North America Industrial Centrifuges Market

Market Size in USD Million

CAGR :

%

USD

644.56 Million

USD

909.64 Million

2024

2032

USD

644.56 Million

USD

909.64 Million

2024

2032

| 2025 –2032 | |

| USD 644.56 Million | |

| USD 909.64 Million | |

|

|

|

|

Industrial Centrifuge Market Size

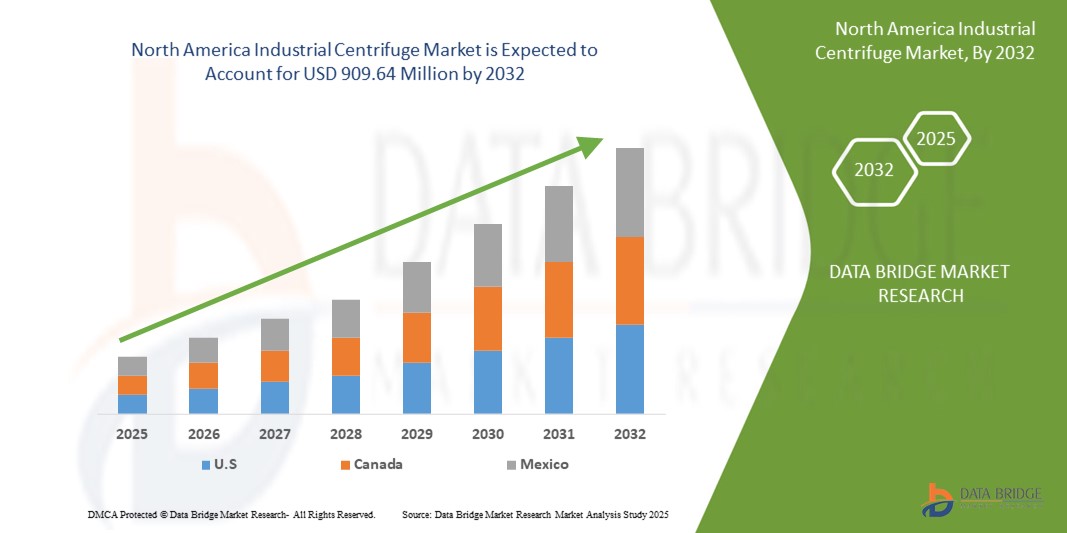

- The North America industrial centrifuge market size was valued at USD 644.56 million in 2024 and is expected to reach USD 909.64 million by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is primarily driven by increasing demand from the food and beverage, pharmaceutical, and biotechnology industries, coupled with rising needs for wastewater treatment and technological advancements in centrifuge systems

- Growing consumer demand for efficient, high-capacity separation technologies in processing industries and stringent environmental regulations are establishing industrial centrifuges as critical equipment for modern industrial applications

Industrial Centrifuge Market Analysis

- Industrial centrifuges, specialized machinery used for separating solids from liquids or liquid-liquid-solid systems through centrifugal force, are vital in applications such as food processing, pharmaceutical production, and wastewater treatment due to their efficiency and precision

- The rising demand for industrial centrifuges is fueled by the expansion of the food and beverage industry, increasing pharmaceutical and biotechnology innovations, and the need for effective wastewater management solutions to comply with environmental standards

- The U.S. dominated the North America industrial centrifuge market with the largest revenue share of approximately 60% in 2023, driven by its advanced industrial infrastructure, significant investments in research and development, and a strong presence of key industry players

- Canada is expected to be the fastest-growing country in the North America industrial centrifuge market during the forecast period, attributed to increasing government initiatives for wastewater management and growing adoption of advanced centrifugation technologies in the food and beverage sector

- The sedimentation centrifuge segment dominated the largest market revenue share of 61.68% in 2024, driven by its extensive use in industries such as pharmaceuticals and food and beverages for efficient separation processes, particularly for decanters used in liquid-liquid-solid separation and solids from liquids

