North America Medical Device Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

70.71 Billion

USD

185.34 Billion

2023

2031

USD

70.71 Billion

USD

185.34 Billion

2023

2031

| 2024 –2031 | |

| USD 70.71 Billion | |

| USD 185.34 Billion | |

|

|

|

|

North America Medical Device Outsourcing Market Size

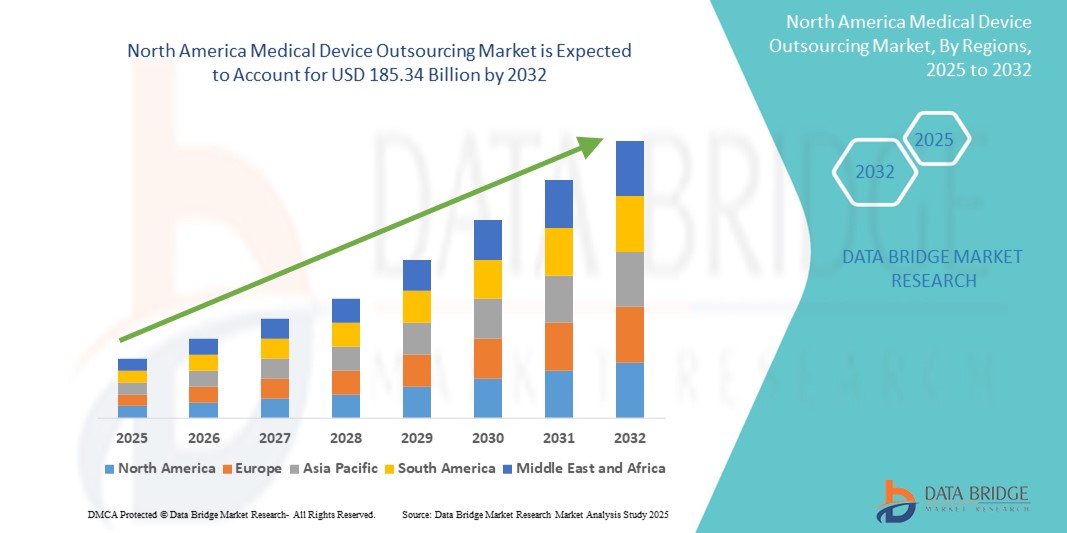

- The North America medical device outsourcing market size was valued at USD 70.71 billion in 2024 and is expected to reach USD 185.34 billion by 2032, at a CAGR of 12.80% during the forecast period

- The market growth is primarily driven by the increasing need for cost-effective manufacturing solutions and the growing complexity of medical devices, prompting OEMs to rely on outsourcing partners for design, development, and production

- In addition, heightened regulatory requirements and the need for faster product launches are encouraging companies to collaborate with specialized outsourcing firms, which provide regulatory expertise and scalability. These factors collectively are propelling the adoption of outsourcing in the medical device sector, significantly enhancing market expansion

North America Medical Device Outsourcing Market Analysis

- Medical device outsourcing, involving third-party services for design, development, manufacturing, and regulatory support, is becoming increasingly crucial in the North American healthcare landscape due to the region's focus on cost efficiency, innovation, and time-to-market acceleration

- The growing demand for outsourced services is primarily driven by the rising complexity of medical technologies, increasing R&D costs, and heightened pressure on OEMs to comply with evolving regulatory standards while maintaining profitability

- U.S. dominated the North America medical device outsourcing market with the largest revenue share of 79.1% in 2024, supported by a strong base of medical device companies, advanced healthcare infrastructure, and a well-established network of contract manufacturers and service providers

- Canada is expected to experience fastest growth in the the North America medical device outsourcing market during the forecast period, attributed to supportive government initiatives, an expanding healthcare sector, and increasing collaborations between OEMs and domestic outsourcing partners

- The contract manufacturing segment led the market with a share of 45.8% in 2024, fueled by the need for scalable production solutions, quality assurance, and the ability to meet stringent regulatory compliance requirements

Report Scope and North America Medical Device Outsourcing Market Segmentation

|

Attributes |

North America Medical Device Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Medical Device Outsourcing Market Trends

“Digital Transformation and Technological Integration in Outsourcing Services”

