North America Marine And Freshwater Seedsseedlings Market

Market Size in USD Million

CAGR :

%

USD

63.08 Million

USD

85.05 Million

2024

2032

USD

63.08 Million

USD

85.05 Million

2024

2032

| 2025 –2032 | |

| USD 63.08 Million | |

| USD 85.05 Million | |

|

|

|

North America Marine and Freshwater Seeds/Seedlings Market Analysis

The North America marine and freshwater seeds/seedlings market is experiencing significant growth due to increasing aquaculture practices, rising demand for seafood, and a heightened focus on sustainable fishing practices. This market encompasses a diverse range of species, including various fish, shellfish, and aquatic plants, catering to both commercial and recreational sectors. The integration of advanced breeding techniques and biotechnology is enhancing seed quality and yield, while favorable government policies and investments in aquaculture infrastructure further propel the market. However, challenges such as environmental concerns, disease management, and competition from wild-caught seafood pose risks to market stability. Overall, the market holds promising potential as it adapts to meet the growing North America food demands and environmental sustainability goals.

North America Marine and Freshwater Seeds/Seedlings Market Size

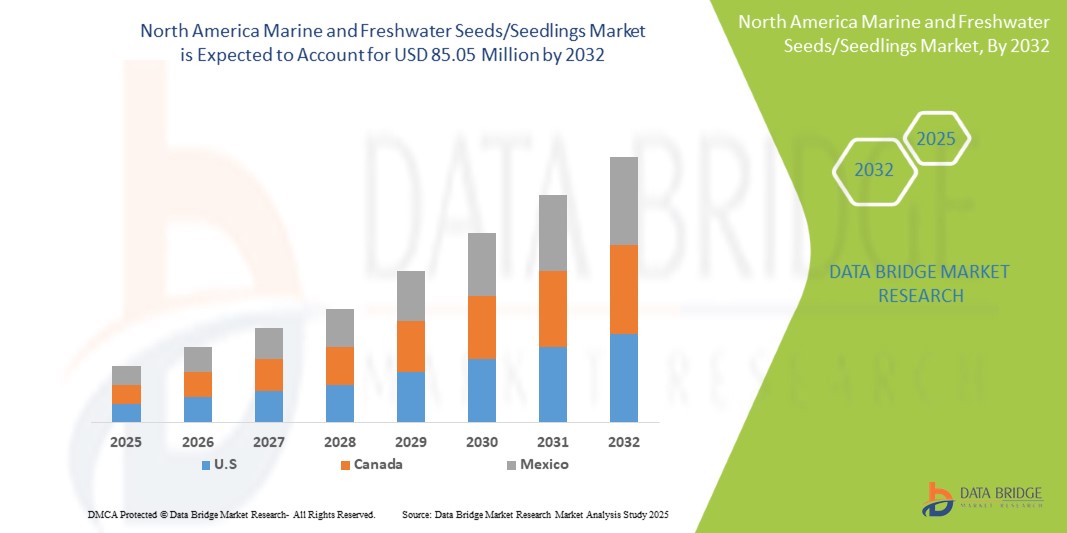

North America marine and freshwater seeds/seedlings market size was valued at USD 63.08 million in 2024 and is projected to reach USD 85.05 million by 2032, growing with a CAGR of 3.9% during the forecast period of 2025 to 2032.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

North America Marine and Freshwater Seeds/Seedlings Market Trends

“Increasing Adoption of Sustainable Aquaculture Practices”

One significant trend in the North America marine and freshwater seeds/seedlings market is the increasing adoption of sustainable aquaculture practices. As environmental concerns grow regarding overfishing and habitat destruction, both consumers and regulatory bodies are pushing for more responsible sourcing of seafood. This has led to a heightened focus on breeding seedstocks that are disease-resistant and adaptable to changing environmental conditions, thereby optimizing production efficiency while minimizing ecological impact. Additionally, advancements in aquaculture technology, such as recirculating aquaculture systems (RAS) and aquaponics, further enhance sustainability by reducing resource consumption and waste. As a result, the market is experiencing a shift towards more eco-friendly practices that not only cater to consumer demand for sustainable products but also ensure the long-term viability of aquatic ecosystems.

