North America Meat Poultry And Seafood Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.57 Billion

USD

8.36 Billion

2024

2032

USD

5.57 Billion

USD

8.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 8.36 Billion | |

|

|

|

|

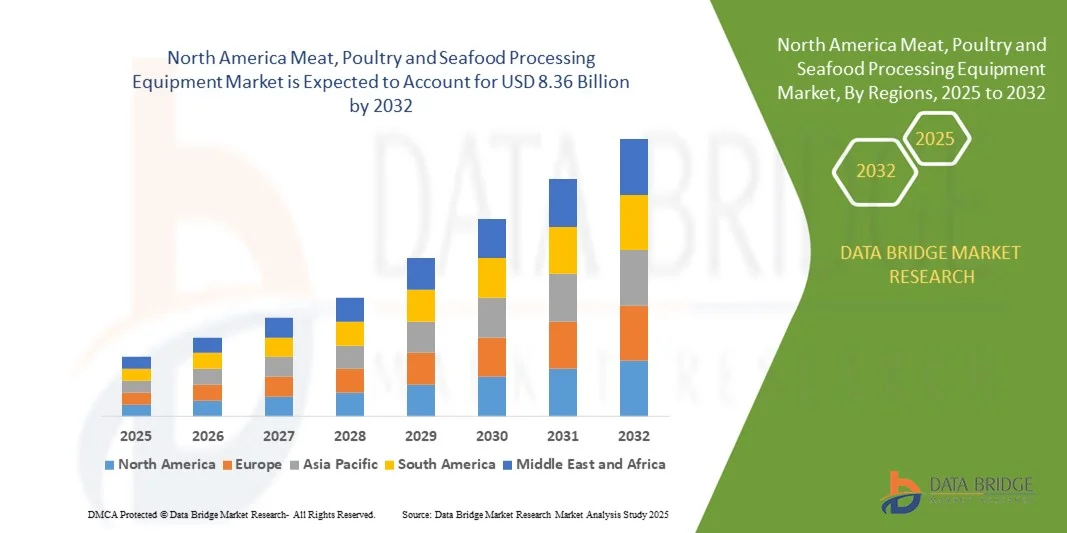

What is the North America Meat, Poultry and Seafood Processing Equipment Market Size and Growth Rate?

- The North America meat, poultry and seafood processing equipment market size was valued at USD 5.57 billion in 2024 and is expected to reach USD 8.36 billion by 2032, at a CAGR of5.2% during the forecast period

- Increasing consumption of processed meat, poultry and seafood products, and growing number of fast food and restaurant chains in the market leads to demand for better processed meat and others products. Also, technological advancements in the equipment market especially in the meat, poultry and seafood has increased the market value at present

- The factors which are restraining the growth of the market are High capital investment, slow replacement of equipment due to longer life span

What are the Major Takeaways of Meat, Poultry and Seafood Processing Equipment Market?

- Increasing automation in the food processing industry can be the best opportunity for meat, poultry & seafood processing equipment market

- High cost of machines, low infrastructure in developing countries and excessive usage of water during processing and pipe line cleaning can be the threat for the market

- U.S. dominated the North America Meat, Poultry, and Seafood Processing Equipment market in 2025, capturing the largest revenue share of 42.6%, driven by rapid industrialization, high adoption of automation, and increasing investments in advanced food processing technologies

- The Canada meat, poultry, and seafood processing equipment market is projected to witness the fastest growth rate of 11.2%, driven by rising demand for processed and frozen meat, poultry, and seafood products, along with government initiatives to modernize the food processing sector

- The Cutting and Portioning Equipment segment dominated the market in 2025 with a market share of 42.8%, driven by the growing demand for precision slicing, portion control, and automated trimming in large-scale meat and seafood processing plants

Report Scope and Meat, Poultry and Seafood Processing Equipment Market Segmentation

|

Attributes |

Meat, Poultry and Seafood Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Meat, Poultry and Seafood Processing Equipment Market?

