North America High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.92 Billion

2025

2033

USD

1.20 Billion

USD

1.92 Billion

2025

2033

| 2026 –2033 | |

| USD 1.20 Billion | |

| USD 1.92 Billion | |

|

|

|

|

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Size

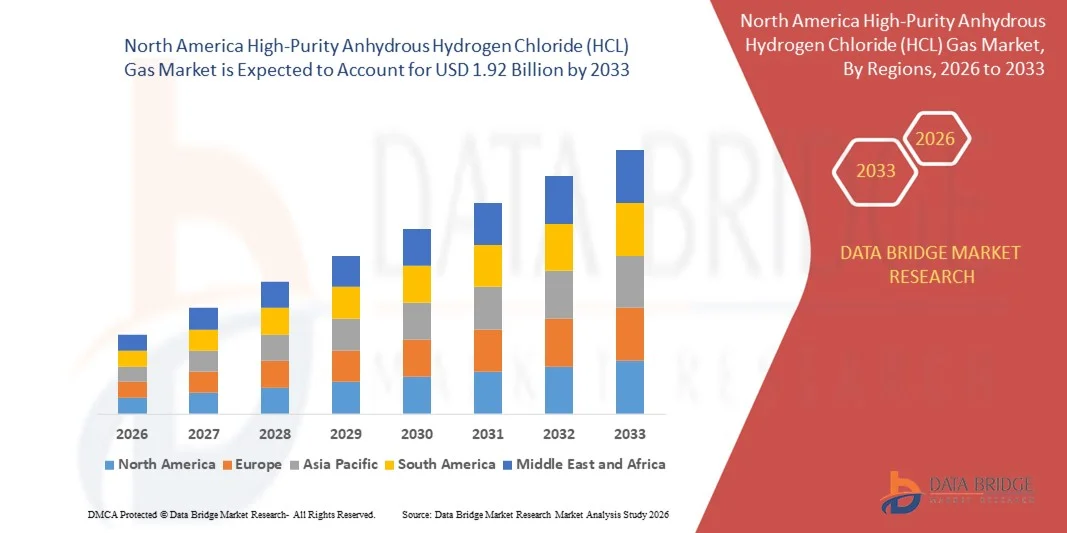

- The North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market was valued at USD 1.20 billion in 2025 and is projected to reach USD 1.92 billion by 2033, expanding at a CAGR of 6.06% throughout the forecast period.

- Market expansion is primarily driven by escalating demand from semiconductor fabrication, pharmaceuticals, and specialty chemicals, where ultra-high purity HCl gas is essential for etching, purification, and synthesis applications amid increasing regional manufacturing capacity.

- Additionally, the push for advanced electronics, tighter purity standards, and greater investment in high-tech infrastructure is strengthening reliance on premium-grade HCl gas, accelerating adoption across end-use industries and significantly propelling overall market growth.

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Analysis

- High-purity anhydrous hydrogen chloride (HCl) gas, used extensively in semiconductor etching, pharmaceutical synthesis, and specialty chemical production, is becoming an increasingly critical input across advanced manufacturing due to its ultra-high purity levels, process reliability, and compatibility with next-generation fabrication technologies.

- The rising demand for high-purity HCl gas is primarily driven by expanding semiconductor manufacturing capacity, growing pharmaceutical production, and increasing emphasis on stringent purity standards across chemical processes.

- U.S. dominated the North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market with the largest revenue share of 32.2% in 2025, supported by strong investment in semiconductor fabs, robust pharmaceutical R&D, and the presence of leading gas producers. The U.S. led regional growth, propelled by large-scale chip manufacturing initiatives and technological advancements in ultra-clean gas delivery systems.

- Canada is expected to be the fastest-growing region in the North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market during the forecast period due to rapid industrialization, expanding electronics manufacturing, and rising demand for high-precision chemical processes.

- The electronics grade segment dominated the market with the largest revenue share of approximately 64.5% in 2025, driven by its critical use in semiconductor wafer cleaning, etching, and microfabrication processes that require extremely high purity levels.

Report Scope and North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Segmentation

|

Attributes |

High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Trends

Advancements in Automation and Digital Process Optimization

- A significant and rapidly accelerating trend in the global North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market is the expanding integration of advanced automation, digital monitoring, and AI-enabled process control within semiconductor, pharmaceutical, and specialty chemical manufacturing. This technological shift is greatly enhancing efficiency, precision, and safety in high-purity gas handling and delivery systems.

