North America Magnetic Resonance Imaging Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.04 Billion

USD

4.12 Billion

2024

2032

USD

3.04 Billion

USD

4.12 Billion

2024

2032

| 2025 –2032 | |

| USD 3.04 Billion | |

| USD 4.12 Billion | |

|

|

|

|

North America Magnetic Resonance Imaging Devices Market Size

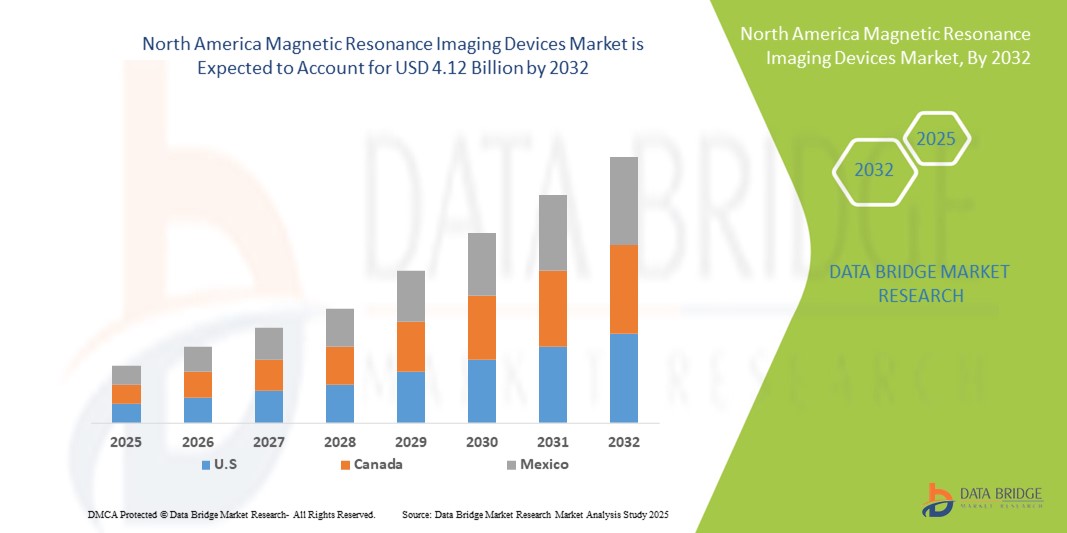

- The North America magnetic resonance imaging devices market size was valued at USD 3.04 billion in 2024 and is expected to reach USD 4.12 billion by 2032, at a CAGR of 3.90% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, including cancer and neurological disorders, as well as the increasing aging population, which is driving demand for advanced diagnostic imaging solutions across hospitals and diagnostic centers

- Furthermore, continuous technological advancements, such as high-field MRI systems and functional MRI innovations, coupled with the focus of leading players on product development and strategic collaborations, are enhancing imaging accuracy and expanding clinical applications. These converging factors are accelerating the adoption of MRI devices, thereby significantly boosting the industry's growth

North America Magnetic Resonance Imaging Devices Market Analysis

- Magnetic Resonance Imaging (MRI) devices, providing non-invasive, high-resolution imaging for diagnostic and clinical applications, are increasingly critical components of modern healthcare facilities in both hospitals and diagnostic centers due to their accuracy, advanced imaging capabilities, and integration with hospital information systems

- The rising demand for MRI devices is primarily fueled by the increasing prevalence of chronic diseases such as cancer, neurological disorders, and cardiovascular conditions, along with the growing aging population requiring advanced diagnostic imaging

- U.S. dominated the North America magnetic resonance imaging devices market with the largest revenue share of 77.8% in 2024, driven by early adoption of advanced medical technologies, high healthcare expenditure, and a strong presence of leading industry players. The country experienced substantial growth in MRI installations across hospitals and outpatient centers, propelled by innovations from established companies such as Siemens Healthineers, GE Healthcare, and Philips Healthcare, focusing on high-field and functional MRI systems

- Canada is expected to witness the fastest growth in the North America magnetic resonance imaging devices market during the forecast period due to increasing healthcare infrastructure investments, expanding diagnostic services, and rising awareness of advanced imaging technologies

- High-field MRI segment dominated the North America magnetic resonance imaging devices market with a market share of 43.7% in 2024, driven by superior image resolution, faster scan times, and expanding clinical applications in neurology, oncology, and musculoskeletal imaging

