North America Liver Fibrosis Treatment Market

Market Size in USD Billion

CAGR :

%

USD

7.55 Billion

USD

16.87 Billion

2024

2032

USD

7.55 Billion

USD

16.87 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 16.87 Billion | |

|

|

|

North America Liver Fibrosis Treatment Market Size

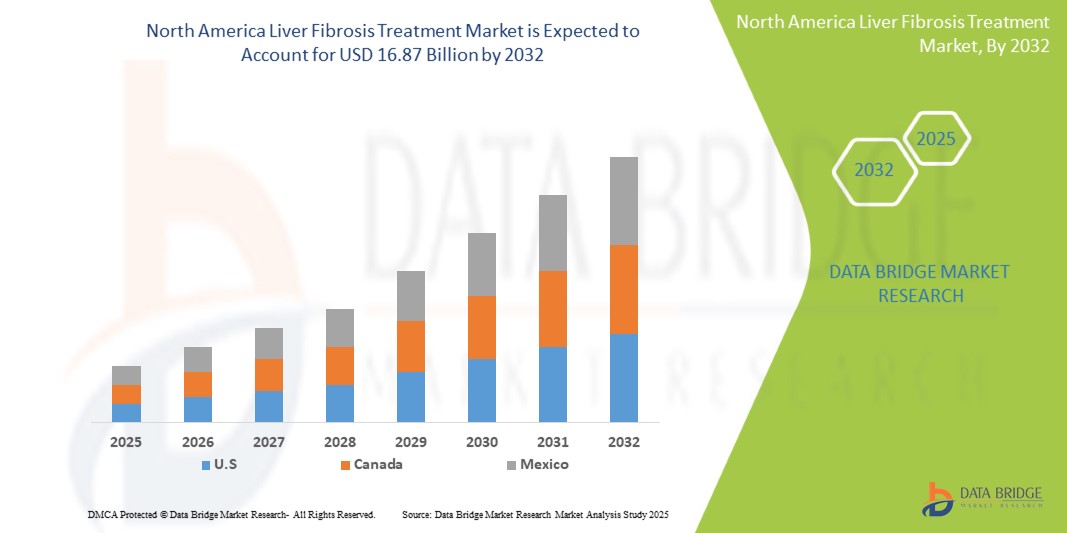

- North America liver fibrosis treatment market was valued at USD 7.55 billion in 2024 and is expected to reach USD 16.87 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.8%, primarily driven by the increasing consumer awareness of natural health solutions

- This growth is driven by factors such as Increasing Prevalence of Liver Diseases. additionally, affordability drives Rising Consumption of Alcohol.

North America Liver Fibrosis Treatment Market Analysis

- The growing number of liver diseases creates a larger patient population in need of effective therapeutic options, particularly for conditions such as hepatitis B and C. Contributing factors such as rising alcohol consumption, unhealthy dietary habits, and an increase in obesity rates have all led to more people being diagnosed with these liver conditions

- As liver damage advances, the risk of developing liver fibrosis increases, placing a significant burden on healthcare systems to offer effective treatment options. This growing demand drives the development and availability of targeted therapies, fueling market growth as healthcare providers seek innovative solutions for managing this condition

- Moreover, increased awareness among healthcare practitioners and the general public has led to more individuals being screened and diagnosed at earlier stages of liver disease. Advancements in diagnostic techniques, including non-invasive imaging and blood tests, have facilitated the identification of liver fibrosis sooner in the disease's progression. This early detection allows for timely interventions, stimulating the demand for innovative treatments that effectively reverse or manage liver fibrosis

- For instance, in August 2023, as per an article published by NCBI, liver disease accounts for two million deaths annually and is responsible for 4% of all deaths (1 out of every 25 deaths worldwide); approximately two-thirds of all liver-related deaths occur in men. This alarming statistic underscores the urgent need for effective treatment options and highlights the significant public health burden posed by liver diseases, further motivating healthcare systems and pharmaceutical companies to prioritize the development of innovative therapies specifically targeting liver fibrosis and its underlying causes

- Consequently, pharmaceutical companies and medical researchers are compelled to invest in developing new therapeutic options, thus propelling the market as stakeholders aim to combat the rising incidence of liver diseases and their associated complications.

