North America Lymphedema Treatment Market

Market Size in USD Million

CAGR :

%

USD

560.25 Million

USD

1,268.05 Million

2024

2032

USD

560.25 Million

USD

1,268.05 Million

2024

2032

| 2025 –2032 | |

| USD 560.25 Million | |

| USD 1,268.05 Million | |

|

|

|

|

North America Lymphedema Treatment Market Size

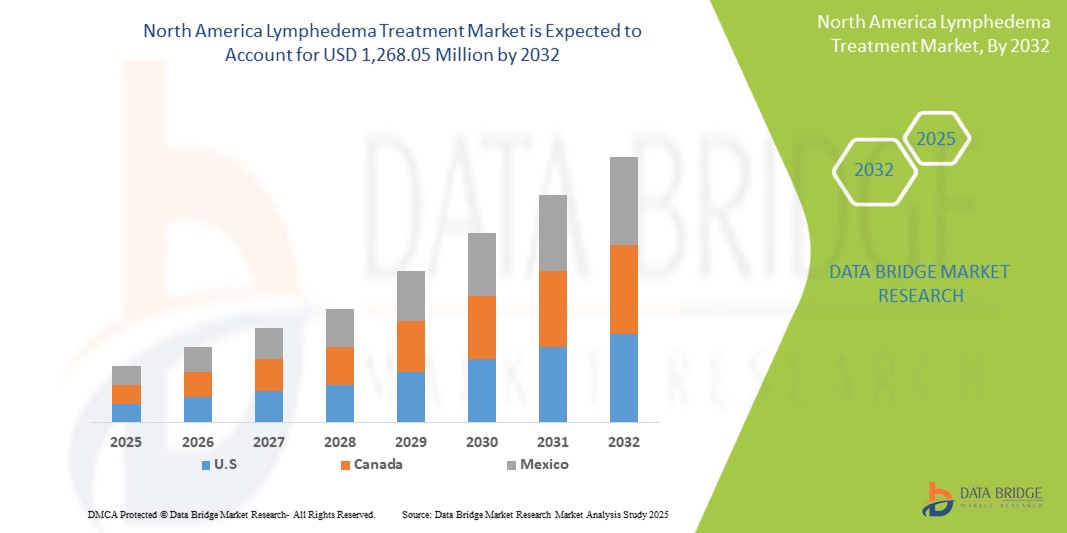

- The North America lymphedema treatment market size was valued at USD 560.25 million in 2024 and is expected to reach USD 1,268.05 million by 2032, at a CAGR of 11.0% during the forecast period

- The market growth in North America is largely fueled by the rising regional prevalence of lymphedema and cancer-related lymphedema, coupled with significant technological advancements in diagnostic imaging modalities and innovative treatment approaches, leading to improved identification and management of the condition.

- Furthermore, increasing patient and clinician demand across the region for more effective, accessible, and integrated solutions for managing chronic swelling and enhancing quality of life is establishing advanced compression therapies, lymphatic drainage techniques, and microsurgical interventions as the modern standard of lymphedema care. These converging factors are accelerating the uptake of lymphedema management solutions in North America, thereby significantly boosting the industry's regional growth.

North America Lymphedema Treatment Market Analysis

- Lymphedema, characterized by chronic swelling caused by impaired lymphatic system function, is an increasingly vital area of focus in modern North American healthcare due to its significant impact on patient quality of life, often arising as a complication of cancer treatment or genetic predispositions.

- The escalating demand for lymphedema treatments in North America is primarily fueled by the rising regional prevalence of lymphedema and cancer-related lymphedema, increasing awareness among healthcare professionals and patients, and continuous technological advancements in diagnostic and therapeutic modalities

- U.S. dominated the lymphedema market in 2024 and is expected to witness the highest growth rate during the forecast period, driven by a high prevalence of lymphedema cases (particularly cancer-related lymphedema), advanced healthcare infrastructure, and strong consumer awareness and early adoption of innovative therapies

- The compression therapy segment is expected to dominate the North American lymphedema treatment market, driven by its established reputation as the first-line and most common treatment for managing swelling, its non-invasive nature, and ongoing innovations in compression garments and devices offering improved comfort, accessibility, and clinical efficacy

