North America Meditation Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

10.21 Billion

2024

2032

USD

2.80 Billion

USD

10.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.80 Billion | |

| USD 10.21 Billion | |

|

|

|

|

Meditation Market Size

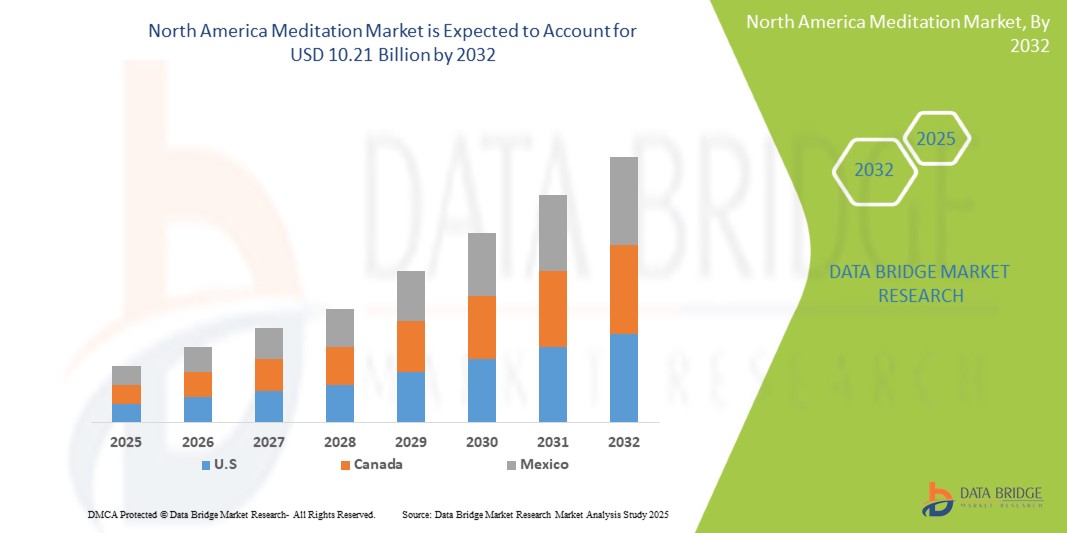

- The North America meditation market size was valued at USD 2.80 billion in 2024 and is expected to reach USD 10.21 billion by 2032, at a CAGR of 17.6% during the forecast period

- The market growth is largely fueled by the rising adoption of mindfulness practices and the technological progress in meditation apps and digital wellness platforms, leading to increased integration of meditation into daily routines across personal and professional settings.

- Furthermore, growing consumer demand for accessible, user-friendly, and personalized mental wellness solutions is positioning meditation tools and platforms as a preferred choice for stress management and emotional well-being. These converging factors are accelerating the adoption of meditation solutions, thereby significantly boosting the industry's growth.

Meditation Market Analysis

- Meditation solutions, including digital platforms and mobile applications, are increasingly vital components of modern mental health and wellness routines in both personal and corporate settings due to their ease of use, on-demand access, and seamless integration with digital health ecosystems.

- The escalating demand for meditation tools is primarily fueled by the widespread adoption of wellness technologies, growing mental health awareness among consumers, and a rising preference for convenient, self-guided mindfulness practices.

- U.S. dominates the meditation market with the largest revenue share of 73.30% in 2024, driven by growing mental health awareness, increasing smartphone penetration, and widespread use of meditation apps across diverse age groups.

- U.S. is expected to be the fastest-growing region in the meditation market during the forecast period, driven by increasing urbanization, rising disposable incomes, and a growing awareness of mental health benefits, which is encouraging more individuals to adopt meditation practices and digital wellness solutions.

- Online product segment is expected to dominate the meditation market with a market share of 64.84% in 2025, driven by the convenience and accessibility of e‑commerce channels, growing consumer comfort with online purchases, the wide availability of diverse digital meditation resources, and the ability to instantly access personalized content from anywhere

Report Scope and Meditation Market Segmentation

|

Attributes |

Meditation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Meditation Market Trends

“Rising Incidence of Mental Health Disorders”

- The North America surge in psychological disorders such as anxiety, depression, insomnia, and PTSD has become a critical public health concern, driving interest in meditation as a therapeutic practice. Stress-related conditions have sharply increased due to factors such as urban crowding, digital overload, financial insecurity, and disrupted work-life balance.

- As traditional treatments alone often fall short or bring side effects, individuals are increasingly exploring meditation for its calming effects and long-term benefits on emotional regulation. Meditation offers a structured, time-tested method to manage mental strain, attracting those seeking sustainable, drug-free interventions to restore psychological equilibrium and improve quality of life.

