North America Mycotoxin Testing Market

Market Size in USD Million

CAGR :

%

USD

7.46 Million

USD

14.02 Million

2024

2032

USD

7.46 Million

USD

14.02 Million

2024

2032

| 2025 –2032 | |

| USD 7.46 Million | |

| USD 14.02 Million | |

|

|

|

|

Mycotoxin Testing Market Size

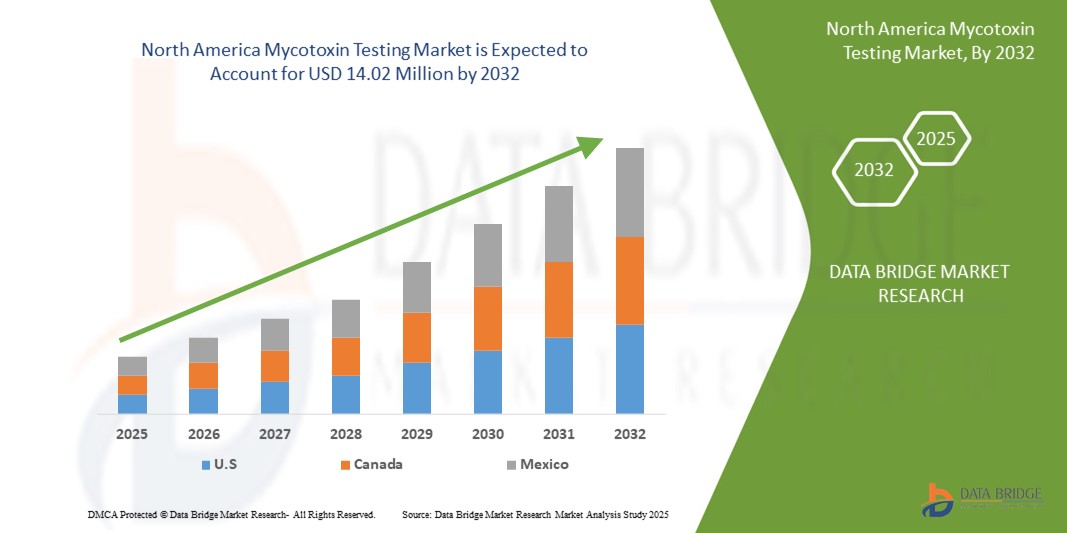

- The North America mycotoxin testing market size was valued at USD 7.46 million in 2024 and is expected to reach USD 14.02 million by 2032, at a CAGR of 8.2% during the forecast period

- The market growth is primarily driven by increasing regulatory requirements for food and feed safety, growing consumer awareness of mycotoxin-related health risks, and advancements in testing technologies

- The rising demand for accurate, rapid, and cost-effective testing solutions in food, feed, and pharmaceutical industries is establishing mycotoxin testing as a critical component of quality control, significantly boosting market expansion

Mycotoxin Testing Market Analysis

- Mycotoxin testing, essential for detecting and quantifying harmful fungal toxins in food, feed, and pharmaceuticals, is increasingly vital due to its role in ensuring safety, compliance with stringent regulations, and protecting public health

- The demand for mycotoxin testing is fueled by heightened concerns over food safety, the expansion of the food and beverage industry, and the need for reliable testing methods to mitigate risks associated with mycotoxin contamination

- The U.S. dominated the North America mycotoxin testing market with the largest revenue share of 65.3% in 2024, driven by robust regulatory frameworks, high adoption of advanced testing technologies, and a strong presence of key market players. The country sees significant demand in food and feed testing, particularly in grain and dairy industries, supported by innovations in chromatography and immunoassay-based technologies

- Canada is expected to be the fastest-growing country in the North America mycotoxin testing market during the forecast period, attributed to increasing agricultural exports, rising awareness of food safety standards, and investments in testing infrastructure

- The aflatoxins segment dominated the largest market revenue share of 30.2% in 2024, driven by their high toxicity, carcinogenic properties, and frequent occurrence in food and feed products such as grains, nuts, and spices

