North America Lung Cancer Screening Software Market

Market Size in USD Million

CAGR :

%

USD

29.07 Million

USD

117.72 Million

2024

2032

USD

29.07 Million

USD

117.72 Million

2024

2032

| 2025 –2032 | |

| USD 29.07 Million | |

| USD 117.72 Million | |

|

|

|

|

North America Lung Cancer Screening Software Market Size

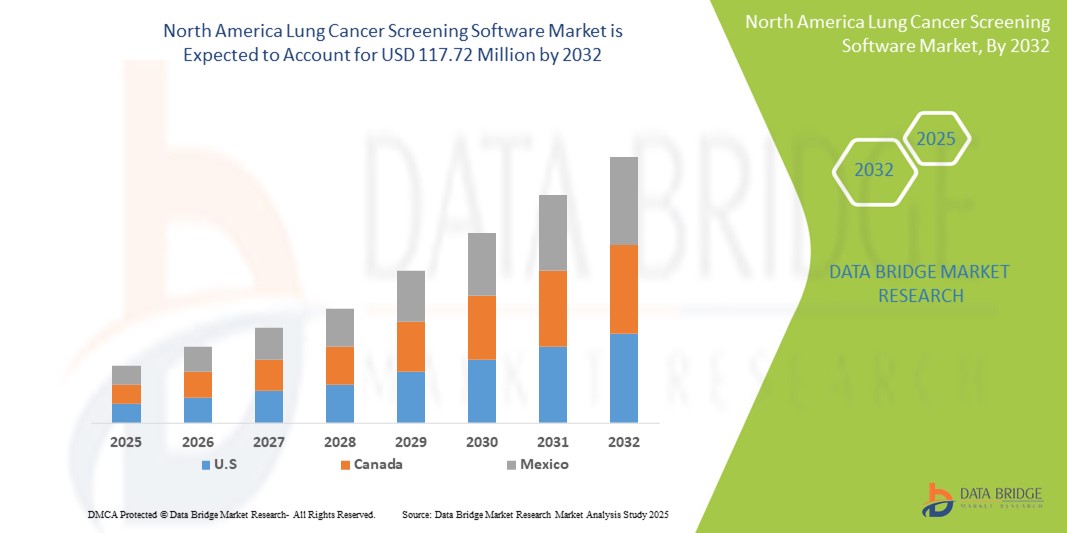

- The North America lung cancer screening software market size was valued at USD 29.07 million in 2024 and is expected to reach USD 117.72 million by 2032, at a CAGR of 19.10% during the forecast period

- The market growth is primarily driven by increasing awareness of early lung cancer detection and the expanding adoption of low-dose CT screening programs across the U.S. and Canada

- In addition, the integration of artificial intelligence, cloud-based platforms, and data analytics to support clinical decision-making and streamline radiology workflows is further enhancing the appeal of lung cancer screening software. These combined trends are propelling the demand for advanced, automated screening tools in the region, significantly contributing to market expansion

North America Lung Cancer Screening Software Market Analysis

- Lung cancer screening software, designed to facilitate early detection and streamline diagnostic workflows, is becoming a critical tool in radiology departments and cancer care centers across North America due to its ability to enhance screening accuracy, patient tracking, and data integration within healthcare systems

- The rising demand for lung cancer screening software is primarily fueled by the growing prevalence of lung cancer, increasing emphasis on early detection programs, and government-backed screening guidelines such as those from the U.S. Preventive Services Task Force (USPSTF).

- U.S. dominated the North America lung cancer screening software market with the largest revenue share of 58.5% in 2024, supported by a mature healthcare IT infrastructure, favorable reimbursement policies, and proactive implementation of AI-driven solutions in radiology

- Canada is expected to be the fastest growing region in the North America lung cancer screening software market, due to rising awareness, improved screening access, and national lung screening initiatives

- The standalone segment dominated the North America lung cancer screening software market with a share of 62% in 2024, owing to its compatibility with existing hospital information systems (HIS) and its ability to provide scalable, vendor-neutral integration across various imaging platforms.

