North America Hydroxyl Terminated Polybutadiene Htpb Market

Market Size in USD Million

CAGR :

%

USD

53.56 Million

USD

83.35 Million

2024

2032

USD

53.56 Million

USD

83.35 Million

2024

2032

| 2025 –2032 | |

| USD 53.56 Million | |

| USD 83.35 Million | |

|

|

|

Hydroxyl-Terminated Polybutadiene (HTPB) Market Analysis

There has been a rapid rise in air passenger traffic and increased exports and imports of goods in the last decade, which is expected to drive the demand for aerospace components. Most aerospace parts manufacturers have decided to adjust their operations to achieve maximum flexibility with modernization investments, spanning the entire organization. These initiatives might include simple processes and product designs that involve the application of hydroxyl-terminated polybutadiene on a large scale during the manufacturing of the components.

Propellants are chemical compounds or mixtures that, on the ignition, exhibit self-sustained combustion and generate large volumes of hot gases at controlled, predetermined rates. The technological development of propellants, which are used in a solid and hybrid rocket motor, uses hydroxyl-terminated polybutadiene (HTPB) as a binder in the manufacturing process of the rocket motor.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Size

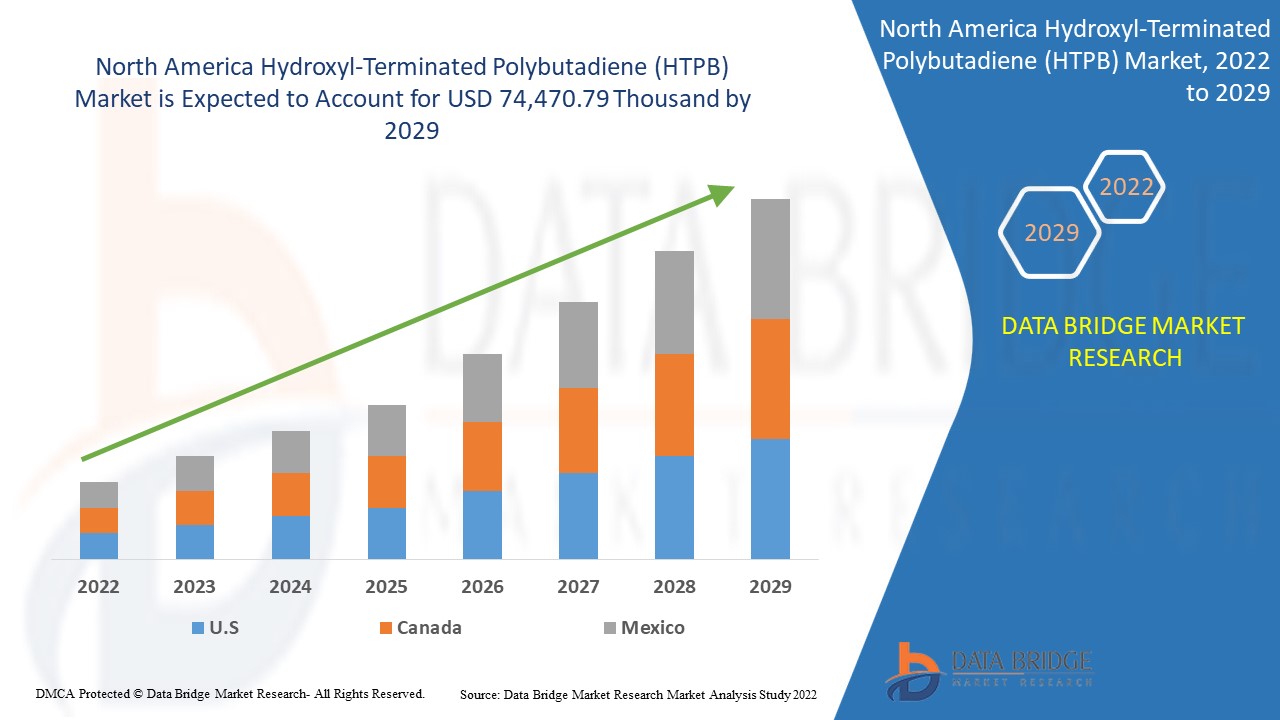

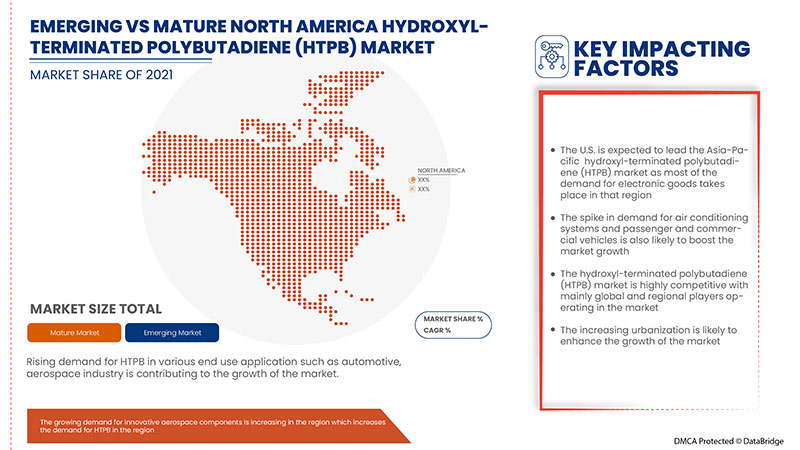

North America Hydroxyl-Terminated Polybutadiene (HTPB) market size was valued at USD 53.56 million in 2024 and is projected to reach USD 83.35 million by 2032, with a CAGR of 5.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Trends

“Gaining Popularity of Hydroxyl-Terminated Polybutadiene (HTPB) In the Automotive Industry”

The North American Hydroxyl-Terminated Polybutadiene (HTPB) market is experiencing a notable surge in demand driven primarily by the increasing adoption of HTPB across the automotive industry. This specialized liquid rubber offers several performance advantages that align closely with the evolving needs of automotive manufacturers, including durability, high flexibility, and low-temperature stability.

HTPB’s unique properties make it an ideal component in the formulation of polyurethane adhesives, sealants, and elastomers used extensively within the automotive sector. As vehicle manufacturers continue to prioritize lighter weight, improved fuel efficiency, and enhanced durability in their designs, HTPB's capacity to reduce weight without compromising strength makes it particularly attractive. Its ability to adhere to a range of materials, including metals, plastics, and composites, further drives its usage in automotive assembly processes. Moreover, the rising demand for Electric Vehicles (EVs) in North America is further boosting the growth of HTPB usage. HTPB's compatibility with advanced EV battery components, thanks to its heat resistance and insulating properties, contributes to safer and longer-lasting battery systems. As automakers strive to innovate in EV design and safety, HTPB’s properties make it a key enabler of high-performance solutions, reinforcing market demand.

