North America Hematology Analyzers Reagents Market

Market Size in USD Million

CAGR :

%

USD

172.32 Million

USD

338.13 Million

2024

2032

USD

172.32 Million

USD

338.13 Million

2024

2032

| 2025 –2032 | |

| USD 172.32 Million | |

| USD 338.13 Million | |

|

|

|

|

Hematology Analyzers and Reagents Market Size

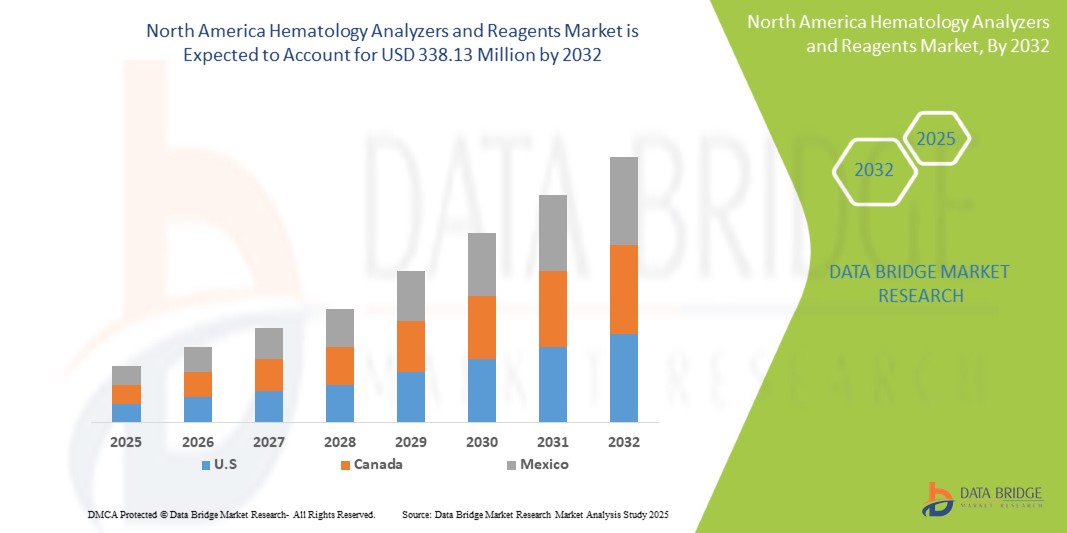

- The North America Hematology Analyzers and Reagents Market size was valued at USD 172.32 Million in 2024 and is expected to reach USD 338.13 Million by 2032, at a CAGR of 8.8% during the forecast period

- The market growth is largely fueled by the increasing prevalence of blood-related disorders and chronic diseases, which is driving demand for advanced diagnostic solutions such as hematology analyzers and reagents in clinical and hospital settings.

- Furthermore, rising investments in healthcare infrastructure, coupled with technological advancements in automation and data analysis within hematology systems, are enhancing diagnostic accuracy and operational efficiency. These converging factors are accelerating the adoption of Hematology Analyzers and Reagents solutions, thereby significantly boosting the industry's growth.

Hematology Analyzers and Reagents Market Analysis

- Hematology analyzers and reagents, offering automated and precise blood analysis capabilities, are increasingly vital components of modern diagnostic and clinical laboratories in both hospital and outpatient settings due to their enhanced efficiency, high throughput, and integration with electronic health record (EHR) systems.

- The escalating demand for hematology analyzers is primarily fueled by the rising incidence of chronic diseases, growing aging population, and the increasing need for early and accurate diagnostic tools to support personalized and preventive healthcare.

- U.S. dominates the Hematology Analyzers and Reagents Market with the largest revenue share of 44.01% in 2025, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of leading diagnostic equipment manufacturers. The U.S., in particular, is experiencing substantial growth in hematology analyzer installations across hospitals, diagnostic centers, and research facilities, driven by innovations in automation, AI integration, and compact, point-of-care devices.

- Canada is expected to be the fastest growing country in the Hematology Analyzers and Reagents Market during the forecast period due to increasing urbanization, expanding healthcare access, and rising investments in healthcare technology and infrastructure.

