North America Hydrographic Survey Equipment Market

Market Size in USD Million

CAGR :

%

USD

925.24 Million

USD

1,555.52 Million

2024

2032

USD

925.24 Million

USD

1,555.52 Million

2024

2032

| 2025 –2032 | |

| USD 925.24 Million | |

| USD 1,555.52 Million | |

|

|

|

North America Hydrographic Survey Equipment Market Analysis

The North America hydrographic survey equipment market has seen significant growth driven by advancements in technology and increasing demand for accurate water data across various industries. The market includes a wide range of products such as sonar systems, multi-beam and single-beam echo sounders, underwater drones, GPS systems, and data management software. Key applications span across marine navigation, environmental monitoring, coastal engineering, oil and gas exploration, and defense sectors. The rising need for precise mapping of underwater terrain, coupled with the growth in maritime trade, offshore activities, and environmental protection initiatives, continues to fuel market expansion. In addition, innovations such as automation, AI integration, and improved sensor technology are shaping the future of hydrographic surveys, making them more efficient and cost-effective.

Hydrographic Survey Equipment Market Size

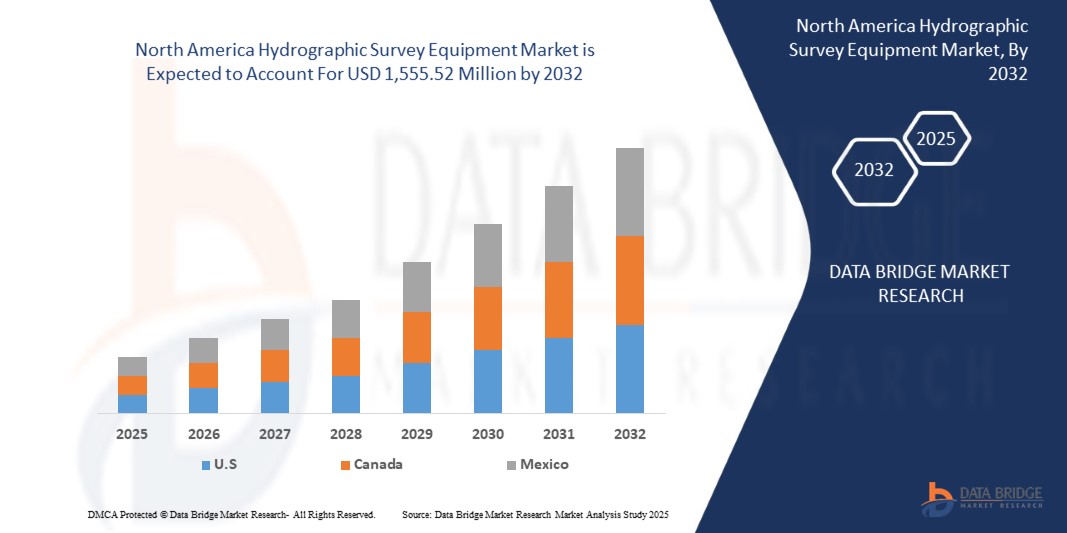

North America hydrographic survey equipment market size was valued at USD 925.24 million in 2024 and is projected to reach USD 1,555.52 million by 2032, with a CAGR of 6.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Hydrographic Survey Equipment Market Trends

“Expansion of Maritime Trade and Commerce”

The expansion of maritime trade and commerce is a key driver for the North America hydrographic survey equipment market. As international shipping activities grow, the need for accurate and up-to-date marine data becomes crucial for safe navigation and efficient port operations. Hydrographic surveys help in mapping shipping lanes, identifying submerged hazards, and ensuring the safe passage of vessels, thereby supporting the smooth flow of goods across international waters. In addition, the increasing complexity of North America trade routes and the need for sustainable port development require advanced survey technologies. This growing demand for precise data ensures the continued growth of the hydrographic survey equipment market. With expanding trade volumes, the market is positioned to witness increased investments in advanced surveying technologies. As such, hydrographic surveys play a vital role in sustaining the North America maritime economy.

