North America Methyl Acrylate Market Analysis and Insights

Methyl acrylate is used as a chemical intermediate in the production of other chemicals such as acrylic acid and acrylamide. It is also used as a solvent for various resins, oils, and waxes.

However, methyl acrylate is a dangerous chemical and must be handled with care. It is flammable and can form explosive peroxides in contact with air. It can also cause skin and eye irritation and is toxic if swallowed or inhaled.

The market for methyl acrylate is primarily driven by the demand for its end uses, particularly in the coating and adhesive industries. Factors such as the availability of raw materials, regulatory policies, and technological advancements also influence the demand for methyl acrylate.

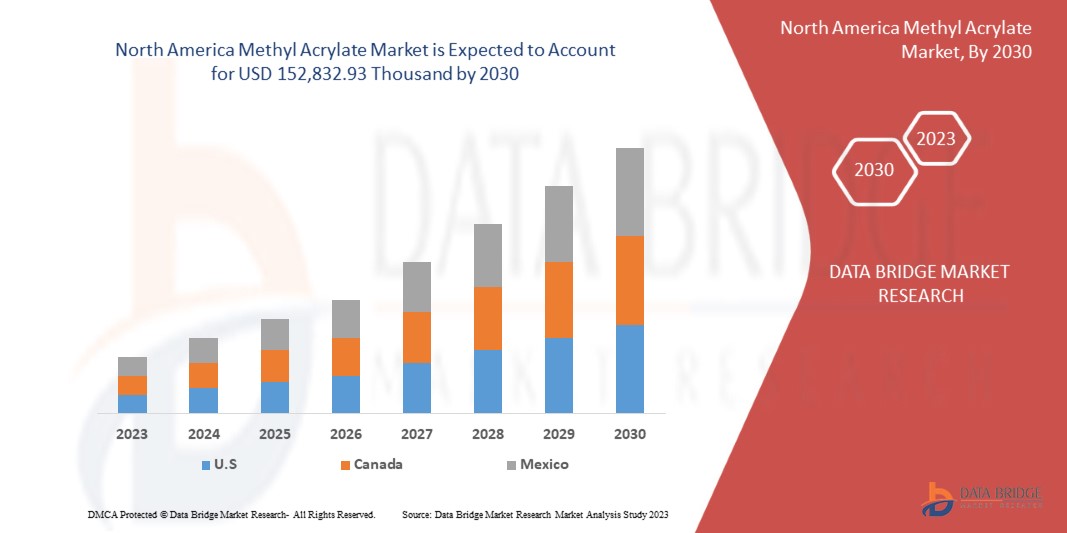

Data Bridge Market Research analyzes that the North America methyl acrylate market is expected to reach the value of USD 152,832.93 thousand by 2030, at a CAGR of 6.3% during the forecast period The type segment accounts for the largest segment in the market due to the growing use of methyl acrylate in various industrial applications.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Tons, and Pricing in USD |