- A notable and fast-growing trend in the North America medical device outsourcing market is the digital transformation of outsourced services, including the integration of advanced technologies such as artificial intelligence (AI), additive manufacturing, and real-time data analytics into product development and manufacturing processes. These innovations are enabling enhanced precision, faster prototyping, and improved quality control in outsourced operations

- For instance, companies such as Jabil and Flex are leveraging AI and data analytics to enhance supply chain visibility and ensure traceability in manufacturing, helping OEMs comply with stringent regulatory standards. Similarly, Integer Holdings Corporation uses advanced robotics and automation in their outsourced manufacturing services to reduce lead times and minimize human error

- The adoption of digital twins and 3D printing technologies is revolutionizing the rapid prototyping and customization of medical devices, allowing contract manufacturers to deliver complex, patient-specific solutions efficiently. These capabilities are especially critical in orthopedics, cardiovascular, and diagnostic device segments

- Furthermore, outsourcing partners are increasingly offering end-to-end services that span R&D, regulatory consulting, design validation, and lifecycle management, creating integrated and seamless solutions for OEMs. The shift from transactional relationships to strategic partnerships is transforming the outsourcing landscape in the region

- This trend towards high-tech, value-added outsourcing is setting new industry benchmarks, compelling companies to continuously invest in cutting-edge capabilities. As a result, outsourcing is not just a cost-saving strategy but a competitive advantage, accelerating innovation while ensuring compliance and quality across the device lifecycle

North America Medical Device Outsourcing Market Dynamics

Driver

“Increased Demand for Cost-Efficiency and Specialized Expertise”

- The rising complexity of medical devices and the increasing pressure on OEMs to reduce operational costs while maintaining high standards of quality are key drivers fueling the growth of the medical device outsourcing market in North America

- For instance, in March 2024, MedPlast, a contract manufacturing firm, announced the expansion of its North American production facilities to support growing OEM demands for efficient, scalable production and regulatory support. These expansions underscore the industry's shift toward outsourcing to meet market needs effectively

- Outsourcing enables OEMs to access specialized expertise in areas such as biocompatibility testing, sterilization, and regulatory affairs, which are critical for product approvals in a highly regulated environment

- In addition, it allows companies to focus on core competencies such as innovation and brand development while delegating production and compliance to experienced partners

- This strategy reduces time-to-market and ensures more predictable cost structures, making it particularly attractive for startups and mid-sized firms

Restraint/Challenge

“Regulatory Complexity and Intellectual Property Concerns”

- One of the major challenges in the North America medical device outsourcing market is navigating the complex regulatory landscape, especially with frequent updates from authorities such as the FDA. Ensuring compliance while outsourcing critical development and manufacturing processes requires robust quality management systems and vigilant oversight

- For instance, third-party manufacturers must meet FDA’s Quality System Regulation (QSR) and ISO 13485 standards, which can be resource-intensive and costly to implement and monitor. These regulatory complexities can deter smaller firms from engaging in outsourcing relationships or result in delays and additional costs

- Moreover, concerns around intellectual property (IP) protection also pose a barrier. OEMs must ensure that outsourcing partners adhere to strict confidentiality and data protection protocols, especially when outsourcing product design and innovation-related tasks

- Trust issues and lack of transparency in the outsourcing chain can hinder collaboration and may result in legal disputes or unauthorized use of proprietary technologies. To overcome these concerns, leading outsourcing firms are investing in secure IT infrastructure and adopting strict contractual agreements to safeguard client IP

- Addressing these regulatory and IP-related challenges through enhanced collaboration, compliance audits, and risk mitigation strategies will be critical for sustaining growth in the outsourcing sector

North America Medical Device Outsourcing Market Scope

The market is segmented on the basis of services, product, device type, application, and end user.

- By Services

On the basis of services, the North America medical device outsourcing market is segmented into quality assurance, regulatory affairs services, product design and development services, product testing and sterilization services, product implementation services, product upgrade services, product maintenance services, raw material services, medical electrical equipment services, contract manufacturing, and materials and chemical characterization. The contract manufacturing segment dominated the market with the largest market revenue share of 45.8% in 2024, driven by the increasing need among OEMs for scalable, efficient, and cost-effective production solutions. Contract manufacturers offer comprehensive capabilities including precision machining, assembly, and packaging, making them vital partners for large-scale medical device production.