Sustainability considerations also bolster HTPB's appeal. Given the industry’s shift towards sustainable practices and materials, HTPB’s low environmental impact in comparison to traditional materials makes it a favored choice for eco-conscious automotive projects. This trend aligns well with regulatory measures and consumer preferences pushing for greener vehicles, further contributing to HTPB’s market penetration.

Report Scope and Hydroxyl-Terminated Polybutadiene (HTPB) Market Segmentation

|

Attributes |

Hydroxyl-Terminated Polybutadiene (HTPB) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Evonik Industries AG (Germany), Idemitsu Kosan Co., Ltd. (Japan), NIPPON SODA CO., LTD. (Japan), Resin Solutions, LLC (U.S.), Island Pyrochemical Industries (IPI) (U.S.), Polymer Source. Inc. (Canada), and CRS Chemicals (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydroxyl-Terminated Polybutadiene (HTPB) Market Definition

Hydroxyl-Terminated Polybutadiene (HTPB) is a liquid, telechelic polymer with reactive hydroxyl (-OH) groups at its chain ends. It serves as a versatile pre-polymer that can be cured or cross-linked with various isocyanates to form solid polymers, elastomers, or rubbery materials. HTPB exhibits excellent mechanical properties, low-temperature flexibility, hydrophobicity, and chemical resistance, making it widely used in aerospace, adhesives, sealants, and elastomeric applications. In the defense industry, it acts as a binder for composite propellants and explosives, enhancing their mechanical integrity and performance. It is valued for its tunable properties and compatibility with diverse formulation requirements.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Dynamics

Drivers

- Growing Demand for Innovative Aerospace Components

There has been a rapid rise in air passenger traffic and increased exports and imports of goods in the last decade, which is expected to drive the demand for aerospace components. Most aerospace parts manufacturers have decided to adjust their operations to achieve maximum flexibility with modernization investments, spanning the entire organization. These initiatives might include simple processes and product designs that involve the application of hydroxyl-terminated polybutadiene on a large scale during the manufacturing of the components.

