North America Hepatitis Delta Virus Hdv Infection Market

Market Size in USD Million

CAGR :

%

USD

7.13 Million

USD

10.06 Million

2024

2032

USD

7.13 Million

USD

10.06 Million

2024

2032

| 2025 –2032 | |

| USD 7.13 Million | |

| USD 10.06 Million | |

|

|

|

|

North America Hepatitis Delta Virus (HDV) Infection Market Size

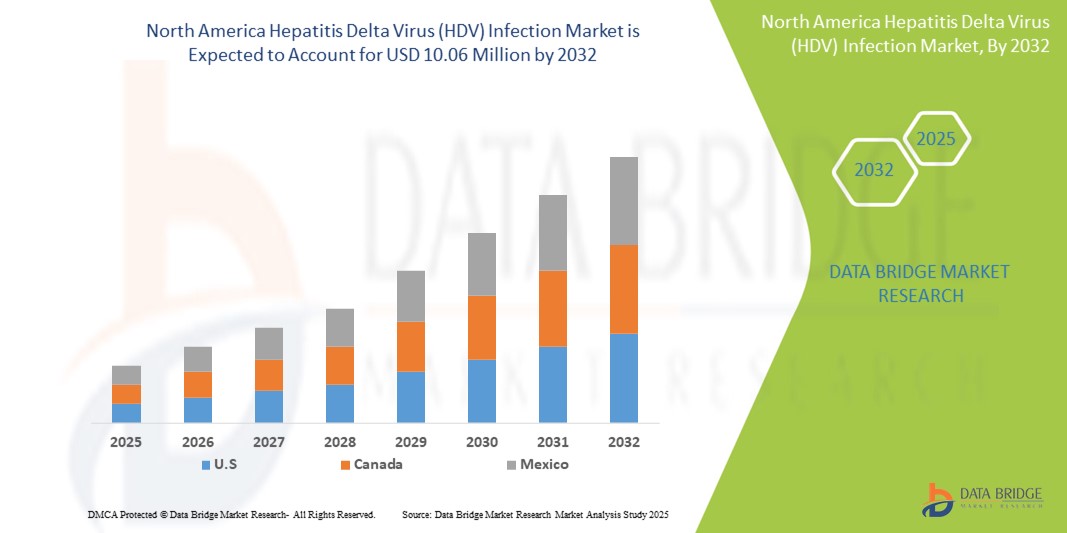

- The North America hepatitis delta virus (HDV) infection market size was valued at USD 7.13 million in 2024 and is expected to reach USD 10.06 million by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of co-infection with hepatitis B virus (HBV) and the increasing awareness regarding liver health, especially in endemic countries across the North America region. Government-led public health initiatives and improved diagnostic capabilities are enabling early detection and treatment of HDV, thus accelerating market expansion

- Furthermore, growing investment in antiviral research and the launch of advanced therapeutics—including RNA-targeted agents and novel interferon therapies—are establishing HDV-targeted treatments as a critical segment within the broader hepatology space. These converging factors are accelerating the uptake of North America Hepatitis Delta Virus (HDV) Infection solutions, thereby significantly boosting the industry's growth across emerging and developed healthcare markets in the region

North America Hepatitis Delta Virus (HDV) Infection Market Analysis

- The North America Hepatitis Delta Virus (HDV) Infection market is experiencing significant growth due to increasing awareness, improved diagnostic capabilities, and enhanced access to advanced healthcare services across developed countries in the region

- The growing burden of liver-related diseases, rising healthcare expenditures, and government-led hepatitis elimination programs are the primary factors driving market expansion in North America

- The U.S. dominated the North America hepatitis delta virus (HDV) infection market with the largest revenue share of 46.84% in 2024, driven by its robust healthcare infrastructure, advanced diagnostic technologies, and widespread implementation of hepatitis control programs across federal and state levels

- Mexico is expected to witness the fastest-growing country in the North America hepatitis delta virus (HDV) infection market with a CAGR of 6.9% during the forecast period, fueled by rising healthcare awareness, increasing investment in public health infrastructure, and collaborative efforts with international health agencies to expand hepatitis screening and treatment access