Report Scope and North America Liver Fibrosis Treatment Market Segmentation

|

Attributes |

Global Liver Fibrosis Treatment Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Liver Fibrosis Treatment Market Trends

“Increasing Prevalence of Liver Diseases”

- The increasing prevalence of liver diseases is emerging as a significant North America health concern, contributing substantially to healthcare burdens worldwide

- Factors such as excessive alcohol consumption, rising obesity rates, viral hepatitis infections, and unhealthy lifestyles are leading to a surge in conditions like fatty liver disease, cirrhosis, and liver cancer

- The growing incidence of non-alcoholic fatty liver disease (NAFLD), particularly linked to diabetes and metabolic syndrome, is also alarming. As a result, there is an increased demand for early diagnosis, effective treatment options, and public health initiatives. This trend is expected to drive innovation and growth in the liver disease treatment market

North America Liver Fibrosis Treatment Market Dynamics

Drivers

“Rising Consumption of Alcohol”

- Rising alcohol consumption is a significant contributor to the North America liver fibrosis treatment market due to its direct correlation with the incidence of liver diseases, particularly Alcoholic Liver Disease (ALD)

- As more individuals consume alcohol regularly and in larger quantities, the risk of developing liver-related complications, including liver fibrosis and cirrhosis, increases significantly

- Chronic alcoholism leads to inflammation, fat accumulation, and, ultimately, fibrosis as the liver undergoes repeated damage and repair

- This growing prevalence of alcohol-related liver conditions creates a pressing demand for effective treatments and management strategies to help mitigate liver damage and improve patient outcomes

For instance,

- In October 2024, as per an article published by the International Journal of Mental Health Systems, the prevalence of alcohol consumption was 54.5% and 47.7% at the baseline and follow-up, respectively. Moreover, 12% of men reported to have newly started drinking. This prevalence of alcohol consumption leads to an increased incidence of liver fibrosis North Americaly, potentially impacting market growth

- In June 2024, as per STAT, alcohol-related deaths are on the rise, and experts are particularly concerned about an increase among young people and women. The U.S. saw a 25.5% spike in alcohol-related deaths between 2019 and 2020 — accounting for 3% of all deaths. Moreover, the largest increases in alcohol-related deaths were among people 25 to 34 and 35 to 44 years old, wherein deaths in both groups increased by over 37%

- Moreover, the increasing societal acceptance and normalization of alcohol consumption, particularly in younger demographics, further exacerbate the issue, leading to a greater number of individuals at risk for liver fibrotic changes

- This trend promotes the growth of the liver fibrosis treatment market and emphasizes the importance of public health initiatives aimed at reducing alcohol consumption and preventing liver disease

Opportunities

“Emerging Technologies and Advanced Treatments in Liver Fibrosis Management”

-

Emerging technologies like gene therapy, targeted molecular therapies, and biologic agents are transforming the treatment landscape

-

Recent innovations focus on drugs that specifically target fibrosis progression pathways, such as FXR agonists, TGF-β inhibitors, and anti-inflammatory agents. In addition, non-invasive diagnostic tools like elastography are improving early detection

-

These advancements offer more effective, personalized treatments for conditions such as NASH (Non-Alcoholic Steatohepatitis) and cirrhosis, leading to better patient outcomes

-

In February 2024, an article published in Springer Nature, The article reviews emerging approaches for diagnosing and inhibiting liver fibrogenesis. Advances include non-invasive biomarkers, imaging technologies, and cell therapies like mesenchymal stem cells. Promising antifibrotic drugs, including pirfenidone and obeticholic acid, along with innovations in tissue engineering, nanotechnology, and microfluidic models, show potential for personalized, precision treatments

-

A September 2021, article by NCBI highlighted that Emerging technologies in liver fibrosis treatment focus on advanced therapies targeting molecular pathways like hepatic stellate cell activation. Innovations such as gene therapy, biologics, small molecule inhibitors, and non-invasive diagnostics improve early detection and treatment. Stem cell therapies and tissue engineering also offer promise for reversing fibrosis and enhancing recovery

-

With the continuous evolution of treatment strategies and diagnostic technologies, liver fibrosis therapies are advancing rapidly

