North America Interventional Cardiology Peripheral Vascular Devices Market

Market Size in USD Billion

CAGR :

%

USD

11.90 Billion

USD

21.69 Billion

2025

2033

USD

11.90 Billion

USD

21.69 Billion

2025

2033

| 2026 –2033 | |

| USD 11.90 Billion | |

| USD 21.69 Billion | |

|

|

|

|

North America Interventional Cardiology and Peripheral Vascular Devices Market Size

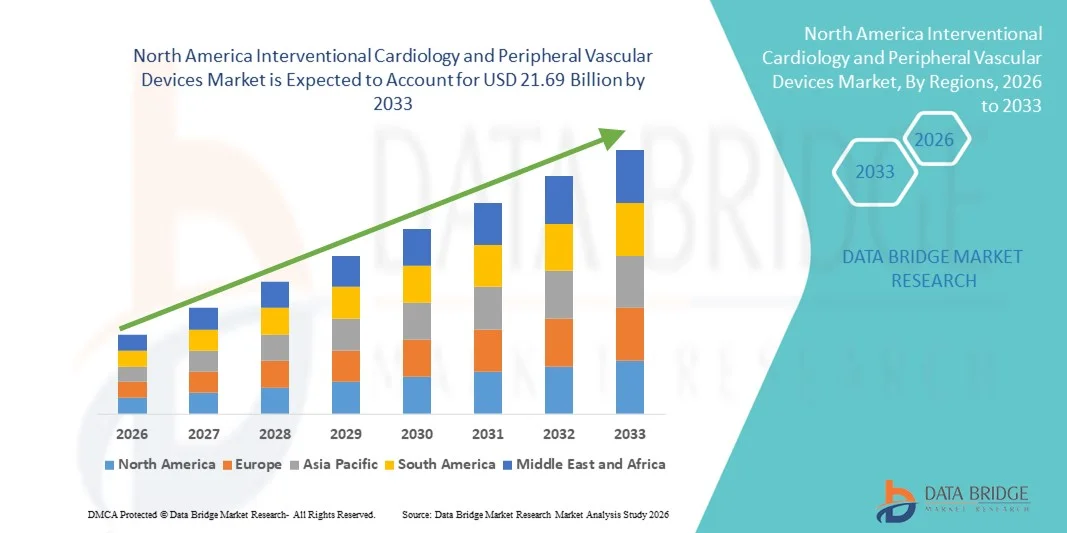

- The North America interventional cardiology and peripheral vascular devices market size was valued at USD 11.9 billion in 2025 and is expected to reach USD 21.69 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising geriatric population, and continuous technological advancements in minimally invasive procedures across the region, leading to greater adoption of advanced interventional and peripheral vascular devices in hospitals and specialty clinics

- Furthermore, growing preference for catheter-based treatments, expanding reimbursement coverage, and strong presence of leading medical device manufacturers are establishing interventional cardiology and peripheral vascular devices as essential components of modern cardiovascular care. These converging factors are accelerating product uptake, thereby significantly boosting the regional market growth

North America Interventional Cardiology and Peripheral Vascular Devices Market Analysis

- Interventional Cardiology and Peripheral Vascular Devices Market, comprising advanced medical technologies such as angioplasty balloons, stents, catheters, endovascular aneurysm repair stent grafts, inferior vena cava (IVC) filters, plaque modification devices, accessories, and hemodynamic flow alteration devices, plays a pivotal role in the minimally invasive management of peripheral arterial disease and coronary interventions across hospitals and specialty cardiovascular centers due to improved clinical precision, reduced hospitalization time, and enhanced patient recovery outcomes

- The escalating demand for these devices is primarily fueled by the high burden of peripheral arterial disease and coronary artery disease, expanding geriatric population, growing preference for minimally invasive procedures, and continuous technological advancements in conventional and standard device platforms across North America

- The United States dominated the North America interventional cardiology and peripheral vascular devices market with the largest revenue share of 78.6% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and strong presence of leading medical device manufacturers

- Canada is expected to witness steady growth during the forecast period due to increasing healthcare expenditure, rising awareness regarding early diagnosis of vascular diseases, and expanding access to advanced endovascular treatment options

- Stent segment dominated the market in 2025 with a market share of 34.9%, driven by its extensive use in both peripheral arterial disease and coronary intervention procedures, supported by continuous innovation in design, durability, and improved long-term patency rates across adult and geriatric patient populations