- The Parenteral route of administration segment dominated the North America hepatitis delta virus (HDV) infection market with a share of 66.5% in 2024, supported by the widespread use of injectable pegylated interferon as the standard treatment, ensuring effective viral suppression and alignment with established clinical protocols throughout the region

Report Scope and North America Hepatitis Delta Virus (HDV) Infection Market Segmentation

|

Attributes |

North America Hepatitis Delta Virus (HDV) Infection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Hepatitis Delta Virus (HDV) Infection Market Trends

“Increasing Adoption of Advanced Diagnostic and Monitoring Technologies”

- A significant and accelerating trend in the North America hepatitis delta virus (HDV) infection market is the deepening integration of advanced diagnostic platforms and digital health ecosystems, aimed at improving early detection, disease monitoring, and patient compliance

- For instance, leading diagnostic manufacturers are launching HDV-specific test kits and real-time PCR-based solutions that enable faster and more accurate detection of HDV in co-infected hepatitis B patients. These advancements are being increasingly adopted across hospitals and diagnostic centers in countries such as China, India, and Japan

- Digital health platforms are also enabling more efficient disease tracking, patient education, and follow-up care. Some mobile health apps now assist healthcare professionals in monitoring liver function, treatment adherence, and patient-reported outcomes, thereby facilitating more personalized HDV care pathways

- The seamless integration of diagnostic tools with electronic medical records (EMRs) and national hepatitis registries is further enhancing surveillance capabilities, enabling policymakers to allocate resources effectively and target high-risk populations

- This trend toward more intelligent, data-driven, and interconnected disease management solutions is fundamentally reshaping expectations around HDV care and treatment. As a result, companies and healthcare systems across the North America region are investing in scalable diagnostic innovations and telemedicine platforms to extend their reach

- The demand for reliable, fast, and integrated diagnostic tools is growing rapidly across both public and private healthcare sectors, as stakeholders increasingly prioritize early intervention, efficient patient tracking, and comprehensive infectious disease management

North America Hepatitis Delta Virus (HDV) Infection Market Dynamics

Driver

“Growing Need Due to Increasing Disease Burden and Unmet Medical Needs”

- The North America hepatitis delta virus (HDV) infection market is witnessing accelerated growth due to the rising prevalence of hepatitis B and D co-infections, which contribute to the growing demand for effective diagnostics and therapeutics in the region

- For instance, countries such as China, India, and Pakistan report high HBV carrier rates, increasing the risk of HDV superinfections. This has prompted regional governments and health agencies to prioritize hepatitis screening and treatment programs, thereby boosting the HDV market

- Furthermore, increasing healthcare expenditure, expanding access to diagnostic testing, and heightened awareness campaigns regarding viral hepatitis are contributing significantly to the region’s demand for HDV treatment solutions

- Advancements in antiviral therapies and liver disease management, alongside partnerships between global pharmaceutical companies and local healthcare providers, are expected to accelerate HDV drug development and distribution across Asia-Pacific

- The emergence of new therapeutic approaches—such as bulevirtide and other entry inhibitors—and rising participation in clinical trials are strengthening the treatment landscape in the region

Restraint/Challenge

“Limited Access to Specialized Diagnostics and Cost Constraints”

- Despite growing demand, several countries across North America face challenges in diagnosing and treating Hepatitis D due to the limited availability of HDV-specific testing kits and the need for advanced laboratory infrastructure

- Delayed diagnosis due to low awareness among healthcare professionals and patients continues to be a major barrier, especially in rural or low-resource settings

- In addition, the high cost of HDV therapeutics, such as emerging biologics or entry inhibitors, limits affordability for a large segment of the population

- Reimbursement limitations and the absence of targeted national strategies in some APAC countries also hinder access to standardized HDV treatment pathways

- To overcome these challenges, increased funding for liver disease screening programs, development of affordable biosimilars, and stronger healthcare infrastructure are essential to unlock the full potential of the North America HDV Infection market

North America Hepatitis Delta Virus (HDV) Infection Market Scope

The market is segmented on the basis of type, treatment, drug type, route of administration, age group, gender, transmission, end user, and distribution channel.

