North America Lubricating Oil Additives Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

5.84 Billion

2024

2032

USD

4.65 Billion

USD

5.84 Billion

2024

2032

| 2025 –2032 | |

| USD 4.65 Billion | |

| USD 5.84 Billion | |

|

|

|

|

Lubricating Additives Oil Market Size

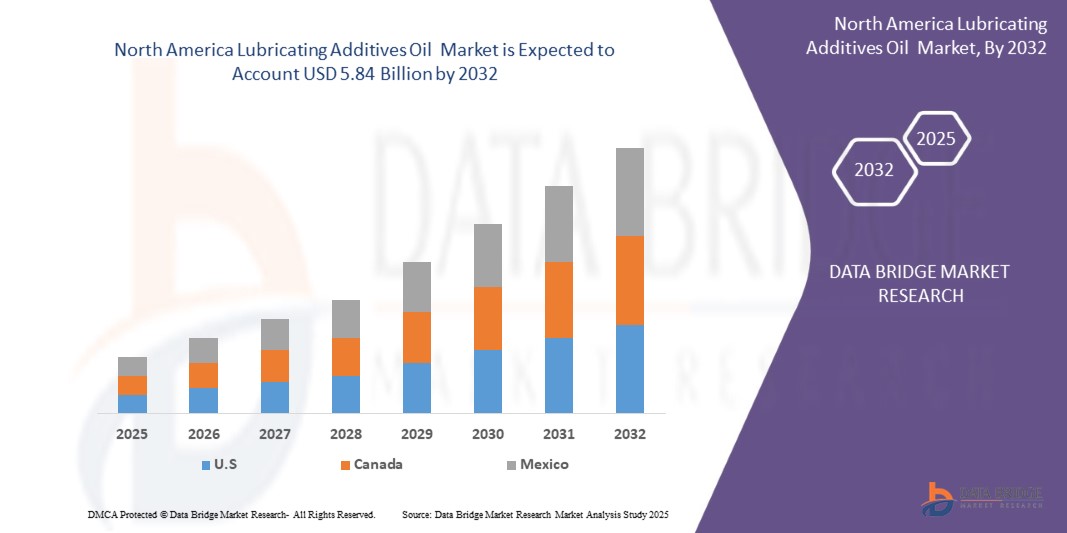

- The North America Lubricating Additives Oil market size was valued at USD 4.65 billion in 2024 and is expected to reach USD 5.84 billion by 2032, at a CAGR of 3.3% during the forecast period

- The market growth is largely fueled by increasing demand for sustainable and recyclable paper products, rapid industrialization in emerging economies, technological advancements in chemical formulations, expansion of end-use industries like packaging and tissue paper, and stringent environmental regulations driving adoption of eco-friendly Lubricating Additives Oil globally.

- Furthermore, the growth of the market is primarily driven by rising consumer preference for eco-friendly products, advancements in chemical technologies, and increasing investments in sustainable packaging solutions across various industries worldwide.

Lubricating Additives Oil Market Analysis

- The lubricating additives oil market is experiencing significant growth due to increasing demand from automotive and industrial sectors. Rising vehicle production and industrial machinery usage fuel the need for advanced lubricants that enhance engine performance, reduce wear, and improve fuel efficiency. Technological innovations, such as synthetic additives, further boost market expansion by offering superior protection under extreme conditions.

- Environmental regulations and the push for sustainable products are reshaping the lubricating additives oil market. Manufacturers are developing eco-friendly additives with lower emissions and better biodegradability. Additionally, growth in emerging economies, urbanization, and increased industrial activities contribute to the rising consumption of lubricating oils, making the market highly competitive and innovation-driven.

- U.S. dominates the North America lubricating oil additives market, accounting for approximately 85% of the regional production and consumption. This leadership is attributed to U.S. 's extensive automotive manufacturing sector, robust industrial base, and significant investments in infrastructure and energy production, including renewable energy projects. The country's steel industry, being the world's largest, also contributes substantially to the demand for metalworking fluid additives.

- U.S. is projected to be the fastest-growing country in the North America lubricating oil additives market. The country's rapid industrialization, expanding automotive sector, and increasing vehicle ownership contribute to this growth. Government initiatives like further support the demand for high-performance lubricants.

