North America Medium Voltage Synchronous Motors Market

Market Size in USD Billion

CAGR :

%

USD

1.47 Billion

USD

2.06 Billion

2024

2032

USD

1.47 Billion

USD

2.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.47 Billion | |

| USD 2.06 Billion | |

|

|

|

Medium Voltage Synchronous Motors Market Analysis

The North America Medium voltage synchronous motors market is driven by increasing industrial automation, the demand for energy-efficient solutions, and the growing need for reliable and high-performance motors in sectors such as manufacturing, mining, oil & gas, and utilities. Medium voltage synchronous motors are preferred for their superior efficiency, robust performance, and low maintenance costs, making them ideal for heavy-duty applications. Technological advancements in motor design, control systems, and cooling mechanisms enhance motor efficiency and operational lifespan, contributing to reduced energy consumption and operational costs. Market growth is further supported by the rising demand for electrification and the global shift toward sustainable energy solutions. However, challenges such as high initial installation costs, complex maintenance requirements, and the need for skilled workforce in operation and maintenance pose barriers to growth. Nonetheless, emerging economies, advancements in digitalization, and increasing adoption of renewable energy systems present significant growth opportunities, making the market more competitive and innovation-driven.

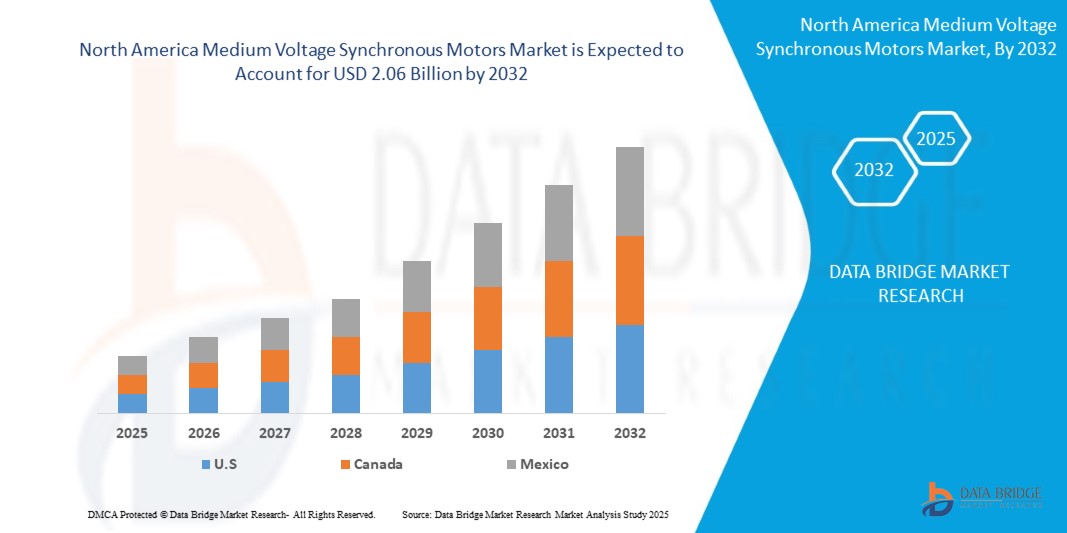

Medium Voltage Synchronous Motors Market Size

The North America medium voltage synchronous motors market is expected to reach USD 2.06 billion by 2032 from USD 1.47 billion in 2024, growing with a substantial CAGR of 4.48% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Medium Voltage Synchronous Motors Market Trends

“Adoption of Variable Speed Drives (VSDs)”

The North America medium voltage synchronous motors market is driven by the demand for energy-efficient and high-performance motors across industries. Key trends include the adoption of variable speed drives (VSDs) to optimize energy consumption, along with advancements in motor design and control systems. Digital monitoring and predictive maintenance technologies are enhancing motor performance and reliability. The rise of electrification and automation in sectors such as manufacturing, mining, and utilities further supports growth. In addition, there is an increasing focus on sustainable solutions to meet stricter environmental regulations, as well as a trend toward modular, compact motor designs for improved integration.

