North America Iot Sensor Market

Market Size in USD Billion

CAGR :

%

USD

3.80 Billion

USD

39.27 Billion

2024

2032

USD

3.80 Billion

USD

39.27 Billion

2024

2032

| 2025 –2032 | |

| USD 3.80 Billion | |

| USD 39.27 Billion | |

|

|

|

|

IoT Sensor Market Size

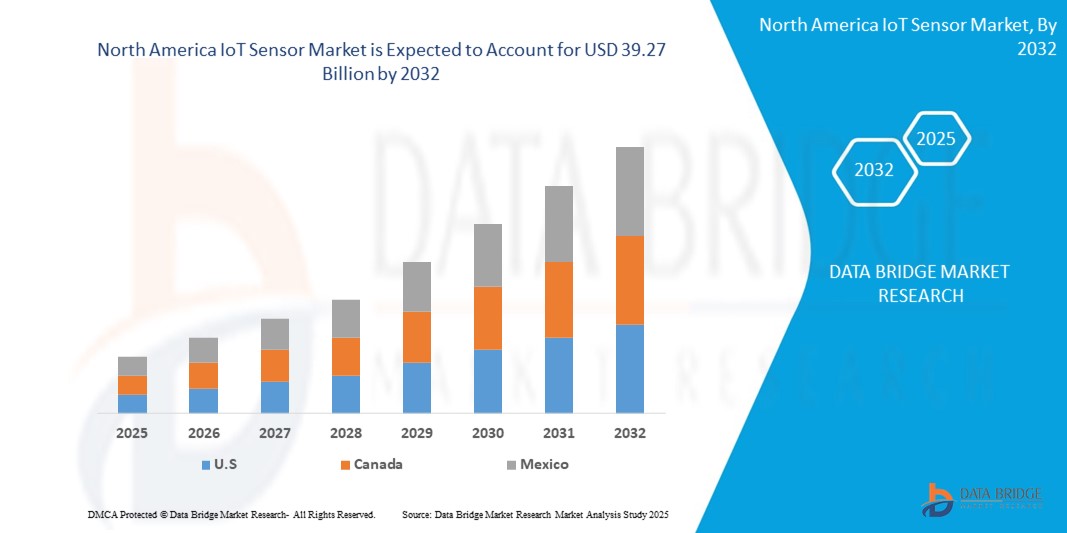

- The North America IoT Sensor Market size was valued at USD 3.8 billion in 2024 and is expected to reach USD 39.27 billion by 2032, at a CAGR of 39.6% during the forecast period[AN1]

- This growth is driven by factors such as the Rising demand for smart infrastructure, industrial automation, and supportive government initiatives

IoT Sensor Market Analysis

- The IoT sensors are considered to be one of the most vital and prepared with IoT cloud based applications. It is connected wirelessly to the mainframe system that is utilized for identification. The key purpose is to collect data and control the immediate environments through its several sensors including humidity sensors, temperature sensors and others.

- U.S. is expected to dominate the IoT Sensors market due to rise in the demand for connected and wearables devices

- Canada is expected to be the fastest growing region in the IoT Sensor Market during the forecast period due to rising awareness about eye health

- Temperature Sensors segment is expected to dominate the market with a market share of 52.16% due to its widespread use in industrial automation, smart homes, and healthcare applications.

Report Scope and IoT Sensor Market Segmentation

|

Attributes |

IoT Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

IoT Sensor Market Trends

“Increased Adoption of Smart Cities and Infrastructure”

- As cities worldwide embrace smart technology, IoT sensors are playing a crucial role in transforming urban environments into smarter, more efficient spaces. The increased adoption of smart cities is a key market trend driving growth in the IoT sensor industry. Temperature sensors are becoming essential in managing and optimizing infrastructure such as heating, cooling, and lighting systems. For instance, temperature sensors are helping regulate public transportation systems by monitoring climate control in buses and trains. This is improving comfort and energy efficiency.

- Additionally, smart streetlights equipped with IoT sensors are adjusting their brightness based on environmental factors like weather and time of day.

- For instance, In April 2023, San Antonio launched a six-month smart streetlight pilot program in collaboration with CPS Energy, AT&T, and Itron, focusing on energy savings and improved public safety. These initiatives highlight the pivotal role of IoT sensors in transforming urban environments, making them more sustainable and efficient. The growing emphasis on smart infrastructure is also evident in the increasing investments and partnerships among technology providers, municipalities, and utility companies across the region.