Report Scope and North America Lung Cancer Screening Software Market Segmentation

|

Attributes |

North America Lung Cancer Screening Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Lung Cancer Screening Software Market Trends

“AI-Powered Diagnostic Enhancement and Workflow Optimization”

- A significant and accelerating trend in the North America lung cancer screening software market is the integration of artificial intelligence (AI) and machine learning into diagnostic platforms, improving the accuracy of lung nodule detection and streamlining radiology workflows. These innovations are enabling earlier identification of lung abnormalities, minimizing false positives, and increasing diagnostic confidence among clinicians

- For instance, Riverain Technologies offers ClearRead CT software, which integrates with radiology systems to enhance nodule detection on chest CT scans, reducing visual noise and assisting radiologists in identifying suspicious areas more efficiently. Similarly, Vuno Med-LungCT AI supports automated analysis of CT images to highlight potentially malignant lesions and track changes over time

- AI integration enables features such as automated case prioritization, risk stratification, and longitudinal tracking of nodule evolution, enhancing clinical decision-making. These capabilities reduce radiologist burden and promote consistent adherence to screening protocols, particularly in high-volume hospital settings

- Cloud-based platforms are also gaining traction, providing seamless access to screening tools and enabling collaboration across care teams and facilities. This facilitates centralized management of patient data, appointment scheduling, and follow-up care, fostering improved operational efficiency and patient outcomes

- The integration of AI-enhanced software with broader clinical information systems, including EHRs and PACS, supports comprehensive lung cancer care pathways and reinforces the shift toward personalized medicine

- This trend toward intelligent, scalable, and interconnected screening systems is redefining early lung cancer detection standards. Consequently, software providers are focusing on regulatory-compliant, AI-enabled tools that offer real-time analysis, remote accessibility, and decision support to meet the growing demands of healthcare systems across the U.S. and Canada.

North America Lung Cancer Screening Software Market Dynamics

Driver

“Rising Lung Cancer Incidence and Federal Screening Guidelines Fuel Adoption”

- The increasing prevalence of lung cancer, coupled with government-supported screening initiatives, is a significant driver for the adoption of lung cancer screening software across North America

- For instance, following the U.S. Preventive Services Task Force’s 2021 update expanding screening eligibility, many hospitals and diagnostic centers have implemented low-dose CT screening programs supported by specialized software. This regulatory backing is fueling the deployment of digital tools that ensure adherence to guidelines and improve patient management

- Lung cancer screening software enables structured reporting, automated risk-based scheduling, and real-time data sharing, enhancing workflow efficiency and compliance with clinical protocols

- Moreover, the growing emphasis on early detection as a means to reduce mortality is prompting health systems to invest in AI-assisted tools that can identify high-risk individuals and monitor disease progression more accurately

- The combination of rising public awareness, expanding insurance coverage for screenings, and improved interoperability with clinical systems is driving broader implementation of lung cancer screening software across urban and rural healthcare settings in the region

Restraint/Challenge

“Data Privacy Concerns and Integration Barriers in Smaller Health Facilities”

- Data security and integration complexity remain significant challenges to the widespread adoption of lung cancer screening software, particularly in small to mid-sized healthcare facilities with limited IT capabilities

- For instance, concerns about maintaining HIPAA compliance and protecting sensitive imaging data in cloud-based systems may deter some providers from adopting digital screening tools. The implementation of these solutions often requires substantial upfront investment and IT infrastructure, which can be a barrier for facilities with constrained budgets

- In addition, the lack of standardization in AI model performance, limited validation datasets, and clinician skepticism about algorithmic accuracy can further hinder adoption. Training and familiarization are required to build trust and ensure seamless integration into existing clinical workflows

- While software vendors are focusing on enhancing transparency, security, and scalability, overcoming these obstacles will require continued investment in user-friendly, cost-effective solutions and strategic partnerships to support deployment across diverse care environments

North America Lung Cancer Screening Software Market Scope

The market is segmented on the basis of mode of delivery, product, type, application, platform, purchase mode, end user, and distribution channel.

- By Mode Of Delivery

On the basis of mode of delivery, the North America lung cancer screening software market is segmented into cloud-based solutions, on-premise solutions, and web-based solutions. The cloud-based solutions segment held the largest market revenue share of 55.4% in 2024, driven by its scalability, reduced infrastructure costs, and the growing need for remote access to diagnostic tools. Healthcare providers increasingly prefer cloud-based systems due to their ability to integrate across departments, support multi-location access, and enhance data security through regular software updates.

The on-premise solutions segment is expected to witness the fastest CAGR from 2025 to 2032, from institutions with strict data compliance regulations or legacy systems, particularly those prioritizing full control over data storage and system configuration. The web-based solutions segment is gaining momentum as it offers the advantage of easy deployment, real-time updates, and device accessibility without requiring dedicated software installations.