- The Hematology Products and Services segment is expected to dominate the Hematology Analyzers and Reagents Market with a market share of 32.23% in 2025, driven by its critical role in disease diagnosis and monitoring, and its broad application across clinical and research settings. Continued innovation, automation, and integration with digital healthcare platforms further fuel demand for these solutions in North America.

Report Scope and Hematology Analyzers and Reagents Market Segmentation

|

Attributes |

Hematology Analyzers and Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hematology Analyzers and Reagents Market Trends

“Enhanced Diagnostic Accuracy Through AI and Automation Integration”

- A significant and accelerating trend in the North America Hematology Analyzers and Reagents Market is the deepening integration of artificial intelligence (AI), machine learning algorithms, and advanced automation in laboratory diagnostics. This convergence is substantially improving diagnostic accuracy, workflow efficiency, and real-time clinical decision-making.

- For instance, leading systems such as Sysmex XN-Series and Beckman Coulter’s DxH platforms are leveraging AI to refine cell classification, reduce manual review rates, and flag abnormal samples with greater precision—thus improving turnaround times and minimizing human error.

- AI-powered hematology analyzers can learn from vast datasets, enabling predictive analytics and anomaly detection that support early disease identification and risk stratification. These systems are also capable of auto-validating results and suggesting additional tests, helping labs optimize resource utilization.

- Integration with digital health records and hospital information systems enables seamless data flow, while voice-enabled lab assistants and smart automation platforms allow for hands-free instrument control, reagent monitoring, and workflow coordination—especially valuable in high-throughput environments.

- This trend toward intelligent, connected, and automated diagnostic solutions is reshaping the expectations of clinical laboratories and healthcare providers. In response, companies such as Abbott, Mindray, and Siemens Healthineers are investing in next-gen analyzers with embedded AI, cloud connectivity, and remote monitoring capabilities.

- The demand for hematology solutions that offer seamless AI integration and advanced automation is rapidly growing across both hospital and independent diagnostic labs, as the industry prioritizes speed, accuracy, and data-driven patient care..

Hematology Analyzers and Reagents Market Dynamics

Driver

“Growing Need for Advanced Diagnostics Due to Rising Disease Burden and Aging Population”

- The increasing prevalence of chronic and infectious diseases, along with the rapidly aging population across North America, is a major driver of the rising demand for hematology analyzers and reagents. Accurate, high-throughput blood analysis is essential for early detection, diagnosis, and disease management, particularly for conditions such as anemia, leukemia, and sepsis.

- For instance, according to the CDC, nearly 6 million Americans are living with heart failure, and blood tests play a critical role in both diagnosis and ongoing monitoring. This growing diagnostic need is pushing healthcare providers to adopt more sophisticated hematology systems that offer speed, precision, and ease of integration into laboratory workflows.

- Furthermore, healthcare systems are increasingly prioritizing preventive care and early disease detection, driving demand for solutions that can deliver accurate results with minimal manual intervention. Hematology analyzers meet this demand through features like automated flagging, advanced cell morphology, and AI-assisted analysis.

- The expansion of outpatient diagnostic services, growing investment in point-of-care testing, and broader insurance coverage for laboratory diagnostics are also fueling adoption. In addition, technological advancements and increased awareness about the importance of regular blood screening are making hematology solutions a core component of modern clinical diagnostics.

Restraint/Challenge

“High Equipment Costs and Maintenance Burden for Smaller Facilities”

- Despite strong market growth, high initial investment and ongoing maintenance costs of advanced hematology analyzers present a significant challenge, particularly for smaller clinics, independent labs, and rural healthcare facilities.

- Sophisticated systems that offer 5-part or 6-part differential analysis, flow cytometry capabilities, or AI-enhanced features often come at a premium, limiting access for budget-constrained institutions. This creates a market divide where only larger hospitals or diagnostic chains can fully benefit from the latest technology.

- In addition to equipment costs, recurring expenses such as reagents, quality control materials, and service contracts can strain operating budgets. Delays in reimbursement or lack of insurance coverage for specific tests further complicate return on investment for providers.

- Addressing this challenge requires the development of cost-effective, compact analyzers tailored to low-volume settings, alongside expanded reimbursement models and government support programs. Leading players are increasingly focusing on scalable, modular solutions and subscription-based pricing to reduce financial barriers and drive broader adoption across all tiers of the healthcare system.