Report Scope and North America Marine and Freshwater Seeds/Seedlings Market Segmentation

|

Attributes |

North America Marine and Freshwater Seeds/Seedlings Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

e PT Central Proteina (Indonesia), Prima Tbk (CP Prima) (Indonesia), Blue Ridge Aquaculture (Virginia), Bangla Krishi Khamar (Bangladesh), Dunns Fish Farm (U.S.), Tawakkal Fish Hatchery (Bangladesh), Rishi Aqua Tech Fish Seeds (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Marine and Freshwater Seeds/Seedlings Market Definition

The North America marine and freshwater seeds/seedlings market refers to the commercial sector that involves the production, distribution, and utilization of genetically improved or selectively bred aquatic seeds and seedlings used for farming various species of fish, shellfish, and aquatic plants in both marine and freshwater environments. This market encompasses a diverse array of products, including fish fry, fingerlings, shellfish larvae, and aquatic plant seedlings, which are critical for aquaculture operations, restoration projects, and ecosystem management. The market serves multiple stakeholders, including aquaculture enterprises, fishermen, horticulturists, and environmental agencies, and is driven by the increasing demand for sustainable seafood sources, advancements in breeding technologies, and enhanced focus on conserving aquatic biodiversity.

North America Marine and Freshwater Seeds/Seedlings Market Dynamics

Drivers

- Increasing Demand for Aquaculture

The increasing demand for aquaculture is a significant driver for the North America fishery seeds and seedlings market. As the North America population grows and seafood consumption rises, the need for sustainable, large-scale fish production has become more critical. Aquaculture plays a crucial role in meeting this demand, providing a reliable and controlled environment for seafood production. To support the expansion of aquaculture, there is a growing need for high-quality fishery seeds and seedlings that are disease-resistant, fast-growing, and capable of thriving in various farming conditions. With the increasing pressure to produce seafood efficiently and sustainably, fishery seed producers must ensure a consistent supply of robust seedlings that meet the quality standards required by aquaculture operations. This demand for top-quality fishery seeds and seedlings is directly fueling the market, as the need for reliable, high-performance aquaculture solutions rises to support North America seafood production. As a result, the growing need for aquaculture-driven seafood production significantly boosts the market for fishery seeds and seedlings, making it an essential component in the industry's expansion.

For instance,

- In, June 2024, the State of World Fisheries and Aquaculture (SOFIA) reported a 4.4% increase in global fisheries and aquaculture production in 2022, reaching 223.2 million tonnes. This surge, with 185.4 million tonnes of aquatic animals, highlights the growing demand for aquaculture. This rising production directly drives the need for high-quality fishery seeds and seedlings to meet market requirements, boosting the market’s growth

- In February 2024, according to the article published by The National Provisioner, 54% of Americans are eating more seafood than two years ago, with 74% wishing they consumed more. This growing interest in seafood, coupled with an increased demand for convenience in preparation, drives the need for more aquaculture production. This surge in consumer preference fuels the global demand for fishery seeds and seedlings, acting as a key market driver

Advancements in Aquaculture Technologies

Advancements in aquaculture technologies play a pivotal role in driving the growth of the North America fishery seeds and seedlings market. Innovations in breeding techniques like Selective Breeding, Genomic Selection and Hybridization have allowed for the development of superior fish strains that grow faster, are more resilient, and have better survival rates in various farming conditions. Genetic improvements further enhance the quality of fishery seeds, ensuring that only the healthiest and most productive seedlings are produced for aquaculture. In addition, the development of disease-resistant fish species has greatly reduced the impact of epidemics, which were once a major challenge in fish farming. These technological improvements not only boost the sustainability and efficiency of fishery seed production but also help meet the growing demand for seafood. With improved productivity, reduced mortality rates, and a higher overall yield, the advancements in aquaculture technologies directly contribute to the expansion of the fishery seeds and seedlings market, supporting the increasing North America need for aquaculture-based seafood production.