The regulatory affairs services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the evolving and increasingly stringent regulatory landscape across North America. As compliance requirements grow in complexity, particularly from the U.S. FDA and Health Canada, many medical device companies are outsourcing these services to specialized firms that offer expertise in submissions, audits, and quality assurance.

- By Product

On the basis of product, the North America medical device outsourcing market is segmented into finished goods, electronics, and raw materials. The finished goods segment held the largest market revenue share in 2024 due to the growing trend among OEMs to outsource the final manufacturing and assembly of fully packaged medical devices, allowing them to focus on innovation and commercialization.

The electronics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing incorporation of electronic components into diagnostic, monitoring, and wearable devices. The outsourcing of PCB fabrication, sensor integration, and microelectronics is becoming essential for companies to meet performance and miniaturization requirements.

- By Device Type

On the basis of device type, the North America medical device outsourcing market is segmented into Class I, Class II, and Class III. The Class II segment dominated the market with the largest revenue share in 2024, owing to the wide usage of these moderately regulated devices in areas such as diagnostics, dental tools, and surgical instruments. The outsourcing of manufacturing and compliance management for Class II devices helps OEMs meet regulatory expectations while reducing costs.

The Class III segment is anticipated to register strong growth over the forecast period, driven by increasing demand for high-risk and life-sustaining medical devices, such as implantable cardiac and neurostimulation devices. These devices require sophisticated engineering and rigorous regulatory compliance, making outsourcing an attractive option.

- By Application

On the basis of application, the North America medical device outsourcing market is segmented into cardiology, diagnostic imaging, orthopaedic, IVD, ophthalmic, general and plastic surgery, drug delivery, dental, endoscopy, diabetes care, and others. The cardiology segment dominated the market with the largest market revenue share in 2024, supported by high outsourcing demand for stents, pacemakers, and catheters. Outsourcing ensures faster time-to-market, regulatory support, and cost control in this high-demand specialty.

The IVD segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for diagnostic solutions, rising testing volumes, and the complexity of reagent kits and automated analyzers, which drives OEMs to partner with specialized outsourcing firms.

- By End User

On the basis of end user, the North America medical device outsourcing market is segmented into small medical device companies, medium medical device companies, large medical device companies, and others. The large medical device companies segment dominated the market with the largest market revenue share in 2024, due to their strategic use of outsourcing to streamline operations, expand capacity, and accelerate product development across multiple device categories.

The small medical device companies segment is expected to grow at the fastest CAGR from 2025 to 2032, as these companies increasingly rely on outsourcing partners to gain access to specialized R&D, manufacturing infrastructure, and regulatory expertise without the capital burden of in-house development.

North America Medical Device Outsourcing Market Regional Analysis

- The U.S. dominated the North America medical device outsourcing market with the largest revenue share of 79.1% in 2024, supported by a strong base of medical device companies, advanced healthcare infrastructure, and a well-established network of contract manufacturers and service providers

- U.S.-based companies strongly prioritize outsourcing to streamline operations, meet regulatory compliance, and accelerate product development benefiting from the country’s skilled labor force, cutting-edge technology, and proximity to the U.S. FDA

- The dominance of the U.S. is further reinforced by high healthcare spending, continuous innovation in medical technology, and increasing demand for specialized services across design, development, and manufacturing stages, making it a core engine of growth in the regional outsourcing landscape

The U.S. Medical Device Outsourcing Market Insight

The U.S. medical device outsourcing market captured the largest revenue share of 78.6% in 2024 within North America, driven by the strong presence of major OEMs, robust regulatory infrastructure, and a highly advanced ecosystem of contract manufacturers. Outsourcing in the U.S. is propelled by the need for specialized expertise in design, compliance, and scalable production to meet FDA regulations. Increasing pressure to reduce operational costs and accelerate innovation timelines further supports this trend. The U.S. market benefits from a mature outsourcing landscape with extensive service offerings across R&D, prototyping, and finished device manufacturing.