- For instance, In June 2022, according to WHO, around 970 million people, 1 in 8, were living with a mental disorder. This included 301 million with anxiety, 280 million with depression, 40 million with bipolar disorder, and 24 million with schizophrenia. Despite effective treatments, most affected individuals lack access to care and continue to face widespread stigma

- Its simplicity, lack of side effects, and adaptability across age groups make it a highly scalable mental wellness solution. As North America healthcare systems struggle to meet the demand for mental health services, meditation serves as an accessible and empowering tool for both early intervention and long-term emotional resilience.

Meditation Market Dynamics

Driver

“Rising Stress and Tension Drive Global Demand for Meditation Practices”

- Urbanization, fast-paced work routines, and constant digital engagement are contributing to rising stress levels, fueling growth in the North America meditation market. Increasingly, individuals are overwhelmed by long work hours, economic pressures, and societal expectations, leading to a spike in stress-induced mental and physical health problems

- In response, there is a growing demand for holistic, non-invasive therapies such as meditation that promote emotional balance and mental clarity. Meditation is gaining widespread recognition for its scientifically backed benefits in reducing stress and enhancing well-being. This trend is positioning meditation as a vital solution in modern wellness routines

- For instance, In April 2025, as per SingleCare Administrators, countries such as Northern Cyprus (65%), Israel (62%), and Nigeria (59%) report the highest stress rates. As stress affects over half the population in many nations, meditation emerges as a vital tool for emotional balance and mental well-being worldwide

- In addition, the growing accessibility of meditation through mobile apps, virtual sessions, and workplace wellness programs is making it easier for people across demographics to incorporate these practices into their daily lives, further driving market adoption

Restraint/Challenge

“Availability of Alternatives of Meditation”

- The North America meditation market faces potential restraints due to the availability of alternative wellness and stress management practices. While meditation has gained popularity for its effectiveness in promoting mental well-being, individuals have a range of options when seeking stress relief and relaxation.

- These alternatives include mindfulness-based therapies, fitness programs, and even pharmaceutical interventions such as anti-anxiety medications. The existence of these alternatives can divert potential users away from meditation and limit the market's growth

- For instance, In July 2023, as per the Aesthetics of Joy, many alternatives to meditation can promote mental well-being. Visualization, for example, involves imagining peaceful scenes while coloring intricate patterns like mandalas has been shown to reduce anxiety. Other activities, such as drumming, walking, or watching calming videos, such as those of Bob Ross, also offer stress relief

- In addition, the accessibility of online resources and mobile apps offering alternative wellness practices might reduce the perceived need for traditional meditation programs.

- Cost factors, particularly in corporate wellness settings, can also play a role, as companies may prioritize other stress management solutions that seem more immediately practical or budget-friendly.

Meditation Market Scope

The market is segmented on the basis of product type, meditation type, indication, technique type, type, age group, usage, information source, and end user.

By Product Type

On the basis of product type, North America meditation market is segmented into online product, offline product. The online product segment dominates the largest market revenue share of 64.76% in 2024, driven by its accessibility, affordability, and personalized features. Increasing smartphone usage, rising internet penetration, and the popularity of meditation apps contribute significantly to this growth, making digital platforms the preferred choice for modern mindfulness practices worldwide.

The online product segment is anticipated to witness the fastest growth rate of 17.7% from 2025 to 2032, driven by growing interest in in-person experiences, wellness retreats, and traditional meditation practices. Increasing demand for community-based sessions and immersive programs is encouraging users to seek deeper, guided engagement beyond digital platforms.

By Meditation Type

On the basis of medication type, North America meditation market is segmented into progressive relaxation/body scan meditation, mindfulness meditation, breath awareness meditation, transcendental meditation, zen meditation, kundalini yoga, and metta meditation. The progressive relaxation/body scan meditation segment dominates the largest market revenue share of 37.55% in 2024, driven by its effectiveness in reducing stress, improving sleep, and promoting physical relaxation. Its simplicity, ease of practice, and widespread adoption across wellness programs and therapeutic settings contribute to its strong market leadership.

The progressive relaxation/body scan meditation segment is anticipated to witness the fastest growth rate of 18.6% from 2025 to 2032, driven by its effectiveness in reducing stress, improving sleep, and promoting physical relaxation. Its simplicity, ease of practice, and widespread adoption across wellness programs and therapeutic settings contribute to its strong market leadership.

By Indication

On the basis of indication, North America meditation market is segmented into mental condition, physical condition.

