North America Id Barcode Reading In Factory Automation Market

Market Size in USD Billion

CAGR :

%

USD

2.74 Billion

USD

4.53 Billion

2024

2032

USD

2.74 Billion

USD

4.53 Billion

2024

2032

| 2025 –2032 | |

| USD 2.74 Billion | |

| USD 4.53 Billion | |

|

|

|

|

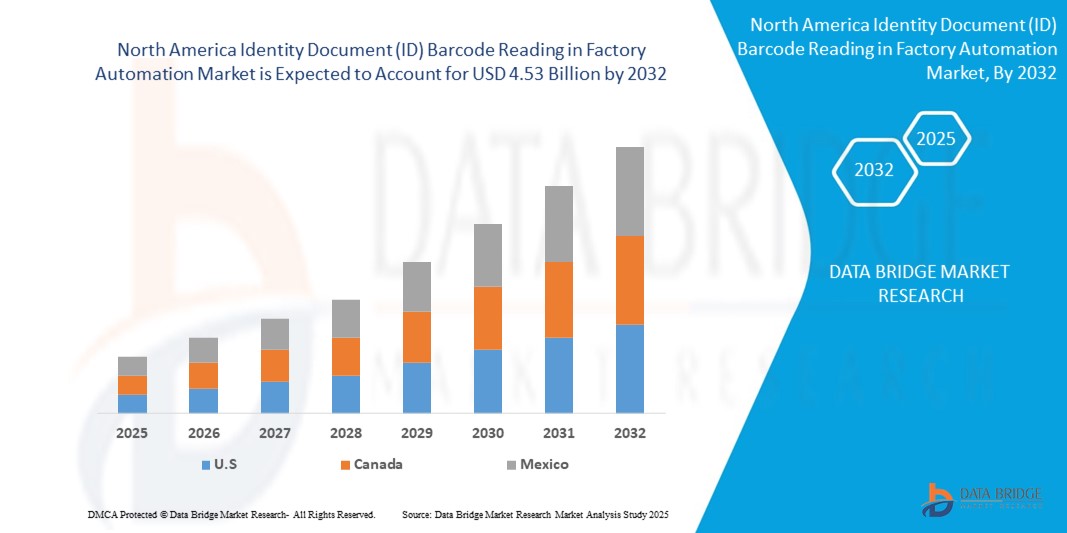

North America Identity Document (ID) Barcode Reading in Factory Automation Market Size

- The North America Identity Document (ID) Barcode Reading in Factory Automation market size was valued at USD 2.74 billion in 2024 and is expected to reach USD 4.53 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by rising demand for automated and error-free data capture in manufacturing processes, as industries prioritize real-time tracking and improved operational efficiency through barcode-based systems. This is especially prominent in sectors such as automotive, food & beverage, and electronics.

- Growing adoption of Industry 4.0 and smart factory initiatives is accelerating the deployment of ID barcode readers, enabling seamless integration with IoT, AI, and robotics for enhanced productivity, traceability, and quality control across global production facilities.

North America Identity Document (ID) Barcode Reading in Factory Automation Market Analysis

- The market for identification barcode readers in factory automation is experiencing significant growth due to the increasing integration of image recognition technologies, which enhance the accuracy and efficiency of automated systems by enabling rapid and precise identification of components and products

- The adoption of image recognition in barcode readers allows for improved quality control and inventory management in manufacturing processes, leading to reduced errors and increased productivity

- The escalating demand for North America Identity Document (ID) Barcode Reading in Factory Automations is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominates the North America Identity Document (ID) Barcode Reading in Factory Automation market with the largest revenue share of 40.01% in 2025, characterized by early smart home adoption, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in North America Identity Document (ID) Barcode Reading in Factory Automation installations, particularly in new smart homes and multi-dwelling units, driven by innovations from both established tech companies and startups focusing on AI and voice-activated features.

- Mexico is expected to be the fastest growing region in the ID Barcode Readers in Factory Automation market during the forecast period due to increasing urbanization and rising disposable incomes

- Deadbolt segment is expected to dominate the North America Identity Document (ID) Barcode Reading in Factory Automation market with a market share of 43.2% in 2025, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and North America Identity Document (ID) Barcode Reading in Factory Automation Market Segmentation

|

Attributes |

North America Identity Document (ID) Barcode Reading in Factory Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Identity Document (ID) Barcode Reading in Factory Automation Market Trends

“Adoption of Image Recognition Reshapes Barcode Scanning”

- The identification barcode readers market in factory automation is witnessing a significant shift towards the integration of image recognition technologies, enhancing the precision and speed of data capture processes

- This trend is driven by the need for more reliable and efficient systems that can accurately read barcodes under various conditions, reducing errors and improving overall productivity in manufacturing environments

- For instance, companies are adopting image-based barcode readers equipped with advanced sensors and algorithms that can decode damaged or poorly printed barcodes, ensuring uninterrupted operations