Report Scope and Mycotoxin Testing Market Segmentation

|

Attributes |

Mycotoxin Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mycotoxin Testing Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The North America mycotoxin testing market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing and analysis, offering deeper insights into contamination patterns, toxin prevalence, and testing efficiency

- AI-powered testing solutions enable proactive identification of potential mycotoxin contamination, reducing risks to food and feed safety before they escalate

- For instances, companies are developing AI-driven platforms that analyze environmental conditions and sample data to predict mycotoxin risks or optimize testing protocols for specific commodities

- This trend enhances the value of mycotoxin testing systems, making them more appealing to food and feed industries as well as regulatory bodies

- AI algorithms can evaluate vast datasets, including toxin types, sample sources, and environmental factors, to improve detection accuracy and streamline testing processes

Mycotoxin Testing Market Dynamics

Driver

“Rising Demand for Food Safety and Regulatory Compliance”

- Growing consumer awareness of food safety and the health risks posed by mycotoxins, such as aflatoxins and deoxynivalenol, is a key driver for the North America mycotoxin testing market

- Mycotoxin testing enhances safety by enabling early detection and mitigation of contamination in food, feed, and pharmaceuticals

- Stringent government regulations, particularly in the U.S. with oversight from the FDA and USDA, mandate rigorous testing to ensure compliance with maximum allowable mycotoxin limits

- The adoption of IoT and advancements in high-speed data transmission technologies, such as 5G, are expanding testing capabilities, enabling real-time monitoring and more efficient data management

- Testing service providers are increasingly offering integrated solutions to meet industry demands and ensure compliance with evolving safety standards

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The significant initial investment required for advanced testing equipment, reagents, and integration of AI-driven systems can be a barrier to adoption, particularly for smaller laboratories and businesses in emerging markets

- Incorporating advanced testing technologies into existing workflows can be complex and expensive

- Data security and privacy concerns are a major challenge, as mycotoxin testing systems collect and transmit sensitive data related to food and feed safety, raising risks of breaches or misuse

- The varied regulatory landscape across North America, particularly differing data protection laws between the U.S. and Canada, complicates compliance for testing providers operating regionally

- These factors may deter adoption and limit market growth, especially in cost-sensitive sectors or regions with heightened data privacy awareness

Mycotoxin Testing market Scope

The market is segmented on the basis of type, product type, technology, sample, and end user.

- By Type

On the basis of type, the North America mycotoxin testing market is segmented into aflatoxins, ochratoxins, fusarium toxins, deoxynivalenol, patulin, penicillium toxins, cyclopiazonic acid, ergot alkaloids, citrinin, sterigmatocystin, alternaria, t-2 toxin, zearalenone, and others. The aflatoxins segment dominated the largest market revenue share of 30.2% in 2024, driven by their high toxicity, carcinogenic properties, and frequent occurrence in food and feed products such as grains, nuts, and spices. Regulatory stringency and widespread testing for aflatoxins in the U.S. further bolster this segment's dominance.

The deoxynivalenol (DON) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its prevalence in cereals such as wheat, barley, and maize, which are staple crops in North America. Increasing regulatory limits and health concerns related to DON’s immunotoxicity and gastrointestinal effects are fueling demand for testing services.

- By Product Type

On the basis of product type, the North America mycotoxin testing market is segmented into Devices, Reagents & Kits, and Services. The Reagents & Kits segment accounted for the largest market revenue share of 45.8% in 2024, driven by their critical role in enabling accurate and efficient mycotoxin detection across various testing platforms. The widespread use of reagents and kits in laboratories and on-site testing applications supports this segment’s dominance.

The Services segment is anticipated to experience the fastest growth rate from 2025 to 2032. The increasing outsourcing of mycotoxin testing to specialized laboratories, particularly in the U.S., and the rising demand for comprehensive testing solutions in food and feed industries are key growth drivers.