- The Anti Wear Agents segment is expected to dominate the Lubricating Additives Oil market with a 34% share in 2025, driven by their essential role in minimizing friction and wear in engines and machinery. Growing automotive production and industrial equipment demand high-performance additives to enhance durability and efficiency.

Report Scope and Lubricating Additives Oil Market Segmentation

|

Attributes |

Lubricating Additives Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lubricating Additives Oil Market Trends

“Growing focus on sustainability and advanced additive technologies.”

- Increasing environmental regulations are driving lubricant manufacturers to develop sustainable additives that reduce harmful emissions, improve biodegradability, and minimize environmental impact, promoting greener industrial and automotive applications globally.

- Advancements in additive technology enable enhanced engine protection, improved fuel efficiency, and longer oil life, meeting evolving industry performance standards and customer expectations.

- Growing consumer preference for eco-friendly products encourages companies to innovate bio-based and synthetic additives, supporting the transition towards sustainable lubricants.

- Integration of nanotechnology and smart additives in lubricants enhances performance under extreme conditions, reducing wear, corrosion, and energy consumption in engines and machinery.

- Collaborations between chemical companies and automotive manufacturers focus on creating customized additive solutions tailored to electric vehicles and next-generation engines, ensuring market relevance amid evolving mobility trends.

Lubricating Additives Oil Market Dynamics

Driver

“Rising demand for efficient, eco-friendly lubricants fuels growth”

- Increasing awareness about environmental protection drives demand for eco-friendly lubricants that reduce pollution and comply with stricter emission regulations, encouraging manufacturers to develop sustainable lubricating additives.

- Growing automotive and industrial sectors require high-performance lubricants to enhance engine efficiency, reduce wear, and extend equipment lifespan, boosting the market for advanced additives.

- Rising fuel costs push industries to adopt fuel-efficient lubricants with additives that improve combustion and reduce friction, contributing to operational cost savings and market expansion.

- Government initiatives promoting green technologies and renewable energy sources incentivize the use of sustainable lubricants, accelerating innovation in biodegradable and non-toxic additive formulations.

For Instance,

- In July 2023 issue of Tribology & Lubrication Technology (TLT) highlights a significant shift in the lubricants industry towards sustainability. Companies are increasingly developing green lubricants and additives from renewable resources like plant-based oils. These biolubricants offer benefits such as biodegradability and reduced environmental impact compared to traditional petroleum-based products. The article also discusses the adoption of carbon-neutral lubricants, which aim to achieve net-zero carbon emissions by offsetting production-related greenhouse gases.

- Consumer preference for longer-lasting, maintenance-reducing lubricants creates demand for additives that improve oil stability and performance, driving growth in the lubricating additives market globally.

Restraint/Challenge

“High formulation costs and strict environmental regulations persist”

- Developing eco-friendly lubricating additives involves expensive R&D processes and sourcing of bio-based raw materials, leading to high production costs that may reduce profit margins and increase end-product prices, limiting adoption in cost-sensitive markets.

- Strict environmental regulations worldwide require compliance with various safety, biodegradability, and emissions standards, creating complexities for manufacturers and necessitating regular product testing, reformulation, and certification, adding to operational challenges.

- Limited availability of sustainable raw materials hampers scalability of production, making it difficult for manufacturers to maintain a consistent supply chain and meet the growing global demand for environmentally safe lubricating additives.

- High formulation costs discourage small and medium-sized enterprises (SMEs) from entering the market, leading to reduced innovation from new players and creating a more consolidated competitive landscape dominated by major manufacturers.

- Regulatory differences between countries complicate global expansion efforts, as lubricating additive manufacturers must adapt formulations to suit varying legal and environmental standards, increasing time to market and hindering international trade and growth.

Lubricating Additives Oil Market Scope

The market is segmented on the basis of functional type, application and end-user.

- By Functional Type

The Anti Wear Agents segment dominates with a 43.2% revenue share in 2025, driven by growing demand for engine protection, reduced maintenance costs, and extended machinery life across automotive and industrial sectors, especially in high-load and high-temperature operating environments.

