North America Lab Automation Market

Market Size in USD Billion

CAGR :

%

USD

5.27 Billion

USD

8.92 Billion

2025

2033

USD

5.27 Billion

USD

8.92 Billion

2025

2033

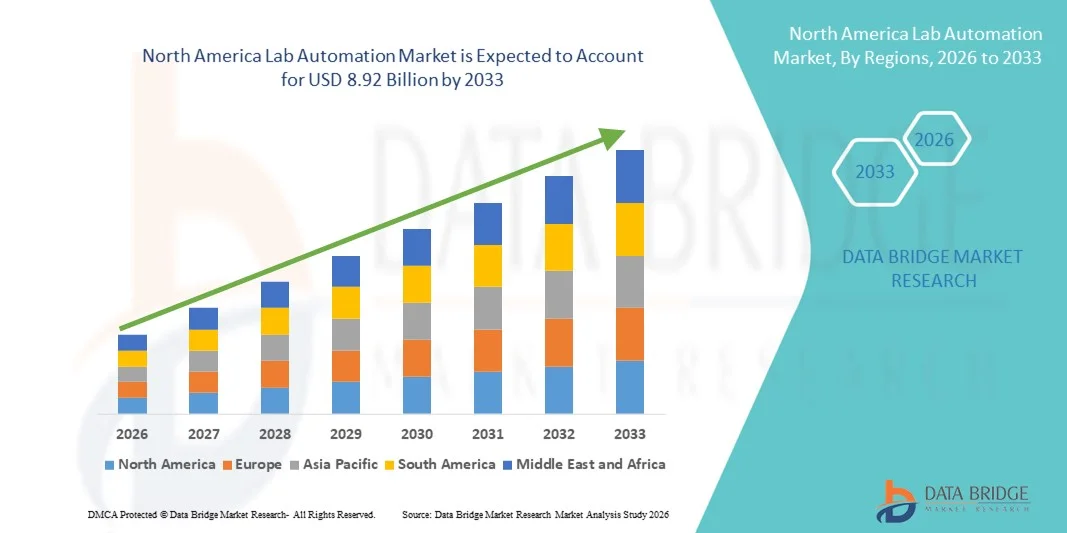

| 2026 –2033 | |

| USD 5.27 Billion | |

| USD 8.92 Billion | |

|

|

|

|

North America Lab Automation Market Size

- The North America lab automation market size was valued at USD 5.27 billion in 2025 and is expected to reach USD 8.92 billion by 2033, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by increasing investments in laboratory equipment automation, advanced robotics and software integration, and rising demand for high-throughput screening and error‑reducing workflows in biotech, clinical diagnostics, and pharmaceutical R&D settings across the U.S., Canada, and Mexico

- Furthermore, ongoing digital transformation of lab processes with AI‑enabled analysis, modular automation platforms, and workflow optimization tools is boosting demand for more efficient, reliable, and reproducible laboratory solutions. Converging technological advancement, workforce shortage mitigation, and capital spending on innovative automated platforms are accelerating the uptake of lab automation systems in North America, thereby significantly supporting industry growth

North America Lab Automation Market Analysis

- Lab automation, encompassing automated analyzers, software & informatics platforms, and robotic equipment, is increasingly critical in modern laboratories across pharmaceutical, clinical, and research settings in countries such as the U.S. and Canada due to enhanced efficiency, accuracy, and seamless integration with digital lab ecosystems

- The growing demand for lab automation is primarily driven by the need for high-throughput processing, reduced human error, faster turnaround times, and the rising adoption of AI, IoT-enabled systems, and cloud-based laboratory information management tools

- The U.S. dominated the North America lab automation market with the largest revenue share of 75.8% in 2025, supported by early adoption of advanced laboratory technologies, significant R&D investments, and a strong presence of key market players

- Canada is expected to witness steady growth during the forecast period due to increased investment in clinical diagnostics, biotechnology research, and adoption of advanced laboratory solutions in hospitals and research institutions

- Analyzers segment dominated the North America lab automation market with a share of 42.7% in 2025, driven by their ability to improve throughput, ensure reproducibility, and integrate efficiently into both modular and total lab automation workflows

Report Scope and North America Lab Automation Market Segmentation

|

Attributes |

North America Lab Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Lab Automation Market Trends

Enhanced Efficiency Through AI and Integrated Workflows

- A significant and accelerating trend in the North America lab automation market is the deepening integration of artificial intelligence (AI) with automated analyzers, modular systems, and software & informatics platforms, enhancing lab efficiency and workflow optimization across pharmaceutical, clinical, and research laboratories

- For instance, Thermo Fisher Scientific’s automated liquid handling platforms integrate AI-enabled scheduling and predictive maintenance to optimize throughput and reduce human error