Report Scope and Industrial Centrifuge Market Segmentation

|

Attributes |

Industrial Centrifuge Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Centrifuge Market Trends

“Increasing Integration of Automation and IoT Technologies”

- The North America industrial centrifuge market is experiencing a significant trend toward integrating automation and Internet of Things (IoT) technologies

- These technologies enable real-time monitoring, predictive maintenance, and enhanced operational efficiency by collecting and analyzing data on centrifuge performance and process conditions

- IoT-enabled centrifuges allow for remote diagnostics and proactive issue resolution, reducing downtime and maintenance costs

- For instance, companies are developing smart centrifuge systems that use IoT to optimize separation processes in industries such as pharmaceuticals and food and beverages, tailoring operations to specific batch requirements or real-time environmental conditions

- This trend is increasing the appeal of industrial centrifuges for both large-scale manufacturers and smaller operations by improving precision, energy efficiency, and process control

- Automation systems can monitor operational parameters such as rotor speed, vibration, and temperature, enabling predictive analytics to anticipate equipment failures before they occur

Industrial Centrifuge Market Dynamics

Driver

“Rising Demand for Efficient Separation Technologies in Key Industries”

- The growing need for high-efficiency separation processes in industries such as food and beverages and pharmaceuticals and biotechnology is a major driver for the North America industrial centrifuge market

- Industrial centrifuges enhance process efficiency by enabling precise separation of solids from liquids, liquid-liquid separation, and liquid-liquid-solid separation, critical for applications such as juice clarification, drug purification, and dairy processing

- Regulatory mandates, particularly in the U.S., for improved waste management and environmental compliance are boosting the adoption of centrifuges in wastewater treatment and food processing

- The advancement of 5G and IoT technologies is further enabling faster data transmission and real-time control, expanding the scope of centrifuge applications in sophisticated industrial processes

- Manufacturers are increasingly incorporating advanced centrifuge systems as standard equipment to meet stringent industry standards and enhance operational output

Restraint/Challenge

“High Initial Costs and Regulatory Compliance Issues”

- The high initial investment required for purchasing, installing, and integrating industrial centrifuge systems poses a significant barrier, particularly for small and medium-sized enterprises in the North American market

- Retrofitting existing facilities with advanced centrifuge systems can be complex and expensive, requiring specialized expertise and infrastructure upgrades

- In addition, compliance with stringent regulatory standards for equipment safety, environmental impact, and industry-specific requirements presents a challenge, increasing operational costs and complexity.

- The diverse regulatory frameworks across the U.S. and Canada regarding emissions, waste disposal, and equipment standards further complicate market operations for manufacturers and end users

- These factors may deter adoption in cost-sensitive sectors or regions with less developed industrial infrastructure, potentially limiting market growth

Industrial Centrifuge market Scope

The market is segmented on the basis of equipment type, mode of operation, design, end user, and distribution channel.

- By Equipment Type

On the basis of equipment type, the Europe industrial centrifuge market is segmented into sedimentation centrifuge and filtering centrifuge. The sedimentation centrifuge segment dominated the largest market revenue share of 61.68% in 2024, driven by its extensive use in industries such as pharmaceuticals and food and beverages for efficient separation processes, particularly for decanters used in liquid-liquid-solid separation and solids from liquids. This segment's dominance is attributed to its ability to achieve high speeds and handle diverse industrial applications effectively.

The filtering centrifuge segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand in industries such as food and beverage, environmental, and wastewater treatment. Filtering centrifuges, such as pusher, peeler, and perforate basket centrifuges, excel in dewatering, solid-liquid separation, and particle size classification, offering versatility and continuous operation capabilities.

- By Mode of Operation

On the basis of mode of operation, the Europe industrial centrifuge market is segmented into batch centrifuge and continuous centrifuge. The continuous centrifuge segment dominated the market with a 53.83% revenue share in 2024, owing to its ability to operate without the need for time-consuming batch processes, making it ideal for large-scale production in industries requiring uninterrupted operation.

