North America Human Insulin Drugs And Delivery Devices Market

Market Size in USD Million

CAGR :

%

USD

649.65 Million

USD

1,293.61 Million

2024

2032

USD

649.65 Million

USD

1,293.61 Million

2024

2032

| 2025 –2032 | |

| USD 649.65 Million | |

| USD 1,293.61 Million | |

|

|

|

|

Human Insulin Drugs and Delivery Devices Market Size

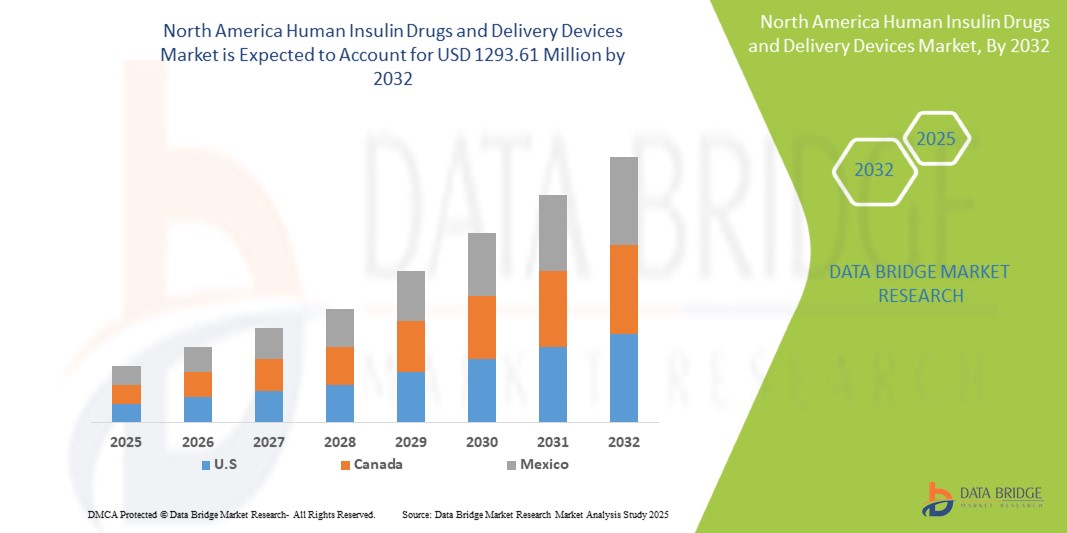

- The North America Human Insulin Drugs and Delivery Devices Market size was valued at USD 649.65 million in 2024 and is expected to reach USD 1293.61 million by 2032, at a CAGR of 9.0% during the forecast period

- The market growth is largely fueled by the increasing prevalence of diabetes and the rising need for effective and convenient glucose management solutions, leading to greater adoption of human insulin drugs and advanced delivery devices across North America.

- Furthermore, growing patient demand for user-friendly, pain-free, and technologically integrated insulin delivery methods—such as insulin pens, pumps, and smart injectors—is transforming traditional treatment approaches. These converging factors are accelerating the uptake of human insulin drugs and delivery devices, thereby significantly boosting the industry's growth.

Human Insulin Drugs and Delivery Devices Market Analysis

- Human insulin drugs and delivery devices, including pens, pumps, and syringes, are becoming increasingly essential components of modern diabetes management due to their enhanced accuracy, user convenience, and improved glycemic control.

- The escalating demand for these solutions is primarily driven by the rising prevalence of diabetes, increased patient awareness, and a growing preference for minimally invasive, easy-to-use delivery options.

- U.S. dominates the Human Insulin Drugs and Delivery Devices market with the largest revenue share of 36.24% in 2025, characterized by high healthcare spending, early adoption of advanced medical technologies, and a strong presence of key pharmaceutical and medtech players. The U.S. leads regional growth with significant uptake of smart insulin delivery systems, supported by innovations from both industry leaders and digital health startups.

- Canada is expected to be the fastest-growing country in the Human Insulin Drugs and Delivery Devices market during the forecast period, due to a sharp rise in diabetes cases, growing urbanization, and improved access to healthcare infrastructure.

- The Basal or Long Acting Insulins segment is expected to dominate the Human Insulin Drugs and Delivery Devices market with a market share of 33.2% in 2025, driven by its ease of use, portability, and increasing patient preference over traditional syringes.