- By Technology

On the basis of technology, the North America mycotoxin testing market is segmented into Chromatography Based, Immunoassay-Based, Lateral Flow Assay Based, Spectroscopy Based, and Others. The Chromatography Based segment, particularly High-Performance Liquid Chromatography (HPLC), held the largest market revenue share of 50.3% in 2024, owing to its high accuracy, sensitivity, and ability to detect multiple mycotoxins simultaneously. Its adoption in food safety testing laboratories across the U.S. reinforces its market leadership.

The Lateral Flow Assay Based segment is expected to witness the fastest growth rate of 9.1% from 2025 to 2032. The demand for rapid, cost-effective, and portable testing solutions, especially for on-site screening in agricultural and food processing settings, is driving this segment’s growth, particularly in Canada.

- By Sample

On the basis of sample, the North America mycotoxin testing market is segmented into Food, Feed, and Pharmaceuticals. The Food segment dominated with a market revenue share of 55.7% in 2024, driven by stringent regulatory requirements for mycotoxin testing in cereals, grains, nuts, and dairy products, which are prone to contamination. The U.S., as the dominating country, enforces rigorous food safety standards, boosting this segment.

The Feed segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing use of telematics for real-time monitoring of animal feed quality. The rising awareness of mycotoxin-related health risks in livestock and the growing feed industry in Canada contribute to this segment’s rapid expansion.

- By End User

On the basis of end user, the North America mycotoxin testing market is segmented into Research Lab, Research Institutes, Food Testing Industries, Feed Testing Industries, and Others. The Food Testing Industries segment held the largest market revenue share of 40.6% in 2024, driven by the need to comply with stringent food safety regulations and consumer demand for safe food products in the U.S. The adoption of advanced testing technologies in food testing laboratories further supports this segment.

The Feed Testing Industries segment is expected to witness the fastest growth rate of 8.9% from 2025 to 2032. The increasing focus on livestock health, coupled with the rising adoption of mycotoxin testing in Canada’s growing feed industry, drives this segment. The need to ensure feed safety for animal health and productivity is a key factor.

Mycotoxin Testing Market Regional Analysis

- The U.S. dominated the North America mycotoxin testing market with the largest revenue share of 65.3% in 2024, driven by robust regulatory frameworks, high adoption of advanced testing technologies, and a strong presence of key market players. The country sees significant demand in food and feed testing, particularly in grain and dairy industries, supported by innovations in chromatography and immunoassay-based technologies

- Canada is expected to be the fastest-growing country in the North America mycotoxin testing market during the forecast period, attributed to increasing agricultural exports, rising awareness of food safety standards, and investments in testing infrastructure

U.S. Mycotoxin Testing Market Insight

The U.S. dominated the North America mycotoxin testing market with the highest revenue share of 76.1% in 2024, fuelled by strong demand from food and feed testing industries and growing consumer awareness of health risks associated with mycotoxin contamination. The trend towards stricter food safety regulations and increasing adoption of advanced testing technologies, such as high-performance liquid chromatography (HPLC), further boost market expansion. The integration of testing services in both regulatory compliance and private sector quality control creates a diverse ecosystem for testing solutions.

Canada Mycotoxin Testing Market Insight

Canada is expected to witness the fastest growth rate in the North America mycotoxin testing market, driven by increasing agricultural production and heightened awareness of mycotoxin-related health risks. The demand for testing in food and feed samples, particularly for aflatoxins and deoxynivalenol, is rising due to Canada’s expanding export market and stringent safety standards. Advancements in rapid testing technologies, such as lateral flow assays, and growing investments in food safety infrastructure support sustained market growth.

Mycotoxin Testing Market Share

The mycotoxin testing industry is primarily led by well-established companies, including:

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- NEOGEN Corporation (U.S.)

- EnviroLogix (U.S.)

- TÜV SÜD (Germany)

- VICAM (U.S.)

- A Waters Business (U.S.)

