Global Peripheral Arterial Disease Pad Market

Market Size in USD Million

CAGR :

%

USD

873.01 Million

USD

1.74 Million

2024

2032

USD

873.01 Million

USD

1.74 Million

2024

2032

| 2025 –2032 | |

| USD 873.01 Million | |

| USD 1.74 Million | |

|

|

|

|

Peripheral Arterial Disease (PAD) Market Size

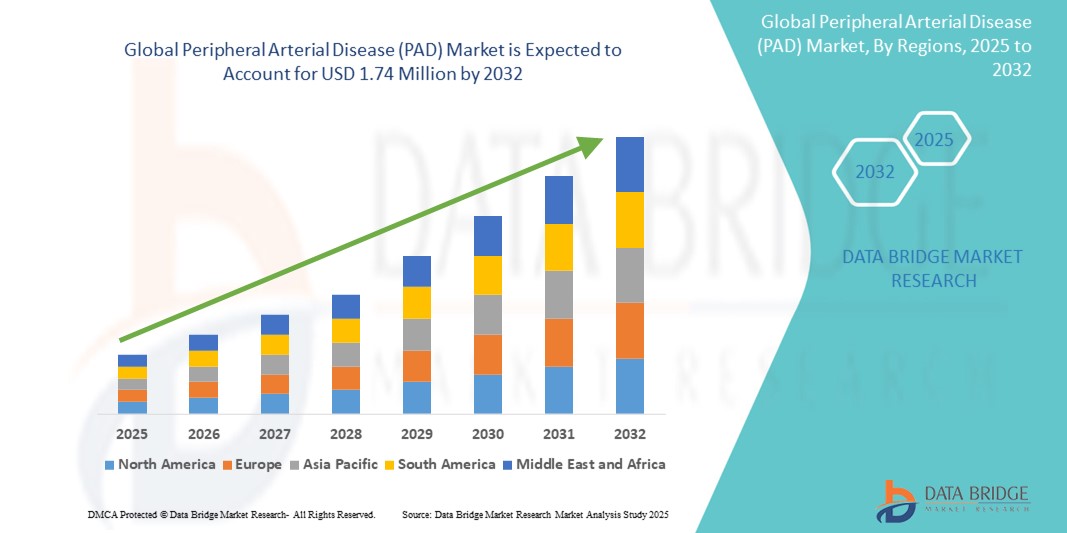

- The global peripheral arterial disease (PAD) market was valued at USD 873.01 million in 2024 and is expected to reach USD 1.74 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.00%, primarily driven by the increasing prevalence of PAD due to aging populations, rising risk factors such as diabetes and hypertension, and advancements in minimally invasive treatment options

- This growth is driven by factors such as the rising incidence of cardiovascular diseases, increased awareness about PAD, advancements in diagnostic technologies, and the development of innovative treatment options such as drug-eluting stents and atherectomy devices

Peripheral Arterial Disease (PAD) Market Analysis

- Peripheral arterial disease (PAD) is a common circulatory problem where narrowed arteries reduce blood flow to the limbs, particularly affecting the lower extremities. PAD treatments include medications, angioplasty, stenting, and surgical interventions

- The demand for PAD treatments is largely driven by the growing prevalence of risk factors such as aging, diabetes, hypertension, and smoking. With the aging global population and increasing chronic conditions, the need for effective PAD management continues to rise

- North America is a dominant region for the PAD market, driven by advanced healthcare infrastructure, high awareness of cardiovascular diseases, and a significant population suffering from risk factors such as diabetes and hypertension. The region is also a leader in adopting new technologies and treatment methods for PAD

- For instance, in the United States, the prevalence of Peripheral Arterial Disease (PAD) is rising, particularly among individuals over the age of 60, due to the aging population and increasing rates of diabetes and hypertension.

- Globally, PAD treatments are considered among the most crucial interventions in cardiovascular care, with a growing focus on minimally invasive techniques such as endovascular surgery, which ensure faster recovery times and better outcomes for patients

Report Scope and Peripheral Arterial Disease (PAD) Market Segmentation

|

Attributes |

Peripheral Arterial Disease (PAD) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Peripheral Arterial Disease (PAD) Market Trends

“Adoption of Minimally Invasive Treatment Technologies”

- A prominent trend in the global peripheral arterial disease market is the increasing adoption of minimally invasive treatment technologies, such as endovascular procedures, atherectomy, and drug-eluting stents

- These advanced techniques provide patients with less invasive alternatives to traditional surgery, resulting in shorter recovery times, reduced complications, and improved overall outcomes.