Report Scope and Hydrographic Survey Equipment Market Segmentation

|

Attributes |

Hydrographic Survey Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Chesapeake Technology (U.S.), Esri North America, Inc. (U.S.), South Surveying & Mapping Technology Co., Ltd (China), Trimble Applanix (Canada), Norbit Asa (Norway), Nortek Group (Norway), Beamworx (Netherlands), Ohmex Ltd (U.K.), R2Sonic, Inc. (U.S.), Syqwest (U.S.), Beijing Hydro-Tech Marine Technology Co., Ltd. (China), Kongsberg Discovery (Norway), Innomar Technologie GmbH (Germany), Teledyne Marine Technologies Incorporated (U.S.), EdgeTech (U.S.), Sonardyne (U.K.), ixblue (France), Tritech International Limited (U.K.), CEE HydroSystems (U.S.), Xylem (U.S.), Thales (France), Seafloor Systems, Inc. (U.S.),and ATLAS ELEKTRONIK GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hydrographic Survey Equipment Market Definition

The hydrographic survey equipment refers to the industries focused on the production and sale of safety-related devices such as controllers, relays, switches, and various sensors. It is driven by increasing demand for automation, stricter safety regulations, and the need for efficient worker protection across industries such as automotive, oil & gas, food & beverage, and manufacturing. Safety sensors are devices used to monitor, detect, and respond to unsafe conditions in industrial environments to protect equipment, personnel, and processes. Safety controllers coordinate multiple safety inputs and outputs to trigger shutdowns or corrective actions. Safety relays isolate and switch circuits when risks are detected, ensuring systems operate safely. Safety switches monitor access points, stopping machinery when guards or doors are opened. Analog sensors provide continuous signals to measure variables such as pressure or temperature, while digital sensors offer discrete on/off signals. Smart sensors incorporate real-time monitoring, diagnostics, and predictive maintenance capabilities, enhancing automation and operational safety.

Hydrographic Survey Equipment Market Dynamics

Drivers

- Increasing Demand For Offshore Oil and Gas Exploration

The rising demand for offshore oil and gas exploration is accelerating the need for advanced hydrographic survey equipment to support precise underwater mapping and data collection. As companies explore deeper and more complex underwater environments, accurate bathymetric charts and seabed data become critical for identifying resource-rich areas, ensuring safe drilling operations, and minimizing environmental risks. This growing activity in offshore energy production is expected to fuel the adoption of state-of-the-art hydrographic technologies, including multibeam echo sounders, side-scan sonars, and ROV-mounted systems, within the North America market.

For Instance:

In February 2024, a hydrographic survey was initiated at a wreckage site off Cove, Tobago, 21 days after a vessel spewing bunker fuel ran aground near the shoreline. The survey aimed to measure water depth and locate navigational hazards to facilitate the removal of the overturned barge while assessing the distribution of fuel and hydrocarbons. Specialists and advanced equipment were deployed for fuel containment and vessel recovery. This incident highlights the critical role of hydrographic survey equipment in offshore oil and gas operations, as it enables precise mapping, risk mitigation, and efficient disaster response, further driving demand in the North America market

In October 2024, Turkey’s advanced oil research vessel, Oruc Reis, began Somalia’s first comprehensive offshore oil exploration program, covering 15,000 square kilometers across three blocks. Equipped with state-of-the-art hydrographic survey and seismic capabilities, the vessel will conduct geological, geophysical, and oceanographic studies over 5-7 months. This initiative, under a Turkey-Somalia partnership, underscores the growing demand for hydrographic survey equipment in offshore oil and gas exploration as countries seek advanced tools to unlock energy resources and drive economic growth in untapped regions

- Rise in Coastal Infrastructure Development

The rise in coastal infrastructure development is contributing to the drive of the North America hydrographic survey equipment market, as accurate and detailed surveying of coastal areas is crucial for the planning and construction of infrastructure such as ports, harbors, and coastal defense systems. As these projects expand North Americaly, the demand for hydrographic survey equipment, including advanced sonar systems, mapping technologies, and environmental monitoring tools, is increasing. These technologies help assess water depths, seabed conditions, and potential environmental impacts, ensuring that coastal infrastructure projects are executed safely, efficiently, and sustainably.