Report Scope and Medium Voltage Synchronous Motors Market Segmentation

|

Attributes |

Medium Voltage Synchronous Motors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Hitachi, Ltd. (Japan), ABB (Switzerland), Wolong Electric Group (China), Nidec ASI spa (Part of Nidec Corporation) (Italy), Johnson Electric Holdings Limited (Honk Kong), Panasonic Industry Co., Ltd. (Japan), WEG (U.S.), Mitsubishi Electric Corporation (Japan), TOSHIBA CORPORATION (Japan), Regal Rexnord Corporation (U.S.), Siemens (Germany), BHARAT HEAVY ELECTRICALS LIMITED (India), IDEAL ELECTRIC POWER CO. (U.S.), ORIENTAL MOTOR USA CORP. (Japan), and TECO-Westinghouse (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Medium Voltage Synchronous Motors Market Definition

Medium voltage synchronous motors are electric motors that operate at medium voltage levels (typically 1 kV to 15 kV) and maintain a constant speed in sync with the power supply frequency. They use a rotor with a DC-excited winding and a stator connected to an AC power source. These motors are highly efficient, offer precise speed control, and are widely used in industrial applications such as compressors, pumps, conveyors, and mills. Their advantages include high power factor correction, reliable performance, and long service life, making them ideal for heavy-duty operations requiring consistent speed and torque.

Medium Voltage Synchronous Motors Market Dynamics

Drivers

- Growing Industrial Automation Enhances Demand for Synchronous Motors Globally

The rapid growth of industrial automation is a key driver of the increasing demand for medium voltage synchronous motors globally. As industries adopt more automated systems to improve operational efficiency, reduce costs, and enhance productivity, the need for high-performance, reliable motors that can handle complex processes becomes more pronounced. Medium voltage synchronous motors, known for their energy efficiency, precision, and consistent performance, are crucial in supporting this shift toward automation.

These motors are essential in industries that require constant speed and high reliability, such as manufacturing, power generation, and oil and gas. They excel in applications with large, heavy-duty equipment, where efficiency and reliability are critical to minimizing downtime and maximizing production. Their ability to maintain a constant speed regardless of load fluctuations makes them particularly valuable in automated systems, where consistency and precise control are paramount. The ongoing integration of advanced technologies, such as IoT, AI, and machine learning, into industrial automation systems further enhances the demand for medium voltage synchronous motors. These technologies enable better monitoring, diagnostics, and optimization of motor performance, making synchronous motors an even more attractive option. By offering precise control, these motors are becoming integral to smart factories, which rely on automation to manage complex processes in real-time.

For instance,

In June 2024, according to an article published by JOINER SERVICES, Industrial automation enhances efficiency by reducing labor costs, improving product quality, and minimizing human error. Key components like sensors, PLCs, and robotics streamline production, improving safety, flexibility, and cycle time. Despite initial high costs and complex maintenance, automation offers long-term savings, and operational improvements, and supports a skilled workforce.

- Rising Energy Efficiency Regulations Drive Market Growth Steadily

Rising energy efficiency regulations are a significant driver of steady growth in the medium voltage synchronous motors market. As governments and regulatory bodies worldwide intensify their focus on sustainability and energy conservation, industries are being compelled to adopt technologies that reduce energy consumption. Medium voltage synchronous motors are particularly well-suited to meet these demands, offering enhanced energy efficiency compared to traditional motor types.

These motors are designed to operate at optimal efficiency levels across a wide range of industrial applications, from manufacturing to power generation. By maintaining a constant speed regardless of load variations, they minimize energy waste and reduce operational costs, making them an attractive choice for industries looking to comply with increasingly stringent energy regulations. As energy efficiency standards become more rigid, businesses are turning to these motors to ensure compliance while achieving long-term savings. The implementation of energy efficiency regulations, such as those set by the International Energy Agency (IEA) and the European Union's Ecodesign Directive, encourages industries to replace outdated, less efficient motors with more advanced solutions such as medium voltage synchronous motors. These regulations are pushing industries to invest in high-performance technologies that not only meet regulatory requirements but also provide a competitive edge in terms of lower energy consumption and reduced carbon emissions.

