North America Industrial Water Treatment Market Analysis and Size

The growing demand for the consumption of clean water and rising awareness regarding the importance of water treatment are some of the essential factors which boost the market growth rate during the forecast period. The water treatment chemicals in industries help remove microbial contaminants from different water sources such as wastewater, industrial feed, wells, and others, thereby converting them to fresh able water for industrial processes.

Several boosters associated with the industrial water treatment market include increasing wastewater generation in chemical industries and regulations to reuse and recycle wastewater. In order to fulfill the growing demand for industrial water treatment products, some companies are expanding their production capacities and entering into agreements across different regions.

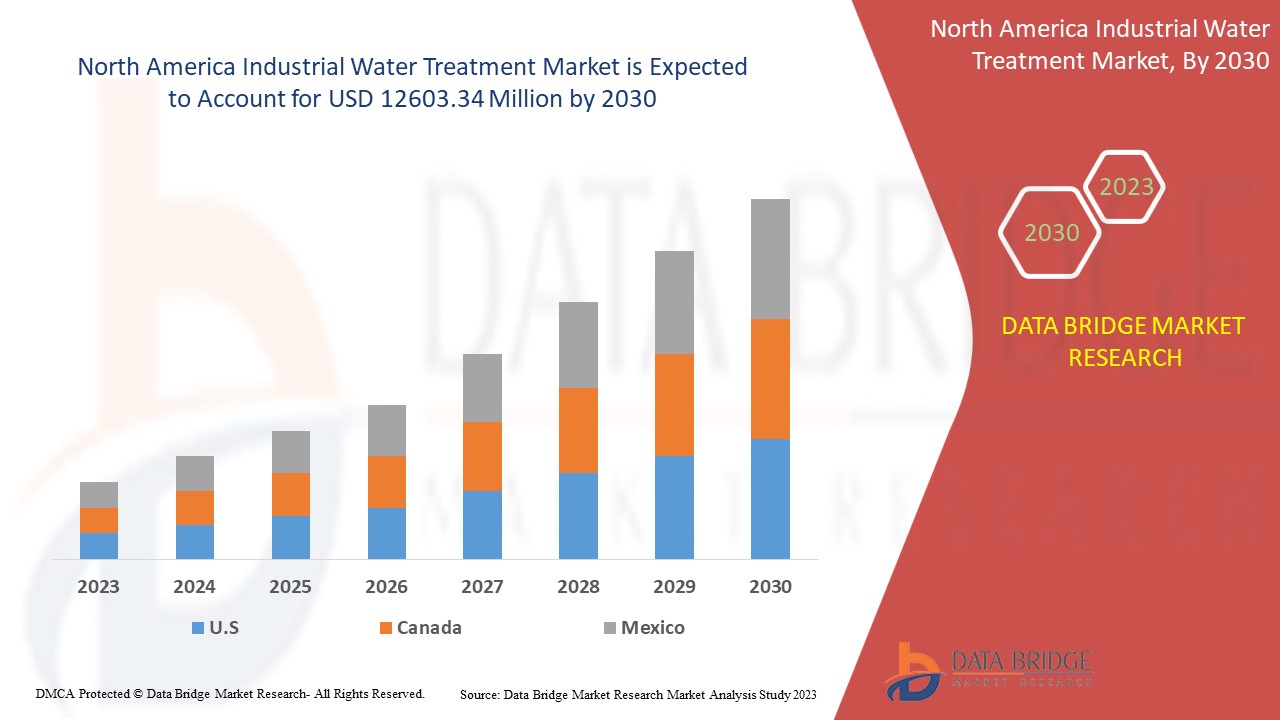

The North America industrial water treatment market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.5% in the forecast period of 2023 to 2030 and is expected to reach USD 12603.34 million by 2030. The major factors driving the growth of the North America Industrial water treatment market are increasing demand from the power industry & Growing awareness regarding waterborne diseases.