- AI integration in lab automation enables features such as predictive analysis for sample processing, anomaly detection in assay results, and intelligent scheduling of robotic workflows. For instance, Hamilton Company’s STARlet systems utilize AI to improve pipetting accuracy over time and can alert operators to irregular workflow patterns

- The seamless integration of lab automation systems with digital platforms and laboratory information management systems (LIMS) facilitates centralized control over multiple instruments, enabling labs to monitor and manage workflows, sample tracking, and data analysis from a single interface

- This trend toward more intelligent, integrated, and connected laboratory solutions is reshaping expectations for productivity and reproducibility. Consequently, companies such as Beckman Coulter are developing AI-enabled automated analyzers capable of predictive maintenance and integration with multiple lab instruments

- The demand for lab automation solutions that offer AI and workflow integration is growing rapidly across pharmaceutical, biotechnology, and clinical diagnostic labs, as organizations increasingly prioritize efficiency, accuracy, and operational scalability

- The rising emphasis on reproducibility and standardization in clinical and research laboratories is further driving adoption of integrated lab automation systems that ensure consistent, high-quality results

North America Lab Automation Market Dynamics

Driver

Growing Need Due to Increasing R&D Activities and Operational Efficiency

- The rising volume of drug discovery, clinical diagnostics, and genomic research activities, combined with the demand for faster, more reliable lab results, is a significant driver for the growing adoption of lab automation systems

- For instance, in March 2025, PerkinElmer launched an AI-enabled modular automation platform to accelerate high-throughput screening in pharmaceutical research, aiming to improve operational efficiency

- As labs face pressure to reduce errors, optimize resource usage, and process larger sample volumes, lab automation offers precise, reproducible, and high-throughput capabilities compared to manual workflows

- Furthermore, the integration of automated analyzers, software & informatics platforms, and modular systems enables seamless lab operations, supporting the growing trend toward centralized and connected laboratory environments

- The ability to track samples, automate repetitive tasks, and manage workflows digitally, along with scalable solutions for both small and large laboratories, is propelling the adoption of lab automation systems in pharmaceutical, biotechnology, and clinical diagnostics sectors

- For instance, Labcyte Echo liquid handling systems improve assay throughput and minimize reagent waste, supporting sustainability goals in R&D labs

- Increasing government and private funding for genomics, proteomics, and personalized medicine research is creating new growth opportunities for automated laboratory solutions across North America

- Rising collaborations between instrument manufacturers and pharmaceutical companies for end-to-end automated workflows are driving adoption of integrated lab automation platforms

Restraint/Challenge

High Initial Investment and Integration Complexity

- The relatively high cost of automated laboratory systems, combined with the complexity of integrating multiple instruments, poses a significant challenge to market adoption, especially for small and mid-sized laboratories

- For instance, laboratories seeking total lab automation solutions often face substantial upfront capital expenditure and require skilled personnel to manage implementation and maintenance

- In addition, concerns around software compatibility, data integration across instruments, and system calibration can slow down deployment and discourage some institutions from investing in advanced automation

- While the ROI of automated systems is strong over time, the initial financial and operational burden can be a barrier, particularly for academic and smaller clinical labs

- Overcoming these challenges through modular solutions, scalable platforms, staff training, and vendor-supported integration services will be crucial for broader adoption and sustained growth of lab automation in North America

- For instance, smaller hospitals may defer adopting advanced robotics due to limited IT infrastructure or technical expertise required for seamless integration

- Stringent regulatory compliance and validation requirements in clinical and pharmaceutical labs can increase implementation time and cost, limiting rapid deployment of new automated systems

- Resistance to change among laboratory personnel accustomed to manual workflows can slow adoption, necessitating extensive training and change management strategies to realize the full benefits of automation

North America Lab Automation Market Scope

The market is segmented on the basis of product type, automation type, application, and end users.

- By Product Type

On the basis of product type, the North America lab automation market is segmented into equipment, software & informatics, and analyzers. The Analyzers segment dominated the market with the largest revenue share of 42.7% in 2025, driven by their critical role in clinical diagnostics, drug discovery, and bioanalysis workflows. Analyzers provide precise, high-throughput sample processing, ensuring reproducibility and accuracy, which is particularly essential in pharmaceutical R&D and hospital laboratories. Their integration with laboratory information management systems (LIMS) allows centralized monitoring and automated reporting of results. In addition, analyzers support diverse laboratory workflows, including genomics, proteomics, and analytical chemistry, making them versatile tools for research and diagnostics. Continuous innovation and miniaturization have also enhanced their adoption, with AI-enabled analyzers offering predictive maintenance and error detection.

