North America Hepato Pancreatico Biliary Hpb Surgeries Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

3.68 Billion

2024

2032

USD

1.89 Billion

USD

3.68 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 3.68 Billion | |

|

|

|

|

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Size

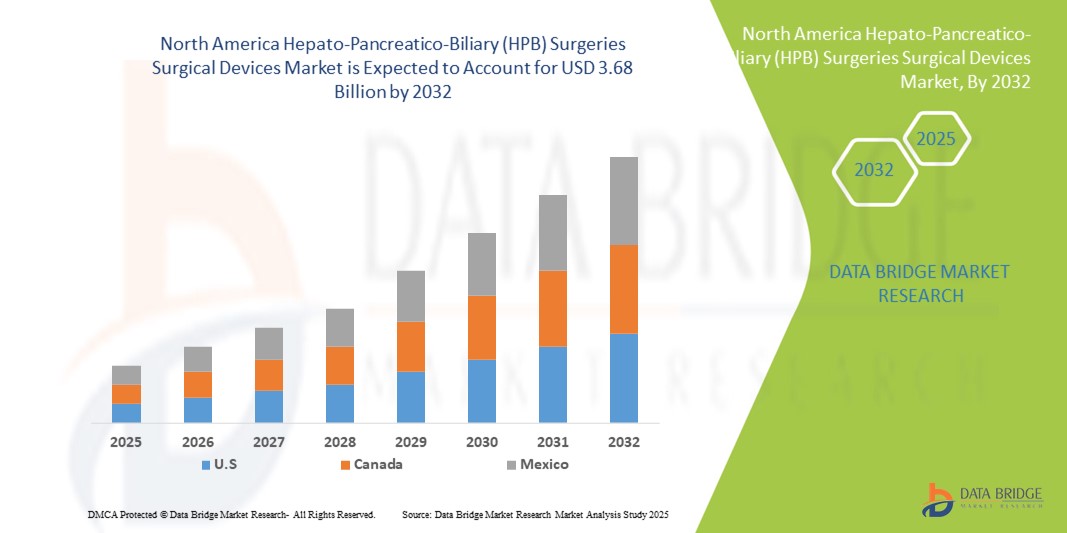

- The North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 3.68 billion by 2032, at a CAGR of 8.7% during the forecast period

- The market growth is largely fueled by the rising adoption of minimally invasive surgical techniques, advancements in surgical device technologies, and an aging population susceptible to liver, pancreas, and biliary diseases

- Furthermore, increasing demand for innovative surgical devices such as electrosurgical instruments, energy/vessel sealing devices, and robotic-assisted surgical systems is establishing advanced HPB surgical devices as the preferred solution for enhancing surgical outcomes and patient safety. These converging factors are accelerating the uptake of HPB surgical devices, thereby significantly boosting the industry's growth

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Analysis

- HPB surgical devices, including instruments for liver, pancreas, and biliary surgeries, are increasingly critical in both hospital and specialized surgical centers due to their role in enhancing precision, reducing invasiveness, and improving patient outcomes

- The rising demand for HPB surgical devices is primarily fueled by the growing prevalence of liver, pancreas, and biliary diseases, increasing adoption of minimally invasive and robotic-assisted surgical techniques, and advancements in surgical device technologies

- U.S. dominated the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market with the largest revenue share of 73.2% in 2024, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and the strong presence of key market players. The U.S. experienced substantial growth in HPB surgical procedures, particularly in high-volume medical centers, driven by innovations from established medical device companies and emerging players focusing on robotic-assisted systems and energy-based surgical instruments

- Canada is expected to be the fastest-growing country in the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market during the forecast period due to increasing surgical procedure volumes and rising healthcare expenditure

- Electrosurgical instruments dominate the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market with a market share of 46.8% in 2024, driven by their established effectiveness in reducing intraoperative bleeding and improving procedural efficiency

Report Scope and North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Segmentation

|

Attributes |

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Trends

Advancements Through Robotic-Assisted and Minimally Invasive Systems

- A significant and accelerating trend in the North American HPB surgical devices market is the increasing adoption of robotic-assisted and minimally invasive surgical systems, which are enhancing surgical precision, reducing recovery times, and improving patient outcomes

- For instance, the da Vinci Surgical System allows surgeons to perform complex liver and pancreatic procedures with enhanced dexterity and 3D visualization, while robotic-assisted laparoscopic instruments enable less invasive interventions in high-risk patients

- Integration of imaging technologies with HPB surgical devices allows for real-time navigation and intraoperative guidance, improving the accuracy of resections and reducing complications. For instance, devices equipped with fluorescence imaging assist in identifying bile ducts and tumor margins more precisely