The batch centrifuge segment is anticipated to experience significant growth from 2025 to 2032. Batch centrifuges offer precise control over separation parameters, making them suitable for applications requiring high purity and efficiency, such as in pharmaceuticals and biotechnology, where varying batch sizes are common.

- By Design

On the basis of design, the Europe industrial centrifuge market is segmented into horizontal centrifuge and vertical centrifuge. The vertical centrifuge segment held the largest market revenue share of 59.13% in 2024, driven by its energy efficiency and cost-effectiveness in filtering liquid products, such as beverages, which are in high demand across the region.

The horizontal centrifuge segment is expected to witness the fastest growth rate from 2025 to 2032. Horizontal centrifuges, also known as basket centrifuges, are increasingly adopted in industries such as food and beverage, pharmaceuticals, and wastewater treatment due to their ability to handle large volumes and diverse materials efficiently.

- By End User

On the basis of end user, the Europe industrial centrifuge market is segmented into food and beverages industry and pharmaceuticals and biotechnology industry. The food and beverages industry segment dominated the market with a 66.35% revenue share in 2024, fueled by high consumer demand for processed food and beverage products, such as dairy, juices, and alcoholic beverages, where centrifuges are critical for fine separation and clarification processes.

The pharmaceuticals and biotechnology industry segment is anticipated to experience robust growth from 2025 to 2032. The increasing demand for high-purity separation in drug manufacturing and biotechnological processes, coupled with advancements in centrifuge technology, drives adoption in this sector.

- By Distribution Channel

On the basis of distribution channel, the Europe industrial centrifuge market is segmented into direct and indirect. The direct distribution channel segment held the largest market revenue share of 63.75% in 2024, driven by strong trust between companies and customers, particularly for replacement and maintenance needs, where direct purchases ensure reliability and quality.

The indirect distribution channel segment is expected to witness significant growth from 2025 to 2032, as third-party distributors and resellers expand their reach, offering cost-effective solutions and broader market access for industrial centrifuge products across diverse industries

Industrial Centrifuge Market Regional Analysis

- The U.S. dominated the North America industrial centrifuge market with the largest revenue share of approximately 60% in 2023, driven by its advanced industrial infrastructure, significant investments in research and development, and a strong presence of key industry players

- Canada is expected to be the fastest-growing country in the North America industrial centrifuge market during the forecast period, attributed to increasing government initiatives for wastewater management and growing adoption of advanced centrifugation technologies in the food and beverage sector

U.S. Industrial Centrifuge Market Insight

The U.S. dominated the North America industrial centrifuge market with the highest revenue share of 66.9% in 2024, fueled by strong demand from the food and beverages, pharmaceuticals, and biotechnology industries. The trend towards automation and the need for high-throughput separation solutions further boost market expansion. Increasing regulations promoting environmental compliance and product quality standards complement the adoption of advanced centrifuges in both OEM and aftermarket segments.

Canada Industrial Centrifuge Market Insight

Canada is expected to witness the fastest growth rate in the North America industrial centrifuge market, driven by increasing investments in wastewater treatment and pharmaceutical manufacturing. Consumers seek centrifuges that offer high efficiency and reliability while meeting environmental regulations. The growth is prominent in both new installations and retrofit projects, with significant uptake due to rising industrial activities and focus on sustainable processing solutions.

Industrial Centrifuge Market Share

The industrial centrifuge industry is primarily led by well-established companies, including:

- Thomas Broadbent & Sons Ltd (U.K)

- Flottweg SE (Germany)

- ANDRITZ (Austria)

- Gruppo Pieralisi - PIERALISI MAIP S.p.A. (Italy)

- HAUS Centrifuge Technologies (Turkey)

- HEINKEL Process Technology GmbH (Germany)

- GEA Group Aktiengesellschaft (Germany)

- SPX FLOW, Inc. (U.S)

- ALFA LAVAL (Sweden)

- Mitsubishi Kakoki Kaisha, Ltd. (Japan)

- Macfuge (Italy)

- Barry-Wehmiller (U.S)

- Hiller GmbH (Germany)

- Ferrum AG (Switzerland)

- SIEBTECHNIK TEMA (Germany)

What are the Recent Developments in North America Industrial Centrifuge Market?

