North America Immunoassay Reagents And Devices Market

Market Size in USD Million

CAGR :

%

USD

123.87 Million

USD

268.16 Million

2024

2032

USD

123.87 Million

USD

268.16 Million

2024

2032

| 2025 –2032 | |

| USD 123.87 Million | |

| USD 268.16 Million | |

|

|

|

|

Immunoassay Reagents and Devices Market Size

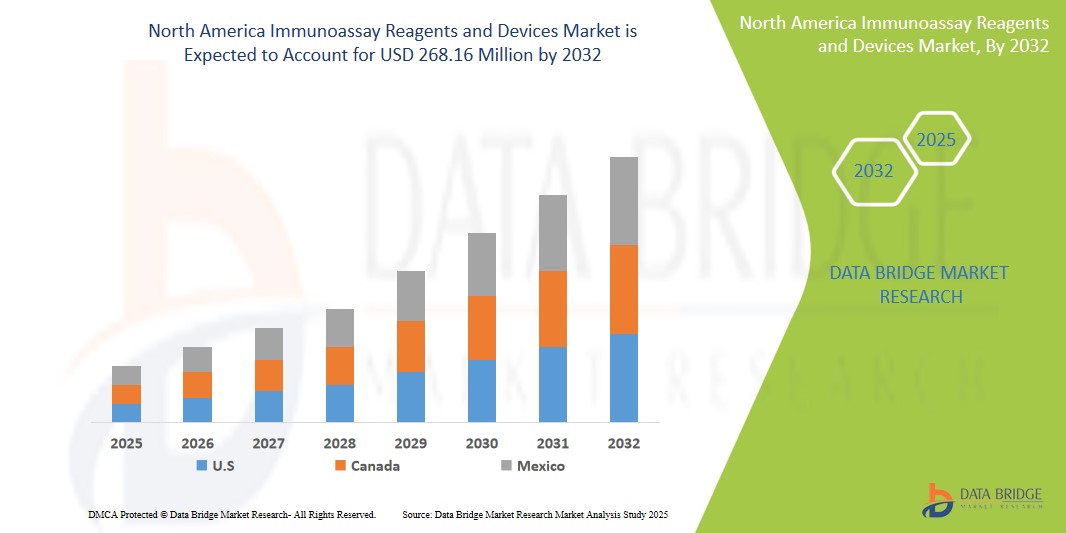

- The North America Immunoassay Reagents and Devices Market size was valued at USD 123.87 million in 2024 and is expected to reach USD 268.16 Million by 2032, at a CAGR of 9.0% during the forecast period

- The market growth is largely driven by the increasing prevalence of infectious and chronic diseases, the expanding use of EIA technologies in diagnostics, and rising demand for early disease detection across healthcare facilities and laboratories.

- Furthermore, advancements in assay sensitivity, automation of laboratory workflows, and the integration of AI in diagnostic platforms are accelerating the adoption of EIA reagents and devices across North America. These factors are significantly contributing to market expansion.

Immunoassay Reagents and Devices Market Analysis

- EIA reagents and devices play a crucial role in detecting antibodies or antigens in samples, making them essential tools in disease surveillance, clinical diagnostics, pharmaceutical research, and food safety testing. Their non-radioactive nature and high throughput capabilities continue to make them the preferred choice in modern laboratories.

- The demand for EIA-based diagnostics is being bolstered by the increasing burden of diseases such as cancer, HIV, hepatitis, and autoimmune disorders, alongside the growing focus on preventive healthcare and population screening programs.

- The U.S. dominates the Immunoassay Reagents and Devices market with the largest revenue share of 38.24% in 2025, owing to advanced healthcare infrastructure, rising healthcare expenditure, early adoption of novel diagnostic technologies, and the presence of leading market players in the region. The U.S. is particularly witnessing substantial growth in EIA applications within hospital labs and academic institutions, driven by innovations in multiplex assays and lab automation.

- Canada is projected to be the fastest-growing country in the Immunoassay Reagents and Devices market during the forecast period, supported by increasing investments in healthcare infrastructure, growing awareness about early disease detection, and a rising patient population.

- The Enzyme Immunoassays segment is expected to dominate the Immunoassay Reagents and Devices market with a market share of 46.1% in 2025, driven by its widespread use in diagnostics due to high sensitivity, specificity, and cost-effectiveness.

Report Scope and Immunoassay Reagents and Devices Market Segmentation

|

Attributes |

Immunoassay Reagents and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immunoassay Reagents and Devices Market Trends

“Shift Toward Multiplex and Point-of-Care Immunoassays”

- A key emerging trend in the North America Immunoassay Reagents and Devices Market is the increasing shift toward multiplex immunoassays and point-of-care (POC) testing, driven by the need for faster, more comprehensive diagnostic solutions in both clinical and decentralized settings.

