North America Heparin Market

Market Size in USD Billion

CAGR :

%

USD

9.85 Billion

USD

14.50 Billion

2024

2032

USD

9.85 Billion

USD

14.50 Billion

2024

2032

| 2025 –2032 | |

| USD 9.85 Billion | |

| USD 14.50 Billion | |

|

|

|

|

Heparin Market Size

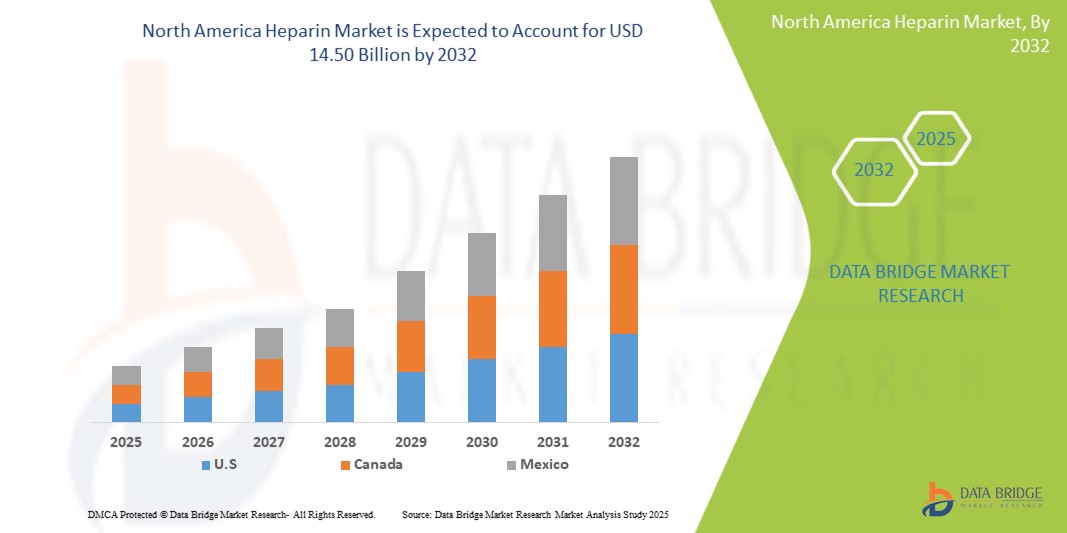

- The North America Heparin Market size was valued at USD 9.85 billion in 2024 and is expected to reach USD 14.50 billion by 2032, at a CAGR of 6.30% during the forecast period

- This growth is driven by factors such as the Increase Demand of Enzyme Replacement Therapy, Rising Demand for Oral Drugs.

Heparin Market Analysis

- Heparin is a drug that prevents and treats blood clots. It's a drug that's used to treat blood coagulation abnormalities. It's also used to prevent blood from clotting after surgery, during blood transfusions, dialysis, and during taking blood samples.

- The demand for treatments in the North America Heparin Market is primarily driven by the increasing prevalence of blood clotting disorders and ongoing research that is leading to the development of improved therapeutic options.

- North America is expected to dominate the Heparin Market owing to its advanced healthcare infrastructure, high healthcare expenditure, and rising awareness of anticoagulant therapies.

- The region's strong presence of leading pharmaceutical companies and ongoing clinical trials further contribute to its market leadership and innovation in Heparin products.

- The Unfractionated Heparin segment is expected to hold a significant market share in the North America Heparin Market, owing to the high prevalence of Fabry disease and the ongoing need for effective management.

Report Scope and Heparin Market Segmentation

|

Attributes |

Heparin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Heparin Market Trends

“Advancements in Enzyme Replacement Therapies & Gene-Based Approaches and Their Implications for the North America Heparin Market”

- One prominent trend in the evolution of the North American heparin market is the increasing focus on developing advanced manufacturing processes and novel formulation techniques.

- These innovations aim to enhance the safety, purity, and efficacy of heparin products, addressing concerns related to contamination and adverse reactions associated with traditional extraction methods.