Automation and Sustainable Processing Technologies

- A major trend shaping the meat, poultry and seafood processing equipment market is the rapid adoption of automation and sustainable processing systems designed to improve efficiency, reduce waste, and enhance food safety. Growing emphasis on energy-efficient operations and hygienic design is driving manufacturers toward eco-conscious innovations

- Companies are increasingly integrating robotics, AI-based inspection, and IoT-enabled monitoring systems to streamline deboning, cutting, and packaging processes, ensuring precision and reducing human error

- In addition, the use of water-saving and waste-reduction technologies is gaining traction as processors aim to meet sustainability regulations and lower operational costs.

- A notable instance is GEA Group Aktiengesellschaft (Germany), which introduced its Sustainable Processing Line integrating smart automation, efficient chilling, and waste recovery systems to optimize meat and seafood production

- This shift toward intelligent, eco-friendly, and energy-saving solutions is transforming the industry, encouraging investments in next-generation equipment that balances productivity, safety, and sustainability

What are the Key Drivers of Meat, Poultry and Seafood Processing Equipment Market?

- Rising global consumption of protein-rich foods and increasing demand for processed meat and seafood products are key drivers boosting the market. Consumers are seeking convenient, safe, and hygienically processed food options, driving equipment modernization

- For instance, in 2025, Marel (Iceland) expanded its product line with automated portioning and slicing systems that enhance yield accuracy and product consistency in poultry and seafood processing

- The industry also benefits from government investments in food safety regulations and export infrastructure, fostering demand for advanced processing machinery

- Moreover, the rise of ready-to-eat (RTE) and frozen products has accelerated equipment upgrades for improved packaging, chilling, and storage capabilities

- Innovations such as AI-driven sorting systems, hygienic conveyors, and vacuum sealing technologies are further enhancing product quality, extending shelf life, and driving market expansion across industrial and commercial segments

Which Factor is Challenging the Growth of the Meat, Poultry and Seafood Processing Equipment Market?

- High capital investment and maintenance costs remain major challenges limiting adoption, particularly among small and medium-sized processors. Equipment such as automated deboners and vacuum fillers demand significant upfront expenditure

- For instance, in 2025, rising stainless steel and electronic component prices increased equipment manufacturing costs for key players such as BAADER (Germany) and JBT Corporation (U.S.), affecting profit margins

- Further, complex cleaning and sanitation requirements can extend downtime, impacting production efficiency

- Environmental and energy regulations also challenge companies to continuously upgrade systems for lower emissions and reduced water usage.

- Despite these barriers, firms such as GEA Group Aktiengesellschaft and Key Technology (U.S.) are addressing these issues through modular, energy-efficient, and easy-to-clean designs. Balancing cost, compliance, and sustainability remains vital to ensuring long-term growth and competitiveness in the market

How is the Meat, Poultry and Seafood Processing Equipment Market Segmented?

The meat, poultry and seafood processing equipment market is segmented on the basis of equipment type, process, mode of operation, application, function, and processed product type.

- By Equipment Type

On the basis of equipment type, the market is segmented into Portioning Equipment, Frying Equipment, Filtering Equipment, Coating Equipment, Cooking Equipment, Smoking Equipment, Killing/Slaughtering Equipment, Refrigeration Equipment, High Pressure Processing (HPP) Equipment, Massaging Equipment, and Others. The Cutting and Portioning Equipment segment dominated the market in 2025 with a market share of 42.8%, driven by the growing demand for precision slicing, portion control, and automated trimming in large-scale meat and seafood processing plants. These systems enhance efficiency, minimize wastage, and maintain consistent product quality.

The High Pressure Processing (HPP) Equipment segment is projected to register the fastest CAGR from 2026 to 2033, fueled by increasing adoption of non-thermal preservation technologies for improving shelf life and ensuring pathogen-free meat and seafood products without compromising nutritional value or texture.