• By Type

On the basis of type, the North America hepatitis delta virus (HDV) infection market is segmented into Acute Hepatitis D and Chronic Hepatitis D. The chronic hepatitis D segment dominated the largest market revenue share of 71.3% in 2024, driven by the higher burden of long-term infections, the need for extended treatment duration, and increased risk of liver complications such as cirrhosis and hepatocellular carcinoma. Chronic HDV cases are more frequently diagnosed due to improved testing among hepatitis B carriers.

The acute hepatitis D segment is anticipated to witness the fastest growth rate of 6.7% from 2025 to 2032, fueled by better disease surveillance, public health initiatives, and improved early-stage screening technologies.

• By Treatment

On the basis of treatment, the North America hepatitis delta virus (HDV) infection market is segmented into surgery (liver transplant) and medication. The medication segment dominated the market with the largest revenue share of 88.6% in 2024, primarily due to the widespread use of antiviral agents and pegylated interferon therapies as the first line of treatment. Increased R&D efforts targeting HDV-specific viral mechanisms further boost this segment.

The surgery (liver transplant) segment is expected to grow with the fastest CAGR of 5.1% from 2025 to 2032, largely used in cases with end-stage liver failure where medical therapy is no longer effective.

• By Drug Type

On the basis of drug type, the market is segmented into branded and generic drugs. The branded drug segment accounted for the largest revenue share of 63.8% in 2024, owing to the presence of patented therapies such as bulevirtide, with high efficacy and specialist prescribing patterns across tertiary care centers.

The generic segment is anticipated to register the fastest CAGR of 7.4% from 2025 to 2032, driven by affordability, increased local manufacturing, and inclusion in national drug lists in developing countries.

• By Route of Administration

On the basis of route of administration, the market is segmented into oral and parenteral. The parenteral segment held the largest market revenue share of 66.5% in 2024, supported by the standard use of injectable pegylated interferon in HDV treatment.

The oral segment is expected to witness the fastest CAGR of 8.3% from 2025 to 2032, with the emergence of promising oral antiviral agents under clinical trials and rising demand for non-invasive, patient-compliant therapies.

• By Age Group

On the basis of age group, the market is segmented into adults, geriatric, and pediatric. The adult segment held the dominant market share of 61.9% in 2024, attributed to higher prevalence of HBV-HDV co-infections among individuals in their working-age population and middle-aged adults.

The geriatric segment is anticipated to grow at the fastest CAGR of 7.1% from 2025 to 2032, as aging populations experience a higher risk of liver complications and more frequent healthcare access.

• By Gender

On the basis of gender, the market is segmented into male and female. The male segment captured the largest market share of 58.2% in 2024, reflecting the higher incidence rates due to behavioral risk factors and higher HBV prevalence in men.

The female segment is expected to grow with the fastest CAGR of 6.5% during the forecast period, supported by increasing awareness, improved maternal health programs, and gender-focused screening in reproductive health services.

• By Transmission

On the basis of transmission, the North America market is segmented into contaminated needles, exposure to infected blood, blood and plasma product transfusion, and others. The contaminated needles segment held the largest market share of 38.6% in 2024, due to unsafe injection practices and rising intravenous drug use in parts of the region.

The blood and plasma product transfusion segment is expected to register the fastest CAGR of 7.9% from 2025 to 2032, driven by increased testing accuracy and gaps in screening protocols in some healthcare facilities.

• By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, home care settings, research institutes and academic centers, ambulatory surgical centers, and others. The hospital segment dominated the market with a revenue share of 47.4% in 2024, backed by integrated diagnostics, inpatient treatment, and transplant infrastructure.

The specialty clinics segment is projected to witness the fastest CAGR of 7.6% from 2025 to 2032, supported by rising demand for outpatient liver care, availability of HDV-focused treatment, and urban expansion.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment held the highest market share of 54.3% in 2024, owing to government procurement, hospital supplies, and public health agency partnerships for hepatitis programs.

The retail sales segment is expected to grow at the fastest CAGR of 7.8%, driven by increasing over-the-counter availability and expanded distribution through e-pharmacies and private clinics.