For instance,

- In June 2024, according to an article published by Global Seafood Alliance, Genome-Wide Association Studies (GWAS) have enabled the identification of genetic variants linked to key traits like growth, disease resistance, and stress tolerance in fish. By advancing molecular marker-assisted breeding, GWAS enhances the precision and efficiency of aquaculture breeding programs. These advancements in genetic research significantly improve fishery seed production, driving the growth of the global fishery seeds and seedlings market

- In December 2024, according to the article published by Springer Nature, Biotechnological innovations like marker-assisted selection (MAS) and genetic modification (GM) have transformed fish breeding. MAS improves traits such as disease resistance and carcass quality using molecular markers, while GM enables the introduction of new traits and simultaneous modifications, enhancing growth rates and feed efficiency. These advancements significantly improve fishery seed production, driving the growth of the global fishery seeds and seedlings market

Growing Focus on Sustainable Fishing Practices

The growing focus on sustainable fishing practices has become a significant driver for the North America fishery seeds and seedlings market. Governments, environmental organizations, and industry stakeholders are increasingly emphasizing the need for aquaculture practices that minimize environmental impact, ensure long-term resource availability, and preserve biodiversity. Sustainable aquaculture practices involve using responsibly sourced, disease-free fishery seeds and seedlings that can thrive in controlled environments while maintaining ecological balance. By prioritizing sustainable breeding methods, such as genetic selection for disease resistance and stress tolerance, the industry helps reduce reliance on wild fisheries and ensures the responsible use of aquatic resources. The push for sustainability not only encourages better management of fish stocks but also boosts the demand for high-quality, well-managed fishery seeds and seedlings. This demand drives the growth of the market, as sustainable aquaculture becomes a crucial component in meeting North America seafood consumption needs while protecting marine ecosystems.

For instance,

- In November 2024, according to the article published by Press Information Bureau< Government of India, India’s shift towards inland fisheries, now contributing 70% of total fish production, is driven by sustainable practices under the Pradhan Mantri Matsya Sampada Yojana (PMMSY). The focus on optimal resource use, technology infusion, and capacity building, along with expanding culture-based fisheries in ponds, boosts production. This growing focus on sustainability directly drives the demand for high-quality fishery seeds and seedlings, fueling market growth

- In December 2024, according to the article published by European Commission, The European Commission's publication of new staff working documents emphasizes sustainable aquaculture by addressing access to space and water for land-based aquaculture, climate-change adaptation, and energy transition. These initiatives promote environmentally responsible practices in aquaculture. As the focus on sustainability intensifies, the demand for high-quality, eco-friendly fishery seeds and seedlings grows, driving the global market forward

Opportunities

- Increasing Population and Growing Protein Demand

The rising North America population and the corresponding increase in the demand for protein-rich food are significant drivers for the aquaculture sector. As populations grow, especially in emerging economies, the need for sustainable and efficient sources of protein becomes more pronounced. Fish, being a highly nutritious and cost effective protein source, is seeing a surge in demand. This shift towards fish consumption is prompting greater reliance on aquaculture to meet the nutritional needs of the expanding North America population. Fishery seed production, in particular, plays a crucial role in ensuring the sustainability and scalability of aquaculture operations, providing the foundation for growing fish stocks. With the increasing pressure to supply protein, the market for fishery seeds and seedlings is experiencing heightened demand, offering opportunities for producers to innovate and scale up operations. As North America food security becomes a more pressing issue, investing in efficient and high-quality fishery seed production presents a major opportunity for market growth and expansion.

For instance,

- In May 2024, according to the article published by Lo! Foods, including high-protein fish like Rohu, Catla, and Hilsa in diets helps meet daily protein requirements while offering essential nutrients like Omega-3 fatty acids, vitamins, and minerals. These fish are crucial for muscle development, heart health, and overall well-being. As protein demand rises, increasing reliance on aquaculture to meet this need creates significant growth opportunities for the fishery seeds and seedlings market

- In September 2023, according to the article published by NCBI, with rising income levels and urbanization, the demand for protein is growing, particularly in emerging markets. As more people seek protein-rich food, the need for sustainable sources like fish increases. This surge in demand drives the growth of the aquaculture sector, creating a significant opportunity for the fishery seeds and seedlings market to expand and cater to this rising need for protein