The Software & Informatics segment is expected to witness the fastest growth during 2026–2033, fueled by rising demand for cloud-based laboratory management, AI-driven workflow optimization, and real-time data analytics. Software solutions enable centralized control of multiple instruments, automate repetitive tasks, and facilitate regulatory compliance through digital recordkeeping. The growing trend toward connected laboratories and remote monitoring further accelerates the adoption of informatics platforms. Research institutions and pharmaceutical companies increasingly leverage software to manage complex experiments, integrate robotic systems, and analyze large-scale datasets. Moreover, as labs adopt modular and total lab automation solutions, software platforms are becoming indispensable for seamless workflow coordination and efficiency improvement.

- By Automation Type

On the basis of automation type, the market is segmented into modular automation and total lab automation. The Modular Automation segment dominated the market in 2025, attributed to its flexibility and adaptability in existing laboratory setups. Modular systems allow laboratories to implement automation in phases, integrating specific instruments such as liquid handlers, analyzers, or sample preparation modules without requiring a full-scale overhaul. This approach reduces upfront capital expenditure and enables incremental scaling of operations. In addition, modular automation supports diverse workflows, from clinical diagnostics to genomics and proteomics research, making it suitable for both small and large laboratories. Laboratories also benefit from improved reproducibility, minimized human error, and streamlined data management through modular integration.

Total Lab Automation is expected to witness the fastest growth during the forecast period, driven by increasing adoption in large pharmaceutical companies, hospitals, and biotechnology research centers. Total lab automation offers end-to-end integration of all laboratory processes, including sample handling, processing, and data analysis, ensuring maximum efficiency and throughput. Organizations pursuing high-throughput screening and complex drug discovery projects increasingly prefer total automation for its time-saving and accuracy-enhancing capabilities. Moreover, advancements in AI and robotics are enhancing total lab automation solutions, enabling predictive maintenance, real-time workflow optimization, and improved resource utilization. Growing investments in R&D and personalized medicine further accelerate demand for fully integrated lab automation platforms.

- By Application

On the basis of application, the market is segmented into drug discovery, clinical diagnostics, genomics solutions, proteomics solutions, bio analysis, protein engineering, lyophilization, system biology, analytical chemistry, and others. The Clinical Diagnostics segment dominated the North America market in 2025, supported by the increasing demand for rapid, accurate testing in hospitals and diagnostic laboratories. Automated clinical diagnostic systems streamline sample handling, minimize human error, and provide faster turnaround times, which is critical for patient care. Integration with LIMS and AI-enabled analyzers further improves efficiency, traceability, and compliance with regulatory standards. Hospitals and clinical labs prioritize automation in high-volume testing scenarios, such as immunoassays, hematology, and molecular diagnostics. The segment also benefits from growing healthcare infrastructure and the rising prevalence of chronic diseases requiring regular diagnostic monitoring.

The Genomics Solutions segment is expected to witness the fastest growth from 2026 to 2033, driven by rising investments in personalized medicine, next-generation sequencing, and precision therapies. Automated genomics platforms reduce manual intervention, enhance reproducibility, and accelerate processing of high-throughput sequencing and sample preparation workflows. Pharmaceutical and biotechnology companies increasingly adopt genomics solutions to support drug discovery, biomarker identification, and clinical research. AI-enabled genomic automation enables predictive analysis, data interpretation, and integration of large datasets for research insights. In addition, government and private funding initiatives for genomics research in the U.S. and Canada are boosting adoption, particularly in academic and corporate laboratories focused on advanced therapeutics.

- By End Users

On the basis of end users, the market is segmented into biotechnology & pharmaceuticals, hospitals & laboratories, research and academic institutions, and others. The Biotechnology & Pharmaceuticals segment dominated the market in 2025, owing to the sector’s reliance on high-throughput automated solutions for drug discovery, bioanalysis, proteomics, and genomics research. Automation reduces manual errors, enhances reproducibility, and accelerates R&D timelines, which is critical in a highly competitive industry. Biopharmaceutical companies also leverage automation for regulatory compliance, efficient resource utilization, and integration with analytical and informatics systems. Strategic collaborations with instrument and software manufacturers further support adoption of advanced automation platforms.

The Research and Academic Institutions segment is expected to witness the fastest growth during the forecast period, driven by increasing funding for advanced research, adoption of automated workflows to enhance reproducibility, and growing interest in interdisciplinary studies such as system biology, analytical chemistry, and protein engineering. Automated solutions enable institutions to conduct large-scale experiments efficiently, integrate robotics with informatics platforms, and train students in advanced laboratory techniques. In addition, adoption is rising in genomics and proteomics labs due to the growing need for high-throughput sample processing and accurate data analysis in translational and personalized research.