Report Scope and North America Magnetic Resonance Imaging Devices Market Segmentation

|

Attributes |

North America Magnetic Resonance Imaging Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Magnetic Resonance Imaging Devices Market Trends

Advancements Through AI and Functional Imaging Integration

- A significant and accelerating trend in the North American MRI devices market is the integration of artificial intelligence (AI) and functional imaging technologies into MRI systems, which enhances diagnostic accuracy, scan efficiency, and workflow automation in both hospitals and diagnostic centers

- For instance, Siemens Healthineers’ AI-Rad Companion for MRI assists radiologists by automatically analyzing scans and providing structured reports, improving diagnostic speed and consistency across clinical settings. Similarly, GE Healthcare’s AIRx AI platform optimizes image quality and reduces scan times for faster patient throughput

- AI-enabled MRI systems allow features such as automated tissue segmentation, anomaly detection, and predictive analysis, potentially improving early disease detection and personalized treatment planning. Functional MRI integration further supports advanced neurological and cardiac studies by capturing dynamic physiological data

- The combination of AI and functional imaging capabilities facilitates centralized control and improved collaboration across radiology departments, allowing clinicians to streamline workflows, reduce manual errors, and achieve higher reproducibility in imaging results

- This trend towards smarter, more intuitive, and data-driven MRI solutions is reshaping clinical expectations for diagnostic imaging. Consequently, companies such as Philips Healthcare are developing AI-powered MRI systems capable of automated reconstruction, motion correction, and advanced functional imaging

- The demand for AI-enabled and functional MRI systems is growing rapidly across both hospitals and specialty imaging centers, as healthcare providers increasingly prioritize efficiency, accuracy, and comprehensive diagnostic capabilities

North America Magnetic Resonance Imaging Devices Market Dynamics

Driver

Increasing Demand Due to Rising Chronic Diseases and Advanced Imaging Adoption

- The increasing prevalence of chronic diseases such as cancer, cardiovascular, and neurological disorders, coupled with the growing adoption of advanced imaging technologies, is a significant driver for MRI device demand

- For instance, in March 2024, GE Healthcare launched the SIGNA Voyager 1.5T MRI system with AI-assisted imaging workflows to improve throughput and diagnostic accuracy, strategies expected to propel MRI adoption in hospitals and diagnostic centers

- As healthcare providers focus on early diagnosis and treatment planning, MRI systems offer non-invasive, high-resolution imaging with features such as 3D reconstruction, functional mapping, and automated analysis, providing a compelling advantage over conventional imaging methods

- Furthermore, the expansion of outpatient imaging centers and specialty clinics is increasing demand for MRI installations, supporting faster and more convenient diagnostic services in urban and suburban areas

- The trend towards AI-enabled and high-field MRI systems, combined with growing healthcare awareness and infrastructure investments, is accelerating MRI adoption across both hospitals and diagnostic facilities

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high acquisition and maintenance costs of MRI systems, particularly high-field and AI-enabled models, pose a significant challenge to broader market penetration, especially among smaller clinics or budget-constrained facilities

- For instance, reports of high installation and operational costs in regional hospitals have made some healthcare providers hesitant to invest in advanced MRI systems without clear return-on-investment projections

- Addressing regulatory compliance, such as FDA approvals and adherence to safety and electromagnetic exposure standards, is crucial for market acceptance. Companies such as Siemens and Philips emphasize their compliance with regulatory guidelines to reassure buyers

- In addition, concerns regarding integration with hospital information systems, training requirements for radiologists and technicians, and periodic software updates can be barriers to adoption, requiring careful planning and support from manufacturers

- Overcoming these challenges through cost-effective system designs, leasing models, enhanced training programs, and streamlined regulatory processes will be vital for sustained growth in the North American MRI devices market

North America Magnetic Resonance Imaging Devices Market Scope

The market is segmented on the basis of type, process, field strength, modality, architecture, application, end users, and distribution channel.

- By Type

On the basis of type, the North America magnetic resonance imaging devices market is segmented into conventional and bio-based MRI systems. The conventional MRI segment dominated the market with the largest revenue share in 2024, driven by its well-established presence in hospitals and diagnostic centers across North America. Conventional MRI systems are preferred for their proven reliability, broad clinical applicability, and compatibility with multiple imaging protocols. Hospitals and large diagnostic centers rely on conventional MRI for oncology, neurology, cardiology, and musculoskeletal diagnostics. The segment also benefits from extensive maintenance support, service networks, and training programs offered by major manufacturers. Its dominance is reinforced by the long-standing adoption in routine clinical workflows and research applications.

