North America Molded Frp Grating Market

Market Size in USD Million

CAGR :

%

USD

35.74 Million

USD

46.70 Million

2024

2032

USD

35.74 Million

USD

46.70 Million

2024

2032

| 2025 –2032 | |

| USD 35.74 Million | |

| USD 46.70 Million | |

|

|

|

|

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Size

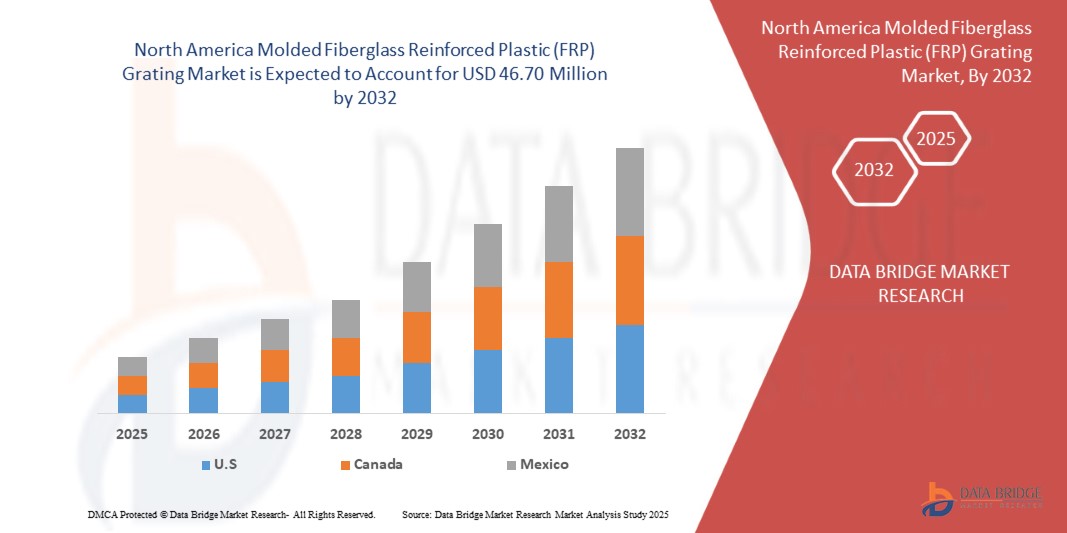

- The North America molded fiberglass reinforced plastic (FRP) grating market size was valued at USD 35.74 million in 2024 and is expected to reach USD 46.70 million by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for lightweight, corrosion-resistant, and durable alternatives to traditional metal grating across industries such as wastewater treatment, chemical processing, and marine applications

- In addition, rising infrastructure investments and stringent regulations promoting worker safety and non-conductive materials are further driving the adoption of molded Fiberglass Reinforced Plastic (FRP) grating in industrial and commercial settings

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Analysis

- The molded fiberglass reinforced plastic grating market in North America is witnessing steady expansion due to increased usage in sectors such as construction, water treatment, and marine industries

- This trend is supported by a shift toward durable, lightweight, and maintenance-free materials that offer long-term value

- The U.S. molded fiberglass reinforced plastic (FRP) grating market captured the largest revenue share of over 80% within North America in 2024, fueled by robust investments in water treatment facilities, chemical plants, and manufacturing units

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America molded fiberglass reinforced plastic (FRP) grating market due to growing adoption of sustainable building materials, infrastructure modernization initiatives, and rising demand in cold-climate applications requiring non-corrosive, slip-resistant solutions in public utilities and industrial facilities

- The polyester segment dominated the market with the largest market revenue share in 2024 due to its excellent balance of mechanical strength, corrosion resistance, and affordability. Widely used in industrial and commercial settings, polyester-based molded fiberglass reinforced plastic (FRP) gratings offer durability and resistance against moisture, making them ideal for both indoor and outdoor use. Their chemical compatibility with diverse substances also drives their demand in sectors such as water management and construction

Report Scope and North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Segmentation

|

Attributes |

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Trends

“Increasing Adoption of Molded Fiberglass Reinforced Plastic (FRP) Grating in Wastewater and Chemical Processing Plants”