Innovation in Sustainable Aquaculture Technologies

Innovation in sustainable aquaculture technologies presents significant growth opportunities for the fishery seeds and seedlings market. As the North America demand for seafood continues to rise, the aquaculture industry is shifting toward more environmentally friendly practices to ensure long-term sustainability. Technologies such as bio-floc systems, recirculatory aquaculture systems (RAS), and sustainable breeding practices are transforming the industry. Bio-floc systems, which use microorganisms to convert waste into feed, and RAS, which recycles water to reduce environmental impact, are gaining traction as highly efficient, resource-saving solutions. Moreover, sustainable breeding practices focus on enhancing fish quality, resilience, and disease resistance. These advancements not only promote more eco-friendly production but also optimize the efficiency of fish farming, which directly influences the need for high-quality fishery seeds and seedlings. As demand for these sustainable aquaculture solutions increases, so does the need for superior fishery seedlings that align with new farming methods. This presents a significant opportunity for growth within the fishery seeds and seedlings market, as producers are called upon to supply the necessary resources for these innovative aquaculture technologies.

For instance,

- In September 2020, according to the article published by National Fisheries Development Board, Biofloc Technology (BFT), a sustainable aquaculture method, recycles nutrients and minimizes water exchange, making it highly eco-friendly. The system produces in-situ microorganisms that serve as food for cultured organisms while improving water quality. This innovative approach reduces environmental impact and enhances production efficiency, driving demand for high-quality fishery seeds and seedlings, thus fostering market growth

- In March 2021, according to the article published by National Fisheries Development Board, Recirculatory Aquaculture Systems (RAS) recycle water through filtration, enabling high-density fish farming with minimal land and water usage. This sustainable method ensures efficient resource management and improved production. As the adoption of RAS grows, it drives the need for quality fishery seeds

Restraints/Challenges

- Disease Outbreaks Among Fish Populations

Disease outbreaks among fish populations present a significant restraint for the North America fishery seeds and seedlings market. The rapid spread of infections such as viral and bacterial diseases leads to high mortality rates, severely reducing the availability of healthy fishery seeds and seedlings. As disease outbreaks affect fish health, the overall quality of the stock diminishes, making it harder for aquaculture farmers to secure quality seeds for their operations. This disruption in the supply of disease-free fishery seeds, combined with the increased costs associated with disease management and control measures, negatively impacts the stability of the market. As a result, the fishery seeds and seedlings market faces significant challenges in ensuring a consistent supply of healthy fish for aquaculture, constraining its growth potential.

For instance,

- In February 2023, according to the article published by NCBI, Disease outbreaks in fish populations, driven by high fish-rearing densities and intensive farming practices, pose a significant challenge for the aquaculture sector. These conditions facilitate the spread of pathogens, leading to high mortality rates. As a result, the availability of healthy fishery seeds and seedlings decreases, creating instability in the market and acting as a major restraint on its growth

Environmental Challenges Impacting the Fishery Seeds Market

Environmental challenges such as water pollution, climate change, and habitat degradation pose significant threats to the North America fishery seeds and seedlings market. Water pollution from agricultural runoff, industrial waste, and plastic debris contaminates aquatic environments, leading to compromised water quality, which affects the health and growth of fishery seedlings. Similarly, climate change results in temperature fluctuations, altered water salinity, and extreme weather events, which stress fish populations and reduce their ability to thrive in both wild and farmed environments. Habitat degradation, caused by deforestation, coastal development, and overfishing, further limits the available space for aquaculture and diminishes the natural resources required for healthy fish production. These factors collectively hinder the growth, survival, and quality of fishery seeds and

seedlings, disrupting the supply chain and creating instability in the market. Consequently, environmental challenges act as a major restraint on the growth and sustainability of the North America fishery seeds and seedlings market.