The North America industrial water treatment market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2016) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Category (Chemicals, Water Treatment Services, and Equipment). |

|

Regions Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Hydrite Chemical, WATERTECH USA, Buckman, 3M, Xylem, KRONOS INTERNATIONAL, Inc., Dorf Ketal, Ecolab, Kemira, Aries Chemical, Inc., Solenis, Thermax Limited., SUEZ Group, Kurita Water Industries Ltd., IXOM, SNF, and MCC, among others. |

Market Definition

Wastewater treatment is the industrial process of converting wastewater into soft water to make it usable for industrial processes. In wastewater treatment, the chemical is required to remove microbial contaminants such as protozoa, viruses, unwanted bacteria, and other suspended solid particles from the water. The use of poor water quality in the industry is dangerous for industrial processing. The chemicals for wastewater treatment are selected on the basis of the properties of water and its constituents, such as melting point, quantity, boiling point density, and velocity.

North America Industrial Water Treatment Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Increasing demand for water treatment services from the power industry

One of the industries where wastewater treatment facilities and services are needed the most is the power industry. Most energy or power industries need wastewater as their requirements do not always need fresh water. However, as per the requirements, untreated raw wastewater cannot be applied for processes in the energy industries because wastewater carries various organic and inorganic components from domestic or municipal sewage. In that case, the water must be treated for energy production. This can be a huge driving factor for North America's industrial water treatment market. The number of power industries is rising as well.

Due to this rising trend, the number and need for wastewater treatment due to various wastewater applications such as cooling boiler systems, and reuse of wastewater in energy production are creating the chance to grow the North America industrial water treatment market. Along with these drivers, the reuse of water treatment is also one of the most important sustainable goals. The power industry is reusing wastewater to produce energy. Besides that, most of the energy-producing industry has a huge area. The whole area must be ready to fight any emergency fire situation. Therefore, there is also a need for treated wastewater that is contaminant free and not potable. Boiler water treatment is also a part of wastewater treatment. Water must be treated regularly to ensure the boiler system's maximum and optimum efficiency.

All the aspects discussed above are demanding requirements from the power industries. These applications and utility of water treatment services are enabling the market to grow in the future. Wastewater treatment sometimes causes greater electricity consumption. To handle this, new innovative technologies are also being adopted from time to time.

Thus, the new edge innovation and increasing demand from power industries for industrial water treatment products and services are expected to ensure the growth of the North America industrial water treatment market.