For instance,

In October 2024, the Indian Navy received the second of four Survey Vessel (Large) ships, Nirdeshak (Yard 3026), built by Garden Reach Shipbuilders & Engineers (GRSE) in Kolkata. Nirdeshak is designed for comprehensive coastal and deep-water hydrographic surveys, which are essential for assessing port and harbor approaches and navigational channels and gathering oceanographic and geophysical data. The ship is equipped with advanced hydrographic technologies, including side scan sonar, DGPS positioning systems, and autonomous underwater vehicles. As coastal infrastructure development continues to rise North Americaly, the demand for such advanced survey vessels, such as Nirdeshak, highlights the growing need for accurate data collection and monitoring for safe, efficient infrastructure planning and development.

In April 2021, the Nigerian Navy's newest Offshore Survey Vessel, NNS LANA, made a port call at Las Palmas, Spain, on its homeward journey to Nigeria. This vessel, a replacement for the decommissioned NNS LANA, is equipped with state-of-the-art hydrographic, oceanographic, and geophysical survey equipment, including an electric propulsion system for minimal data distortion. Designed for hydrographic surveys and maritime security tasks, NNS LANA is a key asset for Nigeria’s maritime capabilities. The vessel’s advanced capabilities will enhance the nation's ability to conduct detailed surveys, supporting coastal infrastructure development. This growing demand for sophisticated survey vessels contributes to the rising need for hydrographic survey equipment North Americaly, particularly in coastal and offshore infrastructure projects.

Opportunities

- Technological Advancements In Survey Equipment

Technological advancements in survey equipment are significantly transforming the North America hydrographic survey equipment market by enabling more accurate, efficient, and cost-effective data collection. Innovations such as Autonomous Underwater Vehicles (AUVs), Remotely Operated Vehicles (ROVs), multibeam sonar systems, and advanced positioning technologies have enhanced survey capabilities, allowing for detailed mapping of complex underwater environments. These developments are driving the adoption of more sophisticated equipment, which is crucial for monitoring and managing coastal infrastructure, marine environments, and navigation routes. As technology continues to evolve, the hydrographic survey equipment market is expected to expand, offering more reliable and sustainable solutions for a variety of applications, from maritime safety to environmental monitoring.

For instance,

In November 2020, IIT-Madras, a university in India, developed a solar-powered unmanned autonomous survey craft designed for hydrographic and oceanographic surveys in Indian ports and inland waterways. This innovative vessel, capable of operating both manually and autonomously, provides an indigenous alternative to costly foreign survey vessels. Equipped with echo sounders, GPS, and broadband communication, the craft can measure depth and underwater topography, transmitting real-time data over long distances. It also offers the potential to be fitted with additional sensors such as LiDAR for seamless topography and bathymetry. This technological advancement aligns with the increasing demand for cost-effective, efficient survey equipment in the North America hydrographic survey equipment market, emphasizing the shift toward more autonomous, sustainable solutions that enhance survey accuracy, reduce operational costs, and enable better management of coastal infrastructure

- Integrating Hydrographic Survey Equipments with Predictive Maintenance Frameworks

As organizations embrace predictive maintenance to improve operational efficiency and reduce downtime, incorporating Hydrographic Survey Equipments into these frameworks presents enormous opportunities. Predictive maintenance uses real-time sensor data to predict equipment breakdowns before they occur, and introducing sensor cleaning methods into these systems can improve sensor performance and durability. This integration not only keeps sensors in top condition, but it also improves the whole value proposition of predictive maintenance programs, especially in businesses that rely on complex machinery and automated systems.For instance,

As per the MDPI article, by using vibration signals from cleaning robots, predictive maintenance frameworks can identify performance degradation and potential safety issues early. This allows for proactive intervention, preventing operational failures in autonomous mobile cleaning systems. The integration of predictive maintenance into sensor cleaning technologies offers a significant opportunity for growth, as it enhances system reliability and reduces downtime. As the demand for autonomous driving increases, sensor cleaning solutions with advanced monitoring capabilities will be essential to maintaining optimal sensor performance. This opens a new avenue for innovation and growth in the sensor cleaning market.

Restraints/Challenges

- Data Privacy and Security Concerns

Data privacy and security concerns present a significant challenge for the North America hydrographic survey equipment market. As hydrographic surveys increasingly rely on digital systems, unmanned vehicles, and cloud-based data storage, the risk of cyberattacks and data breaches rises. Sensitive information, such as detailed seabed mapping and strategic maritime data, is vulnerable to unauthorized access or manipulation. Ensuring the protection of this data, especially in defense and security applications, requires robust cybersecurity measures and compliance with evolving data protection regulations. The complexity of securing these advanced technologies adds an additional layer of difficulty, particularly as the volume of data collected continues to grow.

