North America Lightweight Metals Market

Market Size in USD Billion

CAGR :

%

USD

65.22 Billion

USD

602.59 Billion

2024

2052

USD

65.22 Billion

USD

602.59 Billion

2024

2052

| 2025 –2052 | |

| USD 65.22 Billion | |

| USD 602.59 Billion | |

|

|

|

|

North America Lightweight Metals Market Size

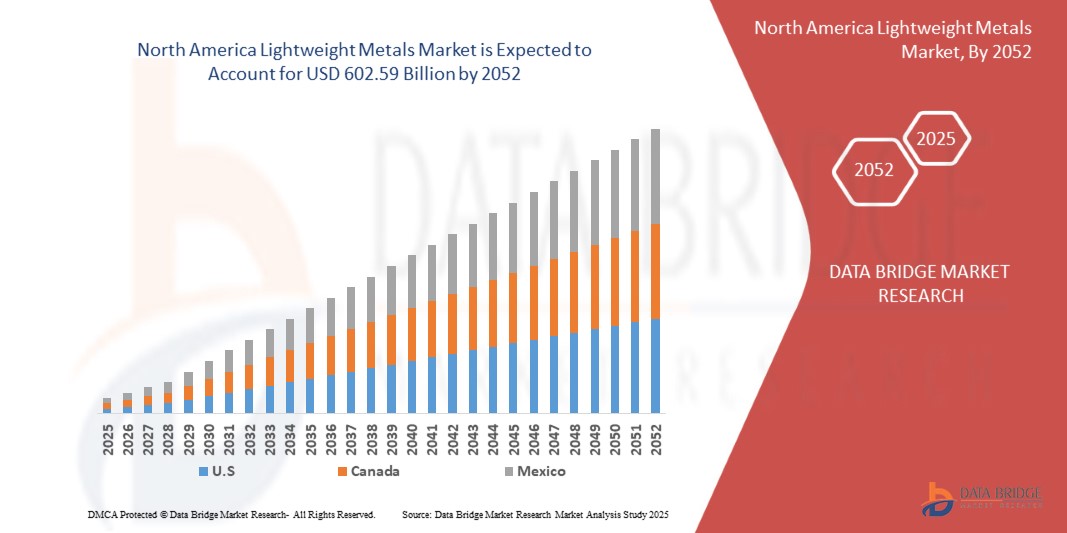

- The North America Lightweight Metals Market size was valued at USD 65.22 billion in 2024 and is expected to reach USD 602.59 billion by 2052, at a CAGR of 8.3% during the forecast period

- The market growth is largely fueled by the rising demand in automotive and aerospace sectors

- Furthermore, lightweight metals growing adoption in consumer durables and appliances. These converging factors are accelerating the uptake of lightweight metals solutions, thereby significantly boosting the industry's growth

North America Lightweight Metals Market Analysis

- Lightweight metals are gaining prominence due to their essential role in industries such as automotive, aerospace, construction, and consumer electronics, where reducing component weight is crucial for enhancing fuel efficiency, performance, and sustainability.

- The growing emphasis on fuel efficiency, carbon emission regulations, and the North America shift towards Electric Vehicles (EVs) is significantly driving the demand for lightweight metals such as aluminum, magnesium, and titanium. Additionally, advancements in metallurgy and metal processing technologies are enabling the production of stronger, lighter, and more corrosion-resistant materials.

- U.S. is expected to dominate the North America Lightweight Metals Market, holding the largest revenue share of 50.56% in 2025, attributed to the robust aerospace and automotive industries, increasing adoption of electric vehicles, strong manufacturing infrastructure, and continuous investments in advanced material technologies across the U.S., Canada, and Mexico.

- U.S. is projected to be the fastest-growing region in the market during the forecast period, driven by stringent environmental regulations promoting light weighting, rising production of electric and hybrid vehicles, and a strong focus on sustainability and green manufacturing practices.

- The aluminum and aluminum alloy segment is expected to dominate the North America Lightweight Metals Market, with a market share of 53.95% in 2025, owing to its versatility, recyclability, and wide usage across multiple sectors including automotive, packaging, aerospace, and construction, further supported by growing North America demand for sustainable and energy-efficient solutions.

