North America Intraoperative Imaging Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

1.89 Billion

2024

2032

USD

1.29 Billion

USD

1.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 1.89 Billion | |

|

|

|

|

Intraoperative Imaging Market Size

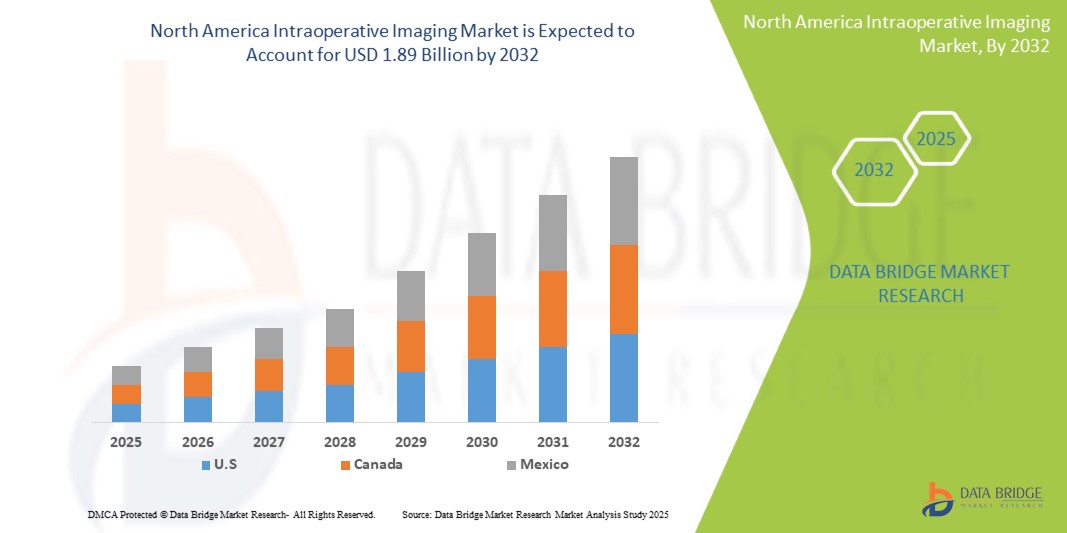

- The North America Intraoperative Imaging Market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 1.89 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of chronic diseases and the growing geriatric population in North America, leading to a higher volume of surgical procedures. Additionally, the rising adoption of minimally invasive surgical techniques, which rely heavily on intraoperative imaging for guidance and precision, is a key driver.

- Furthermore, the demand for enhanced surgical precision, improved patient outcomes, and reduced need for repeat surgeries is establishing intraoperative imaging as a crucial tool in modern operating rooms. These converging factors are accelerating the uptake of intraoperative imaging solutions, thereby significantly boosting the industry's growth in North America.

Intraoperative Imaging Market Analysis

- Intraoperative imaging technologies, including mobile C-arms, intraoperative CT, MRI, and ultrasound systems, are playing a transformative role in real-time surgical navigation and intra-surgical decision-making across North American healthcare facilities. These technologies significantly enhance surgical precision, reduce repeat surgeries, and improve patient outcomes across complex procedures.

- The increasing demand for intraoperative imaging solutions in North America is primarily driven by the rising prevalence of chronic diseases, growth in minimally invasive surgeries, and the region’s strong inclination toward technologically advanced, integrated operating rooms. Intraoperative imaging’s ability to provide dynamic visualization is becoming indispensable in neurosurgery, orthopedic, and cardiovascular interventions.

- The U.S. dominates the North America intraoperative imaging market, holding the largest revenue share of 86.7% in 2025, attributed to its advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and supportive reimbursement framework. Moreover, the country benefits from a strong presence of global medical imaging device manufacturers and academic collaborations for research and clinical validation.

- The U.S. is also projected to be the fastest-growing country in the North American intraoperative imaging market during the forecast period. This growth is fueled by increasing demand for intraoperative neurosurgical and spinal procedures, ongoing hospital upgrades, and government initiatives supporting the adoption of AI-integrated surgical imaging platforms.

- Intraoperative MRI is expected to lead the North America intraoperative imaging market with a market share of 39.4% in 2025, driven by its unmatched soft tissue contrast, widespread use in brain tumor resection, and growing demand for precision-based neurosurgical outcomes. Its integration with neuronavigation and robotic-assisted surgery platforms further supports its dominance in the market.