- By Process

Based on process, the Meat, Poultry, and Seafood Processing Equipment market is classified into Size Reduction, Size Enlargement, Homogenization, Mixing, and Others. The Size Reduction segment dominated the market in 2025 with a market share of 49.5%, as grinding, cutting, and mincing are critical initial stages in meat processing, enabling consistent texture and product uniformity for sausages, patties, and seafood-based products. The efficiency of modern size reduction systems helps optimize throughput and quality.

The Mixing segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by rising demand for blended meat formulations, marinades, and processed seafood. Advanced vacuum and paddle mixers are increasingly being adopted for uniform ingredient distribution, flavor consistency, and improved product stability.

- By Mode of Operation

On the basis of mode of operation, the market is segmented into Automatic, Semi-Automatic, and Manual. The Automatic segment dominated the market in 2025 with a market share of 56.7%, driven by the growing adoption of automation to reduce labor costs, increase production efficiency, and ensure hygiene compliance. Automated systems integrate robotics, sensors, and software to perform complex tasks such as deboning and packaging with precision.

The Semi-Automatic segment is projected to record the fastest CAGR from 2026 to 2033, as small and medium-sized processors seek to balance automation benefits with affordability. Semi-automatic systems offer flexibility, reduced operational complexity, and adaptability to varied production scales.

- By Application

Based on application, the Meat, Poultry, and Seafood Processing Equipment market is segmented into Fresh Processed, Raw Cooked, Precooked, Raw Fermented, Dried Meat, Cured, Frozen, and Others. The Fresh Processed segment held the largest market share of 51.2% in 2025, owing to the high consumption of minimally processed meat and seafood products such as sausages, nuggets, and patties that require advanced cutting, blending, and coating machinery. Demand is supported by consumer preference for fresh-tasting, ready-to-cook meals.

The Frozen segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the rising popularity of frozen seafood and ready meals globally. Improvements in freezing technologies and cold chain logistics are enabling longer shelf life and preservation of texture and flavor.

- By Function

On the basis of function, the market is categorized into Cutting, Blending, Tenderizing, Filling, Marinating, Slicing, Grinding, Smoking, Killing & De-Feathering, Deboning & Skinning, Evisceration, Gutting, Filleting, and Others. The Cutting and Slicing segment dominated the market in 2025 with a market share of 46.4%, as it represents a core function in nearly all meat and seafood processing operations. The demand for precision cutting and slicing systems is fueled by the need to achieve uniform thickness, reduce waste, and maintain product integrity.

The Deboning & Skinning segment is anticipated to exhibit the fastest CAGR from 2026 to 2033, driven by the need for high-efficiency systems that minimize manual labor, improve yield, and enhance hygiene, especially in poultry and fish processing lines.

- By Processed Products Type

Based on processed product type, the market is segmented into Meat, Poultry, and Seafood. The Meat segment dominated the market in 2025 with a market share of 54.9%, attributed to the growing consumption of processed meat products such as sausages, bacon, and ham, especially in North America and North America. Meat processing lines require sophisticated systems for grinding, curing, and packaging to ensure safety and quality.

The Seafood segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing global demand for processed fish, shrimp, and shellfish. Rising seafood exports, coupled with technological advancements in filleting and freezing, are driving automation and capacity expansion in seafood processing facilities worldwide.

Which Region Holds the Largest Share of the Meat, Poultry and Seafood Processing Equipment Market?