-

These innovations provide hope for better management of liver diseases, ensuring that patients have access to more effective, personalized treatments with fewer side effects, ultimately improving North America health outcomes

Restraints/Challenge

“Limited Awareness of Liver Diseases”

- Limited awareness of liver diseases hinders early diagnosis and appropriate intervention. Many individuals remain unaware of the risk factors and symptoms associated with liver conditions, often attributing vague signs of illness to other, less serious issues

- This lack of knowledge delays medical consultations until the disease progresses to advanced stages, such as liver fibrosis or cirrhosis, where treatment options become more complex and less effective

- Consequently, late-stage diagnoses reduce the potential for successful treatment outcomes and restrict the overall market growth by limiting the patient population seeking timely care

For instance,

- In April 2024, Lupin stated that the patients are unaware of their condition until the disease reaches a critical stage, triggering an urgent need to reassess the approach to liver health awareness, detection, and management. However, a significant hurdle in liver health management lies in the limited understanding of liver diseases and associated risk factors

- In July 2021, according to a study that included 11,700 adults (18+ years old) from five National Health and Nutrition Examination Surveys, nearly 96% of adults with NAFLD in the U.S. were unaware they had liver disease, especially among young adults. Therefore, enhancing awareness and education about liver health is crucial for improving patient outcomes and fostering a more proactive approach to liver fibrosis management and treatment market expansion

- In January 2021, Springer Nature reported that among the 825 patients included in the research analysis carried out in the research paper, ‘Lack of awareness of liver organ damage in patients with type 2 diabetes’, 8.1% (95% CI 5.1%-12.7%) of patients with steatosis were aware of having a liver condition. Moreover, in a nationally representative sample of U.S. adults with T2DM, the prevalence of advanced liver fibrosis is high. Less than 20% of those with advanced fibrosis are aware of having any liver condition

- Limited awareness hampers potential treatment outcomes for patients and stifles market growth by reducing the number of individuals engaging with healthcare services early on

- Thus, increasing awareness and education about liver health is crucial for improving early diagnosis, enhancing treatment efficacy, and ultimately fostering a more robust market for liver fibrosis therapies

North America Liver Fibrosis Treatment Market Scope

The market is segmented on the basis product type, treatment, basis of source, application, route of administration, mode of purchase, age group, gender, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Treatment Type |

|

|

By Stages |

|

|

By Indication |

|

|

By End User |

|

|

By Distribution Channel |

|

North America Liver Fibrosis Treatment Market Regional Analysis

“U.S. is the Dominant Country in the Liver Fibrosis Treatment Market”

- U.S. leads the Liver Fibrosis Treatment Market in North America, driven by its robust healthcare infrastructure, high prevalence of liver-related diseases, and strong focus on early diagnosis and intervention strategies

- The country benefits from extensive healthcare coverage, well-established reimbursement policies, and a growing demand for non-invasive diagnostic and treatment options

- U.S.'s leadership in clinical research and its active participation in liver disease awareness campaigns further support market growth

- The rising adoption of advanced therapeutics, increasing patient awareness, and government initiatives to tackle chronic liver conditions contribute to U.S.’s dominance in the region

“U.S. is Projected to Register the Highest Growth Rate”

- U.S. is also the fastest-growing market, fueled by continuous innovation in fibrosis biomarkers, increased R&D investments by pharmaceutical companies, and rising rates of alcohol-related and non-alcoholic fatty liver diseases

- These factors collectively position U.S. as a central hub for liver fibrosis treatment in North America, making it both the largest and most rapidly expanding market in the region

North America Liver Fibrosis Treatment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- La Renon Healthcare Pvt. Ltd. (India)

- GENFIT SA (France)

- Madrigal Pharmaceuticals (U.S.)

- Aligos Therapeutics (U.S.)

- Pfizer Inc. (U.S.)

- Enanta Pharmaceuticals, Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Hepion Pharmaceuticals (U.S.)

- Echosens (France)

- Galectin Therapeutics, Inc. (U.S.)

- Conatus Pharmaceuticals (U.S.)

- Tvardi Therapeutics (U.S.)

- Viking Therapeutics (U.S.)

- Calliditas Therapeutics AB (Sweden)

- Novomedix (U.S.)