- The incorporation of image recognition also facilitates real-time monitoring and quality control, enabling swift identification of defects and anomalies in production lines

- Furthermore, the scalability of these technologies allows for seamless integration into existing systems, providing a cost-effective solution for businesses aiming to modernize their operations

- In conclusion, the ongoing emphasis on image recognition within barcode reader technologies is reshaping factory automation, offering enhanced accuracy and operational efficiency

North America Identity Document (ID) Barcode Reading in Factory Automation Market Dynamics

Driver

“Growing Need for Error-Free Real-Time Data Capture in Manufacturing”

- The ID barcode readers market is expanding due to increased demand for real-time and error-free data capture in automated manufacturing environments, where immediate access to production data is crucial for operational efficiency

- Industries such as automotive and electronics use barcode systems to monitor complex assembly lines, reducing human error and ensuring consistent quality control

- Image-based barcode readers, capable of reading damaged or high-speed labels, are replacing manual methods to support lean manufacturing and real-time decision-making

- For instance, Cognex and Keyence offer machine vision barcode readers that scan multiple codes simultaneously, enhancing speed and accuracy in smart factories

- Real-time data acquisition is vital for identifying production bottlenecks early and minimizing downtime, which is why barcode readers are now integral to Industry 4.0 systems

- In conclusion, this shift toward intelligent automation and immediate data flow is a key factor propelling market growth across industrial sectors

Restraint/Challenge

“High Initial Implementation Costs for Advanced Barcode Systems”

- The high initial investment required for advanced barcode reader systems acts as a major barrier, particularly for small and mid-sized manufacturers with limited budgets

- Image-based and smart barcode readers are significantly more expensive than traditional laser scanners, making the upgrade cost-intensive for many factories

- Infrastructure changes such as modifying conveyor systems or integrating with digital control platforms further elevate installation and implementation expenses

- For instance, replacing handheld scanners with robotic barcode reading setups demands both costly hardware and skilled personnel for operation and maintenance

- Ongoing costs such as software updates, system calibration, and downtime during setup add to the total cost of ownership, slowing adoption in cost-sensitive environments

- In conclusion, this financial burden limits market penetration of cutting-edge barcode technologies among manufacturers lacking technical resources or digital transition support

North America Identity Document (ID) Barcode Reading in Factory Automation Market Scope

The market is segmented on the basis of product type, technology, technology type, barcode type, and vertical.

- By Type

On the basis of type, the smart lock market is segmented into deadbolt, lever handles, padlock, server locks and latches, knob locks, and others. The deadbolt segment dominates the largest market revenue share of 43.2% in 2025, driven by its established reputation for security and ease of retrofit into existing door setups. Homeowners often prioritize deadbolt smart locks for their perceived robustness and the straightforward replacement of traditional deadbolts. The market also sees strong demand for deadbolt types due to their compatibility with various smart home ecosystems and the availability of diverse features enhancing security and convenience.

- By Product Type

On the basis of type, the ID Barcode Readers in Factory Automation market is segmented into Fixed Mount Barcode Scanner, Handheld Scanner, Mobile Computers Barcode Scanner, and Others. The Fixed Mount Barcode Scanner segment holds the largest market revenue share in 2025, attributed to its high-speed scanning capability and suitability for continuous production lines. Factories often prefer fixed mount scanners for their durability and hands-free operation, enabling seamless integration with conveyor systems. Meanwhile, the Handheld Scanner segment is expected to witness significant growth due to its portability and flexibility in warehouse and inventory management.

- By Technology

On the basis of communication protocol, the ID Barcode Readers in Factory Automation market is segmented into Laser Scanner, Omnidirectional Barcode Scanners, Camera-Based Readers, CCD (Charge Coupled Device) Readers, RFID (Radio Frequency Identification). Laser Scanners dominate the market share thanks to their high precision in reading 1D barcodes at long distances, making them popular in fast-paced industrial settings. Camera-Based Readers are gaining traction for their ability to decode both 1D and 2D barcodes, especially in complex applications requiring image capture

Camera-Based Readers are gaining popularity for their ability to read both one-dimensional and two-dimensional barcodes, enabling more complex data capture and image processing. They support enhanced quality control by capturing detailed visual information alongside barcode data.

- By Technology Type

On the basis of unlocking mechanism, the ID Barcode Readers in Factory Automation market is segmented into Pen-Type Scanners, and Others. Pen-Type Scanners, known for their simplicity and cost-effectiveness, continue to serve niche applications where basic barcode reading is sufficient, such as small-scale packaging or manual verification processes. However, advanced systems are rapidly shifting toward automated and integrated readers to boost efficiency.

Other scanner types, including omnidirectional and charge-coupled device readers, support multi-angle and high-speed scanning, which is essential for complex factory automation where barcodes may be positioned variably or on moving parts.

