North America Immunoassay Gamma Counters Market

Market Size in USD Million

CAGR :

%

USD

33.27 Million

USD

50.29 Million

2025

2033

USD

33.27 Million

USD

50.29 Million

2025

2033

| 2026 –2033 | |

| USD 33.27 Million | |

| USD 50.29 Million | |

|

|

|

|

North America Immunoassay-Gamma Counters Market Size

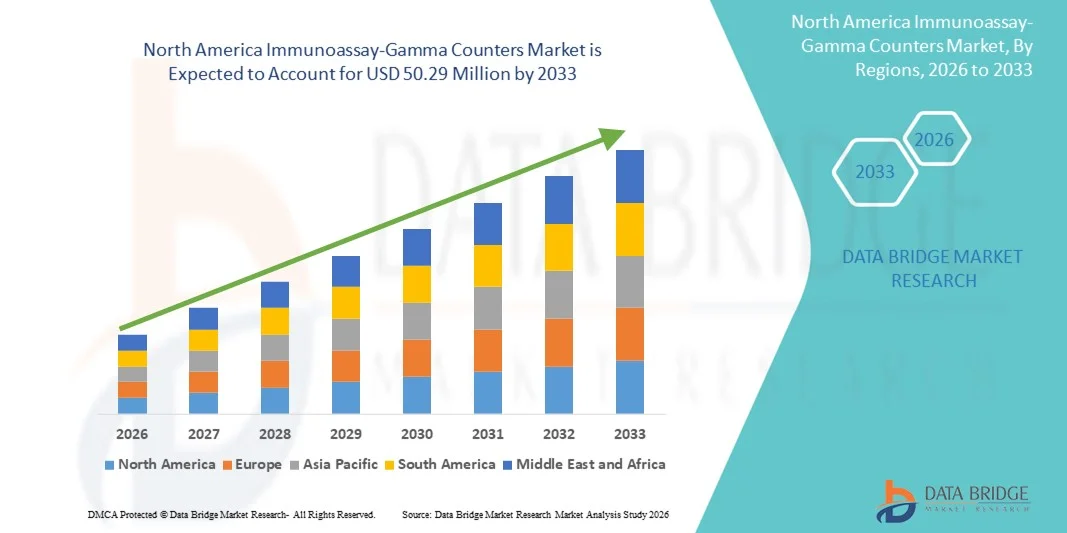

- The North America immunoassay-gamma counters market size was valued at USD 33.27 million in 2025 and is expected to reach USD 50.29 million by 2033, at a CAGR of 5.3% during the forecast period

- The market growth is largely fueled by the region’s advanced healthcare infrastructure, increasing biomedical research funding, and the presence of leading diagnostic equipment manufacturers

- Furthermore, rising demand for highly sensitive and automated diagnostic tools for applications such as endocrinology, oncology, and infectious disease testing is establishing immunoassay-gamma counters as essential instruments in clinical labs and research institutions. These converging factors are accelerating the adoption of gamma counter solutions, thereby significantly boosting the industry's growth

North America Immunoassay-Gamma Counters Market Analysis

- Immunoassay-gamma counters, used for measuring radioactivity in biological samples, are increasingly vital components of modern clinical diagnostics and research laboratories due to their high sensitivity, accuracy, and compatibility with automated assay systems

- The escalating demand for immunoassay-gamma counters is primarily fueled by the growing prevalence of chronic and infectious diseases, increasing adoption of nuclear medicine and radioimmunoassays, and rising need for rapid, precise, and automated laboratory diagnostics

- The United States dominated the North American immunoassay-gamma counters market with the largest revenue share of 64.6% in 2025, characterized by advanced healthcare infrastructure, strong research funding, and a strong presence of key diagnostic equipment manufacturers

- Canada is expected to be the fastest-growing country in the North American immunoassay-gamma counters market during the forecast period due to increasing investments in healthcare infrastructure, rising adoption of automated laboratory diagnostics, and growing demand for high-throughput testing solutions in clinical and research laboratories

- Automated segment dominated the immunoassay-gamma counters market with a market share of 45.5% in 2025, driven by its efficiency, reproducibility, and integration capabilities in high-volume clinical and research laboratory settings

Report Scope and North America Immunoassay-Gamma Counters Market Segmentation

|

Attributes |

North America Immunoassay-Gamma Counters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Immunoassay-Gamma Counters Market Trends