- For instance, endovascular revascularization techniques, such as angioplasty and stenting, allow for targeted treatment of blocked arteries with smaller incisions, enabling faster recovery and less post-operative pain compared to conventional open surgeries

- These technologies also contribute to the development of more personalized treatment options, improving the precision and effectiveness of PAD management

- This trend is transforming the PAD treatment landscape, increasing patient demand for less invasive, quicker recovery solutions and driving the growth of the global PAD market

Peripheral Arterial Disease (PAD) Market Dynamics

Driver

“Increasing Prevalence of Risk Factors and Aging Population”

- The rising prevalence of risk factors such as diabetes, hypertension, smoking, and high cholesterol, combined with the aging global population, is significantly driving the demand for PAD treatments

- As people age, the likelihood of developing PAD increases, particularly in individuals with comorbid conditions such as diabetes, which accelerates the progression of arterial plaque buildup and narrowing of blood vessels

- PAD is one of the most common causes of limb amputation, and early intervention is crucial for preventing severe complications. This has heightened the demand for advanced diagnostic tools and effective treatment options

- The growing awareness of PAD, coupled with the aging population, is driving the need for more specialized procedures and medical equipment aimed at diagnosing and treating PAD, such as angioplasty devices and stents.

- As healthcare systems prioritize managing chronic diseases and improving cardiovascular health, the demand for advanced PAD treatment technologies continues to rise, ensuring better patient outcomes and reducing long-term healthcare costs

For instance,

- In 2021, the American Heart Association reported that more than 8.5 million people in the U.S. aged 40 and older suffer from PAD, and the prevalence is expected to rise as the population ages, directly contributing to the growing demand for PAD treatments and related technologies.

- In 2020, the World Health Organization noted that by 2050, 16% of the global population will be over 65, further highlighting the rising need for effective PAD management and driving the growth of the PAD market

- As a result of the increasing prevalence of risk factors and the aging population, the demand for PAD treatments and diagnostic technologies continues to grow, enhancing market growth and innovation.

Opportunity

“Integration of Artificial Intelligence and Digital Technologies”

- AI and digital technologies offer significant opportunities to enhance the diagnosis, treatment, and management of PAD by improving precision and efficiency in both clinical settings and surgery

- AI-powered systems can analyze diagnostic imaging such as angiograms, CT scans, and MRIs in real-time, helping clinicians identify arterial blockages, stenosis, and other abnormalities with high accuracy. This aids in earlier detection, which is crucial for preventing severe complications such as limb amputation

- In addition, AI algorithms can assist in predictive analytics, enabling healthcare providers to identify high-risk patients and monitor disease progression, leading to more personalized treatment plans and better patient outcomes

For instance,

- In January 2024, a study published in the Journal of Vascular Surgery demonstrated that AI systems could accurately analyze CT angiography images to detect PAD with higher sensitivity than traditional methods, potentially leading to earlier interventions and improved patient prognosis

- In December 2023, a partnership between a leading medical device manufacturer and an AI startup was announced, focusing on integrating machine learning algorithms into stent deployment systems. This innovation aims to improve the precision of stent placement during PAD procedures, minimizing complications and enhancing long-term results

- The integration of AI in PAD treatment is expected to optimize procedural planning, reduce human error, and improve recovery times. AI-powered systems can also assist clinicians in choosing the most effective treatments and monitoring patients over time, opening new avenues for personalized care and improved long-term management of PAD

Restraint/Challenge

“High Treatment and Equipment Costs Hindering Widespread Adoption”

- The high costs associated with PAD treatments and diagnostic equipment present a significant challenge, particularly in low- and middle-income countries. The cost of advanced diagnostic devices such as angiography systems and atherectomy tools, as well as procedures such as stenting and endovascular surgeries, can be prohibitively expensive for many healthcare providers

- These high costs can deter hospitals and clinics, especially those in developing regions, from adopting the latest PAD treatment technologies, limiting the accessibility of advanced care for PAD patients

- The financial burden of these treatments may also place pressure on patients, leading to delayed diagnoses and treatments, which can result in severe complications such as limb amputation or worsening cardiovascular health

For instance,

- In August 2024, a report published by the International Journal of Cardiology highlighted that the high cost of angioplasty and stenting procedures is a major barrier to PAD treatment in developing nations, limiting access to timely interventions and contributing to poorer health outcomes

- Consequently, the high treatment and equipment costs can create disparities in the quality of care and access to advanced PAD management, hindering the market's overall growth and the widespread adoption of innovative PAD treatments and technologies.