The Mental Condition segment dominates the largest market revenue share of 81.06% in 2024, driven by its central role in addressing anxiety, depression, and stress-related disorders. Growing mental health awareness, increased acceptance of alternative therapies, and rising demand for non-pharmacological interventions make meditation a preferred solution for psychological well-being.

The physical condition segment is anticipated to witness the fastest growth rate of 19.5% from 2025 to 2032, driven by growing recognition of meditation’s role in pain management, cardiovascular health, and chronic illness support. Increased integration of mindfulness in rehabilitation and wellness programs is expanding its application in physical health improvement.

By Technique Type

On the basis of technique type, North America meditation market is segmented into traditional meditation, technology-assisted meditation. The traditional meditation segment dominates the largest market revenue share of 56.66% in 2024, driven by its deep-rooted cultural significance, time-tested techniques, and widespread practice in spiritual and religious contexts. Its perceived authenticity and holistic benefits attract both long-time practitioners and newcomers seeking meaningful, structured approaches to mental and emotional well-being.

The technology-assisted meditation segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, driven by innovations in mobile apps, wearables, and AI-powered platforms. Increased demand for personalized, accessible, and on-the-go mindfulness solutions is fueling adoption among tech-savvy users seeking convenient mental wellness tools.

By Type

On the basis of type, North America meditation market is segmented into open monitoring, focused attention, self-transcending meditation. The open monitoring segment dominates the largest market revenue share of 54.97% in 2025, driven by its emphasis on non-judgmental awareness and enhanced cognitive flexibility. Widely adopted in clinical, educational, and corporate settings, its ability to improve focus, reduce stress, and support emotional regulation fuels its widespread popularity and growth.

The Virtual Reality (VR) segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, driven by increasing demand for concentration-enhancing techniques. Widely used for managing ADHD, boosting productivity, and improving academic performance, this method appeals to individuals seeking structured practices to strengthen mental clarity and cognitive control.

By Age group

On the basis of age group, North America meditation market is segmented into adults and children. The Adults segment dominates the largest market revenue share of 88.88% in 2024, driven by the growing recognition of mental health challenges and the adoption of meditation as an effective solution for stress, anxiety, and overall well-being. Increased work-related pressures and lifestyle changes are fueling demand for adult-focused meditation practices.

The adult segment is anticipated to witness the fastest growth rate of 17.6% from 2025 to 2032, driven by the growing recognition of mental health challenges and the adoption of meditation as an effective solution for stress, anxiety, and overall well-being. Increased work-relatxed pressures and lifestyle changes are fueling demand for adult-focused meditation practices.

By Usage

On the basis of usage, North America meditation market is segmented into individual and group. The individual segment dominates the largest market revenue share of 95.27% in 2024, driven by the rising demand for personalized wellness solutions. Individuals increasingly seek meditation practices to manage stress, enhance mental clarity, and improve overall well-being, with many turning to digital platforms for self-guided, flexible meditation experiences.

The individual segment is anticipated to witness the fastest growth rate of 17.6% from 2025 to 2032, driven by the increasing popularity of communal meditation experiences. Individual sessions, often offered in wellness centers, retreats, and corporate environments, foster a sense of community and shared support, enhancing engagement and participation.

By Information source

On the basis of information source, North America meditation market is segmented into internet, articles, books, and newspapers. The internet segment dominates the largest market revenue share of 75.41% in 2025, driven by its accessibility, convenience, and wide reach. The growth of meditation apps, online courses, and digital platforms enables users to practice anytime, anywhere, making it the preferred choice for individuals seeking flexible, on-demand mental wellness solutions.

The internet segment is anticipated to witness the fastest growth rate of 17.9% from 2025 to 2032, driven by the increasing consumption of digital content related to meditation techniques, benefits, and mindfulness. As more individuals seek self-guided resources, articles provide accessible, informative, and engaging content for meditation practitioners.

By End User

On the basis of end user, North America meditation market is segmented into individuals, institutions, government & NGOS, others. The individuals segment dominates the largest market revenue share of 73.81% in 2025, driven by the growing preference for personalized meditation experiences. With increased focus on mental well-being, individuals are seeking self-paced, flexible practices through digital platforms and apps, enhancing accessibility and engagement in their meditation routines.

The institutions segment is anticipated to witness the fastest growth rate of 18.4% from 2025 to 2032, driven by the growing integration of meditation practices in schools, workplaces, and healthcare settings. Institutions are increasingly adopting mindfulness programs to promote mental health, reduce stress, and improve overall productivity and well-being.