- By Product

On the basis of product, the North America lung cancer screening software market is segmented into lung cancer screening radiology solution, lung cancer screening patient management software, nodule management software, data collection and reporting, patient coordination and workflow, lung nodule computer-aided detection, pathology and cancer staging, statistical audit reporting, screening PACS, practice management, and audit log tracking. The lung nodule computer-aided detection (CAD) segment dominated the market with the largest market revenue share in 2024, driven by the growing adoption of AI-powered tools that support radiologists in identifying, measuring, and tracking lung nodules with enhanced accuracy.

The patient coordination and workflow segment is expected to witness the fastest growth rate from 2025 to 2032, as it enables efficient scheduling, follow-up tracking, and communication with patients—crucial functions in large-scale screening programs. Solutions supporting data collection and statistical audit reporting are also gaining importance for regulatory compliance and quality assurance.

- By Type

On the basis of type, the North America lung cancer screening software market is segmented into computer-assisted screening and traditional screening. The computer-assisted screening segment dominated the market with the largest market revenue share in 2024, driven by the integration of artificial intelligence and machine learning algorithms that enhance image analysis, prioritize urgent cases, and reduce diagnostic errors. These tools significantly improve workflow efficiency and help meet the increasing volume of screening procedures.

The traditional screening segment is expected to witness the fastest CAGR from 2025 to 2032, relying on manual image interpretation, continues to see usage in low-resource or rural settings but is expected to decline as advanced technologies become more accessible.

- By Application

On the basis of application, the North America lung cancer screening software market is segmented into non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). The NSCLC segment dominated the market with the largest market revenue share of 77.5% in 2024, driven by its higher incidence rate and the wider adoption of early detection strategies using low-dose CT scans. Screening solutions targeting NSCLC focus on long-term monitoring, nodule classification, and risk assessment.

The SCLC segment is expected to grow at a fastest pace during the forecast period, since clinical trials and screening awareness expand, especially in high-risk smoking populations.

- By Platform

On the basis of platform, the North America lung cancer screening software market is segmented into standalone and integrated systems. The standalone segment dominated the market with the largest market revenue share of 62% in 2024, driven by its ease of deployment, compatibility with various imaging systems, and ability to function independently without complex integration. Standalone solutions are widely adopted in facilities that require quick implementation and flexible operation.

The integrated segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the increasing demand for seamless interoperability across radiology, oncology, and EHR systems within large health networks

- By Purchase Mode

On the basis of purchase mode, the North America lung cancer screening software market is segmented into institutional and individual. The institutional segment dominated the market with the largest market revenue share in 2024, as hospitals, imaging centers, and oncology networks are the primary purchasers of lung cancer screening software to support large-scale screening programs and regulatory compliance.

The individual segment remains is expected to witness the fastest CAGR from 2025 to 2032, with the rise of telehealth services and independent practitioners using cloud-based tools to screen high-risk patients and offer second opinions.

- By End User

On the basis of end user, the North America lung cancer screening software market is segmented into oncology centers, hospitals, ambulatory surgical centers, and others. The hospitals segment dominated the market with the largest market revenue share in 2024, attributed to their high patient intake, access to advanced imaging infrastructure, and comprehensive screening programs.

The oncology centers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing specialization in cancer care and the adoption of dedicated software tools for early lung cancer detection and treatment planning. Ambulatory surgical centers are also incorporating these tools for pre-operative screening and diagnostics.

- By Distribution Channel

On the basis of distribution channel, the North America lung cancer screening software market is segmented into direct tender and third-party distributors. The direct tender segment dominated the market with the largest market revenue share in 2024, as bulk software purchases by healthcare institutions are commonly made directly from manufacturers or authorized vendors, often under long-term service contracts and custom configurations.

The third-party distributors segment is expected to witness the fastest CAGR from 2025 to 2032, particularly among smaller practices and outpatient centers seeking flexible purchase models and quicker deployment without large-scale infrastructure planning.

