North America Insulin Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

8.80 Billion

USD

16.10 Billion

2024

2032

USD

8.80 Billion

USD

16.10 Billion

2024

2032

| 2025 –2032 | |

| USD 8.80 Billion | |

| USD 16.10 Billion | |

|

|

|

|

North America Insulin Delivery Devices Market Size

- The North America Insulin Delivery Devices Market size was valued at USD 8.80 billion in 2024 and is expected to reach USD 16.10 billion by 2032, at a CAGR of 7.85% during the forecast period

- The market growth is largely fueled by the increasing prevalence of diabetes globally, coupled with rising awareness about the benefits of continuous glucose monitoring and advanced insulin delivery solutions. The adoption of innovative insulin delivery devices, such as insulin pumps and smart pens, is driving demand across both developed and emerging regions

- Furthermore, technological advancements in device miniaturization, connectivity, and integration with mobile applications are enhancing patient adherence and improving glycemic control. The growing focus on patient-centric care, home-based diabetes management, and personalized treatment regimens is further accelerating the uptake of insulin delivery devices

North America Insulin Delivery Devices Market Analysis

- North America Insulin Delivery Devices Market is witnessing strong growth globally, driven by the rising prevalence of diabetes, increasing demand for advanced treatment options, and continuous innovations in smart and connected devices. Insulin delivery devices such as pens, pumps, syringes, and emerging patch technologies are increasingly being adopted to provide patients with greater convenience, accuracy, and better glycemic control

- The escalating demand for insulin delivery devices is primarily driven by the increasing prevalence of diabetes, rising patient awareness regarding glycemic control, and technological advancements in insulin administration systems such as insulin pumps, pens, and connected devices. Improved healthcare infrastructure and the expansion of diabetes management programs are further contributing to market growth

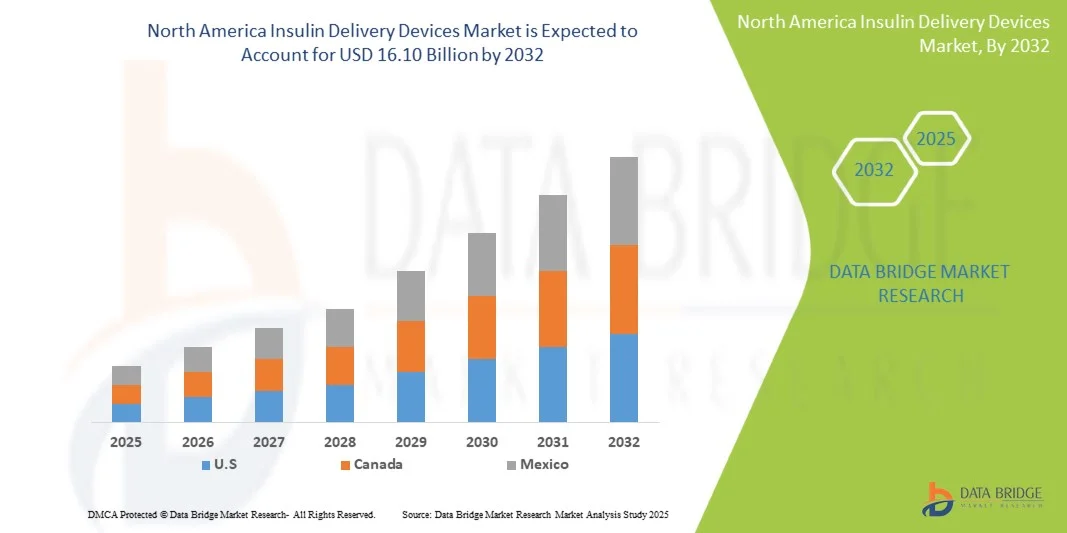

- U.S. dominated the North America Insulin Delivery Devices Market with a revenue share of 78% in 2024 within North America. Market growth is fueled by the increasing diabetic population, rising adoption of advanced insulin pumps and pens, and integration with digital health platforms for remote monitoring and personalized therapy. Continuous innovations, such as smart pens with dose tracking and app connectivity, are further driving the adoption of these devices in clinical and homecare settings

- Canada is expected to witness the fastest growth in the North America Insulin Delivery Devices Market, with a projected CAGR of 7.8% from 2025 to 2032. Growth is supported by expanding healthcare infrastructure, increasing adoption of minimally invasive insulin delivery systems, and government initiatives promoting diabetes management and awareness. In addition, the rising prevalence of diabetes in both urban and semi-urban regions is driving demand for technologically advanced and convenient insulin delivery solutions