Hematology Analyzers and Reagents Market Scope

The market is segmented on the basis of Product and Services, Price Range, application, end user.

- By Product and Services

On the basis of Product and Services, the Hematology Analyzers and Reagents Market is segmented into Hematology Products and Services, Haemostasis Products and Services, Immunohematology Products and Services, Plasma Protein Analyser, Haemoglobin Analysers, Erythrocyte Sedimentation Rate Analyser, Coagulation Analyser, Flow Cytometers, Differential Counters. The Hematology Products and Services held the largest market revenue share of 32.23% in 2025 of, driven by the advanced capabilities of premium hematology analyzers, including higher throughput, multi-parameter analysis, and AI integration. These systems are preferred by large hospitals and diagnostic centers for their accuracy, automation, and efficiency in handling high sample volumes.

The Plasma Protein Analyser segment is anticipated to witness the fastest growth rate of 5.7% from 2025 to 2032, fueled by increasing demand for accurate diagnostic testing, technological advancements in analyser capabilities, and the rising prevalence of plasma protein disorders worldwide.

- By price range

On the basis of price range, the Hematology Analyzers and Reagents Market is segmented into High-End, Mid-Range, Low-End. The High-End held the largest market revenue share in 2025 of, driven by the advanced capabilities of premium hematology analyzers, including higher throughput, multi-parameter analysis, and AI integration. These systems are preferred by large hospitals and diagnostic centers for their accuracy, automation, and efficiency in handling high sample volumes.

The Low-End segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its affordability, ease of use, and suitability for small laboratories and point-of-care settings. Its compact design and minimal maintenance requirements make it ideal for resource-limited and rural healthcare facilities.

- By Application

On the basis of application, the Hematology Analyzers and Reagents Market is segmented into Anemia, Blood Cancer, Hemorrhagic Conditions, Infection-Related Conditions, Immune System Related Conditions, Others. The Anemia held the largest market revenue share in 2025, driven by the the high global prevalence of anemia, particularly among the aging population and individuals with chronic diseases. Increased awareness of anemia’s impact on health and the need for early diagnosis and management is fueling demand for hematology analyzers.

The Hemorrhagic Conditions is expected to witness the fastest CAGR from 2025 to 2032, favored for its increasing prevalence of bleeding disorders such as hemophilia and thrombocytopenia. Advancements in diagnostic technologies are improving the accuracy and speed of identifying these conditions, driving greater demand for specialized hematology testing.

- By end user

On the basis of end user, the Hematology Analyzers and Reagents Market is segmented into Hospital Laboratories, Blood Banks, Commercial Service Providers, Government Reference Laboratories, Research and Academic Institute, Others. The Hospital Laboratories segment accounted for the largest market revenue share in 2024, driven by the high volume of diagnostic tests conducted in hospital settings and the growing need for advanced, accurate hematology testing. Hospitals are increasingly adopting automated and AI-powered hematology analyzers to improve efficiency and diagnostic precision.

The Blood Banks segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the the increasing demand for blood donations and the need for precise blood screening and compatibility testing. Advancements in hematology analyzers that provide rapid, high-accuracy results are enhancing blood bank operations.

Hematology Analyzers and Reagents Market Regional Analysis

- North America Hematology Analyzers and Reagents Market is driven by a growing demand for advanced diagnostic solutions and increasing awareness of early disease detection.

- Consumers in the region highly value the precision, automation, and integration offered by modern hematology analyzers, which streamline laboratory operations and improve diagnostic outcomes.

- This growth is further supported by high healthcare spending, a well-established healthcare infrastructure, and a high demand for cutting-edge medical technologies, making North America a key player in the hematology analyzers market.

U.S. Hematology Analyzers and Reagents Market Insight

The U.S. Hematology Analyzers and Reagents Market captured the largest revenue share of 44.01% within North America in 2025, fueled by rapid adoption of automated diagnostic technologies and increasing investments in healthcare infrastructure. Hospitals and clinical labs in the U.S. are adopting high-throughput and AI-powered hematology analyzers to meet the growing demand for accurate, rapid blood tests, particularly in the context of chronic diseases. The increasing emphasis on personalized medicine and early detection of blood-related disorders is driving the market, with major players innovating to deliver more efficient, integrated solutions.