|

Segments Covered |

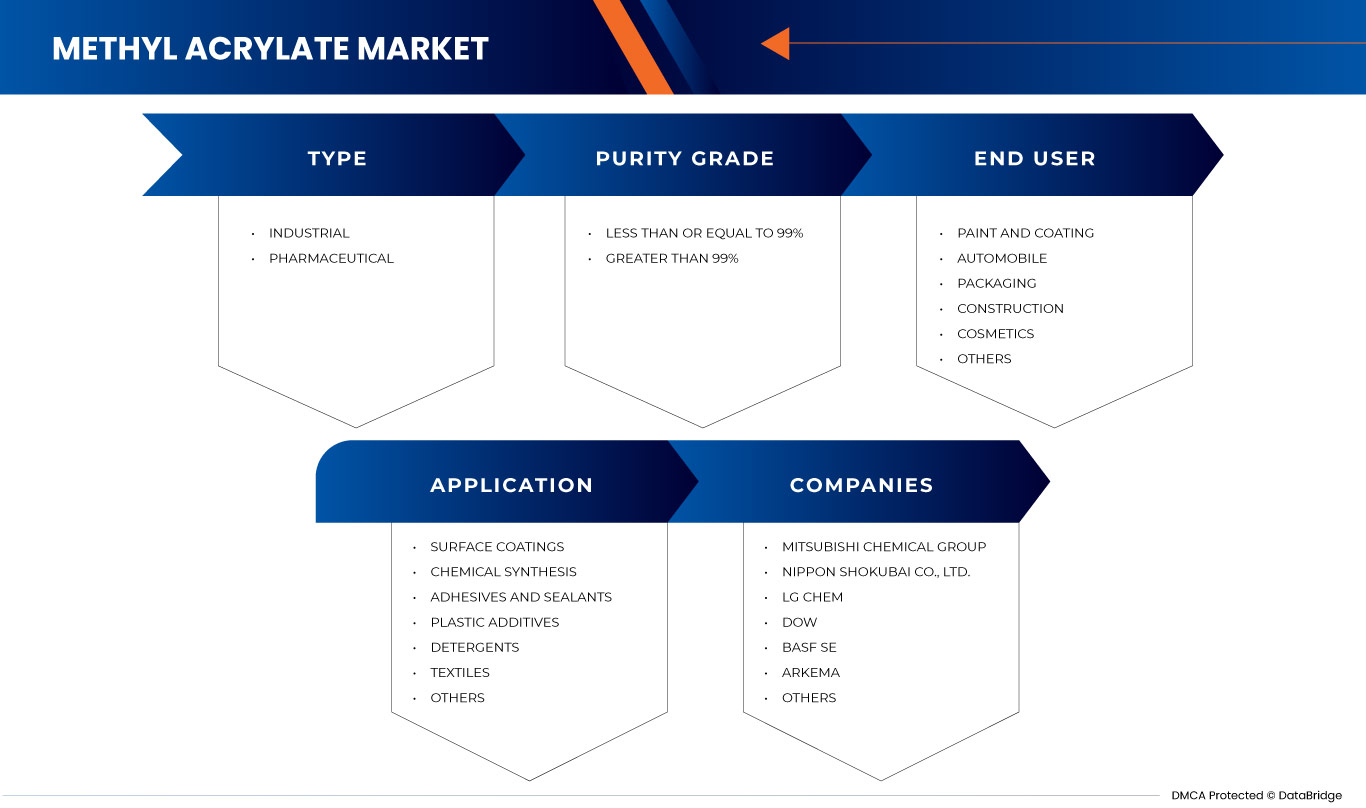

By Type (Industrial and Pharmaceutical), Purity Grade (Less Than Or Equal To 99% and Greater Than 99%), Application (Surface Coatings, Chemical Synthesis, Adhesives and Sealants, Plastic Additives, Detergents, Textiles, and Others), End User (Paint & Coating, Automobile, Packaging, Construction, Cosmetics, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su, and SHANGDONG KAITAI PETROCHEMICAL Co., LTD. among others |

Market Definition

Methyl acrylate is an organic compound with the chemical formula CH2=CHCOOCH3. It is an ester of acrylic acid and methanol and is also known as methyl propionate. Methyl acrylate is a colorless liquid with a strong pungent odor that is highly flammable. It is soluble in most organic solvents, including water.

Methyl acrylate is mainly used as a building block in the production of various chemicals such as polymers, coatings, adhesives, and textiles. It is used in the production of poly (methyl acrylate) and poly (methyl methacrylate), which are widely used in the production of paints, adhesives, and coatings. It is also used as a cross-linker for various polymers.

Methyl acrylate is a reactive monomer often used in the preparation of copolymers. It is often copolymerized with other monomers, such as ethyl acrylate, butyl acrylate, or styrene, to improve the properties of the resulting polymer, such as strength and adhesion.

North America Methyl Acrylate Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Increasing Demand for Methyl Acrylate-Based Products

Methyl acrylate, stabilized is a colorless volatile liquid with a pungent odor. Its vapors may irritate the eyes and respiratory system. It is very toxic if inhaled, ingested, or comes in skin contact. It is less dense than water (0.957 g/cm3) and poorly soluble in water, so it floats on water. Its vapors are heavier than air. It is a raw material in applications including acrylic fibers, fiber treatments, molding resins, adhesives, paints, coatings, and emulsions.

Methyl acrylate is used in a variety of industries, including coatings, adhesives, textiles, and plastics. Growth in these industries is expected to increase the demand for methyl acrylate.

Thus, the increase in the demand for methyl acrylate-based products is acting as a driver for market growth.