Report Scope and Intraoperative Imaging Market Segmentation

|

Attributes |

Intraoperative Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intraoperative Imaging Market Trends

“Enhanced Surgical Precision through Technological Integration”

- A significant and accelerating trend in the North America Intraoperative Imaging Market is the deepening integration of advanced technologies like Artificial Intelligence (AI) and real-time data processing into surgical workflows. This fusion of technologies is significantly enhancing surgical precision and improving patient outcomes.

- For instance, AI-powered image analysis software is being integrated with intraoperative MRI and CT systems, allowing surgeons to identify critical anatomical structures with greater accuracy. Similarly, advanced navigation systems provide real-time guidance based on pre-operative and intra-operative imaging data.

- AI integration in intraoperative imaging enables features such as automated image segmentation, predictive modeling for surgical planning, and real-time feedback to surgeons. For example, some systems utilize AI to enhance image resolution, reduce noise, and provide alerts based on identified anomalies. Furthermore, voice control capabilities are being explored to offer hands-free operation, allowing surgeons to manipulate imaging parameters using simple verbal commands.

- The seamless integration of intraoperative imaging with other operating room technologies and hospital information systems facilitates centralized control over various aspects of the surgical environment. Through a unified interface, surgeons can access comprehensive patient data, control imaging modalities, and utilize surgical navigation tools, creating a more integrated and efficient surgical experience.

- This trend towards more intelligent, intuitive, and interconnected surgical systems is fundamentally reshaping surgical expectations for patient care. Consequently, companies are developing AI-enabled intraoperative imaging solutions with features such as predictive analytics, enhanced visualization, and compatibility with robotic surgery platforms.

- The demand for intraoperative imaging systems that offer seamless AI and technological integration is growing rapidly across both hospitals and specialty surgical centers, as healthcare providers increasingly prioritize enhanced precision, efficiency, and improved patient outcomes.

Intraoperative Imaging Market Dynamics

Driver

“Growing Need for Enhanced Surgical Outcomes and Workflow Efficiency”

- The increasing focus on improving surgical outcomes and enhancing workflow efficiency in North American healthcare facilities is a significant driver for the heightened demand for intraoperative imaging.

- For instance, the adoption of advanced intraoperative imaging technologies helps to minimize the need for repeat surgeries, reduces complications, and shortens patient recovery times. Such benefits are driving increased investment in these systems by key healthcare providers.

- As healthcare providers seek to optimize their surgical processes and improve patient care, intraoperative imaging offers advanced features such as real-time visualization, enhanced anatomical detail, and precise guidance, providing a compelling upgrade over traditional surgical methods.

- Furthermore, the growing emphasis on minimally invasive surgical techniques and the desire for more accurate and efficient procedures are making intraoperative imaging an integral component of modern operating rooms.

- The ability to make informed decisions during surgery, reduce errors, and improve the overall quality of care are key factors propelling the adoption of intraoperative imaging systems in both hospitals and specialty surgical centers across North America. The trend towards the integration of these systems with other advanced surgical technologies further contributes to market growth.

Restraint/Challenge

“High Costs and Complex Regulatory Landscape”

- The high cost associated with the acquisition, installation, and maintenance of intraoperative imaging systems poses a significant challenge to broader market penetration in North America.

- For instance, the substantial capital investment required for advanced MRI or CT systems, coupled with ongoing service and training expenses, can strain the budgets of healthcare facilities, particularly smaller hospitals and clinics.

- Addressing these cost concerns through innovative financing models, technological advancements that lower system prices, and greater insurance coverage for procedures involving intraoperative imaging is crucial for building wider adoption.

- Additionally, the complex regulatory landscape governing the approval and use of medical devices in North America, including stringent requirements from the FDA in the United States and Health Canada, can create barriers for market entry and slow down the adoption of new technologies.

- Navigating these regulatory hurdles, ensuring compliance, and keeping up with evolving standards require significant resources and expertise for both manufacturers and healthcare providers.

- Overcoming these challenges through streamlining regulatory processes, promoting greater harmonization of standards, and supporting initiatives that foster innovation while ensuring patient safety will be vital for sustained market growth in the North America intraoperative imaging market.