Meditation Market Regional Analysis

- U.S. dominates the North America meditation market with the largest revenue share of 73.70% in 2024, driven by increasing mental health awareness, rising stress levels, and growing acceptance of alternative wellness practices

- Consumers in the region prioritize flexible meditation solutions that integrate with busy lifestyles, favoring apps and wearable technologies offering personalized mindfulness sessions and progress tracking

- The market growth is supported by corporate wellness programs, expanding telehealth services, and a strong focus on emotional well-being. High disposable incomes and widespread smartphone adoption further enhance accessibility to digital meditation platforms, solidifying meditation as a key mental wellness tool

United States Meditation Market Insight

The United States meditation market captured the largest revenue share of 73.70% within North America in 2024, propelled by an increasing prevalence of stress and anxiety disorders. Government initiatives, employer-sponsored wellness programs, and health insurance coverage for mental health have promoted meditation adoption across diverse demographic groups. Advanced digital infrastructure and innovation in meditation apps have accelerated usage, making mindfulness practices easily accessible across the country

Canada Meditation Market Insight

The Canada meditation market a is anticipated to grow at a noteworthy CAGR of 17.2% during the forecast,, supported by rising public interest in holistic health and well-being. Strong community-based mindfulness programs, supportive healthcare policies, and growing investments in mental health technologies have contributed to market growth. Canadians are increasingly adopting meditation through online platforms and mobile apps, with a focus on stress reduction and emotional resilience

Meditation Market Share

The Meditation industry is primarily led by well-established companies, including:

- Calm (U.S.)

- Headspace Inc. (U.S.)

- Maharishi International University (U.S.)

- Committee for Children (U.S.)

- Insight Network Inc. (U.S.)

- Aura Health (U.S.)

- Sanity & Self (U.S.)

- Happier Meditation, Inc. (U.S.)

- Inner Explorer Inc. (U.S.)

- Stop.Breathe.Think (U.S.)

- David Lynch Foundation (U.S.)

- WAKING UP, LLC (U.S.)

- MAHARISHI FOUNDATION INTERNATIONAL (U.S.)

- The Raj Resorts, Inc. (U.S.)

- Spirit Rock Meditation Center (U.S.)

- CIVANA (U.S.)

Latest Developments in North America Meditation Market

- In May 2021, BetterMe launched wheelchair workouts on global Accessibility Awareness Day. This workout helped people who are physically disabled. This launch has helped the company to expand its application North Americaly and increase its revenue in the market.

- In April 2025, the Chopra Health Retreat at CIVANA Wellness Resort & Spa received the prestigious "2025 Travelers’ Choice Award" from Tripadvisor. This recognition highlights the retreat's exceptional guest experiences, offering transformative wellness programs, including Ayurvedic treatments, yoga, and meditation. The award reinforces its position as a top destination for health-focused travelers seeking holistic well-being and relaxation.

- In July 2023, Meditopia and Pera Museum have recently collaborated to offer a unique digital experience. Bringing together the power of art and awareness, visitors are taken on a three-dimensional tour of the "Istanbul Panorama," a painting by Antoine de Favray in the 18th century, while listening to meditation music. This will help to attract more consumer base for a unique digital experience.

- In July 2020, Meditopia announced a Series A investment of USD 15 million. The funds were used to expand reach of its culturally-tailored mindfulness app. It worked with mental health professionals in each of its five regions to develop bespoke plans, tailored to the specific and nuanced needs of that culture, language or country.

- In May 2021, MOBIO INTERACTIVE announced that they developed personalized mental health therapy for people affected by the COVID-19 pandemic, which has detrimentally impacted mental health worldwide, causing increased stress, anxiety, and depression. This therapy tremendously helped people during the pandemic and thereby generating more revenue for the company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDITATION MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 FUNDING

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 INDUSTRY INSIGHTS

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.5.3 KEY PRICING STRATEGIES

4.5.4 COST ANALYSIS BREAKDOWN

4.5.5 TECHNOLOGY ROADMAP

4.5.6 REIMBURSEMENT FRAMEWORK

4.5.7 OPPORTUNITY MAP ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5.8 PRICE INDEX

6 REGULATORY COMPLIANCE

6.1 REGULATORY AUTHORITIES

6.2 REGULATORY CLASSIFICATIONS

6.3 REGULATORY SUBMISSIONS

6.4 INTERNATIONAL HARMONIZATION

6.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

6.6 REGULATORY CHALLENGES AND STRATEGIES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING INCIDENCE OF MENTAL HEALTH DISORDERS

