

11.2.9.5 OTHERS

11.2.10 BAKERY PRODUCTS

11.2.10.1 BREADS

11.2.10.2 MUFFINS

11.2.10.3 BISCUITS & COOKIES

11.2.10.4 CAKES & PASTRIES

11.2.10.5 OTHERS

11.2.11 NUTS, SEEDS AND SPICES

11.2.12 FATS AND OIL

11.2.13 DAIRY PRODUCTS

11.2.13.1 CHEESE

11.2.13.2 SPREAD

11.2.13.3 YOGHURT

11.2.13.4 CREAMS

11.2.13.5 ICE-CREAM

11.2.13.6 OTHERS

11.2.14 OTHERS

11.3 DIETARY SUPPLEMENT

11.4 BEVERAGES

11.4.1 ALCOHOLIC BEVERAGES

11.4.1.1 WINES

11.4.1.2 BEERS

11.4.1.3 WHISKEY

11.4.1.4 OTHER ALCOHOLIC DRINK

11.4.2 NON ALCOHOLIC BEVERAGES

11.4.2.1 SOFT DRINKS

11.4.2.2 FLAVORED DRINKS

11.4.2.3 DAIRY DRINKS

11.4.2.4 DAIRY ALTERNATIVES DRINK

11.4.3 WATER

11.4.3.1 DRINKING WATER

11.4.3.2 INDUSTRIAL WATER

11.4.3.3 WASTEWATER

11.5 FEED PRODUCTS

11.5.1 LIVESTOCK FEED

11.5.2 WET PET FOOD

11.5.3 DRY PET FOOD

11.5.4 OTHERS

11.6 PHARMACEUTICAL

11.7 PERSONAL CARE AND COSMETICS

11.7.1 SKIN CARE

11.7.2 HAIR CARE

11.7.3 LIP CARE

11.7.4 OTHERS

11.8 FATS & OILS

11.9 BLOOD & OTHERS SAMPLES

11.1 OTHERS

12 NORTH AMERICA HEAVY METALS TESTING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 BUSINESS EXPANSION

13.3 BUSINESS ACQUISITION

13.4 PRODUCT LAUNCH

13.5 ACQUISITION

13.6 RECOGNISITION

13.7 ACHIEVEMENT

13.8 INAUGURATION

13.9 SEMINAR

13.1 NEW STANDARDS

13.11 APP LAUNCH

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 EUROFINS SCIENTIFIC (2022)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 SWOT

15.1.6 RECENT UPDATE

15.2 INTERTEK GROUP PLC (2022)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 SWOT

15.2.6 RECENT UPDATES

15.3 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA (2022)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 SWOT