For instance,

In May 2023, according to an article published by Gamak Makina Sanayi A.Ş., Energy efficiency refers to using energy more effectively without wasting it, aiming to reduce energy consumption while maintaining service quality. It is crucial for sustainability and environmental protection, helping minimize energy waste, greenhouse gas emissions, and environmental pollution. Regulations and practices are in place across various sectors to promote efficient energy use.

Opportunities

- Rising Renewable Energy Projects Boost Motor Demand Worldwide

The growing demand for renewable energy projects is driving the need for medium voltage synchronous motors, a key component in energy generation systems such as wind turbines, solar power plants, and hydroelectric facilities. As countries focus on transitioning to greener energy sources, they are investing heavily in renewable infrastructure. This shift has led to an increase in the number of installations requiring efficient, durable motors, particularly in the medium voltage range, which are essential for high-power applications

Wind power, in particular, is contributing significantly to this trend. As offshore and onshore wind farms expand globally, the demand for medium voltage synchronous motors is expected to rise. These motors are integral in controlling large turbines, ensuring maximum efficiency and minimal downtime. Furthermore, with the increasing shift toward electrification and hybrid solutions in various industries, the market for medium voltage synchronous motors is likely to continue its upward trajectory.

For instance,

In August 2024, according to a post published by Windings Inc., the article highlights how electric motors, including medium voltage synchronous motors, play a crucial role in renewable energy systems like wind and hydroelectric power. These motors enhance efficiency, reliability, and performance in energy generation, supporting the global shift toward sustainability.

- Technological Advancements Enhance Motor Efficiency and Performance Globally

Technological advancements in motor design and control systems are revolutionizing the efficiency and performance of medium voltage synchronous motors globally. These motors, which are widely used in industrial applications such as power plants, oil refineries, and manufacturing facilities, are benefiting from innovations that improve energy use, reduce maintenance needs, and enhance reliability.

Modern synchronous motors now incorporate advanced materials, better cooling techniques, and more precise control systems. These improvements lead to motors that consume less energy, operate at higher efficiencies, and have longer lifespans. For instance, the integration of permanent magnet technology and digital controls helps optimize motor performance, providing higher torque and reduced energy consumption under varying load conditions.

For instance,

In August 2024, according to an article published by Induportals Media Publishing, advancements in industrial drive systems, such as Variable Frequency Drives (VFDs) and new semiconductor materials such as Silicon Carbide (SiC), enhance the efficiency and performance of medium voltage synchronous motors, benefiting industries with improved energy use and reliability.

Restraints/Challenges

- High Initial Costs Limit Adoption Across Small-Scale Industries

A key restraint in the medium voltage synchronous motors market is the high initial cost of these motors, which limits their adoption, particularly across small-scale industries. While medium voltage synchronous motors offer significant long-term benefits, such as energy efficiency, reduced maintenance, and reliable performance, the upfront investment required for these motors can be a barrier for smaller enterprises with limited capital. The cost of acquiring and installing medium voltage synchronous motors is generally higher compared to traditional motor solutions. Small-scale industries often operate with tighter budgets and may not have the financial flexibility to invest in advanced motor technologies. These industries may opt for more affordable alternatives, such as induction motors, which, although less efficient, present a lower initial expenditure. The higher capital costs associated with synchronous motors, including those for specialized control systems and integration into existing infrastructure, further discourage adoption in price-sensitive smaller businesses.

Moreover, the installation and maintenance of medium voltage synchronous motors often require specialized expertise, adding to the overall cost burden. Small-scale industries, especially in emerging markets, may struggle to justify these expenditures, particularly when immediate returns on investment may not be immediately apparent. This financial constraint is exacerbated by the ongoing economic pressures faced by many smaller enterprises, which may prioritize cost-saving measures over long-term investments in efficiency improvements.