Canada Medical Device Outsourcing Market Insight

The Canada medical device outsourcing market is projected to grow at a steady CAGR throughout the forecast period, supported by government initiatives to enhance healthcare infrastructure and growing investments in medical technology. Canadian OEMs are increasingly turning to outsourcing partners to gain access to regulatory knowledge, cost-effective production, and faster market entry. The rise of medtech clusters, particularly in Ontario and Quebec, and strategic collaborations between local firms and global contract manufacturers are contributing to the sector’s expansion. Demand is particularly strong in diagnostics, orthopedics, and minimally invasive device segments.

Mexico Medical Device Outsourcing Market Insight

The Mexico medical device outsourcing market is gaining traction due to its cost advantages, skilled labor force, and proximity to the U.S., making it a favorable nearshoring destination for American OEMs. Growth is fueled by the development of manufacturing hubs in Baja California and Chihuahua, which house numerous FDA-compliant facilities. Mexico’s strategic trade agreements, including USMCA, and focus on medical device exports are attracting increased outsourcing investments. The market is witnessing growing demand for contract manufacturing and assembly services, especially in Class II and Class III devices for export to the U.S. and Canada.

North America Medical Device Outsourcing Market Share

The North America medical device outsourcing industry is primarily led by well-established companies, including:

- Integer Holdings Corporation (U.S.)

- Jabil Inc. (U.S.)

- TE Connectivity Ltd. (Switzerland)

- Sanmina Corporation (U.S.)

- Celestica Inc. (Canada)

- Flex Ltd. (Singapore)

- Viant Medical, Inc. (U.S.)

- Nortech Systems Incorporated (U.S.)

- Plexus Corp. (U.S.)

- Benchmark Electronics, Inc. (U.S.)

- TTM Technologies, Inc. (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Phillips-Medisize, LLC (U.S.)

- Cadence, Inc. (U.S.)

- SteriPack Group Ltd. (Ireland)

- Providien, LLC (U.S.)

- Gerresheimer AG (Germany)

- Cirtec Medical (U.S.)

- Millstone Medical Outsourcing, LLC (U.S.)

What are the Recent Developments in North America Medical Device Outsourcing Market?

- In May 2024, Integer Holdings Corporation, a leading U.S.-based contract medical device manufacturer, announced the expansion of its facility in Alden, New York. This initiative aims to increase production capacity and improve cleanroom manufacturing capabilities for cardiovascular and neuromodulation devices. The expansion reflects Integer’s commitment to supporting OEMs with advanced manufacturing solutions and meeting the rising demand for outsourced production of high-complexity Class III medical devices in North America

- In April 2024, Viant Medical, a prominent medical device outsourcing partner, acquired LayerMed, a Canada-based design and development firm specializing in minimally invasive surgical instruments. The acquisition enhances Viant’s front-end innovation capabilities and accelerates its ability to offer end-to-end development services to OEMs. This strategic move strengthens Viant’s position in the North American outsourcing ecosystem by broadening its service offerings and geographic reach

- In March 2024, Sanmina Corporation, a U.S.-based contract manufacturer, launched a new digital platform designed to streamline medical device prototyping and reduce design-to-manufacture timelines. The platform incorporates AI-driven modeling and real-time regulatory tracking, enabling faster design iterations and improved compliance. This development underscores Sanmina’s focus on integrating digital transformation into medical device outsourcing services

- In February 2024, TE Connectivity opened a new innovation and manufacturing center in Hermosillo, Mexico, to expand its support for medical device OEMs across North America. The facility includes advanced molding, extrusion, and assembly capabilities for minimally invasive, interventional, and diagnostic devices. This expansion highlights the increasing demand for nearshore manufacturing solutions and TE’s commitment to offering vertically integrated services in a cost-effective location

- In January 2024, Jabil Healthcare, a division of Jabil Inc., announced a collaboration with a U.S.-based startup to develop AI-powered wearable medical devices targeting chronic disease management. Under the agreement, Jabil will provide end-to-end outsourcing services including design, miniaturization, and regulatory support. This partnership demonstrates the growing role of contract manufacturers in accelerating innovation and commercialization for next-generation medical technologies in the North American market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.