North America Liquid Filtration Market

Market Size in USD Million

CAGR :

%

USD

588.40 Million

USD

1,045.50 Million

2024

2032

USD

588.40 Million

USD

1,045.50 Million

2024

2032

| 2025 –2032 | |

| USD 588.40 Million | |

| USD 1,045.50 Million | |

|

|

|

|

Liquid Filtration Market Size

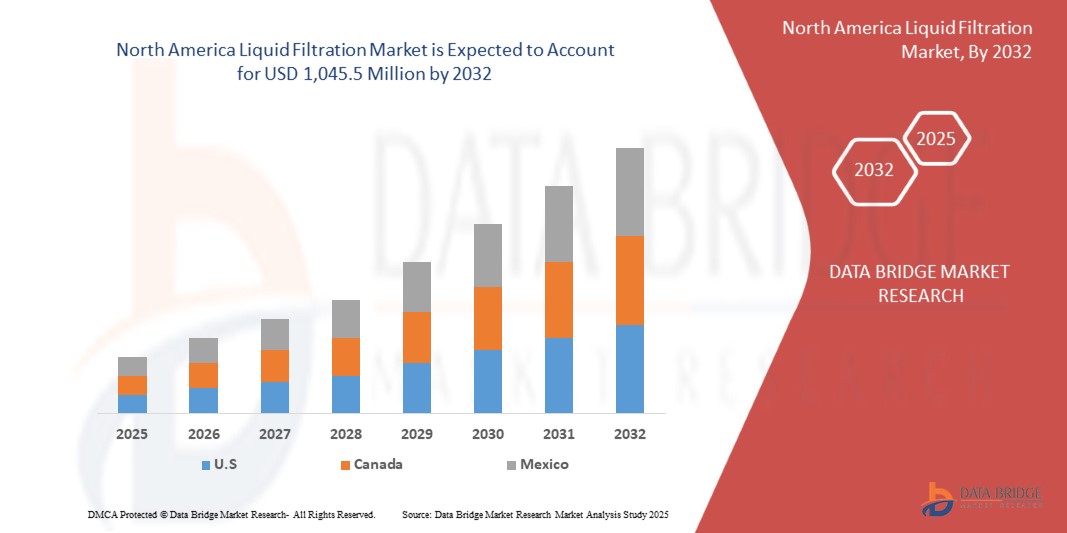

- The North America Liquid Filtration market size was valued at USD 588.4 Million in 2024 and is expected to reach USD 1,045.5 million by 2032, at a CAGR of 7.5% during the forecast period

- The primary drivers for this substantial growth include the increasing adoption and technological advancements in connected home devices and smart home technology. This trend is leading to greater digitalization in both residential and commercial environments

- Furthermore, the rising consumer preference for secure, convenient, and integrated access control solutions for their homes and businesses is establishing smart locks as the preferred modern access system. These combined factors are significantly driving the adoption and expansion of the smart lock industry

Liquid Filtration Market Analysis

- The liquid filtration is a procedure under which undesirable chemicals, suspended solids and biological contaminants are removed or separated from the fluids through a filter medium that keeps solids and allows only clean liquid to pass through it

- The factors such as rapidly increasing industrialization and urbanization are the root cause fuelling up the liquid filtration market growth rate

- U.S. dominated the Liquid Filtration market with the largest revenue share of 67.3% in 2025, characterized by robust industrialization, stringent EPA environmental regulations, and significant investments in municipal water treatment infrastructure. The country is experiencing substantial growth in liquid filtration system installations, particularly in the chemical, food and beverage, and biopharmaceutical sectors, driven by innovations in filter media technology and sustainability-focused upgrades in filtration processes

- Canada is expected to be the fastest growing country in North America Liquid Filtration market during the forecast period due to increasing industrial expansion, stricter environmental regulations, and rising investment in municipal water and wastewater treatment infrastructure

- Non-Woven segment is expected to dominate the Liquid Filtration market with a market share of 61.4% in 2025, driven by its superior filtration efficiency, high dirt-holding capacity, and cost-effectiveness

Report Scope and Liquid Filtration Market Segmentation

|

Attributes |

Liquid Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liquid Filtration Market Trends

“Sustainable Advancements in Filter Media and Fabric Composition”

- A key and rapidly emerging trend in the global Liquid Filtration market is the increased emphasis on sustainability through innovations in filter media and fabric materials. Manufacturers are actively developing eco-friendly solutions that reduce environmental impact while maintaining high filtration efficiency, chemical resistance, and durability

- For instance, Ahlstrom-Munksjö has introduced a new range of sustainable filtration media made from renewable fibers and designed for biodegradability, offering an alternative to traditional synthetic materials. These innovations help meet stringent environmental regulations and appeal to eco-conscious industries.