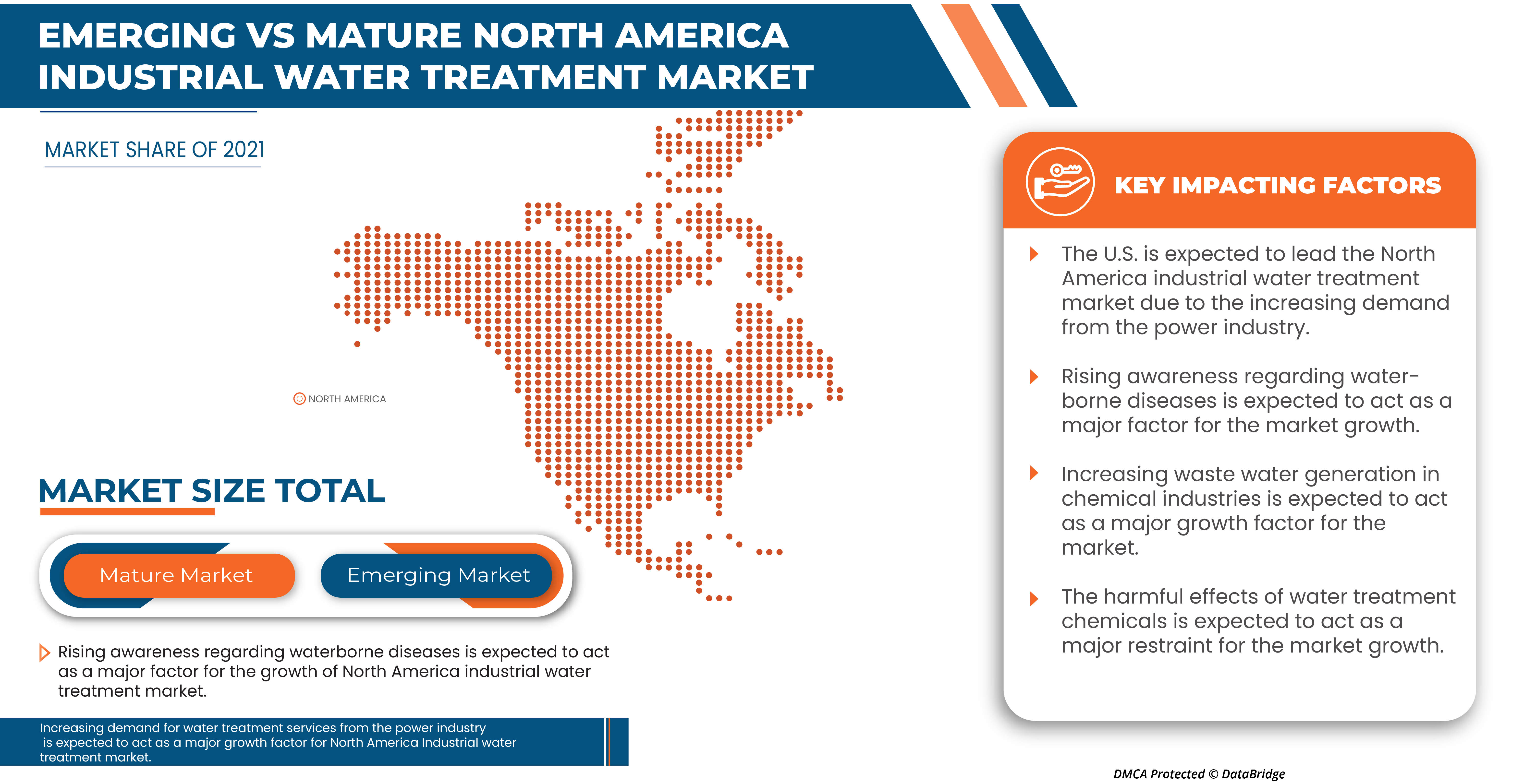

- Growing awareness regarding waterborne diseases

The pandemic of COVID-19 made the public and government highly aware of health in developed countries such as the United States, Canada, and Mexico. People are well aware of airborne and waterborne diseases. Several health campaigns have been held. People in North America have been taught about the effects and prevention of waterborne diseases. This growing awareness is one of the biggest drivers for North America Industrial wastewater treatment. People get aware of the untreated wastewater produced by industries. Several harmful microorganisms and chemicals can contaminate the water, which can be hazardous to the environment. The demand for water treatment products and services is increasing to prevent the growth and prevalence of water-borne diseases. Various surveillance programs have been initiated for Industrial wastewater. Because of the reasons mentioned above, various industries will invest in and modify their wastewater treatment facilities and technologies.

Hence, the growing awareness among people of North America about water-borne diseases and the harmful effects of the chemical contaminated wastewater produced by industries are expected to drive the growth of the North America industrial wastewater treatment market.

- Increasing water scarcity

One of the most important driving factors for the North America Industrial Water Treatment Market is the increasing water scarcity in North America. Several reports have been published about water scarcity and sustainable environmental factors. These environmental factors are enabling the market to expand in the future. For the last 20 years, almost 90% of severe disasters have been caused by floods, droughts, and other water-associated factors. Some reports are also stating water-associated disasters impact 55 million people globally annually. In addition, approximately 2 billion people face water stress annually. Climate change makes drought and desertification very regular across the United States of North America. For this reason, continuous adoption of newer technologies in North America and Industrial wastewater treatment is taken to tackle this harsh situation, which can act as a driver for the market to grow in upcoming years.

Thus, growing water scarcity and demands for wastewater reuse are expected to act as the major driving factors in increasing wastewater generation in chemical industries.

The rising water production by the chemical industries is another factor supporting the growth of North American industrial water treatment. The amount of wastewater generation rises each year along with chemical industry production. The wastewater treatment market is experiencing increased demand as a result of more wastewater treatment. Chemical industries generate a lot of wastewater from ongoing production, cleaning, and washing activities.