The bio-based MRI segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by technological innovations in contrast agents and functional imaging techniques. Bio-based systems provide enhanced molecular imaging and enable real-time monitoring of biological processes. Adoption is particularly high in academic medical centers and research hospitals focused on precision medicine. The segment benefits from increasing demand for targeted diagnostics in oncology, neurology, and cardiac care. Manufacturers are investing in bio-based systems to meet clinical requirements for safer, more effective imaging. Regulatory approvals and R&D advancements are expected to accelerate growth in this subsegment over the forecast period.

- By Process

On the basis of process, the North America magnetic resonance imaging devices market is segmented into trans-esterification and direct esterification. The trans-esterification process segment dominated the market in 2024 due to its cost efficiency, reproducibility, and established use in producing MRI contrast agents. Hospitals and imaging centers prefer MRI systems using trans-esterified agents because of consistent image quality and compliance with regulatory standards. The segment supports conventional MRI applications such as neurology, musculoskeletal, and cardiovascular imaging. Its dominance is reinforced by mature supply chains, extensive industry experience, and long-term partnerships with healthcare providers. Clinicians also rely on trans-esterification-based contrast agents for safe and effective imaging outcomes.

The direct esterification process segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for bio-compatible and highly specific contrast agents. Direct esterification allows development of targeted imaging agents for advanced functional MRI applications. Adoption is increasing in research hospitals and specialized diagnostic centers. The process supports molecular imaging and personalized diagnostic approaches. Growth is further fueled by increasing investment in R&D for safe, efficient, and precise MRI contrast solutions. Manufacturers focusing on direct esterification are poised to capture niche and high-value market segments.

- By Field Strength

On the basis of field strength, the North America magnetic resonance imaging devices market is segmented into high-field (1.5t to 3t), low-to-mid-field (<1.5t), and very-high-field (4t and above) systems. The high-field MRI segment dominated the market in 2024 with a market share of 43.7% due to superior image resolution, faster scan times, and broad clinical applicability across oncology, neurology, cardiology, and musculoskeletal diagnostics. Hospitals and imaging centers prefer high-field systems for their reliability and integration with advanced imaging software. The segment benefits from strong manufacturer support, extensive training, and regular maintenance programs. Its leadership is reinforced by adoption in research institutions and large diagnostic facilities. High-field systems continue to serve as the standard benchmark for advanced clinical imaging in North America.

The low-to-mid-field MRI segment is expected to witness the fastest growth from 2025 to 2032, driven by adoption in outpatient imaging centers, ambulatory surgical centers, and smaller hospitals. These systems are cost-effective, easier to operate, and require lower energy and space, making them attractive for expanding healthcare infrastructure. Adoption is particularly high in suburban and semi-urban regions. The segment also benefits from increasing investments in accessible diagnostics. Manufacturers are developing modular low-to-mid-field systems with AI support and enhanced image quality. This combination of affordability, flexibility, and performance is accelerating market penetration.

- By Modality

On the basis of modality, the North America magnetic resonance imaging devices market is segmented into stationary systems, portable/mobile systems, and point-of-care (POC) systems. The stationary system segment dominated the market in 2024, supported by large hospitals and imaging centers requiring high-throughput, advanced imaging, and multiple clinical applications. These systems are integrated with hospital PACS and IT systems for seamless workflow management. They are preferred for oncology, neurology, and cardiology diagnostics. The segment benefits from extensive manufacturer support and service networks. Its leadership is reinforced by high reliability, patient throughput, and proven diagnostic accuracy. Hospitals continue to invest heavily in stationary MRI systems for long-term operational efficiency.

The portable/mobile MRI segment is expected to witness the fastest growth from 2025 to 2032, driven by demand for mobile imaging solutions in emergency care, field hospitals, rural areas, and temporary medical setups. These systems provide flexibility, rapid deployment, and accessibility where infrastructure is limited. Adoption is increasing in outpatient centers and specialty clinics. Manufacturers are developing lightweight, AI-enabled mobile MRI systems. The segment also benefits from growing awareness of convenient diagnostic access. The combination of mobility, affordability, and adequate imaging quality is fueling growth.

