North America Liquid Chromatography Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

11.02 Billion

2024

2032

USD

4.92 Billion

USD

11.02 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 11.02 Billion | |

|

|

|

|

Liquid Chromatography Devices Market Size

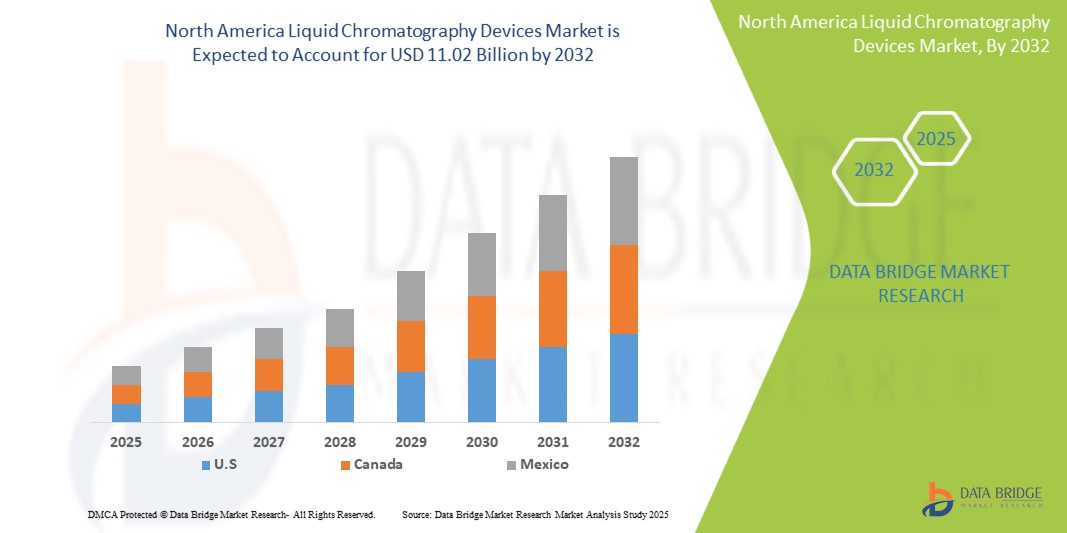

- The North America liquid chromatography devices market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 11.02 billion by 2032, at a CAGR of 10.60% during the forecast period

- This growth is driven by factors such as the increasing demand for advanced diagnostic techniques, rising prevalence of chronic diseases, technological advancements in liquid chromatography devices, expansion of research and development activities, and favorable regulatory policies and reimbursement frameworks

Liquid Chromatography Devices Market Analysis

- Liquid chromatography devices are analytical instruments used in chemical separation processes. They employ a stationary phase and a mobile phase to separate components of a liquid sample based on their differing affinities.

- This technique is crucial in various fields such as pharmaceuticals, biotechnology, environmental analysis, and food testing for accurate compound identification and quantification.

- U.S. is expected to dominate the Liquid Chromatography Devices market with 28.1% due to advanced research facilities, high demand in the pharmaceutical and biotechnology sectors, and significant investments in scientific innovation

- Canada is expected to be the fastest growing region in the Liquid Chromatography Devices market during the forecast period due to expanding healthcare and research sectors, coupled with government support for biotechnology and pharmaceutical advancements

- High-performance liquid chromatography (HPLC), segment is expected to dominate the market with a market share due to its high resolution, accuracy, and versatility. It is widely used in pharmaceuticals, biotechnology, environmental testing, and food safety analysis

Report Scope and Liquid Chromatography Devices Market Segmentation

|

Attributes |

Liquid Chromatography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Chromatography Devices Market Trends

“Integration of Automation and Robotics in Liquid Chromatography Systems”

- The North American liquid chromatography devices market is experiencing a significant trend toward automation and robotics integration

- This shift aims to enhance laboratory efficiency, reduce human errors, and improve throughput

- Automated liquid chromatography systems are increasingly being adopted in pharmaceutical and biotechnology industries to streamline processes such as sample preparation, injection, and data analysis

- For instance, Agilent Technologies has developed automated HPLC systems that offer high-throughput capabilities, catering to the growing demand for rapid and accurate analytical results

- This trend aligns with the industry's push towards operational efficiency and cost-effectiveness, positioning automation as a key driver of market growth in the region

Liquid Chromatography Devices Market Dynamics

Driver

“Increasing Demand for Pharmaceutical and Biotech Applications”

- The escalating demand for pharmaceuticals and biotechnological products is a primary driver of the North American liquid chromatography devices market

- Liquid chromatography plays a crucial role in the development and quality control of drugs, ensuring the purity and efficacy of active pharmaceutical ingredients. With the rise of biologics and personalized medicine, there is a heightened need for precise analytical techniques

- Companies such as Thermo Fisher Scientific and Waters Corporation are at the forefront, providing advanced liquid chromatography systems tailored for pharmaceutical applications

- This surge in demand underscores the pivotal role of liquid chromatography in the evolving healthcare landscape

Opportunity

“Expansion into Environmental and Food Safety Testing”