- The seamless adoption of robotic and minimally invasive devices facilitates shorter hospital stays, lower postoperative complication rates, and faster return to normal activities, improving overall patient satisfaction and healthcare efficiency

- This trend towards technologically advanced, precise, and patient-friendly surgical solutions is reshaping surgeon expectations for HPB procedures. Consequently, companies such as Medtronic and Johnson & Johnson are developing robotic-assisted devices with enhanced ergonomics and integrated imaging features

- The demand for HPB surgical devices that offer advanced robotic assistance and minimally invasive capabilities is growing rapidly across hospitals and specialized surgical centers, as healthcare providers increasingly prioritize patient safety, procedural efficiency, and surgical precision

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Dynamics

Driver

Increasing Need Due to Rising HPB Disease Prevalence and Technological Adoption

- The growing prevalence of liver, pancreas, and biliary diseases, coupled with rising adoption of advanced surgical technologies, is a significant driver for heightened demand for HPB surgical devices

- For instance, the increasing incidence of hepatocellular carcinoma and pancreatic cancer has led hospitals to invest in advanced electrosurgical and robotic-assisted instruments for complex resections, driving market growth

- As surgeons seek to improve patient outcomes and reduce postoperative complications, HPB surgical devices provide precision, better visualization, and enhanced control during procedures, offering a compelling upgrade over conventional surgical instruments

- Furthermore, increasing hospital investments in state-of-the-art operating rooms and the integration of imaging and energy-based devices are making HPB surgical systems an essential component of modern surgical care

- The ability to perform minimally invasive procedures, reduce blood loss, and shorten patient recovery time are key factors propelling the adoption of HPB surgical devices in both specialized and general hospitals

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high cost of advanced HPB surgical devices and stringent regulatory requirements pose a significant challenge to broader market penetration, particularly for smaller hospitals and healthcare centers

- For instance, the investment required for robotic-assisted systems, along with associated maintenance and training costs, can be prohibitive, limiting adoption in budget-constrained institutions

- Compliance with FDA regulations, device approvals, and ongoing clinical validations adds complexity to product launches, making it difficult for emerging players to enter the market quickly

- While cost-effectiveness and procedure efficiency are improving, the perceived high investment for cutting-edge HPB devices can still hinder adoption, especially in smaller hospitals or lower-revenue regions

- Overcoming these challenges through cost-reduction strategies, leasing options, and streamlined regulatory processes will be vital for sustained market growth and wider access to advanced HPB surgical technologies

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Scope

The market is segmented on the basis of product, indication, type of surgery, age group, end user, and distribution channel.

- By Product

On the basis of product, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into electrosurgery instruments, endoscope, visualization and robotic surgical system, hand instruments, access instruments, surgical suture and stapler devices, energy/vessel sealing devices, fluid management systems, stents, and others. The electrosurgery instruments segment dominated the market with the largest revenue share of 46.8% in 2024, owing to their critical role in achieving precise tissue dissection and effective hemostasis in complex liver and pancreatic surgeries. Their widespread adoption stems from their ability to minimize blood loss, reduce operative time, and enhance surgical outcomes. In North America, hospitals and specialty clinics rely heavily on electrosurgical instruments as standard tools for both open and minimally invasive HPB procedures. The availability of advanced models with improved safety features and integration with imaging further strengthens their dominance. Continuous upgrades and surgeon familiarity ensure that this segment retains its leadership across most surgical settings.

The visualization and robotic surgical system segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing adoption of robotic-assisted HPB surgeries in high-volume centers across the U.S. The demand is fueled by their ability to offer enhanced dexterity, magnified 3D views, and minimally invasive access for highly complex resections. Hospitals are increasingly investing in robotic platforms to improve surgical precision, reduce complications, and shorten patient recovery times. This trend is supported by ongoing technological innovation, rising training programs for surgeons, and a shift toward minimally invasive approaches in liver and pancreatic surgery. Growing patient awareness of the benefits of robotic procedures further accelerates uptake in North America.

- By Indication

On the basis of indication, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into liver cancer, pancreatic cancer, bile duct cancer, gallstones, pancreatitis, cirrhosis, cholecystitis, and others. The liver cancer segment dominated the market with the largest revenue share in 2024, primarily due to the high incidence and growing burden of hepatocellular carcinoma across North America. HPB surgical devices play a vital role in enabling complex liver resections, ablations, and transplant-related procedures. Advanced electrosurgical and vessel-sealing instruments are heavily utilized to manage intraoperative bleeding and ensure safety in high-risk cases. Furthermore, favorable reimbursement structures in the U.S. encourage hospitals to adopt advanced devices for liver cancer surgeries. With rising lifestyle-related liver conditions, including fatty liver disease, this segment continues to drive significant device utilization.