Restraint

- Harmful effects of water treatment chemicals

With changing lifestyles to develop the economies, there is a requirement for mass consumption and disposal in industries. This has increased the volume of industrial and domestic wastewater. This has created the requirement for effective advanced wastewater treatment as wastewater contains a variety of constituents such as particles, organic materials, and emulsions depending on the chemicals used in various industries. However, some types of chemicals used during wastewater treatments form different kinds of by-products by reacting between each other and pollutants. These by-products can cause chronic exposure, such as drinking water ingestion, inhalation, and dermal contact. This may pose cancer and non-cancer risks to human health.

Biocides are the chemicals used for the treatment of wastewater in several industries resulting in deter, render harmless and kill living organisms such as mold, bacteria, algae, insects, and rodents. Biocides are products with highly toxic, carcinogenic, endocrine-disrupting properties and may adversely affect human health and the environment.

Increasing health effects due to the use of water treatment chemicals in the industry will lower the demand for water treatment chemicals. Using more corrosion and scale-forming inhibitors also releases several gasses during the wastewater treatment, which are injuries to health if exposed for a long duration.

Thus, the more hazardous effect on humans of the water treatment chemical is expected to result in lower demand by industries, which may restrain the growth of the North America industrial water treatment market.

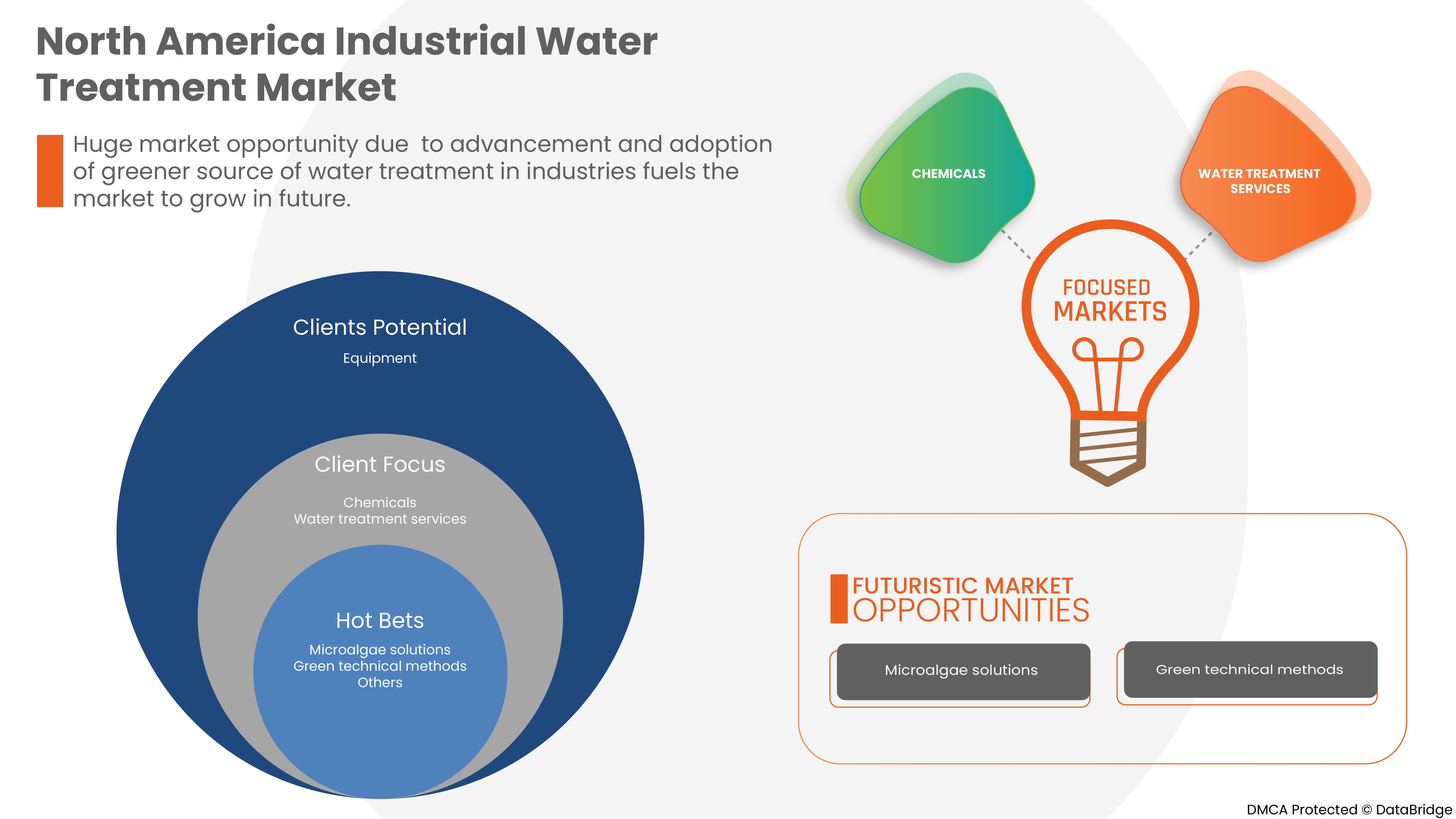

Opportunity

- Advancement and adoption of greener sources for water treatment in industries

With industrialization and urbanization, water pollution is increasing. The sanitation problem is also increasing daily in most developing countries. Water use has increased in the various product manufacturing industries, leading to wastewater formation. The wastewater includes toxic chemicals and sludge, which supposed to be separated through water treatment and then discharged the water by industries should be done. Industries use various chemicals for the treatment of the wastewater which is generated during