North America Industrial Silica Sand Market

Market Size in USD Billion

CAGR :

%

USD

2.21 Billion

USD

4.21 Billion

2024

2032

USD

2.21 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.21 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Industrial Silica Sand Market Size

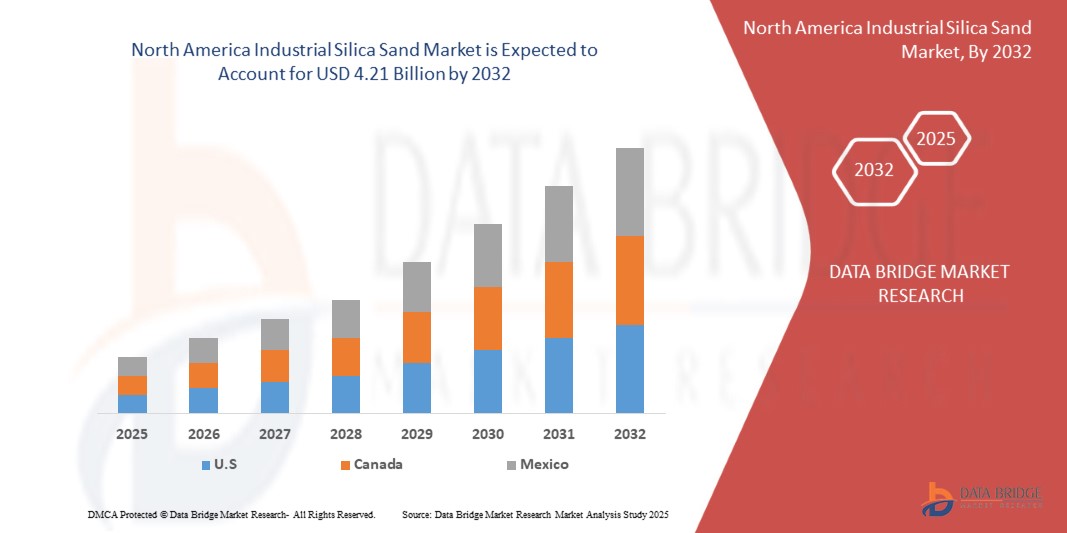

- The North America industrial silica sand market size was valued at USD 2.21 billion in 2024 and is expected to reach USD 4.21 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the rising demand for high-purity silica sand across industries such as glassmaking, construction, oil and gas, and foundry applications, supported by increasing urbanization, infrastructure development, and energy sector expansion globally

- Furthermore, the growing focus on renewable energy projects, particularly solar panel production, and the need for superior-grade silica sand in hydraulic fracturing operations are accelerating the uptake of industrial silica sand, thereby significantly boosting the industry's growth

Industrial Silica Sand Market Analysis

- Industrial silica sand is a high-purity quartz sand used as a critical raw material in applications such as glass manufacturing, hydraulic fracturing in oil and gas, foundry casting, construction materials, and water filtration

- The escalating demand for industrial silica sand is primarily driven by the increasing production of glass for automotive, construction, and solar energy sectors, along with rising shale gas exploration activities where silica sand serves as an essential proppant to enhance well productivity

- U.S. dominated the industrial silica sand market with a share of 73.5% in 2024, due to the country’s strong presence of glass manufacturing, oil and gas exploration, and construction industries that heavily rely on high-quality silica sand

- Mexico is expected to be the fastest growing region in the industrial silica sand market during the forecast period due to country’s growing construction sector, combined with surging demand for silica sand in glass production, metal casting, and oilfield services

- Surface quarrying segment dominated the market with a market share of 58.6% in 2024, due to its cost-effective extraction process and suitability for large-volume silica sand production. Most silica sand deposits near the surface are accessed through open-pit quarrying, which remains the primary method for industrial silica sand operations globally

Report Scope and Industrial Silica Sand Market Segmentation

|

Attributes |

Industrial Silica Sand Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Silica Sand Market Trends

“Rising Demand for High-Purity Silica in Solar and Semiconductor Manufacturing”

- A significant and accelerating trend in the global industrial silica sand market is the rising demand for high-purity silica for use in solar and semiconductor manufacturing such as photovoltaic cells and silicon wafers

- For instance, companies are supplying high-purity silica sand that serves as the primary raw material for producing silicon, which is essential for solar panels and advanced semiconductor devices

- The adoption of high-purity silica sand enables the production of solar-grade silicon with minimal impurities, supporting the efficiency and reliability of solar cells and electronic components

- High-purity silica is processed using advanced methods such as carbothermic reduction and plasma furnace technology to achieve the stringent quality requirements necessary for solar and semiconductor applications

- This trend toward cleaner energy and high-tech manufacturing is fundamentally reshaping resource extraction and processing strategies. Companies and research projects such as SOLSILC are developing environmentally friendly and cost-effective processes for large-scale solar-grade silicon production

