North America Lithium Chemical Market

Market Size in USD Billion

CAGR :

%

USD

3.74 Billion

USD

6.34 Billion

2024

2032

USD

3.74 Billion

USD

6.34 Billion

2024

2032

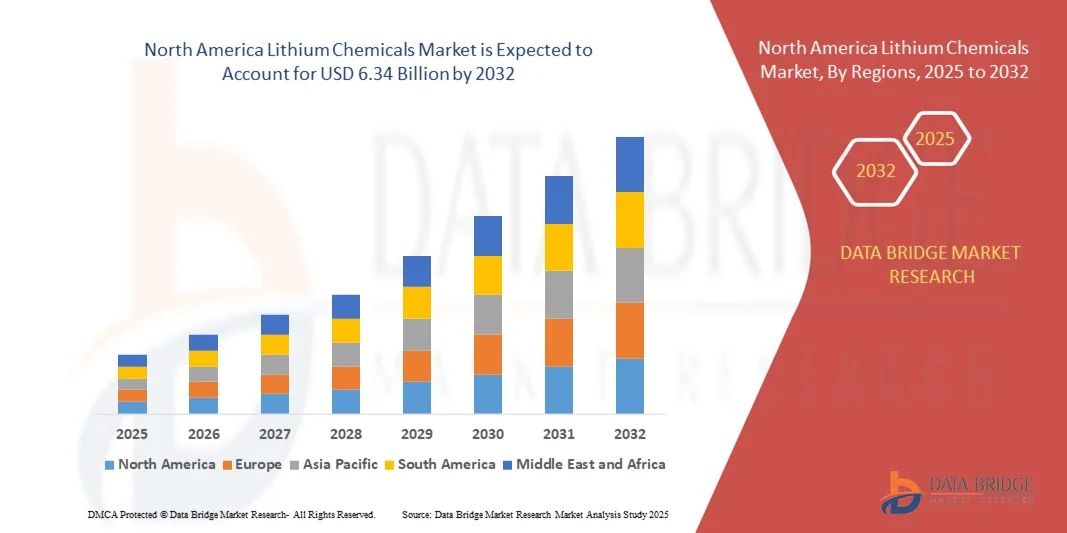

| 2025 –2032 | |

| USD 3.74 Billion | |

| USD 6.34 Billion | |

|

|

|

|

North America Lithium Chemicals Market Size

- The North America lithium chemicals market size was valued at USD 3.74 billion in 2024 and is expected to reach USD 6.34 billion by 2032, at a CAGR of 6.82% during the forecast period

- The market growth is largely fuelled by the increasing demand for lithium-ion batteries in electric vehicles (EVs) and energy storage systems, rising adoption of renewable energy technologies, and expanding applications in the pharmaceutical, glass, and ceramics industries

- Growing investments in EV infrastructure, government incentives for clean energy adoption, and technological advancements in lithium extraction and processing are further supporting market expansion

North America Lithium Chemicals Market Analysis

- The market is witnessing strong demand from the automotive sector, driven by the global transition toward electrification and stricter emission regulations

- Increasing use of lithium chemicals in portable electronics, grid storage solutions, and specialty chemical applications is broadening market opportunities

- U.S. dominated the North America lithium chemicals market with the largest revenue share in 2024, driven by high demand for electric vehicles, consumer electronics, and grid energy storage solutions.

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America lithium chemicals market due to increasing adoption of electric vehicles, growing investment in domestic lithium extraction and processing projects, and supportive government policies promoting clean energy and sustainable transportation. Expansion of advanced lithium technologies and strategic partnerships with global battery manufacturers are accelerating market growth

- The lithium carbonate segment held the largest market revenue share in 2024, driven by its widespread use in lithium-ion battery production and other industrial applications. Lithium carbonate is preferred for its high purity, stability, and versatility, making it a key material for battery manufacturers and chemical processors

Report Scope and North America Lithium Chemicals Market Segmentation

|

Attributes |

North America Lithium Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Lithium Chemicals Market Trends

Increasing Adoption of Lithium-Ion Batteries in Energy Storage and Electric Vehicles