Report Scope and North America Interventional Cardiology and Peripheral Vascular Devices Market Segmentation

|

Attributes |

North America Interventional Cardiology and Peripheral Vascular Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Interventional Cardiology and Peripheral Vascular Devices Market Trends

Technological Advancements in Minimally Invasive and Image-Guided Interventions

- A significant and accelerating trend in the North America interventional cardiology and peripheral vascular devices market is the growing integration of advanced imaging technologies, drug-eluting platforms, and next-generation minimally invasive systems across hospitals and ambulatory surgery centers. This convergence of innovation is significantly enhancing procedural precision and patient outcomes

- For instance, leading manufacturers have introduced next-generation drug-eluting stents and advanced atherectomy systems designed to improve vessel patency and reduce restenosis rates. Similarly, modern endovascular aneurysm repair stent grafts are engineered for improved flexibility and long-term durability in complex anatomies

- Technology integration in vascular devices enables features such as enhanced deliverability, improved lesion crossing capability, and real-time imaging compatibility for more accurate interventions. For instance, some plaque modification devices are optimized for calcified lesions, while advanced hemodynamic flow alteration devices support better embolic protection and flow control during procedures. Furthermore, image-guided navigation capabilities allow physicians to perform complex iliac, femoropopliteal, and tibial interventions with greater safety and efficiency

- The seamless integration of device innovation with catheter-based techniques facilitates comprehensive management of peripheral arterial disease and coronary interventions. Through coordinated use of angioplasty balloons, stents, catheters, and thrombectomy systems, clinicians can deliver customized and minimally invasive treatment strategies across diverse patient populations

- This trend toward more precise, durable, and patient-centric vascular solutions is fundamentally reshaping clinical practice standards in North America. Consequently, companies are investing heavily in R&D to develop next-generation conventional and standard devices with improved biocompatibility, flexibility, and long-term performance outcomes

- The demand for technologically advanced and minimally invasive interventional cardiology and peripheral vascular devices is growing rapidly across hospitals and ambulatory surgery centers, as healthcare providers increasingly prioritize reduced hospital stays, faster recovery, and improved procedural success rates

- In addition, the rising use of hybrid operating rooms equipped with advanced imaging systems is supporting complex endovascular procedures, thereby driving demand for high-performance stents, thrombectomy devices, and embolic protection system

North America Interventional Cardiology and Peripheral Vascular Devices Market Dynamics

Driver

Growing Disease Burden and Preference for Minimally Invasive Procedures

- The increasing prevalence of peripheral arterial disease and coronary artery disease, coupled with the expanding geriatric population, is a significant driver for the heightened demand for interventional cardiology and peripheral vascular devices

- For instance, rising hospitalization rates related to cardiovascular complications have encouraged healthcare systems to expand catheter-based treatment capabilities and adopt advanced angioplasty, stent, and atherectomy technologies. Such strategic investments by hospitals and device manufacturers are expected to drive market growth during the forecast period

- As patients and clinicians increasingly prefer minimally invasive techniques over open surgical procedures, these devices offer reduced procedural risk, shorter recovery times, and lower overall hospitalization costs, making them an attractive alternative to conventional surgery

- Furthermore, favorable reimbursement frameworks and strong healthcare infrastructure in the United States and Canada are accelerating the adoption of innovative vascular devices across hospitals and ambulatory surgery centers

- The growing availability of specialized cardiovascular centers and increasing awareness regarding early diagnosis and treatment of vascular diseases are key factors propelling device utilization across adult and geriatric populations. The shift toward outpatient-based peripheral interventions further contributes to overall market expansion

- Increasing clinical evidence supporting long-term efficacy of drug-eluting stents and plaque modification devices is strengthening physician confidence and encouraging broader procedural adoption

- Technological collaborations between device manufacturers and healthcare institutions are fostering rapid product innovation and accelerating commercialization of next-generation vascular intervention systems

Restraint/Challenge

High Procedure Costs and Stringent Regulatory Requirements

- Concerns surrounding the high cost of advanced interventional devices and procedures pose a significant challenge to broader market penetration, particularly in cost-sensitive healthcare settings. As these devices involve sophisticated technology and materials, they often carry premium pricing structures

- For instance, reimbursement limitations for certain peripheral interventions and variability in insurance coverage policies can restrict patient access to innovative device-based therapies