Advancements in Automation and High-Throughput Capabilities

- A significant and accelerating trend in the North American immunoassay-gamma counters market is the adoption of automated, multi-well systems that enhance throughput, accuracy, and reproducibility in clinical and research laboratories

- For instance, PerkinElmer’s Wizard2 gamma counter offers fully automated multi-well counting and data integration, reducing manual handling and improving workflow efficiency in high-volume laboratories

- Integration with laboratory information management systems (LIMS) and automated sample handling enables real-time data collection, error reduction, and improved reporting accuracy, enhancing operational efficiency and decision-making

- The seamless combination of automated gamma counting with advanced software platforms allows laboratories to manage multiple assays and sample types through a unified interface, improving workflow standardization and consistency

- This trend towards high-throughput, integrated, and automated gamma counting systems is fundamentally transforming laboratory operations, with companies such as Hidex and Wallac developing solutions that support automated sample loading, rapid counting, and direct LIMS integration

- The demand for automated and high-throughput gamma counters is growing rapidly across hospitals, research institutes, and pharmaceutical laboratories, as operators increasingly prioritize efficiency, accuracy, and scalability in their diagnostic and research workflows. For instance, the adoption of touchless sample loading and AI-based data validation in some gamma counters is improving biosafety while minimizing human error, a trend being rapidly embraced in clinical labs

- Continuous miniaturization and compact designs of gamma counters are enabling their use in smaller labs and point-of-care research settings, expanding market penetration beyond large-scale facilities

North America Immunoassay-Gamma Counters Market Dynamics

Driver

Rising Demand for Rapid and Precise Diagnostic Testing

- The increasing prevalence of chronic and infectious diseases, coupled with the growing adoption of nuclear medicine and radioimmunoassays, is a significant driver for heightened demand for immunoassay-gamma counters

- For instance, in March 2025, PerkinElmer launched enhanced high-throughput gamma counters to accelerate oncology and endocrine hormone testing in U.S. hospitals, aimed at reducing assay turnaround times

- As laboratories face higher testing volumes and require accurate, reproducible results, gamma counters offer automated counting, multi-sample handling, and real-time data output, providing a compelling upgrade over manual methods

- Furthermore, growing investment in clinical research and biopharmaceutical development is making gamma counters an integral tool for drug discovery, biomarker validation, and disease monitoring studies

- The efficiency, reproducibility, and integration with laboratory workflows offered by modern gamma counters are key factors propelling adoption in hospitals, research institutes, and pharmaceutical laboratories across North America. For instance, the increasing use of gamma counters in infectious disease testing, including COVID-19 and other emerging pathogens, has driven laboratories to invest in faster and more reliable counting system

- Integration of gamma counters with digital analytics platforms enables predictive insights and trend monitoring in lab operations, further encouraging adoption among technologically advanced research facilities

- Automated reporting and compliance tracking features in modern gamma counters reduce administrative burden, making them more attractive to large hospital networks and centralized testing lab

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- Concerns surrounding high initial acquisition costs and regulatory compliance pose significant challenges to wider market penetration, particularly for smaller laboratories with limited budgets

- For instance, advanced multi-well and automated gamma counters from companies such as Hidex and PerkinElmer can cost several times more than basic manual systems, limiting adoption in price-sensitive labs

- Compliance with FDA and CLIA regulations, along with calibration and radiation safety standards, increases operational complexity and can delay procurement and deployment in clinical settings

- While leasing and rental models are gradually gaining traction, the perceived premium for automated, high-throughput systems can still hinder adoption, especially among smaller research facilities or academic labs

- Overcoming these challenges through cost-effective models, streamlined regulatory support, and training on safe and compliant operations will be crucial for sustained growth in the North American immunoassay-gamma counters market. For instance, delays in obtaining necessary radiation handling approvals and lab certification can prevent timely installation and deployment of gamma counters, particularly in new or expanding laboratories

- The need for regular calibration, maintenance, and specialized operator training further adds to operational costs and complexity, discouraging adoption among smaller and mid-sized labs

- Cybersecurity and data integrity concerns with connected gamma counters, including remote monitoring and LIMS integration, remain a growing challenge for IT and lab management teams

North America Immunoassay-Gamma Counters Market Scope

The market is segmented on the basis of product type, well type, application, disease condition, purchase mode, end-user, and distribution channel.