- By Architecture

On the basis of architecture, the North America magnetic resonance imaging devices market is segmented into closed, standard bore, wide-bore, and open MRI systems. The closed MRI segment dominated the market in 2024 due to superior image quality, magnetic field homogeneity, and high compatibility with high-field systems. Hospitals use closed MRI for advanced oncology, neurology, and cardiovascular imaging. It allows integration with advanced coils, software, and AI technologies. The segment benefits from strong manufacturer support and service networks. Closed MRI systems remain the benchmark for research and clinical precision imaging. Their dominance is reinforced by high throughput, clinical versatility, and patient confidence.

The open MRI segment is expected to witness the fastest growth from 2025 to 2032, driven by patient comfort, reduced claustrophobia, and accessibility for pediatric, obese, and elderly patients. Adoption is growing in outpatient centers and specialized clinics. Open MRI systems balance image quality with patient-friendly design. Manufacturers are enhancing imaging performance while maintaining comfort. The segment is supported by the rising demand for functional and musculoskeletal imaging. Patient-centric hospital policies and clinic expansions are further accelerating adoption.

- By Application

On the basis of application, the North America magnetic resonance imaging devices market is segmented into oncology, neurology, cardiology, gastroenterology, musculoskeletal, mammography, pelvic and abdominal, gynecology, urology, dental, and other applications. The oncology segment dominated the market in 2024 due to rising cancer prevalence and increasing need for precise tumor detection, staging, and treatment monitoring. MRI’s soft-tissue contrast makes it essential for brain, breast, and prostate imaging. Hospitals prioritize MRI for oncology diagnostics, research, and clinical trials. The segment benefits from continuous technological improvements and integration with AI software. Its dominance is reinforced by strong adoption across both public and private healthcare facilities.

The neurology segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing neurological disorders, stroke, and spinal conditions. Functional and AI-enabled MRI solutions are increasingly adopted for early diagnosis, treatment planning, and post-surgical assessment. Hospitals and research centers are primary users. The segment benefits from integration with advanced imaging software. Manufacturers are focusing on neurology-specific MRI innovations to capture this market. Growing awareness of neurological health and preventive care is accelerating adoption.

- By End Users

On the basis of end users, the North America magnetic resonance imaging devices market is segmented into hospitals, imaging centers, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2024 due to high patient volume, advanced infrastructure, and multiple clinical applications. Large hospitals use MRI across oncology, cardiology, and neurology departments. The segment benefits from long-term procurement contracts and manufacturer support. Hospitals are early adopters of AI-enabled and high-field MRI systems. Its dominance is reinforced by centralized diagnostic workflows. Hospitals also invest in training programs and maintenance contracts to ensure operational efficiency.

The imaging centers segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing private investment in outpatient diagnostic facilities. Imaging centers adopt high-field, portable, and AI-enabled MRI systems. Expansion is driven by demand for faster diagnostics and reduced patient wait times. The segment benefits from flexible procurement options, leasing models, and service support. Growth is fueled by rising awareness and accessibility in urban and suburban areas. Manufacturers are targeting this segment to expand market penetration and reach underserved populations.

- By Distribution Channel

On the basis of distribution channel, the North America magnetic resonance imaging devices market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2024 due to large hospital procurement strategies and bulk purchase agreements with leading manufacturers. Direct tenders provide installation, maintenance, and IT integration support. Hospitals prefer direct tenders for streamlined procurement. The segment benefits from long-term service contracts, training programs, and on-site support. Manufacturer relationships strengthen segment dominance. This channel ensures high adoption among large healthcare facilities.

The retail sales segment is expected to witness the fastest growth from 2025 to 2032, fueled by smaller clinics, imaging centers, and specialty facilities seeking flexible purchasing options. Leasing, financing, and modular MRI systems are expanding adoption. The segment benefits from growing private healthcare investments and outpatient expansions. Retail sales support increased accessibility in suburban and rural areas. Manufacturers target this channel to boost market penetration and reach new end users. Flexibility, affordability, and support services drive rapid growth in this segment.