- By Barcode Type

On the basis of application, the ID Barcode Readers in Factory Automation market is segmented into 1D, and 2D. The 1D barcode segment commands a significant market share due to its widespread use in traditional manufacturing and retail sectors. However, the 2D barcode segment is expected to register faster growth because of its higher data capacity, error correction features, and growing adoption in industries requiring detailed tracking such as pharmaceuticals and electronics.

Two-Dimensional Barcodes are becoming more prevalent as they store greater data volumes, including URLs and detailed product information, making them valuable for industries such as healthcare and logistics that require advanced traceability and quick scanning.

- By Vertical

On the basis of application, the ID Barcode Readers in Factory Automation market is segmented into Consumer Electronics, Automotive, Logistics, Food and Beverage, Pharmaceutical and Medical, Packaging, Oil and Gas, and Others. The Automotive segment leads the market, driven by complex assembly lines requiring precise tracking and quality control. The Pharmaceutical and Medical segment is also expanding rapidly, propelled by stringent regulatory requirements for serialization and traceability.

The pharmaceutical and medical sectors drive growth by needing reliable barcode systems to comply with strict regulations on traceability, patient safety, and quality assurance, requiring scanners that can handle diverse packaging and detailed data encoding.

North America Identity Document (ID) Barcode Reading in Factory Automation Market Regional Analysis

- North America dominates the Identity Document (ID) Barcode Reading in Factory Automation market with the largest revenue share in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by ID Barcode Readers in Factory Automations with other smart devices such as thermostats and lighting systems.

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for remote monitoring and control, establishing ID Barcode Readers in Factory Automations as a favored solution for both residential and commercial properties.

U.S. Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The U.S. ID Barcode Readers in Factory Automation market captured the largest revenue share within North America in 2025, fueled by the swift uptake of connected devices and the expanding trend of home automation. Consumers are increasingly prioritizing the enhancement of home security through intelligent, keyless entry systems. The growing preference for DIY smart home setups, combined with robust demand for voice-controlled systems and mobile application integration, further propels the ID Barcode Readers in Factory Automation industry. Moreover, the increasing integration of smart home technologies, such as Alexa, Google Assistant, and Apple HomeKit, is significantly contributing to the market's expansion.

North America Identity Document (ID) Barcode Reading in Factory Automation Market Share

The North America Identity Document (ID) Barcode Reading in Factory Automation industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- Clarifai, Inc (U.S.)

- Huawei Technologies Co., Ltd. (China)

- TRAX IMAGE RECOGNITION (Singapore)

- Vispera Information Technologies (Turkey)

- Partium.io (U.S.)

- LTU Tech (France)

- Blippar (U.K.)

- Wikitude GmbH (Austria)

- Trigo (Israel)

- Ricoh (Japan)

- Honeywell International Inc. (U.S.)

- Google (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- Hitachi Information & Telecommunication Engineering, Ltd. (Japan)

- Amazon Web Services (U.S.)

Latest Developments in North America Identity Document (ID) Barcode Reading in Factory Automation Market

- In October 2024, Viziotix showcased its Maxi-Scan technology at Vision 2024 in Stuttgart, Germany. Viziotix introduced its Maxi-Scan algorithm, enabling simultaneous scanning of multiple barcodes in a single image. This advancement allows drones and robots to conduct rapid inventory checks, even in challenging conditions such as low lighting or motion blur. The technology supports real-time processing on edge devices, enhancing automation in logistics and warehouse operations

- In January 2024, Datalogic launched the Blade Series of compact 1D barcode readers. The Blade Series is designed for industrial environments requiring high-performance traceability solutions. Equipped with a 1920x128 pixel camera sensor and advanced lighting, these readers can reliably decode labels even under poor conditions, such as discoloration or damage. This innovation aims to improve efficiency in packaging and intralogistics sectors

- In January 2025, Cognex released the DataMan 290 and 390 AI-powered barcode readers. These new models incorporate advanced AI technology to enhance decoding reliability across various manufacturing applications. The readers feature a user-friendly web interface for easy setup and maintenance, making them accessible even to non-technical users. They are designed to handle a wide range of barcode types, including damaged or low-quality codes

- In August 2024, Scandit acquired MarketLab to enhance its ShelfView capabilities.

This acquisition enables Scandit to offer improved smart data capture solutions for retailers, enhancing store performance and associate efficiency. The integration aims to provide better monetization of shelf data with consumer packaged goods partners, leveraging advanced barcode scanning technologies - In May 2024, Pepperl+Fuchs announced plans to open a new U.S. headquarters in late 2025. The new facility will strengthen the company's presence in North America and support its growth in the industrial automation sector. Pepperl+Fuchs specializes in sensor technology and automation solutions, contributing to advancements in barcode reading and factory automation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Id Barcode Reading In Factory Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Id Barcode Reading In Factory Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Id Barcode Reading In Factory Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.