North America Lab Automation Market Regional Analysis

- The U.S. dominated the North America lab automation market with the largest revenue share of 75.8% in 2025, supported by early adoption of advanced laboratory technologies, significant R&D investments, and a strong presence of key market players

- Organizations in the region highly value the efficiency, accuracy, and reproducibility offered by lab automation solutions, including automated analyzers, modular systems, and software & informatics platforms, which streamline workflows and reduce manual errors

- This widespread adoption is further supported by well-established healthcare and research infrastructure, high funding for drug discovery and genomics research, and increasing demand for high-throughput and integrated laboratory solutions, making lab automation the preferred choice for both research institutions and commercial laboratories

The U.S. Lab Automation Market Insight

The U.S. lab automation market captured the largest revenue share of 75.8% in 2025 within North America, fueled by early adoption of advanced laboratory technologies and high R&D investments across pharmaceutical, biotechnology, and clinical diagnostics sectors. Organizations increasingly prioritize efficiency, reproducibility, and high-throughput capabilities offered by automated analyzers, modular systems, and software & informatics platforms. The growing trend of integrating AI-enabled systems and LIMS platforms enhances workflow optimization and reduces human error, further propelling the market. In addition, the U.S. benefits from strong healthcare and research infrastructure, robust funding for genomics and drug discovery, and a technologically skilled workforce, all supporting market expansion.

Canada Lab Automation Market Insight

The Canada lab automation market is witnessing steady growth, driven by increasing investment in clinical diagnostics, biotechnology research, and adoption of advanced laboratory solutions in hospitals and research institutions. Automated systems are highly valued for improving efficiency, reproducibility, and data accuracy, particularly in genomics and proteomics workflows. The country’s government initiatives supporting innovation and research infrastructure are further facilitating adoption. Integration of modular and total lab automation platforms, along with AI-enabled workflow management, is becoming increasingly common in academic and commercial laboratories. Rising awareness of the benefits of automation in reducing operational costs and turnaround time is also contributing to market expansion.

Mexico Lab Automation Market Insight

The Mexico lab automation market is growing steadily, supported by increasing investment in healthcare, diagnostics, and biotechnology research. Automated analyzers and modular systems are being adopted in hospitals, clinical laboratories, and academic research institutions to improve workflow efficiency, reduce human error, and enhance reproducibility. Government initiatives to modernize laboratories and improve healthcare infrastructure are driving adoption. In addition, the rising presence of multinational pharmaceutical and biotechnology companies is promoting the use of advanced lab automation solutions. Cost-effective automation platforms and local training programs are helping smaller laboratories implement automated workflows. For instance, institutions are integrating robotic liquid handling systems and software platforms to streamline sample processing and analytical workflows.

North America Lab Automation Market Share

The North America Lab Automation industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Opentrons Labworks Inc. (U.S.)

- BioMicroLab (U.S.)

- Biosero, Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Hamilton Company (U.S.)

- PerkinElmer, Inc. (U.S.)

- QIAGEN (Netherlands)

- Eppendorf North America (U.S.)

- Molecular Devices (U.S.)

- Hudson Robotics (U.S.)

- Aurora Biomed Inc. (U.S.)

- AutoGen, Inc. (U.S.)

- BioTek Instruments, Inc. (U.S.)

- Curiox Biosystems (U.S.)

- Sirius Automation (U.S.)

- HighRes Biosolutions, Inc. (U.S.)

- Labcyte, Inc. (U.S.)

- Tomtec Systems, Inc. (U.S.)

What are the Recent Developments in North America Lab Automation Market?

- In February 2026, Agilent Technologies again presented next‑generation automated solutions at SLAS2026, demonstrating expanded automation ecosystems that integrate imaging, AI‑powered optimization, robotics, and software to accelerate discovery in research labs

- In January 2025, Trilobio introduced a whole‑laboratory automation platform at the SLAS2025 conference, showcasing an integrated robotics, equipment, and software system that lets biologists quickly automate research workflows and significantly increase throughput and data reproducibility

- In January 2025, Agilent Technologies showcased new automated laboratory workflow solutions at the SLAS2025 International Conference & Exhibition, highlighting enhancements in sample prep, auto dilution, and delivery automation that drive improved lab performance and reproducibility

- In September 2025, E Tech Group announced it will debut its vendor‑neutral Laboratory Automation and Industrial Robotics (LAIR) orchestration platform at the ISPE Boston Area Product Show, designed to connect lab instruments, robotics, and enterprise systems into scalable automated workflows that improve throughput and compliance

- In July 2025, MilliporeSigma (Merck’s U.S. & Canada life science business) launched the AAW™ Automated Assay Workstation, a plug‑and‑play automation solution powered by Opentrons that reduces hands‑on time and ensures consistent results across diverse lab experiments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.