North America Molecular Diagnostics Services Market

Market Size in USD Million

CAGR :

%

USD

66.14 Million

USD

122.42 Million

2024

2032

USD

66.14 Million

USD

122.42 Million

2024

2032

| 2025 –2032 | |

| USD 66.14 Million | |

| USD 122.42 Million | |

|

|

|

|

North America Molecular Diagnostics Services Market Size

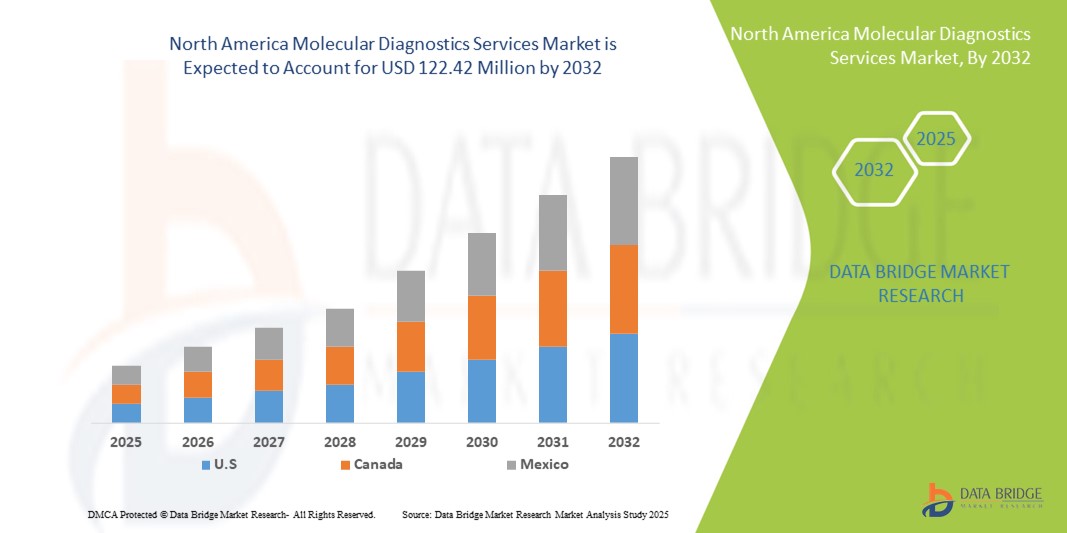

- The North America molecular diagnostics services market size was valued at USD 66.14 million in 2024 and is expected to reach USD 122.42 million by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of molecular diagnostics services in hospitals, diagnostic centers, and research institutions, driven by the need for rapid, accurate, and personalized testing across infectious diseases, oncology, and genetic disorders. Advancements in technologies such as PCR, real-time PCR, next-generation sequencing (NGS), and other molecular assays are further enhancing service capabilities, enabling faster results, improved patient outcomes, and greater clinical utility

- Furthermore, rising demand for early disease detection, precision medicine, and high-throughput diagnostic solutions is establishing molecular diagnostics services as a critical component of modern healthcare infrastructure. These converging factors are accelerating the adoption of advanced molecular diagnostics services, thereby significantly propelling the growth of the market

North America Molecular Diagnostics Services Market Analysis

- Molecular diagnostics services, providing advanced tools for disease detection, genetic testing, and personalized medicine, are increasingly vital in both hospital and clinical laboratory settings due to their accuracy, faster turnaround times, and ability to guide targeted treatment strategies

- The escalating demand for molecular diagnostics services is primarily fueled by the rising prevalence of infectious diseases and cancer, growing emphasis on early disease detection, and the expanding adoption of precision medicine approaches across healthcare systems

- U.S. dominated the North America molecular diagnostics services market with the largest revenue share of 88.7% in 2024, supported by its advanced healthcare infrastructure, high diagnostic testing volumes, and the presence of major service providers. Growth is further driven by the widespread adoption of molecular testing in oncology, infectious diseases, and genetic screening, alongside continuous innovations from both established diagnostic companies and emerging biotech firms

- Canada is expected to be the fastest-growing country in the North America molecular diagnostics services market during the forecast period, projected to expand at a CAGR of 11.5% from 2025 to 2032. This growth is attributed to increasing investment in healthcare infrastructure, rising adoption of molecular testing for cancer and infectious diseases, and government initiatives supporting early disease detection

- The PCR segment dominated the North America molecular diagnostics services market with the revenue share of 41.7% in 2024, owing to its unmatched reliability, speed, and cost-effectiveness as a diagnostic technique. PCR has become the foundation of molecular testing across diverse applications, including infectious disease diagnosis, oncology testing, genetic screening, and forensic analysis