- Addressing these cost concerns through value-based pricing models, clinical evidence generation, and long-term outcome studies is crucial for broader adoption. In addition, stringent regulatory approval processes and post-market surveillance requirements can delay product launches and increase compliance costs for manufacturers

- While regulatory frameworks ensure safety and efficacy, the complexity of approval pathways for new stent platforms, plaque modification devices, and hemodynamic flow systems can extend time-to-market and increase development expenditures

- Although technological innovation continues to advance, budget constraints within healthcare institutions and capital equipment costs may limit procurement decisions, particularly for smaller facilities

- Concerns regarding device-related complications such as restenosis, thrombosis, or embolization may influence physician preference and require continuous post-market performance monitoring

- Overcoming these challenges through cost optimization strategies, streamlined regulatory pathways, expanded reimbursement support, and enhanced clinical training programs will be vital for sustaining long-term growth in the North America interventional cardiology and peripheral vascular devices market

North America Interventional Cardiology and Peripheral Vascular Devices Market Scope

The market is segmented on the basis of product, type, procedure, indication, age group, end user, and distribution channel.

- By Product

On the basis of product, the North America interventional cardiology and peripheral vascular devices market is segmented into angioplasty balloons, stent, catheters, endovascular aneurysm repair stent grafts, inferior vena cava (IVC) filters, plaque modification devices, accessories, and hemodynamic flow alteration devices. The stent segment dominated the market with the largest revenue share of 34.9% in 2025, driven by its extensive utilization in both coronary intervention and peripheral arterial disease procedures. Stents are widely preferred due to their proven clinical efficacy in restoring vessel patency and reducing restenosis risk, particularly with advancements in drug-eluting technologies. Strong clinical guideline support and high procedural volumes across hospitals further reinforce segment dominance. Continuous innovation in bioresorbable and next-generation stent platforms also sustains market leadership. In addition, increasing geriatric population and rising cardiovascular disease burden contribute to consistent product demand across North America.

The plaque modification devices segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing incidence of heavily calcified arterial lesions and rising adoption of atherectomy-based interventions. These devices enhance lesion preparation prior to stent placement, improving procedural outcomes in complex cases. Growing preference for combination therapy approaches involving balloons and stents further accelerates segment expansion. Technological advancements aimed at improving safety, precision, and debris management also support rapid adoption. Expanding awareness among physicians regarding effective calcified lesion treatment is contributing to strong projected growth.

- By Type

On the basis of type, the market is segmented into conventional and standard devices. The conventional segment dominated the market in 2025 due to its long-standing clinical acceptance, established reimbursement frameworks, and widespread availability across healthcare institutions. Conventional devices are considered reliable and cost-effective, making them suitable for high-volume vascular procedures. Their broad compatibility with existing catheterization laboratory infrastructure further supports consistent utilization. Physician familiarity and extensive procedural training associated with these devices strengthen adoption rates. Moreover, strong supply chain networks across the United States and Canada ensure continuous product availability.

The standard segment is expected to witness the fastest CAGR from 2026 to 2033, driven by ongoing product refinement and improvements in material composition and deliverability. These devices are increasingly tailored to address complex anatomical challenges, enhancing clinical outcomes. Rising investments in R&D and rapid commercialization of upgraded device platforms are contributing to accelerated segment growth. Improved flexibility, durability, and enhanced imaging compatibility further encourage physician preference. Growing emphasis on precision-based interventional strategies also supports rising demand.

- By Procedure

On the basis of procedure, the market is segmented into iliac intervention, femoropopliteal interventions, tibial (below-the-knee) interventions, peripheral angioplasty, arterial thrombectomy, and peripheral atherectomy. Peripheral angioplasty dominated the market in 2025 owing to its high procedural frequency and minimally invasive approach. It is widely utilized in treating peripheral arterial disease, particularly among adult and geriatric populations. Shorter recovery periods and lower complication rates compared to open surgery enhance its preference across hospitals and ambulatory surgery centers. Advancements in balloon technologies and adjunctive stent usage further support procedural volumes. Favorable reimbursement policies also sustain strong segment performance.

The tibial (below-the-knee) interventions segment is projected to grow at the fastest rate during the forecast period, primarily driven by rising diabetes prevalence and increasing cases of critical limb ischemia. Growing focus on limb preservation strategies and early intervention is expanding treatment rates in this category. Technological improvements in low-profile balloons and specialized stents for small-caliber vessels are improving success rates. Increasing awareness among clinicians regarding advanced treatment options also contributes to segment growth. Expanding outpatient vascular care services further support rising procedural adoption.