North America Hepatitis Delta Virus (HDV) Infection Market Regional Analysis

- The North America hepatitis delta virus (HDV) infection market is poised to grow at the fastest CAGR of 30.70% during the forecast period of 2025 to 2032, driven by increasing public health awareness, enhanced diagnostic capabilities, and expanding access to healthcare services across the region

- The growing burden of liver-related diseases, government-led hepatitis elimination programs, and increased healthcare funding are significantly accelerating the adoption of HDV diagnostic and therapeutic solutions

- Furthermore, regional efforts to integrate hepatitis B and D screening protocols into public health frameworks, along with improved treatment access and international collaborations, are contributing to sustained market expansion

U.S. Hepatitis Delta Virus (HDV) Infection Market Insight

The U.S. hepatitis delta virus (HDV) infection market dominated the North America market with the largest revenue share of 46.84% in 2024, driven by high hepatitis B prevalence, strong public health initiatives, and the presence of advanced diagnostic and treatment infrastructure. Federal and state-level programs aimed at eliminating viral hepatitis, coupled with collaborations with leading research institutes, continue to strengthen early detection and effective management of HDV cases across the country.

Canada Hepatitis Delta Virus (HDV) Infection Market Insight

The Canada hepatitis delta virus (HDV) infection market is witnessing steady growth due to its universal healthcare system, proactive disease awareness campaigns, and national strategies targeting hepatitis B and D. Government-supported screening initiatives, access to specialty care, and increased focus on underserved communities are driving improvements in HDV diagnosis and treatment throughout the country.

Mexico Hepatitis Delta Virus (HDV) Infection Market Insight

The Mexico hepatitis delta virus (HDV) infection market is expected to witness the fastest-growing CAGR of 6.9% in the North America Hepatitis Delta Virus (HDV) Infection market during the forecast period, fueled by growing public health investments, rising awareness of viral hepatitis, and enhanced access to diagnostic services. National hepatitis programs supported by international agencies are strengthening screening networks and improving access to antiviral treatments, particularly in rural and high-risk populations.

North America Hepatitis Delta Virus (HDV) Infection Market Share

The North America hepatitis delta virus (HDV) infection industry is primarily led by well-established companies, including:

- Gilead Sciences, Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Assembly Biosciences, Inc. (U.S.)

- Eiger BioPharmaceuticals (U.S.)

- GlobeImmune Inc. (U.S.)

- Huahui Health Ltd. (China)

- Johnson & Johnson Services, Inc. (U.S.)

- PharmaEssentia Corporation (Taiwan)

- Replicor (Canada)

- Vir Biotechnology, Inc. (U.S.)

Latest Developments in North America Hepatitis Delta Virus (HDV) Infection Market

- In September 2024, Gilead Sciences, Inc. and Genesis Therapeutics have formed a strategic collaboration to discover and develop novel therapies using advanced AI-driven drug discovery technologies. This partnership aims to accelerate the creation of innovative treatments, enhancing Gilead's pipeline and strengthening its position in the competitive biopharma industry

- In March 2024, Gilead Sciences Inc. completed the acquisition of CymaBay Therapeutics, gaining access to innovative therapies for liver and rare diseases. This acquisition expands Gilead’s research portfolio and strengthens its pipeline, enhancing its capacity to address unmet medical needs. The acquisition of CymaBay provides Gilead with promising new drug candidates and expertise in liver and rare diseases, boosting its research capabilities and expanding its therapeutic offerings

- In March 2024, Gilead Sciences, Inc. and Merus have announced a collaboration to discover novel antibody-based trispecific T-cell engagers, aiming to enhance cancer immunotherapy. This partnership combines Gilead’s expertise with Merus’ innovative technology to develop advanced treatments for cancer

- In March 2024, Alnylam Pharmaceuticals launched the Family Health History Road Trip to promote discussions on hereditary ATTR (hATTR) amyloidosis. Genealogist Bernice Bennett traveled cross-country to highlight the importance of family health history for earlier diagnosis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

4.3 NORTH AMERICA CLINICAL TRIAL MARKET FOR NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

4.4 DISTRIBUTION OF PRODUCTS BY PHASE

5 EPIDEMIOLOGY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF HEPATITIS

6.1.2 INCREASE IN HEALTHCARE EXPENDITURE

6.1.3 ONGOING RESEARCH AND DEVELOPMENT INITIATIVES

6.1.4 ADVANCES IN DIAGNOSTIC TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF HEPATITIS DELTA VIRUS (HDV)

6.2.2 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 RISING INNOVATIVE DRUG DEVELOPMENT