- For instance, the adoption of semi-synthetic and fully synthetic heparin technologies offers more consistent product quality and minimizes the risk of contamination, enabling healthcare providers to manage anticoagulation therapy more effectively—particularly for high-risk patient populations.

- These advancements are transforming the management of thrombotic disorders, improving patient outcomes, and driving the demand for next-generation heparin products with improved safety profiles, better pharmacological properties, and the potential for personalized dosing strategies.

Heparin Market Dynamics

Driver

“Increasing Preference for Parenteral Anticoagulants”

- Parenteral anticoagulants, primarily administered via injection, are expected to drive market growth in North America. The segment's expansion is supported by the widespread use of injectable heparin and low molecular weight heparins in hospitals and clinics, providing effective anticoagulation management.

- As awareness of thrombotic disorders and the importance of anticoagulation therapy increases across North America, the demand for injectable heparin products continues to rise

- With healthcare providers and patients favoring proven, rapid-acting injectable therapies for conditions such as deep vein thrombosis and pulmonary embolism, the preference for parenteral formulations remains strong, contributing to the growth of the heparin market in the region

For instance,

- In December 2021, according to an article published by the National Center for Biotechnology Information, the aging population in North America is growing rapidly, with a significant proportion of individuals aged 65 and older. This demographic shift is expected to lead to increased healthcare needs, including the management of thrombotic and cardiovascular disorders.

- As a result of the rising prevalence of age-related comorbidities and enhanced diagnostic screening practices, there is a notable increase in the demand for heparins in North America. This is particularly true among the elderly population, who are more susceptible to complications related to thromboembolic events and require effective anticoagulant therapy.

Opportunity

“Advancing North America Heparin Market with Innovative Technologies and Digital Integration”

- AI-powered platforms in the North America heparin market can enhance patient management by improving the accuracy of anticoagulation therapy, automating data analysis, and supporting real-time monitoring of treatment efficacy, thereby enabling clinicians to make more informed dosing and therapeutic decisions.

- AI algorithms can analyze patient data, including coagulation profiles, genetic factors, and clinical history, providing instant insights into anticoagulant response, identifying potential risks of bleeding or thrombosis, and predicting therapy resistance.

- Additionally, AI-driven tools can assist in evaluating laboratory and imaging data over time, allowing healthcare providers to monitor patient responses, adjust heparin dosages precisely, and optimize long-term anticoagulation management strategies.

For instance,

- In January 2025, according to an article published in the JMA Journal, AI models, particularly those utilizing deep learning, have demonstrated potential in optimizing anticoagulation therapy in the North America heparin market. These systems can analyze complex clinical and laboratory data to improve dosing accuracy, detect early signs of bleeding or thrombosis, and enhance patient safety. The ability of AI to predict adverse events and monitor therapeutic response is crucial for timely intervention and better management of anticoagulation therapy.

- The integration of AI in heparin management can also lead to improved patient outcomes, reduced complications, and enhanced quality of care. By leveraging AI-driven analytics, healthcare providers can identify high-risk patients earlier, monitor treatment efficacy in real time, and take proactive measures to optimize anticoagulation strategies and prevent severe adverse events.

Restraint/Challenge

“High Treatment Costs Hindering Market Penetration in the North America Heparin Market”

- The high cost of heparin therapies presents a significant challenge for market penetration in North America, impacting the purchasing decisions of healthcare providers, insurers, and patients—particularly as healthcare costs continue to rise.

- While heparin itself remains a relatively cost-effective anticoagulant compared to some advanced therapies, the overall expenses associated with managing anticoagulation therapy, including monitoring and associated healthcare services, can be substantial.