15.3.6 RECENT UPDATE

15.4 ALS (2022)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 SWOT

15.4.6 RECENT UPDATES

15.5 LGC LIMITED (2022)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 SWOT

15.5.6 RECENT UPDATES

15.6 ALEX STEWART INTERNATIONAL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 SWOT

15.6.4 RECENT UPDATE

15.7 APPLIED TECHNICAL SERVICES.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 SWOT

15.7.4 RECENT UPDATE

15.8 ASUREQUALITY.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 SWOT

15.8.4 RECENT UPDATES

15.9 BROOKSAPPLIED LABS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 SWOT

15.9.4 RECENT UPDATES

15.1 CONSUMER PRODUCT TESTING℠ COMPANY.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 SWOT

15.10.4 RECENT UPDATES

15.11 EMSL ANALYTICAL, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 SWOT

15.11.4 RECENT UPDATE

15.12 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 SWOT

15.12.4 RECENT UPDATES

15.13 MÉRIEUX NUTRISCIENCES CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 SWOT

15.13.4 RECENT UPDATE

15.14 MICROBAC LABORATORIES, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 SWOT

15.14.4 RECENT UPDATE

15.15 OMIC USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 SWOT

15.15.4 RECENT UPDATES

15.16 QUICKSILVER SCIENTIFIC, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 SWOT

15.16.4 RECENT UPDATE

15.17 SYMBIO LABORATORIES

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 SWOT

15.17.4 RECENT UPDATES

15.18 TUV SUD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 SWOT

15.18.4 RECENT UPDATE

15.19 UFAG LABORATOREIN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 SWOT

15.19.4 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA METALS SPECIATION (METHYL MERCURY) IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA ATOMIC ABSORPTION SPECTROSCOPY (AAS) IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SOFTWARE IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA HARDWARE IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA FULLY AUTOMATIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA SEMI AUTOMATIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA MANUAL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MERCURY IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA CADMIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA LEAD IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA ARSENIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA ZINC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA TIN IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA CHROMIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SELENIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA COPPER IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TUNGSTEN IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA NICKEL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA DIETARY SUPPLEMENT IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA PERSONAL CARE AND COSMETICS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA FATS & OILS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA BLOOD & OTHERS SAMPLES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA HEAVY METALS TESTING MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 U.S. SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 U.S. HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 77 U.S. HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 78 U.S. HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 79 U.S. FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 U.S. CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 U.S. PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.S. CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 U.S. BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 U.S. ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.S. NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 CANADA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 92 CANADA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 CANADA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 CANADA SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 CANADA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 96 CANADA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 97 CANADA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 98 CANADA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 CANADA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 CANADA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 CANADA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 CANADA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 CANADA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 CANADA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 CANADA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 MEXICO HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 111 MEXICO ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MEXICO HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 MEXICO SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 MEXICO HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 115 MEXICO HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 116 MEXICO HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 117 MEXICO FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 MEXICO CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MEXICO PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MEXICO CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 MEXICO BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 MEXICO DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 MEXICO BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MEXICO WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MEXICO FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA HEAVY METALS TESTING MARKET

FIGURE 2 NORTH AMERICA HEAVY METALS TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAVY METALS TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAVY METALS TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAVY METALS TESTING MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA HEAVY METALS TESTING MARKET: MULTIVARIATE MODELLING

FIGURE 8 PRODUCT LIFELINE CURVE

FIGURE 9 NORTH AMERICA HEAVY METALS TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA HEAVY METALS TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA HEAVY METALS TESTING MARKET: MARKET END – USE COVERAGE GRID

FIGURE 12 NORTH AMERICA HEAVY METALS TESTING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA HEAVY METALS TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 NORTH AMERICA HEAVY METALS TESTING MARKET: SEGMENTATION

FIGURE 15 GROWING AWARENESS FOR FOOD AND CONSUMER SAFETY IS EXPECTED TO DRIVE THE NORTH AMERICA HEAVY METALS TESTING MARKET IN THE FORECAST PERIOD

FIGURE 16 ICP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAVY METALS TESTING MARKET IN 2023 & 2030

FIGURE 17 NORTH AMERICA HEAVY METALS TESTING MARKET, BY COUNTRY, 2021-2030

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEAVY METALS TESTING MARKET

FIGURE 19 NORTH AMERICA HEAVY METALS TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 20 NORTH AMERICA HEAVY METALS TESTING MARKET: BY OFFERING, 2022

FIGURE 21 NORTH AMERICA HEAVY METALS TESTING MARKET: BY AUTOMATION, 2022

FIGURE 22 NORTH AMERICA HEAVY METALS TESTING MARKET: BY TARGET METAL, 2022

FIGURE 23 NORTH AMERICA HEAVY METALS TESTING MARKET: BY END-USE, 2022

FIGURE 24 NORTH AMERICA HEAVY METALS TESTING MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA HEAVY METALS TESTING MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA HEAVY METALS TESTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 NORTH AMERICA HEAVY METALS TESTING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 NORTH AMERICA HEAVY METALS TESTING MARKET: BY TECHNOLOGY (2023-2030)

FIGURE 29 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

North America Heavy Metal Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Heavy Metal Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Heavy Metal Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.