The pancreatic cancer segment is expected to witness the fastest growth through 2032, as cases of pancreatic adenocarcinoma continue to rise in the U.S. and Canada. Surgical resection remains the only curative option, requiring advanced visualization and robotic surgical systems for complex procedures such as the Whipple operation. Increasing awareness, earlier diagnosis, and greater availability of specialized surgical centers are fueling demand for HPB surgical devices in this indication. The segment is also supported by technological advances in minimally invasive pancreatic surgery, enabling reduced morbidity and shorter hospital stays. Growing investments in cancer treatment infrastructure further accelerate this segment’s expansion.

- By Type of Surgery

On the basis of type of surgery, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into open surgery and minimally invasive surgery. The open surgery segment dominated the market with the largest revenue share in 2024, as it remains the standard of care for many complex HPB procedures, especially in cases involving advanced tumors or complicated anatomy. Surgeons rely on electrosurgical devices, staplers, and suturing systems to perform extensive resections safely. Despite the shift toward minimally invasive approaches, a substantial proportion of liver and pancreatic procedures are still conducted via open surgery, sustaining demand for conventional instruments. High surgical volumes in tertiary care hospitals and transplant centers continue to uphold the dominance of open surgery within the North American market.

The minimally invasive surgery segment is expected to record the fastest growth from 2025 to 2032, fueled by rising adoption of laparoscopic and robotic-assisted techniques for HPB procedures. Minimally invasive approaches are increasingly preferred for their ability to reduce intraoperative trauma, shorten recovery times, and lower complication risks. Hospitals in the U.S. and Canada are rapidly integrating advanced visualization systems, energy-based devices, and robotic platforms into HPB surgical suites. Patient demand for less invasive procedures and healthcare cost pressures favoring faster discharges further accelerate this trend. Ongoing training programs are also expanding surgeon expertise in these techniques, boosting adoption rates.

- By Age Group

On the basis of age group, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into pediatric, adult, and geriatric. The adult segment dominated the market with the largest revenue share in 2024, reflecting the high incidence of liver, pancreatic, and gallbladder diseases in this population group. Lifestyle-related risk factors such as obesity, alcohol consumption, and viral hepatitis significantly contribute to the burden of HPB conditions in adults. This drives demand for surgical devices across a wide spectrum of procedures, ranging from cholecystectomy to complex cancer resections. Adults also represent the majority of patients undergoing transplants, further increasing utilization of advanced surgical instruments in hospitals and specialty clinics.

The geriatric segment is projected to witness the fastest growth during the forecast period, as aging populations in the U.S. and Canada experience higher rates of cirrhosis, pancreatic disorders, and biliary complications. Improvements in surgical safety and minimally invasive technologies have expanded surgical eligibility among elderly patients, who were previously considered high-risk. Surgeons are increasingly adopting energy-based and robotic-assisted devices to perform HPB surgeries with reduced trauma and enhanced precision for this age group. Rising life expectancy and healthcare access further support growth of the geriatric-driven demand segment.

- By End User

On the basis of end user, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, trauma centers, and others. The hospitals segment dominated the market with the largest revenue share in 2024, as they serve as the primary centers for complex HPB surgeries across North America. Hospitals possess advanced infrastructure, skilled surgical teams, and access to robotic systems and imaging technologies. They also handle high volumes of liver transplants, Whipple procedures, and advanced resections, ensuring strong demand for a wide range of surgical devices. Favorable reimbursement and government funding in tertiary care hospitals further reinforce this segment’s leadership.

The ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the increasing shift of less complex HPB procedures, such as gallbladder removals and bile duct interventions, into outpatient settings. ASCs offer cost-effective alternatives to hospital care and benefit from rising patient preference for faster discharge and lower expenses. The adoption of advanced minimally invasive and energy-based devices in ASCs is expanding as these centers continue to scale up capabilities for specialized HPB procedures. This trend is particularly strong in the U.S., where ASCs are rapidly growing in number and scope.

- By Distribution Channel

On the basis of distribution channel, the North America Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with the largest revenue share in 2024, as hospitals and large surgical centers prefer bulk procurement directly from manufacturers or distributors. Direct tendering ensures steady supply of critical surgical devices, favorable pricing, and reliable after-sales support. This channel is particularly dominant in the U.S., where high surgical volumes require long-term partnerships with medical device companies.

