North America Needle Biopsy Market

Market Size in USD Million

CAGR :

%

USD

659.07 Million

USD

1,140.90 Million

2025

2033

USD

659.07 Million

USD

1,140.90 Million

2025

2033

| 2026 –2033 | |

| USD 659.07 Million | |

| USD 1,140.90 Million | |

|

|

|

|

North America Needle Biopsy Market Size

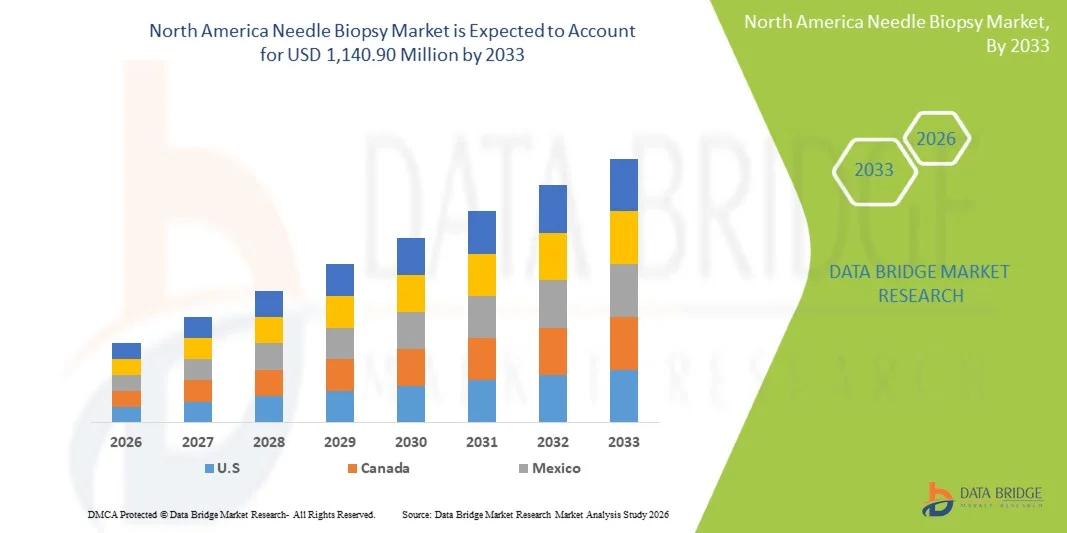

- The North America needle biopsy market size was valued at USD 659.07 million in 2025 and is expected to reach USD 1,140.90 million by 2033, at a CAGR of 7.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cancer, growing adoption of minimally invasive diagnostic procedures, and a strong focus on early disease detection across the region

- Furthermore, rising demand for disposable biopsy tools, which offer improved safety and efficiency over reusable devices, is establishing needle biopsy as the preferred diagnostic method in hospitals and clinics

North America Needle Biopsy Market Analysis

- Needle biopsy procedures, enabling minimally invasive tissue sampling for diagnostic purposes, are increasingly critical in early cancer detection and management across both hospitals and diagnostic centers due to their precision, reduced patient discomfort, and faster recovery compared to surgical biopsies

- The rising demand for needle biopsy is primarily driven by the increasing prevalence of cancer, growing awareness about early detection, and the preference for minimally invasive diagnostic methods over conventional surgical approaches

- The United States dominated the needle biopsy market with the largest revenue share of 65.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of minimally invasive procedures, and a strong presence of key medical device manufacturers, with substantial growth in needle biopsy installations in oncology centers and diagnostic clinics, driven by innovations in imaging-guided and automated biopsy systems

- Canada is expected to be the fastest-growing country in the needle biopsy market during the forecast period due to rising healthcare investments, increasing cancer prevalence, and expanding access to diagnostic facilities

- Core needle biopsy segment dominated the market with a market share of 46.2% in 2025, driven by its established accuracy, cost-effectiveness, and compatibility with imaging guidance for precise tissue sampling

Report Scope and North America Needle Biopsy Market Segmentation

|

Attributes |

North America Needle Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Needle Biopsy Market Trends

“Advancements in Imaging-Guided and Automated Biopsy Systems”

- A significant and accelerating trend in the North America needle biopsy market is the increasing integration of imaging-guided and automated biopsy technologies, enhancing precision, reducing procedural time, and improving patient comfort