- The type II diabetes segment dominated the North America Insulin Delivery Devices Market with the largest revenue share of 64.3% in 2024. This dominance is explained by the high prevalence of type II diabetes across North America, fueled by obesity, sedentary lifestyles, and aging populations

Report Scope and North America Insulin Delivery Devices Market Segmentation

|

Attributes |

Insulin Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Insulin Delivery Devices Market Trends

Enhanced Convenience Through Technological Advancements and Connectivity

- A significant and accelerating trend in the North America Insulin Delivery Devices Market is the growing adoption of connected and smart insulin delivery systems. These devices are increasingly being designed to integrate with continuous glucose monitoring (CGM) systems and mobile health applications, offering patients real-time insights into their blood glucose levels and insulin dosing. This integration is significantly enhancing treatment convenience, accuracy, and patient adherence

- For instance, several leading companies have introduced advanced insulin pens and pumps that can automatically record dosage data and sync it with digital platforms, allowing patients and healthcare providers to track therapy progress more effectively. Such innovations are reducing the burden of manual logging while improving treatment outcomes

- Smart insulin delivery devices also enable features such as personalized dosage recommendations, reminders for missed doses, and remote monitoring by clinicians. This helps optimize therapy and provides more intelligent alerts if irregular usage patterns are detected, thereby strengthening overall diabetes management

- The seamless integration of insulin delivery devices with digital health platforms allows patients to manage their treatment alongside other aspects of their healthcare through a single, unified system. This holistic approach is empowering patients with greater control over their condition while also supporting healthcare professionals with accurate, real-time data

- This trend toward more intelligent, connected, and patient-friendly insulin delivery solutions is fundamentally reshaping expectations for diabetes care. Consequently, major players are focusing on developing devices with enhanced connectivity, user-friendly designs, and integration with broader digital health ecosystems

- The demand for insulin delivery devices that combine accuracy, safety, and convenience is growing rapidly across both the U.S. and Canada, as patients increasingly prioritize effective long-term management of diabetes with minimal disruption to daily life

North America Insulin Delivery Devices Market Dynamics

Driver

Growing Need Due to Rising Diabetes Prevalence and Technological Advancements

- The increasing prevalence of diabetes, particularly in North America, coupled with the rising demand for user-friendly and accurate insulin delivery systems, is a significant driver for the heightened adoption of insulin delivery devices

- For instance, in March 2024, Medtronic plc announced the U.S. FDA approval of its MiniMed 780G insulin pump system with meal detection technology, offering automated insulin adjustments and enhanced precision for patients. Such innovations by key companies are expected to drive the Insulin Delivery Devices industry growth in the forecast period

- As patients and healthcare providers increasingly prioritize effective disease management and lifestyle convenience, insulin delivery devices such as pens, pumps, and smart injectors are emerging as preferred solutions over traditional methods

- Furthermore, the growing popularity of connected diabetes care and the desire for seamless integration with continuous glucose monitoring (CGM) devices are making insulin delivery systems a critical component of advanced diabetes management ecosystems

- The convenience of features such as dose accuracy, reduced pain through finer needles, remote monitoring, and smartphone-based management are key factors propelling adoption in both hospital and homecare settings. In addition, the trend toward patient-centric care and the availability of customizable, user-friendly insulin delivery options further contribute to market growth

Restraint/Challenge

Concerns Regarding Device Costs and Technical Limitations

- High upfront costs of advanced insulin delivery systems, particularly insulin pumps and smart injectors, remain a significant challenge for widespread adoption. Price sensitivity among patients, especially in regions with limited reimbursement coverage, can restrict market penetration

- For instance, in February 2023, reports highlighted cost-related challenges faced by U.S. patients using advanced insulin pumps, where affordability and insurance coverage gaps limited access to cutting-edge technologies

- In addition, certain insulin delivery devices face technical challenges, such as infusion site infections in pumps, device malfunctions, or user errors, which can create hesitancy among patients and healthcare providers

- Addressing these concerns through improvements in device durability, safety features, and enhanced training for both patients and clinicians is crucial to building trust in the technology. Companies such as Insulet Corporation and Novo Nordisk continue to emphasize affordability initiatives and innovative designs to reassure potential users

- While prices are gradually declining due to increased competition and product diversification, the perception of high costs and potential technical barriers may still hinder adoption. Overcoming these challenges through wider insurance coverage, value-based pricing, and ongoing technological refinement will be vital for sustained market growth

North America Insulin Delivery Devices Market Scope

The market is segmented on the basis of product type, application, end user, and distribution channel.