Report Scope and Human Insulin Drugs and Delivery Devices Market Segmentation

|

Attributes |

Human Insulin Drugs and Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

Expansion of Digital Health Integration Rising Demand in Emerging Demographics |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Human Insulin Drugs and Delivery Devices Market Trends

“Rising Preference for Non-Invasive and Wearable Delivery Solutions”

- A growing trend in the North America Human Insulin Drugs and Delivery Devices Market is the increasing shift toward non-invasive and wearable insulin delivery technologies, driven by patient demand for greater comfort, mobility, and discretion in diabetes management.

- Wearable insulin pumps, continuous glucose monitors (CGMs), and patch-based delivery systems are gaining popularity, as they eliminate the need for multiple daily injections and offer more precise and continuous insulin administration.

- Companies such as Insulet (maker of the Omnipod) and Tandem Diabetes Care are leading this trend by developing compact, tubeless, and waterproof insulin delivery devices designed for lifestyle flexibility and improved user compliance.

- Integration of these wearables with smartphone apps and Bluetooth-enabled monitoring tools provides users with real-time data and automated dosing insights, supporting better glycemic control without manual intervention.

- This trend reflects a broader push toward patient-centric care, where convenience, comfort, and ease-of-use are prioritized. As healthcare systems promote remote patient monitoring and personalized therapy, wearable insulin devices are positioned to play a central role in the next generation of diabetes treatment.

- With rising R&D investment and favorable reimbursement policies in the U.S. and Canada, adoption of wearable and non-invasive delivery systems is expected to accelerate, further transforming the landscape of insulin therapy.

Human Insulin Drugs and Delivery Devices Market Dynamics

Driver

“Growing Need Due to Rising Diabetes Prevalence and Demand for Convenient Insulin Delivery”

- The rising global prevalence of diabetes, particularly in North America, is a primary driver behind the increasing demand for human insulin drugs and advanced delivery devices. As the diabetic population continues to grow, the need for effective, safe, and user-friendly insulin administration solutions is intensifying.

- For instance, in 2024, Eli Lilly and Company announced new advancements in their connected insulin pen technologies, aimed at improving treatment adherence and real-time monitoring. Such innovations by major players are expected to significantly contribute to market growth during the forecast period.

- Patients are increasingly seeking devices that offer convenience, portability, and reduced injection frequency. This demand is fueling the adoption of smart insulin pens, patch pumps, and continuous subcutaneous insulin infusion (CSII) systems.

- Moreover, the emphasis on self-care, coupled with the rise in home-based diabetes management, is promoting the integration of digital health features such as Bluetooth connectivity, dose tracking, and cloud-based data sharing into delivery systems.

- The trend toward value-based care and patient-centric treatment models is also encouraging the use of intelligent insulin delivery devices that improve compliance and glycemic control, thereby reducing long-term healthcare costs and complications associated with diabetes.

Restraint/Challenge

“High Costs and Limited Access to Advanced Technologies”

- Despite the growing availability of innovative insulin delivery systems, high costs remain a significant barrier, particularly for uninsured patients or those in low- and middle-income brackets. Advanced devices such as insulin pumps or AI-integrated smart pens often come with a premium price, limiting their accessibility.

- For instance, newer technologies that offer automated insulin dosing and real-time monitoring may require additional investments in compatible CGMs and digital platforms, further increasing the financial burden on patients and healthcare systems.

- Insurance coverage variability and reimbursement challenges also create obstacles for widespread adoption, especially in markets where healthcare spending is constrained or fragmented.

- In addition to cost, the learning curve associated with newer devices, along with inconsistent access to diabetes education and training, can hinder proper usage and long-term adherence.

- Addressing these challenges will require coordinated efforts among manufacturers, healthcare providers, and policymakers to expand insurance coverage, reduce device pricing, and increase awareness and education around the benefits of modern insulin therapy solutions.

Human Insulin Drugs and Delivery Devices Market Scope

The market is segmented on the basis of Drugs, Device, Delivery Devices, Application, Product, Distribution Channel, end user.