- Complex Maintenance Requirements Reduce Market Growth Potential Globally

Complex maintenance requirements pose a significant restraint on the North America medium voltage synchronous motors market, potentially reducing their growth potential. While these motors offer high efficiency, reliability, and performance, they come with maintenance demands that can be more intricate and costly compared to conventional motor types. This complexity can deter industries, particularly those in cost-sensitive sectors, from adopting or fully utilizing medium voltage synchronous motors

In addition, the maintenance of medium voltage synchronous motors often involves high-tech control systems, which can require periodic software updates and system recalibrations to ensure optimal performance. This ongoing need for technical expertise and specialized tools further complicates maintenance routines and adds layers of cost that can be burdensome, especially for industries with limited budgets.

For instance,

In January 2025, according to an article published by PDF Supply, regular motor maintenance is crucial for preventing failures and extending service life. Three main types are preventive (scheduled checks), predictive (data-driven analysis to anticipate failures), and corrective (repairs after breakdowns). Proper maintenance improves performance, reduces downtime, enhances safety, saves costs, and ensures energy efficiency for motor systems.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Medium Voltage Synchronous Motors Market Scope

The market is segmented on the basis of on speed range, Horsepower (HP), application, sales channel, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Speed Range

- High Speed (1200–3600 RPM)

- Low Speed (≤900 RPM)

- Super Synchronous Speed (Above 3600 RPM)

Horsepower (HP)

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

Application

- Pumps & Fans

- Compressors

- Conveyors

- Steam Turbines

- Industrial Mixers

- Electric Vehicles (EVs)

- Robotics

- Others

Sales Channel

- Direct Sales/Through OEMs

- Distribution

- System Integrators

End Use

- Manufacturing

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Oil & Gas

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Power Generation

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Mining

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Marine

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Petrochemicals

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Water and Wastewater

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

- Others

- 1,000 HP – 2,000 HP

- 2,000 HP – 5,000 HP

- 500 HP – 1,000 HP

- Below 500 HP

- 5,000 HP – 10,000 HP

- Above 10,000 HP

Medium Voltage Synchronous Motors Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, speed range, Horsepower (HP), application, sales channel, and end use as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate and the fastest-growing country in the market due to rapid industrialization, increasing investments in manufacturing and infrastructure, and the growing demand for energy-efficient motors in industries such as mining, oil & gas, and power generation.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Medium Voltage Synchronous Motors Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Medium Voltage Synchronous Motors Market Leaders Operating in the Market Are:

- Hitachi, Ltd. (Japan)

- ABB (Switzerland)

- Wolong Electric Group (China)

- Nidec ASI spa (Part of Nidec Corporation) (Italy)

- Johnson Electric Holdings Limited (Honk Kong)

- Panasonic Industry Co., Ltd. (Japan)

- WEG (U.S.)

- Mitsubishi Electric Corporation (Japan)

- TOSHIBA CORPORATION (Japan)

- Regal Rexnord Corporation (U.S.)

- Siemens (Germany)

- BHARAT HEAVY ELECTRICALS LIMITED (India)

- IDEAL ELECTRIC POWER CO. (U.S.)

- ORIENTAL MOTOR USA CORP. (Japan)

- TECO-Westinghouse (U.S.)

Latest Developments in Medium Voltage Synchronous Motors Market

- In May 2024, Hitachi and Google Cloud have partnered to enhance enterprise innovation and productivity with generative AI. This collaboration focuses on developing AI solutions for software modernization, customer service, and secure operations across on-premises and cloud environments. Hitachi will train over 50,000 GenAI Professionals to accelerate AI-driven transformation globally

- In September 2024, Hitachi Industrial Products has commercialized the world's first copper die-cast rotor for railway traction motors, reducing weight by 15 kg compared to traditional copper bar types. This innovation improves energy efficiency and supports carbon neutrality, offering lighter and more efficient solutions for railway vehicle operations

- In May 2024, ABB has expanded its electrification portfolio by acquiring Siemens' wiring accessories business in China. This acquisition will enhance ABB's product offerings in the fast-growing Chinese market, focusing on advanced wiring solutions for residential, commercial, and industrial applications

- In November 2024, Wolong showcased its dedication to green, low-carbon, and new energy technologies at the 7th China International Import Expo (CIIE). By presenting efficient electric drive solutions, electric transportation, automation, renewable energy, and life-cycle service solutions, Wolong highlighted its role in energy transformation and the "double carbon" goal