Peripheral Arterial Disease (PAD) Market Scope

The market is segmented on the basis of treatment type, route of administration, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Treatment Type |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel

|

|

Peripheral Arterial Disease (PAD) Market Regional Analysis

“North America is the Dominant Region in the Peripheral Arterial Disease (PAD) Market”

- North America holds a dominant share of the global PAD market, driven by its advanced healthcare infrastructure, high awareness of cardiovascular diseases, and early adoption of cutting-edge medical technologies

- U.S. plays a crucial role in this dominance due to its well-established healthcare system, rising prevalence of PAD, and strong focus on cardiovascular health. With an aging population and a growing number of PAD cases, the demand for diagnostic tools and treatment options continues to rise

- The region benefits from high investment in research & development by leading medical device companies, ensuring the availability of the latest treatment methods, including minimally invasive procedures such as angioplasty and stent placement

- In addition, the reimbursement policies in the U.S. contribute significantly to the accessibility of PAD treatments, further driving market growth

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to register the highest growth rate in the PAD market, driven by rapid improvements in healthcare infrastructure, rising awareness about vascular diseases, and increasing prevalence of risk factors such as diabetes and hypertension

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, increasing cases of diabetes and cardiovascular diseases, and aging demographics. These nations are focusing on enhancing healthcare services to address the growing burden of PAD.

- Japan, with its advanced healthcare system and aging population, remains a significant market for PAD diagnostics and treatments, offering opportunities for the adoption of advanced treatment technologies such as drug-eluting stents and atherectomy devices

- In China and India, rising government and private sector investments in healthcare infrastructure and the expansion of PAD treatment options are contributing to the growing demand for innovative PAD therapies, positioning the region for substantial market growth

Peripheral Arterial Disease (PAD) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bayer AG (Germany)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Biotronik (Germany)

- Cardinal Health (U.S.)

- Terumo Corporation (Japan)

- AngioDynamics (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- iVascular (Spain)

- Endologix LLC (U.S.)

- BD (U.S.)

- Meril Life Sciences Pvt. Ltd. (India)

- Lombard Medical (U.K.)

- Shockwave Medical Inc. (U.S.)

- Cordis (U.S.)

- Penumbra, Inc. (U.S.)

- BIOCARDIA, INC. (U.S.)

- Heraeus Group (Germany)

Latest Developments in Global Peripheral Arterial Disease (PAD) Market

- In March 2024, Becton, Dickinson and Company (BD) launched the AGILITY clinical study to evaluate the safety and effectiveness of its Vascular Covered Stent in treating PAD. The study is being conducted internationally across the U.S., Europe, Australia, and New Zealand, with the goal of expanding treatment options for PAD

- In May 2024, The American Heart Association (AHA) published updated guidelines that emphasize early diagnosis, structured exercise therapy, and coordinated multispecialty care to reduce the risk of amputations in PAD patients. These guidelines also highlight racial and ethnic disparities in PAD outcomes.

- In May 2024, The American Heart Association introduced a comprehensive roadmap that emphasizes early diagnosis, structured exercise, and coordinated care to mitigate the risk of amputations for PAD patients. This initiative focuses on reducing healthcare disparities and improving patient outcomes.

- In March 2024, BD announced the enrollment of the first patient in its AGILITY study, a global clinical trial assessing the safety and effectiveness of its Vascular Covered Stent for PAD treatment. The goal is to offer a new solution for interventional treatments of PAD