- The demand for high-purity silica sand is growing rapidly across both established and emerging markets, as the expansion of renewable energy and electronics industries drives the need for superior raw materials

Industrial Silica Sand Market Dynamics

Driver

“Growing Demand in Construction Sector”

- The expansion of the global construction sector, coupled with the need for durable and high-performance building materials, is a significant driver for the increased demand for industrial silica sand

- For instance, silica sand is widely used in concrete, glass, and other construction materials, providing essential properties such as strength, durability, and workability

- As infrastructure projects and urban development accelerate, the use of silica sand in a variety of construction applications such as cement, mortar, and specialty glass is supporting market growth

- The shift toward sustainable and energy-efficient buildings is making high-quality silica sand an important input for advanced construction products

- The convenience of using silica sand in both traditional and modern construction methods, along with its availability in bulk quantities, is propelling adoption in diverse regions. The growth of government investments and private sector participation in infrastructure development further contributes to market expansion

Restraint/Challenge

“Competition from Substitutes Limit Growth”

- Competition from substitute materials such as synthetic and recycled alternatives poses a significant challenge to the growth of the industrial silica sand market

- For instance, the development and increasing use of recycled glass, engineered stone, and other alternative materials in construction and manufacturing are reducing the reliance on natural silica sand

- Addressing these challenges through product innovation, improved processing, and value-added applications is crucial for maintaining market share. Companies are focusing on enhancing the purity and performance of silica sand to differentiate it from substitutes

- The cost and availability of substitutes can be a barrier to market expansion, especially in regions where environmental regulations restrict sand mining or where recycled materials are more economically attractive

- Overcoming these challenges through sustainable mining practices, regulatory compliance, and the development of high-purity specialty grades will be vital for sustained market growth and competitiveness

Industrial Silica Sand Market Scope

The market is segmented on the basis of classification, product, type, processing, application, and end-user.

• By Classification

On the basis of classification, the industrial silica sand market is segmented into Less Than 40 Mesh, 40-70 Mesh, and More Than 70 Mesh. The 40-70 Mesh segment accounted for the largest market revenue share in 2024, owing to its widespread use in hydraulic fracturing (fracking) operations across the oil and gas industry. The ideal grain size, strength, and sphericity of 40-70 mesh silica sand make it highly suitable as a proppant to enhance permeability in shale formations, contributing to its strong demand, particularly from North America and emerging markets involved in shale gas exploration.

The More Than 70 Mesh segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising applications in glassmaking, water filtration, and specialized construction materials. The fine particle size of this silica sand category enhances surface finish, structural integrity, and filtration efficiency, which is increasingly preferred in industries requiring high purity and precision.

• By Product

On the basis of product, the market is segmented into Glass Sand, Foundry Sand, and Others. The Glass Sand segment held the dominant market revenue share in 2024, supported by the growing demand for high-clarity, durable glass across construction, automotive, and consumer goods sectors. Industrial silica sand, particularly with low iron content, is a critical raw material for producing flat glass, container glass, and solar glass, with rising investments in renewable energy further boosting the segment's growth.

The Foundry Sand segment is anticipated to register the fastest growth from 2025 to 2032, driven by increasing production of cast metal components for automotive, heavy machinery, and aerospace industries. High-purity silica sand provides excellent molding characteristics, thermal resistance, and dimensional stability, making it essential for precision metal casting applications.

• By Type

On the basis of type, the market is categorized into Whole Grain Silica and Ground Silica. The Whole Grain Silica segment dominated the largest market share in 2024, attributed to its extensive use as proppants in oil and gas operations, as well as in filtration and foundry applications. Its superior grain strength and resistance to crushing make it ideal for demanding industrial uses.

The Ground Silica segment is forecasted to experience the highest growth between 2025 and 2032, supported by its increasing role in producing coatings, paints, adhesives, and rubber products. Ground silica improves tensile strength, abrasion resistance, and surface smoothness in finished products, driving its adoption across diverse manufacturing sectors.

• By Processing

On the basis of processing, the market is segmented into Surface Quarrying, Ripping, Drilling, and Blasting. The surface quarrying segment captured the largest market revenue share 58.6% in 2024, due to its cost-effective extraction process and suitability for large-volume silica sand production. Most silica sand deposits near the surface are accessed through open-pit quarrying, which remains the primary method for industrial silica sand operations globally.

Drilling and Blasting processes are expected to witness the fastest growth rate from 2025 to 2032, as deeper, high-purity silica deposits are explored to meet the increasing demand for specialized applications such as glassmaking, electronics, and high-grade foundry sands. These methods enable efficient access to more challenging reserves while ensuring consistent quality.