- In December 2024, the Nidec 50Hertz Second Generation STATCOM project is a collaboration between Nidec Conversion and the German transmission system operator 50Hertz. This innovative system, known as E-STATCOM, integrates supercapacitor storage to ensure both voltage and frequency stability in high voltage transmission grids. It can exchange up to 150 MW in just 1.25 seconds, providing dynamic reactive power and inertial response to grid fluctuations. The project is part of Germany's strategy to achieve 100% renewable energy by 2032

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 COMPANY COMPARATIVE ANALYSIS

4.3 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.3.1 ENERGY EFFICIENCY SOLUTIONS AND GREEN TECHNOLOGIES:

4.3.2 INTEGRATION WITH RENEWABLE ENERGY SOURCES

4.3.3 CUSTOMIZATION AND NICHE APPLICATIONS

4.3.4 PARTNERSHIPS AND JOINT VENTURES

4.3.5 AFTERMARKET SERVICES AND MAINTENANCE

4.3.6 CONCLUSION

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4.1 AUTOMATION AND ROBOTICS

4.5 PENETRATION AND GROWTH PROSPECT MAPPING

4.5.1 ENERGY-INTENSIVE INDUSTRIES

4.5.1.1 OIL & GAS, MINING, AND HEAVY INDUSTRIES

4.5.1.2 POWER GENERATION AND RENEWABLE ENERGY

4.5.2 KEY DRIVERS

4.5.2.1 ENERGY EFFICIENCY REGULATIONS

4.5.2.2 RENEWABLE ENERGY INTEGRATION

4.5.2.3 SUSTAINABILITY AND GREEN INITIATIVES

4.5.2.4 COST-EFFECTIVE RETROFIT SOLUTIONS

4.5.3 CONCLUSION

4.6 TECHNOLOGY ANALYSIS

4.7 USE CASES & ITS ANALYSIS

4.8 PRICE INDEX

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INDUSTRIAL AUTOMATION ENHANCES DEMAND FOR SYNCHRONOUS MOTORS GLOBALLY

6.1.2 RISING ENERGY EFFICIENCY REGULATIONS DRIVE MARKET GROWTH STEADILY

6.1.3 EXPANSION IN MINING AND MANUFACTURING BOOSTS MOTOR ADOPTION RATES

6.1.4 RENEWABLE ENERGY INTEGRATION INCREASES NEED FOR ADVANCED MOTORS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS LIMIT ADOPTION ACROSS SMALL-SCALE INDUSTRIES

6.2.2 COMPLEX MAINTENANCE REQUIREMENTS REDUCE MARKET GROWTH POTENTIAL GLOBALLY

6.3 OPPORTUNITIES

6.3.1 RISING RENEWABLE ENERGY PROJECTS BOOST MOTOR DEMAND WORLDWIDE

6.3.2 TECHNOLOGICAL ADVANCEMENTS ENHANCE MOTOR EFFICIENCY AND PERFORMANCE GLOBALLY

6.3.3 EXPANDING INDUSTRIALIZATION IN EMERGING ECONOMIES DRIVES MARKET GROWTH

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES IMPACT MOTOR PRODUCTION COSTS

6.4.2 SKILLED WORKFORCE SHORTAGE HAMPERS INSTALLATION AND MAINTENANCE

7 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE

7.1 OVERVIEW

7.2 HIGH SPEED (1200–3600 RPM)

7.3 LOW SPEED (≤900 RPM)

7.4 SUPER SYNCHRONOUS SPEED (ABOVE 3600 RPM)

8 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP)