manufacturing. There is increasing popularity of green or Eco-friendly technical methods for treating industrial water, such as using microalgae and its component for wastewater treatment. Wastewater treatment using microalgae has several positive applications over conventional methods as it is useful in wastewater treatment. The green technical methods are very cost-effective and more efficient for treating the wastewater produced by industries in the country.

Manufacturers have the opportunity to produce microalgae solutions for the treatment of wastewater with the green technical method. As the method is cost-effective will have more demand by the industries for wastewater treatment, which will help the manufacturer earn more revenue in coming years.

Hence, adopting a greener source for water treatment in industries will help the North America industrial water treatment market grow in the future.

Challenge

- High-quality chemicals are required for separating wastes from water

Water is involved in numerous stages during the manufacturing of various products in different industries. During these subsequent stages and usages, the water gets polluted with hazardous chemicals and substances. This is due to the difficult water treatment, resulting in the discharge of toxic water into the water bodies such as the sea by the industries and affecting the sea life and different water ecologies.

Paint industries use chemicals for manufacturing their products. In this process, the generation of toxic chemicals takes place. These toxic chemicals are later released into the water bodies without proper treatment, which may lead to the loss of aquatic life. The chemicals, which are used in the manufacturing of the paints, are very difficult to separate. These difficulties lead to the high cost of Industrial wastewater treatment. In the automotive sector, several metals and chemicals are used to manufacture cars and machines, generating hazardous liquid waste in the factories. Water separation from these liquids needs very high-quality chemicals to be treated, which can exceed the manufacturer's budget.

Thus, the wastewater generated by the industries is highly toxic, requiring high-quality chemicals to separate water and waste. This is a challenge for the North America industrial water treatment market.