IoT Sensor Market Dynamics

Driver

“Rising Demand for Energy Efficiency and Sustainability”

- The growing demand for energy efficiency and sustainability is one of the major drivers behind the expansion of the IoT sensor market. As industries, businesses, and governments push for greener solutions, IoT sensors play a crucial role in managing energy use more effectively. The global focus on reducing carbon emissions, lowering energy consumption, and promoting sustainability has led to widespread IoT sensor adoption in sectors like manufacturing, transportation, and commercial real estate. These sensors allow businesses to monitor, analyze, and optimize energy usage, thereby reducing waste and improving efficiency.

- Similarly, in industrial sectors, IoT sensors optimize equipment operations and improve energy management. As the demand for sustainable solutions continues to grow, temperature sensors will be integral in helping businesses achieve their energy efficiency goals, driving the market forward.

For instance,

- In September 2022, Honeywell introduced its advanced IoT-based energy management systems to optimize heating, cooling, and lighting in large buildings, reducing energy usage and improving sustainability. Another example is Microsoft’s smart campus in Redmond, Washington, which integrates IoT sensors for real-time monitoring of energy use, reducing energy consumption by over 20% since 2020.

Opportunity

“Expansion of Industrial IoT (IIoT) Applications”

- The expansion of Industrial IoT (IIoT) applications is one of the most significant opportunities driving growth in the IoT sensor market. As industries such as manufacturing, logistics, and energy continue to digitize their operations, IIoT plays a pivotal role in improving efficiency, productivity, and safety. IoT sensors enable real-time monitoring of equipment, machinery, and processes, allowing companies to predict failures, optimize performance, and reduce downtime. The integration of IIoT also supports smart factories, enabling automation and data-driven decision-making.

- As businesses increasingly adopt these smart technologies, IIoT is becoming essential for operations across various sectors, offering substantial opportunities for growth in the IoT sensor market. The demand for more connected, efficient, and autonomous industrial processes will continue to drive market innovation and investment.

For instance,

- In January 2023, Siemens launched its MindSphere platform, enhancing IIoT capabilities for industrial customers to analyze data from connected machines, helping them improve operational efficiency and reduce energy consumption.

Restraint/Challenge

“Data Privacy and Security Concerns”

- Data privacy and security concerns are significant challenges hindering the growth of the IoT sensor market, particularly as the number of connected devices continues to rise. With more sensitive data being transmitted across networks, there are increasing risks related to data breaches, cyberattacks, and unauthorized access. As IoT sensors collect and share vast amounts of information—from personal user data to critical infrastructure metrics—ensuring the protection of this data has become a top priority for businesses and governments alike.

- These incidents highlight the need for robust security frameworks to protect IoT devices and networks. As IoT adoption grows, addressing data privacy and security challenges will be critical to ensure the continued development and trust in the market.

For instance,

- In March 2023, Amazon Web Services (AWS) launched the AWS IoT Device Defender to enhance the security of IoT devices. The platform is designed to monitor and protect IoT devices from threats by providing continuous security auditing. Despite such advancements, the threat of cyberattacks remains a major issue.

IoT Sensor Market Scope

The market is segmented on the basis sensor type, technology and vertical.

|

Segmentation |

Sub-Segmentation |

|

Sensor type |

|

|

Technology |

|

|

Vertical |

|

In 2025, the Temperature Sensors is projected to dominate the market with a largest share in segment

In 2025, the Temperature Sensors segment is projected to dominate the market, holding the largest share of 52.16%. This dominance is driven by the widespread application of temperature sensors in industries such as automotive, healthcare, and manufacturing. Temperature monitoring plays a crucial role in optimizing energy efficiency, improving system reliability, and ensuring safety across various sectors.

The Pressure Sensors is expected to account for the largest share during the forecast period in market

The Pressure Sensors segment is expected to account for the largest share of 48.25% during the forecast period in the IoT sensor market. This growth is mainly driven by their critical role in applications such as industrial automation, automotive systems, and environmental monitoring. Pressure sensors are essential for detecting fluid and gas pressure, ensuring equipment safety and operational efficiency. Their integration into smart devices and systems enhances real-time monitoring capabilities. As industries continue to automate processes, the demand for reliable pressure sensing technology is expected to rise significantly.

IoT Sensor Market Regional Analysis

“U.S. Holds the Largest Share in the IoT Sensor Market”[AN2]

- The U.S. holds the largest share in the global IoT sensor market, driven by strong technological advancements and widespread adoption of IoT solutions across industries. Key sectors such as manufacturing, healthcare, automotive, and smart cities are significantly contributing to market growth. The country’s favorable regulatory environment and heavy investment in research and development foster innovation in IoT technologies.