Report Scope and North America Lightweight Metals Market Segmentation

|

Attributes |

Lightweight Metals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Lightweight Metals Market Trends

Rising Demand in the Automotive and Aerospace Sectors

- A major driving force behind the North America Lightweight Metals Market is the increasing push for fuel efficiency, emission reduction, and performance optimization, particularly in the automotive and aerospace industries, driven by environmental concerns and regulatory mandates across regions

- For instance, In May 2021, researchers Jovan Tan and Seeram Ramakrishna published a comprehensive review highlighting magnesium’s engineering appeal, citing its lightweight nature, high strength-to-weight ratio, and excellent machinability. These features make it ideal for automotive and aerospace applications focused on energy efficiency and emission reduction

- In the automotive sector, the transition toward Electric Vehicles (EVs) has significantly increased demand for lightweight metals. Automakers are now incorporating aluminum body panels, magnesium structural parts, and metal alloys in critical components like chassis, frames, and suspension systems to offset battery weight and extend vehicle range

- Meanwhile, the aerospace industry continues to adopt advanced aluminum-lithium alloys and titanium components to reduce takeoff weight, improve fuel economy, and extend the operational life of aircraft. With global air travel and EV production on the rise, lightweight metals are expected to remain in high demand

- According to a press release by Industry Outlook Manufacturing, aluminum and magnesium are being rapidly adopted in vehicle design, offering a 6–8% improvement in fuel economy for every 10% reduction in vehicle weight. Their affordability and structural performance make them especially well-suited for EVs over traditional steel

- The rising demand from automotive and aerospace sectors, coupled with advancements in additive manufacturing and metal alloy innovation, is accelerating the adoption of lightweight metals globally. As industries prioritize sustainable mobility and next-gen aircraft, the role of aluminum, magnesium, and titanium continues to expand across both traditional and emerging applications

North America Lightweight Metals Market Dynamics

Driver

Growing Adoption of Consumer Durables and Appliances

- The increasing demand for lightweight metals is significantly driven by the rising consumer preference for energy-efficient, durable, and lightweight appliances, which align with sustainability goals and performance expectations in the consumer durables sector.

- For instance, a blog post by the International Magnesium Association emphasized the growing demand for compact, transportable devices, with magnesium alloys increasingly replacing plastics. Magnesium offers a comparable lightness with significantly greater strength, superior heat transfer, and shielding from electromagnetic and radio frequency interference, making it ideal for modern appliances.

- Lightweight metals like aluminum and magnesium are widely used in refrigerators, washing machines, air conditioners, and cooking appliances due to their corrosion resistance, enhanced thermal management, and design flexibility. These benefits facilitate easier transportation and installation while reducing overall shipping costs and carbon emissions.

- In a blog post by Magnum Australia, magnesium and other lightweight alloys were cited as superior alternatives to plastics, thanks to their strength, heat dissipation, and electromagnetic shielding. Sony’s November 2023 application of magnesium in the internal structure of its FE 300mm F2.8 GM OSS lens further underscores the metal’s growing role in advanced consumer electronics.

- Additionally, Bleno highlighted aluminum’s rising popularity in modern kitchen cabinetry, where it is favored for its sleek appearance, strength, and corrosion resistance. These attributes make it an ideal material for contemporary kitchen designs that demand a combination of aesthetics and functionality.

- Beyond appliances, titanium alloys are also seeing increased adoption in biomedical equipment, as noted in a December 2023 article published by the National Library of Medicine. The material’s excellent biocompatibility, strength, and corrosion resistance have driven its use in orthopedic implants, dental devices, and cardiovascular applications, with production technologies often overlapping those in the high-end consumer durable market.

- The growing adoption of aluminum and magnesium in appliances is further supported by regulatory initiatives and voluntary standards like ENERGY STAR, which push manufacturers to meet higher efficiency benchmarks. As R&D in alloy development and design innovation continues, lightweight metals are becoming integral to creating appliances that meet both consumer demands and environmental standards, reinforcing their role in the sustained growth of the North America Lightweight Metals Market.