7.1.2 RISING STRESS AND TENSION DRIVE NORTH AMERICA DEMAND FOR MEDITATION PRACTICES

7.1.3 GROWTH IN AWARENESS AMONG THE POPULATION

7.1.4 CORPORATE WELLNESS PROGRAMS PROMOTE MEDITATION FOR EMPLOYEE HEALTH AND PRODUCTIVITY

7.2 RESTRAINTS

7.2.1 AVAILABILITY OF ALTERNATIVES OF MEDITATION

7.2.2 HIGH DROPOUT RATES AMONG NEW PRACTITIONERS

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF SMARTPHONES AND RELIANCE ON DIGITAL PLATFORMS

7.3.2 BUSINESS STRATEGIES AMONG KEY MARKET PLAYERS

7.3.3 RISING DEMAND FOR MEDITATION-FOCUSED TRAVEL EXPERIENCES

7.4 CHALLENGES

7.4.1 AGE BARRIER DUE TO DIGITAL LITERACY GAP

7.4.2 OVERCROWDED MARKET WITH NUMEROUS COMPETING MEDITATION PROVIDERS

8 NORTH AMERICA MEDITATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 OPEN MONITORING

8.3 FOCUSED ATTENTION

8.4 SELF-TRANSCENDING MEDITATION

9 NORTH AMERICA MEDITATION MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ONLINE PRODUCT

9.2.1 MOBILE APPLICATIONS

9.2.2 ONLINE COURSES

9.2.3 WEBSITES

9.2.4 HEAD-MOUNTED DISPLAY-BASED APPLICATION

9.2.4.1 VR

9.2.4.2 AR

9.2.4.3 MR

9.2.5 OTHERS

9.3 OFFLINE PRODUCT

9.3.1 MEDITATION PROGRAMS

9.3.2 YOGA CENTERS

9.3.3 BOOKS

9.3.4 WORKSHOPS

9.3.5 OTHERS

10 NORTH AMERICA MEDITATION MARKET, BY INDICATION

10.1 OVERVIEW

10.2 MENTAL CONDITION

10.2.1 STRESS

10.2.2 ANXIETY DISORDER

10.2.3 DEPRESSION

10.2.4 MOOD DISORDER

10.2.5 OTHERS

10.3 PHYSICAL CONDITION

10.3.1 PAIN

10.3.2 INSOMNIA

10.3.3 SUBSTANCE ABUSE

10.3.4 ASTHMA

10.3.5 PREGNANCY

10.3.6 OTHERS

11 NORTH AMERICA MEDITATION MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 ADULTS

11.3 CHILDREN

12 NORTH AMERICA MEDITATION MARKET, BY MEDITATION TYPE

12.1 OVERVIEW

12.2 PROGRESSIVE RELAXATION/BODY SCAN MEDITATION

12.3 MINDFULNESS MEDITATION

12.4 BREATH AWARENESS MEDITATION

12.5 TRANSCENDENTAL MEDITATION

12.5.1 BASIC TRANSCENDENTAL MEDITATION

12.5.1.1 PERSONALIZED VEDIC MANTRA

12.5.1.2 OTHERS

12.5.2 ADVANCED (TM-SIDHI PROGRAM)

12.5.2.1 YOGIC FLYING SUTRAS

12.5.2.2 SUTRAS

12.5.2.3 OTHERS

12.5.3 OTHERS

12.5.4 INDIVIDUALS

12.5.5 INSTITUTIONS

12.5.5.1 SCHOOLS & UNIVERSITIES

12.5.5.2 CORPORATIONS

12.5.5.3 HOSPITALS & MENTAL HEALTH CLINIC

12.5.6 GOVERNMENT & NGOS

12.5.6.1 MILITARY & VETERAN PROGRAMS

12.5.6.2 PRISON REHABILITATION INITIATIVES

12.5.7 OTHERS

12.6 ZEN MEDITATION

12.7 KUNDALINI YOGA

12.8 METTA MEDITATION

13 NORTH AMERICA MEDITATION MARKET, BY TECHNIQUE TYPE

13.1 OVERVIEW

13.2 TRADITIONAL MEDITATION

13.3 TECHNOLOGY-ASSISTED MEDITATION

13.3.1 MEDITATION APPS

13.3.2 BIOFEEDBACK DEVICES

13.3.3 VIRTUAL REALITY (VR)

13.3.4 OTHERS

14 NORTH AMERICA MEDITATION MARKET, BY USAGE

14.1 OVERVIEW

14.2 INDIVIDUAL

14.3 GROUP

15 NORTH AMERICA MEDITATION MARKET, BY INFORMATION SOURCE

15.1 OVERVIEW

15.2 INTERNET

15.3 ARTICLES

15.4 BOOKS

15.5 NEWSPAPERS

16 NORTH AMERICA MEDITATION MARKET, BY END USER

16.1 OVERVIEW

16.2 INDIVIDUALS

16.3 INSTITUTIONS

16.3.1 SCHOOLS & UNIVERSITIES

16.3.2 CORPORATIONS

16.3.3 HOSPITALS & MENTAL HEALTH CLINIC

16.4 GOVERNMENT & NGOS

16.4.1 MILITARY & VETERAN PROGRAMS

16.4.2 PRISON REHABILITATION INITIATIVES

16.5 OTHERS

17 NORTH AMERICA MEDITATION MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA MEDITATION MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILES