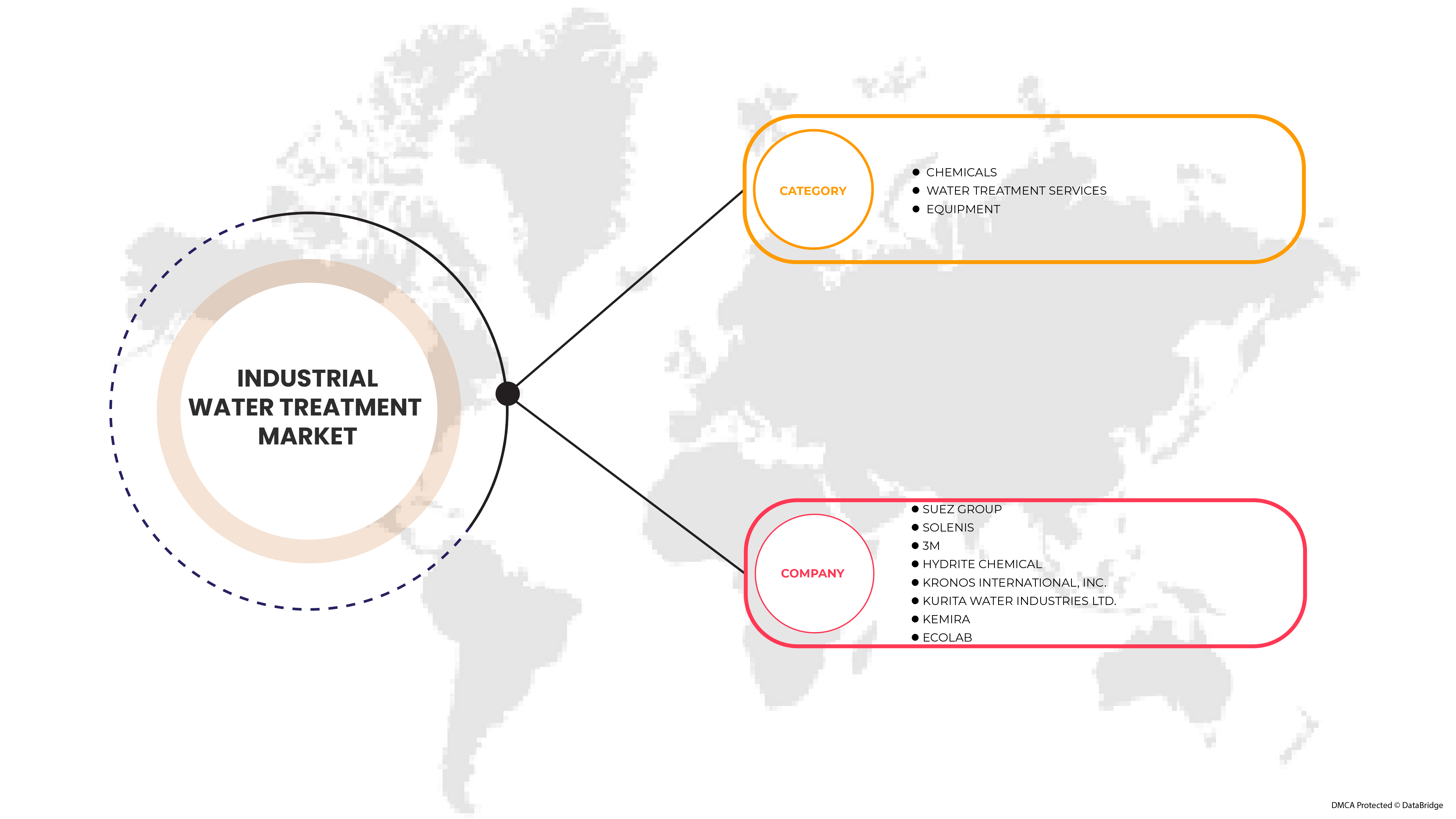

North America Industrial Water Treatment Market Scope

The North America industrial water treatment market is segmented based on category into chemicals, water treatment services, and equipment. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Category

- Chemicals

- Water Treatment Services

- Equipment

On the basis of category, the North America industrial water treatment market is segmented into chemicals, water treatment services, and equipment.

North America Industrial Water Treatment Market Regional Analysis/Insights

The North America industrial water treatment market is segmented on the basis of category.

The countries in the North America industrial water treatment market are the U.S., Canada, and Mexico.

In 2023, the U.S. is expected to dominate the North America industrial water treatment market in terms of market share and revenue due to the strong presence of key market players in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Industrial Water Treatment Market Share Analysis

The competitive North America industrial water treatment market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the Asia-Pacific cosmetics market.

Some of the major players operating in the North America industrial water treatment market are Hydrite Chemical, WATERTECH USA, Buckman, 3M, Xylem, KRONOS INTERNATIONAL, Inc., Dorf Ketal, Ecolab, Kemira, Aries Chemical, Inc., Solenis, Thermax Limited., SUEZ Group, Kurita Water Industries Ltd., IXOM, SNF, and MCC, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market, and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors as you require data about in the format and data style you are looking for. Our team of analysts can also provide you with data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 COUNTRY SUMMARY