Opportunity

Advancements in Recycling and Green Metal Production

- The rising focus on sustainability and circular economy is driving demand for lightweight metals produced through low-emission methods and closed-loop recycling systems.

- Advanced technologies—like AI-driven alloy sorting, solar-powered smelting, and dross recovery—are enabling the production of high-purity recycled aluminum and magnesium for use in automotive, aerospace, and construction sectors

- Governments and corporations are supporting green metal initiatives through policy incentives, ESG-focused procurement, and investments in low-carbon infrastructure.

- In 2024, Emirates Global Aluminium (EGA) became the first to produce aluminum commercially using solar power (CelestiAL), significantly cutting emissions tied to traditional smelting processes

- In Feb 2025, research published in Resources, Conservation & Recycling introduced a CNN-based system with SIFT and HOG features for classifying aluminum alloy scrap with over 90% accuracy, improving recycling efficiency

- The EU-backed RAD4AL project developed Europe’s first radiation-curing aluminum coil coating line, eliminating natural gas ovens and VOC solvents, drastically improving energy efficiency and reducing emissions

Restraint/Challenge

High Production and Processing Costs

- The high production and processing costs associated with the manufacturing of Lightweight Metals, including aluminum, titanium, and magnesium, present a significant barrier to regional market expansion. These metals require energy-intensive extraction and refinement methods, such as high-temperature smelting, electrolysis, and vacuum distillation, all of which demand advanced infrastructure and substantial capital investment.

- For instance, in December 2023, a study titled "Titanium: High Performance, High Cost—Barriers and Challenges to Widespread Use" by researchers at CNR-STEMS, Italy, highlighted the Kroll process as a major contributor to titanium's high production cost. The study identified the numerous extraction steps, titanium’s reactivity with oxygen and nitrogen, and poor machinability due to low thermal conductivity as the primary cost drivers.

- Additionally, a February 2023 MDPI study explored the limitations of the Kroll process, emphasizing that producing just 1 kg of titanium requires approximately 257.78 megajoules of energy. Despite being the industry standard, the inefficiency and energy demands of the Kroll process severely hinder the scalability and affordability of titanium production.

- The complexity of producing lightweight metals, particularly in sectors like aerospace and automotive, also necessitates strict quality control and precision machining, increasing labor costs and process time. These factors deter smaller manufacturers and emerging economies from entering the market and limit the widespread adoption of these metals in cost-sensitive applications.

- While ongoing R&D into recycling technologies, alloy optimization, and manufacturing efficiency is promising, current energy and cost constraints continue to reduce competitiveness, discourage investment, and restrict market penetration—especially in regions with unstable or expensive energy supplies.

- Until cost-effective, scalable alternatives to processes like Hall–Heroult for aluminum and Kroll for titanium become commercially viable, the high cost structure will remain a central restraint on the North America Lightweight Metals Market. Overcoming these challenges will be essential to unlocking broader adoption across diverse end-use industries.

North America Lightweight Metals Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the market is segmented into aluminum and aluminum alloy, titanium and titanium alloys, magnesium and magnesium alloy, beryllium and beryllium alloy, steel and steel alloys, others. In 2025, the aluminum and aluminum alloy segment will dominate the market with a market share of 53.95% driven by its widespread use across automotive, aerospace, packaging, and construction industries. Key factors include aluminum’s lightweight nature, corrosion resistance, high recyclability, and adaptability for energy-efficient and sustainable applications.

The aluminum and aluminum alloy segment is anticipated to witness the fastest growth rate of 8.5% from 2025 to 2052, fueled by its increasing adoption in aerospace, medical implants, and defense due to high strength-to-weight ratio, biocompatibility, and superior resistance to extreme environments.

- By Application

On the basis of application, the market is segmented into automotive & transportation, aerospace & defense, agriculture, electronics & consumer goods, marine and others. The automotive & transportation segment is expected to hold the largest market revenue share of 39.26% in 2025, driven by the widespread adoption of lightweight metals to enhance fuel efficiency, reduce emissions, and meet stringent regulatory standards. The growing shift toward electric vehicles (EVs) and increased use of materials like aluminum and magnesium in body structures and powertrain components have further propelled segment growth.