- The growing shift toward lithium-ion batteries (LiBs) is transforming the lithium chemicals market by driving demand for high-purity lithium carbonate, lithium hydroxide, and lithium metal. The surge in electric vehicle (EV) production and renewable energy storage applications is pushing manufacturers to expand lithium chemical production capacity, ensuring timely supply for battery manufacturers. In addition, technological advancements in battery chemistry are further enhancing demand for specialized lithium compounds suitable for next-generation high-energy-density batteries

- The high demand for lithium chemicals in portable electronics, consumer devices, and grid storage systems is accelerating the development of advanced lithium compounds. These compounds are particularly critical for high-performance and long-life batteries, helping improve energy efficiency and reduce overall system costs. Growing adoption of lithium-based energy storage solutions across commercial, industrial, and residential sectors is also increasing consumption across multiple end-user industries

- The scalability and reliability of modern lithium chemical processing plants are making production more efficient and cost-effective. Manufacturers benefit from optimized extraction and refining techniques, enabling consistent supply to meet growing industrial demand. In addition, strategic partnerships with mining companies and vertical integration initiatives are helping producers secure raw material supply and mitigate market volatility

- For instance, in 2023, several battery manufacturers expanded their lithium hydroxide sourcing agreements with chemical producers to secure uninterrupted supply for EV battery production. This approach not only ensures steady production but also strengthens relationships across the value chain, reducing supply chain risks and enhancing market resilience

- While lithium chemicals are essential for energy storage and EV adoption, their market impact depends on sustainable extraction, processing efficiency, and cost management. Producers must focus on technological innovations and supply chain optimization to fully capitalize on this growing demand. Growing regulatory focus on environmental compliance and resource sustainability further reinforces the need for efficient and responsible production practices

North America Lithium Chemicals Market Dynamics

Driver

Rising Demand for Electric Vehicles and Renewable Energy Storage Solutions

The global push toward electrification and clean energy is increasing the demand for lithium chemicals as a critical component of lithium-ion batteries. Growing EV sales and government incentives are accelerating investment in battery-grade lithium compounds. In addition, the rising adoption of renewable energy sources such as solar and wind is driving the need for reliable grid-scale energy storage systems powered by lithium-based solutions

Automotive manufacturers and energy storage companies are increasingly prioritizing high-purity lithium chemicals to improve battery performance, lifespan, and safety. This is leading to strategic partnerships and long-term supply agreements with lithium chemical producers. The focus on next-generation battery technologies such as solid-state and high-nickel cathodes is further increasing demand for specialized lithium derivatives

Public and private sector initiatives supporting renewable energy deployment and energy storage systems are boosting lithium chemical consumption. Programs to promote energy security and reduce carbon emissions are creating consistent demand for battery-grade lithium. In addition, investment in microgrids, off-grid storage solutions, and portable energy systems is expanding opportunities for lithium chemical producers

For instance, in 2022, several governments announced subsidies and incentives for EV battery production and energy storage deployment, significantly increasing domestic lithium chemical consumption and stimulating new production facilities. Policies promoting sustainable transportation and clean energy adoption are further fueling demand for lithium chemicals

While growing EV and energy storage demand is driving the market, ensuring sustainable sourcing, cost efficiency, and stable supply remains critical for long-term growth. Market players are increasingly investing in recycling technologies and circular economy initiatives to reduce dependency on primary lithium sources and enhance supply security

Restraint/Challenge

High Production Costs and Limited Availability of High-Grade Lithium Resources

- The extraction and refining of lithium chemicals require significant investment in specialized equipment, high energy consumption, and advanced technology, increasing production costs compared to alternative materials. Moreover, the complexity of processing lithium from brine and hard rock sources adds operational challenges that can impact overall efficiency and scalability

- Many regions face raw material shortages and resource limitations, leading to supply chain volatility and fluctuating pricing for lithium carbonate, hydroxide, and other battery-grade compounds. Geopolitical uncertainties, export restrictions, and competitive global demand further exacerbate pricing instability and supply risk for manufacturers

- Limited capacity for large-scale, sustainable lithium production remains a key challenge, especially for rapidly growing EV and energy storage markets. Securing high-quality lithium feedstock is critical to meet industrial demand. In addition, environmental concerns related to water usage, brine extraction, and ecological impact require companies to invest in sustainable mining and production practices

- For instance, in 2023, several lithium chemical producers reported production slowdowns due to feedstock scarcity and operational constraints, impacting supply consistency. These disruptions highlighted the importance of supply diversification, strategic stockpiling, and long-term procurement contracts to mitigate market risk

- While technological advancements aim to improve efficiency and reduce costs, addressing raw material availability and sustainable extraction practices remains essential to unlock the full potential of the global lithium chemicals market. Collaboration between mining companies, chemical producers, and policymakers is critical to balance supply, demand, and environmental sustainability

North America Lithium Chemicals Market Scope

The market is segmented on the basis of type, grade, application, and end-user.