- By Indication

On the basis of indication, the market is segmented into peripheral arterial disease and coronary intervention. The coronary intervention segment dominated the market in 2025 due to the high burden of coronary artery disease and strong adoption of percutaneous coronary intervention procedures in the United States. Established clinical guidelines and extensive availability of advanced stent technologies reinforce its dominance. High patient awareness and access to specialized cardiac centers further contribute to procedural volume. Technological advancements in drug-eluting stents also enhance long-term outcomes. Strong reimbursement coverage continues to sustain market leadership.

Peripheral arterial disease is expected to witness the fastest growth from 2026 to 2033, attributed to increasing aging demographics and lifestyle-related risk factors such as obesity and smoking. Rising screening initiatives and improved diagnostic capabilities are enabling earlier detection. Growing awareness regarding minimally invasive treatment options is accelerating patient acceptance. Expanding healthcare infrastructure in Canada also contributes to projected growth. Continuous innovation in atherectomy and thrombectomy devices further strengthens the segment outlook.

- By Age Group

On the basis of age group, the market is segmented into geriatric, adults, and pediatric. The geriatric segment dominated the market in 2025 as elderly individuals exhibit higher susceptibility to atherosclerosis and vascular complications. Aging-related vascular degeneration significantly increases intervention rates within this population. Higher hospitalization rates among older patients further contribute to sustained demand. Increasing life expectancy in North America continues to expand the target patient base. Comprehensive insurance coverage for elderly populations also supports segment leadership.

The adult segment is anticipated to witness the fastest growth rate during the forecast period, supported by rising incidence of lifestyle-associated cardiovascular disorders among middle-aged individuals. Increasing health awareness and preventive screening programs are encouraging earlier interventions. Improved access to minimally invasive procedures also enhances treatment adoption. Workplace health initiatives and insurance coverage expansion further contribute to growth. Technological advancements enabling safer outpatient procedures are supporting adult segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgery centers, nursing facilities, clinics, and others. The hospitals segment dominated the market in 2025 due to the availability of advanced catheterization laboratories and hybrid operating rooms. Presence of skilled interventional cardiologists and comprehensive emergency care infrastructure strengthens segment dominance. High patient inflow and complex case handling capabilities further support leadership. Strong procurement agreements with device manufacturers ensure consistent supply. Integration of advanced imaging systems also enhances hospital-based procedural volumes.

Ambulatory surgery centers are projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing preference for outpatient minimally invasive procedures. Cost efficiency and reduced hospitalization durations attract both patients and providers. Streamlined workflows and quicker patient turnover improve operational efficiency. Expanding reimbursement coverage for outpatient vascular interventions supports growth. Rising investment in standalone cardiovascular specialty centers further accelerates segment expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third party distributors, and others. The direct tender segment dominated the market in 2025 as large hospitals and integrated healthcare systems prefer direct procurement contracts to maintain pricing transparency and supply consistency. Bulk purchasing agreements help reduce overall device costs. Strong manufacturer-hospital relationships enhance product availability and service support. Centralized procurement strategies further strengthen this segment. Direct engagement also facilitates rapid adoption of newly launched devices.

The third party distributors segment is expected to witness the fastest growth during the forecast period due to expanding regional healthcare facilities and increasing demand from smaller clinics and ambulatory centers. Distributors provide flexible supply chain solutions and improved regional coverage. They play a crucial role in ensuring timely product delivery across diverse healthcare settings. Growing number of independent specialty clinics further supports demand. Enhanced logistics capabilities and inventory management systems contribute to segment expansion.

North America Interventional Cardiology and Peripheral Vascular Devices Market Regional Analysis

- The United States dominated the North America interventional cardiology and peripheral vascular devices market with the largest revenue share of 78.6% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and strong presence of leading medical device manufacturers

- Healthcare providers in the country highly prioritize clinical efficiency, improved patient outcomes, and reduced hospitalization time offered by advanced stents, angioplasty balloons, catheters, and atherectomy devices, particularly across specialized cardiac centers and ambulatory surgery facilities

- This widespread procedural adoption is further supported by favorable reimbursement frameworks, a rapidly growing geriatric population, continuous technological innovation, and strong presence of leading medical device manufacturers, establishing interventional cardiology and peripheral vascular devices as essential components of modern cardiovascular care across hospitals and outpatient settings