Report Scope and North America Lymphedema Treatment Market Segmentation

|

Attributes |

Lymphedema Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Lymphedema Treatment Market Trends

Enhanced Patient Care Through AI and Digital Integration

- A significant and accelerating trend in the North America lymphedema market is the deepening integration with artificial intelligence (AI) and digital health platforms, encompassing remote monitoring, personalized treatment algorithms, and telehealth solutions. This fusion of technologies is significantly enhancing patient convenience, treatment adherence, and overall management of their chronic condition.

- For instance, in November 2014, as per the American Cancer Society, over 4 million breast cancer survivors are living in the U.S., with an estimated 20–40% at risk for developing lymphedema post-treatment—highlighting a critical patient segment driving regional demand for long-term lymphedema management solutions.

- AI integration in North American lymphedema care enables features such as analyzing vast patient data to predict potential flare-ups, optimizing compression garment pressure levels based on individual responses, and providing more intelligent alerts for early intervention. For instance, emerging AI-driven solutions are being developed across the U.S. and Canada to improve the accuracy of early lymphedema detection through imaging analysis and to guide patients through personalized rehabilitation exercises. Furthermore, digital platforms with integrated communication capabilities offer patients the ease of virtual consultations, allowing them to discuss symptoms and receive guidance remotely from care providers.

- The seamless integration of lymphedema monitoring devices and self-management tools with broader digital health ecosystems across North America facilitates centralized control over various aspects of a patient's care. Through a single interface, users can manage their limb measurements, therapy adherence, and communicate with their care team, creating a unified and more proactive health management experience.

North America Lymphedema Treatment Market Dynamics

Driver

Growing Need Due to Rising Disease Prevalence and Enhanced Diagnostic Capabilities

- The increasing prevalence of lymphedema in North America, particularly secondary lymphedema resulting from cancer treatments such as breast, prostate, and gynecological cancer therapies, combined with accelerating advancements in diagnostic technologies and rising awareness, is a major driver for the growing demand for lymphedema management solutions in the region

- For instance, in April 2020, an article published by ResearchGate GmbH stated that the pooled prevalence of arm lymphedema was 27%, with considerable heterogeneity. The pooled incidence for arm lymphedema was 21%. Evidence also showed that a higher body mass index (> 25)—a common issue in the U.S. and Canada—was associated with an increased risk of arm lymphedema

- As North American healthcare professionals and patients become more informed about the long-term consequences of untreated lymphedema, there is a growing emphasis on early intervention. Advanced diagnostic tools such as bioimpedance spectroscopy (BIS) and near-infrared fluorescence imaging (e.g., ICG lymphography) are increasingly adopted in U.S. and Canadian clinics, offering superior accuracy and earlier detection than traditional methods like limb circumference measurement

- The shift toward patient-centric care and improved quality of life for individuals living with chronic conditions is driving the integration of comprehensive lymphedema management into standard post-cancer treatment and chronic disease care pathways. This integration supports continuity of care through coordinated rehabilitation programs and supportive therapies

- The availability of digital health tools that enable early diagnosis, facilitate personalized treatment planning, and support symptom self-management through advanced compression wearables and guided exercise routines is significantly boosting adoption in both clinical and home-based care settings across North America. The trend toward proactive screening, combined with greater access to easy-to-use, patient-friendly lymphedema products, is further accelerating market growth in the region.

Restraint/Challenge

Concerns Regarding Underdiagnosis and High Treatment Costs

- Concerns surrounding the widespread underdiagnosis and misdiagnosis of lymphedema in North America, coupled with the significant financial burden of long-term treatment, pose a major challenge to broader market penetration and effective patient care. In many cases, lymphedema presents with subtle symptoms in its early stages and is often overlooked or misidentified by healthcare providers, resulting in delayed intervention, disease progression, and increased patient anxiety regarding long-term health outcomes