- Technological Advancement in the Manufacturing Process of Methyl Acrylate

Methyl acrylate is often used in the production of polymers and resins, especially acrylic fibers, coatings, and adhesives. It is also used as a starting material in the synthesis of various chemicals, including agricultural chemicals, medicines, and perfumes.

The traditional method of making methyl acrylate involves the reaction of acrylic acid with methanol in the presence of a catalyst. The reaction is exothermic and usually requires cooling to control the temperature.

Thus, technological advancement in the manufacturing process of methyl acrylate is acting as a driver for market growth.

RESTRAINT

- The Fluctuating Cost of Raw Materials used in Methyl Acrylate Production

Methyl acrylate is mainly obtained from petrochemicals, and any fluctuations in the price of crude oil can significantly affect the production costs of methyl acrylate.

One of the most important raw materials for the production of methyl acrylate is propylene, which is obtained from crude oil or natural gas. As a result, fluctuations in the prices of these goods can significantly affect the price of propylene and therefore, the total cost of production of methyl acrylate.

Crude oil is the main raw material used in the production of many chemicals, including propylene, which is used in the production of methyl acrylate. Therefore, fluctuations in the price of crude oil can significantly affect the production costs of methyl acrylate.

OPPORTUNITY

-

Increasing Demand for Sustainable and Ecofriendly Products

Developing trends in the production of sustainable and environmentally friendly methyl acrylate products are increasing the demand for methyl acrylate in the market.

The increasing use of sustainable and environmentally friendly methyl acrylate products reflects a growing awareness of the importance of environmental sustainability in chemical production. By adopting more sustainable practices and developing ecological products, the industry strives to minimize its environmental impact and respond to the changing needs of customers.

Growing concern for the environment increases the demand for sustainable and environmentally friendly products. Methyl acrylate is a sustainable alternative to traditional petrochemicals and may offer growth opportunities in this area.

Thus, increasing demand for sustainable and eco-friendly products acts as an opportunity for market growth.

CHALLENGE

- Stringent Government Regulations Regarding the use of Methyl Acrylate

Government regulations regarding the use of methyl acrylate vary by country and region. However, some jurisdictions have imposed strict regulations due to concerns about the potential health and environmental effects of the compound.

According to the REACH regulation, companies that produce or import more than one ton of methyl acrylate per year must register it with the European Chemicals Agency (ECHA). The registration process involves providing information on the properties and uses of the substance, as well as the potential danger it may present to human health or the environment.

In general, the REACH regulations for methyl acrylate aim to ensure that its production, import, and use are safe and do not pose a risk to human health or the environment. Companies using or producing methyl acrylate in the EU must comply with these regulations to avoid possible legal and financial penalties.

Hence, the stringent government regulations regarding the use of methyl acrylate act as a challenge to market growth.

Recent Development

- In June 2020, Merck KGaA received approval for BAVENCIO, a PD-L1 targeted NK–cell therapy for the treatment of locally advanced or metastatic urothelial carcinoma. This approval helped the company to enhance its product portfolio for cancer treatment.

North America Methyl Acrylate Market Scope

The North America methyl acrylate market is segmented into four notable segments such as type, purity grade, application, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Type

- Industrial

- Pharmaceutical

On the basis of type, the market is segmented into industrial and pharmaceutical.

By Purity Grade

- Less Than Or Equal To 99%

- Greater Than 99%

On the basis of purity grade, the market is segmented into less than or equal to 99% and greater than 99%.

By Application

- Surface Coatings

- Adhesives And Sealants

- Textiles

- Plastic Additives

- Chemical Synthesis

- Detergents

- Others

On the basis of application, the market is segmented into surface coatings, chemical synthesis, adhesives and sealants, plastic additives, detergents, textiles, and others.

By End User

- Paint And Coating

- Automobile

- Packaging

- Construction

- Cosmetics

- Others

On the basis of end user, the market is segmented into paint and coating, automobile, packaging, construction, cosmetics, and others.

North America Methyl Acrylate Market Regional Analysis/Insights

The North America methyl acrylate market is segmented into four notable segments based on type, purity grade, application, and end user.

