North America Industrial Ethanol Market

Market Size in USD Billion

CAGR :

%

USD

57.92 Billion

USD

114.56 Billion

2025

2033

USD

57.92 Billion

USD

114.56 Billion

2025

2033

| 2026 –2033 | |

| USD 57.92 Billion | |

| USD 114.56 Billion | |

|

|

|

|

What is the North America Industrial Ethanol Market Size and Growth Rate?

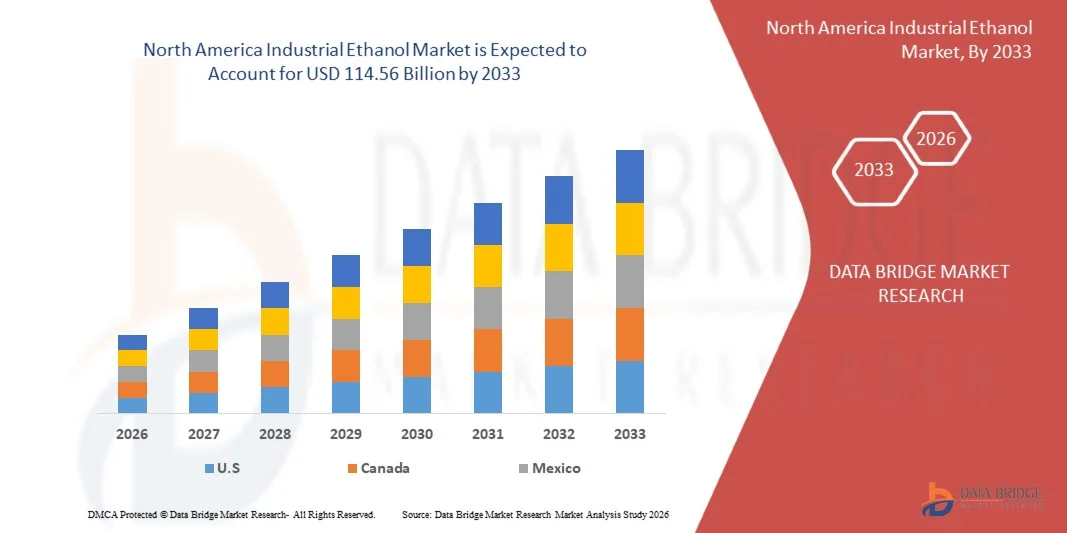

- The North America Industrial Ethanol Market size was valued at USD 57.92 billion in 2025 and is expected to reach USD 114.56 billion by 2033, at a CAGR of 8.9% during the forecast period

- The market growth is largely fuelled by rising demand from chemical manufacturing, pharmaceuticals, cosmetics, paints and coatings, and personal care industries

- In addition, increasing adoption of bio-based solvents, growing focus on sustainable and renewable raw materials, and expanding use of ethanol as an industrial feedstock are supporting market expansion

What are the Major Takeaways of North America Industrial Ethanol Market?

- The market is characterised by strong demand for ethanol as a versatile solvent, disinfectant, and intermediate in the production of chemicals, polymers, and pharmaceutical formulations

- Manufacturers are increasingly focusing on bio-based and low-carbon ethanol production to align with environmental regulations, sustainability goals, and corporate decarbonisation strategies

- The U.S. dominated the North America Industrial Ethanol Market with an estimated 45.26% revenue share in 2025, driven by strong demand across pharmaceutical manufacturing, chemical processing, personal care products, food processing, and industrial solvents

- Canada is projected to register the fastest CAGR of 9.54% during the forecast period, driven by increasing demand from pharmaceuticals, food processing, personal care, and industrial manufacturing sectors

- The bio-based segment held the largest market revenue share in 2025 driven by growing demand for renewable and sustainable feedstocks, government incentives for green chemicals, and increasing adoption across pharmaceutical, personal care, and chemical industries

Report Scope and North America Industrial Ethanol Market Segmentation

|

Attributes |

North America Industrial Ethanol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the North America Industrial Ethanol Market?