- Although specific cost data for North America varies, patients in the U.S. frequently report high out-of-pocket expenses for lymphedema care—including costs associated with compression garments, manual lymphatic drainage therapy, and pneumatic compression devices—which can total several thousand dollars annually depending on disease severity and insurance coverage. While legislative efforts such as the Lymphedema Treatment Act (signed into U.S. law in 2022) aim to improve Medicare reimbursement for compression treatment items, the costs of lifelong management still remain a substantial burden for many patients, especially those without comprehensive insurance

- Addressing the challenge of underdiagnosis in North America requires enhanced medical education for general practitioners, standardized screening protocols in oncology and surgical aftercare settings, and expanded public awareness campaigns. Advocacy and educational efforts by organizations like the Lymphatic Education & Research Network (LE&RN) and the National Lymphedema Network (NLN) are critical in improving early detection and long-term outcomes for patients

- Furthermore, the relatively high and recurring cost of essential lymphedema products remains a barrier to treatment adherence for many, particularly in lower-income or underserved communities. This financial challenge can discourage proactive management and routine care, particularly in cases where patients lack adequate insurance or access to specialized lymphedema clinics

- Although awareness across the region is improving, the chronic nature of lymphedema and the absence of a definitive cure continue to affect patient motivation and consistent care-seeking behavior. Overcoming these barriers through increased healthcare provider training, improved reimbursement mechanisms, and the development of more affordable and scalable treatment solutions will be essential to support long-term market growth and improve patient quality of life across North America

North America Lymphedema Treatment Market Scope

The North America lymphedema treatment market is categorized into seven notable segments which are based on treatment type, type, affected area, age group, route of administration, end user, and distribution channel.

By Treatment Type

On the basis of treatment type, the North America lymphedema market is segmented compression therapy, surgery, drug therapy, laser therapy and others. The compression therapy segment is expected to dominate the largest market revenue share in the region (estimated to be over 70.00% in 2025 for the compression therapy market where lymphedema is a major application), driven by its established reputation as the gold standard for lymphedema management and its non-invasive nature. This makes it highly accessible and preferred by a broad range of patients across the U.S. and Canada. Patients in North America often prioritize compression therapy due to its proven effectiveness in reducing swelling, improving limb mobility, and enhancing daily comfort. The market also benefits from high demand for compression garments, sleeves, and pneumatic pumps, supported by ongoing innovations in fabric technologies and wearable design, which enhance patient compliance and comfort.

The surgical procedures segment is anticipated to witness the fastest growth rate during the forecast period in North America, driven by advancements in microsurgical techniques such as lymphovenous anastomosis (LVA) and vascularized lymph node transfer (VLNT). Rising patient awareness of these potentially curative options for advanced or refractory lymphedema cases is increasing the acceptance of surgical treatment. Specialized lymphedema surgery centers across the U.S., along with increasing physician referrals and insurance support for surgical options, are further contributing to the growing popularity of these interventions. Surgical procedures are especially appealing to patients seeking long-term limb volume reduction and improved quality of life after limited success with conservative therapies

By Type

On the basis of type, the North America lymphedema treatment market is segmented into primary lymphedema and secondary lymphedema. The secondary lymphedema segment is expected to dominate the largest market revenue share in the region, estimated to be 79.26% in 2025, driven by its significantly higher prevalence across the U.S. and Canada. This form of lymphedema is largely associated with cancer treatments such as lymph node dissection, mastectomy, and radiation therapy—common procedures in the management of breast, prostate, and gynecological cancers.

The primary lymphedema segment is anticipated to witness a fastest growth rate during the forecast period, fueled by increasing awareness and diagnostic capabilities for this often hereditary and early-onset condition, alongside advancements in genetic testing and specialized pediatric lymphedema care. Greater understanding of genetic mutations linked to primary lymphedema is leading to earlier diagnosis.

By Affected Area

On the basis of affected area, the North America lymphedema treatment market is segmented into lower extremity, upper extremity and genitalia. The lower extremity segment is expected to dominate the largest market revenue share in the region, estimated to be 53.61% in 2025, driven by the higher incidence of leg lymphedema across the U.S. and Canada. This is frequently associated with underlying conditions such as chronic venous insufficiency, obesity, and treatments for cancers like prostate and gynecological malignancies. Patients affected by lower extremity lymphedema often experience reduced mobility and significant discomfort, prompting earlier medical attention.