For instance: -

In October 2024, according to the blog published by Balbix Inc., data privacy and security concerns have become a major challenge for IoT systems, which can be directly related to the North America hydrographic survey equipment market. As hydrographic survey equipment increasingly integrates IoT devices, the same issues of weak security protocols, poor vulnerability testing, and unpatched software arise. Many devices lack robust security measures, leaving them vulnerable to cyberattacks. The vast amount of data generated by these systems, such as detailed seabed mapping, can also pose significant privacy risks if not properly safeguarded. These concerns complicate efforts to ensure secure data management and protection, highlighting the need for stronger security measures in hydrographic survey technologies.

- Limited Funding in Developing Regions

Limited funding in developing regions presents a significant challenge for the North America hydrographic survey equipment market. Many countries in these regions struggle to allocate sufficient resources for advanced technologies such as hydrographic survey equipment, which are crucial for effective coastal management, infrastructure development, and environmental monitoring. This financial constraint hampers the adoption of modern equipment, limiting the ability to gather accurate data, make informed decisions, and support sustainable development efforts. As a result, these regions may fall behind in achieving reliable survey capabilities, impacting their overall growth and development.

For instance: -

In October 2023, according to the blog published by UNCTAD, the 46 Least Developed Countries (LDCs) faced severe financial challenges due to multiple North America crises, growing debt, and dependence on volatile commodities. These financial constraints have significantly reduced their fiscal space, making it difficult to invest in critical infrastructure, including hydrographic survey equipment. Limited funding in these regions has hindered their ability to adopt modern technologies for effective environmental monitoring and infrastructure development. The financial squeeze, exacerbated by the climate emergency and North America economic disruptions, presents a major obstacle to the growth of the hydrographic survey equipment market in these developing nations.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Hydrographic Survey Equipment Market Scope

The North America hydrographic survey equipment market is segmented into seven notable segments based on the offering, equipment type, depth, survey type, deployment, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Product

- Software

Equipment Type

- Pole Mounted

- Portable

- Compact

Depth

- Shallow Water

- Deep Water

Survey Type

- General hydrographic Surveys

- Coastal Surveys

- Harbor Surveys

- Passage Surveys

- Wreckage Surveys

Deployment

- Manned Vessels

- Unmanned Aerial Vehicles (UAVS)

- Unmanned Underwater Vehicles(UUVS)

- Unmanned Surface Vehicles (USVS))

Application

- Offshore Oil And Gas Survey

- Hydrographic/ Bathymetric Survey

- Cable/ Pipeline Route Survey

- Port And Harbor Management

- Charting

End User

- Defense

- Commercial

- Research

Hydrographic Survey Equipment Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, offering, equipment type, depth, survey type, deployment, application, and end user as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S currently dominates the North America hydrographic survey equipment market. This dominance is driven by the region's strong industrial base, particularly in sectors such as shipping , and manufacturing, where sensor reliability and performance are critical. Asia region has seen significant adoption of smart factory technologies and Industry 4.0 initiatives, driving demand for sensor cleaning solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Hydrographic Survey Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Hydrographic Survey Equipment Market Leaders Operating in the Market Are:

- Chesapeake Technology (U.S.)

- Esri North America, Inc. (U.S.)

- South Surveying & Mapping Technology Co., Ltd (China)

- Trimble Applanix (Canada)

- Norbit Asa (Norway)

- Nortek Group (Norway)

- Beamworx (Netherlands)

- Ohmex Ltd (U.K.)

- R2Sonic, Inc. (U.S.)

- Syqwest (U.S.)

- Beijing Hydro-Tech Marine Technology Co., Ltd. (China)

- Kongsberg Discovery (Norway)

- Innomar Technologie GmbH (Germany)

- Teledyne Marine Technologies Incorporated (U.S.)

- EdgeTech (U.S.)

- Sonardyne (U.K.)

- ixblue (France)

- Tritech International Limited (U.K.)

- CEE HydroSystems (U.S.)

- Xylem (U.S.)

- Thales (France)

- Seafloor Systems, Inc. (U.S.)