- An emerging opportunity in the North American liquid chromatography devices market lies in the expansion into environmental and food safety testing

- As regulatory standards become more stringent, there is an increasing need for accurate analytical tools to detect contaminants in water, soil, and food products

- Liquid chromatography offers high sensitivity and precision, making it ideal for environmental monitoring and food safety applications

- Companies are capitalizing on this opportunity by developing specialized systems for environmental testing

- For Instance, Agilent Technologies has introduced liquid chromatography systems designed for environmental laboratories, enabling the detection of trace pollutants in various matrices. This diversification into new application areas presents significant growth prospects for the market

Restraint/Challenge

“High Initial Investment and Operational Costs”

- A significant challenge facing the North American liquid chromatography devices market is the high initial investment and operational costs associated with these systems

- The advanced technology and precision engineering of liquid chromatography instruments contribute to their substantial price tags, making them less accessible for smaller laboratories and research institutions

- Additionally, the maintenance, calibration, and consumables required for optimal performance add to the ongoing expenses. This financial barrier can hinder the adoption of liquid chromatography technology, particularly in cost-sensitive sectors

- For instance, smaller biotech firms may find it challenging to justify the investment in such sophisticated equipment, potentially limiting their research capabilities and slowing market penetration

Liquid Chromatography Devices Market Scope

The market is segmented on the basis of product type, modularity, technique, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Modularity |

|

|

By Technique |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the High-Performance Liquid Chromatography (HPLC) is projected to dominate the market with a largest share in technique segment

The high-performance liquid chromatography (HPLC) segment is expected to dominate the Liquid Chromatography Devices market with the largest share in 2025 due to its high resolution, accuracy, and versatility. It is widely used in pharmaceuticals, biotechnology, environmental testing, and food safety analysis. HPLC systems offer a well-established technology that is reliable for a wide range of applications, ensuring its leading position in the market.

The instruments is expected to account for the largest share during the forecast period in product type market

In 2025, the instruments segment is expected to dominate the market with the largest market share of 51.31% due to the increasing demand for high-precision analytical equipment, which is critical for pharmaceutical, biotechnology, and academic research applications. Instruments such as pumps, detectors, and chromatography columns are vital for the functionality of liquid chromatography systems.

Liquid Chromatography Devices Market Regional Analysis

“U.S. Holds the Largest Share in the Liquid Chromatography Devices Market”

- The U.S. holds the largest share with 28.1% of the North American liquid chromatography devices market, driven by its advanced research infrastructure and significant investments in scientific research

- The U.S. is home to numerous leading pharmaceutical, biotechnology, and academic institutions, fostering a robust demand for analytical instruments such as liquid chromatography devices

- The country's emphasis on technological innovation and precision medicine propels the adoption of advanced chromatographic techniques across various sectors

- Stringent regulatory standards in the U.S. necessitate the use of high-quality analytical tools for compliance, further boosting market demand

- Partnerships between industry leaders, such as Waters Corporation and SCIEX, enhance the availability and advancement of liquid chromatography systems in the U.S.

“Canada is Projected to Register the Highest CAGR in the Liquid Chromatography Devices Market”

- Canada is experiencing rapid growth in the liquid chromatography devices market, attributed to its expanding biotechnology and healthcare sectors

- Increased funding in clinical diagnostics and pharmaceutical research drives the demand for advanced analytical instrument

- Government initiatives and favorable policies support the adoption of sophisticated technologies in research and healthcare applications

- Canadian universities and research institutions contribute significantly to the development and application of liquid chromatography techniques

Liquid Chromatography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Agilent Technologies, Inc. (U.S.)

- Thermo Fischer Scientific Inc (U.S.)

- PerkinElmer Inc (U.S.)

- Gilson Incorporated (U.S.)

- Hamilton Company (U.S.)

- Restek Corporation (U.S.)

- SIELC Technologies (U.S.)

- Valco Instruments Co. Inc. (U.S.)

- Waters Corporation (U.S.)

- Cytiva (U.S.)

- Bio-Rad Laboratories, Inc (U.S.)

- Hitachi High-Tech Corporation (U.S.)

- Orochem Technologies Inc (U.S.)

- Practichem (U.S.)

Latest Developments in North America Liquid Chromatography Devices Market

- In October 2024, Thermo Fisher Scientific acquired CHROMADMIN, a manufacturer of HPLC columns and accessories, to broaden its line of chromatography consumables. This acquisition aims to enhance the company's product offerings and cater to the growing demand in the pharmaceutical industry

- In March 2024, Shimadzu Corporation launched the Nexera Ultra High-Performance Liquid Chromatograph series, which incorporates artificial intelligence to detect and resolve instrumentation issues automatically

- In July 2022, PerkinElmer, Inc. launched the GC 2400 Platform, an advanced, automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) solution designed to help lab teams simplify lab operations, drive precise results, and perform more flexible monitoring

- In May 2022, Agilent Technologies signed a collaboration agreement with APC Ltd., in which the companies committed to combining their technologies to provide unique workflows to customers that support automated process analysis via liquid chromatography (LC)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.