North America Network Packet Broker Market

Market Size in USD Million

CAGR :

%

USD

284.99 Million

USD

396.06 Million

2024

2032

USD

284.99 Million

USD

396.06 Million

2024

2032

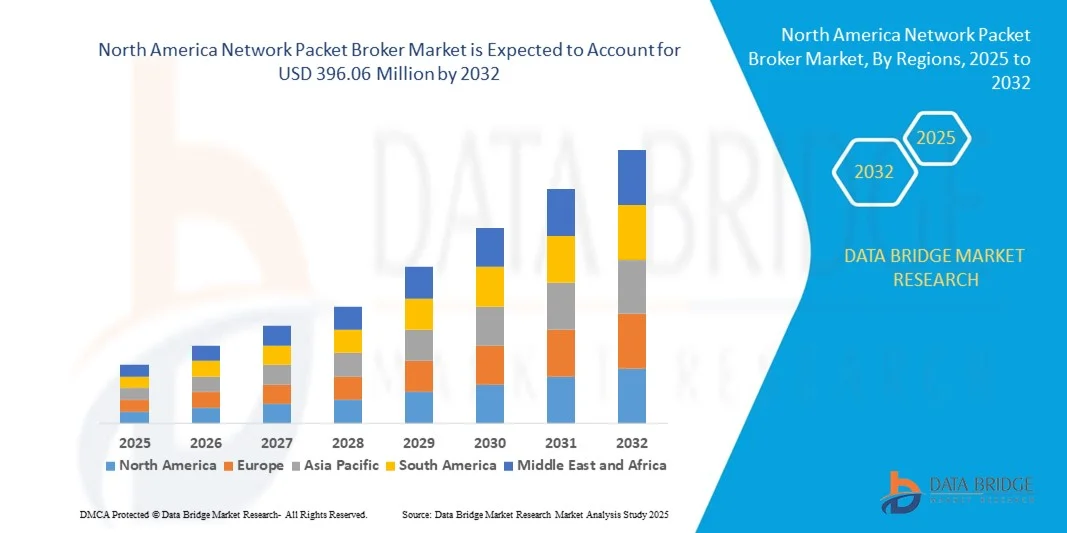

| 2025 –2032 | |

| USD 284.99 Million | |

| USD 396.06 Million | |

|

|

|

|

North America Network Packet Broker Market Size

- The North America network packet broker market size was valued at USD 284.99 million in 2024 and is expected to reach USD 396.06 million by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for network visibility, rising adoption of cloud services, growing cyber threats, and the need for efficient data traffic management across enterprises and service providers

- The adoption of packet brokers is also supported by the expansion of cloud computing, virtualization, and heightened concerns around cybersecurity and compliance requirements

North America Network Packet Broker Market Analysis

- Increasing network complexity across hybrid and multi-cloud environments is driving demand for network packet brokers

- Rising cybersecurity threats and strict compliance requirements are boosting the adoption of packet brokers for enhanced monitoring and threat detection

- U.S. dominated the North America network packet broker market with the largest revenue share in 2024, driven by early adoption of advanced network monitoring solutions, high enterprise IT spending, and increasing focus on cybersecurity and compliance

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America network packet broker market due to increasing digitalization, growing demand for network monitoring and security solutions, and expansion of cloud-based services across enterprises

- The 1 Gbps and 10 Gbps segment held the largest market revenue share in 2024, driven by the growing deployment of enterprise and SME networks requiring efficient traffic monitoring at moderate data rates. These packet brokers provide reliable performance for typical corporate and data center environments, enabling real-time analytics and traffic optimization

Report Scope and North America Network Packet Broker Market Segmentation

|

Attributes |

North America Network Packet Broker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Network Packet Broker Market Trends

Rise of Cloud-Integrated and AI-Driven Packet Brokers

- The increasing integration of AI and cloud-based capabilities in network packet brokers is transforming the North America market by enabling intelligent traffic management and real-time analytics. These advancements allow organizations to detect anomalies quickly, optimize network performance, and reduce downtime. This is particularly critical for large enterprises and service providers managing complex, multi-site networks

- The growing adoption of hybrid IT environments and remote network monitoring is accelerating the deployment of cloud-integrated packet brokers. These solutions are highly effective for organizations requiring centralized visibility over distributed networks, ensuring proactive threat detection and efficient traffic routing. Government and corporate initiatives promoting digital infrastructure development are further supporting this trend