- ATLAS ELEKTRONIK GmbH (Germany)

Latest Developments in North America Hydrographic Survey Equipment Market

- In September 2024, Teledyne Marine has named iOne Resources Inc. as its official distributor in the Philippines, expanding its footprint in Southeast Asia. This collaboration allows local customers to access Teledyne Marine's advanced hydrographic survey equipment, including high-resolution multibeam sonar systems, single-beam echo sounders, and robust data acquisition software, along with improved support and services

- In February 2024, Applanix has launched the POS MV series – Surfmaster, Wavemaster, and Oceanmaster – a complete inertial navigation system offering precise attitude, heading, heave, position, and velocity data for marine vessels and sensors. This advancement strengthens Applanix’s reputation as a leader in hydrographic survey equipment, providing highly reliable, accurate solutions that thrive in challenging marine environments, making it the preferred choice for professionals in the field

- In October 2023, ATLAS ELEKTRONIK and Israel Aerospace Industries unveiled the BlueWhale ASW platform for advanced anti-submarine warfare. An advanced autonomous underwater vehicle integrating ELTA’s sophisticated sensor systems and ATLAS ELEKTRONIK’s towed passive sonar array, designed for efficient submarine detection. This collaboration enhances both companies’ capabilities in naval defense, leveraging IAI’s expertise in unmanned systems and ELTA’s advanced sensor technologies, resulting in a state-of-the-art, long-endurance ASW solution suitable for various naval operations

- In March 2022, Xylem and UNICEF have deepened their partnership to tackle urgent water and sanitation challenges in the Horn of Africa, focusing on Ethiopia, Somalia, Sudan, and Uganda. This collaboration addresses climate-induced crises such as droughts and floods, aiming to enhance sustainable water and sanitation access through innovations such as solar-powered boreholes and capacity building for local utilities. The initiative strengthens Xylem’s commitment to water security, showcasing its expertise and social responsibility, while fostering brand credibility and driving sustainable solutions North Americaly

- In January 2022, Esri India has launched GeoInnovation 2022 in collaboration with AGNIi to support start-ups across sectors such as agriculture, healthcare, and smart cities by leveraging Location Intelligence technology. The program integrates Esri's GIS solutions into the start-up ecosystem, promoting innovation, particularly in hydrographic surveys. By incorporating geospatial data into industries such as offshore energy and maritime defense, Esri enhances its role in shaping the future of hydrographic survey solutions, fostering growth in this emerging market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGY TRENDS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 CONSUMER BEHAVIOUR ANALYSIS

4.6 PATENT ANALYSIS

4.7 CASE STUDY

4.8 VALUE CHAIN ANALYSIS

4.9 CURRENT SCENARIO VS FUTURISTIC SCENARIO (2025–2032)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANSION OF MARITIME TRADE AND COMMERCE