- Additionally, major U.S. companies like Qualcomm, Honeywell, and Cisco are leading the development and deployment of IoT sensors. Government initiatives aimed at enhancing infrastructure and energy efficiency further boost demand for IoT solutions. The rapid digitization of industries and smart city projects is expected to maintain the U.S.'s dominant market position in the coming years.

“Canada is Projected to Register the Highest CAGR in the IoT Sensor Market[AN3] ”

- Canada is projected to register the highest CAGR in the IoT sensor market, driven by increasing investments in digital transformation and smart technologies. The country is rapidly expanding its smart city initiatives, which rely heavily on IoT sensors for energy management, transportation, and infrastructure monitoring. Canada's strong push toward sustainable development and environmental monitoring has also boosted the demand for temperature, pressure, and air quality sensors. Government-backed programs and funding for industrial innovation are encouraging companies to adopt IoT solutions at a faster pace.

- Additionally, the growth of the healthcare and automotive sectors is fueling demand for advanced sensor technologies. French tech startups and established firms alike are contributing to a dynamic and competitive IoT landscape. Enhanced connectivity infrastructure, including 5G rollout, is further enabling sensor integration across various sectors. As a result, Canada is set to experience the fastest growth rate in North America’s IoT sensor market during the forecast period.

IoT Sensor Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sierra Wireless, Inc.,

- Moxa Inc.,

- GENERAL ELECTRIC,

- Skyworks Solution Inc.,

- Infineon Technologies AG,

- Honeywell International Inc.,

- Texas Instruments Incorporated,

- Siemens Healthcare GmbH,

- CANON MEDICAL SYSTEMS CORPORATION,

- NXP Semiconductors,

- STMicroelectronics,

- IBM,

- Sensata Technologies, Inc,

- Robert Bosch GmbH,

- TE Connectivity

- Qualcomm Technologies, Inc.

Latest Developments in North America IoT Sensor Market

- In March 2025, Infineon Technologies announced the launch of its PSOC™ 4 microcontroller family featuring Multi-Sense capabilities. This new offering expands Infineon's capacitive sensing technology, CAPSENSE™, by introducing proprietary inductive sensing and non-invasive liquid sensing solutions. The PSOC 4 enables innovative human-machine interface (HMI) designs, such as touch-over-metal buttons and waterproof touch sensors, catering to applications in consumer electronics and industrial automation. The PSOC 4000T series, including the PSOC 4000T and the upcoming PSOC 4100T Plus, are now available, with the latter expected to launch in Q2 2025.

- In January 2025, Honeywell and NXP Semiconductors announced an expanded collaboration to enhance building energy management. By integrating NXP's neural network-enabled processors into Honeywell's building management systems, the partnership aims to optimize energy consumption and improve sustainability in commercial buildings. The collaboration focuses on leveraging AI and machine learning to enable real-time, autonomous decision-making for energy efficiency. This initiative aligns with the growing demand for smart building solutions and supports Honeywell's commitment to advancing building automation technologies.

- In December 2024, NXP Semiconductors partnered with geo (Green Energy Options Ltd.) to launch the SeeZero home energy management system, a Matter-certified solution designed for mass-market adoption. The SeeZero system allows consumers to monitor and control their energy consumption, integrating with smart home devices to enhance energy efficiency. NXP's integrated system solutions provide the necessary connectivity, processing, and security features to support this innovative energy management platform. This collaboration underscores NXP's commitment to advancing smart energy solutions in the residential sector.

- In January 2025, GE Appliances, a Haier company, was named "Smart Appliance Company of the Year" at the IoT Breakthrough Awards. The company was recognized for integrating advanced technologies, including Generative AI, into their connected home appliances. Notably, GE Appliances introduced the CookCam™ AI, an in-oven camera that identifies the food being cooked and recommends optimal cooking settings. This innovation exemplifies GE Appliances' leadership in smart home technology and its commitment to enhancing consumer experiences through IoT-enabled solutions.

- In March 2025, Canon Medical Systems announced regulatory clearance for major AI enhancements to its Aquilion ONE / INSIGHT Edition CT scanner. The updates include the new PIQE 1024 matrix and SilverBeam technologies, expanding the device's capabilities across a broader range of clinical applications. These advancements enable high-resolution imaging and improved diagnostic accuracy, reinforcing Canon Medical Systems' position at the forefront of medical imaging technology. The cleared enhancements are now available for deployment in healthcare facilities.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Iot Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Iot Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Iot Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.