Canada Hematology Analyzers and Reagents Market Insight

The Canada Hematology Analyzers and Reagents Market is expected to experience steady growth, driven by increasing demand for accurate and efficient diagnostic solutions in both public and private healthcare sectors. Canada’s well-established healthcare infrastructure, coupled with its high healthcare expenditure, provides strong support for the adoption of advanced hematology analyzers in hospitals, diagnostic labs, and clinics.The growing prevalence of chronic diseases, an aging population, and the increasing focus on personalized medicine are further propelling the need for advanced hematology testing solutions. Additionally, Canada’s emphasis on healthcare innovation and research is fostering the growth of new technologies, which is expected to drive market expansion during the forecast period.

Mexico Hematology Analyzers and Reagents Market Insight

The Mexico Hematology Analyzers and Reagents Market is projected to expand at a moderate yet steady pace, driven by the country’s improving healthcare infrastructure and growing demand for advanced diagnostic tools. With a rising population, increasing awareness of blood-related diseases, and the growing focus on early disease detection, the adoption of hematology analyzers is gaining momentum in both public and private healthcare institutions.The government’s investments in healthcare modernization, along with increased access to affordable diagnostic solutions, are key factors expected to drive the demand for hematology analyzers in Mexico. Furthermore, the country’s proximity to the U.S. and its role as a manufacturing hub for medical devices are expected to make advanced hematology technologies more accessible to Mexican healthcare providers.

Hematology Analyzers and Reagents Market Share

The Hematology Analyzers and Reagents industry is primarily led by well-established companies, including:

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Beckman Coulter, Inc. (A subsidiary of Danaher Corporation)

- Sysmex America, Inc.

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- Horiba Medical

- Mindray North America

- Bio-Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Latest Developments in North America Hematology Analyzers and Reagents Market

- In April 2023, Abbott Laboratories, a global leader in healthcare diagnostics, launched an advanced hematology analyzer in North America, aimed at improving blood disorder diagnosis in clinical labs. The new analyzer integrates machine learning algorithms to provide faster and more accurate results, reducing manual error and enhancing efficiency in hematology testing. Abbott’s initiative underscores its commitment to innovation and its focus on providing cutting-edge diagnostic solutions to healthcare providers across North America.

- In March 2023, Thermo Fisher Scientific introduced a new line of hematology reagents designed to work seamlessly with its advanced hematology analyzers. The reagents provide enhanced accuracy in detecting and analyzing blood cells, supporting the growing demand for precision medicine and faster diagnosis. This launch emphasizes Thermo Fisher’s dedication to improving healthcare diagnostics through innovation and high-quality, reliable reagents.

- In February 2023, Beckman Coulter Life Sciences, a subsidiary of Danaher Corporation, unveiled a new automated hematology analyzer that offers improved testing capabilities for the detection of anemia and other blood disorders. The device incorporates AI-driven features to optimize workflow efficiency, minimize human error, and reduce turnaround times. Beckman Coulter’s focus on integrating artificial intelligence into hematology diagnostics reflects the ongoing trend of digitization and automation in the medical field.

- In January 2023, Siemens Healthineers expanded its portfolio of hematology solutions with the launch of a new multi-parameter analyzer, designed for high-volume diagnostic settings. The analyzer features integrated software that enhances laboratory productivity and provides real-time monitoring of test results. Siemens' continuous investment in research and development demonstrates its dedication to advancing hematology diagnostic technologies and addressing the evolving needs of healthcare providers in North America.

- In December 2022, Sysmex America Inc. introduced a new reagent kit designed to complement their hematology analyzers, specifically for use in detecting chronic diseases such as leukemia. The kit features more accurate testing and faster results, enhancing the overall diagnostic process for healthcare professionals. Sysmex’s innovation in reagents showcases its commitment to improving diagnostic testing, providing healthcare providers with the tools necessary to offer accurate and timely treatment plans for patients.

- In November 2022, Becton, Dickinson and Company (BD) launched a next-generation hematology analyzer in North America aimed at providing healthcare facilities with a more compact, cost-effective solution for routine blood testing. The new device is designed to streamline laboratory operations, enhance diagnostic accuracy, and reduce labor costs, reflecting BD’s commitment to making advanced diagnostic technologies more accessible to healthcare providers in diverse settings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.