- Multiplex immunoassays allow simultaneous detection of multiple biomarkers in a single sample, significantly improving diagnostic efficiency, reducing sample volume, and enabling more detailed patient profiling—especially critical in oncology, infectious disease monitoring, and autoimmune diagnostics.

- The demand for rapid, on-site testing is further fueling the adoption of compact, portable POC immunoassay devices, particularly in emergency departments, outpatient clinics, and rural healthcare settings where immediate diagnostic decisions are necessary.

- Manufacturers are responding to this trend by developing user-friendly, cartridge-based immunoassay platforms with minimal sample preparation and built-in quality controls, tailored for use by non-specialist operators.

- For instance, companies like QuidelOrtho and Abbott have expanded their POC product lines to include multiplex immunoassay systems capable of detecting respiratory pathogens, cardiac markers, and inflammation indicators within minutes.

- This transition toward multiplex and POC testing is enhancing diagnostic accessibility, supporting faster clinical decision-making, and aligning with broader healthcare goals focused on early detection, patient convenience, and decentralized care delivery.

Immunoassay Reagents and Devices Market Dynamics

Driver

“Rising Demand for Personalized Medicine and Biomarker-Based Testing”

- The increasing focus on personalized medicine is driving the demand for advanced immunoassay reagents and devices capable of detecting specific biomarkers associated with various diseases and therapeutic responses.

- Immunoassays are playing a pivotal role in the development and implementation of targeted therapies, particularly in oncology, cardiology, and autoimmune disease management, where individualized treatment plans depend on accurate biomarker profiling.

- The expansion of companion diagnostics, which rely heavily on immunoassay-based technologies, is further accelerating the need for high-precision assays that support drug development pipelines and clinical decision-making.

- For instance, companies such as Roche Diagnostics and Bio-Techne are actively investing in biomarker discovery and immunoassay development to support precision diagnostics and stratified treatment approaches.

- As healthcare providers and pharmaceutical companies increasingly adopt personalized treatment protocols, the demand for robust, scalable immunoassay platforms that support multiplex biomarker detection is expected to rise significantly across North America.

Restraint/Challenge

“Regulatory Complexities and Stringent Compliance Requirements”

- Navigating the evolving regulatory landscape presents a significant challenge for manufacturers of immunoassay reagents and devices, particularly as authorities introduce stricter guidelines to ensure assay accuracy, reliability, and clinical validity.

- The need to comply with regional and international regulatory standards, such as those set by the FDA, Health Canada, and ISO, can delay product approvals and market entry, especially for novel or multiplex assays.

- Frequent updates to compliance frameworks—such as the In Vitro Diagnostic Regulation (IVDR) in the EU and increasing emphasis on real-world evidence and post-market surveillance—require continuous documentation, revalidation, and alignment with changing norms.

- Smaller companies and startups may face resource constraints in maintaining compliance, conducting clinical trials, and generating the necessary evidence to satisfy regulatory bodies, thereby limiting innovation and product launch timelines.

- While regulatory rigor enhances public trust and product reliability, the associated time and cost burdens can pose barriers to entry and slow down technological adoption in the immunoassay space. Proactive regulatory engagement and streamlined approval pathways will be key to overcoming these challenges.

Immunoassay Reagents and Devices Market Scope

The market is segmented on the basis of Technology, Product, Application, End users.

By Technology (Enzyme immunoassays, Fluorescent immunoassays, Chemiluminescence immunoassays and Radioimmunoassay), Product (Analyzers and Reagents), Application (Oncology, Infectious diseases, Cardiology, Bone and mineral, Endocrinology, Autoimmunity, Toxicology, Hematology and Neonatal screening), End users (Hospitals, Laboratories, Academics and Pharmaceutical industries)

- By Technology

On the basis of Technology, the Immunoassay Reagents and Devices market is segmented into Enzyme immunoassays, Fluorescent immunoassays, Chemiluminescence immunoassays and Radioimmunoassay. The Enzyme immunoassays segment dominates the largest market revenue share of 46.1% in 2025, driven by its high sensitivity, cost-effectiveness, and widespread application in clinical diagnostics and research laboratories.

The Radioimmunoassay segment is anticipated to witness the fastest growth rate of 9.7% from 2025 to 2032, fueled by its exceptional sensitivity in detecting low-abundance biomarkers and its continued use in hormone and oncology diagnostics.

- By Product

On the basis of Product, the Immunoassay Reagents and Devices market is segmented into Analyzers and Reagents. The Analyzers held the largest market revenue share in 2025 of, driven by their critical role in automating immunoassay processes, improving throughput, and ensuring accurate and reproducible diagnostic results across high-volume clinical laboratories.

The Reagents segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its recurring demand in diagnostic workflows, expanding test menu availability, and essential role in ensuring assay sensitivity and specificity.

- By Application

On the basis of Application, the Immunoassay Reagents and Devices market is segmented into Oncology, Infectious diseases, Cardiology, Bone and mineral, Endocrinology, Autoimmunity, Toxicology, Hematology and Neonatal screening. The Oncology held the largest market revenue share in 2025, driven by the increasing prevalence of cancer, the growing demand for early detection biomarkers, and advancements in targeted therapies that rely on precise diagnostic testing.