• By Application

On the basis of application, the market is segmented into Construction Materials, Glassmaking, Golf Courses and Sports Fields, Industrial Abrasives, Water Filtration, Ceramics and Refractories, Coatings Formation, Chemical Production, Metal Production, Foundry, and Others. The Glassmaking segment led the market in 2024, driven by escalating demand for architectural, automotive, and solar glass products globally. Silica sand's high purity and specific chemical properties are indispensable in achieving the desired clarity, strength, and thermal performance in glass manufacturing.

The Water Filtration segment is anticipated to exhibit the fastest CAGR from 2025 to 2032, owing to the rising global emphasis on clean water initiatives, wastewater treatment infrastructure, and strict regulatory standards. Industrial silica sand is a critical filtration medium in municipal and industrial water treatment processes due to its high durability, permeability, and contaminant removal efficiency.

• By End-User

On the basis of end-user, the market is segmented into Building and Construction, Chemicals, Mining, Paints and Coatings, Oil and Gas, and Others. The Building and Construction segment held the largest market revenue share in 2024, fueled by robust infrastructure development, urbanization, and the growing need for durable, high-performance construction materials. Silica sand is widely used in concrete, mortars, asphalt, and composite materials, making it a vital component for modern construction projects worldwide.

The Oil and Gas segment is projected to record the fastest growth from 2025 to 2032, primarily driven by increasing hydraulic fracturing activities, especially in North America, the Middle East, and emerging shale gas markets. Industrial silica sand serves as an essential proppant, facilitating enhanced hydrocarbon recovery, which is crucial in unconventional oil and gas extraction.

Industrial Silica Sand Market Regional Analysis

- U.S. dominated the industrial silica sand market with the largest revenue share of 73.5% in 2024, driven by the country’s strong presence of glass manufacturing, oil and gas exploration, and construction industries that heavily rely on high-quality silica sand

- The rising demand for silica sand as a proppant in hydraulic fracturing operations across major shale basins, combined with large-scale infrastructure development and renewable energy projects, continues to support the market’s growth in the U.S.

- The country’s well-established mining sector, abundant silica reserves, and advancements in sand processing technologies further solidify the U.S. as the leading market for industrial silica sand production and consumption

Canada Industrial Silica Sand Market Insight

The Canada industrial silica sand market is expected to witness steady growth from 2025 to 2032, supported by increasing demand from construction, oil and gas, and water filtration industries. Expanding infrastructure projects, along with rising investments in shale oil and gas exploration, are driving the consumption of silica sand across the country. Canada’s significant silica deposits and focus on sustainable resource extraction enhance its market potential, while growing environmental regulations promote higher-grade, processed silica sand for industrial use.

Mexico Industrial Silica Sand Market Insight

Mexico is projected to record the fastest CAGR in the North America industrial silica sand market during the forecast period of 2025 to 2032. The country’s growing construction sector, combined with surging demand for silica sand in glass production, metal casting, and oilfield services, is fueling market expansion. Mexico benefits from abundant natural silica reserves, competitive production costs, and proximity to major export markets such as the U.S., positioning it as a strategic player in regional silica sand supply chains. Increasing investments in infrastructure, automotive manufacturing, and renewable energy further contribute to market growth across Mexico.

Industrial Silica Sand Market Share

The industrial silica sand industry is primarily led by well-established companies, including:

- U.S. Silica. (U.S.)

- Hi-Crush Inc. (U.S.)

- Mitsubishi Corporation. (Japan)

- Covia Holdings LLC. (U.S.)

- Source Energy Services (Canada)

- Badger Mining Corporation (U.S.)

- Pattison Sand Company. (U.S.)

- Sil Industrial Minerals (Canada)

- Smart Sand, Inc. (U.S.)

- Sssands.com. (U.S.)

- Eagle Materials Inc. (U.S.)

- Sibelco (U.S.)

- Alpine Silica (U.S.)

- VRX Silica (Canada)

Latest Developments in North America Industrial Silica Sand Market

- In June 2023, Covia, a mineral solutions provider, plans a price hike of up to 20% for non-contracted business due to escalating costs, impacting the industrial silica sand market's pricing dynamics and highlighting challenges in maintaining profitability amid supply chain pressures

- In July 2022, Sibelco's acquisition of EchasaSA expands its presence in the industrial silica sand market, leveraging proximity advantages in Spain to enhance operational efficiency and product accessibility, influencing regional market dynamics and competition

- In April 2022, Source Energy Services' partnership agreement to boost frac sand production signifies market expansion strategies within the industrial silica sand sector, aiming to meet growing demand and capitalize on emerging opportunities, shaping competitive dynamics and market growth trajectories

- In April 2020, U.S. Silica's strategic decision to relocate its stakeholders' meeting amid COVID-19 demonstrates adaptability, potentially enhancing brand reputation and customer engagement, influencing market perception and bolstering the company's position in the industrial silica sand sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Industrial Silica Sand Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Silica Sand Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Silica Sand Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.