- The adoption of sustainable fabrics such as bio-based polymers and recyclable aramid blends is particularly notable in industries like biopharmaceuticals and chemicals, where both compliance and ESG goals are key. Companies are responding to client demands for greener supply chains by integrating circular economy principles into their filtration systems

- Moreover, advances in production technologies are enabling lower energy consumption and reduced water use during filter media manufacture, further enhancing environmental benefits. These process improvements help companies reduce their carbon footprint and operational costs simultaneously

- This shift toward greener material use not only enhances corporate sustainability profiles but also opens new revenue opportunities for filtration companies aligned with global climate and waste reduction targets. As end-users increasingly demand high-performance and low-impact solutions, sustainable filter innovation is becoming a vital competitive differentiator in the market

Liquid Filtration Market Dynamics

Driver

“Rising Industrial Wastewater and Municipal Effluent Treatment Requirements”

- The surging demand for effective filtration solutions in response to growing industrial wastewater discharge and municipal effluent treatment requirements is a key driver propelling the global Liquid Filtration market. Stricter environmental regulations and sustainability goals are compelling industries and governments to invest in high-performance filtration systems

- For instance, in March 2024, the U.S. Environmental Protection Agency (EPA) updated its guidelines on industrial wastewater treatment, pushing industries in chemical, mining, and food processing sectors to adopt advanced liquid filtration technologies

- Governments worldwide are increasing investment in wastewater treatment infrastructure, especially in emerging economies, to address water scarcity and pollution issues. This is significantly boosting demand for efficient and durable filter media and fabric types like polymer-based nonwovens and aramid composites

- Additionally, the rapid urbanization and expanding populations are straining municipal water systems, creating a heightened need for reliable liquid filtration solutions to meet rising demand and ensure compliance with water quality standards

- As industries seek to recycle and reuse water to cut operational costs and meet environmental, social, and governance (ESG) targets, liquid filtration systems are being integrated into core production processes, fostering long-term market growth and innovation across sectors

Restraint/Challenge

“High Capital Investment and Maintenance Complexity in Industrial Applications”

- The substantial capital investment required for the installation of advanced liquid filtration systems, particularly in large-scale industrial facilities, presents a significant restraint to market growth. Industries often face budget constraints that delay or limit the adoption of modern filtration technologies

- For instance, mining and chemical processing sectors require high-performance filters capable of withstanding extreme conditions, which often come with elevated upfront costs and complex system integration challenges

- Maintenance and operational complexity further challenge market expansion, as some filtration systems demand skilled personnel for monitoring, replacement, and optimization. This is especially critical in remote or resource-limited regions, where access to trained technicians and spare parts is limited

- Additionally, varying filtration needs across different end users—such as pharmaceuticals vs. food & beverages—necessitate custom solutions, increasing procurement and implementation costs

- Overcoming this challenge requires industry players to focus on developing cost-effective, easy-to-maintain filtration systems and offering comprehensive after-sales services, training, and modular solutions that reduce complexity and total cost of ownership

Liquid Filtration Market Scope

The market is segmented on the basis of filter media, fabric and end user.

- By Filter Media

On the basis of filter media, the Liquid Filtration market is segmented into Woven and Non-Woven. The non-woven segment dominates the largest market revenue share of 61.4% in 2025, driven by its increasing demand for cost-effective, disposable filtration solutions. Non-woven media are preferred for their excellent filtration efficiency, versatility in pore size customization, and compatibility with complex fluid systems, especially in municipal and pharmaceutical applications.

Woven segment is expected to witness fastest growth at a CAGR of 8.2% from 2025 to 2032 on account of extensive scope in industrial applications where consistent performance under high pressure and temperature is critical, including chemical processing and food & beverage filtration.

- By Fabric

On the basis of fabric, the Liquid Filtration market is segmented into Polymer, Aramid, Metal, and Cotton. The Polymer fabric segment held the largest market revenue share in 2025, driven by its chemical resistance, lightweight nature, and adaptability in diverse filtration processes. Polymers like polypropylene and polyester are widely used across various end-user industries due to their cost-efficiency and longevity.

The Aramid segment is expected to witness the fastest CAGR from 2025 to 2032, due to its high-temperature resistance and mechanical robustness. Aramid fabrics are increasingly used in high-demand environments such as mining and chemical filtration where thermal and chemical resilience is essential.

- By End User

On the basis of end user, the Liquid Filtration market is segmented into Food and Beverages, Municipal, Chemical, Mining, Biopharmaceutical, and Others. The Municipal segment accounted for the largest market revenue share in 2025, fueled by growing investments in water treatment infrastructure, regulatory mandates on wastewater management, and the rising need for clean water in urbanizing regions.