- SGS SA (Switzerland)

- AB Sciex Pte. Ltd. (U.S.)

- R-Biopharm AG (Germany)

- TLR International Laboratories (Netherlands)

- QIMA (Hong Kong)

- Certified Laboratories (U.S.)

- Romer Labs Division Holding GmbH (Austria)

- OMIC USA Inc. (U.S.)

What are the Recent Developments in North America Mycotoxin Testing Market?

- In March 2025, Alltech released its comprehensive 2024 U.S. Harvest Analysis, highlighting a moderate-to-high overall risk of mycotoxin contamination in key crops such as corn grain and corn silage. The report attributes the elevated risk to early-season rains followed by late-season droughts, which created ideal conditions for the proliferation of type B trichothecenes, zearalenone, and fumonisins—especially in the Midwest. The analysis revealed that over 95% of crop samples contained at least one mycotoxin, with many showing multiple contaminants, posing significant threats to animal health and performance. The findings emphasize the importance of proactive mycotoxin management, including regular testing, region-specific risk assessments, and tailored mitigation strategies to protect livestock and maintain feed quality

- In March 2025, DSM-Firmenich and Selko released their 2024 global mycotoxin analyses, revealing a sharp rise in contamination levels across all six major mycotoxins—aflatoxin (AFLA), zearalenone (ZEA), deoxynivalenol (DON), fumonisins (FUM), T-2 toxin, and ochratoxin A (OCHRA)—compared to 2023. The findings identified North and Central America as regions facing “extreme risk”, with high co-contamination rates and elevated concentrations in feed ingredients such as grains and protein meals. Selko’s review, based on over 86,000 samples from 47 countries, found ZEA to be the most frequently detected mycotoxin globally, while DSM-Firmenich’s survey emphasized the growing threat to animal health, feed safety, and agricultural sustainability. These results underscore the urgent need for advanced testing, risk mitigation strategies, and region-specific monitoring to safeguard livestock and food systems

- In October 2024, BrucePac issued a nationwide recall of approximately 11.8 million pounds of ready-to-eat meat and poultry products due to potential contamination with Listeria monocytogenes. The recall, announced by the U.S. Department of Agriculture’s Food Safety and Inspection Service (FSIS), affected products produced between May 31 and October 8, 2024, and distributed to restaurants, schools, and institutions across the U.S.. Although no confirmed illnesses were reported, the recall underscores the critical importance of robust food safety protocols, especially for pathogens such as Listeria, which can cause serious illness in vulnerable populations. BrucePac halted production and is working with federal authorities to ensure consumer safety and prevent future contamination

- In February 2024, DSM-Firmenich released its annual global mycotoxin prevalence survey for the 2023 calendar year, offering critical insights into contamination trends across feed and raw materials. The survey revealed a notable increase in all six major mycotoxins—including aflatoxin, zearalenone, deoxynivalenol (DON), fumonisins, T-2 toxin, and ochratoxin A—compared to 2022. With over 28,000 samples analyzed from 95 countries, the findings underscore the growing importance of regular testing to safeguard animal health, feed quality, and food safety. This research supports the development of advanced detection tools and risk mitigation strategies tailored to regional and species-specific needs

- In January 2024, Fratelli Beretta USA, Inc. recalled approximately 11,097 pounds of Busseto Foods brand ready-to-eat charcuterie meat products due to potential contamination with Salmonella. The affected products—charcuterie samplers containing prosciutto, sweet sopressata, and dry coppa—were distributed to Sam’s Club locations in multiple U.S. states. The recall was initiated after the Minnesota Department of Agriculture detected the outbreak strain of Salmonella in an unopened product sample. This incident, though unrelated to mycotoxins, highlights the critical importance of comprehensive food safety testing across all potential contaminants. It also reflects the rigorous regulatory oversight in North America aimed at protecting public health and maintaining consumer trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Mycotoxin Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Mycotoxin Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Mycotoxin Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.