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 EPIDEMIOLOGY

7 INDUSTRY INSIGHTS

8 REGULATORY FRAMEWORK

9 PIPELINE ANALYSIS

9.1 PHASE III CANDIDATES

9.2 PHASE II CANDIDATES

9.3 PHASE I CANDIDATES

9.4 OTHERS (PRE-CLINICAL AND RESEARCH)

10 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY TREATMENT TYPE

10.1 OVERVIEW

10.1.1 THERAPEUTIC DRUGS

10.1.1.1. CHOLESTEROL-LOWERING MEDICATIONS

10.1.1.1.1. WARFARIN

10.1.1.1.2. HEPARIN

10.1.1.1.3. STATINS

10.1.1.1.3.1 ATORVASTATIN

10.1.1.1.3.2 FLUVASTATIN

10.1.1.1.3.3 LOVASTATIN

10.1.1.1.3.4 PITAVASTATIN

10.1.1.1.3.5 SIMVASTATIN

10.1.1.1.3.6 OTHERS

10.1.1.2. BLOOD-PRESSURE LOWERING

10.1.1.2.1. ANGIOTENSIN-CONVERTING ENZYME (ACE) INHIBITORS

10.1.1.2.1.1 BENAZEPRIL

10.1.1.2.1.2 CAPTOPRIL

10.1.1.2.1.3 ENALAPRIL

10.1.1.2.1.4 MOEXIPRIL

10.1.1.2.1.5 PERINDOPRIL

10.1.1.2.1.6 OTHERS

10.1.1.2.2. BETA BLOCKERS

10.1.1.2.2.1 NEBIVOLOL

10.1.1.2.2.2 METOPROLOL SUCCINATE

10.1.1.2.2.3 OTHERS

10.1.1.3. BLOOD SUGAR CONTROL

10.1.1.3.1. DPP-4 INHIBITORS

10.1.1.3.1.1 SAXAGLIPTIN

10.1.1.3.1.2 SITAGLIPTIN

10.1.1.3.1.3 LINAGLIPTIN

10.1.1.3.1.4 OTHERS

10.1.1.3.2. GLP-1 RECEPTOR AGONISTS

10.1.1.3.2.1 EXENATIDE

10.1.1.3.2.2 LIRAGLUTIDE

10.1.1.3.2.3 ALBIGLUTIDE

10.1.1.3.2.4 OTHERS

10.1.1.4. ANTIPLATELET MEDICINES

10.1.1.4.1. ASPIRIN THERAPY

10.1.1.4.2. CLOPIDOGREL

10.1.1.4.3. TICLOPIDINE

10.1.1.4.4. DIPYRIDAMOLE

10.1.1.4.5. OTHERS

10.1.1.5. SYMPTOM-RELIEF MEDICATIONS

10.1.1.5.1. CILOSTAZOL

10.1.1.5.2. PENTOXIFYLLINE

10.1.1.5.3. OTHERS

10.1.2 THERAPUETIC DEVICES

10.1.2.1. PERIPHERAL VASCULAR STENTS

10.1.2.1.1. SELF-EXPANDABLE

10.1.2.1.2. BALLOON-EXPANDABLE

10.1.2.1.3. COVERED

10.1.2.1.4. DRUG-ELUTING STENTS

10.1.2.2. PERCUTANEOUS TRANSLUMINAL ANGIOPLASTY (PTA) BALLOON CATHETERS

10.1.2.2.1. STANDARD PTA BALLOON

10.1.2.2.2. HIGH PRESSURE PTA BALLOON

10.1.2.2.3. SCORING PTA BALLOON

10.1.2.2.4. CUTTING BALLOONS

10.1.2.2.5. DRUG COATED BALLOON

10.1.2.2.6. OTHERS

10.1.2.3. PERIPHERAL TRANSLUMINAL ANGIOPLASTY (PTA) GUIDEWIRES

10.1.2.3.1. COATED PTA GUIDEWIRES

10.1.2.3.2. NON-COATED PTA GUIDEWIRES

10.1.2.4. ATHERECTOMY DEVICES

10.1.2.4.1. ORBITAL ATHERECTOMY DEVICES

10.1.2.4.2. ROTATIONAL ATHERECTOMY DEVICES

10.1.2.4.3. LASER ATHERECTOMY DEVICES

10.1.2.4.4. DIRECTIONAL ATHERECTOMY DEVICES

10.1.2.5. EMBOLIC PROTECTION DEVICES

10.1.2.5.1. DISTAL OCCLUSION ASPIRATION DEVICES

10.1.2.5.2. DISTAL FILTERS ASPIRATION DEVICES

10.1.2.5.3. PROXIMAL OCCLUSION ASPIRATION DEVICES

10.1.2.6. INFERIOR VENA CAVA FILTERS

10.1.2.6.1. PERMANENT INFERIOR VENA CAVA FILTERS

10.1.2.6.2. RETREIVABLE INFERIOR VENA CAVA FILTERS

10.1.2.7. OTHER DEVICES

11 GLOBAL MEDICATION IN PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY MODE OF PRESCRIPTION

11.1 OVERVIEW

11.2 PRESCRIPTION

11.3 OVER THE COUNTER (OTC)

12 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY TYPE

12.1 OVERVIEW

12.2 FUNCTIONAL PERIPHERAL ARTERIAL DISEASE PAD

12.3 ORGANIC PERIPHERAL ARTERIAL DISEASE PAD

13 GLOBAL MEDICATION IN PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY ROUTE OF ADMINISTRATION

13.1 OVERVIEW

13.2 ORAL

13.2.1 TABLET

13.2.2 CAPSULE

13.2.3 OTHERS

13.3 PARENTERAL

13.3.1 INTRAVENOUS

13.3.2 SUBCUTANEOUS

13.3.3 OTHERS

14 GLOBAL MEDICATION IN PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY AGE

14.1 OVERVIEW

14.2 CHILDREN

14.3 ADULT

