North America Industrial X Ray Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

2.19 Billion

2024

2032

USD

1.18 Billion

USD

2.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 2.19 Billion | |

|

|

|

|

North America Industrial X Ray Market Size

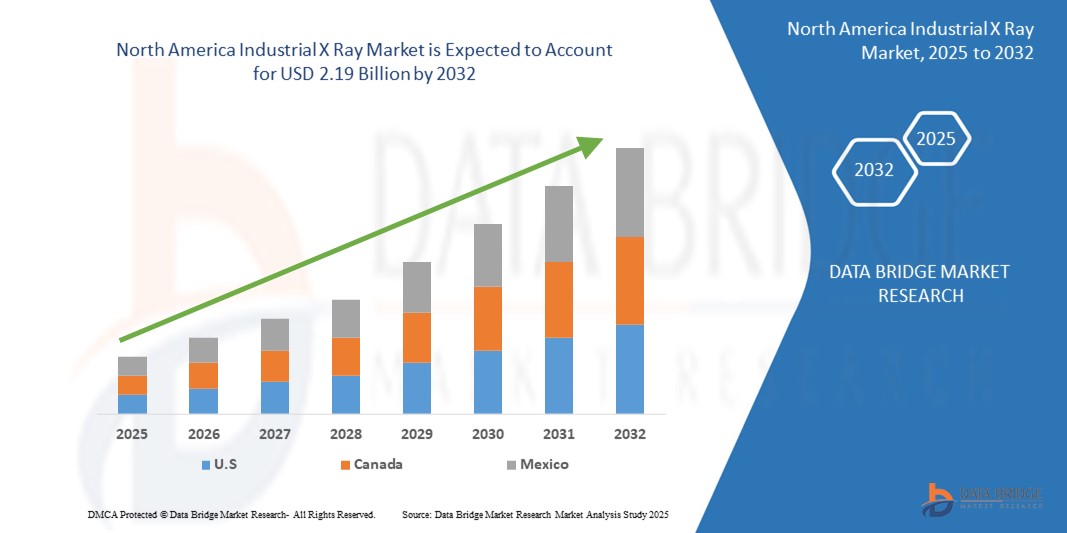

- The North America industrial X ray market size was valued at USD 1.18 billion in 2024 and is expected to reach USD 2.19 billion by 2032, at a CAGR of 8.10% during the forecast period

- This growth is driven by factors such as the increasing demand for non-destructive testing (NDT) in critical industries like aerospace, automotive, and oil & gas, rising safety and quality standards, and the growing adoption of advanced imaging technologies for defect detection and preventive maintenance.

North America Industrial X Ray Market Analysis

- The current industrial X-ray market in North America is experiencing consistent growth, driven by its widespread use in non-destructive testing during manufacturing

- Market analysis highlights a clear trend toward adopting digital X-ray systems, which provide higher precision and faster processing compared to conventional systems

- U.S. is expected to dominate the North America industrial X rays market due to with 30.05% share due to its robust defense sector and advanced manufacturing capabilities

- Mexico is expected to be the fastest growing region in the North America industrial X ray market during the forecast period due to the country’s expanding manufacturing sector, particularly in industries such as automotive, aerospace, and oil & gas

- The digital radiography segment is expected to dominate the North America Industrial X Ray market with the largest share of 70.12% in 2025 due to its advantages in providing faster image acquisition, enhanced image quality, and the ability to easily store and transmit data digitally

Report Scope and North America Industrial X Ray Market Segmentation

|

Attributes |

North America Industrial X Ray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Industrial X Ray Market Trends

“Rising Adoption of Digital X-Ray Systems”

- The current industrial X-ray market is increasingly shifting toward the use of digital systems to improve inspection accuracy and efficiency

- Companies are replacing film-based X-ray methods with real-time digital imaging to speed up quality control processes

- This trend supports faster decision-making in manufacturing by delivering clearer images and immediate results

- The preference for digital systems is also growing due to their compatibility with automated production environments