5.1.2 INCREASING DEMAND FOR OFFSHORE OIL AND GAS EXPLORATION

5.1.3 RISE IN COASTAL INFRASTRUCTURE DEVELOPMENT

5.1.4 TECHNOLOGICAL ADVANCEMENTS IN SURVEY EQUIPMENT

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS ACROSS REGIONS

5.2.2 HIGH COST OF ADVANCED EQUIPMENT

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN AI AND DATA ANALYTICS

5.3.2 INTEGRATION OF IOT TECHNOLOGY WITH HYDROGRAPHIC SURVEY EQUIPMENT

5.3.3 RISING DEFENSE AND SECURITY APPLICATIONS FOR UNDERWATER SURVEILLANCE

5.4 CHALLENGES

5.4.1 DATA PRIVACY AND SECURITY CONCERNS

5.4.2 LIMITED FUNDING IN DEVELOPING REGIONS

6 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 SENSING SYSTEM

6.2.1.1 BATHYMETRIC SYSTEM

6.2.1.1.1 Multi Beam Eco Sounder

6.2.1.1.2 Single Beam Eco Sounder

6.2.1.2 Side Scan Sonar

6.2.1.3 Synthetic Aperture Sonar (SAS)

6.2.1.4 Sub Bottom Profiler

6.2.2 POSITIONING SYSTEM

6.2.2.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

6.2.2.2 Inertial Navigation System

6.2.2.3 Acoustic Positioning System

6.2.3 SENSORS

6.2.3.1 Sound Velocity Center

6.2.3.2 Motion Sensor

6.2.3.3 Tide Gauges And Wave Recorder

6.2.3.4 Magnetometer

6.2.3.5 Others

6.3 SOFTWARE

6.3.1 DATA ACQUISITION

6.3.2 DATA PROCESSING

6.3.3 DATA MANAGEMENT

6.3.4 OTHERS

7 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY EQUIPMENT TYPE

7.1 OVERVIEW

7.2 POLE MOUNTED

7.3 PORTABLE AND COMPACT

8 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPTH

8.1 OVERVIEW

8.2 SHALLOW WATER

8.3 DEEP WATER

9 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY SURVEY TYPE

9.1 OVERVIEW

9.2 GENERAL HYDROGRAPHIC SURVEYS

9.3 COASTAL SURVEYS

9.4 HARBOR SURVEYS

9.5 PASSAGE SURVEYS

9.6 WRECKAGE SURVEYS

10 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPLOYMENT

10.1 OVERVIEW

10.2 MANNED VESSELS

10.3 UNMANNED AERIAL VEHICLES (UAVS)

10.4 UNMANNED UNDERWATER VEHICLES (UUVS)

10.5 UNMANNED SURFACE VEHICLES (USVS)

11 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 OFFSHORE OIL AND GAS SURVEY