“Rising Demand For Bio-Based And Sustainable Industrial Inputs”

- The increasing focus on sustainability and reduction of carbon emissions is significantly shaping the North America Industrial Ethanol Market, as industries seek renewable and bio-based alternatives to fossil-derived chemicals. Industrial ethanol is gaining traction due to its versatility as a solvent, intermediate, and disinfectant, while supporting cleaner production processes. This trend is strengthening its adoption across chemicals, pharmaceuticals, personal care, paints and coatings, and industrial manufacturing sectors, encouraging producers to enhance capacity and efficiency

- Growing awareness around environmental responsibility and regulatory compliance has accelerated the use of industrial ethanol in green chemistry applications. Manufacturers are increasingly incorporating ethanol derived from renewable feedstocks to meet sustainability targets and improve environmental profiles of end products. This shift is also driving investments in advanced fermentation technologies and feedstock optimisation to improve yield and reduce production costs

- Sustainability-driven purchasing decisions are influencing industrial buyers, with greater emphasis on traceable sourcing, lower lifecycle emissions, and compliance with environmental standards. These factors are enabling suppliers of bio-based industrial ethanol to differentiate offerings, strengthen long-term contracts, and build trust with downstream industries focused on ESG goals

- For instance, in 2024, BASF in Germany increased the use of bio-based ethanol as an intermediate in chemical and specialty product manufacturing. These initiatives were introduced to support sustainability commitments and reduce reliance on petrochemical inputs, contributing to lower carbon footprints and improved process efficiency

- While demand for industrial ethanol continues to rise, sustained market growth depends on stable feedstock availability, efficient production technologies, and maintaining cost competitiveness against conventional petrochemical alternatives. Producers are focusing on scalability, supply chain integration, and process innovation to support long-term market expansion

What are the Key Drivers of North America Industrial Ethanol Market?

- Rising demand for renewable and environmentally friendly industrial inputs is a major driver for the North America Industrial Ethanol Market. Manufacturers across chemicals, pharmaceuticals, and personal care industries are increasingly using ethanol as a bio-based solvent and intermediate to align with sustainability regulations and corporate decarbonisation goals

- Expanding applications in pharmaceuticals, disinfectants, coatings, inks, and industrial chemicals are supporting market growth. Industrial ethanol offers high purity, effective solvency, and compatibility with diverse formulations, making it a preferred choice for multiple industrial processes. Increased emphasis on hygiene and sanitation further reinforces demand

- Chemical and industrial manufacturers are actively promoting ethanol-based formulations through product innovation, process optimisation, and sustainability reporting. These efforts are supported by stricter environmental regulations and growing customer preference for low-carbon and renewable materials, encouraging partnerships between ethanol producers and end-use industries

- For instance, in 2023, Bayer in Germany reported increased consumption of industrial ethanol in pharmaceutical manufacturing and formulation processes. This shift was driven by demand for high-purity, compliant solvents and alignment with sustainability initiatives, enhancing operational efficiency and regulatory compliance

- Despite strong demand drivers, long-term growth depends on feedstock cost management, production efficiency, and reliable supply chains. Investment in advanced fermentation technologies, waste-based feedstocks, and logistics optimisation will be critical to sustain competitiveness

Which Factor is Challenging the Growth of the North America Industrial Ethanol Market?

- Fluctuating prices and availability of agricultural feedstocks such as corn, sugarcane, and grains remain a key challenge for the North America Industrial Ethanol Market. Variability in crop yields, weather conditions, and competing demand from fuel ethanol can impact production costs and pricing stability for industrial-grade ethanol

- Regulatory complexities related to alcohol handling, taxation, and compliance create operational challenges, particularly for cross-border trade and industrial distribution. Strict licensing requirements and varying regulations across markets can limit flexibility and increase administrative burden for manufacturers and distributors

- Supply chain and storage challenges also affect market growth, as industrial ethanol requires controlled handling, specialised storage infrastructure, and adherence to safety standards. These requirements increase operational costs and can limit adoption among smaller industrial users

- For instance, in 2024, chemical distributors across Europe supplying coatings and pharmaceutical manufacturers reported margin pressure due to rising agricultural feedstock costs, higher energy prices, and stringent regulatory compliance requirements. These factors influenced pricing strategies, increased operational expenses, and led to delayed procurement decisions among industrial end users

- Addressing these challenges will require diversification of feedstock sources, improved supply chain efficiency, and regulatory harmonisation. Investment in second-generation and waste-based ethanol production, along with stronger collaboration between producers, regulators, and end users, will be essential to unlock the long-term growth potential of the global North America Industrial Ethanol Market

How is the North America Industrial Ethanol Market Segmented?