20.1 CALM

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 SERVICE PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 HEADSPACE INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 SERVICE PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 MAHARISHI INTERNATIONAL UNIVERSITY

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 SERVICE PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.4 COMMITTEE FOR CHILDREN

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 SERVICE PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 INSIGHT NETWORK INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 SERVICE PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AURA HEALTH

20.6.1 COMPANY SNAPSHOT

20.6.2 SERVICE PORTFOLIO

20.6.3 RECENT DEVELOPMENTS

20.7 BETTERME

20.7.1 COMPANY SNAPSHOT

20.7.2 SERVICE PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 CIVANA

20.8.1 COMPANY SNAPSHOT

20.8.2 SERVICE PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DAVID LYNCH FOUNDATION

20.9.1 COMPANY SNAPSHOT

20.9.2 SERVICE PORTFOLIO

20.9.3 RECENT DEVELOPMENTS

20.1 NORTH AMERICA COUNTRY OF WORLD PEACE

20.10.1 COMPANY SNAPSHOT

20.10.2 SERVICE PORTFOLIO

20.10.3 RECENT DEVELOPMENTS

20.11 NORTH AMERICA MOTHER DIVINE ORGANIZATION (TRANSCENDENTAL MEDITATION FOR WOMEN)

20.11.1 COMPANY SNAPSHOT

20.11.2 SERVICE PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 HAPPIER MEDITATION, INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 SERVICE PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 INNER EXPLORER INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 SERVICE PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 INTERNATIONAL MEDITATION CENTER

20.14.1 COMPANY SNAPSHOT

20.14.2 SERVICE PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 MEDITOPIA

20.15.1 COMPANY SNAPSHOT

20.15.2 SERVICE PORTFOLIO

20.15.3 RECENT DEVELOPMENT/NEWS

20.16 MAHARISHI FOUNDATION INTERNATIONAL.

20.16.1 COMPANY SNAPSHOT

20.16.2 SERVICE PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 MAHARISHI MAHESH YOGI VEDIC VISHWAVIDYALAYA

20.17.1 COMPANY SNAPSHOT

20.17.2 SERVICE PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 MOBIO INTERACTIVE

20.18.1 COMPANY SNAPSHOT

20.18.2 SERVICE PORTFOLIO

20.18.3 RECENT DEVELOPMENTS

20.19 MRITYUNJY YOGPEETH FOUNDATION

20.19.1 COMPANY SNAPSHOT

20.19.2 SERVICE PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 PORTAL LABS LTD.

20.20.1 COMPANY SNAPSHOT

20.20.2 SERVICE PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SANITY & SELF

20.21.1 COMPANY SNAPSHOT

20.21.2 SERVICE PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SIDDHI YOGA INTERNATIONAL PTE LTD

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 SMILING MIND

20.23.1 COMPANY SNAPSHOT

20.23.2 SERVICE PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 SPIRIT ROCK MEDITATION CENTER

20.24.1 COMPANY SNAPSHOT

20.24.2 SERVICE PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 SPIRITUAL REGENERATION MOVEMENT FOUNDATION OF INDIA