North America Magnetic Resonance Imaging Devices Market Regional Analysis

- The U.S. dominated the North American magnetic resonance imaging devices market with the largest revenue share of 77.8% in 2024, driven by early adoption of advanced medical technologies, high healthcare expenditure, and a strong presence of leading industry players

- Healthcare providers in the region prioritize high-resolution imaging, AI-enabled systems, and functional MRI technologies to support accurate diagnostics and treatment planning across oncology, neurology, and cardiology applications

- This widespread adoption is further supported by high healthcare expenditure, early adoption of innovative medical technologies, and the presence of leading MRI device manufacturers, establishing MRI systems as essential diagnostic tools in both hospitals and specialized imaging centers

U.S. North America Magnetic Resonance Imaging Devices Market Insight

The U.S. magnetic resonance imaging devices market captured the largest revenue share of in 2024 within North America, driven by rising demand for advanced diagnostic imaging and early disease detection. Hospitals and imaging centers are increasingly investing in high-field MRI systems, AI-enabled imaging software, and functional MRI technologies to improve diagnostic accuracy across oncology, neurology, and cardiology applications. The growing prevalence of chronic diseases, combined with significant healthcare infrastructure investment and government support for advanced medical technologies, is further propelling the market. Moreover, the adoption of outpatient imaging centers and ambulatory surgical facilities is expanding access to MRI services. The presence of major MRI manufacturers and continuous R&D initiatives supports ongoing innovation and market growth.

Canada Magnetic Resonance Imaging Devices Market Insight

The Canada magnetic resonance imaging devices market is expected to grow at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare expenditure, rising patient awareness of advanced diagnostics, and the growing prevalence of neurological and cardiovascular disorders. The adoption of AI-integrated MRI systems and the expansion of outpatient imaging facilities are promoting faster and more efficient diagnostics. Canadian hospitals and specialty imaging centers are prioritizing high-resolution imaging and patient-friendly systems to enhance clinical outcomes. Government initiatives supporting healthcare modernization and digital imaging infrastructure are fostering MRI adoption. In addition, Canada’s focus on precision medicine and research-based healthcare applications contributes to significant market growth.

Mexico Magnetic Resonance Imaging Devices Market Insight

The Mexico magnetic resonance imaging devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by improving healthcare infrastructure, increasing urbanization, and the rising incidence of chronic and lifestyle-related diseases. Hospitals and diagnostic centers are increasingly adopting advanced MRI technologies, including low-to-mid-field systems for cost-effective imaging solutions. Government-led healthcare modernization programs are facilitating investment in high-quality diagnostic tools. In addition, growing awareness among patients regarding the benefits of MRI for early disease detection is fueling demand. Private hospitals and imaging centers are actively integrating MRI systems into their diagnostic portfolios to cater to both urban and semi-urban populations.

North America Magnetic Resonance Imaging Devices Market Share

The North America magnetic resonance imaging devices industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Esaote S.p.A. (Italy)

- Bruker Corporation (U.S.)

- Fonar Corporation (U.S.)

- Neusoft Corporation (China)

- Hologic, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- United Imaging Healthcare Co., Ltd. (China)

- Resonance Technology, Inc. (U.S.)

- PAN AM IMAGING (U.S.)

- Promaxo, Inc. (U.S.)

- MR Solutions, Inc. (U.S.)

- JMP Industries, Inc. (U.S.)

- Carestream Health, Inc. (U.S.)

What are the Recent Developments in North America Magnetic Resonance Imaging Devices Market?

- In June 2025, Siemens Healthineers received FDA clearance for the Magnetom Flow.Ace, its first 1.5T MRI platform with a closed helium circuit and no quench pipe, significantly reducing reliance on helium. The system features AI-powered image reconstruction and a variety of coils suitable for varied human anatomy as well as veterinary applications

- In May 2025, Hyperfine, Inc. announced FDA clearance for its next-generation Swoop Portable MRI System (V2), which offers enhanced image quality and an optimized user experience. The system is designed to empower clinicians to acquire scans when and where it matters most, particularly in emergency departments and critical care settings

- In November 2024, Canon Medical introduced the Vantage Fortian MRI system at the European Congress of Radiology (ECR). This system features innovative workflow solutions, enhanced image quality, and accelerated scan technologies, aiming to reduce MRI procedure times and improve patient throughput

- In July 2022, Siemens Healthineers and Dentsply Sirona presented the first dental-dedicated MRI system, the MAGNETOM Free.Max Dental Edition. This system is being developed as part of a joint research project between the two companies to explore MRI applications in dental imaging

- In July 2022, Canon Medical introduced the Vantage Fortian at ECR 2022. The new MRI system features innovative workflow solutions, image enhancement, and accelerated scan technology, which together contribute to reducing the time required for MRI procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.