By Product Type

On the basis of product type, the North America Insulin Delivery Devices Market is segmented into insulin pens, insulin pumps, pen needles, insulin syringes, insulin injectors, and others. The insulin pens segment dominated the market with the largest revenue share of 41.8% in 2024. This dominance is driven by their convenience, accuracy in dosing, and patient-friendly features such as portability and discreet usage. Insulin pens significantly reduce the chances of dosing errors compared to syringes, which makes them highly preferred by both patients and healthcare professionals. The increasing adoption of smart insulin pens with connectivity and data tracking features adds further value, helping patients and doctors monitor therapy more effectively. Reimbursement support and continuous product innovations also encourage usage. With the growing diabetic population in the U.S. and Canada, insulin pens are becoming a mainstay in diabetes management, particularly in homecare settings.

The insulin pumps segment is projected to witness the fastest CAGR of 10.6% from 2025 to 2032. Growth is supported by the adoption of technologically advanced pumps that deliver precise and continuous insulin doses, improving patient quality of life and reducing long-term complications. Next-generation insulin pumps with hybrid closed-loop systems, miniaturized patch designs, and integration with continuous glucose monitoring (CGM) devices are further driving adoption. Pediatric and young adult patients, in particular, are increasingly switching to pumps due to convenience and improved control. Insurance coverage and awareness campaigns are also making these devices more accessible. Rising investments from both global and regional manufacturers in innovative pump technology will continue to fuel strong growth.

By Application

On the basis of application, the North America Insulin Delivery Devices Market is segmented into type I diabetes and type II diabetes. The type II diabetes segment dominated the market with the largest revenue share of 64.3% in 2024. This dominance is explained by the high prevalence of type II diabetes across North America, fueled by obesity, sedentary lifestyles, and aging populations. Patients with type II diabetes often progress to insulin therapy over time, leading to a consistent demand for delivery devices. Insulin pens and pumps are especially popular among type II patients for their convenience, safety, and compliance benefits. Awareness campaigns promoting timely insulin therapy, coupled with reimbursement support, encourage adoption. Moreover, new product launches with advanced dosing features are meeting the growing demand for effective long-term management of type II diabetes.

The type I diabetes segment is expected to register the fastest CAGR of 9.8% from 2025 to 2032. Rising prevalence of type I diabetes, especially in children and young adults, is driving demand for advanced insulin delivery devices. Patients and caregivers are shifting from syringes to insulin pens and pumps for better safety, accuracy, and flexibility. Innovations such as smart pens, patch pumps, and integration with CGM devices have enhanced the management of type I diabetes. Favorable reimbursement and healthcare programs targeted at pediatric patients are further supporting adoption. The segment continues to benefit from the growing emphasis on digital health solutions and improved disease awareness among young populations and their families.

By End User

On the basis of end user, the North America Insulin Delivery Devices Market is segmented into hospitals and clinics, homecare, and specialty centers. The hospitals and clinics segment held the largest revenue share of 46.5% in 2024. Hospitals dominate due to their central role in initiating insulin therapy, monitoring treatment outcomes, and training patients on device use. Their advanced medical infrastructure and skilled professionals make them the primary setting for the adoption of high-cost devices such as insulin pumps. Patients rely on hospitals for ongoing management, which ensures consistent demand. Additionally, hospitals act as the main entry point for newly launched devices, supported by partnerships with manufacturers. Reimbursement policies also make hospitals a favorable environment for advanced device adoption, further reinforcing their market dominance.

The homecare segment is anticipated to grow at the fastest CAGR of 9.5% from 2025 to 2032. Growth is driven by the rising preference for self-administration of insulin at home and patient-centric models of care. Homecare adoption is supported by the availability of user-friendly insulin pens, smart injectors, and portable patch pumps. Patients value the convenience of managing their condition at home, reducing the burden of frequent hospital visits. Increasing use of telemedicine and digital monitoring further supports adoption. Insurance coverage for self-use devices and rising healthcare expenditure in chronic disease management also boost growth in this segment.

By Distribution Channel

On the basis of distribution channel, the North America Insulin Delivery Devices Market is segmented into hospital pharmacy, retail pharmacy, online sales, and diabetes clinics/centers. The retail pharmacy segment accounted for the largest revenue share of 39.7% in 2024. Retail pharmacies dominate as the primary distribution hub due to their wide accessibility, strong networks, and ability to provide immediate access to insulin pens, needles, and syringes. Patients prefer retail outlets for convenience, professional guidance, and affordability. Strategic partnerships with manufacturers, patient education programs, and loyalty benefits further strengthen their role. Retail pharmacies also act as chronic disease management partners, reinforcing their leading position in insulin delivery devices distribution.