- By Product Type

On the basis of product type, the immunoassay-gamma counters market is segmented into automated and manual/semi-automated systems. The automated segment dominated the market with the largest market revenue share of 45.5% in 2025, driven by high throughput, reduced human error, and integration with laboratory information management systems (LIMS). Laboratories increasingly prioritize automated counters for their efficiency in handling large sample volumes and multiple assay types simultaneously. Hospitals and research institutes are adopting automated systems to meet growing testing demands and regulatory compliance standards. Automated gamma counters support complex workflows in oncology, endocrinology, and infectious disease testing, offering standardized results and improved reproducibility. Continuous innovations in AI-based sample analysis, automated reporting, and data validation further reinforce the dominance of automated systems.

The manual/semi-automated segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in smaller laboratories and academic research facilities with budget constraints. These systems are valued for their lower initial cost, portability, and flexibility in handling customized assays. Manual and semi-automated counters are also preferred in training labs and specialized research projects where fully automated systems are not feasible. Their simplicity allows installation in space-limited labs and point-of-care research settings. Growing awareness of cost-effective solutions among academic and smaller clinical labs is further driving adoption.

- By Well Type

On the basis of well type, the market is segmented into multi-well and single-well gamma counters. The multi-well segment dominated the market with the largest revenue share in 2025 due to its ability to process large numbers of samples simultaneously, which is critical for high-throughput laboratories. Multi-well systems are extensively used in hospitals, research institutes, and pharmaceutical labs for oncology, endocrine, and infectious disease testing. The segment benefits from integration with automated sample handling systems and LIMS, which streamline workflow and reduce human error. Laboratories prefer multi-well counters for their efficiency, faster assay turnaround, and capability to handle multiple assay formats in a single run. Continuous advancements in software and AI analytics further strengthen the appeal of multi-well counters. Integration with digital reporting platforms also allows laboratories to maintain regulatory compliance and quality control.

The single-well segment is expected to witness the fastest growth from 2026 to 2033 due to increasing adoption in smaller labs, specialized research applications, and decentralized testing facilities. Single-well counters are cost-effective, easy to maintain, and suitable for low-volume testing. Their compact design allows installation in space-limited laboratories and mobile research units. The simplicity and flexibility of single-well counters make them a preferred choice for customized assay protocols and academic institutions. Growing interest in niche research studies and pilot projects further drives adoption of single-well systems.

- By Application

On the basis of application, the market is segmented into radioimmunoassays, nuclear medicine assays, and others. The radioimmunoassay segment dominated the market in 2025, driven by its critical role in cancer biomarker analysis, hormone level monitoring, and therapeutic drug evaluation. Laboratories increasingly rely on gamma counters for precise quantification of radio-labeled samples used in diagnostic assays. The segment benefits from the widespread adoption of automated multi-well systems that enhance accuracy and reproducibility. Research institutes and pharmaceutical companies favor radioimmunoassays due to their sensitivity and reliability in clinical studies. Continuous innovations in assay protocols and gamma counting software further consolidate the dominance of this segment. Hospitals and specialized labs increasingly integrate radioimmunoassays into routine diagnostics, further strengthening adoption.

The nuclear medicine assays segment is expected to witness the fastest growth from 2026 to 2033 due to rising demand for diagnostic imaging, therapeutic monitoring, and radioactive tracer studies. Hospitals and specialized diagnostic centers are increasingly investing in gamma counters to support nuclear medicine applications. The segment growth is fueled by the need for accurate, high-throughput measurements and regulatory compliance in radiopharmaceutical testing. Nuclear medicine assays are gaining traction in personalized medicine and targeted therapy research. Growing awareness of early diagnosis and treatment monitoring supports segment growth.

- By Disease Condition

On the basis of disease condition, the market is segmented into cancer biomarker, infectious diseases, therapeutic drug monitoring, endocrine hormones, allergy, neonatal screening, cardiac markers, autoimmune disease, and others. The cancer biomarker segment dominated in 2025 due to the increasing prevalence of cancer and the critical need for precise diagnostic and monitoring assays in clinical and research labs. Gamma counters provide high sensitivity and reproducibility in quantifying radio-labeled cancer biomarkers, supporting early detection and personalized treatment strategies. The segment benefits from automated, multi-well systems that handle high sample volumes efficiently. Pharmaceutical and biotechnology companies rely on gamma counters for oncology drug development and clinical trials. Hospitals integrate these counters for routine cancer diagnostics. Continuous technological advancements in gamma counting and data analysis reinforce the dominance of cancer biomarker applications.