The Anti Wear Agents segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032. This segment encompasses additives that form protective layers on metal surfaces, minimizing friction and wear in engines and machinery, enhancing durability, operational efficiency, and supporting performance under extreme pressure and temperature conditions.

- By Application

The Industrial Oil segment held the largest market revenue share in 2025, driven by rising demand across manufacturing, mining, and power generation industries, where lubricants are essential for equipment reliability, reduced downtime, and enhanced operational efficiency under harsh and continuous operating conditions.

The Industrial Oil segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing industrialization, automation, and the need for high-performance lubricants that ensure equipment longevity, energy efficiency, and minimal maintenance in heavy-duty and high-temperature operational environments.

Lubricating Additives Oil Market Regional Analysis

- U.S. dominates the North America lubricating oil additives market, accounting for approximately 85% of the regional production and consumption. This leadership is attributed to U.S. 's extensive automotive manufacturing sector, robust industrial base, and significant investments in infrastructure and energy production, including renewable energy projects. The country's steel industry, being the world's largest, also contributes substantially to the demand for metalworking fluid additives.

- It’s dominance in the North America lubricating oil additives market is further strengthened by its rapid urbanization, growing middle class, and increasing vehicle ownership. Government initiatives promoting cleaner technologies and stricter emission standards are accelerating demand for advanced, eco-friendly additives, fostering innovation and market expansion in the region.

- It’s oil additives market benefits from strong government support for green technologies and environmental regulations, encouraging development of biodegradable and low-emission additives. Additionally, its expanding manufacturing sector, rising industrial automation, and increasing demand for high-performance lubricants across automotive, construction, and energy industries drive sustained market growth and innovation.

U.S. Lubricating Additives Oil Market Insight

The U.S. lubricating additives oil market captured the largest revenue share of 85% within Asia Pacific in 2025, fueled by its vast automotive industry, expanding manufacturing sector, growing demand for high-performance lubricants, and strong government focus on environmental regulations and sustainable technologies.

Lubricating Additives Oil Market Share

The Lubricating Additives Oil industry is primarily led by well-established companies, including:

- Lubrizol Corporation (USA)

- Chevron Oronite Company LLC (USA)

- Afton Chemical Corporation (USA)

- Infineum International Limited (USA/UK)

- BASF SE (Germany/USA)

- Clariant AG (Switzerland/USA)

- Eastman Chemical Company (USA)

- Evonik Industries AG (Germany/USA)

- Croda International Plc (UK/USA)

- Chevron Phillips Chemical Company LLC (USA)

- NewMarket Corporation (USA)

- Innospec Inc. (USA)

- SI Group, Inc. (USA)

- R.T. Vanderbilt Holding Company, Inc. (USA)

- Lubrifiants et Additifs Spéciaux (Canada)

Latest Developments in North America Lubricating Additives Oil Market

- In March 2025, Japan's largest oil refiner, Eneos, announced plans to gradually halt lubricant and grease production at its Yokohama facility by March 2028. The decision aims to enhance production efficiency amidst declining domestic demand and increasing global competition.

- In September 2024, IndustryARC forecasted the global lubricating oil additives market to reach $24.5 billion by 2030, driven by advancements in additive technology for electric vehicles (EVs). The rise in EV adoption necessitates specialized lubricants for enhanced performance and efficiency.

- In August 2024, SNS Insider reported that the lubricating oil additives market is projected to grow from $19.66 billion in 2023 to $25.66 billion by 2032, driven by the adoption of synthetic lubricants and increased demand from the automotive and industrial sectors.

- In December 2021, Castrol introduced "Engine Shampoo," an oil change pre-treatment product designed to remove engine sludge buildup, enhancing engine efficiency and longevity. This innovation caters to gasoline and light diesel engines, aiming to improve overall engine performance and reduce maintenance needs.

- In June 2021, Vestige launched "Mach Drive Nano Energiser," an engine oil additive utilizing 20-nanometer zirconia powder coated with platinum. This product aims to reduce engine drag, friction, and noise, thereby improving fuel economy and extending engine life in automotive applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.