The Endocrinology is expected to witness the fastest CAGR from 2025 to 2032, favored for its growing demand in the diagnosis and monitoring of hormone-related disorders, such as diabetes, thyroid diseases, and adrenal conditions, alongside advances in personalized medicine.

- By End User

On the basis of end user, the Immunoassay Reagents and Devices market is segmented into Hospitals, Laboratories, Academics and Pharmaceutical industries. The Hospitals segment accounted for the largest market revenue share in 2024, driven by the increasing volume of diagnostic tests, the need for advanced diagnostic tools in patient care, and the growing adoption of automated EIA systems for faster and more accurate results.

The Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for high-throughput testing, advancements in laboratory automation, and the growing focus on research and diagnostic applications.

Immunoassay Reagents and Devices Market Regional Analysis

- U.S. dominates the Immunoassay Reagents and Devices market with the largest revenue share of 38.24% in 2025, driven by the growing demand for advanced diagnostic tools in hospitals, research laboratories, and healthcare settings, alongside increasing awareness and adoption of high-performance diagnostic technologies.

- The country’s strong healthcare infrastructure, increased funding for healthcare innovation, and the rising demand for early disease detection and precision medicine are key factors contributing to the market’s dominance.

- Additionally, the U.S. leads in the development and implementation of AI-driven EIA platforms, further enhancing the efficiency and accuracy of diagnostic testing.

U.S. Immunoassay Reagents and Devices Market Insight

The U.S. Immunoassay Reagents and Devices market captured the largest revenue share of 38.24% within North America in 2025, fueled by the rapid adoption of advanced diagnostic technologies in clinical and research settings. The expanding prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions is significantly driving demand for EIA solutions.

The U.S. healthcare system's focus on early diagnostics, personalized medicine, and laboratory automation is further contributing to the market's growth. The adoption of multiplex EIA assays, which can simultaneously detect multiple biomarkers, is gaining traction in clinical diagnostics, enhancing the market expansion. Moreover, the increasing preference for integrated, automated diagnostic platforms is expected to propel demand for EIA reagents and devices in the region.

Canada Immunoassay Reagents and Devices Market Insight

The Canada Immunoassay Reagents and Devices market is expected to witness significant growth during the forecast period, driven by rising investments in healthcare innovation, the expansion of research institutions, and a growing focus on early-stage disease detection. The increasing adoption of high-sensitivity immunoassays in hospitals and diagnostic centers is expected to contribute to the market’s expansion.

Additionally, Canada’s strong healthcare policies, public health initiatives, and focus on personalized medicine are driving the uptake of EIA-based diagnostic solutions. As the demand for precise and rapid diagnostics grows, Canada is positioning itself as a key player in the North American EIA market.

Mexico Immunoassay Reagents and Devices Market Insight

The Mexico Immunoassay Reagents and Devices market is projected to grow at a significant CAGR from 2025 to 2032, primarily driven by an expanding healthcare infrastructure, increased government healthcare spending, and the rising burden of chronic diseases.

Mexico is increasingly adopting EIA technologies for diagnostic purposes in both public and private healthcare sectors, including hospitals and clinics. The growing emphasis on affordable diagnostics, coupled with the demand for innovative healthcare solutions, is expected to foster the market’s growth. As healthcare access improves and awareness of early-stage disease detection rises, the EIA market in Mexico is expected to see substantial expansion.

Immunoassay Reagents and Devices Market Share

The Immunoassay Reagents and Devices industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Roche Diagnostics Corporation

- MilliporeSigma (a business of Merck Group)

- Quidel Corporation

- Ortho Clinical Diagnostics

- Beckman Coulter Life Sciences

- Fisher Scientific (part of Thermo Fisher Scientific)

Latest Developments in North America Immunoassay Reagents and Devices Market

- In April 2023, Thermo Fisher Scientific announced the launch of a new line of enzyme immunoassay kits designed to improve diagnostic accuracy in detecting rare diseases. The kits utilize advanced biotechnological innovations to offer faster results and enhanced reliability in clinical testing. This development solidifies Thermo Fisher's leadership in the EIA reagents and devices market, reinforcing its commitment to advancing healthcare diagnostics in North America.

- In March 2023, Abbott Laboratories introduced a groundbreaking immunoassay platform, the ARCHITECT i1000SR, which offers a highly efficient and automated solution for clinical laboratories. This system significantly reduces turnaround times and increases the accuracy of test results for a variety of infectious diseases and chronic conditions. Abbott’s continuous innovation in EIA technologies is reshaping the diagnostic landscape in North America.

- In March 2023, PerkinElmer launched a new EIA diagnostic platform for early-stage cancer detection, featuring advanced biomarker detection technology designed to enhance screening accuracy and support early intervention in oncology.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.