6.3.2 INCREASING DEVELOPMENT OF COMBINATION THERAPIES

6.3.3 GROWING ADVANCEMENTS IN DIGITAL HEALTH SOLUTIONS

6.4 CHALLENGES

6.4.1 SIDE EFFECTS OF CURRENT TREATMENTS

6.4.2 SLOW REGULATORY APPROVALS

7 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE

7.1 OVERVIEW

7.2 ACUTE HEPATITIS D

7.3 CHRONIC HEPATITIS D

8 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT

8.1 OVERVIEW

8.2 SURGERY (LIVER TRANSPLANT)

8.3 MEDICATION

8.3.1 APPROVED THERAPIES

8.3.1.1 PEGYLATED INTERFERON ALPHA

8.3.1.2 ENTRY INHIBITOR (BULEVIRTIDE)

8.3.2 EMERGING THERAPIES

9 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM

9.1 OVERVIEW

9.2 TABLET

9.3 CAPSULE

9.4 INJECTABLE

10 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.3 GENERIC

11 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 CAPSULE

11.2.3 OTHERS

11.3 PARENTERAL

12 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER

12.1 OVERVIEW

12.2 FEMALE

12.3 MALE

13 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

13.4 PEDIATRIC

14 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION

14.1 OVERVIEW

14.2 CONTAMINATED NEEDLES

14.3 EXPOSURE TO INFECTED BLOOD

14.4 BLOOD AND PLASMA PRODUCT TRANSFUSION

14.5 OTHERS

15 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 SPECIALTY CENTERS

15.4 HOME CARE SETTING

15.5 RESEARCH INSTITUTES & ACADEMIC CENTERS

15.6 AMBULATORY SURGICAL CENTERS

15.7 OTHERS

16 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.3.1 HOSPITAL PHARMACY

16.3.2 RETAIL PHARMACY

16.3.3 ONLINE PHARMACY

16.4 OTHERS

17 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 GILEAD SCIENCES, INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PIPELINE PRODUCT

20.1.5 RECENT DEVELOPMENTS

20.2 GENENTECH, INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 RECENT DEVELOPMENT

20.3 ALNYLAM PHARMACEUTICALS, INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PIPELINE PRODUCT

20.3.4 RECENT DEVELOPMENTS

20.4 ASSEMBLY BIOSCIENCES, INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PIPELINE PRODUCT

20.4.4 RECENT DEVELOPMENTS

20.5 EIGER BIOPHARMACEUTICALS

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 PIPELINE PRODUCT

20.5.6 RECENT DEVELOPMENT

20.6 GLOBEIMMUNE INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 PIPELINE PRODUCT

20.6.3 RECENT DEVELOPMENT

20.7 HUAHUI HEALTH LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 PIPELINE PRODUCT

20.7.3 RECENT DEVELOPMENT

20.8 JOHNSON & JOHNSON SERVICES, INC.

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PIPELINE PRODUCT

20.8.4 RECENT DEVELOPMENT

20.9 PHARMAESSENTIA CORPORATION

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PIPELINE PRODUCT

20.9.4 RECENT DEVELOPMENT

20.1 REPLICOR

20.10.1 COMPANY SNAPSHOT

20.10.2 PIPELINE PRODUCT

20.10.3 RECENT DEVELOPMENTS

20.11 VIR BIOTECHNOLOGY, INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALAYSIS

20.11.3 PRODUCT PIPELINE

20.11.4 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 EMERGING NOVEL THERAPIES FOR HDV

