North America Medical Imaging Market

Market Size in USD Million

CAGR :

%

USD

537.32 Million

USD

824.62 Million

2022

2030

USD

537.32 Million

USD

824.62 Million

2022

2030

| 2023 –2030 | |

| USD 537.32 Million | |

| USD 824.62 Million | |

|

|

|

North America Medical Imaging Market Analysis and Size

The burden of chronic diseases is increasing and medical imaging technologies are essential for accurately diagnosing these conditions. These prevalent and expensive long-term health issues are steadily rising as a result of the ageing population's growth and shifting social norms. Obesity, diabetes, cardiovascular disease and cancer account for the majority of deaths from chronic illnesses. According to GLOBOCAN, 19.3 million new cases of cancer were reported in 2020, and this figure is projected to rise to 30.2 million by 2040, Emerging markets would be particularly impacted because it is projected that population increase will be most considerable in developing regions.

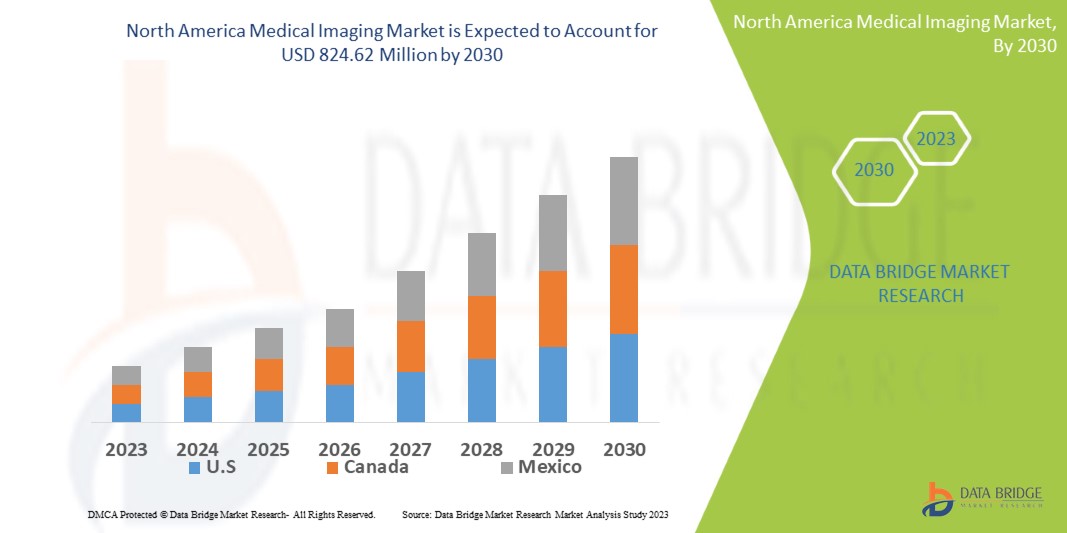

Data Bridge Market Research analyses that the medical imaging market which is USD 537.32 million in 2022, is expected to reach USD 824.62 million by 2030, at a CAGR of 5.5% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Medical Imaging Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (X-ray, CT, MRI, Ultrasound), Mobility (Stationary, Mobile), Technology (Digital Radiology, Computed Radiology), Patient Age (Adults, Pediatric), Application (Cardiology, Pelvic and Abdominal, Oncology, Mammography, Gynecology, Neurology, Urology, Musculoskeletal, Dental, Others), End Users (Hospitals, Diagnostic Centers, Imaging Centers, Specialty Clinics, Ambulatory Surgical Centers, Academic and Research Institutes, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), RamSoft, Inc.(Canada), InHealth Group (U.K.), Radiology Reports online (U.S.), Siemens (Germany), Sonic Healthcare Limited ( Australia), RadNet, Inc. (U.S.), General Electric (U.S.), Akumin Inc. (U.S.), Hologic Inc. (U.S.), Shimadzu Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CANON MEDICAL SYSTEMS CORPORATION (Japan), Carl Zeiss Ag (Germany), FUJIFILM Corporation (Japan), Hitachi, Ltd. (Japan), MEDNAX Services, Inc. (U.S.), Carestream Health (U.S.), Teleradiology Solutions (U.S.), UNILABS (Switzerland), ONRAD, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Medical imaging, as applied in digital health refers to methods and procedures for producing images of different body sections for diagnostic and therapeutic purposes. The phrase "medical imaging" refers to a wide range of radiological imaging methods, including X-ray radiography, fluoroscopy, magnetic resonance imaging (MRI), medical ultrasound or sonography, endoscopy, elastography, tactile imaging, thermography, medical photography and nuclear medicine functional imaging methods, such as positron emission tomography (PET). In all medical settings and at all levels of healthcare, medical imaging is essential.

Medical Imaging Market Dynamics

Drivers

- Increased investment and reimbursement programmes

Increased investment and reimbursement programmes by the government, rising need for early detection tools, technical developments to enhance turnaround time, and construction of new facilities by market participants in developing countries are believed to be driving the market's growth. As an illustration, the Indian government introduced X-Ray Setu in June 2021 as a free Artificial Intelligence (AI)-based platform to help physicians with the early COVID-19 therapies. In order to meet the rising demand for CT scanners and strengthen its market position, Siemens Healthineers opened a new CT scanner production facility in India in 2022.