Report Scope and Molecular Diagnostics Services Market Segmentation

|

Attributes |

Molecular Diagnostics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Molecular Diagnostics Services Market Trends

Enhanced Diagnostic Accuracy Through AI and Data Integration

- A significant and accelerating trend in the North America molecular diagnostics services market is the deepening integration of artificial intelligence (AI), machine learning, and advanced bioinformatics with existing molecular testing workflows. This fusion of technologies is improving analytical sensitivity and specificity across a wide range of assays—from PCR and next-generation sequencing to digital PCR and multiplex panels—enabling laboratories to extract more clinically meaningful information from the same data

- For instance, AI-driven algorithms are increasingly used to automate complex NGS pipelines—performing tasks such as read alignment, variant calling, and annotation—thereby reducing hands-on time, minimizing human error, and accelerating the movement of results from raw data to clinically actionable reports. These automated pipelines also help standardize interpretation across labs and support reproducible decision making in oncology, rare disease testing, and infectious disease surveillance

- AI integration enables advanced capabilities such as automated image analysis for digital pathology, predictive models for disease progression and treatment response, and intelligent flagging of atypical results that require specialist review. Machine learning models can prioritize variants of clinical significance, suggest likely functional impacts, and help triage cases that need confirmatory testing, improving both diagnostic throughput and clinical relevance

- The seamless linking of molecular diagnostics platforms with laboratory information management systems (LIMS), electronic health records (EHRs), and secure cloud infrastructures is facilitating real-time result delivery, remote specialist consultation, and longitudinal patient monitoring. Centralized dashboards and interoperable data pipelines allow clinicians and public-health teams to visualize trends, track outbreaks, and integrate molecular findings into care pathways more efficiently

- This move toward more intelligent, automated, and interconnected diagnostics workflows is reshaping expectations for clinical laboratories and healthcare providers. Service providers are developing end-to-end solutions that combine sample tracking, automated wet-lab instrumentation, AI-assisted analysis, and clinician-facing reports—resulting in faster turnaround times, higher throughput, and improved cost-effectiveness for routine and complex molecular tests

- Demand for molecular diagnostics services that deliver integrated AI and data-driven insights is growing rapidly across hospitals, reference laboratories, and public-health agencies. Stakeholders increasingly prioritize actionable, timely results that support personalized treatment decisions, antimicrobial stewardship, and rapid response to emerging infectious threats, making AI-enabled molecular services a strategic priority for many labs and health systems

North America Molecular Diagnostics Services Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Advancements in Precision Medicine

- The rising North America prevalence of chronic and infectious diseases, coupled with the growing focus on early detection and prevention, is significantly driving demand for molecular diagnostics services

- For instance, in March 2024, QIAGEN announced the expansion of its next-generation sequencing (NGS)-based testing portfolio to support precision medicine initiatives, enabling faster and more accurate disease diagnosis. Such strategies by leading companies are expected to accelerate the growth of the Molecular Diagnostics Services industry during the forecast period

- As healthcare systems increasingly prioritize accurate and timely disease identification, molecular diagnostics services offer advanced solutions such as real-time PCR, next-generation sequencing, and biomarker-based testing, which deliver higher sensitivity and specificity compared to traditional diagnostic approaches

- Furthermore, the integration of molecular diagnostics with digital health platforms and clinical decision-support systems is enhancing their utility across hospitals, diagnostic centers, and research institutions, making these services an essential component of modern healthcare delivery

- The rising adoption of personalized medicine, coupled with the increasing availability of user-friendly and scalable molecular diagnostic solutions, further contributes to market expansion, particularly in oncology, infectious disease management, and genetic disorder screening

Restraint/Challenge

Concerns Regarding High Service Costs and Data Privacy Issues

- The relatively high costs associated with advanced molecular diagnostic services, including NGS and specialized biomarker testing, remain a significant barrier to widespread adoption, particularly in low- and middle-income regions where affordability is limited

- For instance, the expenses related to equipment calibration, maintenance, and compliance services can increase the overall cost burden on diagnostic centers and patients, restricting broader utilization

- Addressing these challenges through the development of cost-effective testing solutions, innovative pricing models, and government-funded reimbursement programs will be critical to fostering market penetration. In addition, concerns surrounding patient data privacy and the handling of sensitive genomic information pose challenges, as molecular diagnostic services often rely on cloud-based platforms and integrated data systems

- Reports of data security vulnerabilities in healthcare IT systems have made some institutions cautious about fully adopting molecular diagnostics, despite their benefits

- Ensuring robust data encryption, secure compliance with regulations such as GDPR and HIPAA, and ongoing consumer education around privacy safeguards are vital steps in building trust. Moreover, the development of more affordable and accessible molecular diagnostic service offerings will be essential for sustained global market growth

North America Molecular Diagnostics Services Market Scope

The market is segmented on the basis of service type, technology, and end user.