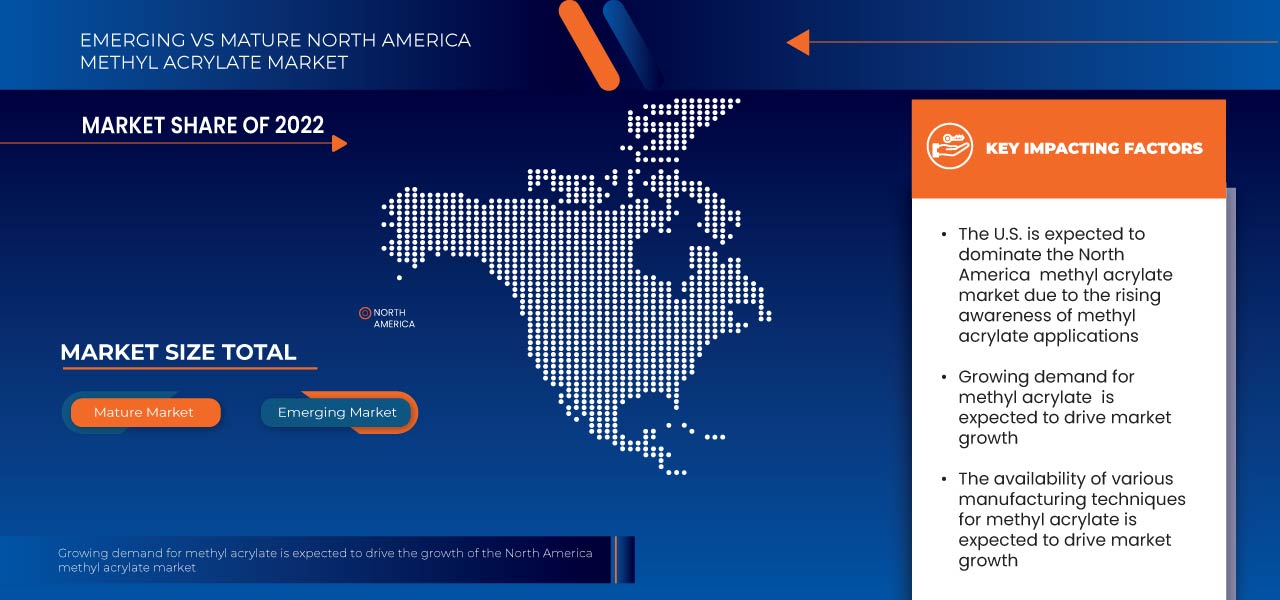

The countries covered in this market report are U.S., Canada, and Mexico.

In 2023, the U.S. is dominating the market due to the presence of key market players in the largest consumer market with high GDP.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Methyl Acrylate Market Share Analysis

The North America methyl acrylate market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, product width and breath, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the North America methyl acrylate market are Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su, and SHANGDONG KAITAI PETROCHEMICAL Co., LTD. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL COVERAGE