- Rising usage of AI

The market growth is also anticipated to be boosted by using AI to automate the picture quantification and identification process. To ensure the early detection of age-related macular degeneration, Google's AI platform, known as Google's Deepmind, worked with Moorfields Eye Hospital to read all eye scans produced using an optical CT scanner. The development of 3D MRI and CT scans also makes it possible for radiologists to examine scans fast, cutting down on analysis time and increasing efficacy.

Opportunities

- High rate of Product Launches will have a Huge Impact on Market Growth

The rising number of product launches has caused the impact on market growth. Businesses are eager to invest extensively in the creation of effective goods in an effort to expand their customer base due to the enormous potential that medical imaging holds on a global scale. A new ultrasound system, which is said to perform better than competing models, was launched by Canon Medical Systems in April 2019. The company released the "Aplio-A" line, which has a variety of clinical uses and is reasonably priced. The future expansion of the market as a whole would be encouraged by the availability of such affordable items with great efficiency.

Restraints/Challenges

- Risks associated with medical imaging

The market's growth is likely to be hampered by a lack of experienced medical personnel, high equipment costs, a scarcity of imaging reagent providers, and stringent government regulations.

This medical imaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical imaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Medical Imaging Market

According to a letter published in the Journal of the American College of Radiology, scientists from the University of California at Los Angeles (UCLA) and the University of Southern California (USC) are developing Magnetic Resonance Imaging (MRI) suits that can significantly lower any transmission risks to radiologists, operators and patients. The requirement for routine chest imaging to track the long-term consequences of COVID is projected to increase, especially in basic healthcare institutions. As a result, the lack of medical care for conditions other than COVID-19 has had a detrimental effect on the number of medical imaging procedures. Another key aspect that has a negative impact on the medical imaging reagents market is the limited availability of healthcare personnel around the world. Furthermore, medical imaging for disease problems that are not urgent and may be postponed, such as cancer had a detrimental impact on the industry.

Following the global pandemic scenario, it is clear that there is a device shortage. This can cause significant disruptions in the device supply chain because several countries rely on imports for imaging devices. As a result, it is unclear whether the businesses will be able to ensure an adequate supply of products. As a result of the demand surge, there may be a short-term supply disruption within companies and healthcare provider organizations for certain imaging devices.

Recent Development

- In 2020, Philips launched Affiniti CVx, expanding its cardiovascular ultrasound portfolio. The system is intended to assist cardiology departments in providing better care to a greater number of patients while improving efficiency and throughput.

- In 2021, Philips announced the launch of an AI-enabled MR imaging portfolio, aiming to improve radiology operations' efficiency and sustainability by speeding up MR exams. Such technological advancements are said to exponentially boost market growth.

North America Medical Imaging Market Scope

The medical imaging market is segmented on the basis of product, mobility, technology, patient age, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- X-ray

- Modality

- Radiography

- Fluoroscopy

- Mammography

- Ultrasound

Diagnostic ultrasound devices

- 2D

- 3D/4D

- Doppler

Therapeutic ultrasound devices

- High-intensity focused ultrasound

- Extracorporeal shock wave lithotripsy

Portability

- Handheld

- Cart/Trolley Based

Application

- Ob/Gyn

- Cardiology

- Vascular

- Orthopedics

- General Imaging

- Computed Tomography

Technology

- High-end slice

- Mid end slice

- Low-end slice

- Cone beam

Application

- Oncology

- Neurology

- Cardiology

- Vascular

- Musculoskeletal

- Others

- Magnetic Resonance Imaging (MRI)

Architecture

- Closed System

- Open System

- Field Strength

- Low Field Strength

- Mid Field Strength

- High Field Strength

Application

- Brain and neurological

- Spine and musculoskeletal

- Vascular

- Abdomen

- Cardiac

- Breast

- Other

- Nuclear Imaging

Product

- SPECT

- Analog

- Digital

- Software

- Equipment

- PET

- Analog

- Digital

- Software

- Equipment

Application

- Oncology

- Cardiology

- Neurology

- Others

Technology

- Digital Radiography

- Computed Radiography

Mobility

- Stationary

- Mobile

Patient Age

- Adults

- Pediatric

End-use

- Hospitals

- Diagnostic Centers

- Imaging Centers

- Specialty Clinics

- Ambulatory Surgical Centers

- Academic and Research Institutes

- Others

Medical Imaging Market Regional Analysis/Insights

The medical imaging market is analyzed and market size insights and trends are provided by country, product, mobility, procedure, technology, patient age, application and end-user as referenced above.

The countries covered in the medical imaging market report are U.S., Canada and Mexico in North America.

U.S. region is dominating the market during the forecast period due to the rising number of chronic disorders.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The medical imaging market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for medical imaging market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the medical imaging market. The data is available for historic period 2011-2021.

Competitive Landscape and Medical Imaging Market Share Analysis

The medical imaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical imaging market.

Some of the major players operating in the medical imaging market are:

- Koninklijke Philips N.V. (Netherlands)

- RamSoft, Inc.(Canada)

- InHealth Group (U.K.)

- Radiology Reports online (U.S.)

- Siemens (Germany)

- Sonic Healthcare Limited (Australia)

- RadNet, Inc. (U.S.)

- General Electric (U.S.)

- Akumin Inc. (U.S.)

- Hologic Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Carl Zeiss Ag (Germany)

- FUJIFILM Corporation (Japan)

- Hitachi, Ltd. (Japan)

- MEDNAX Services, Inc. (U.S.)

- Carestream Health (U.S.)

- Teleradiology Solutions (U.S.)

- UNILABS (Switzerland)

- ONRAD, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.