The retail sales segment is expected to witness the fastest growth during the forecast period, supported by increasing availability of HPB surgical devices through third-party distributors and online platforms. Smaller specialty clinics and ambulatory centers often rely on retail purchases for flexibility and lower upfront costs. Growing e-commerce penetration in the medical device sector, coupled with the demand for quick procurement cycles, is expected to accelerate the retail sales channel. Manufacturers are also expanding direct-to-clinic online sales models, further fueling this trend

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Regional Analysis

- U.S. dominated the North American Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market with the largest revenue share of 73.2% in 2024, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and the strong presence of key market players

- Surgeons and healthcare providers in the U.S. place strong emphasis on precision, safety, and efficiency, making electrosurgical instruments, vessel-sealing devices, and robotic-assisted systems critical components in complex HPB procedures

- This widespread adoption is further supported by advanced healthcare infrastructure, favorable reimbursement policies, and the strong presence of leading global and domestic medical device manufacturers, firmly positioning the U.S. as the dominant market for HPB surgical devices in North America

U.S. Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The U.S. Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market captured the largest revenue share in 2024 within North America, fueled by the high prevalence of liver, pancreatic, and biliary disorders alongside strong adoption of advanced surgical systems. Surgeons are increasingly turning to electrosurgery instruments, vessel sealing systems, and robotic-assisted platforms to improve accuracy and reduce operative risks. The growing demand for minimally invasive HPB procedures is accelerating the adoption of visualization systems and stapling devices. Moreover, the presence of world-class healthcare infrastructure, favorable reimbursement frameworks, and key device manufacturers headquartered in the U.S. significantly contribute to market dominance.

Canada Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Canada Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is projected to expand at a substantial CAGR during the forecast period, primarily supported by the rising burden of hepatobiliary cancers and gallstone-related conditions. Increasing awareness regarding early diagnosis and surgical intervention is fueling the demand for advanced surgical tools across Canadian hospitals and specialty clinics. Adoption of minimally invasive surgery, coupled with government investment in healthcare modernization, is encouraging the uptake of energy-based devices and endoscopic systems. The Canadian market is further benefitting from strategic collaborations with U.S. device manufacturers, ensuring greater accessibility to cutting-edge HPB surgical technologies.

Mexico Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Mexico Hepato-Pancreatico-Biliary (HPB) surgeries surgical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rising incidence of gallstones, cholecystitis, and liver-related complications. Expanding healthcare coverage and investment in public hospitals are driving the need for cost-effective but technologically advanced surgical instruments. Increasing adoption of minimally invasive approaches is enhancing demand for laparoscopic hand instruments, energy devices, and suturing systems. In addition, growing partnerships between Mexican healthcare providers and international medical device suppliers are expected to strengthen the market outlook in both urban and semi-urban areas.

North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Share

The North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices industry is primarily led by well-established companies, including:

- Medtronic (U.S.)

- Medical Device Business Services, Inc. (U.S.)

- Intuitive Surgical Operations, Inc. (U.S.)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Olympus America Inc. (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- FUJIFILM Holdings Corporation (Japan)

- CONMED Corporation (U.S.)

- B. Braun SE (Germany)

- Terumo Corporation (Japan)

- Medline Industries, LP (U.S.)

- AngioDynamics, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- Baxter International Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- HOYA Corporation (Japan)

- Paragonix Technologies, Inc. (U.S.)

What are the Recent Developments in North America Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market?

- In August 2025, Jupiter Medical Center was one of the first in Florida to acquire the da Vinci 5 surgical robot, and used it to perform robotic-assisted Whipple procedures in its Johnny and Terry Gray Surgical Institute, reflecting frontline adoption of new robotics platforms for HPB surgery

- In October 2024, CMR Surgical announced that the U.S. FDA cleared its upgraded Versius Surgical System for gallbladder removal surgeries (age 22+), via a De Novo pathway, signaling its entry into the U.S. market and offering a portable robotic option for HPB-related procedures

- In November 2024, TriSalus Life Sciences announced a strategic partnership with Geo-Med, LLC to expand access of its TriNav® Infusion System for liver tumors and a pancreatic retrograde venous infusion system for pancreatic tumors, including among U.S. veteran populations

- In August 2023, the U.S. FDA cleared Levita Magnetics’ new abdominal surgery platform combining proprietary magnetic surgical technology with robotic assistance, intended to reduce incisions and improve surgeon control in minimally invasive abdominal procedures

- In May 2023, surgeons at The Ohio State University Wexner Medical Center published news of using advanced robotic technology to perform pancreatic cancer surgeries, highlighting growing institutional adoption of robotic-assisted HPB procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.