- For instance, the OncoNav Core Biopsy System combines real-time imaging with automated needle deployment, allowing radiologists to accurately target lesions with minimal invasiveness. Similarly, the Vacora Automated Biopsy system enables precise tissue sampling under ultrasound guidance

- Integration with advanced imaging modalities such as MRI and CT scanning allows needle biopsy devices to achieve higher diagnostic accuracy, minimizing repeat procedures and improving workflow efficiency. For instance, some Siemens Healthineers imaging-guided biopsy solutions adapt needle trajectory in real-time to optimize tissue sampling

- The seamless combination of automation and imaging guidance facilitates centralized control and monitoring during biopsy procedures, ensuring consistent outcomes across various clinical settings

- This trend towards more precise, automated, and patient-friendly needle biopsy systems is reshaping clinical expectations, with companies such as Hologic and Becton Dickinson developing automated core biopsy devices with integrated imaging compatibility and enhanced safety features

- The demand for needle biopsy devices offering real-time imaging guidance and automation is growing rapidly across both hospitals and specialized diagnostic centers, as clinicians increasingly prioritize accuracy, safety, and workflow efficiency

- In addition, wireless connectivity and cloud-based data integration in modern biopsy systems are enabling remote monitoring, procedural data tracking, and seamless integration with hospital information systems, improving clinical workflow and patient management

North America Needle Biopsy Market Dynamics

Driver

“Increasing Prevalence of Cancer and Focus on Early Diagnosis”

- The rising prevalence of cancer, along with growing emphasis on early detection and minimally invasive procedures, is a significant driver for heightened adoption of needle biopsy systems

- For instance, in March 2025, Hologic introduced a new automated breast biopsy device integrated with advanced imaging guidance, aimed at improving early cancer detection in outpatient settings. Such innovations by key players are expected to accelerate market growth during the forecast period

- As healthcare providers prioritize timely diagnosis, needle biopsy devices provide high accuracy, rapid results, and reduced patient discomfort, offering a compelling alternative to surgical biopsy procedures

- Furthermore, expanding awareness about the benefits of minimally invasive diagnostics and the increasing availability of advanced biopsy systems are driving adoption in North American hospitals and diagnostic centers

- The preference for outpatient procedures, faster recovery, and improved patient throughput, coupled with growing investments in healthcare infrastructure, further propels the uptake of needle biopsy solutions in clinical settings

- In addition, collaborations between device manufacturers and healthcare providers for training and support are improving clinician adoption rates and procedural success, further driving market growth

Restraint/Challenge

“High Device Cost and Regulatory Compliance Hurdles”

- The relatively high cost of advanced needle biopsy systems and strict regulatory requirements pose significant challenges to market penetration, particularly for smaller clinics and budget-conscious healthcare providers

- For instance, reports indicate that automated MRI-guided biopsy systems can cost significantly more than conventional devices, making adoption slower in resource-limited facilities

- Compliance with FDA and Health Canada regulations for device safety and clinical efficacy adds complexity and time to product launches, potentially slowing market expansion

- While costs are gradually decreasing and financing options are available, the perceived premium for advanced biopsy systems can hinder widespread adoption, especially among smaller diagnostic centers or outpatient clinics

- Overcoming these challenges through cost optimization, streamlined regulatory approvals, and demonstration of clear clinical benefits will be vital for sustained growth of the North America needle biopsy market

- For instance, some smaller clinics delay adoption due to reimbursement uncertainties and long approval processes for new biopsy technologies

- Furthermore, the need for specialized training for clinicians and technicians to operate advanced biopsy systems can limit rapid adoption, highlighting the importance of comprehensive training and support programs

North America Needle Biopsy Market Scope

The market is segmented on the basis of needle type, ergonomics, procedure, sample site, utility, application, end user, and distribution channel.

- By Needle Type

On the basis of needle type, the North America needle biopsy market is segmented into trephine biopsy needles, klima sternal needle, salah needle, aspiration needle, jamshidi needle, and others. The Trephine Biopsy Needles segment dominated the market with the largest revenue share in 2025, driven by their high precision and reliability in obtaining core tissue samples, particularly for bone marrow diagnostics. Trephine needles are widely preferred in hospitals and specialized diagnostic centers due to their standardized design and proven clinical accuracy. They are highly compatible with imaging-guided procedures, making them suitable for complex hematology and oncology applications. Their consistent performance, clinician familiarity, and low complication rates contribute to sustained demand. In addition, rising early cancer detection initiatives support increased adoption of trephine needles in outpatient and inpatient settings. Trephine needles also benefit from support by key medical device manufacturers who continuously innovate on ergonomics and safety features.