Intraoperative Imaging Market Scope

The market is segmented on the basis of product, component, application, and end user

- By Product

On the basis of product, the North America Intraoperative Imaging Market is segmented into Mobile C-Arms, Intraoperative Computed Tomography (CT), Intraoperative Magnetic Resonance Imaging (MRI), and Intraoperative Ultrasound. The Intraoperative MRI segment holds the largest market revenue share of 41.5% in 2025, owing to its superior soft-tissue imaging capabilities, particularly in neurosurgical and spinal procedures. The high-resolution imaging provided by intraoperative MRI allows surgeons to perform real-time assessments during surgery, reducing the need for repeat operations.

Meanwhile, the Mobile C-Arms segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by its versatility, ease of integration into operating rooms, and increasing demand in orthopedic and trauma surgeries. Their cost-effectiveness and mobility make them ideal for both large hospitals and smaller ambulatory surgical centers.

- By Component

On the basis of component, the market is segmented into System, Software, and Services. The System segment dominates the market with the 60.35% highest revenue share in 2025, attributed to the high cost and central role of imaging equipment in intraoperative settings. Advanced imaging systems, including intraoperative CT and MRI units, are capital-intensive but essential for surgical precision and intraoperative decision-making.

The Software segment is projected to grow at the fastest CAGR from 2025 to 2032, as healthcare facilities increasingly adopt AI-powered image enhancement, real-time analytics, and 3D visualization tools to optimize surgical outcomes and reduce operating times.

- By Application

Based on application, the market is segmented into Neurosurgery, Orthopedic and Trauma Surgery, Spine Surgery, Cardiovascular Surgery, and Other Applications. The Neurosurgery segment accounted for the largest share of 37.9% in 2025, due to the critical need for real-time brain imaging during tumor resections and other delicate procedures. Intraoperative imaging enables precise localization, improves resection margins, and minimizes neurological damage.

The Orthopedic and Trauma Surgery segment is expected to grow at the fastest pace from 2025 to 2032, fueled by the rising incidence of trauma cases and musculoskeletal disorders across North America. Real-time imaging during fracture repairs and joint replacements significantly enhances surgical precision and outcomes.

- By End User

By end user, the market is segmented into Hospitals, Ambulatory Surgical Centers and Clinics, Academic Institutes, and Research Centers. The Hospitals segment dominates the North America intraoperative imaging market in 2025, due to the widespread installation of high-end imaging systems in operating rooms of tertiary care and multi-specialty hospitals. Their higher patient volumes and funding capabilities support investment in advanced intraoperative imaging technologies.

Ambulatory Surgical Centers (ASCs) and Clinics are expected to witness the fastest CAGR through 2032, driven by the growing preference for minimally invasive procedures in outpatient settings. The shift toward cost-effective, short-stay surgical solutions is encouraging ASCs to adopt compact and mobile intraoperative imaging systems.

Intraoperative Imaging Market Regional Analysis

- The U.S. dominates the North America Intraoperative Imaging market with the largest revenue share of 82.67% in 2024, driven by the widespread adoption of advanced imaging technologies, particularly in high-acuity specialties such as neurosurgery and orthopedic procedures. The country’s robust healthcare infrastructure, high per capita healthcare expenditure, and emphasis on surgical precision contribute significantly to this leadership.

- The market growth in the U.S. is further supported by favorable reimbursement policies for intraoperative imaging procedures, strong clinical evidence supporting their efficacy, and increasing investments in operating room modernization projects across hospitals and academic medical centers.

- Additionally, the presence of global market leaders such as GE HealthCare, Medtronic, Siemens Healthineers, and Stryker Corporation in the U.S. plays a crucial role in boosting innovation, accessibility, and the early adoption of next-generation systems like intraoperative MRI and CT in both public and private hospitals.

- The growing demand for minimally invasive surgeries, particularly in neurology, spine, and trauma care, is accelerating the deployment of mobile C-arms and intraoperative ultrasound devices in outpatient surgical centers and community hospitals, thereby further strengthening the U.S. market.