8.1 OVERVIEW

8.2 1,000 HP – 2,000 HP

8.3 2,000 HP – 5,000 HP

8.4 500 HP – 1,000 HP

8.5 BELOW 500 HP

8.6 5,000 HP – 10,000 HP

8.7 ABOVE 10,000 HP

9 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PUMPS &FANS

9.3 COMPRESSORS

9.4 CONVEYORS

9.5 STEAM TURBINES

9.6 INDUSTRIAL MIXERS

9.7 ELECTRIC VEHICLES (EVS)

9.8 ROBOTICS

9.9 OTHERS

10 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES/THROUGH OEMS

10.3 DISTRIBUTION

10.4 SYSTEM INTEGRATORS

11 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE

11.1 OVERVIEW

11.2 MANUFACTURING

11.3 OIL & GAS

11.4 POWER GENERATION

11.5 MINING

11.6 MARINE

11.7 PETROCHEMICALS

11.8 WATER AND WASTEWATER

11.9 OTHERS

12 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILES

14.1 HITACHI, LTD.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ABB

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 WOLONG ELECTRIC GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 NIDEC ASI SPA (PART OF NIDEC CORPORATION)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 JOHNSON ELECTRIC HOLDING LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 BHARAT HEAVY ELECTRICALS LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 IDEAL ELECTRIC POWER CO.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 MITSUBISHI ELECTRIC CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ORIENTAL MOTOR USA CORP.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 PANASONIC INDUSTRY CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 REGAL REXNORD CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 ROTEK

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 SIEMENS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 TECO-WESTINGHOUSE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 TOSHIBA CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT UPDATES

14.16 WEG

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 USE CASE ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH SPEED (1200–3600 RPM) IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA LOW SPEED (≤900 RPM) IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA SUPER SYNCHRONOUS SPEED (ABOVE 3600 RPM) IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA 1,000 HP – 2,000 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA 2,000 HP – 5,000 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA 500 HP – 1,000 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA BELOW 500 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA 5,000 HP – 10,000 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA ABOVE 10,000 HP IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA PUMPS & FANS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA COMPRESSORS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA CONVEYORS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA STEAM TURBINES IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA INDUSTRIAL MIXERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA ELECTRIC VEHICLES (EVS) IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA ROBOTICS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA DIRECT SALES/THROUGH OEMS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA DISTRIBUTION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA SYSTEM INTEGRATORS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 59 U.S. MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE, 2018-2032 (USD MILLION)

TABLE 60 U.S. MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 61 U.S. MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 62 U.S. MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 63 U.S. MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 64 U.S. MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 65 U.S. OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 66 U.S. POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 67 U.S. MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 68 U.S. MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 69 U.S. PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 70 U.S. WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 71 U.S. OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 72 CANADA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE, 2018-2032 (USD MILLION)

TABLE 73 CANADA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 74 CANADA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 CANADA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 76 CANADA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 77 CANADA MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 78 CANADA OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 79 CANADA POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 80 CANADA MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 81 CANADA MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 82 CANADA PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 83 CANADA WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 84 CANADA OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 85 MEXICO MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE, 2018-2032 (USD MILLION)

TABLE 86 MEXICO MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 87 MEXICO MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 MEXICO MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 MEXICO MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 90 MEXICO MANUFACTURING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 91 MEXICO OIL & GAS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 92 MEXICO POWER GENERATION IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 93 MEXICO MINING IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 94 MEXICO MARINE IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 95 MEXICO PETROCHEMICALS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 96 MEXICO WATER AND WASTEWATER IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

TABLE 97 MEXICO OTHERS IN MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY HORSEPOWER (HP), 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET

FIGURE 2 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SPEED RANGE (2024)

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING INDUSTRIAL AUTOMATION ENHANCES DEMAND FOR SYNCHRONOUS MOTORS GLOBALLY IS EXPECTED TO DRIVE THE NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE HIGH SPEED (1200–3600 RPM) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET

FIGURE 18 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: BY SPEED RANGE, 2024

FIGURE 19 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: BY HORSEPOWER (HP), 2024

FIGURE 20 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY APPLICATION, 2024

FIGURE 21 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY SALES CHANNEL, 2024

FIGURE 22 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET, BY END USE, 2024

FIGURE 23 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: SNAPSHOT (2024)

FIGURE 24 NORTH AMERICA MEDIUM VOLTAGE SYNCHRONOUS MOTORS MARKET: COMPANY SHARE 2024 (%)

North America Medium Voltage Synchronous Motors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Medium Voltage Synchronous Motors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Medium Voltage Synchronous Motors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.