The automotive & transportation segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2052, driven by the rising demand for next-generation aircraft, increased military modernization efforts, and the use of titanium and aluminum-lithium alloys to reduce aircraft weight, enhance performance, and improve fuel efficiency.

North America Lightweight Metals Market Regional Analysis

- North America is the largest market for lightweight metals, holding a substantial revenue share in 2025 and is projected to grow at a robust CAGR of 8.3% from 2025 to 2052. The region's growth is driven by stringent emissions regulations, growing adoption of electric mobility, and increased investments in lightweight technologies across the automotive, aerospace, and consumer goods sectors.

- North America benefits from strong policy frameworks like the North American Green Deal and Fit for 55 package, which encourage vehicle light weighting and energy efficiency. Moreover, collaborations between OEMs and material science innovators, as well as government-supported R&D programs, are fueling technological advancements in aluminum, titanium, and magnesium applications.

- Countries such as U.S., Canada, and the Mexico lead the region with large-scale adoption of lightweight materials across key industries and robust manufacturing infrastructures

U.S. North America Lightweight Metals Market Insight

U.S. accounted for the largest market revenue share in North America in 2025, owing to its leadership in automotive manufacturing, strong presence of Tier-1 aerospace suppliers, and continuous investments in advanced materials R&D.

Canada North America Lightweight Metals Market Insight

Canada is expected to register a notable CAGR from 2025 to 2052, driven by the aerospace and defense sector, particularly the presence of global players like Airbus. Government-backed initiatives for green aviation, lightweight materials research, and the promotion of circular economy practices are fueling demand for high-performance alloys and composites.

Mexico North America Lightweight Metals Market Insight

Mexico is emerging as a key contributor to North America’s North America Lightweight Metals Market, supported by automotive electrification programs, sustainable material innovation hubs, and public-private partnerships. With significant funding for clean energy vehicles and defense modernization.

North America Lightweight Metals Market Share

The lightweight metals industry is primarily led by well-established companies, including:

- China Hongqiao Group Limited (China)

- Hindalco Industries Ltd. (India)

- thyssenkrupp Steel Europe (Germany)

- AMETEK Inc. (U.S.)

- Vedanta Limited (India)

- Kaiser Aluminum (U.S.)

- Alcoa Corporation (U.S.)

- Precision Castparts Corp. (U.S.)

Nucor (U.S.) - US Magnesium LLC (U.S.)

- ATI, Inc. (U.S.)

- Vulcan, Inc. (U.S.)

- Materion Corporation (U.S.)

- Clinton Aluminum (U.S.)

- Metalwerks (U.S.)

- TW Metals, LLC. (U.S.)

- DWA Aluminum Composites USA, Inc. (U.S.)

- Rio Tinto (UK/Australia)

- Norsk Hydro ASA (Norway)

- Constellium (France)

- ArcelorMittal (Luxembourg)

Latest Developments in North America Lightweight Metals Market

- In January 2025, the Alumina Second Branch at Hongqiao has implemented advanced testing protocols to significantly enhance both the quality and efficiency of its production processes. The initiative focuses on stricter quality controls, faster data analysis, and improved equipment calibration. As a result, the branch has achieved greater consistency in product standards and minimized defects. This move reflects Hongqiao’s commitment to high performance, operational safety, and customer satisfaction. Continuous training and upgraded lab facilities are also key contributors to this improvement

- In June 2025, Hindalco acquired U.S.-based AluChem Companies, Inc. for USD 125 million through its subsidiary, Aditya Holdings LLC. AluChem, a producer of high-purity alumina, adds strategic value to Hindalco’s global expansion in the high-tech alumina segment. This move strengthens Hindalco’s focus on value-added products, supported by the strong growth and profitability of its existing specialty alumina business

- In October 2024, thyssenkrupp Steel advanced its bluemint Steel, producing low-CO₂ steel using scrap in blast furnaces. This helps both the company and its customers reduce carbon footprints. High-performance, ultra-high-strength steels are also being developed, enabling lighter, safer vehicles with better fuel efficiency and performance