- Galecto Biotech (Denmark)

- Pilant Therapeutics, Inc. (U.S.)

- Sagimet Biosciences (U.S.)

- Gyre Therapeutics, Inc. (U.S.)

- Akero Therapeutics, Inc. (U.S.)

- CureVac SE (Germany)

- Novo Nordisk A/S (Denmark)

- Ipsen Pharma (France)

- AdAlta Limited (Australia)

- Alentis Therapeutics AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis AG (Switzerland)

- Intercept Pharmaceuticals, Inc. (U.S.)

Latest Developments in North America Liver Fibrosis Treatment Market

- In June 2024, Gilead Sciences presented the new research at the 2024 European Association for the Study of the Liver (EASL) Congress in Milan, focusing on liver diseases such as primary biliary cholangitis (PBC), hepatitis B (HBV), hepatitis delta virus (HDV), and others. Key presentations will include long-term data from the ASSURE study on seladelpar for PBC, results on tenofovir for liver cancer prevention in HBV, and findings from the MYR204 and MYR301 studies on Hepcludex for HDV. This research highlights Gilead's commitment to advancing treatment options for liver diseases

- In October 2024, Intercept Pharmaceuticals, Inc discussed their ongoing efforts to explore racial differences and disparities in Primary Biliary Cholangitis (PBC) care. The company is addressing how various populations may face different challenges in the diagnosis, treatment, and management of PBC. By exploring these disparities, Intercept aims to improve access to care and treatment outcomes for all patients, potentially reducing barriers to effective treatment of liver diseases, including fibrosis

- In November 2022, The U.S. Food and Drug Administration (FDA) approved Vemlidy (tenofovir alafenamide) for the treatment of chronic hepatitis B virus (HBV) infection in pediatric patients aged 12 years and older with compensated liver disease. This approval extends the use of Vemlidy, which was initially approved in 2016 for adults with chronic HBV. The approval is based on a Phase 2 clinical trial demonstrating Vemlidy’s efficacy and safety in this younger patient group

- In September 2022, Gilead Sciences completed its acquisition of MiroBio, a UK-based biotechnology company focused on restoring immune balance through agonists targeting immune inhibitory receptors. The acquisition, valued at approximately $405 million, provides Gilead with MiroBio’s discovery platform and its portfolio of immune inhibitory receptor agonists. MiroBio’s lead investigational antibody, MB272, targets immune cells to suppress inflammatory immune responses and is currently in Phase 1 clinical trials. This acquisition enhances Gilead's efforts in addressing chronic immune-mediated conditions

- In March 2021, Gilead Sciences and Novo Nordisk expanded their collaboration in the treatment of non-alcoholic steatohepatitis (NASH) by initiating a Phase 2b clinical trial. The study investigates the safety and efficacy of semaglutide, a GLP-1 receptor agonist from Novo Nordisk, combined with Gilead's cilofexor (an FXR agonist) and firsocostat (an ACC inhibitor) in patients with cirrhosis due to NASH. The trial will assess the treatments' impact on liver fibrosis and NASH resolution, with recruitment expected to start in the second half of 2021

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.2.1 LIVER TRANSPLANTATION VOLUME AND THEIR COST FOR LIVER FIBROSIS BY COUNTRY

4.2.2 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES FOR LIVER FIBROSIS: VOLUME AND COST BY COUNTRY

4.2.3 PARTIAL HEPATECTOMY (LIVER RESECTION) COST BY COUNTRY

4.2.4 CELL-BASED THERAPY COST FOR LIVER FIBROSIS TREATMENT BY COUNTRY

4.3 EPIDEMIOLOGY

4.3.1 INCIDENCE OF ALL BY GENDER

4.3.2 TREATMENT RATE

4.3.3 TREATMENT RATE

4.3.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.3.5 PATIENT TREATMENT SUCCESS RATES

4.4 MARKETED DRUG ANALYSIS

4.5 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5.1 PATIENT FLOW DIAGRAM