20.25.1 COMPANY SNAPSHOT

20.25.2 SERVICE PORTFOLIO

20.25.3 RECENT NEWS

20.26 STOP.BREATHE.THINK

20.26.1 COMPANY SNAPSHOT

20.26.2 SERVICE PORTFOLIO

20.26.3 RECENT DEVELOPMENTS

20.27 THE MEDITATION TRUST

20.27.1 COMPANY SNAPSHOT

20.27.2 SERVICE PORTFOLIO

20.27.3 RECENT DEVELOPMENTS

20.28 THE RAJ RESORTS, INC.

20.28.1 COMPANY SNAPSHOT

20.28.2 SERVICE PORTFOLIO

20.28.3 RECENT DEVELOPMENTS

20.29 WAKING UP, LLC.

20.29.1 COMPANY SNAPSHOT

20.29.2 SERVICE PORTFOLIO

20.29.3 RECENT DEVELOPMENTS

20.3 YASH FOUNDATION

20.30.1 COMPANY SNAPSHOT

20.30.2 SERVICE PORTFOLIO

20.30.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 TABULATED REPRESENTATION OF COMPANY FUNDINGS

TABLE 2 NORTH AMERICA MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA OPEN MONITORING IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA FOCUSED ATTENTION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA SELF-TRANSCENDING MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDITATION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA ONLINE PRODUCT IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ONLINE PRODUCT IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA HEAD-MOUNTED DISPLAY-BASED APPLICATION IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA OFFLINE PRODUCT IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA OFFLINE PRODUCT IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA MEDITATION MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA MENTAL CONDITION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MENTAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA PHYSICAL CONDITION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA PHYSICAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA MEDITATION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ADULTS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA CHILDREN IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA MEDITATION MARKET, BY MEDITATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PROGRESSIVE RELAXATION/BODY SCAN MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA MINDFULNESS MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA BREATH AWARENESS MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA BASIC TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ADVANCED (TM-SIDHI PROGRAM) IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA ZEN MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA KUNDALINI YOGA IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA METTA MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA MEDITATION MARKET, BY TECHNIQUE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA TRADITIONAL MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA MEDITATION MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA INDIVIDUAL IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA GROUP IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA MEDITATION MARKET, BY INFORMATION SOURCE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA INTERNET IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA ARTICLES IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA BOOKS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA NEWSPAPERS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDIVIDUALS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INSTITUTIONS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA GOVERNMENT & NGOS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA OTHERS IN MEDITATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA MEDITATION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA MEDITATION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA ONLINE PRODUCT IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEAD-MOUNTED DISPLAY-BASED APPLICATION IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA OFFLINE PRODUCT IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA MEDITATION MARKET, BY MEDITATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA BASIC TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA ADVANCED (TM-SIDHI PROGRAM) IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA MEDITATION MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA MENTAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA PHYSICAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA MEDITATION MARKET, BY TECHNIQUE TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA MEDITATION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA MEDITATION MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA MEDITATION MARKET, BY INFORMATION SOURCE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. MEDITATION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. ONLINE PRODUCT IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. HEAD-MOUNTED DISPLAY-BASED APPLICATION IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. OFFLINE PRODUCT IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. MEDITATION MARKET, BY MEDITATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. BASIC TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. ADVANCED (TM-SIDHI PROGRAM) IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. MEDITATION MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. MENTAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. PHYSICAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. MEDITATION MARKET, BY TECHNIQUE TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. MEDITATION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. MEDITATION MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. MEDITATION MARKET, BY INFORMATION SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA MEDITATION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA ONLINE PRODUCT IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA HEAD-MOUNTED DISPLAY-BASED APPLICATION IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA OFFLINE PRODUCT IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA MEDITATION MARKET, BY MEDITATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA BASIC TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA ADVANCED (TM-SIDHI PROGRAM) IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA MEDITATION MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA MENTAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA PHYSICAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA MEDITATION MARKET, BY TECHNIQUE TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA MEDITATION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA MEDITATION MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA MEDITATION MARKET, BY INFORMATION SOURCE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO MEDITATION MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO ONLINE PRODUCT IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO HEAD-MOUNTED DISPLAY-BASED APPLICATION IN MEDITATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OFFLINE PRODUCT IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO MEDITATION MARKET, BY MEDITATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO BASIC TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO ADVANCED (TM-SIDHI PROGRAM) IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO TRANSCENDENTAL MEDITATION IN MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO MEDITATION MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 134 MEXICO MENTAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO PHYSICAL CONDITION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO MEDITATION MARKET, BY TECHNIQUE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO TECHNOLOGY-ASSISTED MEDITATION IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO MEDITATION MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO MEDITATION MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO MEDITATION MARKET, BY INFORMATION SOURCE, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO MEDITATION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO INSTITUTIONS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO GOVERNMENT & NGOS IN MEDITATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA MEDITATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDITATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDITATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDITATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDITATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDITATION MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA MEDITATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA MEDITATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDITATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDITATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 LINE CHART, BY PRODUCT TYPE (2024)

FIGURE 12 NORTH AMERICA MEDITATION MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA MEDITATION MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE NORTH AMERICA MEDITATION MARKET, BY PRODUCT TYPE (2024)