- By Drugs

On the basis of Drugs, the Human Insulin Drugs and Delivery Devices market is segmented into Basal or Long-Acting Insulins, Bolus or Fast-Acting Insulins, Traditional Human Insulins, Combination Insulins and Biosimilar Insulins. The Basal or Long-Acting Insulins segment dominates the largest market revenue share of 33.2% in 2025, driven by its ability to provide steady, 24-hour glucose control with fewer injections and improved patient compliance in managing Type 1 and Type 2 diabetes. Its widespread adoption is further supported by advancements in formulation and delivery methods that enhance safety, efficacy, and ease of use.

The Bolus or Fast-Acting Insulins segment is anticipated to witness the fastest growth rate of 5.7% from 2025 to 2032, fueled by the rising prevalence of postprandial glucose management needs and growing demand for rapid-onset insulin therapies. This growth is further supported by increased adoption of flexible mealtime insulin regimens and the development of ultra-rapid formulations offering faster absorption and improved glycemic control.

- By Device

On the basis of Device, the Human Insulin Drugs and Delivery Devices market is segmented into Insulin Pumps, Insulin Pens, Insulin Syringes and Insulin Jet Injectors. The Insulin Pumps, Insulin Pens, Insulin Syringes and Insulin Jet Injectors held the largest market revenue share in 2025 of, driven by widespread use in diabetes management due to ease of administration, precise dosing capabilities, and growing patient preference for less invasive, user-friendly delivery options. Technological advancements and increased accessibility to smart and connected devices have further supported this segment’s dominance across both clinical and homecare settings.

The Insulin Pens segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its ease of use, portability, and improved dose accuracy, making it highly preferred among patients for daily insulin administration. Rising adoption of smart pens with digital tracking and integration capabilities is further propelling growth, especially among tech-savvy and newly diagnosed diabetic populations.

- By Delivery Devices

On the basis of Delivery Devices, the Human Insulin Drugs and Delivery Devices market is segmented into Syringes, Pens and Pen Needles. The Syringes held the largest market revenue share in 2025, driven by their widespread availability, cost-effectiveness, and continued preference in low- and middle-income regions for insulin delivery. Their compatibility with various insulin types and minimal device training requirements make them a dependable choice, particularly in clinical and resource-limited settings.

The Pens is expected to witness the fastest CAGR from 2025 to 2032, favored for its user-friendly design, dose accuracy, and convenience for self-administration. Its growing popularity is also supported by advancements in smart pen technology and increased adoption among newly diagnosed diabetic patients seeking discreet and portable insulin delivery options.

- By Application

On the basis of application, the Human Insulin Drugs and Delivery Devices market is segmented into Type II Diabetes and Type II Diabetes. The Type II Diabetes segment accounted for the largest market revenue share in 2024, driven by the growing global prevalence of lifestyle-related diabetes and the increasing need for long-term insulin therapy. This dominance is further supported by aging populations, rising obesity rates, and enhanced diagnosis and treatment rates across both developed and emerging markets.

The Type II Diabetes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing awareness, early diagnosis, and the rising adoption of advanced insulin delivery devices. Additionally, growing investments in diabetes care infrastructure and the availability of personalized treatment options are fueling market growth in this segment.

- By Product

On the basis of product, the Human Insulin Drugs and Delivery Devices market is segmented into HI Drugs, HI Delivery Devices. The HI Drugs segment accounted for the largest market revenue share in 2024, driven by the widespread use of human insulin therapies in diabetes management and their proven efficacy in controlling blood glucose levels. This segment’s growth is further supported by ongoing product innovations, increasing prevalence of diabetes, and strong physician preference for established insulin formulations.

The HI Delivery Devices segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in user-friendly, portable, and connected delivery technologies such as insulin pens and pumps. Rising patient preference for convenience, accuracy, and improved dosing compliance, along with increasing adoption of digital health solutions, are key factors propelling this segment’s growth.

- By distribution channel

On the basis of distribution channel, the Human Insulin Drugs and Delivery Devices market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/ Centers and Other. The Hospital Pharmacy segment accounted for the largest market revenue share in 2024, driven by the high demand for insulin drugs and delivery devices in inpatient care settings. Hospitals prioritize reliable, timely access to insulin for diabetes management, supported by established procurement processes and increasing prevalence of diabetes-related hospitalizations.

The Retail Pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing prevalence of diabetes, advancements in insulin delivery technologies, and a growing emphasis on patient-centric care.