Canada Intraoperative Imaging Market Insight

The Canada Intraoperative Imaging market is expected to witness steady growth throughout the forecast period, supported by increased investments in surgical infrastructure, emphasis on advanced imaging technologies, and the rising prevalence of complex neurosurgical and orthopedic procedures. Canada’s universal healthcare system and government-led funding for digital health transformation have encouraged hospitals and academic centers to adopt intraoperative CT, MRI, and mobile C-arm systems to improve surgical precision and outcomes. Further driving market growth is the increased integration of intraoperative imaging in hybrid operating rooms, particularly in large urban hospitals and teaching institutions. Collaborations with U.S.-based manufacturers, compliance with Health Canada’s stringent regulatory framework, and rising demand for minimally invasive procedures are contributing to the uptake of imaging technologies across the country. Moreover, training initiatives aimed at neurosurgeons and orthopedic specialists are fostering wider adoption and clinical confidence in real-time imaging during surgery.

Mexico Intraoperative Imaging Market Insight

The Mexico Intraoperative Imaging market is projected to grow at a healthy CAGR during the forecast period, driven by improvements in surgical capacity across private and public hospitals, increased patient access to specialized care, and rising investments in modernizing healthcare facilities. The expansion of high-end hospitals in cities like Mexico City, Monterrey, and Guadalajara is creating a demand for mobile C-arm and intraoperative ultrasound technologies that support precision-guided surgeries. Government healthcare initiatives, such as “Seguro Popular” and institutional investments in cancer and trauma care, are encouraging the gradual adoption of intraoperative imaging systems, particularly in neurology and spinal surgeries. Although high-end technologies like intraoperative MRI are currently concentrated in premium facilities, growing interest from multinational medical device companies and regional distributors is likely to expand access in the coming years. The push for improving surgical outcomes, along with better training for radiologists and surgeons, is anticipated to accelerate the intraoperative imaging market in Mexico.

Intraoperative Imaging Market Share

The Intraoperative Imaging industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens Healthineers AG (Germany/U.S. operations)

- Koninklijke Philips N.V. (Netherlands/U.S. operations)

- Medtronic plc (Ireland/U.S. operations)

- Canon Medical Systems USA, Inc. (U.S.)

- Stryker Corporation (U.S.)

- Ziehm Imaging Inc. (U.S.)

- IMRIS, Deerfield Imaging Inc. (U.S.)

- Brainlab Inc. (U.S.)

- Shimadzu Medical Systems USA (U.S.)

- Esaote North America, Inc. (U.S.)

- NeuroLogica Corp. (subsidiary of Samsung Electronics, U.S.)

- Hitachi Healthcare Americas (U.S.)

- Carestream Health, Inc. (U.S.)

- Mobius Imaging LLC (U.S.)

- CurveBeam LLC (U.S.)

- SurgicEye, Inc. (U.S.)

- United Imaging Healthcare Co., Ltd. (U.S. division)

- OrthoScan Inc. (U.S.)

- Novarad Corporation (U.S.)

Latest Developments in North America Intraoperative Imaging Market

- In February 2024, GE Healthcare announced a strategic collaboration with Biofourmis, aimed at enhancing continuity of care by enabling safe, effective, and accessible home-based healthcare, supporting patients beyond traditional hospital settings. This partnership combines the strengths of two industry leaders to scale and deliver next-generation care-at-home solutions, setting a strong foundation for the future of remote healthcare delivery

- In January 2024, Siemens Healthineers AG expanded its partnership with City Cancer Challenge (C/Can) on a global level, with the objective of supporting C/Can city projects in low- and middle-income countries. This initiative reflects Siemens Healthineers’ commitment to strengthening cancer care infrastructure globally and improving healthcare equity

- In October 2023, GE Healthcare achieved a key milestone by leading the U.S. Food and Drug Administration (FDA) list of artificial intelligence (AI)-enabled medical devices, with 58 listed 510(k) clearances or authorizations in the United States. This accomplishment highlights GE Healthcare’s leadership in driving innovation and integrating AI technology into modern medical solutions

- In November 2022, Ziehm Imaging GmbH introduced a new Indium Gallium Zinc Oxide (IGZO) flat-panel detector for intraoperative imaging at the Radiological Society of North America (RSNA) conference, offering superior image quality while minimizing radiation exposure for patients. This advancement underscores Ziehm Imaging’s focus on enhancing imaging safety and effectiveness in surgical environments

- In April 2022, SPARSH Hospital partnered with the Sita Bhateja Trust to introduce the advanced O-arm surgical imaging system and StealthStation S8 surgical navigation system, enhancing the precision and visualization in brain and spine surgeries. This collaboration marks a significant step toward elevating surgical outcomes and technological adoption in healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.