- Molded fiberglass reinforced plastic (FRP) grating is increasingly adopted in sectors such as wastewater treatment and chemical processing due to its resistance to harsh environments

- For instance, a wastewater facility in Houston, Texas, replaced steel grating with fiberglass reinforced plastic (FRP) to combat corrosion from constant chemical exposure

- The grating resists acids, alkalis, and moisture, making it ideal for applications where traditional materials deteriorate quickly

- Its non-conductive and anti-slip properties align with OSHA and other safety regulations, making workplaces safer

- Molded fiberglass reinforced plastic (FRP) grating requires minimal maintenance, offering lower lifecycle costs compared to metal or wood alternatives

- Multiple installations in California, Texas, and Louisiana underscore a growing preference for fiberglass reinforced plastic (FRP) in industrial infrastructure upgrades

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Dynamics

Driver

“Rising Demand for Corrosion-Resistant and Low-Maintenance Materials”

- The demand for corrosion-resistant and low-maintenance materials is a key driver of the molded fiberglass reinforced plastic (FRP) grating market in North America

- Traditional materials such as steel and wood deteriorate in harsh conditions, whereas molded fiberglass reinforced plastic (FRP) grating withstands chemicals, moisture, and extreme weather, making it ideal for industrial and municipal use

- fiberglass reinforced plastic (FRP) grating is widely used in sectors such as wastewater treatment, chemical processing, and marine infrastructure due to its superior reliability and safety under challenging conditions

- Its lightweight design, ease of installation, and minimal maintenance needs help lower labor costs and total lifecycle expenses, attracting industries seeking long-term value

- For instance, multiple industrial plants in Texas and California have replaced rust-prone metal floors with molded fiberglass reinforced plastic (FRP) grating, cutting maintenance costs and operational disruptions significantly

Restraint/Challenge

“High Initial Cost and Limited Awareness Hindering Adoption”

- The high initial cost of molded fiberglass reinforced plastic (FRP) grating compared to steel or aluminum limits adoption, especially for budget-constrained projects or smaller municipalities

- Lack of awareness and technical understanding among contractors and facility managers hampers confidence in the long-term benefits of fiberglass reinforced plastic (FRP) grating

- Many buyers default to traditional materials due to familiarity and misconceptions about the strength and durability of composite alternatives

- Customization needs and varying local standards further raise costs and extend lead times, making fiberglass reinforced plastic (FRP) less appealing in regions with strict codes

- For instance, several facilities in rural parts of the U.S. have opted for steel over fiberglass reinforced plastic (FRP) grating due to limited technical guidance and upfront budget limitations

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Scope

The market is segmented on the basis of type, product type, grating height, technology, application, and end-user.

- By Type

On the basis of type, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into polyester, vinyl ester, phenolic, epoxy, polyurethanes, and others. The polyester segment dominated the market with the largest market revenue share in 2024 due to its excellent balance of mechanical strength, corrosion resistance, and affordability. Widely used in industrial and commercial settings, polyester-based molded fiberglass reinforced plastic (FRP) gratings offer durability and resistance against moisture, making them ideal for both indoor and outdoor use. Their chemical compatibility with diverse substances also drives their demand in sectors such as water management and construction.

The vinyl ester segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior chemical and thermal resistance. This material type is increasingly preferred in harsh environments such as chemical processing plants and marine applications. Its enhanced durability and long service life make vinyl ester a valuable choice for industries prioritizing high-performance composites.

- By Product Type

On the basis of product type, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into angles, square, flat strip, I beams, U channel, round tube, wide flange beams, trench covers, solid rods, fluted tubes/ladder rung, kick plate/toe plate, and others. The I beams segment held the largest revenue share in 2024, driven by their structural strength and frequent application in heavy-load support scenarios such as platforms and walkways. Their lightweight yet high load-bearing capacity makes I beams a preferred product in industrial flooring and framing systems.

The trench covers segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing investments in infrastructure and safety upgrades. These covers are valued for their anti-slip surfaces, corrosion resistance, and easy installation, making them ideal for use in drainage and utility channels in public and private facilities.