The Aspiration Needle segment is expected to witness the fastest growth during forecast period, due to increasing demand for minimally invasive procedures in tumor diagnostics. Aspiration needles are favored for their ability to quickly extract cellular material with minimal patient discomfort. Growing prevalence of fine-needle aspiration (FNA) procedures in oncology and increasing awareness about minimally invasive diagnostics further fuel this segment. Hospitals, diagnostic labs, and ambulatory surgical centers are increasingly adopting aspiration needles for soft tissue biopsies. Technological innovations improving needle flexibility, accuracy, and safety are further driving uptake. Regulatory approvals for new aspiration needle systems also contribute to market expansion.

- By Ergonomics

On the basis of ergonomics, the market is segmented into sharp, blunt, quincke, chiba, franseen, and others. The Franseen segment dominated the market in 2025 due to its superior cutting edge design, which ensures precise tissue collection with minimal trauma. Franseen needles are commonly used in core needle biopsies for liver, breast, and thyroid tissues, where accurate sampling is critical. Hospitals and research organizations prefer Franseen needles because of their high clinical accuracy and low complication rates. The segment benefits from widespread clinician familiarity and established procedural protocols. Compatibility with imaging-guided procedures and automated biopsy systems enhances their adoption. Continuous product improvements and strong manufacturer support also drive the market dominance of Franseen needles.

The Chiba segment is expected to register the fastest growth during forecast period due to its effectiveness in image-guided fine-needle aspiration procedures. Chiba needles are thin and flexible, allowing access to difficult anatomical sites safely. Increasing adoption of ultrasound and CT-guided biopsies in oncology and interventional radiology is driving growth. Clinicians favor Chiba needles for their minimal invasiveness, patient comfort, and reduced risk of complications. Technological advancements enhancing precision and real-time monitoring further boost the segment. Awareness programs and training initiatives are also contributing to increased adoption across North America.

- By Procedure

On the basis of procedure, the market is segmented into fine-needle aspiration biopsy (FNA), core needle biopsy, vacuum-assisted biopsy, and image-guided biopsy. The Core Needle Biopsy segment dominated the market in 2025 with a market share of 46.2% due to its high diagnostic accuracy and ability to obtain larger tissue samples. Hospitals and diagnostic centers prefer core needle biopsies for breast, liver, and prostate lesion evaluations. Core needle systems are widely integrated with imaging modalities, improving procedural success and reducing repeat biopsies. The adoption is driven by strong clinical guidelines recommending core biopsies for specific cancers. Ease of use, reliability, and compatibility with minimally invasive procedures contribute to its dominance. Furthermore, ongoing innovations and automation in core needle systems enhance clinical workflow and patient outcomes.

The Image-Guided Biopsy segment is expected to witness the fastest growth during forecast period due to the rising adoption of minimally invasive procedures integrated with real-time imaging. This segment benefits from advancements in ultrasound, CT, and MRI-guided needle systems, improving targeting accuracy and reducing patient complications. Increasing early cancer detection initiatives and hospital investments in imaging infrastructure are fueling rapid adoption. Clinicians prefer image-guided biopsies for difficult-to-access lesions. Improved procedural safety, reduced tissue trauma, and faster recovery times make this segment highly attractive. In addition, growing use in interventional radiology and oncology centers supports market expansion.

- By Sample Site

On the basis of sample site, the market is segmented into muscles, bones, and other organs. The Bones segment dominated the market in 2025 due to the high prevalence of bone marrow examinations for hematological malignancies. Bone biopsies are critical for diagnosing leukemia, lymphoma, and metastatic cancers. Trephine and Jamshidi needles are widely used for these procedures. Hospitals and oncology centers prioritize bone biopsies for their diagnostic reliability and accuracy. Standardized protocols and high clinician familiarity further strengthen this segment’s dominance. Growth is supported by rising investments in oncology care and hematology research facilities.

The Other Organs segment is expected to witness the fastest growth during forecast period, driven by increasing biopsy procedures in liver, pancreas, kidney, and lung tissues. Rising cancer incidence and demand for minimally invasive tissue sampling support this growth. Image-guided procedures are increasingly used for organ biopsies. Adoption is further driven by patient preference for less invasive techniques and reduced recovery time. Specialized diagnostic centers and academic hospitals are increasingly using these procedures. Technological advancements in needle design and imaging integration support the rapid growth of this segment.