- For Instance, modern semiconductor fabrication facilities increasingly employ AI-driven gas monitoring platforms that track HCl gas purity in real time, ensuring ultra-clean process conditions essential for wafer etching and cleaning. Similarly, automated gas distribution systems used by leading suppliers allow continuous purity validation and minimized contamination risks across production lines.

- AI integration within high-purity gas management enables capabilities such as predictive maintenance, advanced leak detection, and automated optimization of gas flow rates based on ongoing process demands. Certain next-generation gas cabinets use machine-learning algorithms to detect anomalies in pressure, purity, or consumption patterns, allowing operators to act proactively and avoid costly production interruptions.

- The seamless integration of digital sensors, automation controls, and centralized monitoring platforms allows manufacturers to manage HCl gas supply alongside other critical process gases, creating a unified and highly efficient production environment with improved traceability and regulatory compliance.

- This move toward smarter, automated, and interconnected gas delivery infrastructure is redefining operational expectations across the semiconductor and chemical industries. Consequently, companies are increasingly adopting digital gas-management solutions with features such as remote monitoring, automated purity reporting, and AI-based process optimization.

- Demand for high-purity HCl systems that support advanced automation and intelligent control is growing rapidly across North America, as end users prioritize higher throughput, improved process reliability, and enhanced safety within increasingly complex manufacturing environments.

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Dynamics

Driver

Growing Need Driven by Expanding Semiconductor and Pharmaceutical Production

- The rapid expansion of semiconductor fabrication facilities and pharmaceutical manufacturing across North America is significantly driving the demand for high-purity anhydrous hydrogen chloride (HCl) gas. As chipmakers scale production of advanced nodes and pharmaceutical firms increase output of specialty compounds, the requirement for ultra-clean, high-performance process gases continues to rise.

- For Instance, leading semiconductor manufacturers have announced large-scale investments in new wafer fabrication plants, each requiring substantial volumes of ultra-high-purity HCl for etching, wafer cleaning, and surface preparation. These industry expansions, coupled with capacity upgrades by key gas suppliers, are expected to fuel strong market growth over the forecast period.

- As manufacturing processes become more refined and purity specifications tighten, high-purity HCl gas offers critical advantages including improved process consistency, reduced contamination risk, and enhanced product yields—making it an essential chemical input across high-tech industries.

- Furthermore, the growing emphasis on advanced materials, electronics miniaturization, and biologics production is pushing end users to integrate high-purity HCl into broader process ecosystems, where it works seamlessly alongside other specialty gases and precision equipment.

- The increasing need for reliable, consistent, and high-purity gas supply—driven by regulatory demands and the push for higher manufacturing efficiency—is accelerating adoption across both established and emerging production facilities. Growing interest in automated gas handling and digital monitoring systems further contributes to long-term market growth.

Restraint/Challenge

Supply Chain Constraints and High Production Costs

- Supply chain challenges associated with sourcing, purifying, and distributing high-purity anhydrous HCl present a significant barrier to broader market expansion. Production of ultra-high-purity HCl requires specialized equipment, stringent purification processes, and tightly controlled transportation systems, leading to vulnerabilities and logistical complexities that can impact availability.

- For Instance, disruptions in the supply of precursor chemicals, limited availability of high-grade cylinders and gas cabinets, or delays in semiconductor-grade purification components can affect manufacturers’ ability to maintain consistent production levels.

- Addressing these supply chain constraints requires substantial investment in purification infrastructure, redundancy systems, and strategic partnerships across the value chain. Major suppliers are increasingly emphasizing facility modernization, advanced quality-control technologies, and contingency planning to meet rising demand.

- Additionally, the high cost of producing and maintaining ultra-high-purity gas systems can be a deterrent for smaller manufacturers or companies with limited budgets. Compared to lower-purity alternatives, semiconductor- or pharmaceutical-grade HCl requires costly purification technologies, specialized containment systems, and strict regulatory compliance.

- While technological advancements continue to reduce operational costs over time, the premium pricing associated with ultra-high-purity gas remains a challenge, particularly for industries or regions where cost efficiency is prioritized over ultra-high-purity specifications.

- Overcoming these challenges through expanded production capacity, improved logistics, and ongoing innovations in purification technology will be essential for sustaining long-term growth in the North American high-purity anhydrous HCl gas market.