4.5.2 KEY PRICING STRATEGIES

4.5.3 KEY PATIENT ENROLLMENT STRATEGIES

5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF LIVER DISEASES

6.1.2 RISING CONSUMPTION OF ALCOHOL

6.1.3 RISING LIVER TRANSPLANTATION RATES

6.1.4 GROWING INCIDENCE OF NON-ALCOHOLIC FATTY LIVER DISEASE (NAFLD) & NASH

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF LIVER DISEASES

6.2.2 REGULATORY CHALLENGES

6.3 OPPORTUNITIES

6.3.1 EMERGING TECHNOLOGIES AND ADVANCED TREATMENTS IN LIVER FIBROSIS MANAGEMENT

6.3.2 PROGRESS IN PIPELINE PRODUCTS FOR LIVER FIBROSIS TREATMENT

6.3.3 STRATEGIC MERGERS AND ACQUISITIONS AMONG THE KEY PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF EFFECTIVE AND APPROVED ANTI-FIBROTIC DRUGS

6.4.2 HIGH COST OF TREATMENTS IN LIVER FIBROSIS CARE

7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 ANTIVIRAL AGENTS

7.2.1.1 VELPATASVIR/SOFOSBUVIR

7.2.1.2 TENOFOVIR

7.2.1.3 LEDIPASVIR/SOFOSBUVIR

7.2.1.4 SOFOSBUVIR

7.2.1.5 ENTECAVIR

7.2.2 ANTIFIBROTIC AGENTS

7.2.2.1 OBETICHOLIC ACID

7.2.2.2 TGF-Β INHIBITORS

7.2.2.3 CONNECTIVE TISSUE GROWTH FACTOR (CTGF) INHIBITORS

7.2.2.4 LYSYL OXIDASE-LIKE 2 (LOXL2) INHIBITORS

7.2.2.5 OTHERS

7.2.3 ANTI-INFLAMMATORY DRUGS

7.2.3.1 CORTICOSTEROIDS

7.2.3.1.1 PREDNISONE

7.2.3.1.2 DEXAMETHASONE

7.2.3.2 TUMOR NECROSIS FACTOR (TNF) INHIBITORS

7.2.3.2.1 INFLIXIMAB

7.2.3.2.2 ETANERCEPT

7.2.3.3 INTERLEUKIN (IL) INHIBITORS

7.2.3.3.1 IL-6 INHIBITORS (TOCILIZUMAB)

7.2.3.3.2 IL-1 INHIBITORS (ANAKINRA)

7.2.4 IMMUNOSUPPRESSANTS

7.2.4.1 MYCOPHENOLATE MOFETIL

7.2.4.2 TACROLIMUS

7.2.4.3 CYCLOSPORINE

7.2.5 MARKETED DRUGS

7.2.5.1 VELPATASVIR/SOFOSBUVIR

7.2.5.2 TENOFOVIR

7.2.5.3 LEDIPASVIR/SOFOSBUVIR

7.2.5.4 OBETICHOLIC ACID (OCA)

7.2.5.5 SOFOSBUVIR

7.2.5.6 PIRFENIDONE

7.2.5.7 OTHERS

7.2.6 PIPELINE DRUGS

7.2.7 BRANDED DRUGS

7.2.7.1 EPCLUSA

7.2.7.2 VIREAD AND VEMLIDY

7.2.7.3 OCALIVA

7.2.7.4 HARVONI

7.2.7.5 SOVALDI

7.2.7.6 BARACLUDE

7.2.7.7 ACTOS

7.2.7.8 OTHERS

7.2.8 GENERIC DRUGS

7.2.9 ORAL

7.2.10 PARENTERAL

7.2.11 OTHERS

7.3 SURGERY/THERAPY

7.3.1 LIVER TRANSPLANTATION

7.3.2 ORTHOTOPIC LIVER TRANSPLANT (OLT)

7.3.3 LIVING DONOR LIVER TRANSPLANT (LDLT)

7.3.4 SPLIT LIVER TRANSPLANTATION

7.3.5 DOMINO LIVER TRANSPLANT

7.3.6 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES

7.3.6.1 ENDOSCOPIC VARICEAL LIGATION (EVL)

7.3.6.2 TRANSJUGULAR INTRAHEPATIC PORTOSYSTEMIC SHUNT (TIPS)

7.3.6.3 LIVER ABLATION PROCEDURES

7.3.6.3.1 RADIOFREQUENCY ABLATION (RFA)

7.3.6.3.2 MICROWAVE ABLATION (MWA)

7.3.7 PARTIAL HEPATECTOMY (LIVER RESECTION)

7.3.7.1 SEGMENTAL RESECTION

7.3.7.2 LOBECTOMY

7.3.7.3 WEDGE RESECTION

7.3.8 CELL-BASED THERAPY

7.3.8.1 STEM CELL THERAPY

7.3.8.1.1 MESENCHYMAL STEM CELLS (MSCS)