The upper extremity segment is expected to witness a significant growth rate during the forecast period in North America, largely fueled by the increasing number of breast cancer survivors, particularly in the U.S., where post-surgical and radiation-related arm lymphedema is common following axillary lymph node dissection. Growing awareness among oncology care providers and patients about early signs of lymphedema has led to the development and adoption of tailored solutions such as compression sleeves, gloves, and advanced pneumatic compression devices.

By Age Group

On the basis of age group, the Asia-Pacific lymphedema treatment market is segmented into Adult, Geriatric and Pediatric. The adult segment is expected to continue dominating the largest market revenue share in the APAC region. This is primarily driven by the high incidence of secondary lymphedema linked to cancer treatments, such as those for breast, gynecological, and prostate cancers, which are increasingly prevalent in the adult population across Asia-Pacific due to changing lifestyles, environmental factors, and improving cancer diagnostics. In addition, various acquired causes, including trauma, infections (like filariasis in certain endemic areas), and other medical conditions, contribute to lymphatic dysfunction in adults. Adult patients in APAC form the largest demographic seeking lymphedema treatment due to the sheer size of this population segment and the growing awareness of available treatment options. The market also benefits from a broad range of products and solutions specifically tailored for adult lymphedema management.

The geriatric segment is anticipated to witness the fastest growth rate in the Asia-Pacific region during the forecast perod. This accelerated growth is fueled by the significant increase in the aging population across APAC, which is inherently more susceptible to age-related lymphatic decline, leading to reduced lymphatic function. The rising prevalence of co-morbidities such as chronic venous insufficiency, obesity, and other age-related chronic conditions also contributes to the higher incidence of lymphedema in older adults. As life expectancy continues to rise in many APAC countries, so does the burden of chronic conditions, including lymphedema, in the elderly.

By Route Of Administration

On the basis of route of administration, the Asia-Pacific lymphedema treatment market is segmented into oral, injectable and topical. The oral segment is expected to hold a largest market share with 51.84% in the APAC region in 2025. This is driven by the convenience of at-home use for supportive medications, such as diuretics for managing swelling symptoms, antibiotics for preventing or treating recurrent cellulitis (a common complication of lymphedema), and various anti-inflammatory drugs. There's also growing interest in and investigation of emerging oral therapies aimed at improving lymphatic function. Patients in APAC often prefer oral medications due to their ease of self-administration, which promotes better adherence to treatment plans outside of clinical settings.

The injectable segment is anticipated to witness the fastest growth rate in the Asia-Pacific region during the forecast perod. This rapid expansion is fueled by the ongoing research and development efforts in novel biological therapies, growth factors (such as VEGF-C, which stimulates lymphatic regeneration), and gene therapies. These advanced treatments often require parenteral (injectable) administration to effectively stimulate lymphatic regeneration, reduce inflammation, or modulate disease progression.

By End User

On the basis of end user, the lymphedema treatment market is segmented into hospitals, specialty clinics, ambulatory surgical centers (ASCs), and others. The hospital segment is expected to hold the largest market share. This dominance is attributed to the hospital's ability to offer a full spectrum of lymphedema treatment options—from early-stage conservative therapies like manual lymphatic drainage and compression therapy to advanced surgical procedures such as lymphovenous anastomosis and vascularized lymph node transfer. Hospitals also serve as the primary referral point for complicated or advanced-stage cases, which require multidisciplinary care, including imaging, diagnostics, and surgical intervention.

The specialty clinics segment is anticipated to witness the fastest growth rate during the forecast period. This growth is driven by the increasing number of lymphedema-focused rehabilitation and outpatient care centers that provide non-invasive therapies and chronic condition management. These clinics cater especially to patients with mild to moderate lymphedema who require regular therapy sessions, making them cost-effective and convenient alternatives to hospital visits. Their rise is further supported by growing awareness campaigns and government-led initiatives for chronic edema management, particularly in urban settings.