Aerospace components are usually made from advanced materials, including hydroxyl-terminated polybutadiene, titanium alloys, nickel-based superalloys, and other ceramics. Aircraft manufacturers have significantly benefited due to advancements in material science. Therefore, hydroxyl-terminated polybutadiene used in aerospace technology improves airplane wings' efficiency and makes aircraft more lightweight and fuel-efficient.

For instance,

According to the report of Industry Outlook, 2021, there is an increase in demand for aerospace parts from North Atlantic Treaty Organization (NATO) countries for surveillance aircraft as well as fighter aircraft, owing to increasing security threats.

- Use of Hydroxyl-terminated Polybutadiene (HTPB) in Solid Rocket Propellant

In recent times, the growing active participation and interest by governments in strengthening their space capabilities has increased the demand for hydroxyl-terminated polybutadiene. Moreover, rise in efforts and initiatives by space agencies, research centers and even private companies in some parts of the globe to launch unmanned space vehicles along with growing satellite launches for communication purposes have also propelled the demand for hydroxyl-terminated polybutadiene. Therefore, the growth in the global aerospace industry directly impacts the growth of the Hydroxyl-Terminated Polybutadiene (HTPB) market.

Hydroxyl-terminated polybutadiene (HTPB) is widely used in solid rocket propellant (SRP). It is an essential propellant with its critical mechanical and ballistic properties. The material is used in rocket motors as a liner and binder for composite propellants. HTPB finds application in the propellant composition and on the liner coating of the rocket motor.

For instance,

In November 2023, according to an article published on Shanghai Theorem Chemical Technology Co., Ltd. Website, Hydroxyl-Terminated Polybutadiene (HTPB) is crucial in rocket propellants, providing enhanced safety and high performance. HTPB-based propellants are less sensitive to shock and impact, improving handling safety. They exhibit excellent elasticity and mechanical strength, withstanding high pressure and acceleration during combustion. Their high specific impulse ensures greater thrust and efficiency, making HTPB an ideal choice for aerospace propulsion.

Opportunities

- Rising Government Initiatives for Emerging Nations

The North American Hydroxyl-Terminated Polybutadiene (HTPB) market stands to benefit significantly from the growth of the infrastructure and construction sectors across the region. With substantial investments being channeled into infrastructure upgrades, new construction projects, and green building initiatives, HTPB presents a compelling opportunity due to its unique properties that enhance structural performance and longevity.

HTPB-based adhesives, sealants, and coatings play a pivotal role in modern construction by offering high flexibility, durability, and resistance to environmental factors, such as moisture, chemicals, and temperature extremes. These characteristics make HTPB a preferred choice for applications in sealing joints, bonding critical structural components, and coating surfaces exposed to harsh conditions. As infrastructure projects, including bridges, highways, and buildings, prioritize durability and reduced maintenance costs, the demand for HTPB solutions is expected to surge.

For instance,

In February 2023, according to an article published by U.S Department of Transportations, U.S. government's USD 1.2 trillion investment in infrastructure includes funding for roads, bridges, public transit, water systems, and broadband. This influx of capital drives demand for advanced building materials that can withstand extreme conditions and provide long-term durability. HTPB-based coatings and sealants are being utilized in bridge maintenance projects to protect against corrosion and extend lifespan, showcasing their value in critical infrastructure upgrades.

Restraints/Challenges

- High Strain Rate and Shock Properties of Hydroxyl-Terminated Polybutadiene (HTPB)

Hydroxyl-terminated polybutadiene (HTPB) is a widely-used polymeric binder in Polymer-Bonded Explosives (PBXs) and solid rocket propellants. Even though used in small fractions, the elastomeric binder absorbs much of the impact energy. It, therefore, requires careful modeling of its mechanical behavior to accurately simulate the response of PBXs when they are subjected to large strains and strain rates.

The field of high strain-rate experimentation and modelling has expanded greatly in recent years, increasing high-speed diagnostics. While the normal response of HTPB has been characterized under uniaxial stress and uniaxial strain loading, shear strength measurements under large pressures and large shear strain rates of HTPB have not been made so far. Such measurements are critical for modelling localization, leading to failure in PBXs and accurate prediction of hotspot formation.