7.3.8.1.2 HEMATOPOIETIC STEM CELLS (HSCS)

7.3.8.2 GENE THERAPY

7.3.8.2.1 CRISPR-BASED LIVER REGENERATION

7.3.8.2.2 HEPATIC STELLATE CELL (HSC) INHIBITORS

7.3.8.2.3 SIRNA-BASED THERAPIES

7.3.8.2.4 HEPATOCYTE APOPTOSIS INHIBITORS

7.3.8.2.4.1 OXIDATIVE STRESS INHIBITORS

7.3.8.2.4.2 EMRICASAN

7.3.8.2.4.3 PENTOXIFYLLINE

7.3.8.2.4.4 LOSARTAN

7.3.8.2.4.5 METHYL FERULIC ACID

7.3.8.2.4.6 OTHERS

7.4 OTHERS

8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES

8.1 OVERVIEW

8.2 F2

8.3 F1

8.4 F3

8.5 F4

9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 NON-ALCOHOLIC STEATOHEPATITIS (NASH)

9.3 HEPATITIS B & C-INDUCED FIBROSIS

9.3.1 CHRONIC HEPATITIS B VIRUS (HBV) FIBROSIS

9.3.2 CHRONIC HEPATITIS C VIRUS (HCV) FIBROSIS

9.4 ALCOHOLIC LIVER DISEASE (ALD)

9.5 AUTOIMMUNE LIVER DISEASES

9.5.1 AUTOIMMUNE HEPATITIS (AIH)

9.5.2 PRIMARY BILIARY CHOLANGITIS (PBC)

9.5.3 PRIMARY SCLEROSING CHOLANGITIS (PSC)

9.6 GENETIC DISORDERS

9.6.1 HEMOCHROMATOSIS

9.6.2 WILSON’S DISEASE

9.6.3 ALPHA-1 ANTITRYPSIN DEFICIENCY

9.7 OTHERS

10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER

10.1 OVERVIEW

10.2 MALE

10.2.1 40-55 YEARS

10.2.2 ABOVE 55 YEARS

10.2.3 BELOW 40 YEARS

10.3 FEMALE

10.3.1 ABOVE 55 YEARS

10.3.2 40-55 YEARS

10.3.3 BELOW 40 YEARS

11 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC HOSPITALS

11.2.2 PRIVATE HOSPITALS

11.3 SPECIALTY CLINICS

11.3.1 HEPATOLOGY CLINICS

11.3.2 GASTROENTEROLOGY CLINICS

11.4 CLINICS

11.5 AMBULATORY AND RESEARCH CENTERS

11.6 OTHERS

12 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.2.1 RETAIL SALES

12.2.1.1 HOSPITAL PHARMACY

12.2.1.2 RETAIL PHARMACY

12.2.1.3 ONLINE PHARMACY

13 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 GILEAD SCIENCES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 ABBVIE, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MERCK & CO, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NOVARTIS AG

16.4.1 COMPANY SNAPSHOTS

16.4.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 PIPELINE PRODUCT PORTFOLIO

16.4.6 RECENT DEVELOPMENT

16.5 INTERCEPT PHARMACEUTICALS, INC.

16.5.1 COMPANY SNAPSHOTS

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 PIPELINE PRODUCT PORTFOLIO

16.5.6 RECENT NEWS

16.6 ABBOTT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 1.1.5 RECENT DEVELOPMENT

16.7 ALIGOS THERAPEUTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ALNICHE LIFE SCIENCES PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ALENTIS THERAPEUTICS AG

16.9.1 COMPANY SNAPSHOT

16.9.2 PIPELINE PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ADALTA LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PIPELINE PRODUCT PORTFOLIO