U.S. Interventional Cardiology and Peripheral Vascular Devices Market Insight

The U.S. interventional cardiology and peripheral vascular devices market captured the largest revenue share within North America in 2025, fueled by the high prevalence of coronary artery disease and peripheral arterial disease, along with strong adoption of minimally invasive procedures. Healthcare providers are increasingly prioritizing advanced stents, angioplasty balloons, catheters, and atherectomy systems to improve procedural success and reduce hospital stays. The growing preference for catheter-based interventions over open surgeries, combined with favorable reimbursement frameworks, further propels market growth. Moreover, continuous technological innovation and the strong presence of leading medical device manufacturers are significantly contributing to the expansion of vascular intervention procedures across hospitals and ambulatory surgery centers.

Canada Interventional Cardiology and Peripheral Vascular Devices Market Insight

The Canada interventional cardiology and peripheral vascular devices market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by rising cardiovascular disease burden and increasing healthcare expenditure. The growing aging population and expanding access to advanced endovascular treatment options are fostering device adoption across major provinces. Canadian healthcare systems are increasingly integrating minimally invasive vascular procedures to enhance patient outcomes and reduce long-term treatment costs. The presence of well-established hospitals and specialized cardiac centers further supports market expansion, alongside improved awareness regarding early diagnosis and timely intervention.

Mexico Interventional Cardiology and Peripheral Vascular Devices Market Insight

The Mexico interventional cardiology and peripheral vascular devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by improving healthcare infrastructure and rising incidence of lifestyle-related cardiovascular disorders. Increasing investments in hospital modernization and catheterization laboratories are encouraging adoption of angioplasty, stent placement, and thrombectomy procedures. Growing awareness regarding minimally invasive treatment options and expanding private healthcare facilities are stimulating demand for advanced vascular devices. Furthermore, supportive government initiatives aimed at strengthening cardiovascular care services are expected to contribute to sustained market growth.

North America Interventional Cardiology and Peripheral Vascular Devices Market Share

The North America Interventional Cardiology and Peripheral Vascular Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Cordis Corporation (U.S.)

- Cardinal Health, Inc. (U.S.)

- B. Braun SE (Germany)

- Cook (U.S.)

- Teleflex Incorporated (U.S.)

- BIOTRONIK SE & Co. KG (Germany)

- Edwards Lifesciences Corporation (U.S.)

- AngioDynamics, Inc. (U.S.)

- Becton, Dickinson and Company (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Getinge AB (Sweden)

- LeMaitre Vascular, Inc. (U.S.)

- MicroPort Scientific Corporation (China)

- Control Medical Technology, LLC (U.S.)

- Walk Vascular, LLC (U.S.)

- Transit Scientific, Inc. (U.S.)

What are the Recent Developments in North America Interventional Cardiology and Peripheral Vascular Devices Market?

- In November 2025, Vesalio received two FDA 510(k) clearances in the United States for its expanded range of aspiration devices used in peripheral and neurovascular applications, broadening tools available for clot removal and vascular intervention

- In October 2025, Orchestra BioMed announced first patient enrollments in its U.S. pivotal IDE trial (Virtue Trial) for the Virtue® Sirolimus AngioInfusion™ Balloon a differentiated investigational system aimed at improving outcomes in coronary ISR and small vessel disease

- In July 2025, Medtronic expanded its U.S. peripheral portfolio by finalizing an exclusive distribution agreement to sell novel stainless-steel peripheral guidewires (F-14 and F-18) designed for radial access in lower extremity interventions

- In March 2025, Boston Scientific received FDA approval for its Agent Drug-Coated Balloon (DCB) for the treatment of coronary in-stent restenosis, offering clinicians a new therapeutic option to improve restenosis outcomes in coronary artery disease patients

- In January 2024, AngioDynamics announced FDA 510(k) clearance of its Auryon XL radial access catheter a long-length, laser-based catheter designed to treat peripheral arterial disease (PAD) via radial access, expanding options for minimally invasive intervention and potentially improving patient mobility and recovery

- In June 2025, the U.S. Food and Drug Administration granted de novo clearance for Reflow Medical’s Spur peripheral retrievable stent system, designed for infrapopliteal arterial disease, marking the first peripheral stent system with retrievable scaffold therapy that increases acute luminal diameter and modifies lesion compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.