The online sales segment is projected to record the fastest CAGR of 11.2% from 2025 to 2032. The rapid shift to e-commerce for healthcare products is driving this trend, supported by increasing internet penetration, home delivery convenience, and cost savings. Online platforms allow patients to access a wider range of products, compare prices, and benefit from subscription models for regular insulin refills. Manufacturers are also expanding their direct-to-consumer channels, further boosting growth. Privacy, ease of ordering, and telehealth integration are accelerating the shift towards online sales, making it the most dynamic distribution channel.

North America Insulin Delivery Devices Market Regional Analysis

- U.S. dominated the North America Insulin Delivery Devices Market with a revenue share of 78% in 2024 within North America. Market growth is fueled by the increasing diabetic population, rising adoption of advanced insulin pumps and pens, and integration with digital health platforms for remote monitoring and personalized therapy. Continuous innovations, such as smart pens with dose tracking and app connectivity, are further driving the adoption of these devices in clinical and homecare settings

- Canada is expected to witness the fastest growth in the North America Insulin Delivery Devices Market, with a projected CAGR of 7.8% from 2025 to 2032. Growth is supported by expanding healthcare infrastructure, increasing adoption of minimally invasive insulin delivery systems, and government initiatives promoting diabetes management and awareness. In addition, the rising prevalence of diabetes in both urban and semi-urban regions is driving demand for technologically advanced and convenient insulin delivery solutions

- This strong adoption is further supported by high healthcare expenditure, a favorable reimbursement framework, and the increasing emphasis on patient-centric care, establishing insulin delivery devices as essential tools for effective diabetes treatment in both clinical and homecare settings

U.S. North America Insulin Delivery Devices Market Insight

The U.S. North America Insulin Delivery Devices Market captured the largest revenue share of 78% in 2024 within North America, fueled by the increasing diabetic population and the rapid adoption of advanced insulin pumps and smart pens. Market growth is further supported by integration with digital health platforms that enable remote monitoring, dose tracking, and personalized therapy. Continuous innovations, such as connected insulin pens with Bluetooth-enabled dose reminders and insulin pumps with automated insulin delivery algorithms, are driving widespread adoption in hospitals, clinics, and homecare environments.

Canada North America Insulin Delivery Devices Market Insight

The Canada North America Insulin Delivery Devices Market is expected to witness the fastest growth in the North America Insulin Delivery Devices Market, with a projected CAGR of 7.8% from 2025 to 2032. Growth is supported by expanding healthcare infrastructure, favorable government initiatives promoting diabetes awareness, and increasing adoption of minimally invasive and user-friendly insulin delivery systems. The rising prevalence of diabetes across urban and semi-urban populations is also driving demand for advanced devices, making Canada an attractive growth market in the region.

North America Insulin Delivery Devices Market Share

The Insulin Delivery Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Insulet Corporation (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Lilly USA, LLC. (U.S.)

- BD (U.S.)

- Abbott (U.S.)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Ypsomed (Switzerland)

- MannKind Corporation (U.S.)

- Owen Mumford Ltd. (U.K.)

Latest Developments in North America Insulin Delivery Devices Market

- In August 2022, Insulet Corporation received FDA clearance of the Omnipod 5 Automated Insulin Delivery (AID) system for individuals aged two years and older with type 1 diabetes. The Omnipod 5 is the first tubeless AID system integrated with the Dexcom G6 Continuous Glucose Monitoring system, designed to automatically adjust insulin delivery and help users maintain glucose levels in target range. This milestone expanded access to younger children, giving families more flexible and user-friendly diabetes management options

- In April 2023, the U.S. FDA approved Medtronic’s MiniMed 780G System for use in children and adults aged seven years and older with type 1 diabetes. This system is the world’s first insulin pump with meal detection technology, featuring auto-corrections every five minutes to help users maintain tighter glucose control. The approval marked a major step forward in automated insulin delivery, offering greater convenience and improved outcomes for pediatric and adult patients

- In December 2023, Tandem Diabetes Care released updated software for the t:slim X2 insulin pump to integrate with Dexcom G7 CGM in the U.S. This update enabled users to seamlessly connect the latest generation Dexcom sensor with Tandem’s pump platform, enhancing accuracy, usability, and overall diabetes management. The integration underscored Tandem’s commitment to expanding digital health capabilities and providing patients with the most up-to-date tools for effective insulin delivery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.