11.2.1 OFFSHORE OIL AND GAS SURVEY, BY TYPE

11.2.1.1 SENSING SYSTEM

11.2.1.1.1 SENSING SYSTEM BY TYPE

11.2.1.1.1.1 BATHYMETRIC SYSTEM

11.2.1.1.1.2 SIDE SCAN SONAR

11.2.1.1.1.3 SYNTHETIC APERTURE SONAR (SAS)

11.2.1.1.1.4 SUB BOTTOM PROFILER

11.2.1.2 POSITIONING SYSTEM

11.2.1.2.1 POSITIONING SYSTEM, BY TYPE

11.2.1.2.1.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

11.2.1.2.1.2 INERTIAL NAVIGATION SYSTEM

11.2.1.2.1.3 ACOUSTIC POSITIONING SYSTEM

11.2.1.3 SENSORS

11.2.1.3.1 SENSORS, BY TYPE

11.2.1.3.1.1 SOUND VELOCITY CENTER

11.2.1.3.1.2 MOTION SENSOR

11.2.1.3.1.3 TIDE GAUGES AND WAVE RECORDER

11.2.1.3.1.4 MAGNETOMETER

11.2.1.3.1.5 OTHERS

11.2.1.4 UNMANNED VEHICLES

11.2.1.5 OTHERS

11.2.1.5.1 DATA ACQUISITION

11.2.1.5.2 DATA PROCESSING

11.2.1.5.3 DATA MANAGEMENT

11.2.1.5.4 OTHERS

11.3 HYDROGRAPHIC/ BATHYMETRIC SURVEY

11.3.1 HYDROGRAPHIC/ BATHYMETRIC SURVEY, BY TYPE

11.3.1.1 SENSING SYSTEM

11.3.1.1.1 SENSING SYSTEM BY TYPE

11.3.1.1.1.1 BATHYMETRIC SYSTEM

11.3.1.1.1.2 SIDE SCAN SONAR

11.3.1.1.1.3 SYNTHETIC APERTURE SONAR (SAS)

11.3.1.1.1.4 SUB BOTTOM PROFILER

11.3.1.2 POSITIONING SYSTEM

11.3.1.2.1 POSITIONING SYSTEM, BY TYPE

11.3.1.2.1.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

11.3.1.2.1.2 INERTIAL NAVIGATION SYSTEM

11.3.1.2.1.3 ACOUSTIC POSITIONING SYSTEM

11.3.1.3 SENSORS

11.3.1.3.1 SENSORS, BY TYPE

11.3.1.3.1.1 SOUND VELOCITY CENTER

11.3.1.3.1.2 MOTION SENSOR

11.3.1.3.1.3 TIDE GAUGES AND WAVE RECORDER

11.3.1.3.1.4 MAGNETOMETER

11.3.1.3.1.5 OTHERS

11.3.1.4 UNMANNED VEHICLES

11.3.1.5 OTHERS

11.3.1.5.1 DATA ACQUISITION

11.3.1.5.2 DATA PROCESSING

11.3.1.5.3 DATA MANAGEMENT

11.3.1.5.4 OTHERS

11.4 CABLE/ PIPELINE ROUTE SURVEY

11.4.1 CABLE/ PIPELINE ROUTE SURVEY, BY TYPE

11.4.1.1 SENSING SYSTEM

11.4.1.1.1 SENSING SYSTEM BY TYPE

11.4.1.1.1.1 BATHYMETRIC SYSTEM

11.4.1.1.1.2 SIDE SCAN SONAR

11.4.1.1.1.3 SYNTHETIC APERTURE SONAR (SAS)

11.4.1.1.1.4 SUB BOTTOM PROFILER

11.4.1.2 POSITIONING SYSTEM

11.4.1.2.1 POSITIONING SYSTEM, BY TYPE

11.4.1.2.1.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

11.4.1.2.1.2 INERTIAL NAVIGATION SYSTEM

11.4.1.2.1.3 ACOUSTIC POSITIONING SYSTEM

11.4.1.3 SENSORS

11.4.1.3.1 SENSORS, BY TYPE

11.4.1.3.1.1 SOUND VELOCITY CENTER

11.4.1.3.1.2 MOTION SENSOR

11.4.1.3.1.3 TIDE GAUGES AND WAVE RECORDER

11.4.1.3.1.4 MAGNETOMETER

11.4.1.3.1.5 OTHERS

11.4.1.4 UNMANNED VEHICLES

11.4.1.5 OTHERS

11.4.1.5.1 DATA ACQUISITION

11.4.1.5.2 DATA PROCESSING

11.4.1.5.3 DATA MANAGEMENT

11.4.1.5.4 OTHERS

11.5 PORT AND HARBOR MANAGEMENT

11.5.1 PORT AND HARBOR MANAGEMENT, BY TYPE

11.5.1.1 SENSING SYSTEM

11.5.1.1.1 SENSING SYSTEM BY TYPE

11.5.1.1.1.1 BATHYMETRIC SYSTEM

11.5.1.1.1.2 SIDE SCAN SONAR

11.5.1.1.1.3 SYNTHETIC APERTURE SONAR (SAS)

11.5.1.1.1.4 SUB BOTTOM PROFILER

11.5.1.2 POSITIONING SYSTEM

11.5.1.2.1 POSITIONING SYSTEM, BY TYPE

11.5.1.2.1.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

11.5.1.2.1.2 INERTIAL NAVIGATION SYSTEM

11.5.1.2.1.3 ACOUSTIC POSITIONING SYSTEM

11.5.1.3 SENSORS

11.5.1.3.1 SENSORS, BY TYPE

11.5.1.3.1.1 SOUND VELOCITY CENTER

11.5.1.3.1.2 MOTION SENSOR

11.5.1.3.1.3 TIDE GAUGES AND WAVE RECORDER

11.5.1.3.1.4 MAGNETOMETER

11.5.1.3.1.5 OTHERS

11.5.1.4 UNMANNED VEHICLES

11.5.1.5 OTHERS

11.5.1.5.1 DATA ACQUISITION

11.5.1.5.2 DATA PROCESSING

11.5.1.5.3 DATA MANAGEMENT

11.5.1.5.4 OTHERS

11.6 CHARTING

11.6.1 CHARTING, BY TYPE

11.6.1.1 SENSING SYSTEM

11.6.1.1.1 SENSING SYSTEM BY TYPE

11.6.1.1.1.1 BATHYMETRIC SYSTEM

11.6.1.1.1.2 SIDE SCAN SONAR

11.6.1.1.1.3 SYNTHETIC APERTURE SONAR (SAS)

11.6.1.1.1.4 SUB BOTTOM PROFILER

11.6.1.2 POSITIONING SYSTEM

11.6.1.2.1 POSITIONING SYSTEM, BY TYPE

11.6.1.2.1.1 NORTH AMERICA NAVIGATION SATELLITE SYSTEMS (GNSS)

11.6.1.2.1.2 INERTIAL NAVIGATION SYSTEM

11.6.1.2.1.3 ACOUSTIC POSITIONING SYSTEM

11.6.1.3 SENSORS

11.6.1.3.1 SENSORS, BY TYPE

11.6.1.3.1.1 SOUND VELOCITY CENTER

11.6.1.3.1.2 MOTION SENSOR

11.6.1.3.1.3 TIDE GAUGES AND WAVE RECORDER

11.6.1.3.1.4 MAGNETOMETER

11.6.1.3.1.5 OTHERS

11.6.1.4 UNMANNED VEHICLES

11.6.1.5 OTHERS

11.6.1.5.1 DATA ACQUISITION

11.6.1.5.2 DATA PROCESSING

11.6.1.5.3 DATA MANAGEMENT

11.6.1.5.4 OTHERS

11.7 OTHER

12 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 DEFENSE

12.3 COMMERCIAL

12.4 RESEARCH

13 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

14 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 XYLEM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT/SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 TRIMBLE INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCTS PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 TELEDYNE MARINE TECHNOLOGIES INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCTS PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 ESRI

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 ATLAS ELEKTRONIK GMBH

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT/SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 BEAMWORX BV

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CEE HYDROSYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT/SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CHESAPEAKE TECHNOLOGY

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT/SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 EDGETECH

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCTS PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 INNOMAR TECHNOLOGIE GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 IXBLUE