- In January 2024, GEA unveiled its next-generation X Control system for centrifuges, marking a major leap toward intelligent automation. Designed to improve integration, connectivity, data processing, and operational safety, X Control also lays the foundation for AI integration in future centrifuge applications. With enhanced computing power, it enables faster data collection and analysis, supports cloud-based services, and facilitates seamless integration into SCADA systems. The system’s modular design and manufacturer-independent communication (via MTP) allow for flexible, scalable deployment across various centrifuge models throughout the year

- In January 2023, GN Separation launched its High-Speed Tubular Centrifuge, engineered for precision separation in industries such as pharmaceuticals, biotechnology, food, and chemicals. Also known as a tubular bowl separator, this centrifuge delivers centrifugal forces up to 17,000 G, enabling it to perform solid-liquid and liquid-liquid-solid separations that conventional centrifuges cannot handle. It is particularly effective for suspensions with low concentrations, fine particles, and minimal density differences. With models such as GNGQ and GNGF, the system offers flexibility for clarification and separation tasks, supported by stainless-steel construction and variable speed control

- In September 2022, Thermo Fisher Scientific Inc. launched the Thermo Scientific™ DynaSpin™ Single-Use Centrifuge, a cutting-edge solution for large-scale cell culture harvesting. Designed to streamline single-use bioprocesses, DynaSpin significantly reduces reliance on traditional depth filtration cartridges, enabling faster, more efficient separation. The system enhances product yield while minimizing waste, operational costs, and equipment footprint. With its closed-system design, ergonomic operation, and automation-ready features, DynaSpin supports sustainable biomanufacturing and simplifies scale-up from development to production. This innovation was unveiled at the BioProcess International conference, reinforcing Thermo Fisher’s commitment to advancing biologics production

- In August 2022, GEA introduced its Kytero range of pharmaceutical centrifuge systems tailored for the North American market. These single-use separators are engineered for rapid deployment and efficient cell harvesting, offering high yield and gentle product handling. The Kytero systems minimize filter area by up to 75% and feature a simplified component exchange design, eliminating the need for traditional clean-in-place (CIP) and sterilize-in-place (SIP) processes. With plug-and-produce functionality, compact footprint, and no requirement for utilities such as water or buffers, Kytero ensures fast setup and biocontainment, making it ideal for modern biopharmaceutical production

- In February 2022, Beckman Coulter launched the Allegra V-15R refrigerated benchtop centrifuge, designed to deliver exceptional versatility and performance in laboratory workflows. This compact system supports up to 10 rotor configurations and features 50 programmable runs, making it adaptable for a wide variety of applications—from blood and cell separation to high-throughput screening. Its comprehensive adapter selection allows compatibility with numerous tube types and volumes. With a maximum speed of 13,500 rpm and force up to 20,412 x g, the Allegra V-15R ensures efficient sample processing while maintaining a quiet operation and compact footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 TECHNOLOGICAL ANALYSIS

5.3 REGULATORY FRAMEWORK

5.4 PESTLE ANALYSIS

5.5 PRICING ANALYSIS

5.6 EXPORT AND IMPORT TRADE ANALYSIS

6 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY TYPE (IN VALUE AND VOLUME)