- In conclusion, this trend indicates a broader transformation in inspection methods as industries move toward more precise, time-saving technologies to meet high production standards

North America Industrial X Ray Market Dynamics

Driver

“Growing Need for High-Precision Inspection in Critical Industries”

- High-precision inspection needs in industries like aerospace and automotive are increasing the use of industrial X-ray systems

- These systems allow internal inspection without damaging components during the manufacturing process

- Complex and lightweight parts require detailed inspection, which X-ray systems can efficiently perform

- Strict quality regulations are making industrial X-ray systems essential for zero-defect production

- In conclusion, industrial X-ray systems are now a key part of quality control in advanced manufacturing environments

Opportunity

“Expansion of Industrial Automation and Smart Manufacturing”

- The rapid advancement of industrial automation and smart manufacturing is creating a significant opportunity for integrating industrial X-ray systems into automated workflows

- By combining X-ray technology with intelligent data analysis tools and robotic systems, manufacturers can enhance productivity and minimize manual errors

- Industrial X-ray machines that communicate with automated systems are capable of performing 24/7 with minimal human intervention, which benefits sectors like electronics and automotive

- For instance, in an automated assembly line, X-ray systems can detect defects and instantly trigger corrective actions without disrupting the production process

- The trend of remote monitoring and cloud-based storage is opening the door for predictive maintenance and real-time diagnostics, increasing the scalability of X-ray systems

- In conclusion, this integration of X-ray systems with smart manufacturing represents a strong growth opportunity as industries seek more efficient, automated, and connected solutions for quality control

Restraint/Challenge

“High Equipment Cost and Maintenance Complexity”

- One of the main challenges in the industrial X-ray market is the high initial investment and ongoing maintenance costs of advanced X-ray systems

- The complex technology of these systems requires substantial capital, which makes them inaccessible for smaller companies with limited budgets

- Operating and maintaining these machines requires skilled personnel for tasks like radiation safety, image interpretation, and troubleshooting, increasing overall costs

- Regulatory compliance adds complexity, as periodic audits, certifications, and safety measures must be followed, further raising operational expenses

- The rapid technological advancement of X-ray systems creates a need for frequent updates and new models, adding pressure to reinvest and stay competitive

- In conclusion, these financial and operational challenges hinder the widespread adoption of industrial X-ray systems, especially for smaller businesses

North America Industrial X Ray Market Scope

The market is segmented on the basis of imaging technique, application, modality, range, source, distribution channel, and product type.

|

Segmentation |

Sub-Segmentation |

|

By Imaging Technique |

|

|

By Application |

|

|

By Modality |

|

|

By Range

|

|

|

By Source |

|

|

By Distribution Channel |

|

|

By Product Type |

|

In 2025, the digital radiography segment is projected to dominate the market with a largest share in Imaging Technique segment

The digital radiography segment is expected to dominate the North America industrial X ray market with the largest share of 70.12% in 2025 due to its advantages in providing faster image acquisition, enhanced image quality, and the ability to easily store and transmit data digitally. This shift from traditional film-based systems to digital radiography reduces operational costs, minimizes environmental impact, and improves workflow efficiency, making it highly attractive.

The X-Ray Instruments segment is expected to account for the largest share during the forecast period in product type segment

In 2025, the X-ray instruments segment is expected to dominate the market with the largest market share of 25.05% due to the increasing demand for advanced, high-precision inspection systems across various industries such as aerospace, automotive, and electronics. X-ray instruments offer detailed internal imaging capabilities, enabling the detection of minute defects and structural issues that are crucial for ensuring product quality and safety.