The market is segmented on the basis of raw material, type, and application.

• By Raw Material

On the basis of raw material, the Europe North America Industrial Ethanol Market is segmented into bio-based and synthetic. The bio-based segment held the largest market revenue share in 2025 driven by growing demand for renewable and sustainable feedstocks, government incentives for green chemicals, and increasing adoption across pharmaceutical, personal care, and chemical industries. Bio-based ethanol is preferred for its lower carbon footprint and alignment with environmental regulations, making it a popular choice among industrial manufacturers.

The synthetic segment is expected to witness the fastest growth rate from 2026 to 2033, supported by consistent supply, lower production costs, and suitability for large-scale chemical and industrial processes. Synthetic ethanol is particularly favored where high-volume applications and cost efficiency are critical.

• By Type

On the basis of type, the Europe North America Industrial Ethanol Market is segmented into absolute ethanol, ethanol 95%, denatured ethanol, and others. The absolute ethanol segment dominated in 2025 due to its high purity and widespread use in pharmaceutical, laboratory, and specialty chemical applications. Absolute ethanol offers consistent quality and performance, making it critical for regulated industrial processes.

The denatured ethanol segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its extensive application in paints, coatings, cleaning solutions, and household products where cost-effective ethanol is required without the need for high purity.

• By Application

On the basis of application, the Europe North America Industrial Ethanol Market is segmented into paints and coatings, pharmaceutical, food & beverages, printing ink, agricultural, household and industrial cleaning solutions, cosmetics and personal care, adhesives, and others. The pharmaceutical segment held the largest revenue share in 2025, attributed to rising demand for ethanol as a solvent, disinfectant, and intermediate in drug formulations.

The paints and coatings segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing industrialisation, growth in construction activities, and expanding demand for eco-friendly and bio-based coating formulations across Europe.

Which Region Holds the Largest Share of the North America Industrial Ethanol Market?

- The U.S. dominated the North America Industrial Ethanol Market with an estimated 45.26% revenue share in 2025, driven by strong demand across pharmaceutical manufacturing, chemical processing, personal care products, food processing, and industrial solvents. Increasing use of ethanol as a solvent, disinfectant, intermediate chemical, and processing aid, combined with a well-established industrial base, continues to support regional growth

- Presence of advanced refining infrastructure, large-scale bioethanol production capacity, and strong R&D investments has accelerated market development across the U.S. Government support for bio-based chemicals, renewable feedstocks, and sustainable manufacturing practices is encouraging wider adoption of industrial-grade ethanol across multiple end-use industries

- Growing emphasis on healthcare expansion, hygiene and sanitation standards, regulatory compliance, and industrial modernization, along with rising investments in pharmaceuticals, cosmetics, and specialty chemicals manufacturing, continues to drive Industrial Ethanol demand across North America

Canada North America Industrial Ethanol Market Insight

Canada is projected to register the fastest CAGR of 9.54% during the forecast period, driven by increasing demand from pharmaceuticals, food processing, personal care, and industrial manufacturing sectors. Strong availability of bio-based feedstocks, supportive government policies promoting renewable chemicals, and expanding domestic ethanol production capacity are supporting sustained market expansion.

Mexico North America Industrial Ethanol Market Insight

Mexico is witnessing steady growth in the North America Industrial Ethanol Market, supported by rising utilization across pharmaceuticals, chemicals, beverages, and industrial manufacturing industries. Expansion of healthcare infrastructure, increasing demand for sanitizers and solvents, and growing industrial activity are expected to support long-term market development across the country.

Which are the Top Companies in North America Industrial Ethanol Market?

The industrial ethanol industry is primarily led by well-established companies, including:

- Smiths Detection Group Ltd (U.K.)

- Westminster Group Plc (U.K.)

- QinetiQ (U.K.)

- OD Security (Netherlands)

- Rohde & Schwarz (Germany)

- VITRONIC (Germany)

- Artec Europe (Luxembourg)

- Metrasens (U.K.)

- Braun & Company Ltd (U.K.)

- LINEV Group (U.K.)

- Scan X Security Ltd (U.K.)

- ScioTeq (U.K.)

- CEIA SpA (Italy)

- Millivision Technologies (U.K.)

- 3F Advanced Systems (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Industrial Ethanol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Ethanol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Ethanol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.