- This financial burden may influence the adoption and utilization of certain heparin products, especially in settings with budget constraints, prompting a focus on optimizing treatment protocols and cost-effective management strategies within the North American healthcare system

For instance,

- In November 2024, according to an article published by the Institute for Health Metrics and Evaluation, the high cost of heparin therapies in North America raises concerns about healthcare affordability and equitable access. The financial burden on healthcare systems and patients can limit the capacity to implement comprehensive screening and treatment programs, particularly in underserved communities, thereby affecting patient outcomes.

- Consequently, these economic challenges may lead to disparities in the quality of care and access to effective anticoagulation therapies, ultimately hindering the growth and market penetration of heparin products across North America

Heparin Market Scope

The market is segmented on the basis product type, mode of administration, Ingredients, source, Availability, Treatment, Therapeutics, Strength, Type, Container, Packaging, end user, distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Mode of Administration |

|

|

By Source |

|

|

By Ingredients |

|

|

By Availability |

|

|

By Treatmnet |

|

|

By Application |

|

|

By Therapeutics |

|

|

By Strength |

|

|

By Type |

|

|

By Container |

|

|

By Packaging |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the Unfractionated Heparin is projected to dominate the market with a largest share in application segment

The Unfractionated Heparin segment is expected to dominate the North American heparin market in 2025, accounting for the largest share of 56.22%. This is driven by its widespread use in anticoagulation therapy, high clinical adoption, and established efficacy in various medical settings. The growing demand for reliable and cost-effective anticoagulants, coupled with advancements in administration and monitoring techniques, further supports its market dominance. Additionally, increasing awareness among healthcare providers, along with improved diagnostic capabilities, contributes to the continued prominence of unfractionated heparin in North America.

The Bovine is expected to account for the largest share during the forecast period in technology market

In 2025, the Bovine segment is expected to dominate the North American heparin market with a 51.31% share, driven by its proven effectiveness, high demand for precision anticoagulation, and increasing prevalence of thromboembolic and cardiovascular conditions among aging populations.

Heparin Market Regional Analysis

“U.S. Holds the Largest Share in the Heparin Market”

- U.S. dominates the Heparin market, driven by advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and presence of key industry players.

- The region's significant market share is supported by rising demand for precise anticoagulant treatments, increasing prevalence of thromboembolic disorders, and ongoing advancements in healthcare therapies.

- Robust reimbursement policies and substantial R&D investments by leading pharmaceutical companies further bolster market growth.

- In addition, a focus on early diagnosis, personalized medicine, and increasing awareness of cardiovascular conditions are propelling market expansion across North America.

“U.S. is Projected to Register the Highest CAGR in the Heparin Market”

- The Asia-Pacific region is expected to experience the highest growth rate in the heparin market, driven by increasing demand for anticoagulant therapies, ongoing advancements in medical technologies, and rising prevalence of cardiovascular and thrombotic disorders

- Within North America, the United States emerges as a key market due to its large patient population, high healthcare expenditure, and strong presence of leading pharmaceutical and biotech companies investing in innovative heparin formulation

- Canada and Mexico are also contributing to regional growth, with rising healthcare investments and growing awareness of anticoagulant therapies supporting market expansion.

- The U.S., with its well-developed healthcare infrastructure and regulatory support for new drug approvals, continues to lead in adopting advanced heparin products and ensuring improved patient outcomes

Heparin Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Aspen Holdings (Ireland)

- Changzhaou Qianhong Bio-pharma Co., Ltd. (China)

- Eisai Co., Ltd. (Japan)

- Fresenius Kabi AG (Germany)

- Hebei Changshan Biochemical Pharmaceutical Co., Ltd. (China)

- Hikma Pharmaceuticals PLC (U.K.)

- LEO Pharma A/S (Denmark)

- Novartis AG (Switzerland)

- SARIA A/S GmbH & Co. KG (Germany)

- OPOCRIN S.P.A. (Italy)

- Bristol-Myers Squibb Company (U.S.)

- GlaxoSmithKline plc. (U.K.)

- Dr. Reddy’s Laboratories Ltd. (India)

- B. Braun Melsungen AG (Germany)

- Baxter (U.S.).

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.