16.10.4 RECENT NEWS

16.11 AKERO THERAPEUTICS, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PIPELINE PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BRISTOL-MYERS SQUIBB

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CALLIDITAS THERAPEUTICS AB

16.13.1 COMPANY SNAPSHOT

16.13.2 PIPELINE PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CUREVAC SE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 CONATUSPHARMA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT/NEWS

16.16 ENANTA PHARMACEUTICALS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 ECHOSENS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT/NEWS

16.18 F. HOFFMANN-LA ROCHE LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 GALECTO BIOTECH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PIPELINE PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT/NEWS

16.2 GALECTIN THERAPEUTICS, INC.

16.20.1 COMPANY SNAPSHOTS

16.20.2 REVENUE ANALYSIS AND SEGMENTAL ANALYSIS

16.20.3 PIPELINE PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 GYRE THERAPEUTICS, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT/NEWS

16.22 GENFIT SA

16.22.1 COMPANY SNAPSHOTS

16.22.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.22.3 PIPELINE PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 HEPION PHARMACEUTICALS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PIPELINE PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 IPSEN PHARMA

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PIPELINE PRODUCT PORTFOLIO

16.24.4 RECENT NEWS/DEVELOPMENTS

16.25 LA RENON HEALTHCARE PVT. LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 MADRIGAL PHARMACEUTICALS

16.26.1 COMPANY SNAPSHOTS

16.26.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 NOVO NORDISK A/S

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PIPELINE PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 NOVOMEDIX

16.28.1 COMPANY SNAPSHOT

16.28.2 PIPELINE PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 PILANT THERAPEUTICS, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PIPELINE PRODUCT PORTFOLIO

16.29.4 RECENT NEWS

16.3 PFIZER INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PIPELINE PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT/NEWS

16.31 SAGIMET BIOSCIENCES

16.31.1 COMPANY SNAPSHOTS

16.31.2 REVENUE ANALYSIS

16.31.3 1.1.4 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT/NEWS

16.32 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 PIPELINE PRODUCT PORTFOLIO

16.32.4 PRODUCT PORTFOLIO

16.32.5 RECENT DEVELOPMENT

16.33 TVARDI THERAPEUTICS

16.33.1 COMPANY SNAPSHOT

16.33.2 PIPELINE PRODUCT PORTFOLIO

16.33.3 RECENT DEVELOPMENT/NEWS

16.34 VERTEX PHARMACEUTICALS INCORPORATED

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 PRODUCT PORTFOLIO

16.34.4 RECENT DEVELOPMENT

16.35 VIKING THERAPEUTICS

16.35.1 COMPANY SNAPSHOT

16.35.2 REVENUE ANALYSIS

16.35.3 PIPELINE PRODUCT PORTFOLIO

16.35.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA INCIDENCE OF CIRRHOSIS BY GENDER (2019)

TABLE 2 TREATMENT ADHERENCE LEVELS IN LIVER DISEASE PATIENTS

TABLE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 16 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 17 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 24 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA F2 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA F1 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA F3 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA F4 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA NON-ALCOHOLIC STEATOHEPATITIS (NASH) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ALCOHOLIC LIVER DISEASE (ALD) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA AMBULATORY AND RESEARCH CENTERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA DIRECT TENDER IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 78 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 86 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 88 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 89 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 91 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 92 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 94 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 95 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 97 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 98 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 130 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 131 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 133 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 134 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 136 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 138 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 139 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 141 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 142 U.S. INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 144 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 145 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 147 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 148 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 180 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 181 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 183 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 184 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 186 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 188 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 189 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 191 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 192 CANADA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 195 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 197 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 198 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 228 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 230 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 231 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 233 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 234 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 236 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 238 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 239 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 241 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 242 MEXICO INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 244 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 245 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 247 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 248 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 249 MEXICO MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LIVER DISEASES IS EXPECTED TO DRIVE THE GROWTH OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET FROM 2025 TO 2032

FIGURE 12 THE MEDICATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET IN 2025-2032

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

FIGURE 14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

FIGURE 17 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2024

FIGURE 22 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2024

FIGURE 26 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2024

FIGURE 30 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL 2024

FIGURE 38 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.