- U.S. dominated the North America Meat, Poultry, and Seafood Processing Equipment market in 2025, capturing the largest revenue share of 42.6%, driven by rapid industrialization, high adoption of automation, and increasing investments in advanced food processing technologies

- The country’s strong manufacturing base, combined with regulatory focus on food safety and quality standards, supports extensive production and utilization of modern meat, poultry, and seafood processing equipment. Leading domestic and international companies are investing in energy-efficient, automated, and traceable systems, driving the market forward

- Overall, the U.S.’s leadership in innovation, infrastructure, and technological adoption has positioned it as the dominant country in North America’s meat, poultry, and seafood processing equipment market

Canada Meat, Poultry and Seafood Processing Equipment Market Insight

The Canada meat, poultry, and seafood processing equipment market is projected to witness the fastest growth rate of 11.2%, driven by rising demand for processed and frozen meat, poultry, and seafood products, along with government initiatives to modernize the food processing sector. Canadian manufacturers are increasingly investing in automated cutting, deboning, marinating, and packaging solutions to improve operational efficiency and maintain compliance with food safety regulations. Sustainability measures, including energy-efficient refrigeration and reduced water usage, further contribute to growth. Canada’s focus on innovation, automation, and quality assurance positions it as a key growth engine within the North American region.

Mexico Meat, Poultry and Seafood Processing Equipment Market Insight

The Mexico meat, poultry, and seafood processing equipment market is expanding steadily, fueled by increasing domestic consumption of processed protein products and rising export demand to the U.S. and other Latin American countries. Mexican manufacturers are adopting modern slaughtering, slicing, packaging, and portioning equipment to meet hygiene standards and improve productivity. Government incentives supporting modernization of processing plants, along with growing investment in cold chain infrastructure, further accelerate market adoption. With its strategic location, skilled workforce, and growing industrial base, Mexico plays an important role in strengthening North America’s meat, poultry, and seafood processing equipment market.

Which are the Top Companies in Meat, Poultry and Seafood Processing Equipment Market?

The Meat, Poultry and Seafood Processing Equipment industry is primarily led by well-established companies, including:

- Equipamientos Cárnicos, S.L. (Spain)

- BRAHER INTERNACIONAL, S.A. (Spain)

- RZPO (Poland)

- Minerva Omega Group s.r.l. (Italy)

- GEA Group Aktiengesellschaft (Germany)

- RISCO S.p.A (Italy)

- PSS SVIDNÍK, a.s. (Slovakia)

- Metalbud (Poland)

- BAADER (Germany)

- JBT Corporation (U.S.)

- Marel (Iceland)

- Key Technology (U.S.)

- Illinois Tool Works Inc. (U.S.)

- The Middleby Corporation (U.S.)

- Bettcher Industries, Inc. (U.S.)

- BIZERBA (Germany)

What are the Recent Developments in North America Meat, Poultry and Seafood Processing Equipment Market?

- In February 2025, JBT Marel partnered with Ace Aquatec in a strategic alliance, appointing the company as its preferred vendor of fish stunning solutions for food processing machinery. This collaboration strengthens JBT Marel’s position in sustainable seafood processing and expands its innovative machinery portfolio

- In January 2025, U.S.-based JBT acquired Marel in full, forming the new entity JBT Marel Corporation. This merger creates a powerful global leader in food processing technology, enhancing efficiency and innovation across multiple food sectors

- In November 2024, Fortifi Food Processing Solutions announced the acquisition of the intellectual property, customer relationships, selected inventories, and fixed assets of JWE-BANSS GmbH (Germany), a key manufacturer of protein processing systems. This acquisition bolsters Fortifi’s expertise in meat processing and strengthens its footprint in the North Americaan market

- In July 2024, Ross Industries launched the AMS 400 Membrane Skinner, a solution tailored for craft and mid-sized meat processors to improve operational efficiency and final product quality. This launch reflects Ross Industries’ focus on addressing the evolving automation needs of small and medium-scale food producers

- In March 2024, Fortifi Food Processing Solutions was officially launched as a unified global platform of food processing and automation brands operating across five continents. This establishment marks a strategic step toward offering integrated solutions across protein, dairy, and fruit and vegetable processing industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Meat Poultry And Seafood Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Meat Poultry And Seafood Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Meat Poultry And Seafood Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.