- By Utility

On the basis of utility, the market is segmented into disposable and reusable needles. The Disposable segment dominated in 2025 due to concerns regarding infection control, sterility, and procedural safety in hospitals and diagnostic centers. Disposable needles eliminate cross-contamination risks and reduce sterilization requirements. High patient throughput in oncology and diagnostic facilities further drives adoption. Hospitals prefer disposable needles to comply with safety and hygiene regulations. Clinicians value the convenience and consistency provided by disposable systems. Strong manufacturer focus on single-use needle innovations reinforces market dominance.

The Reusable segment is expected to witness the fastest growth during forecast period in specialized research and academic centers where repeated procedures are performed under controlled environments. Reusable needles offer cost efficiency for long-term applications. Growing emphasis on training programs and procedural standardization in research institutions fuels adoption. Reusable systems are often integrated with automated biopsy platforms. Technological advancements in sterilization and durability support increased usage. Strong clinical guidelines and institutional preference for reusable devices further enhance growth.

- By Application

On the basis of application, the market is segmented into tumor, infection, inflammation, and others. The Tumor segment dominated the market in 2025, driven by increasing prevalence of cancer and demand for early diagnosis through minimally invasive tissue sampling. Hospitals and diagnostic labs extensively use needle biopsy procedures for solid tumors in breast, liver, prostate, and thyroid. Strong clinical guidelines and standardization of procedures further support dominance. Technological innovations in image-guided biopsy systems improve accuracy. High reimbursement coverage for cancer diagnostics enhances adoption. Ongoing R&D and physician preference for minimally invasive tumor sampling reinforce market dominance.

The Infection segment is expected to witness the fastest growth during forecast period due to rising awareness of targeted tissue sampling for infectious diseases. Increasing use of biopsy in diagnosing abscesses, osteomyelitis, and other infections supports rapid uptake. Image-guided techniques reduce complications in infection sampling. Growth is fueled by expanding outpatient and diagnostic lab services. Rising demand for accurate and rapid infectious disease diagnosis contributes to adoption. Technological improvements in needle design enhance procedural safety and accuracy.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centres, biopsy labs, ambulatory surgical centres, academic and research organizations, and others. The Hospitals segment dominated the market in 2025 due to their established infrastructure, availability of advanced imaging systems, and high patient volume. Hospitals perform the majority of biopsy procedures, including core and fine-needle aspirations. Established procurement channels and trained clinical staff support adoption. Integration with diagnostic imaging facilities enhances efficiency. Hospitals often lead adoption of automated and image-guided biopsy systems. Government funding and insurance coverage further reinforce hospital dominance.

The Diagnostic Centres segment is expected to witness the fastest growth during forecast period owing to increasing outsourcing of biopsy procedures and specialized diagnostic services. Diagnostic centers provide focused services for cancer screening, FNA, and image-guided biopsies. They benefit from rising patient awareness and insurance coverage. Lower operational costs compared to hospitals support rapid adoption. Growing partnerships with hospitals and academic centers fuel expansion. Rapid deployment of advanced biopsy technologies in these centers drives growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market in 2025, as hospitals and large diagnostic centers prefer direct procurement from manufacturers for quality assurance, device compatibility, and after-sales support. Bulk purchasing agreements and service contracts make direct tenders favorable for large healthcare institutions. Manufacturers focus on long-term contracts with key hospitals. Strong technical support and training programs reinforce dominance. Direct tender ensures consistent supply and timely delivery of advanced biopsy systems. Regulatory compliance requirements are easier to meet through direct tender agreements.

The Retail Sales segment is expected to witness the fastest growth during forecast period due to increasing adoption of needle biopsy devices in smaller clinics, outpatient centers, and academic institutions. Retail channels provide accessibility, quick delivery, and flexible purchasing options for a diverse range of biopsy tools. Growth is supported by rising awareness of minimally invasive procedures in smaller healthcare facilities. Retail sales are increasingly facilitated by online medical device platforms. Technological innovations in disposable and compact biopsy systems drive adoption. Training and support services offered through retail channels enhance user confidence and accelerate uptake.