- Presence of Substitute Product

The North American Hydroxyl-Terminated Polybutadiene (HTPB) market is facing increasing challenges due to the presence of substitute products, which pose significant competition and threaten to limit HTPB’s market growth. Alternative materials such as epoxies, silicones, and polyurethanes are widely used across industries that traditionally rely on HTPB, including automotive, aerospace, and consumer electronics. These substitutes offer compelling advantages, such as high mechanical strength, temperature resistance, and customization potential, thereby driving market fragmentation.

The increasing emphasis on sustainable and eco-friendly materials also presents a challenge to HTPB. Some substitute products boast lower carbon footprints or enhanced recyclability, making them attractive options as industries pivot toward greener practices. This shift in focus forces HTPB producers to innovate and adapt to evolving environmental standards, often at higher costs.

For instance,

In August 2023, according to an article published by Performance Plastics LTD, epoxies play a critical role in the aerospace industry by providing superior adhesive and structural properties. These high-performance resins bond composite materials, offering exceptional mechanical strength, thermal stability, and resistance to harsh conditions, such as extreme temperatures and chemical exposure.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Scope

The market is segmented on the basis of product, application, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

Applications

- Rocket Fuel

- Polyurethane

- By Application

- Adhesives and Sealants

- Membranes

- Surface Coatings

- Potting and Encapsulation

- Others

- By Application

- Paint

- Rubber Material

- Others

End Use

- Aerospace & Defense

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

- Automotive

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

- Building & Construction

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

- Electrical & Electronics

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

- Packaging

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

- Others

- By Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

- By Product

Hydroxyl-Terminated Polybutadiene (HTPB) Market Regional Analysis

The market is analyzed and market size insights and trends are provided product, application, and end use as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the market due to leading country in aerospace and defense applications. HTPB is widely used in solid rocket propellants and other advanced applications such as missiles and space launch vehicles. The government's consistent investment in these sectors provides a robust demand for HTPB.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- Idemitsu Kosan Co., Ltd. (Japan)

- NIPPON SODA CO., LTD. (Japan)

- Resin Solutions, LLC (U.S.)

- Island Pyrochemical Industries (IPI) (U.S.)

- Polymer Source. Inc. (Canada)

- CRS Chemicals (U.S.)

Latest Developments in Hydroxyl-Terminated Polybutadiene (HTPB) Market

- In January 2024, Evonik Industries AG expanded its production capacities for Hydroxyl-Terminated Polybutadienes (HTPB) at Marl, Germany site by 50%. This development aims to meet the growing global demand for HTPB in industries such as aerospace and specialty adhesives. The expanded capacity is expected to enhance supply reliability and further establish Evonik as a leading supplier in this sector

- In February 2024, Resin Solutions, LLC completed its acquisition of polybutadiene resin product lines from TotalEnergies. This strategic acquisition expands their capabilities and strengthens their position in the adhesives and coatings market. The move aligns with their ongoing efforts to enhance their portfolio and offer innovative solutions to customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 VENDOR SELECTION CRITERIA

4.4.1 PRODUCT QUALITY AND CONSISTENCY

4.4.2 TECHNICAL EXPERTISE AND CUSTOMIZATION CAPABILITIES

4.4.3 SUPPLY CHAIN RELIABILITY AND LEAD TIMES

4.4.4 COST COMPETITIVENESS AND VALUE PROPOSITION

4.4.5 SUSTAINABILITY AND ENVIRONMENTAL CONSIDERATIONS

4.4.6 REGULATORY COMPLIANCE AND CERTIFICATIONS

4.4.7 CUSTOMER SERVICE AND AFTER-SALES SUPPORT

4.4.8 INNOVATION AND MARKET LEADERSHIP

4.4.9 CONCLUSION

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST’S RECOMMENDATIONS

4.6 HTPB AND ITS PROCUREMENT BY DEPARTMENT OF DEFENSE (DOD)

4.6.1 DEPARTMENT OF DEFENSE PROCUREMENT IN THE HTPB MARKET

4.6.1.1 MISSILE DEFENSE SYSTEMS

4.6.1.2 TACTICAL AND THEATER MISSILES

4.6.1.3 HYPERSONIC AND ADVANCED WEAPONS DEVELOPMENT

4.6.2 ROLE AND OPERATIONS OF RESIN SOLUTIONS (FORMERLY CRAY VALLEY)

4.6.3 HTPB MARKET DYNAMICS AND SUPPLY CHAIN

4.6.4 MARKET TRENDS AND FUTURE OUTLOOK

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9.1 ENHANCED POLYMERIZATION TECHNIQUES