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCTS PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 KONGSBERG DISCOVERY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 LYMTECH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCTS PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NORBIT ASA

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTS PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 NORTEK GROUP

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCTS PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 R2SONIC, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SEAFLOOR SYSTEMS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT/SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SONARDYNE

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCTS PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCTS PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 SYQWEST INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 THALES

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT/SERVICE PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 TRITECH INTERNATIONAL LIMITED

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCTS PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA SAFETY STANDARDS FOR HYDROGRAPHIC SURVEY EQUIPMENT

TABLE 2 COMPANY COMPETITIVE ANALYSIS

TABLE 3 HYDROGRAPHIC SURVEY EQUIPMENT REGULATIONS ACROSS REGIONS

TABLE 4 PRICES OF THE ADVANCED EQUIPMENT USED IN HYDROGRAPHIC SURVEY EQUIPMENT (AS OF 2024)

TABLE 5 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA PRODUCT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA PRODUCT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA BATHYMETRIC SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA POLE MOUNTED IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA PORTABLE AND COMPACT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SHALLOW WATER IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA DEEP WATER IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY SURVEY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA GENERAL HYDROGRAPHIC SURVEYS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA COASTAL SURVEYS ENTERPRISES IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA HARBOUR SURVEYS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA PASSAGE SURVEYS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA WRECKAGE SURVEYS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPLOYMENT, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MANNED VESSELS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA UNMANNED AERIAL VEHICLES (UAVS) IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA UNMANNED UNDERWATER VEHICLES (UUVS) IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA UNMANNED SURFACE VEHICLES (USVS) IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OTHERS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA DEFENSE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA COMMERCIAL IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA RESEARCH IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA PRODUCT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA BATHYMETRIC SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY SURVEY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPLOYMENT, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. PRODUCT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. BATHYMETRIC SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 165

TABLE 113 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY SURVEY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPLOYMENT, 2018-2032 (USD THOUSAND)

TABLE 117 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA PRODUCT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA BATHYMETRIC SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY SURVEY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY DEPLOYMENT, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA OFFSHORE OIL AND GAS SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA HYDROGRAPHIC/ BATHYMETRIC SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA CABLE/ PIPELINE ROUTE SURVEY IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA PORT AND HARBOR MANAGEMENT IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA CHARTING IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA SENSING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA POSITIONING SYSTEM IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA SENSORS IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA SOFTWARE IN HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET, BY OFFERING (2024)

FIGURE 14 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 EXPANSION OF MARITIME TRADE AND COMMERCE IS EXPECTED TO DRIVE THE NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET

FIGURE 19 TRENDS OF INDIAN SHIPPING VESSELS DURING THE LAST 3 YEARS

FIGURE 20 TOP 5 COUNTRIES WITH MORE NUMBER OF MARINE SHIPPING GOODS

FIGURE 21 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY OFFERING, 2024

FIGURE 22 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY EQUIPMENT TYPE, 2024

FIGURE 23 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY DEPTH, 2024

FIGURE 24 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY SURVEY TYPE, 2024

FIGURE 25 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY DEPLOYMENT, 2024

FIGURE 26 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: BY END USER, 2024

FIGURE 28 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA HYDROGRAPHIC SURVEY EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.