For instance,

- In June 2024, according to the article published by Science Direct, Pollution, including toxic chemicals, heavy metals, and pesticides, adversely affects aquatic organisms by disrupting oxygen levels, pH, and immune systems. Chronic exposure leads to reproductive issues and habitat abnormalities, severely impacting aquaculture production. These environmental challenges compromise the health of fishery seedlings, reducing their quality and survival rates. Consequently, pollution acts as a significant restraint on the global fishery seeds and seedlings market

- In October 2020, according to the article published by Intechopen, Climate change, including rising water temperatures, sea level rise, and water intrusion, disrupts aquaculture production and impacts fish farming economics. These environmental shifts reduce fish health and productivity, directly affecting the availability of quality fishery seeds and seedlings. As a result, climate-related challenges act as a major restraint on the growth and stability of the global fishery seeds and seedlings market

North America Marine and Freshwater Seeds/Seedlings Market Scope

The market is segmented on the basis of type, species, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- Fish Seeds

- Shellfish Seeds

- Others

By Species

- Finfish

- Salmon

- Bass

- Trout

- Catfish

- Tuna

- Others

- Shellfish

- Shrimp

- Oyster

- Mussel

- Crab

- Lobster

- Others

- Seaweed

- Red Seaweed (Rhodophyta)

- Brown Seaweed (Phaeophyceae)

- Green Seaweed (Chlorophyta)

- Eels

- Octopus

- Others

By Application

- Commercial Aquaculture

- Marine Aquaculture

- Freshwater Aquaculture

- Aquarium and Ornamental Purposes

- Research and Development

- Restocking Programs

- Others

By End User

- Food

- Animal Feed

- Fertilizers

- Pharmaceuticals

- Cosmetics

- Others

North America Marine and Freshwater Seeds/Seedlings Market Regional Analysis

The market is segmented on the basis of type, species, application, and end user.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate and fastest growing country in this region because increasing demand for aquaculture and advancements in aquaculture technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Marine and Freshwater Seeds/Seedlings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Marine and Freshwater Seeds/Seedlings Market Leaders Operating in the Market Are:

- PT Central Proteina (Indonesia)

- Prima Tbk (CP Prima) (Indonesia)

- Blue Ridge Aquaculture (Virginia)

- Bangla Krishi Khamar (Bangladesh)

- Dunns Fish Farm (U.S.)

- Tawakkal Fish Hatchery (Pakistan)

- Rishi Aqua Tech Fish Seeds (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 NORTH AMERICA FISHERY SEEDS AND SEEDLINGS MARKET: REGULATIONS