- In July 2025, Tata Group Chairman N. Chandrasekaran marked the groundbreaking of Tata Steel UK's new Electric Arc Furnace (EAF) in Port Talbot. This USD 2.25 billion green steel project, backed by GBP 500 million from the UK Government, aims to reduce carbon emissions by 90% and secure 5,000 jobs. The EAF will be one of the world’s largest, producing 3 million tonnes of low-carbon steel annually. The initiative marks a major step in Tata’s decarbonisation and UK industrial transformation strategy

- In April 2024, Vedanta Aluminium hosted the Auto-Edge conclave to promote the use of aluminium in the automotive industry. The event brought together leading automotive companies to discuss the future of mobility and the role of lightweight metals. Vedanta showcased its diverse range of products, including aluminium alloys for vehicle manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 VALUE CHAIN ANALYSIS: NORTH AMERICA LIGHTWEIGHT METALS MARKET

4.3.1 PROCUREMENT:

4.3.2 MANUFACTURING:

4.3.3 MARKETING & DISTRIBUTION:

4.4 VENDOR SELECTION CRITERIA

4.4.1 QUALITY AND CONSISTENCY OF SUPPLY

4.4.2 RELIABILITY AND TIMELINESS

4.4.3 COST COMPETITIVENESS

4.4.4 TECHNICAL CAPABILITY AND INNOVATION

4.4.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.4.6 FINANCIAL STABILITY

4.4.7 CUSTOMER SERVICE AND SUPPORT

4.5 BRAND OUTLOOK

4.5.1 BRAND COMPETITIVE ANALYSIS OF THE NORTH AMERICA LIGHTWEIGHT METALS MARKET

4.5.2 PRODUCT VS BRAND OVERVIEW

4.5.3 PRODUCT OVERVIEW

4.5.4 BRAND OVERVIEW

4.5.5 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIALS

4.7.2 ENERGY CONSUMPTION

4.7.3 LABOR AND OPERATIONAL COSTS

4.7.4 RESEARCH AND DEVELOPMENT

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM-SIZE COMPANIES

4.8.3 END USERS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.10.4 ANALYST RECOMMENDATIONS

4.11 CONSUMER BUYING BEHAVIOUR

4.12 PROFIT MARGINS SCENARIO

4.12.1 MARGIN RANGE BY PRODUCT TYPE

4.12.2 KEY FACTORS INFLUENCING MARGINS

4.12.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.13 RAW MATERIAL SOURCING ANALYSIS ON THE NORTH AMERICA LIGHTWEIGHT METALS MARKET

4.13.1 ALUMINUM

4.13.2 MAGNESIUM

4.13.3 TITANIUM

4.13.4 BERYLLIUM

4.13.5 CARBON AND METAL MATRIX COMPOSITES (ADDITIVES)

4.13.6 CONCLUSION

4.14 TECHNOLOGIES ADVANCEMENTS

4.14.1 OVERVIEW

4.14.2 ADVANCED ALLOY DEVELOPMENT

4.14.3 METALLURGICAL PROCESS INNOVATIONS

4.14.4 SURFACE ENGINEERING AND COATINGS

4.14.5 RECYCLING AND CIRCULAR MANUFACTURING TECHNOLOGIES

4.14.6 INTEGRATED LIGHTWEIGHT DESIGN AND SIMULATION TOOLS

4.15 TARIFFS AND THEIR IMPACT ON MARKET

4.15.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.15.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.15.3 VENDOR SELECTION CRITERIA DYNAMICS

4.15.4 IMPACT ON SUPPLY CHAIN

4.15.4.1 RAW MATERIAL PROCUREMENT

4.15.4.2 MANUFACTURING AND PRODUCTION

4.15.4.3 LOGISTICS AND DISTRIBUTION

4.15.4.4 PRICE PITCHING AND POSITION OF MARKET

4.15.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.15.5.1 SUPPLY CHAIN OPTIMIZATION