- By Grating Height

On the basis of grating height, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into 10–30 mm, 31–50 mm, and above 50 mm. The 31–50 mm segment dominated the market in 2024 due to its optimal balance between load capacity and weight. It is widely adopted across industrial walkways and maintenance platforms, offering strength while ensuring ease of installation.

The above 50 mm segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing deployment in heavy-duty applications such as chemical plants, docks, and marine platforms, where enhanced strength and durability are critical.

- By Technology

On the basis of technology, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into compression molding, cold press molding, vacuum molding, foam molding, and others. Compression molding accounted for the largest revenue share in 2024 due to its ability to produce high-strength gratings with uniform quality at large volumes. This process is extensively used across sectors such as oil & gas, construction, and marine due to its efficiency and cost-effectiveness.

Vacuum molding is expected to witness the fastest growth rate from 2025 to 2032, supported by its capability to produce precise and lightweight components. Its usage is increasing in high-performance industries such as aerospace and electronics, where dimensional accuracy and advanced material performance are essential.

- By Application

On the basis of application, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into stair treads, walkways, platforms, docks, handrails, walls, and others. The walkways segment held the largest share in 2024, driven by the widespread use of molded fiberglass reinforced plastic (FRP) gratings in industrial plants and wastewater facilities, where slip resistance and corrosion durability are essential.

Platforms is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing use in elevated workspaces in sectors such as petrochemicals and construction. Their strength-to-weight ratio and ease of maintenance make molded fiberglass reinforced plastic (FRP) gratings ideal for platform applications.

- By End-User

On the basis of end-user, the North America molded fiberglass reinforced plastic (FRP) grating market is segmented into petrochemicals, pulp & paper, building & construction, food & beverages, mining, pharmaceutical, oil & gas, electrical & electronics, water management, marine, defense, sports & leisure, and others. The building & construction segment led the market in 2024 due to rising demand for durable, lightweight, and non-corrosive grating solutions in commercial and industrial projects.

The oil & gas segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing investments in offshore and onshore exploration. The resistance of molded fiberglass reinforced plastic (FRP) gratings to harsh chemicals, moisture, and UV exposure makes them a reliable choice in extreme environments.

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Regional Analysis

- The U.S. molded fiberglass reinforced plastic (FRP) grating market captured the largest revenue share of over 80% within North America in 2024, fueled by robust investments in water treatment facilities, chemical plants, and manufacturing units

- The U.S. market benefits from strong regulatory compliance with OSHA and ANSI standards, which encourages the use of non-slip, fire-retardant grating materials

- Furthermore, industries are increasingly focusing on improving workplace safety and operational efficiency, which drives the adoption of molded fiberglass reinforced plastic (FRP) grating

- The integration of fiberglass reinforced plastic (FRP) gratings in retrofitting and modernization projects in commercial infrastructure also contributes significantly to market growth

Canada Molded Fiberglass Reinforced Plastic (FRP) Grating Market Insight

The Canada molded fiberglass reinforced plastic (FRP) grating market is projected to experience steady growth through 2032, supported by increasing infrastructure upgrades and a strong focus on sustainability. The country’s industrial and municipal sectors are adopting Fiberglass Reinforced Plastic (FRP) gratings for applications in water treatment plants, marine structures, and public utilities due to their durability and resistance to corrosion and chemicals. Government regulations emphasizing worker safety and environmental compliance are also contributing to the rising demand. Moreover, Canada's cold climate necessitates the use of non-slip, weather-resistant materials, making molded fiberglass reinforced plastic (FRP) grating a preferred choice across critical sectors.

North America Molded Fiberglass Reinforced Plastic (FRP) Grating Market Share

The North America molded fiberglass reinforced plastic (FRP) Grating industry is primarily led by well-established companies, including:

- Fibergrate (U.S.)

- Gebrüder MEISER GmbH (Germany)

- Fibrolux GmbH (Germany)

- McNICHOLS CO., INC. (U.S.)

- STRONGWELL CORPORATION (U.S.)

- Bedford Reinforced Plastics (U.S.)

- AIMS INTERNATIONAL (U.S.)

- American Grating (U.S.)

- Peabody Engineering & Supply, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Molded Frp Grating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Molded Frp Grating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Molded Frp Grating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.