- By Service Type

On the basis of service type, the molecular diagnostics services market is segmented into instrument repair services, training services, compliance services, calibration services, maintenance services, scalable automation services, turnkey services, instrument relocation services, hardware customization, performance assurance services, design and development services, supply chain solutions, new product introduction services, manufacturing services, environmental & regulatory services, medical management systems certification & auditing, clinical research services, consultative services, and other services. The clinical research services segment dominated the largest market revenue share of 28.4% in 2024, largely due to the increasing reliance on molecular diagnostics to support advanced drug development, biomarker discovery, and validation processes. Clinical research services play a critical role in accelerating the development of precision medicine by ensuring reliable data generation and compliance with global regulatory frameworks. The rising prevalence of cancer, infectious diseases, and rare genetic disorders has significantly increased the demand for clinical research partnerships between pharmaceutical companies and molecular diagnostic service providers. In addition, advancements in companion diagnostics and the growing adoption of real-world evidence in clinical trials are further fueling the demand for such services, making this segment the backbone of the industry.

The scalable automation services segment is anticipated to witness the fastest growth rate of 21.6% from 2025 to 2032, driven by the urgent need for high-throughput diagnostic solutions that can handle large test volumes with precision and efficiency. As laboratories worldwide face rising workloads, automation services help streamline workflows, reduce manual intervention, and minimize human error, while also ensuring faster turnaround times. Integration of robotics, AI-based platforms, and automated liquid handling systems into diagnostic pipelines is enabling laboratories to transition toward fully digitized environments. Furthermore, the COVID-19 pandemic highlighted the importance of rapid, scalable diagnostic capabilities, accelerating the adoption of automated services in both public health and clinical applications. With healthcare systems increasingly investing in laboratory modernization, scalable automation services are positioned as a cornerstone for future-ready diagnostics.

- By Technology

On the basis of technology, the molecular diagnostics services market is segmented into PCR, real-time PCR, next-generation sequencing (NGS), and other technologies. The PCR segment held the largest revenue share of 41.7% in 2024, owing to its unmatched reliability, speed, and cost-effectiveness as a diagnostic technique. PCR has become the foundation of molecular testing across diverse applications, including infectious disease diagnosis, oncology testing, genetic screening, and forensic analysis. Its widespread adoption is further supported by the availability of standardized workflows, well-established infrastructure, and regulatory approvals across global healthcare systems. PCR remains the preferred choice for routine molecular diagnostics because of its ease of use and adaptability to different testing environments. In addition, ongoing innovations such as digital PCR and multiplex PCR have expanded its sensitivity and throughput capabilities, reinforcing its dominant position in the market.

The next-generation sequencing (NGS) segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, as the technology is revolutionizing the landscape of precision medicine and advanced diagnostics. NGS provides comprehensive genomic profiling, enabling clinicians to identify rare mutations, detect complex genetic variations, and design highly targeted treatment strategies. Its application in oncology, particularly in liquid biopsy and tumor profiling, has transformed cancer diagnostics by offering actionable insights for personalized therapies. Beyond oncology, NGS is gaining momentum in infectious disease surveillance, rare disease diagnosis, and reproductive health, creating vast opportunities for service providers. Declining sequencing costs, coupled with continuous improvements in bioinformatics tools and cloud-based data analysis platforms, are making NGS more accessible to clinical laboratories worldwide, solidifying its position as the fastest-growing technology in this market.

- By End User

On the basis of end user, the molecular diagnostics services market is segmented into hospitals, diagnostic centers, academic & research institutions, and others. The hospitals segment accounted for the largest revenue share of 46.2% in 2024, supported by their critical role in integrating molecular diagnostics into patient care pathways. Hospitals serve as the primary hubs for advanced diagnostic testing, enabling rapid disease identification, treatment monitoring, and management of complex conditions. The adoption of molecular diagnostics within hospitals is driven by the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and infectious outbreaks, which demand accurate and timely results. Hospitals also benefit from strong reimbursement frameworks and the availability of skilled professionals, ensuring a high standard of service delivery. With investments in in-house molecular labs and collaborations with diagnostic service providers, hospitals continue to dominate the end-user landscape.

The diagnostic centers segment is projected to record the fastest growth rate of 20.1% from 2025 to 2032, owing to the increasing demand for cost-effective, convenient, and accessible testing solutions. Diagnostic centers provide patients with an affordable alternative to hospitals while offering quick turnaround times for test results. Their popularity is rising particularly in urban and semi-urban regions, where growing middle-class populations are increasingly proactive about preventive health screenings. Partnerships between diagnostic chains and molecular diagnostic service providers are expanding their reach, enabling advanced testing even in resource-limited settings. Furthermore, the rise of home sample collection, point-of-care molecular tests, and digital reporting services is making diagnostic centers an attractive choice for consumers, supporting their rapid growth trajectory.