The infectious diseases segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing outbreaks of infectious pathogens and the rising demand for rapid, accurate diagnostic assays. Hospitals, public health labs, and research institutes are adopting gamma counters to detect and monitor infectious diseases. Automated high-throughput counters allow large-scale testing with minimal manual intervention, improving efficiency and biosafety. The integration of LIMS and AI analytics further enhances workflow and result reliability in infectious disease diagnostics. Growing government programs and funding for epidemic monitoring also drive adoption.

- By Purchase Mode

On the basis of purchase mode, the market is segmented into out-right purchase and rental purchase. The out-right purchase segment dominated in 2025 due to strong capital investments by hospitals, research institutes, and pharmaceutical companies in permanent gamma counting infrastructure. Direct ownership provides long-term operational control, maintenance flexibility, and integration with existing lab workflows. Large-scale labs prefer out-right purchase to ensure continuous availability and compliance with testing protocols. The segment is reinforced by technological upgrades in automated and multi-well systems, offering high throughput and reliability. Continuous adoption of long-term service contracts and maintenance plans also supports the dominance of this segment. Manufacturers often provide training and calibration services as part of purchase contracts.

The rental purchase segment is expected to witness the fastest growth from 2026 to 2033, particularly in academic and smaller research labs with budget constraints. Rental options allow laboratories to access high-end gamma counters without upfront capital expenditure. Flexible rental plans encourage adoption for temporary research projects, seasonal testing spikes, and pilot studies. The segment growth is further supported by companies providing maintenance, calibration, and training services as part of rental agreements. Renting provides access to the latest technology without long-term financial commitment.

- By End-User

On the basis of end-user, the market is segmented into laboratory, hospitals, research & academic institutes, pharmaceutical & biotechnology companies, blood banks, and others. The laboratory segment dominated in 2025 due to the large-scale adoption of gamma counters in clinical diagnostic labs and high-throughput research facilities. Laboratories rely on automated multi-well counters to process numerous samples efficiently and maintain reproducibility across assays. Pharmaceutical labs and diagnostic labs further support this segment’s dominance by integrating gamma counters into drug development and clinical trials. Continuous technological advancements and integration with data management systems reinforce laboratory preference. Large commercial labs increasingly invest in automated systems to handle growing sample volumes.

The research & academic institutes segment is expected to witness the fastest growth from 2026 to 2033 due to increasing investments in biomedical research, adoption of gamma counters for teaching, training, and specialized studies, and the growing number of academic research projects requiring precise quantification of radio-labeled samples. The segment benefits from compact, single-well, and semi-automated counters suitable for educational and small-scale research applications. Growing funding and grants for academic research accelerate adoption. Universities and training labs increasingly prioritize hands-on experience with modern gamma counters.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and third-party distributors. The direct tender segment dominated in 2025 due to strong procurement by hospitals, research institutes, and government labs through direct contracts with manufacturers. Direct tenders ensure regulatory compliance, warranty coverage, and reliable service support. Large institutional buyers prefer direct procurement to streamline supply chains and maintain long-term operational control. Manufacturers often offer installation, training, and maintenance packages as part of direct tender agreements. Continuous adoption of high-throughput automated systems reinforces this segment’s dominance. Direct tender agreements also facilitate bulk purchasing and long-term planning.

The third-party distributor segment is expected to witness the fastest growth from 2026 to 2033, particularly among smaller laboratories, academic institutions, and decentralized testing facilities. Distributors offer flexible procurement options, local technical support, and maintenance services, making it easier for smaller labs to adopt gamma counters. The segment benefits from growing partnerships between manufacturers and regional distributors to expand market reach. Distributors provide faster response times and localized support for maintenance and calibration. The increasing number of small and mid-sized labs in North America further drives segment growth.

North America Immunoassay-Gamma Counters Market Regional Analysis

- The United States dominated the North American immunoassay-gamma counters market with the largest revenue share of 64.6% in 2025, characterized by advanced healthcare infrastructure, strong research funding, and a strong presence of key diagnostic equipment manufacturers

- Clinical laboratories, hospitals, and research institutes in the country highly value the accuracy, high throughput, and automation offered by modern gamma counters, which streamline sample processing and enhance diagnostic reliability

- This widespread adoption is further supported by government initiatives, increasing prevalence of chronic and infectious diseases, and growing demand for high-precision laboratory diagnostics, establishing immunoassay-gamma counters as a critical tool in both clinical and research settings