The Biopharmaceutical segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand for high-purity liquid filtration in sterile environments. The segment benefits from the rise in biologics manufacturing, stricter quality control standards, and advancements in microfiltration and ultrafiltration technologies.

Liquid Filtration Market Regional Analysis

- U.S. dominates the North America Liquid Filtration market with the largest revenue share of 67.3% in 2024, driven by a robust industrial base, stringent environmental regulations, and high demand from sectors such as municipal water treatment, food & beverage, and pharmaceuticals

- Consumers and industries in the U.S. increasingly prioritize high-performance filtration systems that ensure compliance with environmental standards and operational efficiency. The emphasis on sustainable practices and wastewater management has led to the widespread adoption of liquid filtration technologies in various verticals

- The market's momentum is also bolstered by high disposable incomes, a tech-savvy population, and a regulatory environment that promotes innovation in water treatment and pollution control. These factors collectively position the U.S. as a dominant force in both adoption and development of liquid filtration solutions

U.S. Liquid Filtration Market Insight

The U.S. Liquid Filtration market captured the largest revenue share of 67.57% within North America in 2025, fueled by the presence of a well-established industrial infrastructure, rigorous environmental compliance standards, and significant investments in water and wastewater treatment technologies. The demand is further supported by strong growth in sectors like food and beverages, pharmaceuticals, and municipal utilities, where filtration plays a critical role in ensuring operational efficiency and product quality.

Canada Liquid Filtration Market Insight

The Canadian Liquid Filtration market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing environmental awareness, stricter government regulations on water treatment, and a rising emphasis on sustainable industrial practices. Growth in sectors such as municipal water treatment, mining, and food & beverage processing is significantly contributing to the demand for high-performance filtration systems. Canada's focus on improving water quality, along with investments in upgrading infrastructure and adopting advanced filtration technologies, is fostering strong market growth. Additionally, the shift toward eco-friendly and energy-efficient filtration materials is expected to further propel the market in the coming years.

Liquid Filtration Market Share

The Liquid Filtration industry is primarily led by well-established companies, including:

- Valmet (Finland)

- Eaton (Ireland)

- Lydall, Inc. (U.S.)

- Sefar AG (Switzerland)

- Sandler AG (Germany)

- GKD Gebr. Kufferath AG (Germany)

- Freudenberg SE (Germany)

- Fibertex Nonwovens A/S (Denmark)

- American Fabric Filter Co. (U.S.)

- Autotech Nonwovens Pvt Ltd. (India)

- Ahlstrom-Munksjö (Finland)

- HL Filter USA LLC (U.S.)

- Schweitzer-Mauduit International Inc. (Luxembourg)

- Hollingsworth & Vose (U.S.)

- Filtercorp International Limited (New Zealand)

- Lenntech B.V. (Netherlands)

- The Kraissl Company (U.S.)

- Shelco Filters (U.S.)

Latest Developments in North America Liquid Filtration Market

- In February 2025, Thermo Fisher Scientific agreed to acquire Solventum’s purification and filtration business for approximately $4.1 billion in cash. This acquisition aligns with Solventum's strategy to refine its portfolio by divesting segments that do not fit its core focus areas like wound care, oral care, healthcare IT, and biopharma filtration. The filtration unit generated about $1 billion in revenue in 2023.

- In July 2024, IDEX Corporation announced its plan to acquire Mott Corporation, a filtration products maker, for $1 billion in cash. Mott specializes in machinery and devices used in industries such as pharmaceuticals, biotechnology, and chemical manufacturing. The acquisition aims to bolster IDEX's presence in the medical technologies industry and is expected to close by the end of Q3 2024.

- In January 2023, Hollingsworth & Vose announced a $40.2 million investment to expand its manufacturing facility in Floyd, Virginia. The expansion will add over 28,000 square feet to accommodate new production equipment, supporting the company's Trupor business, which focuses on high-performance liquid microfiltration media

- In January 2023, Koch Separation Solutions (KSS) partnered with Aqana to offer anaerobic wastewater treatment technology to industrial customers in North America. The collaboration focuses on integrating technologies such as moving bed biofilm reactors (MBBR), membrane bioreactors (MBR), and reverse osmosis (RO) to address various industrial wastewater treatment challenges.

- In October 2024, Veralto, a company spun off from Danaher, increased its annual adjusted profit forecast for the third time that year due to ongoing high demand for its water treatment products, including chemical treatment services and UV-filtration systems. The company's net sales for the third quarter rose by 4.7% to $1.31 billion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Liquid Filtration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Liquid Filtration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Liquid Filtration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.