By Distribution Channel

On the basis of distribution channel, the global lymphedema treatment market is segmented into pharmacy, stores, direct tender, and others. The direct tender segment is projected to dominate the market. This is primarily due to bulk procurement of medical devices such as compression pumps, garments, and surgical kits by public hospitals, rehabilitation centers, and government health agencies. Direct tender channels ensure streamlined procurement processes, compliance with regulatory standards, and preferential pricing, making them the preferred option for large-scale institutional buyers.

The stores segment—which includes both retail and online channels—is expected to be the fastest growing segment during the forecast period. This rapid expansion is attributed to a shift in patient behavior toward home-based lymphedema management, especially post-COVID-19. The convenience of online purchasing, growing e-commerce penetration, and availability of self-management devices such as compression sleeves and wraps have accelerated the segment’s growth. Additionally, the rise of telehealth services has empowered patients to manage early-stage lymphedema at home, increasing reliance on over-the-counter and e-commerce-based treatment tools.

North America Lymphedema Treatment Market Regional Analysis

- North America is expected to dominate the North America lymphedema treatment market with the largest revenue share, often holding around 53.56% in 2025, driven by a high prevalence of lymphedema cases (particularly cancer-related lymphedema), robust healthcare infrastructure, and significant investments in medical research and development

- Healthcare providers and patients in the region highly value the readily available advanced diagnostic tools, comprehensive treatment options, and increasing awareness campaigns offered by specialized clinics and hospitals

- This widespread adoption is further supported by high disposable incomes, strong health insurance penetration, and a proactive approach to chronic disease management, establishing lymphedema care as an integrated part of patient pathways for both cancer survivors and those with other lymphatic disorders

U.S. Lymphedema Treatment Market Insight

The U.S. lymphedema market captured a significant revenue share within North America, often representing over 92.24% in 2024, fueled by the swift uptake of advanced diagnostic tools and the expanding trend of integrated lymphedema care. Healthcare professionals and patients are increasingly prioritizing the early detection and effective management of lymphedema through comprehensive treatment protocols. The growing recognition of the condition among clinicians, combined with robust demand for specialized compression therapies, pneumatic pumps, and digital health monitoring, further propels the lymphedema industry. Moreover, the increasing integration of supportive policies like the Lymphedema Treatment Act, alongside technological advancements in bioimpedance spectroscopy (BIS) and remote patient monitoring platforms, is significantly contributing to the market's expansion, enhancing patient access and adherence to long-term care.

Canada Lymphedema Treatment Market Insight

The Canada lymphedema market captured a notable revenue share of 4.53% within North America, contributing significantly to regional growth in 2025, driven by the gradual uptake of advanced diagnostic tools and the increasing emphasis on integrated lymphedema care within provincial healthcare systems. Healthcare professionals and patients across Canada are increasingly prioritizing early detection and comprehensive management of lymphedema through coordinated treatment protocols and multidisciplinary care approaches. The rising awareness of the condition among clinicians, coupled with growing demand for specialized compression garments, pneumatic compression devices, and emerging digital health tools, is steadily propelling the lymphedema market in the country. Moreover, the supportive role of national advocacy organizations such as the Canadian Lymphedema Framework and provincial initiatives promoting education and patient access, along with technological advancements in diagnostic modalities like bioimpedance spectroscopy (BIS) and remote patient management platforms, is contributing to the market's expansion. These efforts are enhancing access to timely diagnosis and promoting adherence to long-term care strategies, ultimately improving outcomes for Canadian patients living with lymphedema.

North America Lymphedema Treatment Market Share

The lymphedema treatment industry is primarily led by well-established companies, including:

- Tactile Medical (U.S.)

- Essity Aktiebolag (publ) (Sweden)

- 3M (U.S.)

- Cardinal Health (U.S.)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- PAUL HARTMANN AG (Germany)

- medi GmbH & Co. KG (Germany)

- ConvaTec Inc. (U.K.)

- Juzo (Germany)

- Smith + Nephew (U.K.)

- SIGVARIS GROUP (Switzerland)

- Sanyleg Srl (Italy)

- Avet Pharmaceuticals Inc. (U.S.)