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TRADE SCENARIO

4.3.1 OVERVIEW

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.5 PORTER’S FIVE FORCES

4.6 VENDOR SELECTION CRITERIA

4.7 PESTEL ANALYSIS

4.8 REGULATION COVERAGE

4.9 EXCLUSIVE LIST OF POTENTIAL BUYERS

4.1 EXCLUSIVE PRODUCTS LIST MADE FROM METHYL ACRYLATE WITH ESTIMATED %

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 PRICE INDEX

7 SUPPLY CHAIN ANALYSIS

8 PRODUCTION CAPACITY OVERVIEW

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS

9.1.2 TECHNOLOGICAL ADVANCEMENT IN THE MANUFACTURING PROCESS OF METHYL ACRYLATE

9.1.3 GROWING AWARENESS REGARDING PROPERTIES OF METHYL ACRYLATE

9.2 RESTRAINTS

9.2.1 FLUCTUATING COST OF RAW MATERIALS USED IN METHYL ACRYLATE PRODUCTION

9.2.2 AVAILABILITY OF SUBSTITUTES FOR METHYL ACRYLATE

9.3 OPPORTUNITIES

9.3.1 INCREASING DEMAND FOR SUSTAINABLE AND ECOFRIENDLY PRODUCTS

9.3.2 DEVELOPMENT OF NEW APPLICATIONS USING METHYL ACRYLATE

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF METHYL ACRYLATE

9.4.2 HEALTH AND SAFETY CONCERNS ASSOCIATED WITH THE USE OF METHYL ACRYLATE

10 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 PHARMACEUTICAL

11 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE

11.1 OVERVIEW

11.2 GREATER THAN 99%

11.3 LESS THAN OR EQUAL TO 99%

12 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SURFACE COATINGS

12.3 ADHESIVES AND SEALANTS

12.4 TEXTILES

12.5 PLASTIC ADDITIVES

12.6 CHEMICAL SYNTHESIS

12.7 DETERGENTS

12.8 OTHERS

13 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER

13.1 OVERVIEW

13.2 PAINT AND COATING

13.2.1 GREATER THAN 99%

13.2.2 LESS THAN OR EQUAL TO 99%

13.3 AUTOMOBILE

13.3.1 GREATER THAN 99%

13.3.2 LESS THAN OR EQUAL TO 99%

13.4 PACKAGING

13.4.1 GREATER THAN 99%

13.4.2 LESS THAN OR EQUAL TO 99%

13.5 CONSTRUCTION

13.5.1 GREATER THAN 99%

13.5.2 LESS THAN OR EQUAL TO 99%

13.6 COSMETICS

13.6.1 GREATER THAN 99%

13.6.2 LESS THAN OR EQUAL TO 99%

13.7 OTHERS

14 NORTH AMERICA METHYL ACRYLATE MARKET, BY GEOGRAPHY

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA METHYL ACRYLATE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MITSUBISHI CHEMICAL GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BASF SE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 LG CHEM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 NIPPON SHOKUBAI CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ARKEMA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 DOW

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 DUPONT

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 EVONIK

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 JURONG GROUP SU

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 MERCK KGAA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 NOURYON

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGDONG KAITAI PETROCHEMICAL CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHANGHAI HUAYI ACRYLIC ACID CO. LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SIBUR INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SOLVENTIS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 LIST OF TRADERS

TABLE 2 POTENTIAL BUYERS OF METHYL ACRYLATE

TABLE 3 NORTH AMERICA METHYL ACRYLATE MARKET, ESTIMATED SHARE BY APPLICATION, 2022

TABLE 4 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021 AND 2022 (ASP IN TONS)

TABLE 5 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 7 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (ASP IN TONS)

TABLE 8 NORTH AMERICA INDUSTRIAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA PHARMACEUTICAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREATER THAN 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA LESS THAN OR EQUAL TO 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SURFACE COATINGS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ADHESIVES AND SEALANTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA TEXTILES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA PLASTIC ADDITIVES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA CHEMICAL SYNTHESIS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DETERGENTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD TONS)

TABLE 35 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 37 NORTH AMERICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 47 U.S. METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 57 CANADA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 67 MEXICO METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 MEXICO METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 70 MEXICO PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 72 MEXICO PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 MEXICO COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA METHYL ACRYLATE MARKET

FIGURE 2 NORTH AMERICA METHYL ACRYLATE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA METHYL ACRYLATE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA METHYL ACRYLATE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA METHYL ACRYLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA METHYL ACRYLATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA METHYL ACRYLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA METHYL ACRYLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA METHYL ACRYLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA METHYL ACRYLATE MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 NORTH AMERICA METHYL ACRYLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA METHYL ACRYLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA METHYL ACRYLATE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA METHYL ACRYLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA METHYL ACRYLATE MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA METHYL ACRYLATE MARKET

FIGURE 17 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 19 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA METHYL ACRYLATE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2022

FIGURE 22 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2023-2030 (USD THOUSAND)

FIGURE 23 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA METHYL ACRYLATE MARKET: BY PURITY GRADE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, 2022

FIGURE 26 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 27 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA METHYL ACRYLATE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, 2022

FIGURE 30 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 31 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA METHYL ACRYLATE MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA METHYL ACRYLATE MARKET: SNAPSHOT (2022)

FIGURE 34 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2022)

FIGURE 35 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 NORTH AMERICA METHYL ACRYLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 NORTH AMERICA METHYL ACRYLATE MARKET: TYPE (2023-2030)

FIGURE 38 NORTH AMERICA METHYL ACRYLATE MARKET: COMPANY SHARE 2022 (%)

North America Methyl Acrylate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Methyl Acrylate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Methyl Acrylate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.