North America Industrial X Ray Market Regional Analysis

“U.S. Holds the Largest Share in the North America Industrial X Ray Market”

- The U.S. leads the North American industrial X-ray market, with 30.05% share due to its robust defense sector and advanced manufacturing capabilities

- Aerospace and automotive industries in the U.S. heavily rely on industrial X-ray systems for quality control and defect detection

- The presence of major players like North Star Imaging and Varex Imaging bolsters the country's market dominance

- Government regulations and safety standards further propel the adoption of non-destructive testing methods

- Ongoing investments in technological advancements and infrastructure support sustained market leadership

“Asia-Pacific is Projected to Register the Highest CAGR in the North America Industrial X Ray Market”

- Mexico is experiencing rapid growth in the industrial X-ray market, due to its expanding manufacturing sector

- The country's strategic location and trade agreements enhance its appeal for foreign investments in industrial technologies

- Automotive and electronics industries in Mexico increasingly adopt industrial X-ray systems for quality assurance

- Government initiatives promoting industrial modernization contribute to the rising demand for advanced inspection technologies

- Collaborations with international companies facilitate technology transfer and skill development, accelerating market expansion

North America Industrial X Ray Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Teledyne Technologies Incorporated (U.S.)

- Carl Zeiss AG(Germany)

- FUJIFILM Holdings Corporation(Japan)

- General Electric Company(U.S.)

- Applus+(Spain)

- Comet Group (Switzerland)

- Minebea Intec GmbH (Germany)

- Hamamatsu Photonics K.K. (Japan)

- Varex Imaging (U.S.)

- Hitachi, Ltd. (Japan)

- Carestream Health (U.S.)

- Nordson Corporation (U.S.)

- Rigaku Corporation (Japan)

- Shimadzu Corporation (Japan)

- Eastman Kodak Company (U.S.)

- Canon Electron Tubes & Devices Co., Ltd. (Japan)

- North Star Imaging Inc. (U.S.)

- VJ X-Ray (India)

- Avonix Imaging (U.S.)

- PROTEC GmbH & Co. KG (Germany)

- Oehm and Rehbein GmbH (Germany)

- Lucky Healthcare Co., Ltd. (China)

Latest Developments in North America Industrial X Ray Market

- In August 2024, DocGo partnered with MinXray to launch a mobile X-ray program in New York City, aiming to provide rapid chest X-rays for vulnerable populations and identify active tuberculosis (TB) cases. The program utilizes MinXray's portable, battery-powered X-ray systems and artificial intelligence to promptly analyze images, ensuring immediate care for those affected

- In December 2024, Konica Minolta Healthcare Americas partnered with Gleamer to integrate AI-powered BoneView into its X-ray systems. The FDA-cleared solution enhances musculoskeletal imaging by identifying fractures, improving diagnostic accuracy, and optimizing workflows. Available across Konica Minolta’s DR portfolio, it streamlines radiology processes and enhances patient care efficiency

- In August 2023, Rigaku Corporation relocated and expanded its business operations in Singapore, fortifying its capacity for enhanced operations and growth initiatives. This move facilitated broader outreach across diverse industries and customer segments, consolidating the company's position for continued technological advancement and improved service delivery. The relocation to a larger office in Singapore's bustling central business district bolstered Rigaku's capability to cater efficiently to a growing customer base in the region. This strategic move enabled enhanced support and services, reinforcing Rigaku's commitment to its customers and partners, fostering sustained growth and recognition as a North America technology leader

- In August 2021, Carl Zeiss AG and Oak Ridge National Laboratory (ORNL) collaborated on a project funded by the U.S. Department of Energy's Technology Commercialization Fund. The project aims to leverage artificial intelligence (AI) and X-ray CT technology to enable reliable non-destructive characterization of additively manufactured (AM) parts. The partnership will develop a comprehensive powder-to-part characterization methodology for additive manufacturing, improving the quality and accuracy of measurements and potentially revolutionizing non-destructive testing and metrology beyond the AM industry

- In May 2023, Minebea Intec GmbH launched its latest innovative weighing and inspection solutions, demonstrating its commitment to providing cutting-edge technologies to the packaging industry. The company's product highlights included the Mitus metal detector with pioneering MiWave technology, the Essentus checkweigher with an enhanced user interface, and the Dypipe X-ray inspection system. These innovative solutions garnered significant attention from industry professionals, solidifying Minebea Intec's position as a leading provider of weighing and inspection technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.