4.15.5.2 JOINT VENTURE ESTABLISHMENTS

4.15.6 IMPACT ON PRICES

4.15.7 REGULATORY INCLINATION

4.15.7.1 GEOPOLITICAL SITUATION

4.15.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.15.7.2.1 FREE TRADE AGREEMENTS

4.15.7.2.2 ALLIANCE ESTABLISHMENTS

4.15.7.2.3 STATUS ACCREDITATION (INCLUDING MFN)

4.15.7.3 DOMESTIC COURSE OF CORRECTION

4.15.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.15.7.3.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE AND AEROSPACE SECTORS

6.1.2 GROWING ADOPTION OF CONSUMER DURABLES AND APPLIANCES

6.1.3 GROWING DEMAND FOR FUEL-EFFICIENT VEHICLES GLOBALLY

6.1.4 REGULATORY INITIATIVES SUPPORTING LIGHTWEIGHT DESIGN

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PROCESSING COSTS

6.2.2 CORROS.ION SENSITIVITY AND ALLOY LIMITATIONS

6.3 OPPORTUNITIES

6.3.1 RISING PENETRATION OF ELECTRIC VEHICLES WORLDWIDE

6.3.2 ADVANCEMENTS IN RECYCLING AND GREEN METAL PRODUCTION

6.3.3 MARINE INDUSTRY SHIFTING TOWARD WEIGHT-OPTIMIZED DESIGNS

6.4 CHALLENGES

6.4.1 RAW MATERIAL AVAILABILITY AND GEOPOLITICAL DEPENDENCY

6.4.2 COMPATIBILITY ISSUES WITH TRADITIONAL MANUFACTURING EQUIPMENT

7 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 ALUMINUM AND ALUMINUM ALLOY

7.3 TITANIUM AND TITANIUM ALLOYS

7.4 MAGNESIUM AND MAGNESIUM ALLOY

7.5 STEEL AND STEEL ALLOYS

7.6 BERYLLIUM AND BERYLLIUM ALLOY

7.7 OTHERS

8 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.3 AEROSPACE & DEFENSE

8.4 ELECTRONICS & CONSUMER GOODS

8.5 MARINE

8.6 AGRICULTURE

8.7 OTHERS

9 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA LIGHTWEIGHT METALS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CHINA HONGQIAO GROUP LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 RECENT FINANCIALS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HINDALCO INDUSTRIES LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 THYSSENKRUPP STEEL EUROPE

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AMETEK INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 RECENT FINANCIALS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 VEDANTA LIMITED

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ALCOA CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT/NEWS

12.7 ARCELORMITTAL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 AMAG AUSTRIA METALL AG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 AMETEK SPECIALTY METAL PRODUCTS (AMETEK INC.)

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 ATI, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 ATLAS STEELS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS/NEWS

12.12 BAVARIA STAHL UND METALL IMPORT/EXPORT GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS/NEWS

12.13 COSTELLIUM

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 CLINTON ALUMINUM

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 CORPORATION VSMPO-AVISMA

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 DWA ALUMINUM COMPOSITES USA, INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 EMIRATES NORTH AMERICA ALUMINIUM PJSC