5.1 REGULATION IN NORTH AMERICA:

5.2 REGULATION IN SOUTH AMERICA:

5.3 REGULATION IN EUROPE:

5.4 REGULATION IN MIDDLE EAST AND AFRICA:

5.5 REGULATION IN ASIA-PACIFIC:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AQUACULTURE

6.1.2 ADVANCEMENTS IN AQUACULTURE TECHNOLOGIES

6.1.3 GROWING FOCUS ON SUSTAINABLE FISHING PRACTICES

6.1.4 SUPPORTIVE GOVERNMENT POLICIES AND SUBSIDIES

6.2 RESTRAINTS

6.2.1 DISEASE OUTBREAKS AMONG FISH POPULATIONS

6.2.2 ENVIRONMENTAL CHALLENGES IMPACTING THE FISHERY SEEDS MARKET

6.3 OPPORTUNITIES

6.3.1 INCREASING POPULATION AND GROWING PROTEIN DEMAND

6.3.2 INNOVATION IN SUSTAINABLE AQUACULTURE TECHNOLOGIES

6.3.3 EXPANDING AQUACULTURE IN EMERGING REGIONS

6.4 CHALLENGES

6.4.1 COMPETITION FROM WILD CAUGHT FISHERIES

6.4.2 THE RISKS ASSOCIATED WITH AQUACULTURE ESCAPES

7 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FISH SEEDS

7.3 SHELLFISH SEEDS

7.4 OTHERS

8 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES

8.1 OVERVIEW

8.2 FINFISH

8.2.1 SALMON

8.2.2 BASS

8.2.3 TROUT

8.2.4 CATFISH

8.2.5 TUNA

8.2.6 OTHERS

8.3 SHELLFISH

8.3.1 SHRIMP

8.3.2 OYSTER

8.3.3 MUSSEL

8.3.4 CRAB

8.3.5 LOBSTER

8.3.6 OTHERS

8.4 SEAWEED

8.4.1 RED SEAWEED (RHODOPHYTA)

8.4.2 BROWN SEAWEED (PHAEOPHYCEAE)

8.4.3 GREEN SEAWEED (CHLOROPHYTA)

8.5 EELS

8.6 OCTOPUS

8.7 OTHERS

9 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION KEY FINDINGS

9.1 OVERVIEW

9.2 COMMERCIAL AQUACULTURE

9.2.1 MARINE AQUACULTURE

9.2.2 FRESHWATER AQUACULTURE

9.3 AQUARIUM AND ORNAMENTAL PURPOSES

9.4 RESEARCH AND DEVELOPMENT

9.5 RESTOCKING PROGRAMS

9.6 OTHERS

10 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.3 ANIMAL FEED

10.4 FERTILIZERS

10.5 PHARMACEUTICALS

10.6 COSMETICS

10.7 OTHERS

11 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 PT CENTRAL PROTEINA PRIMA TBK (CP PRIMA)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BLUE RIDGE AQAUCULTURE

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 BANGLA KRISHI KHAMAR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 DUNNS FISH FARM

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 TAWAKKAL FISH HATCHERY

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AQUASEARCH OVA APS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AQUASMILE ENTERPRISE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AVANTI FEEDS LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 AQUABIOTECH GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 AQUABOUNTY TECHNOLOGIES, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 BENCHMARK ANIMAL HEALTH

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BIOMAR GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 COOKE AQUACULTURE INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 INVE AQUACULTURE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MANNA FISH FARMS, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PENTAIRAES

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 RVR & CO

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 RISHI AQUA TECH FISH SEEDS

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SPAROS I&D

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 THE CENTER FOR AQUACULTURE TECHNOLOGIES.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 VAXXINOVA INTERNATIONAL

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 XELECT LTD.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (VOLUME IN KILOTONS)

TABLE 3 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 4 NORTH AMERICA FISH SEEDS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA SHELLFISH SEEDS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA OTHERS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA EELS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA OCTOPUS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA AQUARIUM AND ORNAMENTAL PURPOSES IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL AQUACULTURE IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA ANIMAL FEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA RESEARCH AND DEVELOPMENT IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA RESTOCKING PROGRAMS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA ANIMAL FEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA FERTILIZERS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PHARMACEUTICALS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA COSMETICS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (VOLUME IN KILOTONS)

TABLE 34 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 35 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA COMMERCIAL AQUACULTURE IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 42 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (VOLUME IN KILOTONS)

TABLE 44 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 45 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES, 2018-2032 (USD MILLION)

TABLE 46 U.S. FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 47 U.S. SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 U.S. SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 50 U.S. COMMERCIAL AQUACULTURE IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 U.S. MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 52 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (VOLUME IN KILOTONS)

TABLE 54 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 55 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES, 2018-2032 (USD MILLION)

TABLE 56 CANADA FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 CANADA SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 CANADA SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 60 CANADA COMMERCIAL AQUACULTURE IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 CANADA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 62 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (VOLUME IN KILOTONS)

TABLE 64 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 65 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY SPECIES, 2018-2032 (USD MILLION)

TABLE 66 MEXICO FINFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 67 MEXICO SHELLFISH IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 MEXICO SEAWEED IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 70 MEXICO COMMERCIAL AQUACULTURE IN MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 MEXICO MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY END USER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET, BY TYPE

FIGURE 12 NORTH AMERICA FISHERY SEEDS AND SEEDLINGS MARKET EXECUTIVE SUMMARY

FIGURE 13 INCREASING DEMAND FOR AQUACULTURE IS DRIVING THE GROWTH OF THE NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET FROM 2025 TO 2032

FIGURE 14 THE FISH SEEDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOW CYTOMETRY MARKET IN 2025 AND 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY TYPE, 2024

FIGURE 17 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 18 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 19 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY SPECIES, 2024

FIGURE 21 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY SPECIES, 2025-2032 (USD MILLION)

FIGURE 22 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY SPECIES, CAGR (2025-2032)

FIGURE 23 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY SPECIES, LIFELINE CURVE

FIGURE 24 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY APPLICATION, 2024

FIGURE 25 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 26 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY END USER, 2024

FIGURE 29 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 30 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 NORTH AMERICA FLOW CYTOMETRY MARKET: SNAPSHOT (2024)

FIGURE 33 NORTH AMERICA MARINE AND FRESHWATER SEEDS/SEEDLINGS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.