5.1 NORTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR WATER TREATMENT SERVICES FROM THE POWER INDUSTRY

6.1.2 GROWING AWARENESS REGARDING WATERBORNE DISEASES

6.1.3 INCREASING WATER SCARCITY

6.1.4 INCREASING WASTEWATER GENERATION IN CHEMICAL INDUSTRIES

6.1.5 REGULATIONS TO REUSE AND RECYCLE WASTEWATER

6.2 RESTRAINT

6.2.1 HARMFUL EFFECTS OF WATER TREATMENT CHEMICALS

6.3 OPPORTUNITY

6.3.1 ADVANCEMENT AND ADOPTION OF GREENER SOURCES FOR WATER TREATMENT IN INDUSTRIES

6.4 CHALLENGE

6.4.1 HIGH QUALITY CHEMICALS REQUIRED FOR SEPARATING WASTES FROM WATER

7 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 WATER TREATMENT SERVICES

7.2.1 BY PRODUCT

7.2.1.1 OPERATION AND PROCESS CONTROL SERVICES

7.2.1.2 BUILDING AND INSTALLATION

7.2.1.3 MAINTENANCE AND REPAIR SERVICES

7.2.1.4 DESIGN AND ENGINEERING CONSULTING

7.2.1.5 OTHERS

7.2.2 BY END USER

7.2.2.1 POWER GENERATION

7.2.2.2 MUNICIPAL

7.2.2.3 TEXTILE

7.2.2.4 FOOD INDUSTRY

7.2.2.5 MINING

7.2.2.6 OTHERS

7.2.3 BY APPLICATION

7.2.3.1 BOILER WATER

7.2.3.2 COOLING WATER

7.2.3.3 MEMBRANE WATER

7.2.3.4 OTHERS

7.3 CHEMICALS

7.3.1 BY PRODUCT

7.3.1.1 SCALE INHIBITORS

7.3.1.1.1 PHOSPHONATES

7.3.1.1.2 CARBOXYLATES/ACRYLIC

7.3.1.1.3 OTHERS

7.3.1.2 BIOCIDES AND DISINFECTANTS

7.3.1.2.1 OXIDIZING

7.3.1.2.2 NON-OXIDIZING

7.3.1.2.3 DISINFECTANTS

7.3.1.2.4 CORROSION INHIBITORS

7.3.1.2.5 DEFOAMER

7.3.1.2.6 OXYGEN SCAVENGERS

7.3.1.2.7 IONS EXCHANGE

7.3.1.2.8 PH NEUTRALIZER

7.3.1.2.9 OTHERS

7.3.1.3 FLOCCULANTS

7.3.1.3.1 ANIONIC

7.3.1.3.2 CATIONIC

7.3.1.3.3 NON-IONIC

7.3.1.3.4 AMPHOTERIC

7.3.1.3.5 COAGULANTS

7.3.1.3.6 INORGANIC

7.3.1.3.6.1 ALUMINUM SULFATE

7.3.1.3.6.2 POLYALUMINIUM CHLORIDE

7.3.1.3.6.3 FERRIC CHLORIDE

7.3.1.3.6.4 OTHERS

7.3.1.3.7 ORGANIC

7.3.1.3.7.1 POLYAMINE

7.3.1.3.7.2 POLYDADMAC

7.3.2 BY END USER

7.3.2.1 MINING

7.3.2.2 MUNICIPAL

7.3.2.3 POWER GENERATION

7.3.2.4 TEXTILE

7.3.2.5 FOOD INDUSTRY

7.3.2.6 OTHERS

7.3.3 BY APPLICATION

7.3.3.1 BOILER WATER

7.3.3.2 COOLING WATER

7.3.3.3 MEMBRANE WATER

7.3.3.4 OTHERS

7.4 EQUIPMENT

7.4.1 BY PRODUCT

7.4.1.1 OPERATION AND PROCESS CONTROL SERVICES

7.4.1.2 BUILDING AND INSTALLATION

7.4.1.3 MAINTENANCE AND REPAIR SERVICES

7.4.1.4 DESIGN AND ENGINEERING CONSULTING

7.4.1.5 OTHERS

7.4.2 BY END USER

7.4.2.1 POWER GENERATION

7.4.2.2 MUNICIPAL

7.4.2.3 MINING

7.4.2.4 TEXTILE

7.4.2.5 FOOD INDUSTRY

7.4.2.6 OTHERS

7.4.3 BY APPLICATION

7.4.3.1 BOILER WATER

7.4.3.2 COOLING WATER

7.4.3.3 MEMBRANE WATER

7.4.3.4 OTHERS

8 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY COUNTRY

8.1 U.S

8.2 MEXICO

8.3 CANADA

9 COMPANY SHARE ANALYSIS: NORTH AMERICA

9.1 ACQUISITION

9.2 EXPANSION

9.3 COLLABORATION

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SUEZ GROUP (2021)