TABLE 2 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 3 NORTH AMERICA ACUTE HEPATITIS D IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 4 NORTH AMERICA CHRONIC HEPATITIS D IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 6 NORTH AMERICA SURGERY (LIVER TRANSPLANT) IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 NORTH AMERICA MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 NORTH AMERICA MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 NORTH AMERICA APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 11 NORTH AMERICA TABLET IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 NORTH AMERICA CAPSULE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 NORTH AMERICA INJECTABLE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 14 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 NORTH AMERICA BRANDED IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 16 NORTH AMERICA GENERIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 18 NORTH AMERICA ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 NORTH AMERICA ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 NORTH AMERICA PARENTERAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 22 NORTH AMERICA FEMALE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 NORTH AMERICA MALE IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 24 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 25 NORTH AMERICA ADULTS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 NORTH AMERICA GERIATRIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 NORTH AMERICA PEDIATRIC IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONTAMINATED NEEDLES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 NORTH AMERICA EXPOSURE TO INFECTED BLOOD IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 NORTH AMERICA BLOOD AND PLASMA PRODUCT TRANSFUSION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOSPITALS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 NORTH AMERICA SPECIALTY CLINICS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 NORTH AMERICA HOME CARE SETTING IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 NORTH AMERICA RESEARCH INSTITUTES AND ACADEMIC CENTERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 NORTH AMERICA OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 41 NORTH AMERICA DIRECT TENDER IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 NORTH AMERICA RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 NORTH AMERICA RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 45 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 46 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 47 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 49 NORTH AMERICA MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 NORTH AMERICA APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 52 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 53 NORTH AMERICA ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 57 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 59 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 60 NORTH AMERICA RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 63 U.S. MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 U.S. APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 67 U.S. ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 69 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 70 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 71 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 72 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 73 U.S. HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 74 U.S. RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 77 CANADA MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 CANADA APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 81 CANADA ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 83 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 84 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 85 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 86 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 87 CANADA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 88 CANADA RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TREATMENT, 2022-2031 (USD THOUSAND)

TABLE 91 MEXICO MEDICATION IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 MEXICO APPROVED THERAPIES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DRUG TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031 (USD THOUSAND)

TABLE 95 MEXICO ORAL IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DOSAGE FORM, 2022-2031 (USD THOUSAND)

TABLE 97 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY AGE GROUP, 2022-2031 (USD THOUSAND)

TABLE 98 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY GENDER, 2022-2031 (USD THOUSAND)

TABLE 99 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TRANSMISSION, 2022-2031 (USD THOUSAND)

TABLE 100 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 101 MEXICO HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 102 MEXICO RETAIL SALES IN HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET, BY TYPE

FIGURE 12 GROWING PREVALENCE OF HEPATITIS IS DRIVING THE GROWTH OF THE NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET FROM 2024 TO 2031

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET IN 2024 AND 2031

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET

FIGURE 15 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, 2023

FIGURE 16 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, 2024-2031 (USD THOUSAND)

FIGURE 17 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, CAGR (2024-2031)

FIGURE 18 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, 2023

FIGURE 20 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, 2024-2031 (USD THOUSAND)

FIGURE 21 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, CAGR (2024-2031)

FIGURE 22 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, 2023

FIGURE 24 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, 2024-2031 (USD THOUSAND)

FIGURE 25 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, CAGR (2024-2031)

FIGURE 26 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 27 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, 2023

FIGURE 28 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, 2024-2031 (USD THOUSAND)

FIGURE 29 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, CAGR (2024-2031)

FIGURE 30 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, 2023

FIGURE 32 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, 2024-2031 (USD THOUSAND)

FIGURE 33 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2024-2031)

FIGURE 34 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 35 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER,2023

FIGURE 36 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, 2024-2031 (USD THOUSAND)

FIGURE 37 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, CAGR (2024-2031)

FIGURE 38 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY GENDER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, 2023

FIGURE 40 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, 2024-2031 (USD THOUSAND)

FIGURE 41 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, CAGR (2024-2031)

FIGURE 42 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, 2023

FIGURE 44 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, 2024-2031 (USD THOUSAND)

FIGURE 45 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, CAGR (2024-2031)

FIGURE 46 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY TRANSMISSION, LIFELINE CURVE

FIGURE 47 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, 2023

FIGURE 48 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, 2024-2031 (USD THOUSAND)

FIGURE 49 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, CAGR (2024-2031)

FIGURE 50 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 51 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 52 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD THOUSAND)

FIGURE 53 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 54 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 55 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: SNAPSHOT (2023)

FIGURE 56 NORTH AMERICA HEPATITIS DELTA VIRUS (HDV) INFECTION MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.