4.9.2 CUSTOMIZED PROPERTIES FOR SPECIALIZED APPLICATIONS

4.9.3 SUSTAINABILITY AND GREEN CHEMISTRY

4.9.4 IMPROVED MANUFACTURING EFFICIENCY AND AUTOMATION

4.9.5 ADVANCES IN PRODUCT TESTING AND QUALITY CONTROL

4.9.6 CONCLUSION

5 REGULATION COVERAGE

5.1 U.S. REGULATIONS

5.2 CANADIAN REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INNOVATIVE AEROSPACE COMPONENTS

6.1.2 GAINING POPULARITY OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN THE AUTOMOTIVE INDUSTRY

6.1.3 USE OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN SOLID ROCKET PROPELLANT

6.1.4 POSITIVE OUTLOOK TOWARD CONSUMER ELECTRONIC GOODS

6.2 RESTRAINTS

6.2.1 HIGH STRAIN RATE AND SHOCK PROPERTIES OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB)

6.2.2 HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) GRAIN CAN NOT BE RESHAPED, REUSED, OR RECYCLED

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL PROGRESS IN PROPELLANTS USING HYDROXYL-TERMINATED POLYBUTADIENE

6.3.2 RISING GOVERNMENT INITIATIVES FOR EMERGING NATIONS

6.4 CHALLENGES

6.4.1 DIFFICULTIES IN HANDLING THE RESINS

6.4.2 PRESENCE OF SUBSTITUTE PRODUCTS

7 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT

7.1 OVERVIEW

7.1.1 OW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

7.1.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ROCKET FUEL

8.3 POLYURETHANE

8.3.1 POLYURETHANE, BY APPLICATION

8.4 PAINT

8.5 RUBBER MATERIAL

8.6 OTHERS

9 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE

9.1 OVERVIEW

9.2 AEROSPACE & DEFENSE

9.2.1 AEROSPACE & DEFENSE, BY PRODUCT

9.3 AUTOMOTIVE

9.3.1 AUTOMOTIVE, BY PRODUCT

9.4 BUILDING & CONSTRUCTION

9.4.1 BUILDING & CONSTRUCTION, BY PRODUCT

9.5 ELECTRICAL & ELECTRONICS

9.5.1 ELECTRICAL & ELECTRONICS, BY PRODUCT

9.6 PACKAGING

9.6.1 PACKAGING, BY PRODUCT

9.7 OTHERS

9.7.1 OTHERS, BY PRODUCT

10 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 EVONIK INDUSTRIES AG

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 IDEMITSU KOSAN CO., LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 NIPPON SODA CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATE

13.4 RESIN SOLUTIONS, LLC

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 ISLAND PYROCHEMICAL INDUSTRIES (IPI)

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATE

13.6 CRS CHEMICALS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 POLYMER SOURCE. INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 RAW MATERIAL PRODUCTION COVERAGE

TABLE 2 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 3 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 5 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (PRICE (USD/KG)

TABLE 6 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE MARKET, PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 17 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 19 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 29 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 30 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 CANADA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 33 CANADA AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 35 CANADA BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 CANADA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 37 CANADA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 CANADA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 41 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 44 MEXICO AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

FIGURE 2 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: REGIONAL VS COUNTRIES MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR INNOVATIVE AEROSPACE COMPONENTS IS EXPECTED TO DRIVE THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN THE FORECAST PERIOD

FIGURE 16 THE LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

FIGURE 20 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY PRODUCT, 2024

FIGURE 21 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY APPLICATION, 2024

FIGURE 22 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY END USE, 2024

FIGURE 23 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SNAPSHOT (2024)

FIGURE 24 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY SHARE 2024 (%)

North America Hydroxyl Terminated Polybutadiene Htpb Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Hydroxyl Terminated Polybutadiene Htpb Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Hydroxyl Terminated Polybutadiene Htpb Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.