- ThermoTek Inc. (U.S.)

- Huntleigh Healthcare Limited (U.K.)

- KOYA MEDICAL (U.S.)

- AIROS Medical, Inc. (U.S.)

- BIOCOMPRESSION SYSTEMS (U.S.)

- Mego Afek ltd. (Israel)

- Thusane (France)

Latest Developments in North America Lymphedema Treatment Market

- In March 2025, ConvaTec announced a global collaboration with the Wound, Ostomy, and Continence Nurses Society (WOCN) to improve ostomy care education. The partnership launches two free programs—the Advanced Ostomy Care Program and Ostomy Care Associate (OCA) Program—to train over 750 healthcare professionals worldwide. The initiative aims to raise care standards and expand patient access to expert ostomy care

- In April 2025, Lohmann & Rauscher (L&R) Group acquired Unisurge International Ltd., the UK’s leading provider of Custom Procedure Packs and surgical products. This strategic acquisition enhances L&R’s market access to the UK hospital sector. Unisurge will operate independently, retaining its leadership and staff, while benefiting from L&R’s global expertise and commitment to medical innovation

- In February 2025, Tactile Medical has expanded the U.S. launch of its Nimbl pneumatic compression device to treat lower extremity lymphedema, following its initial release for upper limb conditions. Nimbl is the smallest, Bluetooth-enabled PCD of its kind, designed for comfort, portability, and improved adherence. It integrates with the Kylee app, enhancing patient experience and self-managed care at home

- In October 2024, Tactile Medical has launched Nimbl, its next-generation pneumatic compression device, for treating upper extremity lymphedema. FDA-cleared and CMS-approved, Nimbl is 68% lighter and 40% smaller than previous models. Designed for home use and daily convenience, it integrates with the Kylee app to enhance patient monitoring. A lower extremity version is expected to launch soon nationwide

- In July 202, Tactile Medical has launched ComfortEase garments for its Flexitouch Plus system, redesigned for improved fit, comfort, and ease of use. Alongside, the company introduced the Kylee mobile app, empowering patients to track lymphedema symptoms, record treatments, and access educational resources. Both innovations aim to enhance at-home therapy adherence and patient engagement in managing chronic swelling conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS –

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 ANALYSIS AND RECOMMENDATION

4.4 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 MERGERS & ACQUISITIONS

4.4.1.2 TECHNOLOGY COLLABORATIONS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES & MILESTONES

4.4.5 INNOVATION STRATEGIES & METHODOLOGIES

4.4.6 RISK ASSESSMENT & MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PIPELINE ANALYSIS – NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

4.5.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.5.2 DRUG THERAPY PIPELINE

4.5.3 PHASE III CANDIDATES

4.5.4 PHASE II CANDIDATES

4.5.5 PHASE I CANDIDATES

4.5.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.5.7 CONCLUSION

4.6 EPIDEMIOLOGY–

4.6.1 INCIDENCE OF LYMPHEDEMA (NORTH AMERICA & BY GENDER)

4.6.2 INCIDENCE OF LYMPHEDEMA BY GENDER

4.6.3 TREATMENT RATE

4.6.4 MORTALITY RATE

4.6.5 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.6.6 PATIENT TREATMENT SUCCESS RATES

4.7 TARIFF

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 North America vs. Regional Tariff Structures

4.7.2.2 United States: Medicare/Medicaid Tariff Policies, CMS Pricing Models

4.7.2.3 European Union: Cross-border Tariff Regulations and Reimbursement Policies

4.7.2.4 Asia-Pacific: Government-imposed Tariffs on Imported Medical Products

4.7.2.5 Emerging Markets: Challenges in Tariff Implementation

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 Import Duties on Prescription Drugs vs. Generics

4.7.3.2 Impact on Drug Affordability and Access

4.7.3.3 Key Trade Agreements Affecting Pharmaceutical Tariffs

4.7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.7.4.1 Cost Burden on Hospitals and Healthcare Facilities