U.S. Immunoassay-Gamma Counters Market Insight

The U.S. immunoassay-gamma counters market captured the largest revenue share of 64.6% in 2025 within North America, fueled by advanced healthcare infrastructure, robust R&D investment, and the presence of leading diagnostic equipment manufacturers. Clinical laboratories, hospitals, and research institutes are increasingly prioritizing high-throughput, automated gamma counters for enhanced accuracy, reproducibility, and workflow efficiency. The growing adoption of nuclear medicine and radioimmunoassays, coupled with rising prevalence of chronic and infectious diseases, is further propelling market growth. In addition, integration with laboratory information management systems (LIMS) and AI-based analytics is enabling real-time monitoring, predictive insights, and improved operational efficiency. Government initiatives supporting diagnostic advancements and the expansion of academic and pharmaceutical research programs are also contributing to market expansion.

Canada Immunoassay-Gamma Counters Market Insight

The Canadian immunoassay-gamma counters market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and research facilities. Hospitals and diagnostic centers are adopting automated and multi-well gamma counters to meet growing testing demands and improve diagnostic accuracy. The rising focus on infectious disease monitoring and cancer biomarker testing is fostering the uptake of advanced gamma counting systems. Canada’s regulatory support and government-funded research initiatives encourage adoption of innovative laboratory technologies. Furthermore, the presence of a technologically skilled workforce and growing collaborations between academic and pharmaceutical institutions support market expansion.

Mexico Immunoassay-Gamma Counters Market Insight

The Mexican immunoassay-gamma counters market is poised for steady growth due to increasing awareness of advanced diagnostic testing and the rising prevalence of chronic diseases. Hospitals, research labs, and academic institutions are increasingly investing in high-throughput and automated gamma counters to improve diagnostic efficiency. Growing government focus on healthcare modernization, combined with improved laboratory infrastructure, is accelerating market adoption. Cost-effective solutions and rental models are making gamma counters more accessible to smaller laboratories and regional research centers. In addition, partnerships with global equipment manufacturers facilitate technology transfer and local availability of advanced systems.

North America Immunoassay-Gamma Counters Market Share

The North America Immunoassay-Gamma Counters industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Hidex (Finland)

- Berthold Technologies GmbH & Co. KG (Germany)

- LabLogic Systems Ltd (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Mirion Technologies, Inc. (U.S.)

- AMETEK Inc (U.S.)

- Stratec SE (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- ZECOTEK Photonics Inc. (Canada)

- COMECER S.p.A. (Italy)

- Kromek Group plc (U.K.)

- Scintacor (U.K.)

- EuroProbe Ltd (U.K.)

- Mediso Ltd (Hungary)

- Elysia-raytest GmbH (Germany)

- Canberra Industries (U.S.)

- Ludlum Measurements, Inc. (U.S.)

- Biodex Medical Systems, Inc. (U.S.)

- IBA Group (Belgium)

What are the Recent Developments in North America Immunoassay-Gamma Counters Market?

- In August 2025, LabLogic positioned the Hidex AMG as an ideal tool for academic and research labs, emphasizing new workflows with automated sample handling, simple loading, intuitive software, and optional QR-based vial identification. They highlight its capabilities in preclinical biodistribution, in vitro radioassays, and quantitative studies (mass + activity), making it highly suited for modern research needs

- In May 2025, LabLogic announced an update that allows Laura Radiopharma software to directly control the Hidex AMG, letting users build regulatory-compliant radiochromatograms from radio‑HPLC fraction collection data. This update removes the need for manual data entry and Excel-based workflows, significantly reducing error and improving compliance

- In April 2025, Charles River Laboratories publicly shared a case study on how their Edinburgh facility integrated LabLogic’s Laura LIMS software with Hidex hardware, ensuring direct, secure data capture and eliminating the risk of manual edits. This highlights a strong push for data integrity, traceability, and regulatory compliance in high‑volume labs

- In April 2021, LabLogic released a video demonstrating how the Hidex 600 SL liquid scintillation counter achieves 21 CFR Part 11 compliance when used with Laura software. The solution includes audit trails, multi-level security, electronic signatures, and project locking features essential for regulated labs

- In March 2021, LabLogic and Hidex introduced a QR code reader option for the Hidex AMG automatic gamma counter, making it the first commercially available gamma counter with direct, vial‑cap sample identification. This enables 1D/2D barcode scanning of each sample before counting, which improves traceability, links ID to results, and strengthens compliance in FDA 21 CFR Part 11 environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.