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 ICL

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS/NEWS

12.19 KAISER ALUMINUM

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 LUXFER HOLDINGS PLC

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

12.21 METALWERKS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS/NEWS

12.22 MATERION CORPORATION

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENTS/NEWS

12.23 MSKS IP INC.

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 NUCOR CORPORATION

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENTS

12.25 NORSK HYDRO ASA

12.25.1 COMPANY SNAPSHOT

12.25.2 PRODUCT PORTFOLIO

12.25.3 RECENT DEVELOPMENT/NEWS

12.26 PRECISION CASTPARTS CORP.

12.26.1 COMPANY SNAPSHOT

12.26.2 PRODUCT PORTFOLIO

12.26.3 RECENT DEVELOPMENT

12.27 POSCO

12.27.1 COMPANY SNAPSHOT

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENTS/NEWS

12.28 RUSAL

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENT

12.29 RIO TINTO

12.29.1 COMPANY SNAPSHOT

12.29.2 REVENUE ANALYSIS

12.29.3 PRODUCT PORTFOLIO

12.29.4 RECENT DEVELOPMENT

12.3 RELIANCE, INC.

12.30.1 COMPANY SNAPSHOT

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT

12.31 RYERSON HOLDING CORPORATION

12.31.1 COMPANY SNAPSHOT

12.31.2 REVENUE ANALYSIS

12.31.3 PRODUCT PORTFOLIO

12.31.4 RECENT DEVELOPMENTS

12.32 SCOPE METALS GROUP LTD.

12.32.1 COMPANY SNAPSHOT

12.32.2 REVENUE ANALYSIS

12.32.3 PRODUCT PORTFOLIO

12.32.4 RECENT DEVELOPMENT

12.33 SSAB

12.33.1 COMPANY SNAPSHOT

12.33.2 REVENUE ANALYSIS

12.33.3 PRODUCT PORTFOLIO

12.33.4 RECENT DEVELOPMENT

12.34 SMITHS METAL CENTRES LIMITED

12.34.1 COMPANY SNAPSHOT

12.34.2 PRODUCT PORTFOLIO

12.34.3 RECENT DEVELOPMENT

12.35 TW METALS, LLC.

12.35.1 COMPANY SNAPSHOT

12.35.2 PRODUCT PORTFOLIO

12.35.3 RECENT DEVELOPMENT

12.36 TATA STEEL

12.36.1 COMPANY SNAPSHOT

12.36.2 RECENT FINANCIALS

12.36.3 PRODUCT PORTFOLIO

12.36.4 RECENT DEVELOPMENT

12.37 THYSSENKRUPP MATERIALS NA, INC.

12.37.1 COMPANY SNAPSHOT

12.37.2 PRODUCT PORTFOLIO

12.37.3 RECENT DEVELOPMENT

12.38 TOHO TITANIUM CO., LTD.

12.38.1 COMPANY SNAPSHOT

12.38.2 REVENUE ANALYSIS

12.38.3 PRODUCT PORTFOLIO

12.38.4 RECENT DEVELOPMENT

12.39 US MAGNESIUM LLC

12.39.1 COMPANY SNAPSHOT

12.39.2 PRODUCT PORTFOLIO

12.39.3 RECENT DEVELOPMENT

12.4 VULCAN INC.

12.40.1 COMPANY SNAPSHOT

12.40.2 PRODUCT PORTFOLIO

12.40.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA ELECTRIC VEHICLE (EV) SALES AND MARKET SHARE (2023–2024)

TABLE 4 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM WELD PLATES (PER 100 PIECES)

TABLE 5 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM COVER PLATE (PER 100 PIECES)

TABLE 6 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 7 NORTH AMERICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 8 NORTH AMERICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND

TABLE 10 NORTH AMERICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 11 NORTH AMERICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 12 NORTH AMERICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 13 NORTH AMERICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 14 NORTH AMERICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 15 NORTH AMERICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 16 NORTH AMERICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 17 NORTH AMERICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 18 NORTH AMERICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 19 NORTH AMERICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 20 NORTH AMERICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 21 NORTH AMERICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 23 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 26 NORTH AMERICA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 27 NORTH AMERICA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 28 NORTH AMERICA LIGHT COMMERCIAL VEHICLES (LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 29 NORTH AMERICA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 30 NORTH AMERICA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 31 NORTH AMERICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 32 NORTH AMERICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 33 NORTH AMERICA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 34 NORTH AMERICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 35 NORTH AMERICA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 36 NORTH AMERICA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 38 NORTH AMERICA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 39 NORTH AMERICA MARINE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 40 NORTH AMERICA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 41 NORTH AMERICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 42 NORTH AMERICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 43 NORTH AMERICA OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 44 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (USD THOUSAND)

TABLE 45 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (TONS)