North America Needle Biopsy Market Regional Analysis

- The United States dominated the needle biopsy market with the largest revenue share of 65.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of minimally invasive procedures, and a strong presence of key medical device manufacturers, with substantial growth in needle biopsy installations in oncology centers and diagnostic clinics, driven by innovations in imaging-guided and automated biopsy systems

- Healthcare providers in the region highly value the accuracy, safety, and efficiency offered by needle biopsy systems, particularly core needle and image-guided biopsy procedures, which enable early detection and improved patient outcomes

- This widespread adoption is further supported by high investments in healthcare infrastructure, a technologically advanced clinical workforce, and the growing preference for minimally invasive diagnostics, establishing needle biopsy procedures as a preferred solution for both hospitals and diagnostic centers

The U.S. Needle Biopsy Market Insight

The U.S. needle biopsy market captured the largest revenue share of 65.5% in 2025 within North America, fueled by the increasing prevalence of cancer and the rapid adoption of minimally invasive diagnostic procedures. Hospitals, diagnostic centers, and oncology clinics are prioritizing early detection, driving strong demand for core needle, aspiration, and image-guided biopsy systems. The growing preference for outpatient procedures, combined with technological advancements such as automated and imaging-integrated needles, further propels the market. Moreover, robust investments in healthcare infrastructure and R&D initiatives by key medical device manufacturers are significantly contributing to market expansion. Clinician familiarity and training programs also support widespread adoption.

Canada Needle Biopsy Market Insight

The Canada needle biopsy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and increased healthcare spending. The growing demand for minimally invasive tissue sampling, particularly in hospitals and specialized diagnostic centers, fosters adoption of both core and fine-needle biopsy procedures. Canadian healthcare providers are also emphasizing accuracy, patient comfort, and reduced recovery times, increasing reliance on advanced needle biopsy systems. The presence of advanced imaging infrastructure and government initiatives supporting early cancer detection further stimulate growth. Growing awareness and education about minimally invasive diagnostics are encouraging adoption across clinical settings.

Mexico Needle Biopsy Market Insight

The Mexico needle biopsy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on cancer diagnostics and modernization of healthcare facilities. The country is witnessing rising adoption of image-guided and automated biopsy systems in oncology centers and hospitals. Expansion of private healthcare infrastructure and government-supported cancer screening programs are accelerating market growth. Increasing affordability of needle biopsy devices and improved training of clinicians also support adoption. In addition, rising patient awareness about early diagnosis and minimally invasive procedures is boosting demand. The market is further strengthened by partnerships between domestic distributors and international medical device manufacturers.

North America Needle Biopsy Market Share

The North America Needle Biopsy industry is primarily led by well-established companies, including:

- BD (U.S.)

- Hologic, Inc. (U.S.)

- Argon Medical Devices, (U.S.)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Cardinal Health (U.S.)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- B. Braun SE (Germany)

- Stryker (U.S.)

- Danaher (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Terumo Corporation (Japan)

- INRAD, Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- IZI Medical Products (U.S.)

- PAJUNK (Germany)

- Remington Medical Equipment. (U.S.)

- Devicor Medical Products, Inc. (U.S.)

What are the Recent Developments in North America Needle Biopsy Market?

- In November 2024, Mammotome introduced the AutoCore™ Single Insertion Core Biopsy System, the first automated, spring loaded core needle device cleared by the U.S. FDA. This system greatly simplifies ultrasound guided breast biopsies by allowing sampling with just a single insertion, improving efficiency

- In May 2024, Cook Medical launched the EchoTip ClearCore™ EUS Biopsy Needle in the U.S. This 22-gauge needle is designed for endoscopic ultrasound guided fine needle biopsy (FNB) of submucosal lesions, mediastinal masses, lymph nodes, and GI tract adjacent tissues

- In February 2024, BiBB Instruments announced the first U.S. clinical cases performed using EndoDrill® GI at UC Davis Health. Led by Dr. Antonio Mendoza Ladd, the team successfully used the EndoDrill GI to sample upper-GI tract tissue in several patients, demonstrating the device’s clinical usability

- In March 2023, BiBB Instruments received FDA 510(k) clearance for its EndoDrill® GI biopsy instrument. EndoDrill® GI is an electric-driven rotating core biopsy instrument designed for EUS enabling higher-precision tissue sampling

- In September 2022, Merit Medical commercially launched the TEMNO™ Elite Soft Tissue Biopsy System in the U.S. This single use biopsy device is indicated for use in various soft tissue locations such as liver, lung, lymph nodes, and kidney, expanding the range of biopsy applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.