6.1 OVERVIEW

6.2 SEDIMENTATION CENTRIFUGE

6.2.1 DECANTER CENTRIFUGE

6.2.1.1. TWO PHASE DECANTER CENTRIFUGE

6.2.1.2. THREE PHASE DECANTER CENTRIFUGE

6.2.2 CLARIFIER/THICKENER

6.2.3 HYDROCYCLONES

6.2.4 DISC STACK CENTRIFUGE

6.2.5 OTHERS

6.3 FILTERING CENTRIFUGE

6.3.1 SCROLL SCREEN CENTRIFUGE

6.3.2 BASKET CENTRIFUGE

6.3.3 PUSHER CENTRIFUGE

6.3.4 PEELER CENTRIFUGE

6.3.5 INVERTING BASKET CENTRIFUGE

6.3.6 VIBRATORY CENTRIFUGE

7 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INSPECTION

7.3 LUBRICATION

7.4 ALIGNMENTS

7.5 REGASKETING

7.6 TESTING CIP (CLEAN IN PLACE) CHEMICALS

7.7 CALIBRATIONS

7.8 REGULAR INSPECTIONS

7.9 OTHERS

8 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY DESIGN

8.1 OVERVIEW

8.2 VERTICAL

8.3 HORIZONTAL

9 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY MODE OF OPERATION

9.1 OVERVIEW

9.2 CONTINUOUS CENTRIFUGE

9.3 BATCH CENTRIFUGE

10 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 SMALL AND MEDIUM ENTERPRISE