North America Molecular Diagnostics Services Market Regional Analysis

- North America dominated the molecular diagnostics services market with the largest revenue share in 2024, supported by strong healthcare infrastructure, high diagnostic testing volumes, and the presence of leading service providers

- The region benefits from advanced laboratory networks, well-established clinical research facilities, and the increasing integration of molecular testing into routine clinical workflows. Rapid adoption of molecular diagnostics in oncology, infectious disease testing, and genetic screening is further boosting demand

- Moreover, strategic collaborations between hospitals, diagnostic service providers, and pharmaceutical companies are strengthening North America’s market leadership

U.S. Molecular Diagnostics Services Market Insight

The U.S. molecular diagnostics services market captured the largest revenue share of 88.7% within North America in 2024, driven by widespread adoption of molecular testing across oncology, infectious disease, and genetic screening applications. Continuous innovations from both established diagnostic companies and emerging players, including automation of workflows, advanced bioinformatics solutions, and high-throughput testing capabilities, are accelerating market growth. In addition, the increasing emphasis on personalized medicine and precision therapeutics is expanding the use of molecular diagnostics in clinical decision-making, further solidifying the U.S. as the dominant market within the region.

Canada Molecular Diagnostics Services Market Insight

The Canada molecular diagnostics services market is expected to be the fastest-growing in North America during the forecast period, projected to expand at a CAGR of 11.5% from 2025 to 2032. This growth is fueled by increasing investments in healthcare infrastructure, particularly in advanced diagnostic laboratories and cancer centers, which are adopting molecular testing for oncology, infectious diseases, and genetic disorders. Government initiatives supporting early disease detection and nationwide cancer screening programs are further accelerating the uptake of molecular diagnostics. In addition, the growing focus on personalized medicine and precision healthcare in Canada is driving demand for high-throughput testing, next-generation sequencing, and biomarker-driven diagnostics. The combined effect of rising healthcare expenditure, supportive policies, and rapid adoption of cutting-edge molecular technologies positions Canada as the fastest-expanding market in the region.

North America Molecular Diagnostics Services Market Share

The molecular diagnostics services industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Danaher Corporation (U.S.)

- BIOMERIEUX (France)

- QIAGEN (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- DiaSorin S.p.A. (Italy)

- Hologic, Inc. (U.S.)

- LabCorp (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- NeoGenomics Laboratories (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Guardant Health, Inc. (U.S.)

- Fulgent Genetics (U.S.)

Latest Developments in North America Molecular Diagnostics Services Market

- In In December 2022, LumiraDx, a UK-based point-of-care diagnostics company, was awarded USD14.2 million in grants from the Bill & Melinda Gates Foundation. The funding supports the ongoing development of a point-of-care molecular tuberculosis (TB) testing system aimed at improving TB diagnosis in resource-limited settings. This initiative aligns with the foundation's goal to enhance North America health through innovative diagnostics solutions

- In March 2024, Cepheid announced that it had received clearance from the U.S. Food and Drug Administration (FDA) for its Xpert Xpress GBS, a dual-target molecular diagnostic test for the qualitative intrapartum detection of Group B Streptococcus (GBS). The test is designed for use on Cepheid's GeneXpert systems and incorporates new dual targets in highly-conserved regions of the GBS genome to improve sensitivity and bacterial strain coverage

- In March 2024, bioMérieux announced that its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel received U.S. Food and Drug Administration (FDA) Special 510(k) clearance and Clinical Laboratory Improvement Amendments (CLIA) waiver approval. The panel is designed for use on the BIOFIRE SPOTFIRE System and allows for rapid detection of respiratory and sore throat pathogens, facilitating more informed clinical decision-making

- In August 2024, Grail Inc., a company specializing in early cancer detection, announced a reduction of approximately 350 jobs, representing about 30% of its workforce. The restructuring is part of a strategic shift to focus resources on the development of its flagship cancer detection test, Galleri, which is designed to detect multiple types of cancer through a single blood draw

- In April 2025, Revvity, the company formerly known as PerkinElmer's life sciences and diagnostics division, announced a significant increase in research and development (R&D) spending. This move follows the company's split and rebranding in March 2023, aiming to strengthen its focus on life sciences and diagnostics sectors. Revvity plans to enhance its product offerings, including investments in software and research, to drive innovation in the molecular diagnostics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.