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Scope

The market is segmented on market based on product, application

- By Product

On the basis of product, the North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market is segmented into electronics grade and chemical grade. The electronics grade segment dominated the market with the largest revenue share of approximately 64.5% in 2025, driven by its critical use in semiconductor wafer cleaning, etching, and microfabrication processes that require extremely high purity levels. The surge in new semiconductor fabrication plants across the U.S., alongside increased production of advanced chips, continues to strengthen demand for electronics-grade HCl. Its role in enabling defect-free surface preparation and contamination-free processing makes it indispensable for high-performance electronics manufacturing.

The chemical grade segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its rising use in specialty chemical synthesis, pharmaceutical intermediates, and laboratory-scale applications. Increasing investments in chemical R&D and growing pharmaceutical demand are contributing significantly to this segment’s rapid expansion.

- By Application

On the basis of application, the market is segmented into electronics and electricals, pharmaceuticals, chemicals, and others. The electronics and electricals segment held the largest market revenue share of approximately 58.9% in 2025, driven by expanding semiconductor production, growth in advanced packaging, and increased fabrication of sensors, microchips, and other high-end electronic components. High-purity HCl is essential in processes such as silicon etching, III-V semiconductor production, and thin-film deposition, resulting in strong and consistent demand from major U.S. and Canadian semiconductor manufacturers.

The pharmaceuticals segment is expected to witness the fastest CAGR from 2026 to 2033, supported by rising production of active pharmaceutical ingredients (APIs), growing biologics manufacturing, and the increasing need for high-purity reagents in drug formulation. Additionally, stringent purity regulations and expanding R&D activities are accelerating the adoption of high-purity HCl across pharmaceutical synthesis and quality-control operations.

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Regional Analysis

- U.S. dominated the North America High-Purity Anhydrous Hydrogen Chloride (HCl) Gas Market with the largest revenue share of 32.2% in 2025, driven by the strong presence of semiconductor fabrication facilities, advanced pharmaceutical manufacturing hubs, and established specialty chemical industries that rely heavily on ultra-high-purity process gases.

- Manufacturers in the region place a high emphasis on process consistency, contamination control, and regulatory compliance, leading to substantial demand for high-purity HCl used in wafer etching, surface treatment, chemical synthesis, and precision cleaning.

- This strong regional adoption is further supported by significant investments in next-generation chip fabrication, a technologically advanced industrial base, and the growing shift toward automation and digital process monitoring, positioning high-purity HCl gas as a critical input across electronics, pharmaceutical, and specialty chemical production environments.

U.S. High-Purity Anhydrous HCl Gas Market Insight

The U.S. high-purity anhydrous hydrogen chloride (HCl) gas market captured the largest revenue share of 81% in 2025 within North America, driven by the rapid expansion of semiconductor fabrication facilities, strong pharmaceutical production, and advanced specialty chemical manufacturing. The U.S. CHIPS Act and large-scale investments by major chipmakers have significantly increased demand for ultra-high-purity HCl used in wafer etching, cleaning, and epitaxial processes. Additionally, the pharmaceutical and biotech sectors rely on high-purity HCl for API synthesis and quality-controlled manufacturing, further supporting market growth. The country’s robust industrial infrastructure, advanced R&D capabilities, and increasing adoption of automated gas delivery systems continue to propel demand. Moreover, stringent purity standards and continuous innovation in high-tech manufacturing processes are reinforcing the U.S. position as the dominant market for high-purity HCl gas in North America.

Canada High-Purity Anhydrous HCl Gas Market Insight

The Canada high-purity anhydrous HCl gas market is projected to expand at a substantial CAGR throughout the forecast period, driven by growth in pharmaceutical manufacturing, rising investments in chemical production, and increasing participation in North America's semiconductor supply chain. As Canada strengthens its presence in specialty chemical and materials research, demand for high-purity process gases is gaining momentum. The country’s focus on secure supply chains and advanced manufacturing technologies, along with government initiatives supporting industrial modernization, is contributing to the adoption of high-purity HCl. Additionally, rising awareness of process purity requirements and improvements in industrial safety standards are encouraging both established facilities and new entrants to integrate high-purity HCl into their production lines. Growth is notable across pharmaceuticals, chemical synthesis, and emerging electronics applications, with both new infrastructure and retrofitting projects driving market expansion.