FIGURE 16 RISING INCIDENCE OF MENTAL HEALTH DISORDERS IS EXPECTED TO DRIVE THE NORTH AMERICA MEDITATION MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 17 ONLINE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDITATION MARKET IN 2025 & 2032

FIGURE 18 GRAPHICAL REPRESENTATION OF COMPANY FUNDINGS

FIGURE 19 GRAPHICAL REPRESENTATION OF FUNDING ROUNDS

FIGURE 20 FUNDING STAGE DISTRIBUTION

FIGURE 21 DROC ANALYSIS

FIGURE 22 NORTH AMERICA PREVALENCE OF MENTAL HEALTH DISORDERS

FIGURE 23 GENDER DISTRIBUTION OF MENTAL HEALTH DISORDERS

FIGURE 24 REGIONAL PREVALENCE OF MENTAL HEALTH DISORDERS

FIGURE 25 TOP COUNTRIES BY PERCENTAGE OF POPULATION REPORTING HIGH-STRESS LEVELS (2024)

FIGURE 26 LEADING CAUSES OF DAY-TO-DAY STRESS AMONG AMERICANS (2024)

FIGURE 27 NORTH AMERICA MEDITATION MARKET: BY TYPE, 2024

FIGURE 28 NORTH AMERICA MEDITATION MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 29 NORTH AMERICA MEDITATION MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 30 NORTH AMERICA MEDITATION MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 31 NORTH AMERICA MEDITATION MARKET: BY PRODUCT TYPE, 2024

FIGURE 32 NORTH AMERICA MEDITATION MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 33 NORTH AMERICA MEDITATION MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 34 NORTH AMERICA MEDITATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA MEDITATION MARKET: BY INDICATION, 2024

FIGURE 36 NORTH AMERICA MEDITATION MARKET: BY INDICATION, 2025-2032 (USD THOUSAND)

FIGURE 37 NORTH AMERICA MEDITATION MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 38 NORTH AMERICA MEDITATION MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 39 NORTH AMERICA MEDICATION MARKET: BY AGE GROUP, 2024

FIGURE 40 NORTH AMERICA MEDICATION MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 41 NORTH AMERICA MEDICATION MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 42 NORTH AMERICA MEDICATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 43 NORTH AMERICA MEDITATION MARKET: BY MEDITATION TYPE, 2024

FIGURE 44 NORTH AMERICA MEDITATION MARKET: BY MEDITATION TYPE, 2025-2032 (USD THOUSAND)

FIGURE 45 NORTH AMERICA MEDITATION MARKET: BY MEDITATION TYPE, CAGR (2025-2032)

FIGURE 46 NORTH AMERICA MEDITATION MARKET: BY MEDITATION TYPE, LIFELINE CURVE

FIGURE 47 NORTH AMERICA MEDITATION MARKET: BY TECHNIQUE TYPE, 2024

FIGURE 48 NORTH AMERICA MEDITATION MARKET: BY TECHNIQUE TYPE, 2025-2032 (USD THOUSAND)

FIGURE 49 NORTH AMERICA MEDITATION MARKET: BY TECHNIQUE TYPE, CAGR (2025-2032)

FIGURE 50 NORTH AMERICA MEDITATION MARKET: BY TECHNIQUE TYPE, LIFELINE CURVE

FIGURE 51 NORTH AMERICA MEDITATION MARKET: BY USAGE, 2024

FIGURE 52 NORTH AMERICA MEDITATION MARKET: BY USAGE, 2025-2032 (USD THOUSAND)

FIGURE 53 NORTH AMERICA MEDITATION MARKET: BY USAGE, CAGR (2025-2032)

FIGURE 54 NORTH AMERICA MEDITATION MARKET: BY USAGE, LIFELINE CURVE

FIGURE 55 NORTH AMERICA MEDITATION MARKET: BY INFORMATION SOURCE, 2024

FIGURE 56 NORTH AMERICA MEDITATION MARKET: BY INFORMATION SOURCE, 2025-2032 (USD THOUSAND)

FIGURE 57 NORTH AMERICA MEDITATION MARKET: BY INFORMATION SOURCE, CAGR (2025-2032)

FIGURE 58 NORTH AMERICA MEDITATION MARKET: BY INFORMATION SOURCE, LIFELINE CURVE

FIGURE 59 NORTH AMERICA MEDITATION MARKET: BY END USER, 2024

FIGURE 60 NORTH AMERICA MEDITATION MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 61 NORTH AMERICA MEDITATION MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 62 NORTH AMERICA MEDITATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 63 NORTH AMERICA MEDITATION MARKET: SNAPSHOT (2024)

FIGURE 64 NORTH AMERICA MEDITATION MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.