4.7.4.2 Effect on Patient Affordability and Insurance Coverage

4.7.4.3 Tariffs and Their Role in Medical Tourism

4.7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.7.5.1 WTO Regulations on Healthcare Tariffs

4.7.5.2 Impact of Trade Wars on the Healthcare Supply Chain

4.7.5.3 Role of Free Trade Agreements (FTAs) in Reducing Tariffs

4.7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 REGULATORY FRAMEWORK–

5.1 NORTH AMERICA

5.2 SOUTH AMERICA

5.3 EUROPE

5.4 ASIA-PACIFIC

5.5 MIDDLE EAST & AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF LYMPHEDEMA CASES GLOBALLY

6.1.2 INCREASE IN THE PREVALENCE OF CANCERS

6.1.3 INCREASING NUMBER OF HEALTHCARE FACILITIES

6.1.4 AVAILABILITY AND ADVANCEMENT OF MULTIPLE THERAPEUTIC OPTIONS

6.2 RESTRAINTS

6.2.1 SIGNIFICANT COST BURDEN ASSOCIATED WITH LYMPHEDEMA MANAGEMENT

6.2.2 LACK OF AWARENESS ABOUT THE DISEASE

6.3 OPPORTUNITIES

6.3.1 EXPANDING OPPORTUNITIES FOR DRUG DEVELOPMENT AND REGULATORY APPROVALS

6.3.2 STRATEGIC COLLABORATIONS AND ALLIANCES AMONG INDUSTRY STAKEHOLDERS

6.4 CHALLENGES

6.4.1 ABSENCE OF A DEFINITIVE CURATIVE TREATMENT

6.4.2 RESTRICTIVE AND INCONSISTENT REIMBURSEMENT POLICIES

7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 COMPRESSION THERAPY

7.3 SURGERY

7.4 DRUG THERAPY

7.5 LASER THERAPY

7.6 OTHERS

8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 SECONDARY LYMPHEDEMA

8.3 PRIMARY LYMPHEDEMA

9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA

9.1 OVERVIEW

9.2 LOWER EXTREMITY

9.3 UPPER EXTREMITY

9.4 GENITALIA

10 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

11.4 TOPICAL

12 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 PHARMACY STORES

13.3 DIRECT TENDER

13.4 OTHERS

14 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TACTILE MEDICAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESSITY AKTIEBOLAG (PUBL)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARDINAL HEALTH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LOHMANN & RAUSCHER GMBH & CO. KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AIROS MEDICAL, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARJO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 AVET PHARMACEUTICALS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BAUERFEIND

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOCOMPRESSION SYSTEMS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CONVATEC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ENOVIS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HUNTLEIGH HEALTHCARE LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 IMPEDIMED LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 JODAS EXPOIM PVT. LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 JUZO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KOYA MEDICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LLC BINNOPHARM GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MCKESSON MEDICAL-SURGICAL INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MEDI GMBH & CO. KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 MEGO AFEK LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PAUL HARTMANN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PERFORMANCE HEALTH

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 PURETECH HEALTH INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PIPELINE PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SANYLEG SRL A SOCIO UNICO

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SIGVARIS GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SMITH+NEPHEW

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 THERMOTEK

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 THUASNE

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 VIATRIS INC.

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENT

17.32 WHITE SWAN PHARMACEUTICAL

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRODUCTS AND THEIR STAGES IN DEVELOPMENT.

TABLE 2 PHASE-WISE DISTRIBUTION: CLINICAL TRIALS

TABLE 3 PHASE 2 CANDIDATES

TABLE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LASER THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SECONDARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LOWER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA UPPER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA GENITALIA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ADULT IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA GERIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA PEDIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA INJECTABLE IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA TOPICAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HOSPITAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SPECIALITY CLINICS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA PHARMACY STORES IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDER IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 45 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 59 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 60 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 74 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 75 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 89 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 90 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 14 INCREASE IN THE PREVALENCE OF CANCERS IS EXPECTED TO DRIVE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 17 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2024

FIGURE 26 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2024

FIGURE 30 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 34 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2024

FIGURE 38 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 North America Lymphedema Treatment Market: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.