11.1.1 COMPANY SNAPSHOT

11.1.2 PRODUCT PORTFOLIO

11.1.3 RECENT UPDATES

11.2 SOLENIS (2021)

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT UPDATES

11.3 3M

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT UPDATE

11.4 HYDRITE CHEMICAL

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT UPDATES

11.5 KRONOS INTERNATIONAL, INC.

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT UPDATE

11.6 ARIES CHEMICAL, INC. (2021)

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 BUCKMAN

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATES

11.8 DORF KETAL

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATE

11.9 ECOLAB (2021)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 IXOM (2021)

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 KEMIRA (2021)

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT UPDATES

11.12 KURITA WATER INDUSTRIES LTD. (2021)

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT UPDATES

11.13 MCC

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATES

11.14 SNF (2021)

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT UPDATES

11.15 THERMAX LIMITED. (2021)

11.15.1 COMPANY SNAPSHOT

11.15.2 REVENUE ANALYSIS

11.15.3 PRODUCT PORTFOLIO

11.15.4 RECENT UPDATES

11.16 WATERTECH USA

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT UPDATES

11.17 XYLEM

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

12 QUESTIONNAIRES

13 RELATED REPORTS

List of Table

TABLE 1 DISCHARGE LIMIT OF CHEMICALS

TABLE 2 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (THOUSAND LITERS)

TABLE 4 NORTH AMERICA WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SCALE INHIBITORS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BIOCIDES AND DISINFECTANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FLOCCULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA INORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA ORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY COUNTRY, 2021-2030 (THOUSAND LITERS)

TABLE 21 U.S. INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 22 U.S. INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (THOUSAND LITERS)

TABLE 23 U.S. WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 24 U.S. WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 25 U.S. WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 U.S. CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 U.S. SCALE INHIBITORS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. BIOCIDES AND DISINFECTANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. FLOCCULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 U.S. COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. INORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. ORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 34 U.S. CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 U.S. EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 U.S. EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 U.S. EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 38 MEXICO INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 39 MEXICO INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (THOUSAND LITERS)

TABLE 40 MEXICO WATER TREATMENT SERVICES IN CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 MEXICO WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 42 MEXICO WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 MEXICO CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 MEXICO SCALE INHIBITORS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO BIOCIDES AND DISINFECTANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO FLOCCULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MEXICO COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MEXICO INORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MEXICO ORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 MEXICO CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 MEXICO EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 MEXICO EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 54 MEXICO EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 CANADA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 CANADA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2021-2030 (THOUSAND LITERS)

TABLE 57 CANADA WATER TREATMENT SERVICES IN CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 CANADA WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 59 CANADA WATER TREATMENT SERVICES IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 CANADA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 61 CANADA SCALE INHIBITORS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 CANADA BIOCIDES AND DISINFECTANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA FLOCCULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 CANADA COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA INORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA ORGANIC COAGULANTS IN INDUSTRIAL WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 68 CANADA CHEMICALS IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 69 CANADA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 70 CANADA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 71 CANADA EQUIPMENT IN INDUSTRIAL WATER TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FROM THE POWER INDUSTRY IS DRIVING THE NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 WATER TREATMENT SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET

FIGURE 14 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET, BY CATEGORY, 2022

FIGURE 15 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: BY COUNTRY (2022)

FIGURE 17 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: BY CATEGORY (2023 - 2030)

FIGURE 20 NORTH AMERICA INDUSTRIAL WATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

North America Industrial Water Treatment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Industrial Water Treatment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Industrial Water Treatment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.