TABLE 46 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 47 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 48 NORTH AMERICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 49 NORTH AMERICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 50 NORTH AMERICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 51 NORTH AMERICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 52 NORTH AMERICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 53 NORTH AMERICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 54 NORTH AMERICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 55 NORTH AMERICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 56 NORTH AMERICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 57 NORTH AMERICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 58 NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 59 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 60 NORTH AMERICA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 61 NORTH AMERICA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 62 NORTH AMERICA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 63 NORTH AMERICA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 64 NORTH AMERICA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 65 NORTH AMERICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 66 NORTH AMERICA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 67 NORTH AMERICA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 68 NORTH AMERICA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 69 NORTH AMERICA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 70 NORTH AMERICA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 71 NORTH AMERICA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 72 NORTH AMERICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 73 U.S. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 74 U.S. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 75 U.S. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 76 U.S. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 77 U.S. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 78 U.S. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 79 U.S. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 80 U.S. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 81 U.S. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 82 U.S. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 83 U.S. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 84 U.S. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 85 U.S. LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 86 U.S. AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 87 U.S. PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 88 U.S. ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 89 U.S. LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 90 U.S. HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 91 U.S. TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 92 U.S. AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 93 U.S. ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 94 U.S. CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 95 U.S. PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 96 U.S. AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 97 U.S. HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 98 U.S. MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 99 U.S. AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 100 CANADA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 101 CANADA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 102 CANADA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 103 CANADA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 104 CANADA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 105 CANADA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 106 CANADA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 107 CANADA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 108 CANADA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 109 CANADA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 110 CANADA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 111 CANADA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 112 CANADA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 113 CANADA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 114 CANADA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 115 CANADA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 116 CANADA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 117 CANADA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 118 CANADA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 119 CANADA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 120 CANADA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 121 CANADA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 122 CANADA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 123 CANADA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 124 CANADA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 125 CANADA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 126 CANADA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 127 MEXICO LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 128 MEXICO LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 129 MEXICO ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 130 MEXICO ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 131 MEXICO TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 132 MEXICO TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 133 MEXICO MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 134 MEXICO MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 135 MEXICO STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 136 MEXICO STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 137 MEXICO BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 138 MEXICO BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 139 MEXICO LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 140 MEXICO AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 141 MEXICO PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 142 MEXICO ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 143 MEXICO LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 144 MEXICO HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 145 MEXICO TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 146 MEXICO AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 147 MEXICO ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 148 MEXICO CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 149 MEXICO PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 150 MEXICO AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 151 MEXICO HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 152 MEXICO MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 153 MEXICO AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA LIGHTWEIGHT METALS MARKET

FIGURE 2 NORTH AMERICA LIGHTWEIGHT METALS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIGHTWEIGHT METALS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIGHTWEIGHT METALS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIGHTWEIGHT METALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIGHTWEIGHT METALS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA LIGHTWEIGHT METALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA LIGHTWEIGHT METALS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LIGHTWEIGHT METALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 COVERAGE GRID

FIGURE 11 NORTH AMERICA LIGHTWEIGHT METALS MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SIX SEGMENTS COMPRISE THE NORTH AMERICA LIGHTWEIGHT METALS MARKET, BY TYPE

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND IN AUTOMOTIVE AND AEROSPACE SECTORS IS EXPECTED TO DRIVE THE NORTH AMERICA LIGHTWEIGHT METALS MARKET IN THE FORECAST PERIOD OF 2025 TO 2052

FIGURE 16 THE ALUMINUM AND ALUMINUM ALLOY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIGHTWEIGHT METALS MARKET IN 2025 AND 2052

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA LIGHTWEIGHT METALS MARKET

FIGURE 19 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA LIGHTWEIGHT METALS MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DROC ANALYSIS

FIGURE 22 NORTH AMERICA LIGHTWEIGHT METALS MARKET: BY TYPE, 2024

FIGURE 23 NORTH AMERICA LIGHTWEIGHT METALS MARKET: BY APPLICATION, 2024

FIGURE 24 NORTH AMERICA LIGHTWEIGHT METALS MARKET: SNAPSHOT (2024)

FIGURE 25 NORTH AMERICA LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

North America Lightweight Metals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Lightweight Metals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Lightweight Metals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.