10.3 LARGE ENTERPRISE

11 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY END USER

11.1 OVERVIEW

11.2 WASTEWATER TREATMENT PLANTS

11.2.1 BY TYPE

11.2.1.1. SEDIMENTATION CENTRIFUGE

11.2.1.2. FILTERING CENTRIFUGE

11.3 WATER PURIFICATION PLANTS

11.3.1 BY TYPE

11.3.1.1. SEDIMENTATION CENTRIFUGE

11.3.1.2. FILTERING CENTRIFUGE

11.4 POWER

11.4.1 BY TYPE

11.4.1.1. SEDIMENTATION CENTRIFUGE

11.4.1.2. FILTERING CENTRIFUGE

11.5 MINING

11.5.1 BY TYPE

11.5.1.1. SEDIMENTATION CENTRIFUGE

11.5.1.2. FILTERING CENTRIFUGE

11.6 OIL/GAS EXPLORATION AND PETROCHEMICAL INDUSTRY

11.6.1 BY TYPE

11.6.1.1. SEDIMENTATION CENTRIFUGE

11.6.1.2. FILTERING CENTRIFUGE

11.7 CHEMICAL

11.7.1 CHEMICAL, BY TYPE

11.7.1.1. POLYMERS

11.7.1.2. DYES AND PAINTS

11.7.1.3. CELLULOSE AND DERIVATIVES

11.7.1.4. HERBICIDES AND INSECTICIDES

11.7.1.5. SALTS

11.7.1.6. AMINE

11.7.1.7. NITROCOMPOUNDS

11.7.1.8. PEROXIDE

11.7.1.9. PHOSPHORIC ACID

11.7.1.10. POLYACETATES

11.7.1.11. POLYBUTADIENE

11.7.1.12. POLYCARBONATE

11.7.1.13. OTHERS

11.7.2 BY TYPE

11.7.2.1. SEDIMENTATION CENTRIFUGE

11.7.2.2. FILTERING CENTRIFUGE

11.8 METAL PROCESSING

11.8.1 BY TYPE

11.8.1.1. SEDIMENTATION CENTRIFUGE

11.8.1.2. FILTERING CENTRIFUGE

11.9 FOOD AND BEVERAGES

11.9.1 FOOD AND BEVERAGES, BY TYPE

11.9.1.1. BAKERY

11.9.1.1.1. BREAD

11.9.1.1.2. CAKES, PASTRIES & MUFFINS

11.9.1.1.3. DONUTS

11.9.1.1.4. COOKIES & BISCUITS

11.9.1.1.5. OTHERS

11.9.1.2. CONFECTIONERY PRODUCTS

11.9.1.2.1. GUMMIES

11.9.1.2.2. CHOCOLATE

11.9.1.2.3. CHOCOLATE BITES

11.9.1.2.4. CHOCOLATE BARS

11.9.1.2.5. OTHERS

11.9.1.3. MEAT & SEAFOOD PRODUCTS

11.9.1.4. SNACKS & SAVORY PRODUCTS

11.9.1.4.1. SOUPS & SAUCES

11.9.1.4.2. SEASONINGS, DRESSINGS & CONDIMENTS

11.9.1.4.3. NOODLES & PASTA

11.9.1.4.4. SNACKS & EXTRUDED SNACKS

11.9.1.4.5. OTHERS

11.9.1.5. SAUCES, DRESSINGS, AND CONDIMENTS

11.9.1.6. DAIRY & REFRIGERATED PRODUCTS

11.9.1.6.1. YOGURT

11.9.1.6.2. CHEESE

11.9.1.6.3. ICE-CREAM

11.9.1.6.4. FROZEN DESSERTS

11.9.1.6.5. OTHERS

11.9.1.7. READY-TO-EAT PRODUCTS

11.9.1.8. BREWERY AND WINES

11.9.1.9. COFFEE AND TEA

11.9.1.10. JUICE

11.9.1.11. OTHERS

11.9.2 BY TYPE

11.9.2.1. SEDIMENTATION CENTRIFUGE

11.9.2.2. FILTERING CENTRIFUGE

11.1 PHARMACEUTICAL AND BIOTECHNOLOGY

11.10.1 BY TYPE

11.10.1.1. SEDIMENTATION CENTRIFUGE

11.10.1.2. FILTERING CENTRIFUGE

11.11 PULP AND PAPER

11.11.1 BY TYPE

11.11.1.1. SEDIMENTATION CENTRIFUGE

11.11.1.2. FILTERING CENTRIFUGE

11.12 POLYMER INDUSTRY

11.12.1 POLYMER INDUSTRY, BY TYPE

11.12.1.1. PVC

11.12.1.2. POLYPROPYLENE

11.12.1.3. POLYSTYRENE

11.12.1.4. SYNTHETIC RUBBER

11.12.1.5. FIBRES

11.12.1.6. OTHERS

11.12.2 BY TYPE

11.12.2.1. SEDIMENTATION CENTRIFUGE

11.12.2.2. FILTERING CENTRIFUGE

11.13 OTHERS

12 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, BY COUNTRY

NORTH AMERICA INDUSTRIAL CENTRIFUGE Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGERS & ACQUISITIONS

14.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.4 EXPANSIONS

14.5 REGULATORY CHANGES

14.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, SWOT ANALYSIS

16 NORTH AMERICA INDUSTRIAL CENTRIFUGE MARKET, COMPANY PROFILE

16.1 ANDRITZ GROUP

16.1.1 COMPANY OVERVIEW

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 GEA GROUP

16.2.1 COMPANY OVERVIEW

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 BUHLER

16.3.1 COMPANY OVERVIEW

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 SCHLUMBERGER LIMITED

16.4.1 COMPANY OVERVIEW

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DEDERT CORPORATION

16.5.1 COMPANY OVERVIEW

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 B&P LITTLEFORD

16.6.1 COMPANY OVERVIEW

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 SPX FLOW, INC

16.7.1 COMPANY OVERVIEW

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 PNEUMATIC SCALE ANGELUS

16.8.1 COMPANY OVERVIEW

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 FLOTTWEG SE

16.9.1 COMPANY OVERVIEW

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GRUPPO PIERALISI

16.10.1 COMPANY OVERVIEW

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 FERRUM LTD.

16.11.1 COMPANY OVERVIEW

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 SIEBTECHNIK TEMA

16.12.1 COMPANY OVERVIEW

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 HEINKEL DRYING AND SEPARATION GROUP

16.13.1 COMPANY OVERVIEW

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 GRUPPO PIERALISI - MAIP S.P.A.

16.14.1 COMPANY OVERVIEW

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 COMI POLARIS SYSTEMS

16.15.1 COMPANY OVERVIEW

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 US CENTRIFUGE SYSTEMS

16.16.1 COMPANY OVERVIEW

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 ELGIN SEPARATION SOLUTIONS

16.17.1 COMPANY OVERVIEW

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

North America Industrial Centrifuges Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Centrifuges Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Centrifuges Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.