North America Lung Cancer Screening Software Market Regional Analysis

- U.S. dominated the North America lung cancer screening software market with the largest revenue share of 58.5% in 2024, supported by a mature healthcare IT infrastructure, favorable reimbursement policies, and proactive implementation of AI-driven solutions in radiology. Adoption is particularly strong among large hospital networks and cancer centers aiming to optimize clinical efficiency and improve patient outcomes

- Healthcare providers in the region increasingly adopt advanced software platforms to support early detection, automate patient tracking, and comply with national screening guidelines, such as those from the U.S. Preventive Services Task Force (USPSTF)

- The growth is further propelled by the presence of major technology providers, high awareness of lung cancer screening among healthcare professionals, and the availability of robust health IT infrastructure

U.S. North America Lung Cancer Screening Software Market Insight

The U.S. lung cancer screening software market captured the largest revenue share in North America in 2024, supported by well-established screening guidelines, high awareness among healthcare providers, and significant investment in AI-driven diagnostic tools. The widespread implementation of low-dose CT screening programs following USPSTF recommendations has driven hospitals and oncology centers to adopt advanced software for patient tracking, workflow automation, and nodule detection. The presence of key technology vendors and robust reimbursement frameworks further propels market growth, with institutions increasingly integrating cloud-based and AI-powered platforms to enhance clinical efficiency and patient outcomes.

Canada North America Lung Cancer Screening Software Market Insight

The Canada lung cancer screening software market is projected to expand steadily during the forecast period, driven by growing national and provincial-level screening initiatives and increasing digital health investments. As the Canadian healthcare system emphasizes early cancer detection and population health management, software adoption is gaining traction in both public and private healthcare sectors. The demand for cloud-based and interoperable platforms is rising, particularly among radiology departments aiming to improve data sharing and reporting accuracy. Government support for digital transformation and cancer prevention is expected to continue stimulating the market in Canada.

Mexico North America Lung Cancer Screening Software Market Insight

The Mexico lung cancer screening software market is at a nascent stage but shows potential for growth due to increasing healthcare digitization and a rising burden of lung cancer. As public health agencies and private providers recognize the importance of early diagnosis, interest in screening software is gradually increasing. While infrastructure limitations and budget constraints have hindered rapid adoption, partnerships with global technology vendors and pilot screening programs may drive future demand. Expansion of cloud-based and low-cost diagnostic platforms tailored to local needs is expected to support market development in the coming years.

North America Lung Cancer Screening Software Market Share

The North America lung cancer screening software industry is primarily led by well-established companies, including:

- Riverain Technologies (U.S.)

- Aidoc (U.S.)

- Qure.ai (U.S.)

- GE HealthCare (U.S.)

- Canon Medical Systems USA, Inc. (U.S.)

- Visage Imaging, Inc. (U.S.)

- TeraRecon (U.S.)

- RadNet Inc. (U.S.)

- LucidHealth (U.S.)

- REVEALDX (U.S.)

- Optum Inc. (U.S.)

- iCAD, Inc. (U.S.)

- Butterfly Network, Inc. (U.S.)

- Sectra AB (U.S.)

What are the Recent Developments in North America Lung Cancer Screening Software Market?

- In February 2024, Riverain Technologies, a U.S.-based leader in AI imaging diagnostics, expanded the deployment of its ClearRead CT software across multiple hospital networks in North America. This advanced computer-aided detection tool enhances lung nodule visibility in low-dose CT scans, enabling earlier and more accurate diagnosis of lung cancer. The expansion marks a significant step in the use of AI for radiology and highlights Riverain's commitment to empowering clinicians with innovative diagnostic technologies to improve patient outcomes

- In January 2024, the American College of Radiology (ACR) launched an updated version of its Lung Cancer Screening Registry (LCSR), which includes enhanced software features for data tracking, analytics, and reporting. The update is designed to support healthcare providers in complying with CMS reporting requirements and to facilitate more comprehensive lung cancer screening program management. This move reflects the growing emphasis on evidence-based screening supported by integrated software tools across U.S. hospitals and imaging centers

- In December 2023, Aidoc, an AI health tech company headquartered in the U.S., announced a partnership with several large U.S. health systems to deploy its AI-based triage and workflow optimization software for lung cancer screening. The partnership aims to improve case prioritization and reduce turnaround times in radiology departments. This development underscores the increasing demand for intelligent, interoperable solutions to handle growing volumes of CT screenings efficiently

- In October 2023, the Canadian Partnership Against Cancer (CPAC) rolled out a national lung cancer screening framework that incorporates AI-driven software platforms to improve early detection. As part of the initiative, select provinces have begun integrating digital tools to manage patient enrollment, track screening outcomes, and standardize workflows. This development highlights Canada's push to scale lung cancer screening programs through digital health innovation and federal support

- In August 2023, Volpara Health, a medical software company with operations across North America, introduced a lung cancer screening module as part of its broader cancer risk assessment suite. The software is designed to help clinicians identify high-risk patients using demographic, behavioral, and genetic data. This integration offers a more personalized approach to lung cancer screening, reflecting a regional shift toward precision medicine and proactive population health management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.