- By Type

On the basis of type, the North America lithium chemicals market is segmented into lithium carbonate, lithium chloride, lithium hydroxide, lithium fluoride, lithium bromide, and others. The lithium carbonate segment held the largest market revenue share in 2024, driven by its widespread use in lithium-ion battery production and other industrial applications. Lithium carbonate is preferred for its high purity, stability, and versatility, making it a key material for battery manufacturers and chemical processors.

The lithium hydroxide segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-performance electric vehicle batteries and energy storage systems. Lithium hydroxide is particularly critical for producing long-life, high-energy-density cathodes, making it essential for next-generation battery technologies.

- By Grade

On the basis of grade, the market is segmented into industrial grade, battery grade, and others. The battery-grade segment held the largest market share in 2024, driven by rising demand from electric vehicle and energy storage applications requiring high-purity lithium chemicals. Battery-grade lithium compounds are essential for producing safe, durable, and high-capacity batteries.

The industrial-grade segment is expected to register the fastest growth from 2025 to 2032, owing to expanding applications in glass, ceramics, lubricants, and metallurgy. Industrial-grade lithium chemicals are increasingly adopted for their cost-effectiveness and suitability across multiple manufacturing processes.

- By Application

On the basis of application, the market is segmented into battery, lubricant, aluminium smelting & alloy, air treatment, medical, glass & ceramics, metallurgy, polymer, greases, and others. The battery segment held the largest market revenue share in 2024, driven by the booming electric vehicle and energy storage sectors. Lithium chemicals play a pivotal role in battery performance, safety, and energy density.

The lubricant segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for lithium-based greases and lubricants across industrial machinery, automotive, and heavy equipment. Lithium lubricants are valued for their high thermal stability, corrosion resistance, and long operational life.

- By End-User

On the basis of end-user, the market is segmented into industrial, electronics and electricals, transportation, medical, power plants, and others. The transportation segment held the largest market share in 2024, fueled by the rapid adoption of electric vehicles and hybrid vehicles requiring lithium-ion batteries. Lithium chemicals are critical for battery efficiency, longevity, and performance in the transportation sector.

The electronics and electricals segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for portable electronic devices, consumer gadgets, and smart electronics. High-purity lithium compounds are essential for producing reliable, compact, and energy-efficient batteries for these applications.

North America Lithium Chemicals Market Regional Analysis

- U.S. dominated the North America lithium chemicals market with the largest revenue share in 2024, driven by high demand for electric vehicles, consumer electronics, and grid energy storage solutions.

- Strong domestic mining capabilities, large-scale battery production, and government incentives for clean energy technologies have accelerated lithium chemical consumption.

- This growth is further supported by technological advancements in battery manufacturing, strategic supply agreements, and expanding industrial applications, solidifying the U.S. as a key market in North America

Canada Lithium Chemicals Market Insight

The Canada lithium chemicals market is witnessing the fastest growth in North America, fueled by increasing investments in lithium mining and battery-grade chemical production. Rising demand for electric vehicles, energy storage solutions, and sustainable industrial applications is driving market expansion. In addition, government incentives for green technologies, strategic partnerships with global battery manufacturers, and development of domestic supply chains are significantly contributing to growth.

North America Lithium Chemicals Market Share

The North America lithium chemicals industry is primarily led by well-established companies, including:

• Livent Corporation (U.S.)

• Albemarle Corporation (U.S.)

• Piedmont Lithium Inc. (U.S.)

• Lithium Americas Corp. (U.S.)

• American Lithium Corp. (U.S.)

• Standard Lithium Ltd. (U.S.)

• Mineral Resources Ltd. (U.S.)

• Lithium Energy Products, Inc. (U.S.)

• EcoLithium LLC (U.S.)

• Quantum Lithium Corp. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Lithium Chemical Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Lithium Chemical Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Lithium Chemical Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.