- By end user

On the basis of end user, the Human Insulin Drugs and Delivery Devices market is segmented into Hospitals and Clinics, Homecare and Specialty Centers. The Hospitals and Clinics segment accounted for the largest market revenue share in 2024, driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technologies, and a growing demand for specialized healthcare services. Additionally, the expansion of healthcare infrastructure and rising patient volumes contributed to the segment's dominance in the healthcare market.

The Homecare segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising aging population and increasing prevalence of chronic diseases. Additionally, advancements in remote monitoring technologies and cost-effective care delivery are fueling its rapid growth.

Human Insulin Drugs and Delivery Devices Market Regional Analysis

- North America dominates the Human Insulin Drugs and Delivery Devices market with the largest revenue share of 36.24% in 2024, driven by the rising prevalence of diabetes and advancements in insulin delivery technologies.

- Consumers in the region benefit from improved treatment adherence and convenience through smart insulin pens, pumps, and connected delivery devices.

- This growth is further supported by increasing healthcare awareness, strong healthcare infrastructure, and supportive government initiatives promoting diabetes management and patient-centric care.

U.S. Human Insulin Drugs and Delivery Devices Market Insight

The U.S. Human Insulin Drugs and Delivery Devices market captured the largest revenue share of 36.24% within North America in 2025, fueled by the rapid adoption of connected insulin delivery devices and smart health monitoring systems. Consumers increasingly prioritize convenience and better disease management through technologically advanced insulin pumps, smart pens, and remote monitoring features. The growing integration of digital health platforms, telemedicine, and mobile app compatibility significantly contributes to market expansion, enhancing patient adherence and personalized care.

Canada Human Insulin Drugs and Delivery Devices Market Insight

The Canadian market is projected to grow substantially, driven by increasing diabetes prevalence and supportive government healthcare programs encouraging advanced insulin therapies. Rising urbanization and the demand for efficient chronic disease management foster adoption of innovative insulin delivery devices across residential and clinical settings. Canadian consumers value ease of use, safety, and integration with digital health tools, boosting adoption in both new and existing healthcare infrastructures.

Mexico Human Insulin Drugs and Delivery Devices Market Insight

The Mexican market is expected to experience notable growth, propelled by expanding healthcare access and rising awareness of diabetes management through insulin therapies. Increasing demand for affordable, easy-to-use insulin delivery solutions, coupled with growing healthcare investments, supports market growth. Enhanced digital health adoption and improving e-commerce platforms further facilitate access to advanced insulin devices for both urban and rural populations.

Human Insulin Drugs and Delivery Devices Market Share

The Human Insulin Drugs and Delivery Devices industry is primarily led by well-established companies, including:

- Eli Lilly and Company

- Medtronic plc

- Insulet Corporation

- Dexcom, Inc.

- Becton, Dickinson and Company (BD)

- Tandem Diabetes Care, Inc.

- Abbott Laboratories

- Johnson & Johnson

- Novo Nordisk Inc. (U.S. operations)

- Sanofi (U.S. operations)

Latest Developments in North America Human Insulin Drugs and Delivery Devices Market

- In April 2023, Eli Lilly and Company launched a next-generation connected insulin pump system designed to improve glucose management and patient adherence through advanced digital monitoring and integration with mobile health apps. This development emphasizes Eli Lilly’s commitment to enhancing diabetes care with innovative technology.

- In March 2023, Tandem Diabetes Care, Inc. introduced its updated t:slim X2 insulin pump featuring automated insulin delivery capabilities and enhanced user interface, aimed at improving patient convenience and treatment outcomes in both pediatric and adult populations.

- In March 2023, Dexcom, Inc. expanded its continuous glucose monitoring (CGM) device offerings with the release of a more compact, accurate, and longer-lasting sensor, reflecting ongoing innovation in real-time glucose tracking technology.

- In February 2023, Abbott Laboratories received FDA approval for its latest FreeStyle Libre device, which integrates seamlessly with insulin delivery systems to provide comprehensive diabetes management, marking a significant step toward personalized patient care.

- In January 2023, Medtronic plc announced a strategic partnership with digital health companies to develop AI-driven insulin delivery solutions that optimize dosing and predict glucose trends, demonstrating a forward-looking approach to automated diabetes management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.