- The affordability, scalability, and flexibility of modern packet brokers are making them increasingly attractive for organizations of all sizes. Enterprises benefit from enhanced network visibility and simplified traffic management without heavy capital expenditure or complex deployment processes. This is driving adoption across sectors such as finance, telecommunications, healthcare, and government

- For instance, in 2023, several major U.S. telecom operators and cloud service providers implemented AI-driven packet brokers to manage increasing data traffic and improve service reliability. These deployments helped detect network congestion in real time, optimize bandwidth allocation, and reduce operational costs while enhancing user experience

- While cloud-integrated and AI-driven packet brokers are accelerating real-time network optimization, their impact depends on continued innovation, cybersecurity measures, and workforce training. Vendors must focus on localized solutions and deployment strategies to fully capture the growing demand in North America

North America Network Packet Broker Market Dynamics

Driver

Rising Demand for Real-Time Network Visibility and Enhanced Security

- Organizations in North America are increasingly prioritizing network visibility to ensure uninterrupted operations and safeguard critical data. Rising cyber threats, regulatory compliance requirements, and increasing network complexity are accelerating the adoption of advanced packet brokers. Companies are also focusing on proactive network management to minimize downtime and maintain high-quality service delivery across enterprise and service provider networks

- Enterprises and service providers recognize the operational and financial risks associated with undetected network issues, including downtime, data loss, and degraded customer experience. This awareness is prompting significant investment in real-time monitoring and traffic management solutions. Additionally, organizations are implementing predictive analytics to anticipate network anomalies and optimize performance across multiple data centers and cloud environments

- Federal and state-level initiatives supporting network modernization, cybersecurity frameworks, and smart infrastructure projects are driving demand for packet brokers that provide granular visibility and intelligent traffic routing. These initiatives include critical infrastructure protection programs and compliance mandates that require enhanced network observability and reporting. Companies are leveraging these frameworks to strengthen security posture and align with evolving regulatory standards

- For instance, in 2022, several U.S.-based banks and telecom providers upgraded their network infrastructures with AI-powered packet brokers to enhance data monitoring, ensure regulatory compliance, and prevent cyber incidents, boosting market demand for advanced solutions. These deployments also improved bandwidth allocation, reduced latency, and enabled automated threat detection, providing measurable ROI for the organizations

- While growing awareness and institutional support are key drivers, integrating packet brokers into existing legacy networks and ensuring sufficient technical expertise remain challenges. Organizations often face compatibility issues with older hardware, and ongoing maintenance requires skilled personnel to optimize traffic flows and configure advanced analytics features effectively

Restraint/Challenge

High Cost of Advanced Packet Brokers and Limited Skilled Workforce

- The high investment required for advanced network packet brokers, particularly those with AI and cloud capabilities, limits adoption among small and mid-sized enterprises. These systems are often deployed primarily by large organizations with adequate IT budgets, making cost a major barrier to wider adoption. The high upfront and ongoing operational expenses also deter smaller businesses from adopting comprehensive traffic management solutions

- A shortage of trained network engineers capable of deploying, managing, and maintaining complex packet broker systems remains a concern in certain regions, reducing operational efficiency and slowing adoption. Organizations must often rely on external consultants or intensive training programs, which can add to costs and delay deployment. Workforce gaps in emerging networking technologies further complicate scaling network visibility solutions effectively

- Supply chain constraints and infrastructure challenges can also restrict deployment in smaller enterprises or remote areas, where consistent hardware availability and reliable connectivity are less guaranteed. Delays in equipment delivery, lack of local technical support, and limited access to high-speed connectivity can negatively impact network performance and slow adoption of advanced packet brokers. Organizations need flexible deployment models to overcome these limitations

- For example, in 2023, some regional U.S. service providers reported that over 60% of smaller organizations were unable to implement modern packet brokers due to high costs and lack of trained personnel. Many of these enterprises had to rely on legacy network monitoring systems, which offered limited visibility and reactive troubleshooting capabilities, increasing operational risks

- While technology continues to advance, addressing affordability, workforce training, and infrastructure limitations is critical. Vendors must focus on scalable, cost-effective solutions and skill-building initiatives to bridge gaps and support long-term market growth in North America. Strategic partnerships, cloud-based deployments, and managed services are emerging as key approaches to overcome these challenges and ensure wider market penetration

North America Network Packet Broker Market Scope

The market is segmented on the basis of bandwidth, network set-up, security tools, and end user.