14.4 GERIATRIC

15 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.2.1 PUBLIC

15.2.2 PRIVATE

15.3 CATH LABORATORY

15.4 SPECIALTY CLINICS

15.5 AMBULATORY SURGICAL CENTERS

15.6 HOME HEALTHCARE

15.7 OTHERS

16 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL PHARMACY

16.3.1 HOSPITAL PHARMACY

16.3.2 RETAIL PHARMACY

16.3.3 ONLINE PHARMACY

16.3.4 OTHERS

16.4 OTHERS

17 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, BY GEOGRAPHY

18.1 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1.1 NORTH AMERICA

18.1.1.1. U.S.

18.1.1.2. CANADA

18.1.1.3. MEXICO

18.1.2 EUROPE

18.1.2.1. GERMANY

18.1.2.2. FRANCE

18.1.2.3. U.K.

18.1.2.4. HUNGARY

18.1.2.5. LITHUANIA

18.1.2.6. AUSTRIA

18.1.2.7. IRELAND

18.1.2.8. NORWAY

18.1.2.9. POLAND

18.1.2.10. ITALY

18.1.2.11. SPAIN

18.1.2.12. RUSSIA

18.1.2.13. TURKEY

18.1.2.14. NETHERLANDS

18.1.2.15. SWITZERLAND

18.1.2.16. REST OF EUROPE

18.1.3 ASIA-PACIFIC

18.1.3.1. JAPAN

18.1.3.2. CHINA

18.1.3.3. SOUTH KOREA

18.1.3.4. INDIA

18.1.3.5. AUSTRALIA

18.1.3.6. SINGAPORE

18.1.3.7. THAILAND

18.1.3.8. MALAYSIA

18.1.3.9. INDONESIA

18.1.3.10. PHILIPPINES

18.1.3.11. VIETNAM

18.1.3.12. REST OF ASIA-PACIFIC

18.1.4 SOUTH AMERICA

18.1.4.1. BRAZIL

18.1.4.2. ARGENTINA

18.1.4.3. PERU

18.1.4.4. REST OF SOUTH AMERICA

18.1.5 MIDDLE EAST AND AFRICA

18.1.5.1. SOUTH AFRICA

18.1.5.2. SAUDI ARABIA

18.1.5.3. UAE

18.1.5.4. EGYPT

18.1.5.5. ISRAEL

18.1.5.6. REST OF MIDDLE EAST AND AFRICA

18.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, SWOT AND DBMR ANALYSIS

20 GLOBAL PERIPHERAL ARTERIAL DISEASE (PAD) MARKET, COMPANY PROFILE

20.1 ABBOTT.

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 KONINKLIJKE PHILIPS N.V.

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 B. BRAUN SE

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 BIOTRONIK SE & CO. KG

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 BOSTON SCIENTIFIC CORPORATION

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 COOK

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 TERUMO EUROPE NV

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPMENTS

20.8 JANSSEN PHARMACEUTICALS, INC.

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPMENTS

20.9 OTSUKA PHARMACEUTICAL CO., LTD.

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPMENTS

20.1 BAYER AG

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPMENTS

20.11 MEDTRONIC

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPMENTS

20.12 MYLAN N.V.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPMENTS

20.13 ANGIODYNAMICS

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPMENTS

20.14 BD

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPMENTS

20.15 WILLKIE FARR & GALLAGHER LLP

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPMENTS

20.16 ASTRAZENECA

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPMENTS

20.17 PROTEON THERAPEUTICS, INC.

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPMENTS

20.18 APOTEX INC

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPMENTS

20.19 SYMIC BIO, INC.

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPMENTS

20.2 THERAVASC, INC.

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPMENTS

20.21 ENDOLOGIX LLC.

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHIC PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.