Mexico High-Purity Anhydrous HCl Gas Market Insight

The Mexico high-purity anhydrous HCl gas market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by expanding chemical manufacturing, rising pharmaceutical production, and growing integration with North America’s broader electronics and industrial supply chains. Increasing foreign investment in Mexico’s industrial sector, alongside the growth of manufacturing clusters, is driving the demand for high-purity HCl in high-precision chemical and materials processing. Additionally, Mexico’s strengthening role in electronics assembly and component production is expected to gradually boost the need for semiconductor-grade process gases. Rising regulatory emphasis on industrial safety and quality standards is also encouraging industries to adopt higher-purity chemical inputs. As the country continues to modernize its manufacturing infrastructure and attract new industrial projects, demand for high-purity anhydrous HCl is set to increase steadily across multiple applications, including chemicals, pharmaceuticals, and electronics.

North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market Share

The High-Purity Anhydrous Hydrogen Chloride (HCL) Gas industry is primarily led by well-established companies, including:

• Linde plc (U.K.)

• Air Liquide (France)

• Air Products and Chemicals, Inc. (U.S.)

• Matheson Tri-Gas (U.S.)

• Messer Group (U.S.)

• Kanto Denka Kogyo Co., Ltd. (Japan)

• Taiyo Nippon Sanso Corporation (Japan)

• Haohua Chemical Group (China)

• Merck KGaA / EMD Electronics (U.S.)

• Sumitomo Seika Chemicals (Japan)

• Gulf Cryo (U.S.)

• Harbor Gas (U.S.)

• Continental Carbonic Products (U.S.)

• BASF SE (Germany)

• Gujarat Fluorochemicals Ltd. (India)

• SRF Limited (India)

• Dow Chemical Company (U.S.)

• Olin Corporation (U.S.)

What are the Recent Developments in North America High-Purity Anhydrous Hydrogen Chloride (HCL) Gas Market?

- In April 2024, Linde plc announced the expansion of its high-purity anhydrous hydrogen chloride (HCl) production capacity in Texas, aimed at supporting the accelerating growth of semiconductor fabrication in the United States. The initiative includes advanced purification and distribution technologies designed to meet the stringent purity requirements of next-generation chip manufacturing. By leveraging its global expertise in industrial gases, Linde is reinforcing its leadership position in the rapidly expanding North America High-Purity Anhydrous HCl Gas Market while addressing growing regional supply demands.

- In March 2024, Air Liquide unveiled a new ultra-high-purity gas purification facility in Ontario, Canada, dedicated to supplying semiconductor-grade HCl and other critical process gases to electronics manufacturers. The investment strengthens the company’s North American footprint and enhances supply chain resilience for chipmakers. This strategic expansion underscores Air Liquide’s commitment to delivering cutting-edge gas solutions tailored to advanced electronics and high-precision chemical applications.

- In March 2024, Air Products and Chemicals, Inc. initiated a collaboration with a leading U.S. semiconductor manufacturer to implement advanced digital gas-management systems across high-purity HCl supply lines. The initiative integrates real-time monitoring, AI-enabled purity tracking, and automated safety controls, enhancing operational efficiency and contamination prevention. This partnership highlights the rising importance of intelligent gas infrastructure within modern fabrication facilities.

- In February 2024, Merck/EMD Electronics announced a long-term supply agreement with a major pharmaceutical producer in North America for high-purity HCl used in active pharmaceutical ingredient (API) synthesis. The collaboration aims to support the growing demand for high-quality pharmaceutical intermediates and ensure secure, reliable access to ultra-high-purity reagents. This move reinforces Merck’s strategic focus on strengthening its specialty chemicals portfolio and supporting innovation in the life sciences sector.

- In January 2024, Messer Group introduced its next-generation semiconductor-grade HCl distribution system, featuring advanced contamination-control technology and fully automated pressure regulation. Launched at a major U.S. electronics technology conference, the system enables manufacturers to achieve higher yields and improved process stability. The innovation demonstrates Messer’s commitment to advancing high-purity gas delivery solutions and supporting the evolving needs of semiconductor and specialty chemical producers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America High Purity Anhydrous Hydrogen Chloride Hcl Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America High Purity Anhydrous Hydrogen Chloride Hcl Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America High Purity Anhydrous Hydrogen Chloride Hcl Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.