- By Bandwidth

On the basis of bandwidth, the market is segmented into 1 Gbps and 10 Gbps, 40 Gbps and 100 Gbps. The 1 Gbps and 10 Gbps segment held the largest market revenue share in 2024, driven by the growing deployment of enterprise and SME networks requiring efficient traffic monitoring at moderate data rates. These packet brokers provide reliable performance for typical corporate and data center environments, enabling real-time analytics and traffic optimization.

The 40 Gbps and 100 Gbps segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing data traffic in large enterprises, telecom operators, and data centers. High-bandwidth packet brokers are critical for managing heavy workloads, ensuring low latency, and supporting cloud migration and 5G-enabled network infrastructures.

- By Network Set-Up

Based on network set-up, the market is classified into On-Premise, Cloud, and Virtual. The On-Premise segment dominated the market in 2024 due to enterprise preference for direct control over network monitoring and security, particularly in government organizations and large service providers. On-premise deployment ensures data sovereignty, reduces dependency on third-party platforms, and facilitates integration with existing IT infrastructure.

The Cloud and Virtual segments is expected to witness the fastest growth from 2025 to 2032, fueled by the rising adoption of hybrid and distributed networks. Cloud-based packet brokers provide scalable, centralized management, while virtual deployments offer cost-effective, flexible solutions for organizations with dynamic network requirements.

- By Security Tools

The market is segmented into Passive and Active security tools. The Passive segment held the largest share in 2024, as it enables real-time traffic monitoring without interrupting network flows, making it ideal for routine network analysis and troubleshooting.

The Active segment is expected to witness the fastest growth from 2025 to 2032, driven by the need for advanced threat mitigation, deep packet inspection, and automated traffic management in high-performance networks. Active packet brokers are increasingly adopted in data centers, telecom networks, and cloud environments for proactive security and network optimization.

- By End User

On the basis of end user, the market is categorized into Enterprise, Service Providers, and Government Organizations. The Enterprise segment held the largest market revenue share in 2024, driven by the increasing need for network visibility, traffic optimization, and security compliance across corporate IT infrastructures.

The Service Providers and Government Organizations segments is expected to witness the fastest growth from 2025 to 2032, supported by large-scale network expansion, smart city initiatives, and digital transformation projects across the North America.

North America Network Packet Broker Market Regional Analysis

- U.S. dominated the North America network packet broker market with the largest revenue share in 2024, driven by early adoption of advanced network monitoring solutions, high enterprise IT spending, and increasing focus on cybersecurity and compliance

- Organizations across sectors, including finance, healthcare, and telecom, are deploying packet brokers to gain real-time visibility into network traffic, optimize performance, and mitigate potential threats

- The widespread adoption is further supported by strong technological infrastructure, high awareness of cloud-based and AI-integrated solutions, and increasing demand for low-latency, high-bandwidth networks in enterprise and data center environments

Canada Network Packet Broker Market Insight

Canada is expected to witness the fastest growth from 2025 to 2032, fueled by expanding enterprise networks, rising adoption of cloud and hybrid IT infrastructures, and growing need for real-time network monitoring. Canadian enterprises and service providers are increasingly implementing AI-driven and virtual packet broker solutions to enhance network efficiency, automate traffic management, and improve security monitoring. Government initiatives supporting digital infrastructure, smart city projects, and regulatory frameworks for network security are further accelerating the deployment of packet brokers, contributing to rapid market growth in Canada.

North America Network Packet Broker Market Share

The North America network packet broker industry is primarily led by well-established companies, including:

- Gigamon (U.S.)

- NetScout Systems, Inc. (U.S.)

- Ixia (U.S.)

- VIAVI Solutions, Inc. (U.S.)

- APCON, Inc. (U.S.)

- Garland Technology (U.S.)

- Cisco Systems, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Juniper Networks, Inc. (U.S.)

- Big Switch Networks, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Network Packet Broker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Network Packet Broker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Network Packet Broker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.